My rigorous testing shows the best free stock screeners are Stock Rover, TradingView, and Finviz. For premium screening, TrendSpider, Stock Rover, and Trade Ideas lead the pack.

My top-rated stock scanner is TrendSpider; its powerful real-time pattern recognition and backtesting are perfect for US traders. For financial screening, Stock Rover is ideal for long-term US dividend, value, and growth investors.

TradingView is the best stock scanner for trading global markets. Trade Ideas is the best AI-powered stock scanner for day traders, and Finviz is a fast, effective, free stock screener. Finally, ChartMill is an impressive new entry into our top 10 recommendations.

Top Ranked Stock Screeners

After comprehensive hands-on testing, I have identified the best stock screeners as TrendSpider (4.8/5.0), Stock Rover (4.7), TradingView (4.5), and Trade Ideas (4.4).

| Stock Screeners | Rating | Best for: | Free |

| TrendSpider: AI Chart Pattern & News Scanning for Traders | ★★★★★ 4.8 | Traders | ✘ |

| Stock Rover: Best for Growth, Value & Dividend Investors. | ★★★★★ 4.7 | Investors | ✔ |

| TradingView: Best Free Global Stock Screener and App. | ★★★★⯪ 4.5 | Traders | ✔ |

| Trade Ideas: Best AI Day Trading Stock Scanner. | ★★★★⯪ 4.4 | Day Traders | ✘ |

| Finviz: Best Free Stock Screener USA. | ★★★★☆ 4.2 | Investors | ✔ |

| Tickeron: Good AI-Powered Screening. | ★★★★☆ 4.2 | Investors | ✔ |

| MetaStock: Global Chart Scanning & Realtime News. | ★★★★☆ 4.1 | Traders | ✘ |

| ChartMill: Top Screening for Europe, US & UK Stocks | ★★★★☆ 4.0 | Traders | ✔ |

Screener Features Comparison

TrendSpider is our winner, combining AI-powered news, chart patterns, and indicator screening for US traders. Stock Rover is the best free and paid stock screener for US investors, with deep fundamentals, ratings, research reports, and portfolio management. Finally, TradingView is the perfect free screener for day traders covering all international markets.

| Features | TrendSpider | Stock Rover | TradingView | Trade Ideas | Finviz |

|---|---|---|---|---|---|

| Rating | ★★★★★ 4.8 | ★★★★★ 4.7 | ★★★★⯪ 4.5 | ★★★★⯪ 4.5 | ★★★★☆ 4.2 |

| Best for: | Traders | Investors | Traders | Traders | Investors |

| Free Plan | ✘ | ✔ | ✔ | ✘ | ✔ |

| Financial Screening | ✔ | ✔ | ✔ | ✘ | ✔ |

| 10-Year Financials | ✘ | ✔ | ✘ | ✘ | ✘ |

| Portfolio Management | ✘ | ✔ | ✘ | ✘ | ✘ |

| Research Reports | ✘ | ✔ | ✘ | ✘ | ✘ |

| Chart Pattern Scanning | ✔ | ✘ | ✔ | ✔ | ✔ |

| AI Stock Screening | ✔ | ✘ | ✘ | ✘ | ✘ |

| Candle Pattern Scanning | ✔ | ✘ | ✔ | ✘ | ✔ |

| Indicator Scanning | ✔ | ✘ | ✔ | ✘ | ✔ |

| Financial News | ✔ | ✔ | ✔ | ✔ | ✔ |

| News Scanning | ✔ | ✘ | ✘ | ✔ | ✘ |

| Stocks & ETFs | ✔ | ✔ | ✔ | ✔ | ✔ |

| FX/Commodity | ✔ | ✘ | ✔ | ✘ | ✘ |

| USA & Canada | ✔ | ✔ | ✔ | ✔ | ✔ |

| Global Market Data | ✘ | ✘ | ✔ | ✘ | ✘ |

1. TrendSpider: Winner Best Trading Scanner

TrendSpider’s real-time multi-timeframe pattern and indicator scanning make it the best premium screener for US stock traders. Its innovation in AI-powered scanning of trendlines, patterns, candles, indicators, dark pools, block trades, and news makes it a worthy winner.

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

I am a partner and a subscriber to TrendSpider. I have completed thousands of screens and backtesting research using TrendSpider and can assure you this is the best screener and scanner for traders available today.

I have tested indicators, candlestick patterns, and stock chart patterns with TrendSpider. It is incredibly flexible, powerful, and, most of all, easy to use, as it requires zero coding. Yes, it is all point-and-click, which is great because I have only rudimentary scripting skills.

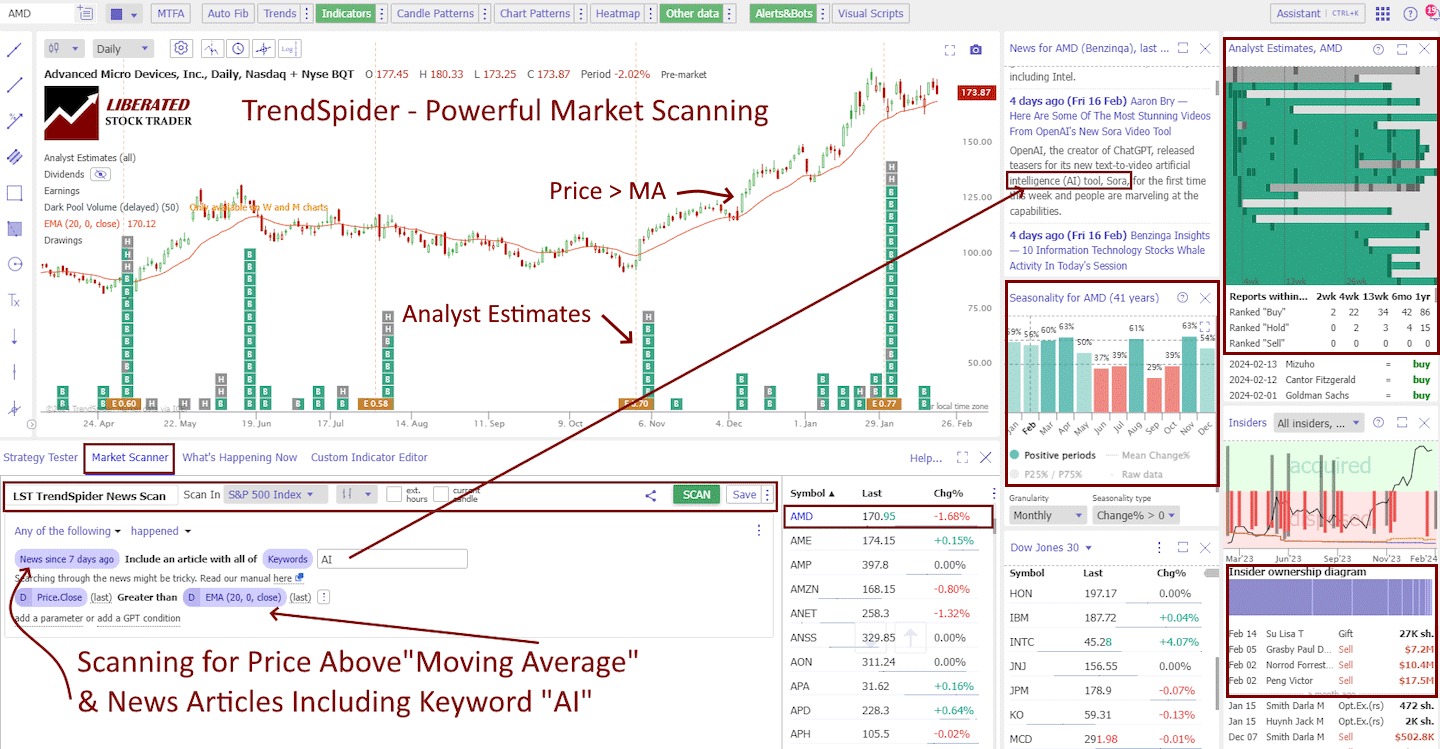

In the above screenshot, I have captured the key essentials to running a market scanner across the S&P 500, searching for stocks in an uptrend with a news announcement mentioning “AI.”

| ⚡ Features | Charts, Watchlists, Screening, Free Real-time Data |

| 🏆 Unique Features | AI Automated Trendlines, Fibonacci, Candlestick Pattern Recognition, Auto-Bot Trading, Code-free Powerful Backtesting, Launch and Train Personal AI Models with Strategy Lab. |

| 🎯 Best for | Stock, Options, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $107/m or $48/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Region | USA |

TrendSpider stands out as a leader in the industry due to its powerful multi-layer approach to screening financials, technicals, news, and analyst reports. It even includes data on dark pools and insider trading, which can all be overlayed on the chart.

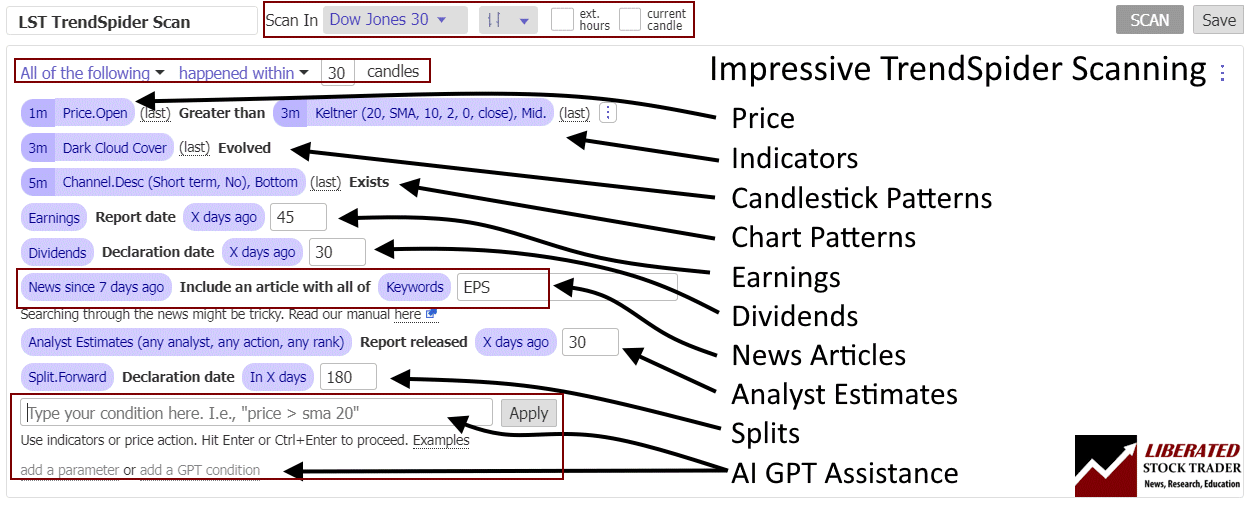

The screenshot below further demonstrates why TrendSpider is our winner. It encompasses the important elements of the platform’s power and flexibility. You can screen for any criteria related to price, indicators, patterns, earnings, dividends, analyst estimates, and stock splits.

For example, you can scan for companies that release their earnings in the next seven days, where analysts expect a positive earnings surprise, and where the new reports mention “AI.”

The financial news scanning is also impressive. It allows you to scan for any article mentioning one or multiple keywords.

TrendSpider also includes an AI GPT Assistant, which enables you to freely type what you want to screen for in plain English. The assistant will then set up the screen or backtest for you.

For example, you could type “find me all stocks above the 20-day moving average with a positive RSI and analyst upgrades in the last 7- days.”

It also provides access to a wealth of diverse datasets, such as dark pools, r/wallstreetbets, short volume, retail trading, seasonality, and insider trading.

2. Stock Rover: Best for Investors

Stock Rover is the best free and paid stock screener for serious long-term US investors. It provides the largest database of company fundamental data, with 670 screening criteria, company ratings, analyst estimates, and a 10-year historical database of all US and Canadian stocks and ETFs.

My testing shows Stock Rover is best for long-term dividend, value, and growth investors. Its exceptional features are in-depth screening of a 10-year financial database, research reports, and broker-integrated portfolio management.

| Stock Rover Rating | 4.7/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 Portfolio & Research | ★★★★★ |

| 📰 News & Social | ★★★✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 🖱 Usability | ★★★★★ |

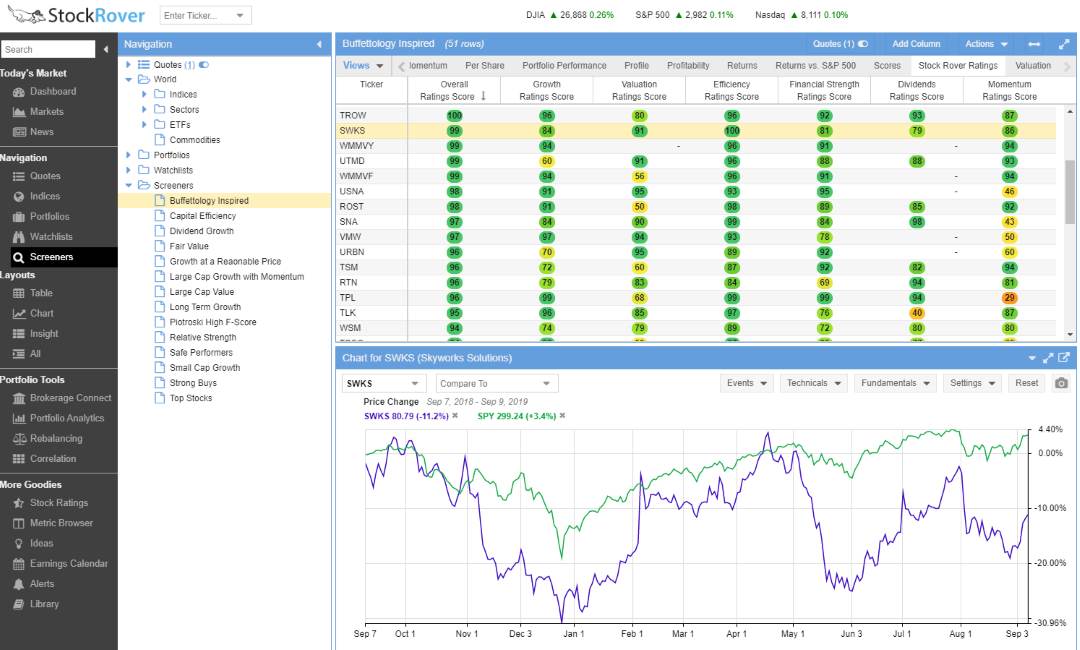

Stock Rover is an industry-leading platform that enables the development of intricate dividend, value, and growth investing strategies.

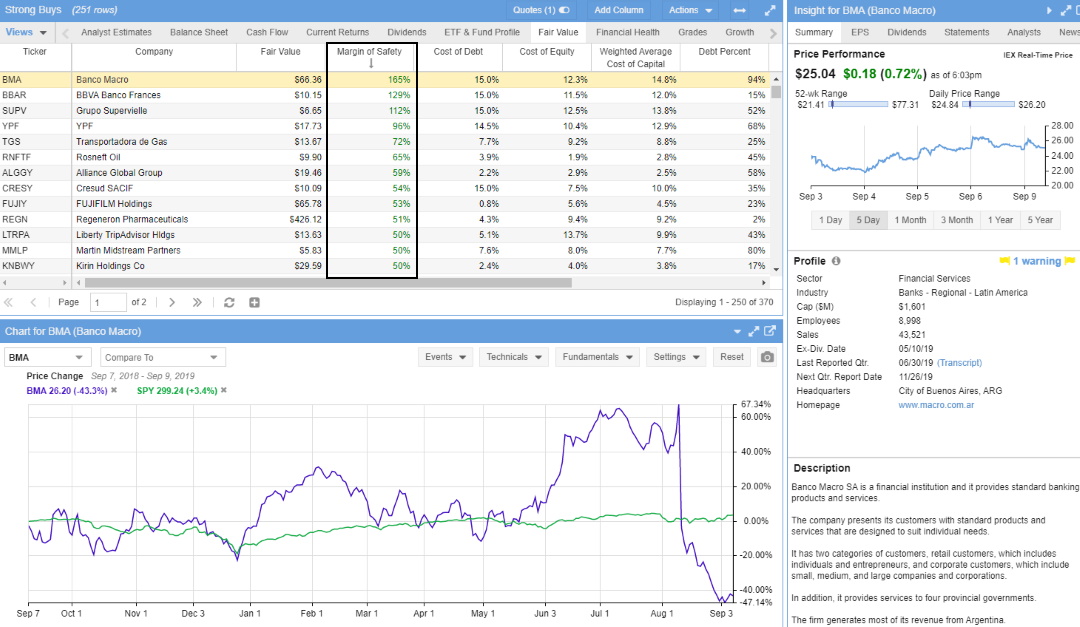

With Stock Rover, I have developed incredible value strategies using its unique fair value, discounted cash flow, and margin of safety data. Its extensive growth investing data, such as performance versus the S&P 500 and industry growth and earnings rankings, make Stock Rover the best choice for serious investors.

Stock Rover’s key benefits include portfolio correlation and balancing and screening for dividends, value, and growth stocks. Its 10-year historical dataset allows you to backtest your screening criteria, which means you can see if your scans were profitable in the past.

Pros

✔ 650+ Financial Screening Metrics

✔ Potent Stock Scoring Systems

✔ Unique 10-Year Historical Financial Data

✔ Warren Buffett Value Screeners & Portfolios

✔ All Important Financial Ratios

✔ Real-time Research Reports

✔ Portfolio Management & Rebalancing

✔ Broker Integration

✔ Winner: Best Value Investing Screener

Cons

✘ No Social Community

✘ Not for Traders

✘ No Cryptocurrency or Forex Data

✘ US Markets Only

I actively use Stock Rover daily to find the stocks that form the foundation of my long-term investments. It is my tool of choice, and I have even developed a Beat the Market Screener that is now integrated into Stock Rover.

Stock Rover is an easy-to-use stock screener that runs on PCs, Macs, Tablets, and Smartphones and requires zero installation. It simply works. Although Stock Rover is user-friendly, it is also the most advanced stock screener for financial analysis on the market. However, the market data, scoring, ranking, and analysis are only for the USA and Canadian markets.

Stock Rover has the best implementation of stock screening, research & portfolio management on the market today.

Stock Rover integrates with every significant broker, enabling it to manage profit and loss reporting, portfolio correlation, and rebalancing. It is a unique package that includes dividend reporting, forecasting, and scoring. Stock Rover is not for day traders but for longer-term investors who want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio.

| ⚡ Stock Rover Features | Charts, News, Watchlists, Broker Integration |

| 🏆 Exceptional Features | Financial Screening, Portfolio Mgt & Rebalancing, 10-Year Database |

| 🎯 Best for | Growth, Dividend & Value Investors |

| ♲ Subscription | Monthly, Yearly |

| 🆓 Free | Try Stock Rover Free |

| 💰 Price | Free or $28/m or $23/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | 14-Day |

| ✂ Discount Code | 25% During Premium+ Trial Period |

| 🌎 Region | USA |

Stock Rover is the industry leader for stock screening with 670 fundamental financial metrics; 226 contain ten years of historical data, allowing you to backtest your screening strategy. Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can set the watchlist and filters to refresh every minute.

Stock Rover has over 150 pre-built screeners you can import and use. Many of these have been tested during this research and are thoughtfully built. To use the most powerful screeners, you will need the Premium Plus service.

Stock Rover is the best value investing stock screener because it has criteria no other software has, such as margin of safety, forward discounted cash flow, fair value, and the Greenblatt formulas. Using these calculations and metrics, a powerful Warren Buffett-style value stock screener is possible. A Buffettology screener built into Stock Rover incorporates the key criteria for Warren Buffett’s value investing methodology.

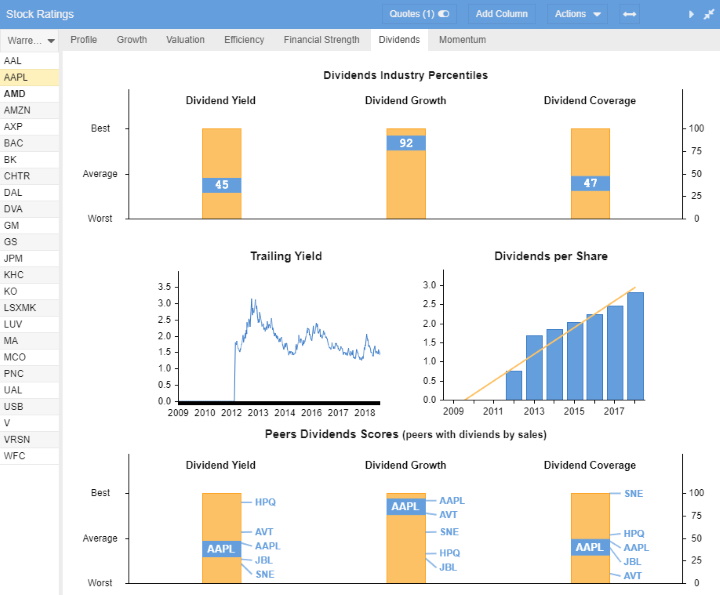

Stock Rover also has the best dividend stock screener because it has many pre-built scans for dividend growth, yield, consistency, and ETF dividends. The broad dividend screening selection criteria include dividend coverage, cash flow, payout ratio, and dividend percentage growth. If you are screening for companies paying a consistent dividend, Stock Rover also allows you to scan for “Consecutive Dividend Growth Years.”

Stock Rover also provides intelligent dividend and income analysis, enabling you to compare company dividend yields, growth, and coverage and estimate future dividend income based on your portfolio or watchlist.

A new addition to the Stock Rover platform is the dynamic research reports. This brand-new service enables you to generate a professional, readable PDF report on any stock’s current and historical performance. Stock Rover calculates anomalies in a company’s financial reports and issues warnings to help lower your investing risk. Get a free premium Stock Rover research report.

3. TradingView: Best Free Screener

TradingView is the best free and paid stock screener for active traders because it combines powerful charts and screening for Stocks, ETFs, Indices, Forex, and cryptocurrencies across all international markets. TradingView enables backtesting trading strategies and has the largest active global community of traders.

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

TradingView is one of the best stock market trading and charting platforms, with over 10 million active users sharing trading ideas and strategies in one big community. TradingView is a winner in our “Best Stock Analysis Software Review” and is now the best stock screener winner.

You can have TradingView for free, but the number of charts, alerts, and devices you can use is limited. I recommend the PRO+ plan at $19 per month, as the benefits include real-time data, market scanning, and a robust alerting system.

TradingView’s screening watchlists have fundamental data separated into Performance, Valuation, Dividends, Margin, Income Statement, and Balance Sheet. TradingView stands out with its vast selection of economic indicators, such as the Civilian Unemployment Rate versus the growth in Company Profits, that you can map and compare on a chart.

| ⚡ TradingView Features | Charts, News, Watchlists, Screening, Chart Pattern & Candlestick Recognition, Full Broker Integration |

| 🏆 Unique Features | Trading, Backtesting, Community, Global Stock, FX & Crypto Markets, Webhook Bot Integration (with Signal Stack) |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free | $13/m to $49/m annually |

| 🆓 Free | Try TradingView’s Free Plan |

| 💻 OS | Web Browser|PC|IOS|Android |

| 🎮 Trial | Yes, Free 30-Day Premium |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Region | Global |

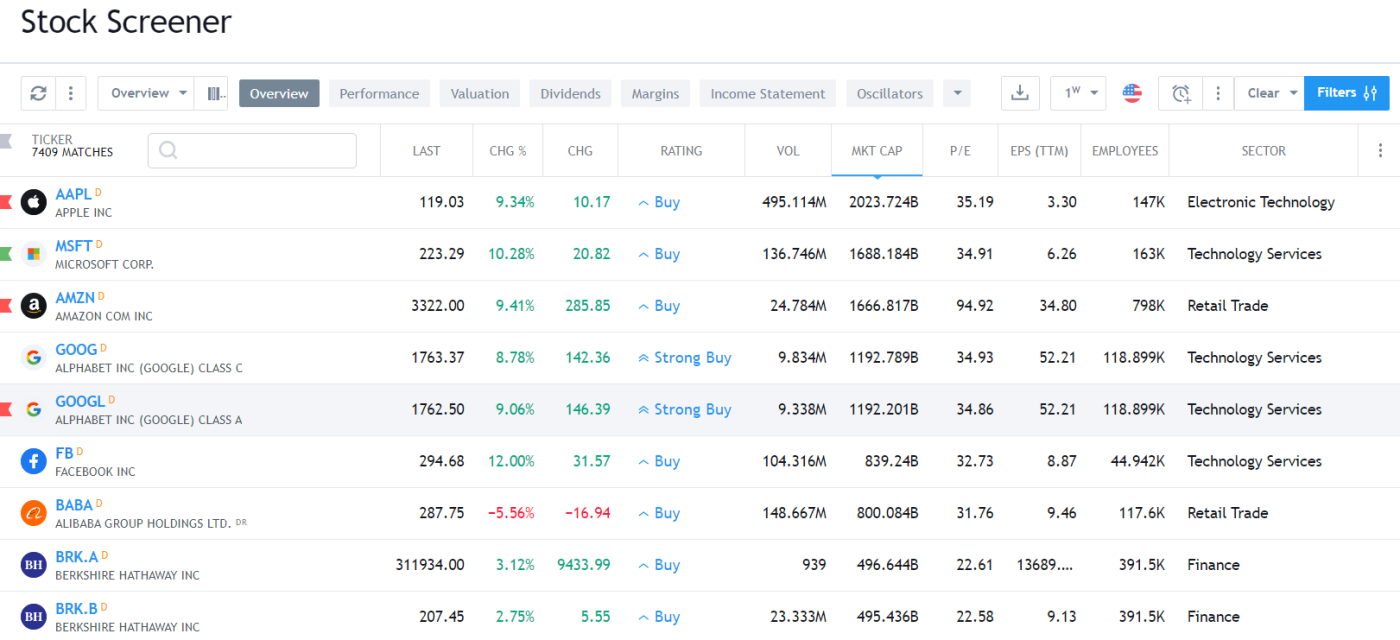

TradingView allows you to run a continuous live real-time stock screen that updates every 10 seconds. This is valuable for day traders scanning for volume spikes, changes in relative volume, or intra-day price spikes. The real-time stock screener covers pre-market gaps, volume, and major indicators such as RSI and Moving Averages.

The TradingView stock screener comes complete with 150 fundamental and technical screening criteria; all the usual measures are there, such as EPS, Quick Ratio, Pre-Tax Margin, and forward/trailing PE Ratio. TradingView also goes deeper with more esoteric criteria such as the number of employees, Goodwill, and Enterprise Value. Another positive is the screener implementation is very customizable; you can configure the columns and filters exactly how you wish.

TradingView’s unique ability to screen for chart patterns and setups for foreign exchange pairs makes it very valuable for day traders searching for volatility and using leverage. The Forex screener can compare performance and volatility together, which can help you narrow down the list of potential trades.

TradingView is extremely easy to use, low cost, and packed with screening power, including economic data. It is the right combination for active international day traders who value a social community.

Video Review: Why I Rate TradingView the Best

4. Trade Ideas: Best AI Day Trading Scanner

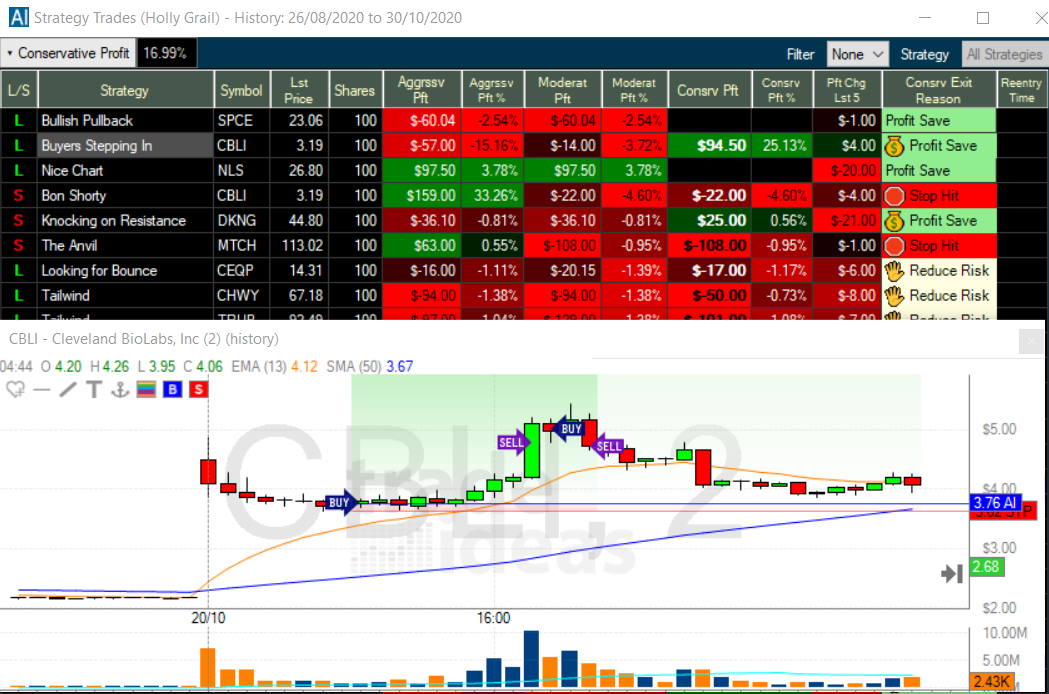

Trade Ideas is the best stock screener for day trading because it has three AI algorithms that provide signals for high-probability short-term trades. The backtesting, scanning, and trade success probabilities are all automated, meaning Trade Ideas can be used for automated day trading commission-free with eTrade.

My in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Trade Ideas is worth it if you are a pattern day trader trading at least three times daily with an account value of over $25K as this will help you profit after paying the Trade Ideas subscription cost.

Pros

✔ 3 AI Trading Algorithms That Beat the Market

✔ Get A Free Holly AI Stock Trade Every Week

✔ Fully Automated Backtesting

✔ Exceptional Stock Scanning

✔ Specific Audited Trade Signals

✔ Auto-trading & broker integration

✔ Auto trade Commission Free With eTrade integration

Cons

✘ Old School User Interface

✘ No Mobile App

Founded in 2003, Trade Ideas is a web & desktop-based software platform for finding day trading opportunities. Historically specializing in real-time scanning for trade opportunities, Trade Ideas now incorporates cutting-edge AI algorithms that backtest every stock in the USA & Canada for high-probability trading opportunities.

There are two tiers of product, Standard & Premium. Trade Ideas Standard costs $118 per month, or you can save $348 by going for an annual subscription costing $1068, a 25% discount. You get a live trading room, access to 40 market scans, and 500 price alerts for this price.

Trade Ideas Premium costs significantly more, at $228 per month, and enables the Holly Artificial Intelligence System. This system comprises three constantly evolving AI screening algorithms: entry and exit signals, trade risk assessments, and AI Auto-Trading.

Trade Ideas is the best AI stock screener because they have built an artificial intelligence algorithm called “Holly AI.” Holly applies 70 different strategies to all the stocks on the US stock exchanges; 70 strategies multiplied by 8,000+ stocks means millions of backtests daily. Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

| ⚡ Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | AI Trade Signals, Trading Room, Trading Competitions |

| 🎯 Best for | US Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $254/m or $178/m annually |

| 🆓 Free Version | ✔ |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | Free Live Trading Room |

| ✂ Discount | -15% Discount Code "LIBERATED" |

| 🌎 Region | USA |

The unique scanner system at the heart of the Trade Ideas platform gives you immediate access to over 40 trading scans. The in-built scans are categorized into Bullish, Bearish, or Neutral. Depending on the overall market direction, you can easily select a potential strategy for the day.

One scan I find particularly impressive and innovative is the “Unusual Social Mentions Scan.” The Trade Ideas AI engine constantly scans StockTwits for surges in mentions of particular stocks. If you click load settings, you will be immediately presented with a list of stocks spiking on social media. Of course, you can customize any of the scans featured here or create your alerts from scratch.

The AI algorithms developed by Trade Ideas are the main reason you want to sign up. I had a lengthy Zoom session with Sean Mclaughlin, Senior Strategist over at Trade Ideas, to delve into how its AI works, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities. There are currently three AI systems in operation.

Trade Ideas 15% Discount Coupon Code

As a partner of Trade Ideas, I requested a discount for all our readers. Use the discount code “Liberated” to get 15% off your first purchase, worth $340, when going for the premium service.

5. Finviz: Best Free USA Stock Screener.

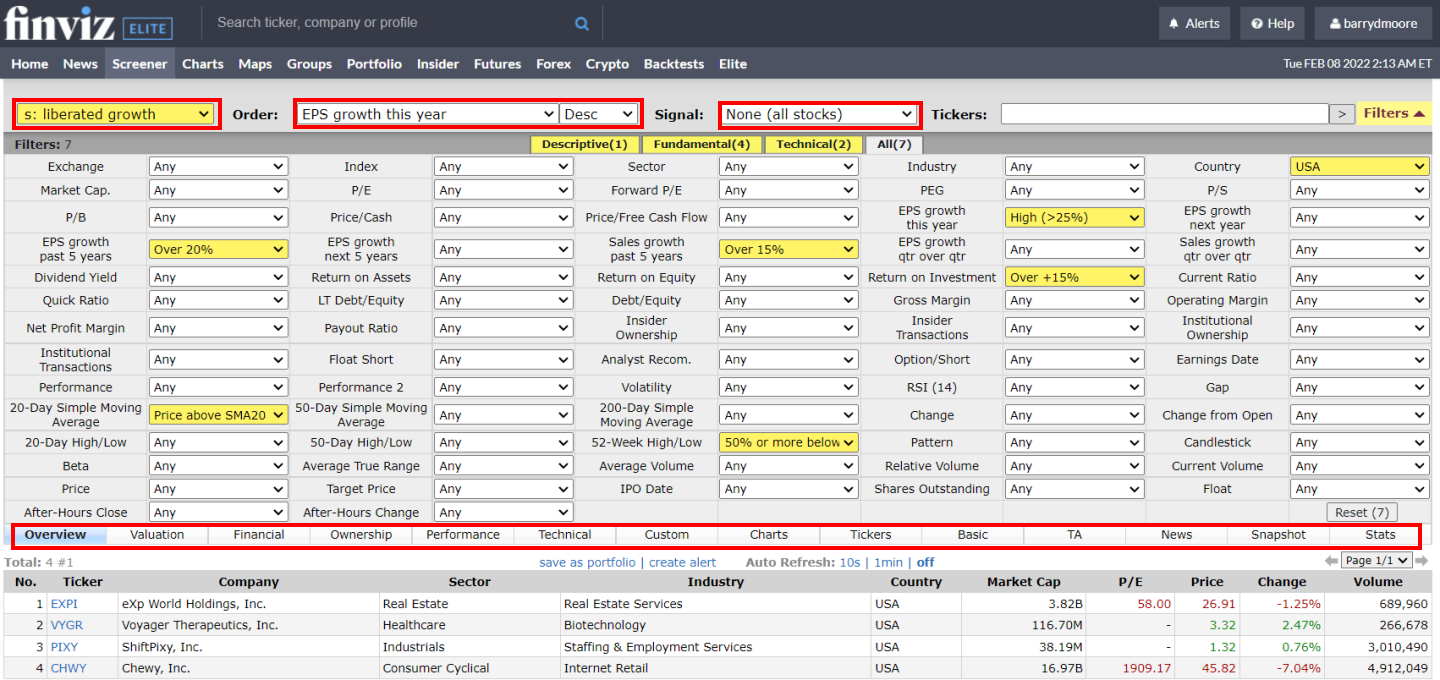

Finviz is one of the best free stock screeners because it includes chart pattern recognition and a great selection of financial metrics at no cost. It uniquely enables investors to visualize vast stock market data on a single screen and has greatly improved its charting, backtesting, and pattern recognition.

After hands-on testing, I found Finviz to be a powerful free stock screener, swift market heatmaps and impressive stock chart pattern recognition.

Thanks to ongoing enhancements to its charting capabilities, Finviz remains a relevant and powerful tool in stock analysis. Through my testing, I found Finviz to be an exceptional free resource, offering intuitive heatmaps, speedy stock screening, and seamless chart pattern recognition.

For those seeking more advanced features, Finviz Elite delivers excellent value at $299 per year, providing real-time data and robust backtesting tools.

Finviz’s elite service provides real-time market data and allows you to perform up to 24 years of backtesting on multiple combinations of 102 technical indicators.

Finviz is targeted at individual investors and institutions and enables investors to screen for stocks and see stocks on the move.

Pros

✔ 67 stock screening metrics

✔ 33 Chart Patterns Recognized

✔ Intraday (1-minute) data with Finviz Elite

✔ One of the best free stock screeners

✔ Good insider trading/news service

✔ Fast heatmaps for sector & industry visualizations

✔ Integrated news aggregation

✔ Backtesting recognizes 102 chart patterns

Cons

✘ Elite Backtesting Could Be More Flexible

✘ 21 chart indicators

✘ No app for Android or iPhone

The Finviz stock screener is extremely fast and allows you to filter on 67 fundamental and technical criteria. You can filter the stocks on specific chart-based signals such as new highs, lows, oversold, analyst upgrades, insider buying, or even chart patterns like double tops and head-and-shoulders.

Finviz allows you to scan for a mix of 67 fundamental criteria and combine it with 30 different trading signals. That may seem like a huge choice, but TradingView offers over 168 criteria, Portfolio123 has 470 filters, and Stock Rover provides over 650 options.

| ⚡ Finviz Features | Screening, Heatmaps, Charts |

| 🏆 Exceptional Features | Patterns, Signals, Auto-Trendlines |

| 🎯 Best for | Beginner Investors/Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $39.50/mo or $25/m annually |

| 🆓 Free Plan | Yes. Try the Free Version |

| 💻 OS | Web Browser |

| 🎮 Trial | 30-Day Money-Back |

| ✂ Discount | -40% With Annual Plan |

| 🌎 Region | US |

Finviz also shines where the others do not because you can also screen on ten major candlestick patterns and 30 stock chart patterns. This mix of fundamental screening criteria for investors, technical charts, and candlestick pattern recognition for traders makes Finviz a good match for short-term and medium-term investors.

In the screenshot above, I have highlighted the key interesting Finviz stock screener fields in red. To test the Finviz screener, I built a growth stocks screening strategy to demonstrate high EPS growth, sales growth, ROI, and price above the 20-day moving average.

Finviz provides incredibly fast stock screening, heatmaps, and stock chart pattern recognition for free. If you want to visualize a large amount of stock data and find investments quickly, Finviz is worth it.

6. Tickeron: Best AI Stock Screening.

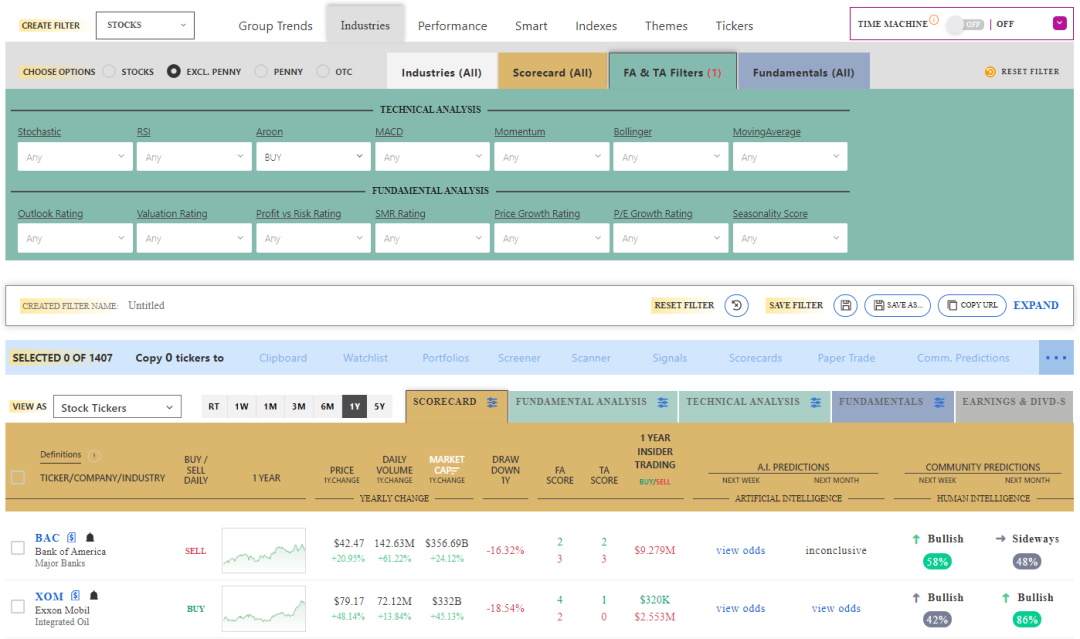

Tickeron provides premium AI-driven investing and trading tools, including portfolio construction, stock price prediction algorithms, and stock screening and scanning. Tickeron enables screening seven fundamental rating indicators, including valuation, profit/risk, price growth rating, and seasonality score.

My Tickeron testing confirms impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron provides reliable thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

Tickeron is designed for day traders, swing traders, and investors.

Pros

✔ 45 Streams of Trade Ideas

✔ Real-Time Pattern Recognition for Stocks, ETFs, Forex, and Crypto

✔ AI Trend Prediction Engines

✔ Investing Portfolios with Audited Track Records

✔ Build Your Portfolios with AI

Cons

✘ Custom Charting Limited

✘ Cannot Plot Indicators

✘ Complicated Pricing

Tickeron bridges the gap for those who want to trade short-term and invest long-term. It uses smart AI algorithms to suggest trading ideas or construct intelligent portfolios.

Tickeron also provides fundamental financial filters for 12 criteria, including price/book, PE ratio cash/share, beta, EPS, ROE, revenue per share, and dividend yield.

Tickeron can find stocks based on industry, sector, market capitalization, or technical buy-and-sell ratings. If you want to perform specific screening for value, dividend, or growth stocks, Tickeron is of little use.

Tickeron is designed to find high-probability trading opportunities, not for long-term investors wishing to build a sustainable portfolio. If you are a long-term investor, I recommend Stock Rover.

Overall, Tickeron is easy to use and provides enough power for demanding traders. You do not need to install software or configure data feeds. The most difficult element of Tickeron is figuring out the pricing model, which is overly complex and granular. I spoke with my contact at Tickeron, who told me they are working to simplify the pricing structure.

You can immediately save 50% on all Tickeron’s plans by signing up for a single annual payment rather than paying monthly. This radically reduces the cost of the Expert plan from $250 per month to $125, which makes it a very cost-effective AI trading service.

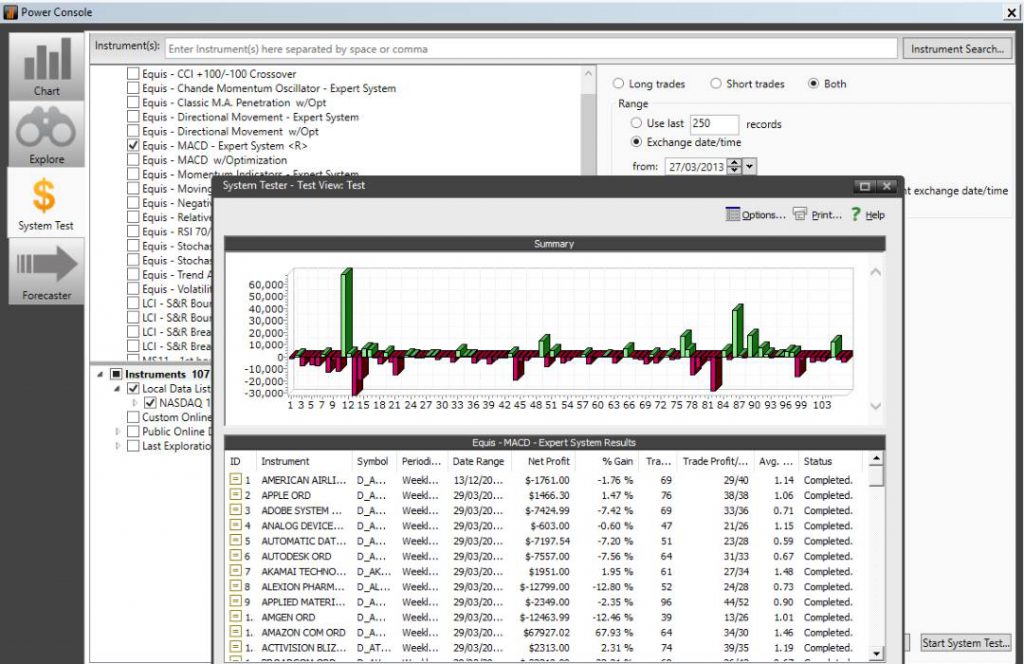

7. MetaStock: Best Global Chart Scanner.

MetaStock is a leading global stock chart scanner because it combines powerful backtesting strategies with over 350 indicators and charting tools. MetaStock’s marketplace has over 100 stock scanning strategies for finding trading opportunities across international stock markets.

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex. MetaStock R/T excels with its advanced backtesting and forecasting features, alongside real-time news updates and efficient screening tools.

MetaStock is best for traders who need excellent real-time news, exceptional technical analysis, a vast stock systems marketplace with global data coverage, and excellent customer service.

However, the full Metastock suite costs $265/m. It rivals the Bloomberg terminal in functionality but lacks the new AI trading features of TrendSpider and Trade Ideas, such as AI Bot trading and pattern recognition.

Pros

✔ Great Selection of Automated “Expert Advisors”

✔ Excellent Deep Backtesting

✔ Unique Stock Price Forecasting

✔ Large Library of Add-on Professional Strategies

✔ Best Charts, Indicators & Real-Time News

✔ Xenith Add-On Rivals Bloomberg Terminals

✔ Works Online & Offline

Cons

✘ Takes Time To Learn

✘ Old School Windows App Design

✘ Too Many Add-ons

MetaStock is a leader in forecasting and technical chart analysis. If you purchase MetaStock R/T (real-time), you essentially get the Refinitiv add-on; this adds Real-time news (from Reuters) and Bloomberg-level fundamental and technical screening.

MetaStock’s Refinitiv integration means you get institutional quality real-time news, analysis, research, and economic outlooks, plus the fastest global news service available in the industry. For international investors, MetaStock is unique because the news is also translated into all major languages.

MetaStock has an incredible database of fundamental global data for screening, not just on companies but economies and industries; the wealth of data is first-class. Using Refinitiv, you can see an in-depth analysis of company fundamentals, from debt structure to the top 10 investors, including level II; combine that with excellent watch lists featuring fundamentals and powerful scanning of the markets.

MetaStock provides scanning on any stock exchange globally, providing you have the market data package for the region. Screening all trading instruments, including ETFs, Funds, Options, and Forex, is possible. Powered by Refinitiv, extensive analyst ratings and 79 core fundamental financial criteria are selectable. In total, 269 technical criteria are available for scanning.

| ⚡ Features | Charts, Watchlists, Scanning, Backtesting |

| 🏆 Unique Features | Algorithmic AI Forecasting, Real-time Global Trading News (Multi-language), Pattern Recognition with Add-ons. |

| 🎯 Best for | Stock, FX & Commodity Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | MetaStock R/T $100/m, Xenith $265/m |

| 💻 OS | PC |

| 🎮 MetaStock Free Trial | 30-Day Free Trial |

| ✂ Discount | 3 Months for 1 |

| 🌎 Region | Global |

MetaStock is not free software; you will pay $250 monthly for powerful scanning. For that investment, you will get the fastest real-time streaming news, industry-leading technical analysis, backtesting, and forecasting.

MetaStock is one of our valued partners, and we have a “3 months for the price of 1” deal, which should save you $500.

An alternative for day traders looking for US real-time news and level I/II data, I encourage you to check out our Scanz review.

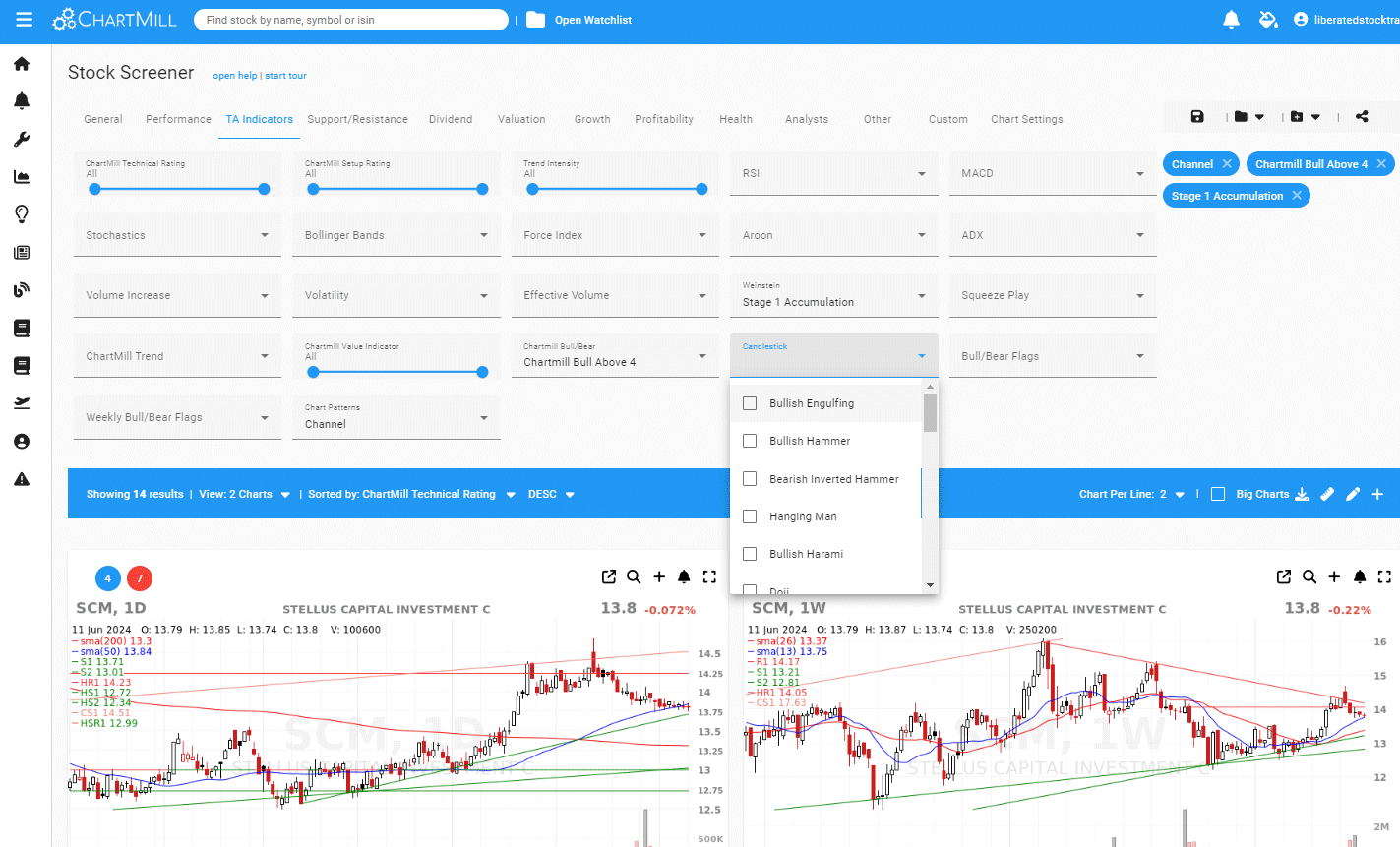

8. ChartMill: Top US & UK Screening

ChartMill offers a sophisticated platform for traders and investors. It seamlessly combines charting, screening, and market analysis tools. It boasts user-friendly navigation, a streamlined workflow, and distinctive features like exclusive ratings for trend, value, growth, and health.

ChartMill provides a slick charting, screening, and market analysis platform for traders and investors. It’s easy to use, with great workflow and unique features, such as proprietary ratings for trend, value, growth, and health.

The platform’s proprietary metrics, like the ChartMill Value Indicator, Weinstein, and Trend Indicator, give users unique insights into stock performance.

Charts are another standout feature. They are customizable and offer a range of technical analysis tools. This helps me identify trends and patterns quickly.

What truly sets ChartMill apart is its ease of use and intricate stock screener, combining technical indicators, pattern recognition, and financial metrics.

Finally, I found the pre-built Trading Ideas strategies particularly helpful. They save time and help generate trade suggestions based on factors like undervalued fundamentals and technical pattern breakouts.

Pros

✔ 85 stock chart indicators and overlays

✔ Candlestick and Heiken Ashi charts

✔ Intraday charting included

✔ Unique stock analyzer feature

✔ 262 trading ideas pre-built screeners

✔ 238 stock screening criteria

✔ 10-year historical data

✔ Free version available

✔ Europe, USA & UK Exchange Data

Cons

✘ No Mobile App

✘ Cannot save chart annotations

✘ No real-time data on any plan

✘ No integrated trading

One of ChartMill’s standout features is the stock screener. It allows users to filter stocks based on over 238 criteria. The screener contains all the expected criteria for profitability, dividends, financials, and valuation, but it also has many unique elements, such as technical ratings, trade setup ratings, and trend intensity.

I find it extremely useful to customize screening criteria to match my investment strategies. ChartMill elegantly combines technical screening with fundamental analysis and even analyst ratings and trading strategies.

The screener supports ten years of historical data, so I can see how my chosen filters would have performed in the past. This feature helps refine the strategies and make more reliable trades.

Additionally, the pre-built screens created by both ChartMill and its users provide a good starting point for new users.

The platform boasts proprietary metrics like the ChartMill Value Indicator, Weinstein, and Trend Indicator, which give users unique insights into stock performance.

Charts are another standout feature. They are customizable and offer a range of technical analysis tools. This helps me identify trends and patterns quickly.

Finally, I found the pre-built Trading Ideas strategies particularly helpful. They save time and help generate trade suggestions based on factors like undervalued fundamentals and technical pattern breakouts.

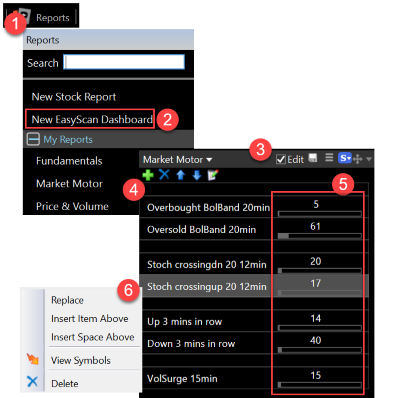

9. TC2000: Best Options Screener App.

TC2000 specializes in real-time stock and options screening for the US stock, ETF, and options markets. The TC2000 EasyScan system enables quick implementation of powerful screening conditions and custom indicators and is the only software with screening available in the Mobile App.

My testing of TC2000 highlights its impressive real-time stock scanning, advanced charting, and customizable indicators, making it a powerful tool for US stock and options traders. It also offers seamless broker integration with TC2000 Brokerage and sophisticated technical analysis features, such as options strategy charting and trade execution.

| TC2000 Rating Our testing and rating methodology. | 4.2/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★★ |

| 📡 Scanning | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charting | ★★★★★ |

| 💡 Pattern Recognition | ★✩✩✩✩ |

| 🔍 Backtesting | ★✩✩✩✩ |

| 🖱 Usability | ★★★★★ |

However, TC2000 falls short when it comes to backtesting capabilities and advanced AI trading features offered by platforms like TrendSpider and Trade Ideas. These include cutting-edge tools such as AI stock trading and pattern recognition, which provide traders with a significant advantage.

Pros

✔ Excellent US Customer Support

✔ Trade Stocks & Options From Charts

✔ Broad Selection of Charts & Indicators

✔ Options Strategies & Live Trading

✔ Real-time Entire Market Scanning

✔ Great Usability & Simple Setup

Cons

✘ No Social Community

✘ No Pattern Recognition

✘ No Backtesting

✘ No AI Trading Features

If you want fundamentals screened in real-time layered with technical screens integrated into live watchlists connected to your charts, TC2000 is a good option.

In 2000, I selected TC2000 as my tool of choice because it offered the best implementation of fundamental scanning, filtering, and sorting available on the market. Twenty years later, they are still a stock screening and scanning leader.

TC2000 offers a large selection of fundamentals, but what makes it unique is that you can, with a few clicks, create your indicators based on the fundamentals. You can then overlay the indicators directly on the charts, opening up a new world of technical and fundamental analysis.

Out of all the software we tested, TC2000 has the best mobile app for stock screening. The “TC2000 Easy Scan Stock Scanner” is built directly into the main screen, and you can start a scan simply by selecting the lightning symbol. TC2000 is unique in its ability to run live and pre-market scans directly from your mobile device.

TC2000 allows you to run screening and scanning on pre-market data. When you open the desktop software before market hours, the app asks if you want to load all pre-market data; this allows you to perform advanced screening before the market opens.

TC2000 is free to test its capabilities, but to access the EasyScan system for stocks, ETFs, and options, you need the Gold Service, currently priced at $29.99 monthly.

TC2000 is the best-integrated stock market software. You can effortlessly glide from effective screening on a broad array of fundamental & technical screens to managing your watchlist and directly trading with the TC2000 Brokerage. The Options screening and on-screen options execution are second to none, leading the industry.

The only downside to TC2000 is that it is only available for those who trade in the US and Canadian stock markets. TC2000 is well suited to Day Traders because its scanning is real-time, and you can trade directly from the charts if you use TC2000 Brokerage.

10. Portfolio 123: Good Backtesting Screener.

The results of our Portfolio123 testing show impressive stock screening software with a robust financial database and integrated commission-free trading with Tradier. Portfolio123 can be used by income, value, and growth investors but is also advantageous for swing traders.

My Portfolio123 testing highlights its solid stock screening, financial database, and easy integration for commission-free trading. Charting and usability can be improved, but it is good for dividend and growth investors. Value investors should look at Stock Rover as a better alternative.

| Portfolio123 Rating | 4.1/5.0 |

|---|---|

| 💸 Pricing | ★★★★✩ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 💡 Portfolio Research | ★★★★★ |

| 🖱 Usability | ★★★✩✩ |

Portfolio123 covers stocks, fixed income, and ETFs on US and Canadian exchanges, so it is unsuitable for international stock investors. However, you can design a fully automated real-time trading strategy with a broker that will hold the stocks that pass your screen and sell those that don’t.

Portfolio123 is a Chicago-based company offering stock screening, research, and portfolio management software.

Pros

✔ 470+ Screening Metrics

✔ 10-Year Backtesting Engine

✔ Unique 10-Year Historical Data

✔ Pre-built Model Screeners

✔ 260 Financial Ratios

✔ Integrated $0 Trading

Cons

✘ No Integrated News

✘ No App for Android or iPhone

✘ Initially, Complex To Use

✘ Missing Fair Value & Margin of Safety Metrics

✘ Technical Analysis Charting Needs Improving

The Portfolio123 screener allows you to filter 10,000+ stocks and 44,000 ETFs to help you find the investments or trades that match your exact criteria. Portfolio123 also has ranked screening, which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful. You can also define your custom universes, setting the macro criteria for which stocks are included in the sample.

Over 225 data points will cover most ideas based on fundamentals. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

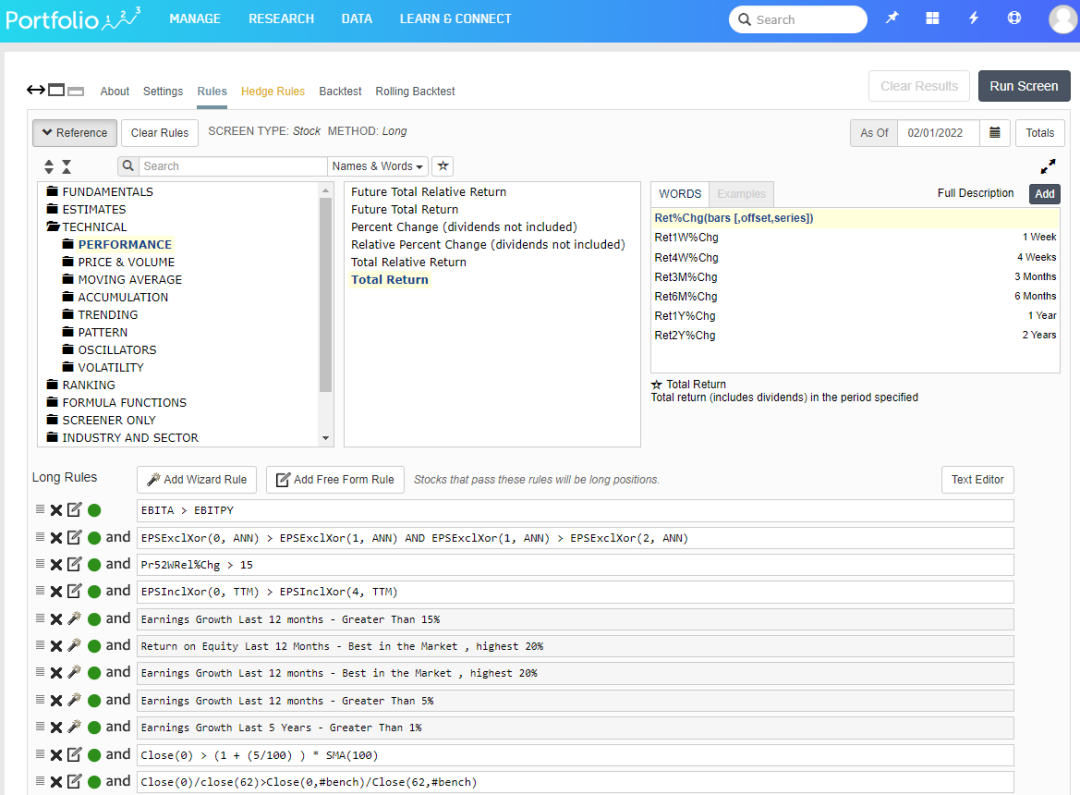

Here is a very complex screening strategy I developed using Portfolio123; as you can see, it is extremely powerful and flexible, with almost limitless rules and conditions.

Building your Portfolio123 screener is theoretically easy; select Research -> Screens, and you can start to play. No programming skills are required to build a Portfolio123 screener, but basic coding will certainly help. If you want to create more powerful screening rules, you must spend significant time studying the coding logic and understanding the names of the proprietary criteria.

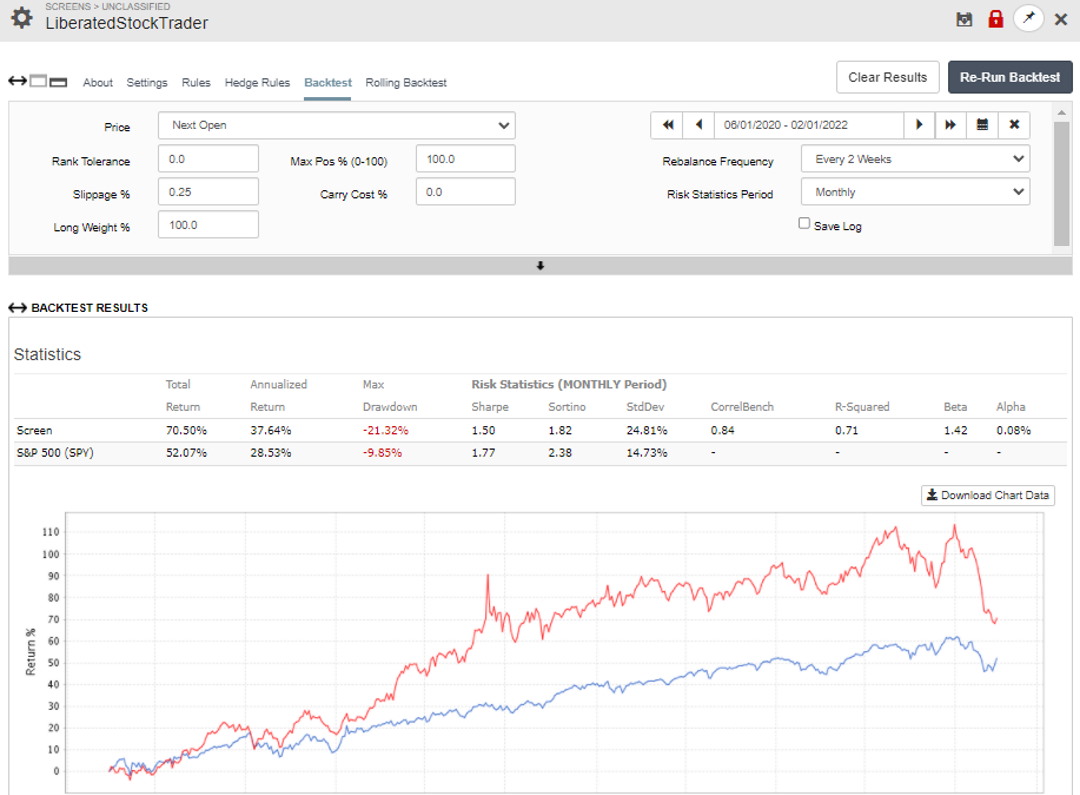

Portfolio123’s backtesting engine is where the software shines. Expertly implemented, fast, and extremely configurable, Portfolio123 has the best backtesting service for people serious about testing fundamental strategies.

Portfolio123 enables you to be very granular in setting up your backtest with entry rules, slippage, weighing, rebalance frequency, and custom timeframes.

The image below shows the LiberatedStockTrader screener I developed in the previous section. I backtested the screener for two years to see how it performed historically. My screener beat the market in this particular timeframe, returning 70.5% versus the S&P500’s 52%.

Portfolio123 has over 76 pre-built screeners that you can import and use. To take advantage of this, you need the Screener subscription plan service. I have personally tested many of them, which are very thoughtfully built. One of my favorites is the “Small Cap Winners” screener.

The Best Trading Scanners

The best stock scanners are TrendSpider, TradingView, and Trade Ideas. TrendSpider is our winner for innovation and easy-to-use power. TradingView enables global market scanning for stocks, Forex, and Crypto. Trade Ideas utilizes 3 AI Bots to scan the market for specific trading opportunities.

The Best Investing Screeners

The best free stock screeners offering the most functionality are Stock Rover for long-term US investors and TradingView for US and international traders and investors. Finviz also has an excellent free stock screener. Stock Rover and TradingView offer the most useful free screening and scanning services.

FAQ

What is a stock screener?

A stock screener is an essential tool for investors allowing them to find stocks that meet specific technical, financial, or quantitative criteria. Stock screeners sort through thousands of stocks to give you a manageable list to research further.

What does a stock screener do?

Stock screeners do the task of finding stocks for investors based on specific investing criteria. Stock screeners save investors time by providing an efficient and effective way to highlight potential stocks that meet their investing strategy requirements.

Are stock screeners good?

Stock screeners are only as good as the person using them. You need to understand what type of stocks you are looking for to use a stock screener effectively. Are you looking for undervalued stocks, dividend stocks, or growth stocks? Each strategy has differing criteria.

What is the difference between a screener and a scanner?

A stock screener enables you to filter stocks based on fundamental financial criteria such as Analyst Estimates, Earnings, Valuation, Cash Flow, and Sales. A stock market scanner will typically scan the market for technical measures, such as a new price high, a price above the moving average, or volume increases.

What is a stock market scanner?

A stock scanner is typically used by day or swing traders using technical analysis to identify short-term trades. Typical market scanning criteria include stock prices, patterns, volume, volatility, and chart indicators like moving averages, RSI, OBV, or MACD.

How to choose the best stock screener?

You should choose a stock screener based on your investing strategy. If you are a long-term growth, value, or dividend investor, then Stock Rover is a good choice. If you are a stock trader, then TradingView is a solid choice. Day Traders should select a scanner like Trade Ideas, which uses AI signals to give you an edge.

What is the point of stock screening?

Stock screening is a critical element in any investing strategy. Whether a day trader scanning the stock market for short-term trading opportunities or a long-term investor screening stocks for profitability, growth, or value, you must choose the right tool for the job.

Why is stock screening important?

Stock screening is a critically important early step in the process of building a stock portfolio. Those steps are: 1. Defining a Strategy. 2. Performing Stock Screening. 3. Research & Stock Selection 4. Purchasing Stocks & Balancing the Portfolio.

What to look for in a stock screener?

When looking for a good stock screener, you must understand your investing strategy. For a value investing strategy, a stock screener needs criteria such as Margin of Safety, Forward Cash-Flow, and Fair Value. An income strategy requires dividend yield, growth, and coverage criteria. For a growth strategy, a screener must have historical financial performance data on price, earnings, debt, and revenue.

Suppose you are day trading or swing trading. In that case, you will need a scanner to filter on technical criteria, such as stock price changes, volatility, volume, and performance, against indicators like MACD, Moving Averages, and RSI.

Do stock screeners work?

Well-designed stock screeners work very well, but unfortunately, many free stock screeners out there perform a very poor job. Our research shows the screeners that work the best are Stock Rover, TradingView, Finviz, Trade Ideas, and MetaStock.

How to use a stock screener?

You can easily learn you use a stock screener by following these steps. 1. Open TradingView. 2. Click on the Stock Screener Tab. 3. Click on Filters. 4. Select Your Criteria, for example, "Exchange = NASDAQ" and "PE Ratio < 25". 5. Review Your List of Fairly Priced Stocks.

What is an example of stock screening?

A good example of stock screening is finding undervalued stocks. A value investor would look for stocks with a Margin of Safety greater than 30%, a positive growing cash flow, and a PE Ratio lower than the industry average. These criteria provide a great example of what stocks value investors purchase.

Are stock screeners free or paid?

Most stock screeners are free to use, but you will need to pay to unlock more filters, features, and benefits. For example, Finviz, TradingView, and Stock Rover are excellent free screeners. But as you become more experienced and your strategies refined, you may want to pay for their premium services.

Are stock screeners worth it?

Yes, stock screeners are worth it because all good investing strategies start with a good stock screener. The three most important tools an investor uses are a stock screener, stock charts, and a brokerage account.

What stock screener should you use?

Our analysis shows that if you are a US value, growth, or dividend investor, you should use Stock Rover. If you are a US day trader, you should use Trade Ideas. If you are a US or international stock trader, then TradingView is a good choice.

What is the best free stock screener?

The best free stock screener for US long-term investors is Stock Rover. The best free screeners for traders are TradingView and Finviz. These free stock screeners offer powerful tools and functionality ideal for finding good potential investments at no cost.

What is the best paid stock screener?

Our research shows that the best stock screener for USA investors is Stock Rover, which provides powerful financial data filters. For international investors, TradingView and MetaStock are excellent choices.

Which stock screener is best in India?

Our research revealed the best stock screeners covering the India Sensex and BSE stock exchanges are TradingView and MetaStock. TradingView's screener covers India and is free. MetaStock Refinitiv's paid service has excellent stock screening, backtesting, and real-time news for all Indian stocks.

What is a good Can Slim stock screener?

Our testing shows there are two good options for finding Can Slim stocks. Stock Rover's stock screener enables you to implement a Can Slim strategy easily. Investors.com is the home of the Can Slim strategy and provides a slick paid screening service.

Does Google have a stock screener?

No, Google does not have a stock screener. Google Finance removed its stock screener over five years ago, and despite a recent redesign and revamp of the site, they have not reintroduced the stock screening functionality. A good alternative to Google's screener is Finviz.

Does TD Ameritrade have a stock screener?

Yes, TD Ameritrade has a basic stock screener with 55 filtering criteria. But compared to our testing of the best stock screeners, TD Ameritrade's screener does not make the Top 10; we recommend Stock Rover as a superior alternative.

What is the gap in stock screeners?

The Gap criteria in a stock screener allows you to filter stocks that have gapped up or down since the last close price. A Gap refers to a Gap in the stock chart price pattern, which indicates a strong buying or selling pressure on the stock. Two of our recommended stock screeners allow Gap screening, TradingView, and Finviz.

What is the best penny stock screener?

The best stock screener for penny stocks is TradingView because it allows you to screen for stock on OTC markets for free. Another good alternative is Finviz for penny stock screening.

What to look for when screening stocks?

When screening stocks for growth, you need to look for stocks that outperform the S&P 500 historically and have strong earnings growth. When looking for value stocks, you should select stocks with a high margin of safety. When looking for a dividend stock, you should seek a stable and consistent dividend yield and payout ratio. Stock Rover is the best US screener for these strategies.

What is the Graham Number in stock screeners?

The price to Graham Number is a conservative valuation measure based on Benjamin Graham's classic formula. The Graham Number is one of his tests for whether a company is undervalued and is computed as the square root of 22.5 times the tangible book value per share times the diluted continuing earnings per share.

Where is the google stock screener?

You might be wondering where the Google stock screener is. Google removed its stock screener over five years ago. Even though Google Finance has improved since 2021, the Google Finance team has not re-established stock screening functionality.

Hmmmm, either you’re not getting around much or you might be playing favourites for fees!?! I can list several other platforms winning awards and/or with sophisticated screening abilities, like Wealth365, IBD, VecorVest, Chaikin Analytics, ChartMill, Gurus, etc. For full disclosure, I do use TC2000, VectorVest, Finviz, and Chartmill for both US and CA stocks. I have commented previously but seems you might be too busy to respond.

Hi Michael, thanks for your input here. I have covered Vectorvest, Finviz, and TC2000 from your list. I will add Chart Mill to my list for testing. Wealth365 looks like a seminar plaform, and Chaikin Analytics seems to cost $5,000 per year for specific stock tips, but will take a look.

When you say Gurus, do you mean GuruFocus? If so I have looked at it. It seems similar to Stock Rover but a lot more expensive and with fewer screening criteria and more restrictions on downloadable data.

I really appreciate your input, and will perform more testing.

Any further input is welcome.

Thanks

Barry

Hi Michael, your review of ChartMill is available here. I quite liked it, a powerful screener and the trading ideas concept was very good. https://www.liberatedstocktrader.com/chartmill-review/

Appreciate very much your research in evaluating the different services. Great reviews; very informative and useful.

Which services are best for identifying sector rotation? Your service covering the major indices seems very useful but you don’t apply it to sectors. Why not?

Stock Rover is the best for sector rotation