Gaps in stock charts are an incredibly predictive way to assess the possible direction of stock prices. Gaps show extreme fear or greed in investor sentiment and provide a unique buying or selling opportunity.

This lesson covers stock chart gaps and how you can trade them.

What is gap analysis in stock charts?

Gap analysis studies how a stock chart price gaps or moves abruptly from one price to another, leaving a space between bars on the chart. Traders use this information to identify potential trading opportunities.

For example, if a stock gaps are higher on heavy volume, this may indicate a strong buying interest and a good opportunity to buy. Conversely, if a stock gap lowers on heavy volume, this may indicate a strong selling interest in the stock and may be a good opportunity to sell.

What are the gaps in stock charts?

When a stock price opens significantly higher or lower than the close on the previous day, it leaves a gap in the stock chart. The gap is because the open and close prices do not overlap.

A gap occurs when the price of a stock during a given period is significantly higher or lower than the price range of that stock for the previous period.

What causes gaps in stock charts?

The prices did not overlap at all over the two periods. This leaves what is known as a “gap” in the price chart. A “gap up” in the stock price is a show of strength. This tells us that the demand for the stock was so strong on the open that it jumped many points higher. The opposite is valid for a “gap down.” This signifies weakness as the stock gaps down usually due to aggressive selling.

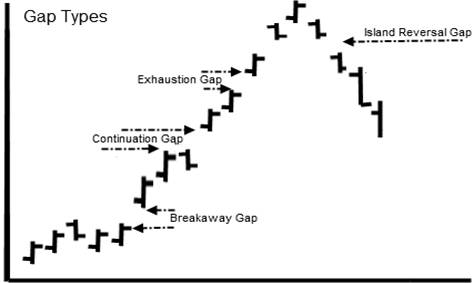

Diagram: Type of gaps in charts

Why are there gaps in stock charts?

Several factors, including earnings announcements, news events, and supply and demand, can cause gaps in stock charts. When a company announces good news, such as strong earnings results, investors may buy the stock aggressively, driving the price up quickly. This can lead to a gap in the chart as the stock jumps from one price to another. Similarly, if a company announces bad news, such as weak earnings results, investors may sell the stock aggressively, driving the price down quickly. This can also lead to a gap in the chart.

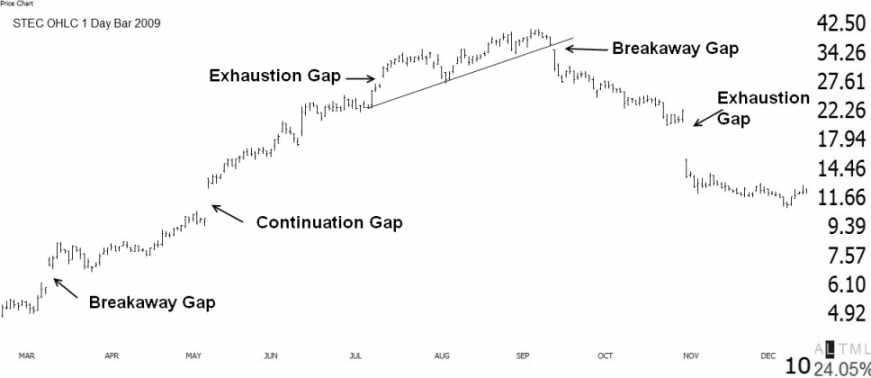

Stock chart gaps example

This chart shows the five types of gaps in action and how they are very useful technical indicators.

What is a breakaway gap?

The Breakaway Gap usually occurs when a stock moves reasonably through a price range or channel, then the demand for the stock explodes, and the stock “gaps out” of the current trend. This is a sign of strength and a very bullish sign with a “gap up.” A breakaway gap to the downside is a sure sign of weakness.

A breakaway gap is a type of gap that occurs when a stock breaks away from its trading range and moves to a new level.

What is a runaway or continuation gap?

The Continuation Gap is another sign of extreme strength or weakness depending on the direction of the trend. A runaway gap shows that demand is still strong, and the trend will continue. This type of gap is often seen as a strong bullish or bearish signal, indicating that the stock has strong momentum.

A runaway gap is a type of gap that occurs when a stock accelerates away from its previous trend.

What is an exhaustion gap?

An exhaustion gap is a type of gap that occurs near the end of a price move. This type of gap indicates that the stock may run out of steam and could reverse direction.

The exhaustion Gap can be the second or third gap and occurs during a powerful upsurge in price. This is a warning, as it might signify that the stock has overextended itself and may be due to a change in trend or a pullback. The opposite is true for an exhaustion gap on the downside, which might signal a bottom is near.

The ultimate trading training course

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

What is the island gap?

The island gap occurs when demand is so high that price and the market participants drive the price up to unacceptable levels, and the demand dries up rapidly. This sudden oversupply causes the stock to plummet as all demand is satiated. Of course, too much supply with no demand causes falling prices.

An island gap is a type of gap that occurs when a stock gaps in one direction, then reverses course and gaps in the other direction. The island gap indicates that the stock may run out of steam and could reverse direction.

The island gap is easy to spot because it leaves a little island of stock price separated from the main price pattern.

Quick Tip: Gaps are important signs of serious shifts in supply and demand. If surges in demand outstrip the supply, prices rise to convince people on the sidelines to sell. Downside gaps indicate supply is outstripping demand, causing prices to fall.

Example of trading gaps with Netflix in 2022

This chart of Netflix in 2022 is a perfect example of how to trade gaps in stock charts. Here, we see the breakaway gap, the runaway gap, and the exhaustion gap.

How to trade chart gaps

There are three ways to trade stock chart gaps: following the gap, fading the gap, and filling the gap.

Following the gap

The best way to trade gaps in a chart is to trade them in the direction they break out. A breakaway gap is a sure sign to trade in the direction of the breakout. Trading the continuation gap in the direction of the trend is probably the safest gap trade.

Trading the island gap is also a good strategy because it is a sure sign of a trend reversal.

Fading the gap

One popular strategy is called “fading the gap.” This involves selling a stock when it gaps higher on heavy volume or buying a stock when it gaps lower on heavy volume. This strategy is based on the idea that stocks often retrace their gaps after the initial move has been made.

Filling the gap

Another popular gap trading strategy is called “gap filling.” This involves buying a stock when it gaps lower on heavy volume or selling a stock when it gaps higher on heavy volume. This strategy is based on the idea that stocks often fill their gaps over time.

Stock chart gaps summary

Several factors, including earnings announcements, news events, and supply and demand, can cause gaps in stock charts. When a company announces good news, such as strong earnings results, investors may buy the stock aggressively, driving the price up quickly. This can lead to a gap in the chart as the stock jumps from one price to another.

Similarly, if a company announces bad news, such as weak earnings results, investors may sell the stock aggressively, driving the price down quickly. This can also lead to a gap in the chart.