Portfolio management is an essential aspect of successful investing. It involves the management and optimization of an individual’s investments to achieve their financial goals. A well-managed portfolio can help investors maximize returns, minimize risks, and maintain a balanced allocation.

Effective stock portfolio management involves seven key tasks: research, performance analysis, rebalancing, correlation assessment, future income planning, tax benefit optimization, and forecasting performance.

These tasks may seem daunting at first, but with the right approach and tools, anyone can become a successful stock investor.

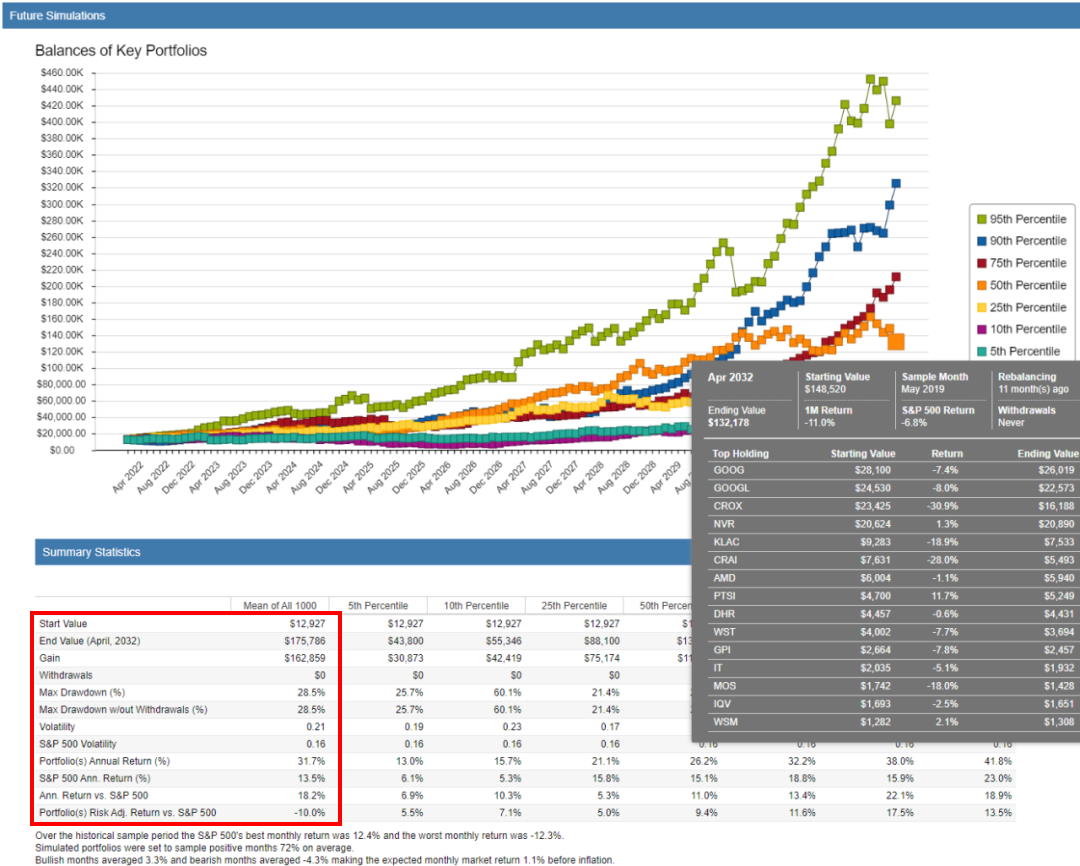

A final advanced portfolio management task is to test future portfolio performance using Monte Carlo simulations.

How to Manage a Stock Portfolio

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.

To demonstrate how to manage a portfolio, I will use Stock Rover, a leading stock screening and portfolio management service, because it is the best tool for these tasks.

1. Perform Ongoing Stock Research

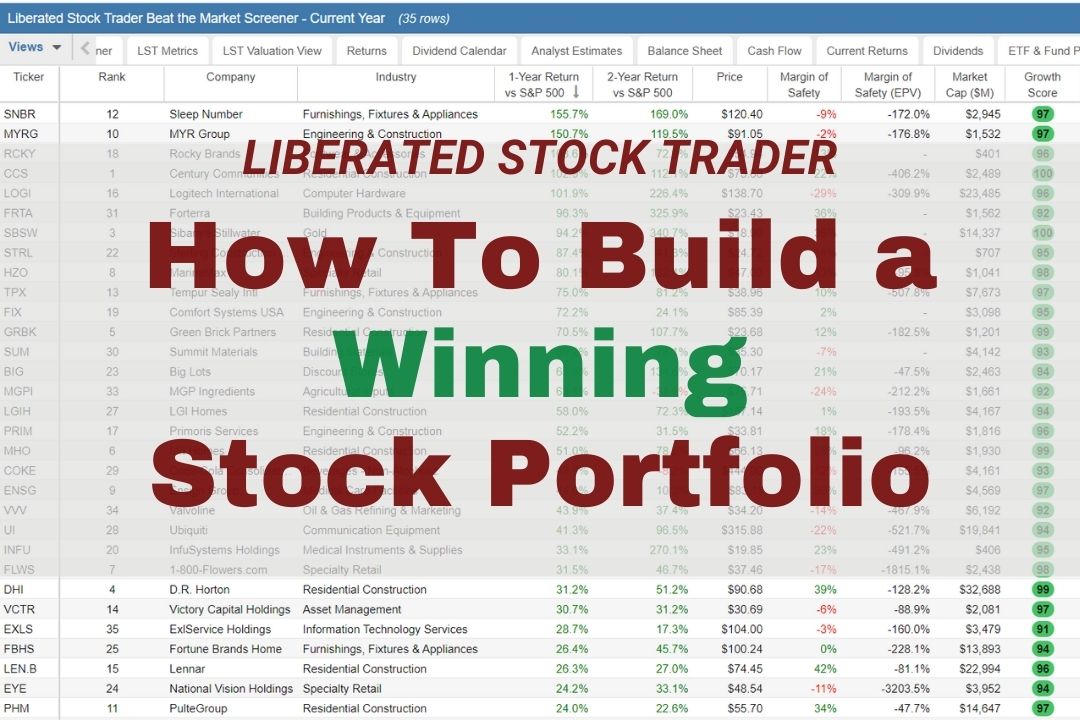

Having built your stock portfolio, you must regularly review the performance of the companies you own to ensure they still meet your selection criteria. For a value stock portfolio, the criteria might include a margin of safety above 30%; for a growth stock portfolio, the criteria might be an annual earnings growth of more than 20%. You may also want to read the highlights of the quarterly earnings report to ensure you still have confidence in your stock selection.

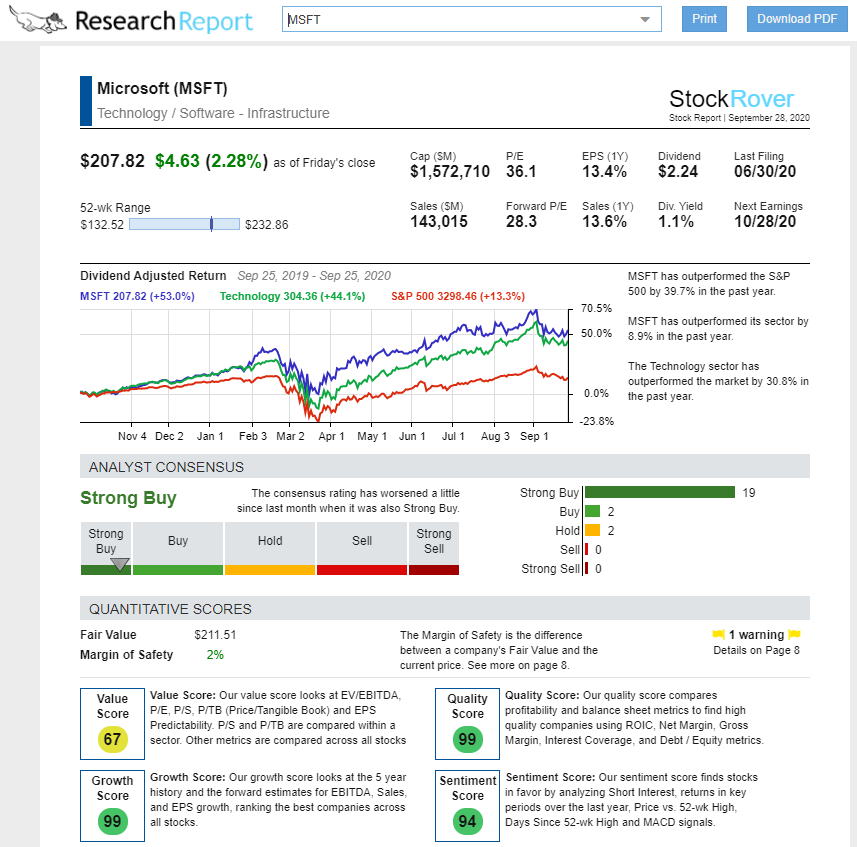

The team at Stock Rover makes this job much easier by providing on-demand, real-time research reports on all US-listed stocks. With stock Rover Research Reports, you do not need to wait until the company’s annual earnings reports; they are always up-to-date.

Get A Free Stock Rover Research Report

The Stock Rover research report creates something new: a human-readable real-time research report highlighting a company’s competitive position, market position, and historical and potential dividend and value returns. The image above shows the dividend-adjusted commentary on Microsoft, a company I invested in because I found its excellent potential using my Buffett Stock Screener.

To help you effectively analyze company reports and financials, here is a list of tools specializing in stock research.

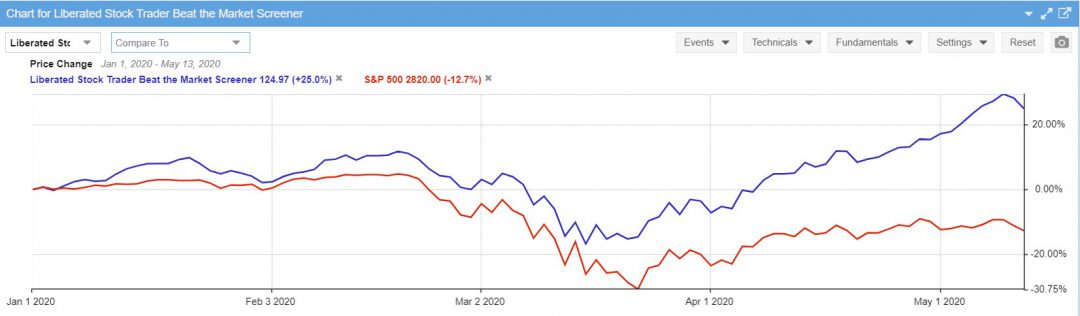

2. Analyze Portfolio Performance

A key task when managing your portfolio is to ensure it maintains solid performance that is in line with your expectations and preferably ahead of current market performance.

But what is good portfolio performance, 5%, 8%, or 10% growth annually? The answer is that any portfolio matching or exceeding the performance of the S&P500 (or a comparable country broad market index) in any given year is deemed a high-performing portfolio.

If the S&P500 grows by 20% in a year, your portfolio should also grow at least 20%. If not, you can invest in an S&P500 index-tracking ETF and save yourself the time and effort of actively managing your portfolio. You will need something that most discount brokers do not provide: detailed portfolio analytics.

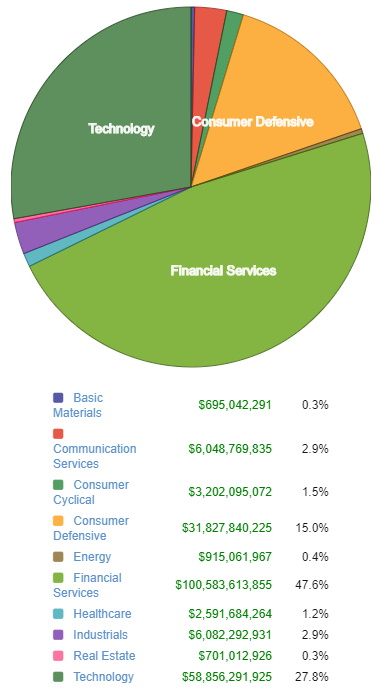

The image below details the reporting and analytics available in Stock Rover. You can see the percentage of your portfolio in each sector and industry and the dollar amount of the investment.

In this example, I used the Berkshire Hathaway Watchlist available in Stock Rover to perform a portfolio analysis of the company’s assets. We can see that Buffett and Berkshire are highly invested in technology and financial services. I guess Warren Buffett is not focused on diversification, as most people believe, but on concentration.

If your portfolio does not meet your expectations, you must investigate stock holdings to identify what is causing the underperformance.

3. Rebalancing a Portfolio

Rebalancing the weighting of stocks in your portfolio is a regular task that can be revisited quarterly or annually.

Some stocks grow faster than others, meaning that they will consume a larger percentage of your overall investment than was typically desired at the portfolio’s inception.

For example, if you want to maintain a 5% per stock weighting in your portfolio, a single stock (Microsoft Corp, for example) has grown to consume 10% of the portfolio. You might want to rebalance by selling some Microsoft shares and purchasing other stocks.

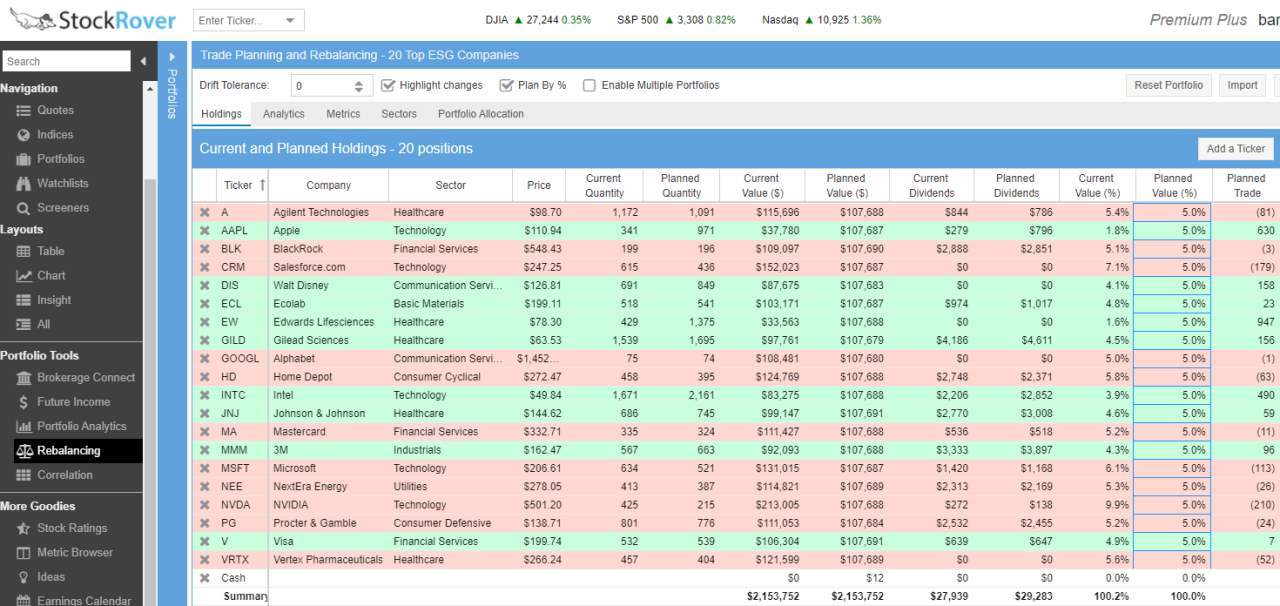

Stock Rover has built-in portfolio rebalancing. It can connect to your brokerage account, perform a detailed portfolio analysis, and suggest which stocks to buy and sell based on your weighting and rebalancing criteria.

Let Stock Rover Help You Build & Manage Your Portfolio

Here, I have run a portfolio rebalancing report in Stock Rover, which enables me to see what actions I need to take to maintain a balance of 5% per stock. It informs me of how many stocks I need to buy and sell for each asset owned.

4. Execute Portfolio Correlation Analysis

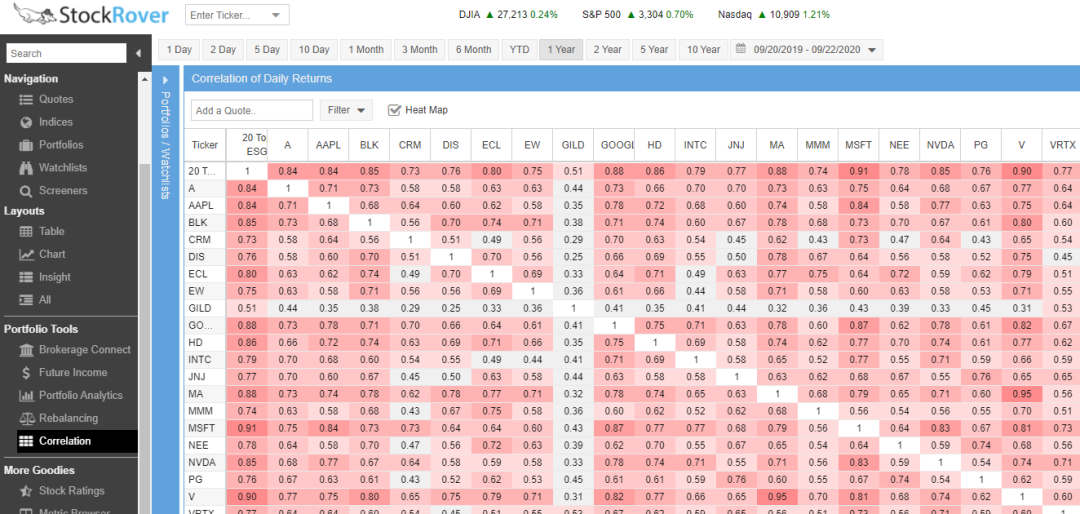

Analyzing portfolio correlation is a key task that professional portfolio managers perform. Modern Portfolio Theory is a well-established concept that proves a portfolio with uncorrelated assets can produce outsize, stable returns and lower risk.

Portfolio correlation is an interesting concept that many portfolio managers like to discuss at length. Essentially, a correlation analysis compares every stock against each other to assess how correlated they are.

If you follow a strictly diversified portfolio concept, you may want to invest in loosely correlated stocks. A loose correlation means that two stocks move independently of each other, while a tight correlation means they move mostly in a synchronized pattern.

I ran a correlation report for one of my portfolios using Stock Rover. In the screenshot below, the red cells represent a higher correlation. A correlation of 1.0 means two assets move in perfect synchrony.

The key rule of thumb for portfolio correlation is that you achieve the goal of loose correlation when most of your portfolio correlates with less than 0.7.

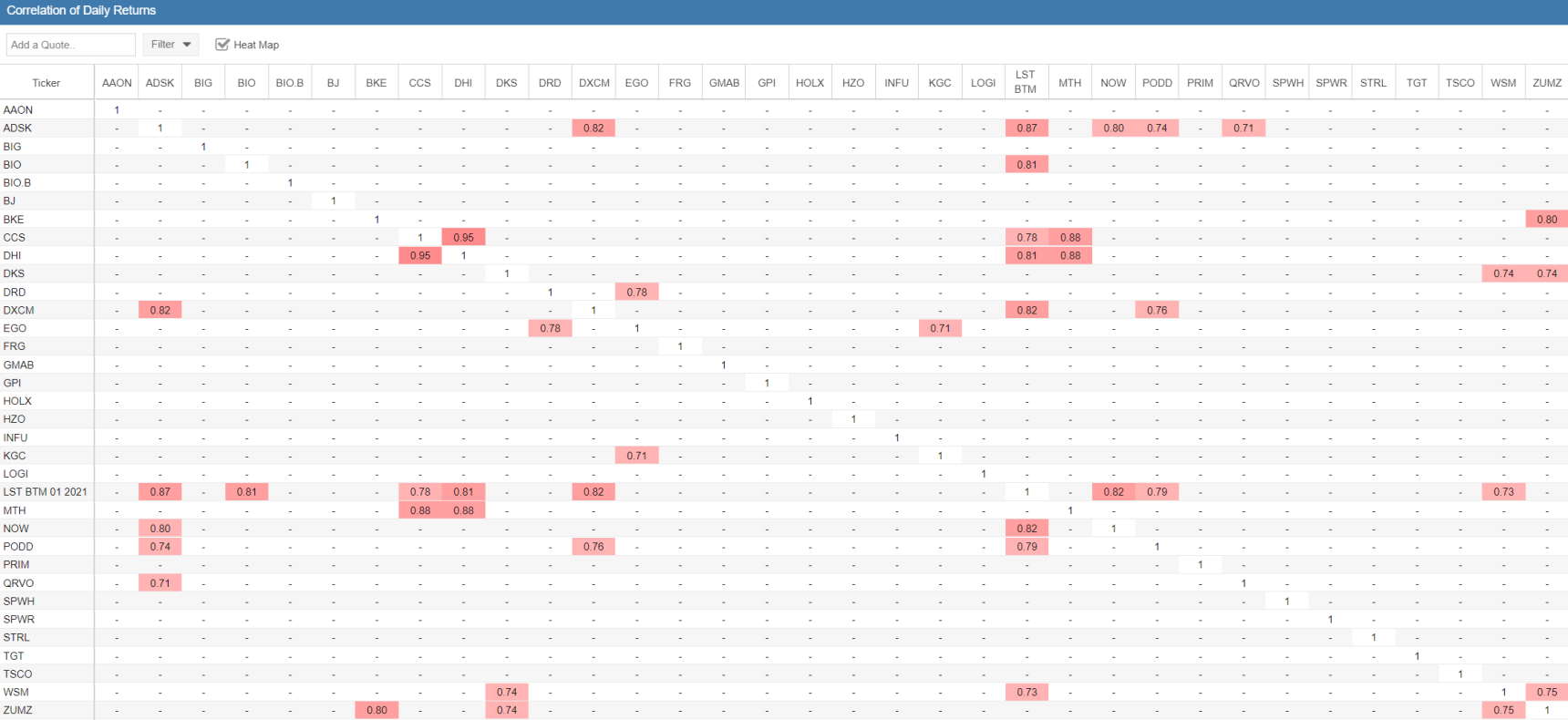

With Stock Rover, I now perform a correlation analysis on my Liberated Stock Trader Beat the Market System and filter the report to show only correlations above 0.7. The screenshot below shows the results of the analysis.

Let Stock Rover Help Diversify Your Portfolio

I work with Stock Rover and enable my Beat the Market system for their Premium Plus subscribers. A Stock Rover vice president contacted me to tell me that he was impressed that the system beats the market because the portfolio has such a low correlation.

5. Plan For Future Portfolio Income

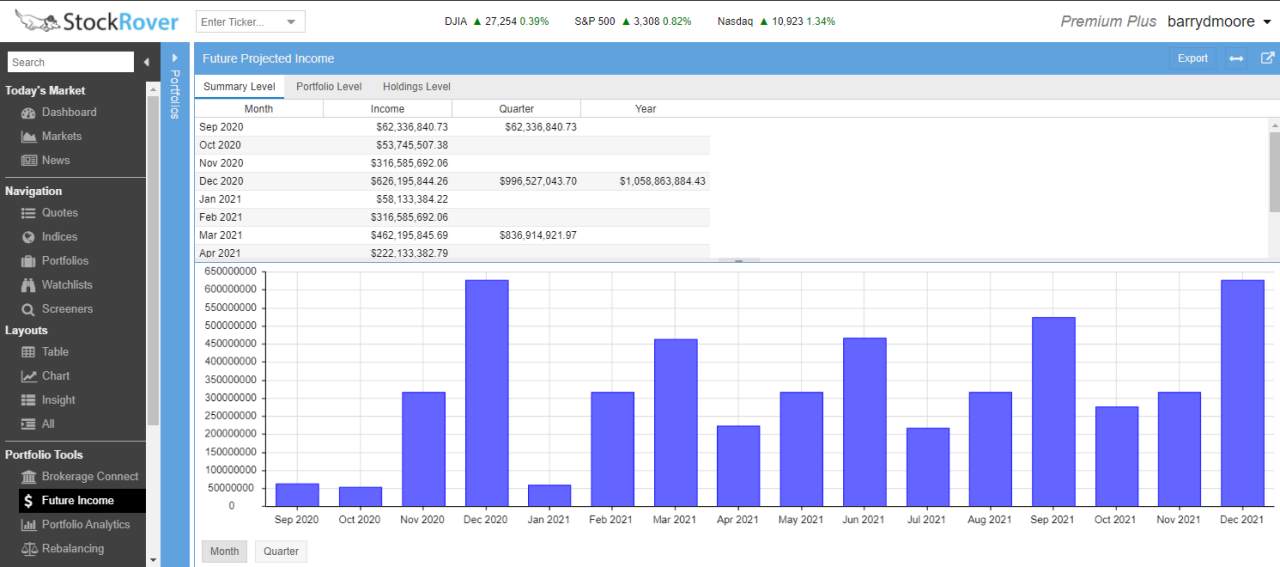

When managing your portfolio, especially an income portfolio reliant on dividend payments, you will want to predict exactly when and how much you will earn in dividends. These reports enable you to plan for future income to support your life or plan for reinvesting those dividends.

The future income tool in Stock Rover allows you to project and predict your expected dividend payments. It also lets you assess whether the predicted income meets your expectations. If you build an income portfolio and the expected dividend earnings are only 1%, this is a poor portfolio.

I have developed numerous strategies for building high-performing dividend portfolios using Stock Rover, including:

- 6 Steps to Build Your Dividend Stock Screener & Strategy

- How to Find High Dividend Yield Stocks [3 Strategies]

- Dividend Growth Stock Screener: 5-Step Timeless Strategy

- How to Calculate Stock Dividend Yield With Easy Examples

Developing a good dividend portfolio requires robust future income reporting.

6. Perform Yearly Tax Loss Harvesting

Tax-loss harvesting is an essential task that good portfolio managers perform before year-end to minimize taxation on a portfolio’s profits. The strategy entails selling any losing assets to offset the loss against the profits of the winning assets.

Tax-loss harvesting can cut your tax bill because the Internal Revenue Service (IRS) lets Americans deduct investment losses from their tax bills. Many investors use tax-loss harvesting to reduce their income before reporting to the IRS.

If a stock’s price doubles in value, the investor could sell that stock to reduce the value of his portfolio. You must be careful with tax harvesting because the IRS does not allow wash sales.

In a wash sale, an investor sells an expensive investment and buys a similar but cheaper stock to limit a portfolio’s value. The IRS considers a transaction a wash sale if the investor buys another stock within 30 days of the sale.

You must keep good records of every transaction if you tax loss harvest. The IRS can ask you for those records at any time.

Tax-loss harvesting can be complex. Only investors who could face a high-income tax bill should consider it. For most investors, the risks will exceed the benefits.

Most tax experts consider tax-loss harvesting a waste of time for those in low tax brackets. Unless you have over $50,000 in stocks, it is probably a waste of time.

Try Powerful Financial Analysis & Research with Stock Rover

7. Plan for the Future with Monte Carlo Simulations

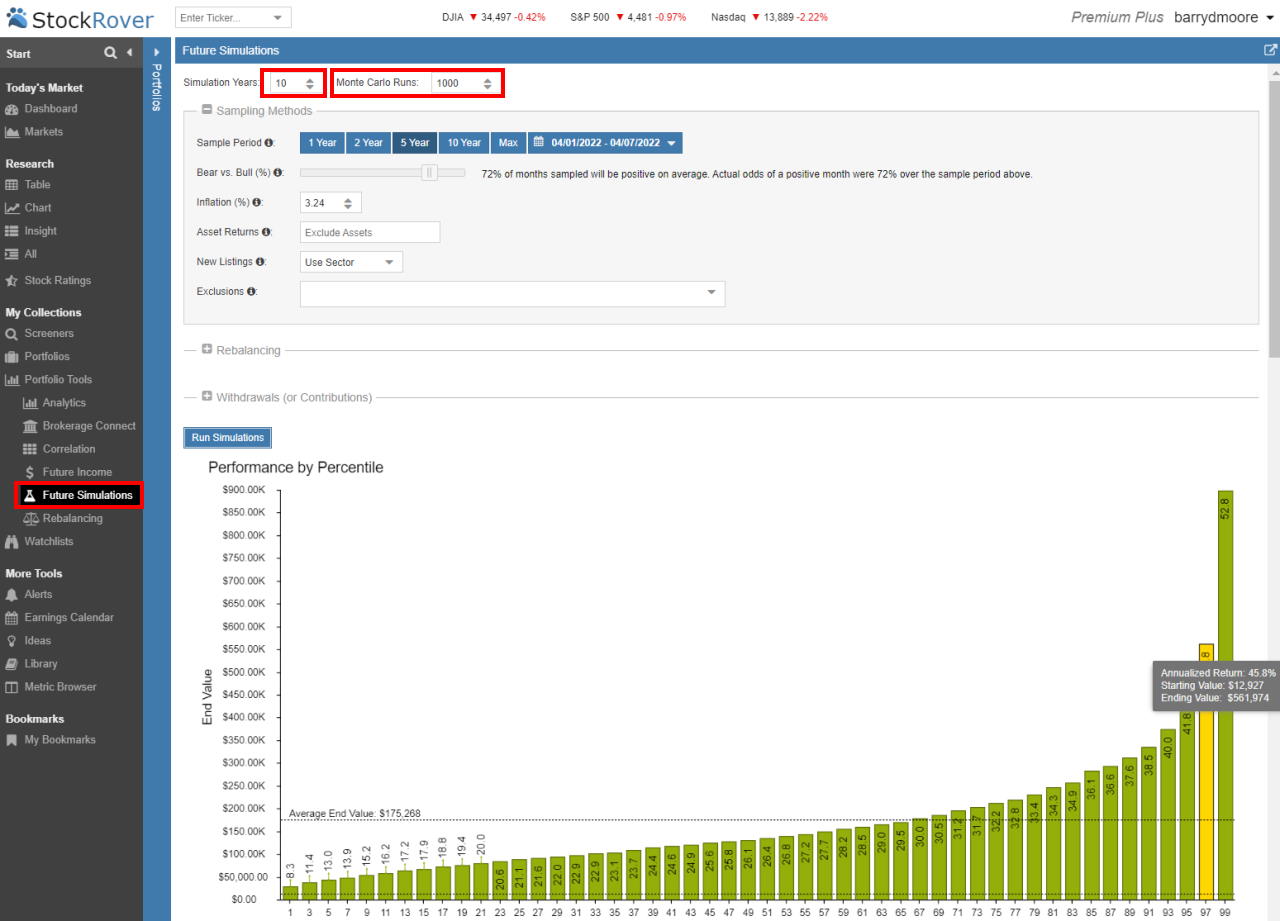

An advanced task in managing a portfolio is to attempt to understand the future performance of your investment. To do this, we can use Monte Carlo simulations. Monte Carlo simulations are used in quantum physics and even engineering to predict the probabilities of patterns.

Stock markets are inherently unpredictable, so Monte Carlo analysis is an ideal solution. To make an estimated outcome, Monte Carlo simulations use a stock’s price movement history to randomly assign past performance to future performance.

When this random algorithm is applied to a portfolio over thousands of iterations, you get a good idea of how your portfolio will perform.

The screenshot below shows a Monte Carlo simulation I ran on the LST Beat the Market Strategy.

In this simulation, I ran a sample of the last five years’ historical performance, including the black swan event of the Covid Crash, to see how well my portfolio might perform in the future. The results are in the screenshot below.

Monte Carlo Simulations: Portfolio Management & Forecasting With Stock Rover

How to Manage a Stock Portfolio Summary

The seven key tasks of managing a stock portfolio are research, performance analysis, rebalancing, correlation analysis, planning future income, tax-loss harvesting, and future performance analysis.

Managing a stock portfolio professionally requires an accurate solution that saves time and maximizes future profit opportunities. Stock Rover is my tool to improve my chances of market outperformance.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com