MOSES ETF Strategy: Protect Your Investments and Outperform the Market

Outperform The Market, Avoid Crashes & Lower Your Risk

In the past century, the stock market has experienced six major crashes, each averaging a 57% loss and taking a decade to recover. Imagine having a strategy that not only shields your investments from such downturns but also positions you for superior returns.

MOSES (Market Outperforming Stocks ETF Strategy) is a comprehensive investing system developed to empower investors like you to:

Learn from Barry D. Moore, a Certified Financial Technician (CFTe) accredited by the International Federation of Technical Analysts (IFTA). With over 20 years of expertise in investing and market analysis.

The Problem

📉 Severe Losses: Each crash averaged losses of 57%, significantly damaging investor portfolios.

📅 Lengthy Recoveries: On average, markets took about 10 years to recover fully after each crash.

🛡️ Retirement Risk: If a crash occurs as you near retirement, you could be forced to delay your plans due to severe losses.

😨 Unpredictability: Most investors are caught off guard—market crashes almost always appear as surprises.

💸 Investment Exposure: Many retirement portfolios heavily rely on Mutual Funds or ETFs, making them especially vulnerable.

The Solution

🔔 Early Crash Alerts: Clearly warns you ahead of impending stock market crashes, giving you time to safeguard your capital.

📊 Designed for Major ETFs: Works seamlessly with the Nasdaq 100, S&P 500, Russell 3000, CAC40, German DAX broad market ETFs.

🧪 Rigorously Tested: Proven through extensive backtesting to reliably detect and anticipate market downturns.

🚦 Clear Market Signals: Simplifies market analysis into five intuitive indicators.

🛠️ Effective Asset Reallocation: Guides you to strategically shift your investments into safer assets to minimize risks and protect your wealth.

Market – The strategy is designed to be used on entire market indices.

Outperforming – The Moses strategies beat the majority of USA & European Stock Markets

Stock – Moses is designed to work on large, liquid stock market indices.

ETF – Using Moses on broad market ETFs to trade an entire index is the ideal strategy.

Strategies – 3 Strategies You Can Choose to Improve Your Decision-Making

Whether you invest actively in the stock market or passively through mutual funds or ETFs, reducing losses over time is crucial.

The MOSES ETF Investing System focuses on avoiding or minimizing the impact of major market crashes.

With three core indicators, MOSES helps you reduce losses and compound your investments to outperform the market.

It alerts you before a crash or significant decline and signals when the bear market is over.

Who Will Benefit Most?

🏖️

Retirement-Focused Investors

Safeguard your portfolio and secure your future.

📅

Investors seeking outsize profits.

MOSES helps you “Beat The Market” by avoiding crashes and buying back into an early recovery

⚡

All Investors

If you have money invested or plans to invest US or European Stock Market Index Tracking ETF Funds.

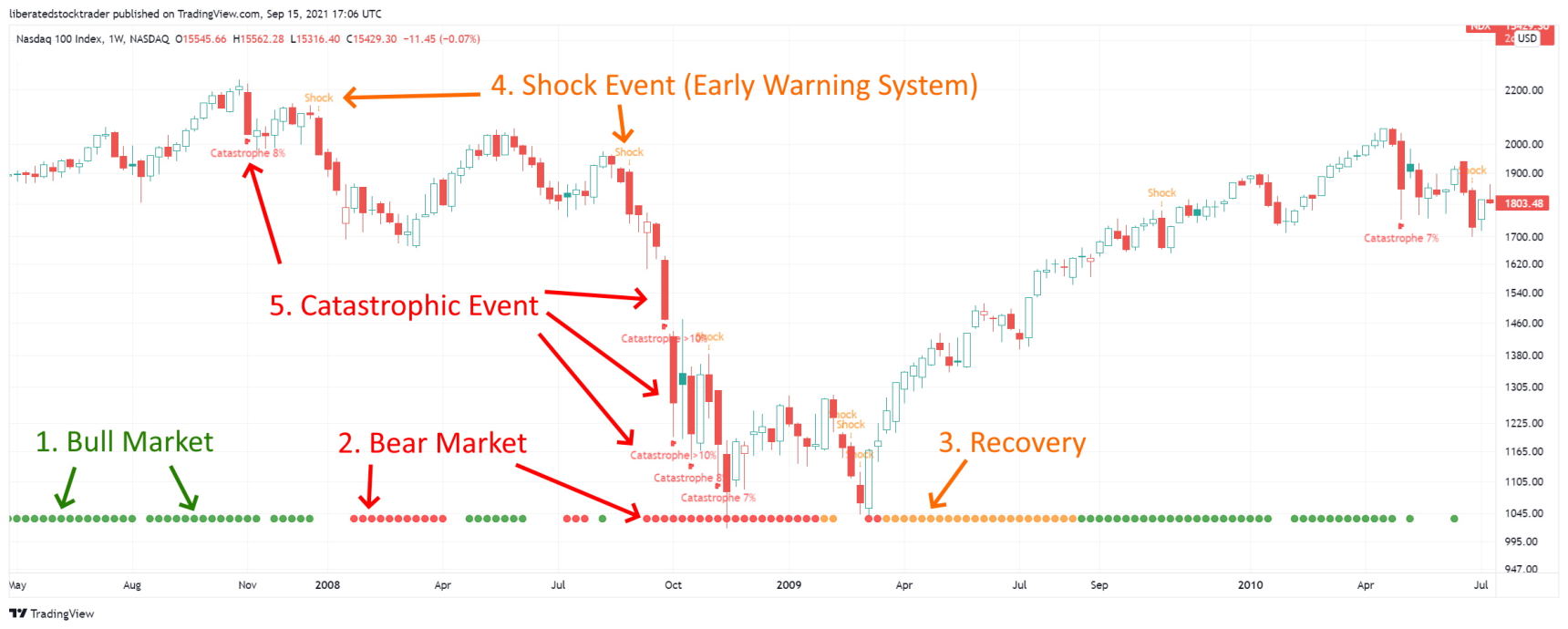

The 5 MOSES Signals

- Bull Market Signal: Confirms Healthy Stock Market (Buy)

- Bear Market Signal: Confirm Bear Market Downtrend (Sell)

- Recovery Signal: Confirms Early Post Crash Recovery (Early Buy Signal)

- Shock Event: Early Warning of Market Disturbance

- Catastrophic Event: Warns of Serious Market Volatility Before or During a Crash

In this chart, you can see that the Catastrophic Event was triggered in November 2007, right at the start of the Financial Crisis and one year before the majority of the crash happened.

MOSES Buy & Sell Alerts

You can choose the strategy that best fits the market you are investing in. MOSES provides different Buy and Sell Alerts depending on the strategy you choose.

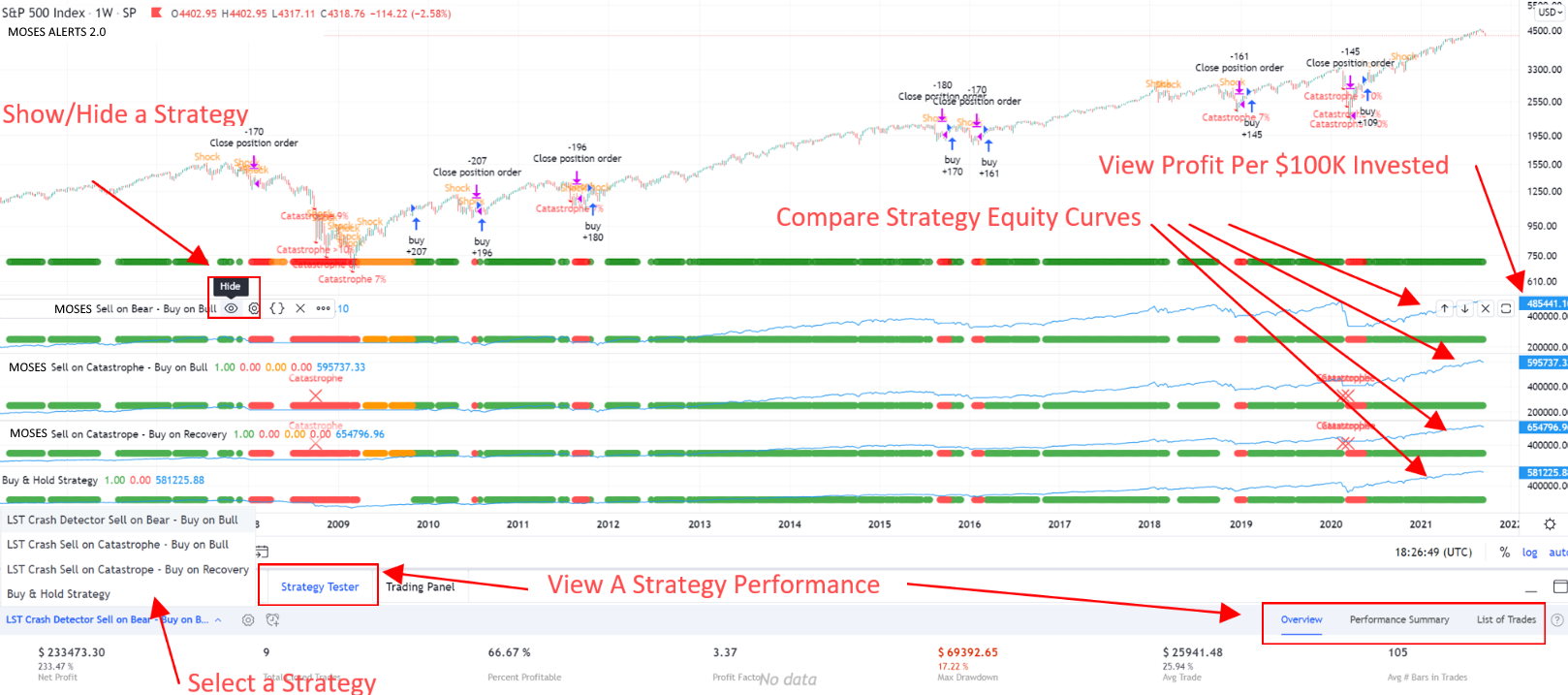

Run 3 MOSES Strategies Side By Side & Compare Performance

With the MOSES automated scripts, you can choose the right strategy for the market you are investing in.

MOSES is fully automated and integrated into TradingView, so you can:

- View a specific strategy’s return.

- Compare all strategies.

- Compare the Equity Line to see your compounded profit & loss.

- See how many trades are executed and when.

- See drawdown & duration per trade.

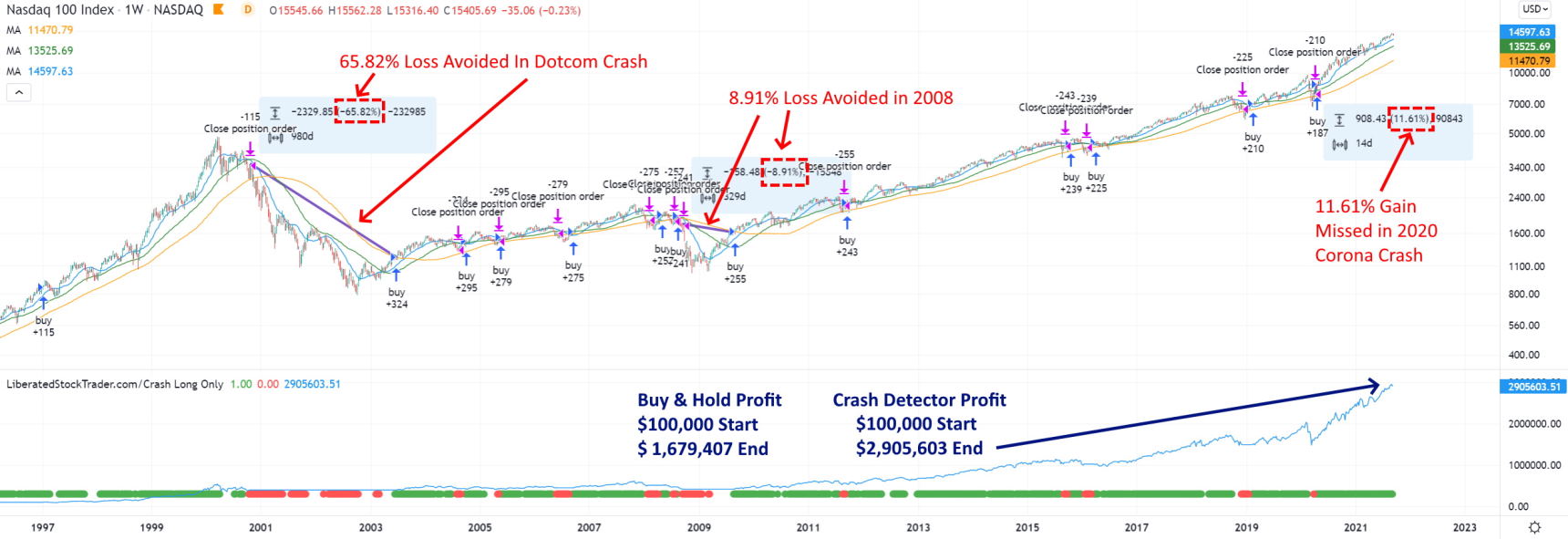

MOSES Performance 1997 to 2025

Here are the exact results of the three MOSES strategies. The strategy started in 1997 to enable the system to act on three major stock market crashes: 2000, 2008, and 2020. The Buy and Hold strategy is the profit from staying invested during the entire period and not avoiding the crashes. The Winning MOSES strategy is highlighted in Green.

| MOSES Strategy Performance | Start Date Jan 03, 1997 | End Date Apr 4, 2025 |

| Initial Investment $100K | $100,000 | |

| Duration (Years) | 28 | |

| Portfolio Value | ||

| MOSES vs. NASDAQ 100 | Apr 4, 2025 | Percent Gain |

| NASDAQ 100 – Buy and Hold | $ 2,217,819.00 | 2118% |

| MOSES Buy Bull – Sell Bear | $ 3,742,186.00 | 3642% |

| MOSES Buy Bull – Sell Catastrophe | $ 2,625,555.00 | 2526% |

| MOSES Buy Recovery – Sell Catastrophe | $ 2,950,909.00 | 2851% |

| MOSES vs. S&P 500 | Apr 4, 2025 | Percent Gain |

| S&P 500 – Buy and Hold | $ 731,608.00 | 632% |

| MOSES Buy Bull – Sell Bear | $ 545,315.00 | 445% |

| MOSES Buy Bull – Sell Catastrophe | $ 667,647.00 | 568% |

| MOSES Buy Recovery – Sell Catastrophe | $ 787,748.00 | 688% |

| MOSES vs. Russell 3000 | Apr 4, 2025 | Percent Gain |

| Russell 3000 – Buy and Hold | $ 739,557.00 | 640% |

| MOSES Buy Bull – Sell Bear | $ 592,025.00 | 492% |

| MOSES Buy Bull – Sell Catastrophe | $ 715,577.00 | 616% |

| MOSES Buy Recovery – Sell Catastrophe | $ 822,097.00 | 722% |

| MOSES vs. NASDAQ Composite | Apr 4, 2025 | Percent Gain |

| NASDAQ Composite – Buy and Hold | $ 1,299,322.00 | 1199% |

| MOSES Buy Bull – Sell Bear | $ 1,568,175.00 | 1468% |

| MOSES Buy Bull – Sell Catastrophe | $ 1,306,720.00 | 1207% |

| MOSES Buy Recovery – Sell Catastrophe | $ 1,349,838.00 | 1250% |

| MOSES vs. CAC 40 France | Apr 4, 2025 | Percent Gain |

| CAC 40 – Buy and Hold | $ 333,524.00 | 234% |

| MOSES Buy Bull – Sell Bear | $ 247,699.00 | 148% |

| MOSES Buy Bull – Sell Catastrophe | $ 307,601.00 | 208% |

| MOSES Buy Recovery – Sell Catastrophe | $ 371,788.00 | 272% |

| MOSES vs. DAX Germany | Apr 4, 2025 | Percent Gain |

| DAX – Buy and Hold | $ 763,771.00 | 664% |

| MOSES Buy Bull – Sell Bear | $ 523,548.00 | 424% |

| MOSES Buy Bull – Sell Catastrophe | $ 797,344.00 | 697% |

| MOSES Buy Recovery – Sell Catastrophe | $ 1,195,465.00 | 1095% |

| MOSES vs. EURO STOXX 50 | Apr 4, 2025 | Percent Gain |

| EURO STOXX 50 – Buy and Hold | $ 279,258.00 | 179% |

| MOSES Buy Bull – Sell Bear | $ 218,992.00 | 119% |

| MOSES Buy Bull – Sell Catastrophe | $ 360,245.00 | 260% |

| MOSES Buy Recovery – Sell Catastrophe | $ 511,607.00 | 412% |

What’s Inside the MOSES ETF Investing System?

📈

3 Proven High-Performance Long-Term Investing Strategies

📈 Buy Bull – Sell Bear

📉 Buy Bull – Sell Catastrophe

🌤️ Buy Recovery – Sell Catastrophe

📘

The MOSES PDF eBook & In-depth Research on the Nature of Stock Market Crashes

💻

4 MOSES Signals Developed for TradingView

📈 Bull Market: Market conditions favorable for growth.

📉 Bear Market: Indicators clearly signal a downward market trend.

⚠️ Shock Event: Early warnings of sudden market disruptions.

🚩 Catastrophic Event: Critical alerts of severe market crashes.

🎬

7-Module Video Training Course

♾️

Lifetime Access to All Videos and Future Course Upgrades

📲

Follow and Message Me Live on TradingView

Ready to Stop Worrying and Start Winning?

Buy Now Only $399; It’s a Great Investment.

Buy Now Only $399; It’s a Great Investment.

Important Legal Disclaimer:

Trading and investing in financial markets involve risk. Past performance of any system or strategy does not guarantee future results. While the MOSES ETF Investing Strategy is designed to detect market trends, no system can predict market movements accurately all the time. Information provided here is for educational purposes only and should not be considered financial advice or a solicitation to buy or sell securities. We accept no liability for losses or damages resulting from your investment decisions or reliance on the information provided. Always consult a qualified financial advisor before making investment decisions.

If you have any questions on the course or issues with the payment process, please get in touch with me directly on

✉ support (at) liberatedstocktrader.com.