Value investing is an investment strategy focused on buying stocks trading at a discount relative to their intrinsic or fair value.

Academic research shows value investing generates lower risk and higher long-term returns than dividend and growth investing.

This workbook explores the realities of value investing and explains how to apply a value investing strategy to your portfolio. We’ll learn how to identify high-quality stocks with undervalued price tags using historical stock returns and market cycles.

What is Value Investing?

Value investing is a school of investment based on the assumption that the stock market does not value a company correctly. Value investors believe they can make a healthy long-term profit by identifying profitable companies that the stock market undervalues.

It involves looking for companies with strong fundamentals and trading at a discount relative to their intrinsic value or the future cash flow they will generate. By buying these stocks at a lower price than they are worth, investors hope to eventually realize profits when the stock market accurately corrects and prices the stock.

Value investing is both a philosophy and an investment strategy. The philosophy is that an asset’s value is its most important characteristic. The strategy is that the market cannot properly value stocks, but well-informed investors can.

Value gurus like Warren Buffett believe most stocks are either overvalued or undervalued.

Try Powerful Financial Analysis & Research with Stock Rover

To determine the real value, value investors usually ignore the stock price and look at the entire company. Value investors will examine a company’s sales data, financial reports, holdings, real estate, patents, intellectual property, research and development, and many other factors.

Value investors dream of finding a good stock that the market dramatically undervalues. Thus, many value investors are bargain hunters seeking the most bang for their buck.

Many value investment strategies emphasize the intrinsic or real value of stocks. A popular value formula calculates the amount of cash a company generates. To determine the intrinsic value, investors examine a wide variety of metrics.

Value investment challenges many modern notions about capitalism. Many value investors reject the efficient market hypothesis and believe the markets are usually inefficient and inaccurate.

Another popular belief of value investors is that investment industry professionals and the media cannot be trusted. These investors think the only reliable information about a company is the financial data. They ignore everything else.

A classic value investing strategy seeks companies with share prices that are far below the intrinsic value per share. Followers of this strategy believe that the stock price will rise over time to reflect the company’s real value.

Most value investors are focused on the company fundamentals, which means they focus on financial reports, income statements, balance sheets, etc. Many investors use financial data to help them estimate intrinsic value. Value investing is often confusing because of the many such financial metrics and calculations.

The value gurus add to the confusion by emphasizing different numbers and factors. Warren Buffett emphasizes future free cash flow as one of the company’s most important criteria. However, Buffett’s teacher, Ben Graham, emphasized the ability of a company to consistently generate dividends for its investors.

Most value investors practice a buy-and-hold investment strategy. In buy and hold, a person purchases and keeps a stock for a long time.

The classic value investing idea is that you will not lose money on a stock that holds its intrinsic value. The usual value investing challenge is identifying low-priced, undervalued stocks with high intrinsic value.

Most value investors can be considered contrarians because they assume popular wisdom about stocks is wrong. A good way to think of value investing is that it believes the market is always wrong.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Ben Graham Value Investing

The British-American investor and economist Benjamin Graham is widely viewed as the father of value investing.

Graham first laid out his principles of value investing in his 1934 textbook Security Analysis. Graham popularized value investing with his 1949 classic stock investing book, The Intelligent Investor.

Both books are based on stock investing lessons Graham and others taught in a popular Columbia Business School course in New York City. The Intelligent Investor first outlined what is now widely viewed as value investing.

The Intelligent Investor teaches Graham’s most influential ideas, including Mr. Market and group investment. Mr. Market was Graham’s characterization of the stock market.

Graham described the stock market as a lunatic named “Mr. Market,” who sold stocks at insane prices. In Graham’s view, the key to making money was to catch Mr. Market when he was selling valuable stocks at low prices.

Graham’s approach is based on the theory that the market is inherently irrational. Mr. Market was Graham’s way of explaining that notion to ordinary people.

One of Graham’s primary teachings is that investors need to evaluate stocks for their ability to make money. Graham’s definition of a good company generates lots of cash. Graham’s definition of a good stock is equity that generates high dividends.

Graham believed that the ability to make money was the only criterion by which to judge stocks. His first rule of investing best sums up his philosophy. When faced with a new stock, Graham asked investors, “Does it make money?”

Graham’s second rule of investing was to “see rule number one.” In Graham’s teaching, the ability to make money is the most important attribute of any investment.

Graham invented what he called the group approach to identify such stocks. In the group approach, you identify criteria for undervalued stocks and search for equities that meet that criteria.

Graham attracted attention for claiming that stocks picked with his group approach gained value at twice the Dow Jones rate. The Dow Jones Industrial Average was the most popular stock index in the 20th Century.

Graham was an active investor who worked on Wall Street for decades. Graham was openly critical of the stock market, most investors, and corporations.

Today, Graham is best known as the primary teacher of his most famous pupil, Warren Buffett. Buffett studied under Graham at Columbia Business School and worked at Graham’s company, the Graham-Newman Partnership, early in his career.

Graham’s influence extends far beyond amateur value investors. Many mutual funds employ Graham’s diversification strategies, group investment, portfolio management, and financial analysis in their stock picking.

The key criteria of a Graham value investment are that a company needs to be cheap and make a lot of money. This simplicity is what makes Graham’s value investing so popular.

Many investment professionals, however, view Graham’s ideas as too limited for today’s complex markets.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Warren Buffett Value Investing

Warren Buffett is the world’s most successful and famous value investor for a good reason.

Buffett is widely admired because he is among the world’s richest people. Most of that fortune comes from stock in his company, Berkshire Hathaway (NYSE: BRK.B). Much of Berkshire Hathaway’s money comes from its stock holdings, which Buffett helps pick.

View this Chart on TradingView

Buffett bases his value investing on Graham’s philosophy but employs different tactics and criteria. Unlike Graham, Buffett is willing to pay higher prices for companies he considers good.

Buffett will buy more expensive stocks that meet his criteria. His portfolio has often contained expensive stocks, including Apple (NASDAQ: AAPL).

Another difference between Warren and Graham is that Buffett will buy large amounts of what he considers good stocks. Buffett’s strategy is to concentrate his investment on moneymaking equities.

When Buffett analyzes a stock, he pays the most attention to its cash flow and assets. Buffett’s core belief is that good companies always have lots of cash.

One difference between Buffett’s approach and Graham’s is the Oracle of Omaha’s focus on growth. Buffett will pay extra for companies like Apple that have healthy growth rates.

Berkshire Hathaway will sell companies with a slow growth rate. In recent years, Buffett sold much of his stake in Walmart (NYSE: WMT) because of that company’s low growth rate.

Another Buffett belief is that investors must keep large amounts of cash. Berkshire Hathaway made headlines for accumulating $122.38 billion in cash and short-term investments in summer 2019.

Buffett teaches that investors need lots of cash to take advantage of opportunities fast. Investors also need cash to cover emergency expenses and to borrow against them.

Like Graham, Buffett is a contrarian famous for his skepticism of the market, the media, investors, and the investment industry. Buffett dismisses investment fads, popular wisdom, professional fund managers, and new technologies.

In recent years, Buffett has become increasingly critical of the wealthy and the American political system. To encourage the rich to give back, Buffett pledged to give 99% of his fortune to charity.

Buffett is a celebrity who has achieved rock-star status among investors. CNN claims over 16,200 people attended Berkshire Hathaway’s carnival-like shareholders’ meeting in Omaha, Nebraska, in May 2019. One highlight of the meeting was a public question-and-answer session where Berkshire Hathaway stockholders could ask Buffett anything.

Buffett’s value investing combines Graham’s philosophy with a contrarian view of the markets and a cynical view of human nature. Buffett likes to tell people to buy companies so simple that “even somebody’s idiot nephew” can run them. The notion is that “somebody’s idiot nephew” will be in charge eventually.

Buffett’s value formula is hard to calculate manually because it emphasizes several divergent criteria.

Unlike most investors, Buffett emphasizes cash flow and growth rate over share price.

Buffett does not take many risks when investing. He invests in stable, simple businesses, including insurance, consumer goods, retail, finance, and media.

Buffett’s methods are not for everybody because of the time it takes to make profits, emphasizing long-term stable profits. Too many people are focused on short-term trading to make money, which is much riskier. Many people, however, swear by Buffett and his investing wisdom.

Research: Value Investing vs. Growth vs. Index Fund Performance

Value investing, growth investing, and index funds are popular investment strategies with unique advantages and risks. This comprehensive analysis aims to compare these strategies based on their performance.

Value Investing Performance

Value investing’s performance can vary significantly. Some studies suggest that value stocks may outperform growth stocks during certain periods 1, while others indicate no superior performance over the national market index 2.

Growth Investing Performance

Several pieces of research indicate that growth stocks have outperformed value stocks over the long term 3. However, there are periods where value stocks have outpaced growth investments.

Index Funds Performance

Index funds’ performance is directly tied to the market index they track. Hence, their success is dependent on overall market performance.

Recommendations for Investors

Investors should consider a balanced approach, incorporating elements from all three strategies. This can mean investing in value stocks with potential, growth stocks for high returns, and index funds for stability and diversification.

In conclusion, while each strategy has merits, the choice largely depends on individual investor goals, risk tolerance, and investment horizon.

Sources:

- When do value stocks outperform growth stocks? Investor sentiment and equity style rotation strategies

- Do value stocks earn higher returns than growth stocks in an emerging market? Evidence from the Istanbul Stock Exchange

- Growth stocks outperform value stocks over the long term

Can You Invest Like Warren Buffett?

Yes, Warren Buffett has been vocal about his investing principles over the years; even his daughter wrote a book called Buffettology about them.

We have distilled it all into our blockbuster article called:

Value Investing Concepts

Most value investors base their decisions on three basic concepts. Each concept is a big idea that underlies the value-investment philosophy.

Three major value investing concepts are:

Intrinsic Value

Intrinsic value is the price of a business calculated through fundamental analysis of a company’s assets and cash flows.

A classic formula for intrinsic value is the market value of a company’s assets added to its cash flows. Buffett value investors ignore a company’s share price when valuing it.

Instead, Buffett values the companies he invests in as if he were buying the entire business for cash. Once these investors calculate intrinsic value, they compare it to the share price and market capitalization. If the intrinsic value is substantially higher than the market capitalization, you can consider the company a value investment.

Buffett arrives at an intrinsic value by studying financial numbers and researching a company’s business model and competitors. For instance, Berkshire Hathaway could compare a company’s products and sales to those of its competitors.

A simple definition of intrinsic value is the cash value of everything a company owns. A slightly more complex estimate will include cash flows or projected cash flows.

Most value investors use several methods of analysis to arrive at intrinsic value. There is no single best formula for intrinsic value. Instead, investors usually base intrinsic value on the calculation that best fits their belief of what makes a great company.

Margin of Safety

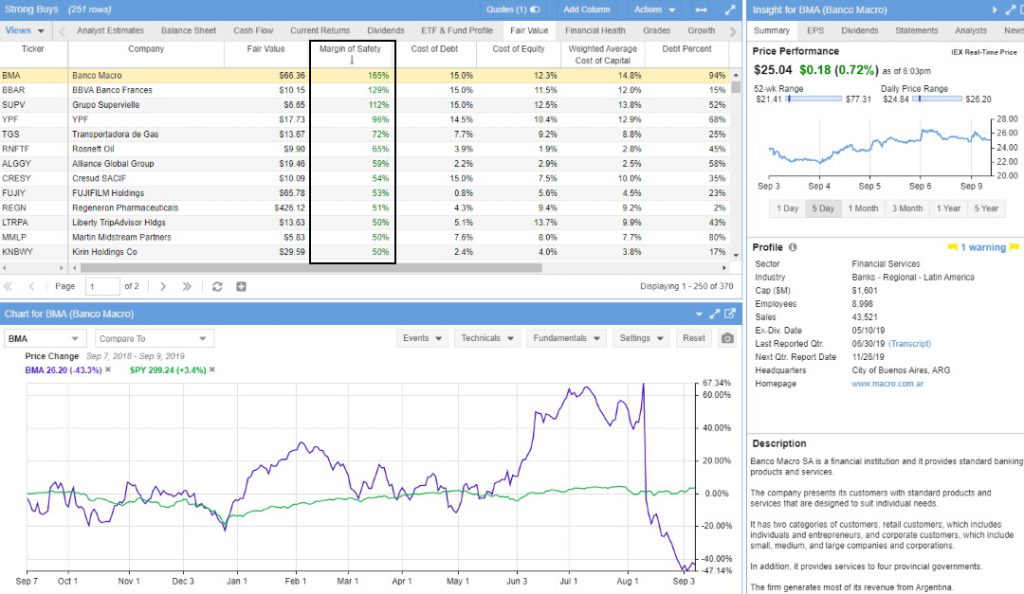

The margin of safety is the difference between the share price and a company’s intrinsic value.

In classic value-investing theory, the margin of safety is the level of risk an investor can live with. The margin of safety estimates the risk a stock buyer takes.

Warren Buffett describes the Margin of Safety like this:

“If you understood a business perfectly and the future of the business, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger the margin of safety you’d need. If you’re driving a truck across a bridge that says it holds 10,000 pounds and you’ve got a 9,800-pound vehicle if the bridge is 6 inches above the crevice it covers, you may feel okay, but if it’s over the Grand Canyon, you may feel you want a little larger margin of safety…”

The Margin of Safety is the percentage difference between a company’s Fair Value and stock price. This is the most significant valuation metric as it is the final output of a detailed discounted cash flow analysis.

A person who pays $300 per share in a company with a low intrinsic value of $200 takes a big risk. Somebody who pays $25 per share in a company with a high intrinsic value of $50 is taking a much lower risk.

In this case, the Margin of Safety is 50%.

Get Stock Rover – The Best Software for U.S. Value & Growth Investors

The Margin of Safety Calculation

Margin of Safety = (Intrinsic Value Per Share – Stock Price) / Intrinsic Value Per Share.

Margin of Safety: (50-25)/50 = 50%

Another name for the margin of safety is the break-even analysis, which measures the share price at which you can profit from a stock.

Ben Graham and David Dodd created the term “margin of safety” in Security Analysis. Today, the Margin of Safety is one of the key concepts of value investing.

All value investors need to understand that the margin of safety is only an estimate of a stock’s risk and profit potential. Fundamental analysis cannot estimate many risks, including politics, regulatory actions, technological developments, natural disasters, popular opinion, and market moves.

The margin of safety you use is the level of risk you are comfortable with. If you are risk-averse, you will want a high margin of safety. A risk-taker, however, could prefer a low margin of safety.

Fundamental Analysis

They call the most common method value investors use to value a company “fundamental analysis.”

Classic fundamental analysts examine the qualitative and quantitative factors surrounding a company. Those factors can include economic conditions, finances, market conditions, the political environment, the regulatory environment, technology, and the industry’s overall state.

Fundamental analysis seeks to ascertain the risks a company is taking and its capacity to make money. Both value and growth investors use fundamental analysis.

Value investors focus on a company’s ability to make money. Growth investors look at a company’s capacity for future growth and stock price appreciation. A value investor could look at the company’s cash flow, while a growth investor will examine its research and development, sales growth, and earnings per share (EPS) growth.

To understand value investing, you need to understand fundamental analysis, intrinsic value, and margin of safety. Not all value investors use these concepts. Buffett will purchase stocks he likes, even if the market price exceeds the fair value margin.

Investors need to understand these concepts are theoretical guidelines and not concrete rules. Many stocks will make money but violate some value investing concepts.

9 Ways to Find Value Stocks

There is no universally best method of valuing a company in value investing. Value investors, instead, use a variety of valuation methods.

Some popular methods for valuing a company in the fundamental analysis are listed next.

Book Value

To a classical value investor, book value appraises all a company’s assets. A good definition of book value is anything the company can sell for cash now. Book value assets include real estate, equipment, inventory, accounts receivable, raw materials, investments, cash assets, intellectual property rights, patents, etc. Disney’s (NYSE: DIS) book value includes the land on which its studios and theme parks sit. Disney’s book value also includes its vast library of films, TV shows, and all the characters and stories Disney owns.

Tangible Value

Tangible value is the potential value that investors can easily calculate. A good example is the market price for equipment or real estate.

Tangible Book Value

Tangible book value or tangible equity measures a company’s value that excludes all intangible assets. It could include only physical assets and cash investments.

Intangible Value

A company’s intangible value is the money it could theoretically make from assets. Intangible assets can include patents, trademarks, business plans, strategies, customer goodwill, fictional characters (in the case of Disney & Marvel), franchises, and research and development capabilities. A good rule of thumb is that an asset is intangible if there is no guarantee it will make money.

Enterprise Value

Enterprise value is the company’s total value, including market capitalization. It is the price another company could pay for a corporation. A classic formula to calculate enterprise value is market capitalization plus assets plus cash and equivalents minus debt.

Franchise Value

The franchise value is a company’s name or reputation. The idea is that a good name or reputation will increase a company’s value, sales, and cash flow. Apple has a high franchise value because of its reputation for making dependable, innovative, and high-quality products. This enables Apple to charge higher prices and sustain high profit margins while maintaining a loyal customer base.

Dividend Value

The dividend value or yield is the amount investors can make from a company’s dividends. They usually calculate dividend value by subtracting the annualized payout from the share price. The annualized payout is the dividends generated by a share of stock in the past year.

Negative Enterprise Value

A company has a negative enterprise value when the cash on the balance sheet exceeds its market capitalization and debts. Value investors look for negative enterprise value because it indicates Mr. Market is undervaluing a company.

Net Current Asset Value Per Share (NCAVPS)

NCAVPS was one of Benjamin Graham’s tools for valuing a stock. You calculate the NCAVPS by subtracting a company’s total liabilities from its current assets. Graham considers preferred stock a liability. The idea is to learn how much money a company will have left after it sells all the cash assets and pays all obligations.

There is no perfect method for valuing a company. Most value investors have a favorite method, but their choices often reflect preferences or prejudices rather than results.

It is best to test and use all the methods and find the one you are most comfortable with.

Value Investing Strategy

Value investing is ultimately a matter of strategy. Thus, we can think of value-investment masters like Buffett and Graham as strategists.

Buffett’s strategy is to look for growing, high-quality companies that generate large amounts of cash. The Graham strategy is to seek stable, low-priced companies that generate lots of cash.

Graham and Buffett ultimately diverged a little in their strategies. Graham’s strategy was diversification, which involved buying several stable stocks to create a high margin of safety.

Buffett uses a concentration strategy in which Berkshire Hathaway (NYSE: BRK.B) buys as much of a good company’s stock as possible, preferably to own the company outright. Buffett considers cash flow, growth, and the margin of safety important. Graham considered the margin of safety the most important aspect of value investing.

In Buffett’s strategy, cash flow is a tool for growth. A cash-rich company can afford to upgrade its technology, expand into new markets, develop new products, increase marketing, and borrow large amounts of money. Thus, a cash-rich company is more likely to grow.

Building the Best Buffett Stock Screener for Value Investing

One of Buffett’s conclusions is that a company is unsafe unless it grows. To ensure growth and cash flow, Buffett designed the strategy of buying growing companies.

Graham designed his strategy to create a wide margin of safety by spreading the investment over many stocks. Buffett’s strategy generates cash by concentrating investment in cash-rich companies.

Dividend Value Strategy

Graham and Buffett use dividend value because it ensures a steady cash flow. The difference is that they use dividend values differently.

Graham strategists view a high dividend yield as a means of increasing the margin of safety, while Buffett strategists see it as cash they can use to fuel future growth.

Franchise value is key to the Buffett strategy but ignored in the Graham strategy. Buffett will pay more for companies with strong franchises because he thinks strong franchises make more money.

Graham strategists view a company’s share price as a more important metric than its franchise value. In their worldview, the share price can tell whether a company is overpriced or underpriced.

Graham strategists consider share price a measure of the margin of safety. In this world, the higher the share price, the smaller the margin of safety.

Under the Buffett worldview, the share price has no relation to the company’s true value. Buffett considers the franchise value a better indicator of a company’s true value. In Buffett’s world, the higher the franchise value, the more money the company can make.

The Strategy of Market Irrationality

Both Buffett’s and Graham’s strategies try to capitalize upon market irrationality.

Graham’s strategy is based on the idea that the market is often grossly under-priced good stocks. A popular view of Graham investors is that investors pay less for stocks they dislike and boring stocks.

Another of Graham’s ideas is that investors pay more for stocks they like, even if they make less money. Modern value investors use the slang of sexy and unsexy stocks.

Value investors believe people pay more for attractive, fashionable, or “sexy” stocks. Therefore, many value investors look closely at unattractive, boring, unfashionable, or “unsexy” stocks. These people seek good stocks that the market does not appreciate.

For instance, a Graham value investor could buy an oil company instead of a tech stock. The oil company is old-fashioned, boring, and offensive to some people, but it makes money. The tech company is attractive and flashy but could make no money.

Market irrationality partially explains Graham’s question: “Does it make money?” Graham investors often look at the balance sheet and ignore the business.

Buffett thinks that popular opinion and the media create market irrationality. Buffett watches the news and looks for bad news about good companies.

The idea behind this strategy is that news reporting is usually shallow, superficial, and concentrated on one aspect of a company’s business. Buffett will sometimes buy companies after a well-publicized scandal.

Despite a scandal at that company, Berkshire Hathaway (NYSE: BRK.B) kept large holdings of the banking giant Bank of America (NYSE: BAC). The public turned on Bank of America after news reports alleged some employees were writing fake loans to get commissions.

Buffett kept Bank of America because the bad loans came from one small piece of its business. Buffett hoped the bad news about Bank of America would fade, but the company could keep making money.

Another key idea in Buffett’s market irrationality strategy is that the media does a bad job of reporting on companies. Buffett bets that most financial news about companies will be inaccurate, limited, short-sighted, biased, and incomplete.

Buffett tries to capitalize on that lack of information by having more information than the rest of the market. Buffett reads financial reports instead of newspapers and blogs because he thinks financial data gives him an edge over other investors.

Buffett assumes that most investors value companies poorly because they rely upon inaccurate media reports. Uncle Warren’s strategy is to find more accurate information and base his decisions on that information.

Diversification Strategy

The most popular value investing strategy is diversification, designed to create a high margin of safety.

Diversified investors assume most people make poor stock choices. The diversified investor tries to counter the poor stock choices by buying various stocks that meet his criteria.

A diversified investor seeking dividend income will buy high-dividend yield stocks in several industries to create safer cash flow. A diversified investor who seeks franchise value will buy stocks in companies with high franchise values.

Buffett buys a variety of growing cash-rich companies to create high cash flow. Buffett hopes that Berkshire Hathaway (NYSE: BRK.B) will always generate some cash from its many businesses.

Understanding the strategy is the key to learning value investing. All good value investors are good strategists. The ultimate goal of a successful value investor is to design and implement a successful value investing strategy.

Simplifying Value Investing

The truth is that today, value investing and dividend investing are a lot easier due to the power of the internet and web-based service providers that do the hard work and calculations for you.

Excel spreadsheet calculations are a thing of the past, as serious computing power enables you to scan an entire stock market for your exact value investing criteria in seconds when you find potential new investments.

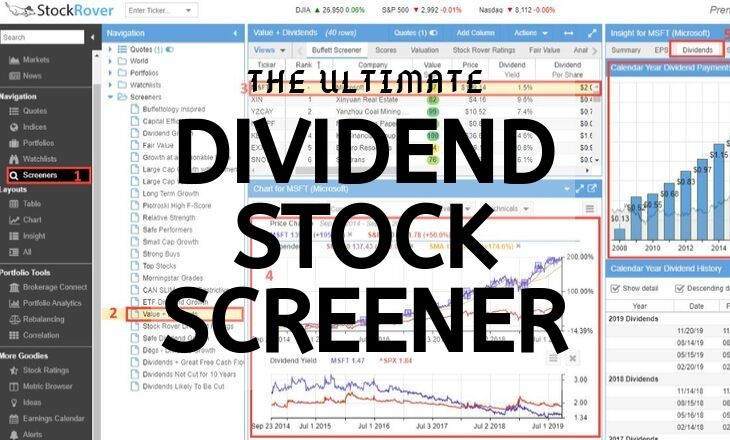

From our thousands of hours of testing, there is only one choice for value investors: Stock Rover, winner of our Best Value Investing Stock Screener Review, and joint winner of our Top 10 Best Stock Analysis Software Review.

Value Stock Screening To Build Your Portfolio

We have several practical guides written and tested to enable you to follow simple steps to build your value portfolio.

Value Stock Screening Strategy & Practical Steps

4 Easy Steps To Build A Buffett Stock Screener

- Understand What Financial Metrics Buffett Looks For In Stocks

- Implement Those Metrics Into A Stock Screener

- Understand How Buffett Evaluates The Business & Industry

- Select The Stocks From Your Screener & Invest In Them

Dividend Stock Screening Strategy & Practical Steps

Our guide to building a great dividend stock screener highlights six steps.

6 Simple Steps To Build The Best Dividend Stock Screener

- Select Your Dividend Stock Screener Software

- Choose Your Dividend Investing Strategy

- Select or Build Your Dividend Screener

- Investigate and select Dividend Stocks for Your Watchlist

- Perform Further Deep Research & Comparisons

- Purchase Stocks & Maintain Your Portfolio

Long-term Proven Success

The biggest advantage of successful value investing is the capacity to make solid profits over time. Market data shows how Warren Buffett uses these advantages at Berkshire Hathaway (NYSE: BRK.A).

According to the Liberated Stock Trader’s Stock Market Statistics, the stock market has never lost money over the past twenty years.

Sometimes, value investments can lead to dramatic revenue growth. Berkshire Hathaway’s annual revenues grew from $81.66 billion in 2005 to $251.44 billion in 2018, Macrotrends estimates. This is a 17.5% average annual growth.

The revenue growth paid off for Berkshire Hathaway’s shareholders in the form of astounding Market Capitalization growth. Berkshire Hathaway’s market cap grew from $135.89 billion in April 2005 to $524.22 billion in September 2019, a stock price growth of over 20% per year.

Berkshire Hathaway shows that value investors can make money if they have patience.

The Simplicity of Value Investing

People often ignore one of value investment’s greatest advantages. That advantage is simplicity.

The complexity of many investment systems can frighten even intelligent people away from the markets. However, classic value investing systems like Graham’s and Buffett’s are easy to understand.

They base most value investing systems on a few simple principles, which makes it easy for ordinary people to grasp those strategies. Almost anybody can understand Graham’s rule: “Does it Make Money?”

Plus, Graham’s concepts, like those of Mr. Market, successfully teach investing philosophies to ordinary people. Mr. Market’s character is an insane salesman who sometimes peddles a new Porsche for $100 and occasionally tries to sell junk cars for $100,000.

Through Mr. Market, Graham teaches that the market is irrational and impossible to comprehend. Yet Graham shows how anybody can take advantage of Mr. Market’s lunacy.

People who observe Mr. Market can find bargains and make money. Using a simple system means there is less that can go wrong.

Buffett also uses simple strategies anybody can understand. He famously refuses to invest in any company or instrument he does not understand. For instance, Berkshire Hathaway did not start investing heavily in tech stocks until recently. By using this rule, Buffett avoids unknown risks and steers clear of markets beyond his expertise.

Cash Flow

The second advantage of value investing is the emphasis on cash. Value investors may sometimes make less money than speculators, but they are more likely to have cash in their pockets, e.g., generated from Dividends. Also, speculators are essentially gambling, which means that the risks are higher and more likely to be wiped out. Long-term value investors usually always win.

Cash is real money, money you can spend. Cash flow measures the amount of cash a company has in its business.

Monitoring a company’s cash flow shows you if the corporation is making money.

You can see how much money the company keeps by comparing the cash flow to metrics like debt, expenditures, revenues, net income, and operating income. People who watch the cash flow can spot cash-rich businesses and exploit them.

Watching cash flow can help you avoid buying into companies that make a lot of revenue but retain little cash. Companies with much revenue but little cash often have high expenses and debt. Those companies often fall into the death spiral because they run out of cash.

Margin of Safety

Most value investors emphasize the margin of safety. This means value stocks can be safer than other stocks.

Value companies are more likely to have cash, which means they are less likely to collapse during economic downturns. Some value companies can expand and grow in a bad economy because they have the cash to buy ailing competitors.

There is no such thing as a safe investment, but the margin of safety provides an extra layer of protection. Diversification can enhance that layer.

The margin of safety can make value investments a better choice for average inv who have little extra money.

Lower Transaction Costs

Many people forget that adopting a long-term value investing strategy lowers costs or “leakage.”

For example, a speculative day trader will buy and sell stocks daily; if your broker charges you $5 per trade and you buy and sell thrice daily, you may incur transactional costs of $6,000 per year. If you are a value investor with ten stock holdings and buy and sell half of your holdings once per year, you will only have transactional costs of $50. This means you would have $5,950 more to invest.

There are some serious risks to value investment. Value strategies can limit your moneymaking capacity and increase some risks. Plus, some value investors can get overconfident and miss opportunities and dangers in the market.

Many value investors miss out on profitable stocks by sticking to their strategies. The Associated Press reports that Warren Buffett calls himself an “idiot” for not buying shares of Amazon (NASDAQ: AMZN) years ago.

Buffett refused to buy Amazon until 2019 because it did not meet his value criteria. By failing to buy Amazon before 2019, Berkshire Hathaway missed out on vast amounts of share value. Amazon’s market cap grew from $13.57 billion in April 2006 to $884.52 billion in September 2019, Macrotrends estimates.

Buffett still made money from his other investments but could have made more if he owned Amazon. By being risk-averse, Buffett cost himself and Berkshire Hathaway shareholders money.

The greatest disadvantages to value investing are those that can destroy any investor. Those weaknesses are overconfidence and complacency.

Many value investors think their holdings are immune from market forces and ignore the market and news. This mistake can hurt you in two ways. First, you can miss opportunities in the market, like new businesses or sexy stocks. Second, market forces and competition can destroy the value of even the best stocks.

The Value Trap

Complacent value investors often fall into the value trap. The value trap is a stock that looks like a great value investment on paper but is not.

An example of a value trap is a company with high cash flows and shrinking revenues. The shrinking revenues show the company’s business could be dying, but the cash attracts value investors.

The company could have a high cash flow because management refuses to modernize equipment, develop new products, undertake research and development, expand into new markets, or market its products. This means there could be no opportunities for growth. The company is relying on older markets, which could shrink.

The value trap springs when the company’s cash flow shrinks. In extreme cases, the company can suddenly run out of money and collapse.

Other value traps include companies with lots of assets and shrinking revenues. Such companies can have high cash flows because management sells or borrows against assets. Most value traps have a low share price. However, Mr. Market can overvalue the cheapest stocks.

A classic value trap can be an older company with much franchise value. Such a company can be a value trap if management does not take advantage of the franchise. For example, management could fail to introduce new products or enter new markets.

The value trap springs because investors become overconfident about seeing the value. No value investment is permanent or perfect, and many value investors forget that because they think their strategy is bulletproof.

Value Investing eBook/PDF Download

Click this link to download and open the Value Investing, Strategy & Screening Guide eBook PDF.

Summary

Value investing is still one of the best stock market investing strategies for independent investors. However, it is not foolproof. You can fail at it and lose money. Only those who work hard to understand value investing can make money.

Only persons willing to commit to doing the work and study needed for successful value investing should attempt it.

FAQ

What software is best for value investors?

The best software for value investing is Stock Rover. I use Stock Rover for all my value investing strategy development, research backtesting, and portfolio management. My original research on growth and value strategies is all conducted with Stock Rover.

Does value investing beat the market?

Yes, research by Fama & French revealed that value investing tends to outperform the market over the long term. However, it's important to note that a value investing strategy may underperform in some years.

Does value investing still work?

Yes, despite periods of underperformance, value investing continues to be a viable strategy. It requires patience and rigorous financial analysis using Stock Rover but has shown potential for high returns over time.

How does value investing work?

Value investing involves identifying stocks that are undervalued compared to their intrinsic value. This requires comprehensive financial analysis and the patience to wait for these stocks to appreciate.

How to do value investing?

To practice value investing, you must screen for value stocks, understand financial statements, identify undervalued stocks, and wait for the market to realize their true value.

How do you find good value investing stocks?

Finding value stocks requires a deep dive into a company's financials. Look for low price-to-earnings (P/E) ratios, strong dividend yields, a high margin of safety, and solid cash flows.

What software is best for margin of safety and fair value?

Stock Rover is the best software for managing value and growth investing using criteria like margin of safety, intrinsic value, and fair value; it is the complete solution for long-term investors.

Is systematic value investing dead?

No, systematic value investing is not dead. There may be periods where it underperforms, but it's a proven strategy for long-term investing, as proven in Eugene Fama's research.

Is value investing still relevant?

Yes, value investing remains relevant. Despite short-term fluctuations and falling in and out of fashion, it still offers a disciplined, systematic approach that can yield solid returns over time.

Is value investing worth it?

The worthiness of value investing depends on individual investor goals and risk tolerance. It can be very rewarding for those who are patient and willing to conduct thorough financial analysis.

Is value or growth investing better?

Neither strategy is inherently better; both have their merits and drawbacks. While growth stocks might excel in bull markets, value stocks outperform during bear markets and economic recessions.

What is a value trap in investing?

A value trap is a stock that appears to be cheap but is actually fundamentally poor. It's a risk for value investors who might be lured by the seemingly undervalued price.

What is relative value investing?

Relative value investing is a strategy that seeks to identify assets and investments where the relative prices of related securities are out of sync to take advantage of any mispricings. It often involves buying assets that are undervalued or selling those that are overvalued.

Why does value investing work?

Value investing works because it capitalizes on market overreactions, buying stocks when they're undervalued and selling when they reach their intrinsic value. It is the ultimate buy low, sell high strategy.

Did Eugene Fama support value investing?

Yes, Eugene Fama was a firm supporter of value investing. In his 1992 paper discussing "the efficient market hypothesis," he concluded that "value stocks tend to outperform growth stocks in the long run." He further argued that these outperformance results may be because markets overreact to new information and follow trends, leading to mispriced securities.

Do a lot of people follow value investing?

Yes, many people follow value investing. Warren Buffett is one of the most famous proponents of value investing, and his strategies have produced massive returns for himself and his investors over time. In addition, numerous hedge and mutual funds utilize value investing to generate consistent returns.

What makes value investing so attractive?

Value investing appeals to investors because it is a low-risk strategy that seeks to identify stocks that are trading at a discount and take advantage of them. If the stock does not perform as expected, the investor can easily exit their position without taking too much of a loss. In addition, value investing allows investors to purchase stocks with strong fundamentals before the market realizes.

Does Buffett still think value investing works?

Yes, Warren Buffett is still a strong believer in value investing. He often cites Benjamin Graham's "intelligent investor" principles as the foundation of his investment philosophy. He has said that he does not invest in anything he does not believe to be undervalued.

Does value investing still make sense?

Yes, for patient investors who understand financial analysis, value investing can make a lot of sense and potentially offer high returns.

Does Value Investing Beat the Market?

Yes, value investing beats the market, but only over long periods of time. Warren Buffett's value investing company Berkshire Hathaway has returned an average 23% per year over the last 30 years. The S&P 500, has averaged 9% year-on-year.