Considering Firstrade’s selection of commission-free stocks, ETFs, and option contracts, our comparison shows that it excels compared to E-Trade, Schwab, and Fidelity.

Firstrade offers an extensive range of commission-free stocks, 2,200+ ETFs, and Options contracts, all available at $0. Coupled with its exceptional platform, it is an excellent choice for brokerage services.

Let’s take a deeper dive into the features that make Firstrade stand out among its competitors.

Review Ratings

| Firstrade Rating |

4.7/5.0 |

| 💸 Trades & Commissions |

★★★★★ |

| 📈 Trading Platform |

★★★★★ |

| 🙋♂️ Customer Support |

★★★✩✩ |

| 📰 Research & News |

★★★★★ |

| 💵 Account Opening Balance | ★★★★★ |

| 🔍 Regulation | ★★★★★ |

Review Summary

Our review testing shows that Firstrade is ideal for investors seeking zero commissions trading on stocks, options, and an industry-best 2,200 commission-free ETFs. Full MorningStar research access plus a full suite of IRA accounts make Firstrade a great choice for brokerage services.

What stands out is the unique offering of over 2,200 commission-free Exchange-Traded Funds (ETFs), over twice as many as the next best competitor.

You also get entirely cost-free access to the Morning Star research suite; only three other brokers offer free research of this quality. The Firstrade Trading Platforms Firstrade Navigator, Options Wizards, and Real-time Watchlists hold up well against the competition.

Key Features

What is Firstrade?

Firstrade Securities has been in business for over 35 years and has gained prominence as the first large broker to offer commission-free trading. Located in New York, Firstrade has received multiple awards for best value trading, customer service, and the “Clean Hands Kiplinger Award.”

Firstrade made the extremely bold move to commission-free trades. Already, our 2018 review winner, Firstrade, had the lowest commissions in the industry; now, they have officially the lowest with $0 commissions and fees. Although major competitors like E-Trade and Schwab moved to commission-free stock trades in 2019, Firstrade still leads the pack today, as you can see in our commission comparison.

Pros

- $0 ZERO Commissions & $0 Fees

- 2,200+ Commission-Free ETFs

- Free MorningStar Research

- Excellent Customer Satisfaction

- International Broker USA, Europe, Canada & Asia

Cons

- No CFD or Forex

- No Cryptocurrency

- Slow Customer Service Responses

Firstrade U.S.A. & International Accounts

Firstrade is also an international broker allowing investors from many countries to take advantage of their commission-free trading.

|

|

|

Firstrade vs. E-Trade, Schwab & Fidelity

When Firstrade is compared to E-Trade, Schwab, and Fidelity, it becomes clear that Firstrade stands out with its wide range of commission-free stocks, ETFs, and option contracts.

E-Trade and Schwab have reluctantly embraced the era of zero commissions. However, Firstrade continues to provide unmatched value for stocks, options, and mutual funds.

Fees & Commissions

Firstrade is still the outright winner in the commission’s war with a $0 flat fee per trade, $0 per options trade, and $0 per Contract. But what also adds to Firstrade’s appeal is the 2,200+ commission-free ETFs on offer, much more than any other broker we reviewed.

You can purchase Mutual Funds for $0, and Bond purchases are on a Net Yield Basis.

Commissions: Firstrade vs. E-Trade vs. Schwab vs. Fidelity

| Commissions & Fees | Firstrade | E*Trade | Schwab | Fidelity |

| Online Stock Orders | $0 | $0 | $0 | $4.95 |

| Online Option Orders | $0 | $0 + $0.65/Contract | $0 + $0.65/Contract | $0 + $0.65/Contract |

| Online Mutual Fund Trades | $0 | $49.99 | $49.95 | $49.95 |

| Broker-assisted Stock | $19.95 | $25 | $25 | $19.95 |

| & Options Trades | (+$0.50/contract) | (+$0.65/contract) | (+$0.65/contract) | (+$0.65/contract) |

| Minimum Initial Deposit | $0 | $500 | $0 | $0 |

Table 1: Firstrade Commissions vs. Competitors

You can see that Firstrade substantially focuses on having the best commissions in the industry. Even though E-Trade and Schwab have now been forced to join the $0 zero commissions bandwagon, Firstrade still offers the best value across stocks, options, and mutual funds.

Options Fees: Firstrade vs. IB vs. Fidelity vs. TDA vs. E-Trade vs. Schwab

Online Options orders have zero commission, while the major competitors still charge $0.65 per Contract. Firstrade also has the largest selection of free-to-trade ETFs and Mutual Funds.

| Commissions | Firstrade | IB | Fidelity | E*Trade | Schwab |

| Online Stock Orders | $0 | $0 | $4.95 | $0 | $0 |

| Online Option Orders | $0 | $1 + $0.50/Contract | $0 + $0.65/Contract | $0 + $0.65/Contract | $0 + $0.65/Contract |

Table 2: Stock Trades & Options Trade Fees

Explicitly looking at broker fees for the six big players, Firstrade maintains the lead even against Interactive Brokers (IB). Interactive Brokers also recently moved to $0 Zero fees for retail trades in North America but still maintains a fixed fee of $1 per trade and a blended rate of $0.50 per Contract for international accounts.

ETF Fund Fees: Firstrade vs. Fidelity vs. TDA vs. E-Trade

| Fees | Firstrade | Fidelity | E*trade |

| Number of Commission-Free ETFs | 2200+ | 93 | 200+ |

| Morningstar Coverage | 1100+ | 52 | 53 |

| Number of ETF providers | 100 | 2 | 13 |

Table 3: No Fee ETF Selection

Open a Commission Free Firstrade Account Now

Exchange-traded funds usually play a role in any well-balanced portfolio, and what I appreciate about Firstrade is that all “loaded” and “no-load” funds are zero fees. With over 2,200 funds, the selection will meet most people’s needs.

The Morningstar investment research service is part of the package, which will keep you up-to-date with analysis and fund performance.

Margin Commissions: Firstrade vs. TDA vs. Fidelity vs. E-Trade vs. IB.

Firstrade also competes with the major competitors on margin rates. Firstrade’s financing rates are at least 1% to 2% lower on every funding tier versus Fidelity or E-Trade. However, Interactive Brokers is still the industry leader if margin is critical to your trading.

In summary, the margin commission fees are higher than those of interactive brokers but much lower than those of other mainstream retail brokers.

Trading Platforms

Firstrade has rebuilt its trading platform from scratch, and the improvement is dramatic. Gone are clunky Java programs, replaced by a fast HTML 5.0 platform. This platform is future-proofed and highly scalable. The user experience is clean, intuitive, and easy to learn.

Also, what we like about it is its price – Free.

The trading platform has several components. The web-based platform is available for all clients. If your account balance is over $10,000, you will have complimentary access to download the Firstrade Navigator software; this compelling trading experience runs locally on your PC or Mac.

The Firstrade App for Android & IOS has two cool features:

- Swipe left to quickly Buy or Sell right from the Positions page or watchlist.

- Face ID and fingerprint recognition features ensure that you’re the only one who can access your account.

Heatmap & Sector & Industries Tool

To find a potential opportunity to trade, you can start with the big-picture view of the market and drill down from there. The heatmap is designed for short-term traders who need to see where the price action and volatility are on any given day.

Alternatively, you can utilize the sectors and industries to evaluate past performance and select a sector to review more deeply.

Advanced Screener, Fundamental Data & Event Calendar

No product set would be complete without scanning and screening stocks based on the fundamental data. Firstrade’s attempt at this is pretty good; it does not match the offerings from Stock Rover, but it is adequate for most investors.

A new event calendar is also available, neatly broken into tabs for earnings announcements, dividends, ratings changes, economic indicators, IPOs, and splits.

OptionsPlay

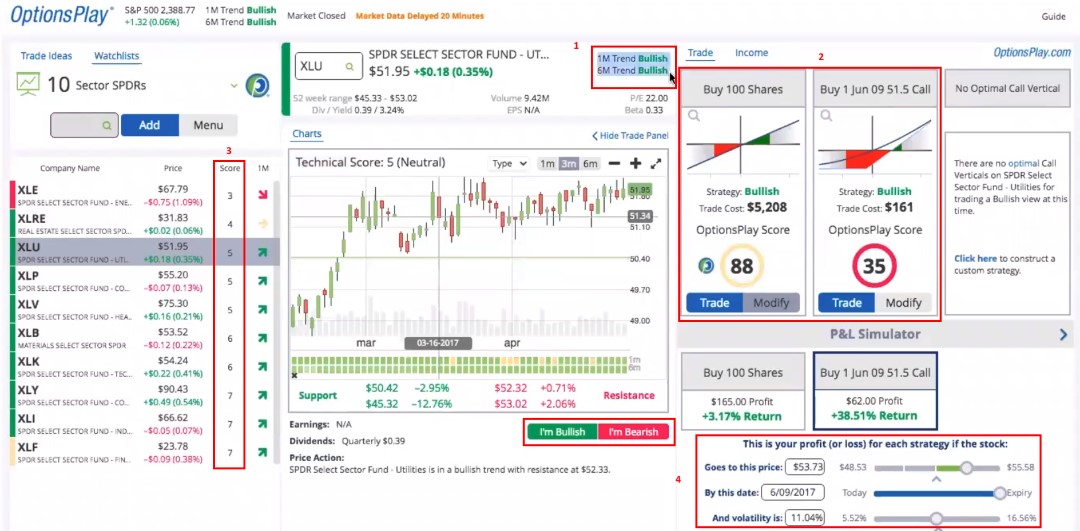

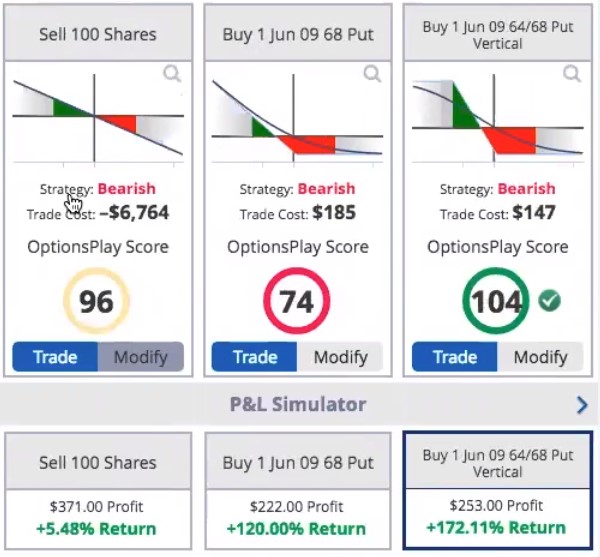

Firstrade has put a lot of effort into the Options Trading Platform OptionsPlay, a first-class platform that focuses first on what kind of options strategy you want to implement. You can drill down through industries and sectors and instantly get a technical analysis for the stock’s bullish or bearish score. You can even sort your watchlist based on the bullish or bearish rating.

The image above shows the OptionsPlay Bullish and Bearish Ratings based on bullish, bearish, or neutral scenarios.

- Strategy 1 – Selling 100 Shares of the stock – A Bearish Strategy – Cost would be $6764 – with a mediocre score of 96 for the trade

- Strategy 2 – Buy the June 9th Put Options – Bearish – Cost $185 – Low probability Rating of 74

- Strategy 3 – Buy June 9th Put Vertical – Bearish – Cost $147 – High Probability Rating of 104

I like the implementation here; it is simple and intuitive.

OptionsPlay Dashboard Walkthrough

- Immediate feedback into the one-month and 6-month trend for the stock.

- This fund has an 88 rating for a bullish strategy but only a 35 rating for a bullish options strategy. The beauty of this is that you can compare whether you should buy the stock or utilize an options strategy.

- The ability to sort your list based on the strongest score is an excellent functionality.

- Finally, the Profit and loss simulator is excellent. It lets you predict your profits based on how much you invest in the strategy.

Firstrade Optionsplay Dashboard Walkthrough

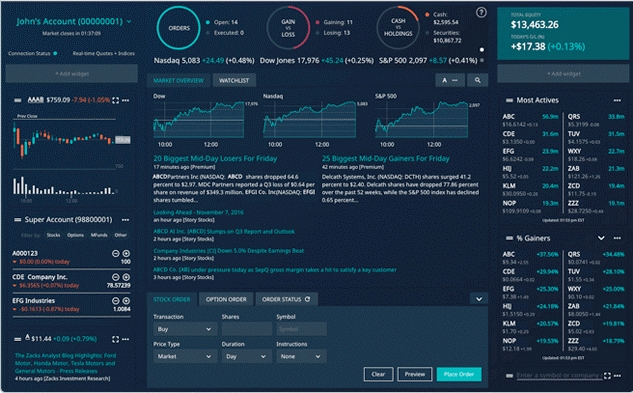

Desktop Trading Platform – Firstrade Navigator

Firstrade Navigator is a well-designed and robust system with a lot of valuable information that is instantly available, allowing you to drill down into the details. Navigator is very customizable and has a selection of widgets to embed into the dashboard. Studies and stock chart indicators are, of course, also included.

Investor Services

Firstrade does not just offer free trades; it offers a suite of traditional services vital to long-term investors and retirees.

Traditional IRA

Contributions may be tax-deductible in a traditional individual retirement account, and investments grow tax-deferred until a withdrawal. Retirement income planning with a Traditional IRA account allows you to deduct all or part of your contributions from your taxable income. The investment earnings of your IRA are not subject to federal income tax until distributions (withdrawals) are made.

Roth I.R.A.

Unlike contributions to a Traditional IRA, contributions to a Roth individual retirement account are not deductible. The significant benefit of Roth IRAs is that earnings from investments are tax-free.

Rollover IRA.

If you’re changing jobs or retiring, you may use a rollover individual retirement account to keep your investments growing tax-deferred without incurring penalties. By directly rolling over assets from your employer-sponsored retirement plan into an IRA Rollover, you’ll defer your tax liability and may be able to avoid penalties altogether.

SEP IRA

A Simplified Employee Pension (SEP) IRA is a written arrangement that allows an employer to contribute to employees’ retirement or personal retirement if they are self-employed without becoming involved in an elaborate retirement plan.

SIMPLE IRA

SIMPLE stands for Savings Incentive Match Plan for Employees; it is a written arrangement that provides a simplified way for employers and employees to contribute to retirement income. Under this individual retirement arrangement, employees may choose whether to make salary reduction contributions to the SIMPLE plan. Also, an employer will contribute to matching or nonelective contributions on behalf of eligible employees.

Coverdell ESA

A Coverdell Education Savings Account (ESA), formerly known as an Education IRA, is an account that helps you save money for the cost of elementary, high school, or higher education for a designated beneficiary. You can open multiple accounts for individuals under 18 and make a non-deductible contribution as long it does not exceed $2,000 per child.

Custodial Account

Firstrade’s Custodial Account can help you save for your child’s education and build a nest egg that will contribute to their future financial stability. A Custodial Account lets you manage a minor’s assets on their behalf, gives you a gift tax advantage, and the flexibility to invest in any combination of stocks, mutual funds, bonds, and ETFs.

Portfolio Management

| Firstrade Stock Portfolio Tracker Features | Visit Firstrade |

| Watchlist Tracking | ✓ |

| Research & News | ✓ |

| Profit & Loss Reporting | ✓ |

| Performance Reporting | ✓ |

| Weighting & Rebalancing | X |

| Portfolio Asset Allocation | ✓ |

| Broker Integration | ✓ |

| Future Income & Dividend Reporting | X |

| Automated Portfolio Management | X |

Customer Support

Firstrade provides full email, chat, and telephone coverage; however, their response times have slipped. It took them ten days to respond to a test request, and when I called, there was a one-hour response time. However, they have had zero negative tweets or TrustPilot reviews in the last 12 months. Customers rave about the service, which is unusual; this means a 5-star customer satisfaction rating.

I also like that they offer free access to Zacks Research, Morningstar Research & Ratings, Breifing.com, and Benzinga (although not the real-time Benzinga PRO version). These third-party services are quite valuable, and considering Firstrade offers zero commissions, they also add value through these services.

Brokerage Regulation & Account Minimum

Any US-based Broker should be a member of the following institutions.

Financial Industry Regulation Authority (FINRA) Membership.

FINRA is a nonprofit organization established to protect investors and ensure members comply with the law and Securities and Exchange Commission rules. It audits all members regularly.

Securities Investor Protection Corporation (SIPC) Membership.

The SIPC is there to protect and hopefully recover any money lost if a Brokerage firm fails. Although Broker failure is rare, it can happen, and SIPC membership ensures that your account is protected up to $500,000.

Firstrade has all the protection required in the U.S.A, they are fully registered in the FINRA Database and have SIPC insurance.

Summary

Firstrade is excellent for traders and investors seeking FREE ZERO Commissions trading on Stocks and Options, plus the industry’s best 2,200 Commission-Free ETFs. Full MorningStar access, 5-star customer satisfaction, and a full suite of IRA accounts mean Firstrade is an excellent choice for brokerage services.