The best Buffett and Graham stock screener is Stock Rover, which provides eight fair value, intrinsic value, and forward cash flow calculations to help you build a great portfolio.

Over the last 50 years, Warren Buffett has proven to be the most successful investor ever. With an average compound rate of return of 23.3% per year, Buffett has a reputation that Wall Street can only dream of.

His wise investing has grown his company, Berkshire Hathaway, into a behemoth worth over $800 billion.

But how did Buffett achieve these great investing returns? He analyses stocks better than anyone else and understands what makes a great company.

The Buffett Stock Screener

A Buffett stock screener needs to filter on investing criteria such as earnings per share (EPS) growth, consistent return on equity (ROE), high return on invested capital (ROIC), and low debt using the solvency ratio. Finally, the screener needs to calculate the margin of safety using discounted cash flow (DCF).

How Does Buffett Screen for Stocks?

Buffett screens for stocks using specific criteria, such as whether the company is profitable and generating a healthy cash flow. He then predicts and discounts the cash flow ten years into the future. If the discounted cash flow value is 30% higher than the company’s stock market valuation, it has a good margin of safety and is a candidate for purchase.

How To Build A Buffett & Graham Stock Screener

1. Understand What Buffett & Graham Look For In Stocks

This first step looks at the key financial metrics against which to screen the stocks. His daughter Mary Buffett’s book The New Buffettology outlines the most detailed analysis of Buffett’s investing methodology. We will use the Buffettology book, plus the two most important criteria created by his mentor, the great Benjamin Graham: Fair Value (Intrinsic Value) and Margin of Safety.

Look for a Fair Value Higher Than The Current Stock Price

Buffett bases his intrinsic value / fair value calculations on future free cash flows. Buffett thinks cash is a company’s most important asset, so he tries to project how much future cash a business will generate and discount it against inflation. This is called the Discounted Cashflow Method. Read more about Buffett’s Fair Value Calculation.

Screener Calculation – Fair Value 30% Higher Than Share Price

A High Margin Of Safety

The margin of safety is probably Buffett’s most important measure in deciding whether to invest in a company.

Warren Buffett describes the margin of safety as this:

“If you understood a business perfectly and the business’s future, you would need very little in the way of a margin of safety. So, the more vulnerable the business is, assuming you still want to invest in it, the larger the margin of safety you’d need. If you’re driving a truck across a bridge that says it holds 10,000 pounds and you’ve got a 9,800-pound vehicle, if the bridge is 6 inches above the crevice it covers, you may feel okay; but if it’s over the Grand Canyon, you may feel you want a little larger margin of safety…”

The Margin of Safety is the percentage difference between a company’s Fair Value and its actual stock price. This metric is the most significant valuation metric in value investing, as it is the final output of a detailed discounted cash flow analysis.

Screener Calculation – Margin of Safety > 20% (Only available in Stock Rover)

A Strong Earnings Per Share History & Growth Rate

Unsurprisingly, earnings per share (EPS) is an important metric for Buffett and Wall Street. Buffett looks for companies with a consistent track record of earnings growth, particularly over a 5 to 10-year period.

Screener Calculation – Yearly EPS growth Year on Year

A Consistently High Return on Equity

Return on equity (ROE) is a profitability measure calculated as net income as a percentage of shareholders’ equity. A high ROE shows an effective use of investors’ money to grow the business’s value.

Screener Calculation – Return on Equity (ROE) 0> 15%

Does the Company Earn a High Return on Total Capital?

Return on Invested Capital (ROIC) quantifies how well a company generates cash flow relative to the capital it has invested in its business.

It is defined as Net Operating Profit after Taxes / (Total Equity + Long-term Debt and Capital Lease Obligation + Short-term Debt and Capital Lease Obligation)

Screener Calculation – 10-Year ROIC Average => 12%

Is the Company Conservatively Financed?

“For a company to pull out of any business difficulties it may encounter, it needs plenty of financial power. Companies with a durable competitive advantage usually create such great wealth for their owners that they are long-term debt-free or close to it. Standard debt-to-equity ratios give a poor picture of the business’s financial strength in that shareholder’s equity is seldom used to extinguish the debt. A business’s earning power is the only real measure of a company’s ability to service and retire its debt. You need to ask yourself, how many years of current net earnings would be required to pay off all the long-term debt of the business in the current year?”. Source The New Buffettology

To achieve this very specific calculation, you can use the closest match, the Solvency Ratio.

The solvency ratio measures whether a company generates enough cash to stay solvent. It is calculated by summing net income and depreciation and dividing by current liabilities and long-term debt. A value above 20% is considered good.

Screener Calculation – Solvency Ratio > 20%

The Initial Rate of Return (IRR) for the Stock is Greater than The Return on U.S. Treasury Bonds

If a company cannot make a profit per share higher than the return of a safe asset like treasury bonds, you should not invest in it. IRR is an easy calculation, and we will use the Earnings Yield. Earnings Yield is the earnings per share for the most recent 12-month period divided by the current market price per share.

Screener Calculation – Earnings Yield > 3%

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

2. Implement The Buffett/Graham Criteria In A Stock Screener

Only one stock screener and analysis platform on the market will enable you to implement a real Buffett stock screener.

The best tool for the job is Stock Rover. Also, Stock Rover won our Best Value Investing Stock Screener.

5 Easy Steps To Setup Your Buffett Munger Undervalued Stock Screener in Stock Rover.

Step 1 – Get Stock Rover

Sign up for a free 14-day trial of Stock Rover (no card required); this will give you the Premium Plus Service for free for 14 days. You need the Premium Plus Service to access the awesome Fair Value and Margin of Safety criteria, exclusive to Stock Rover.

Step 2 – Locate The Buffettology Screener

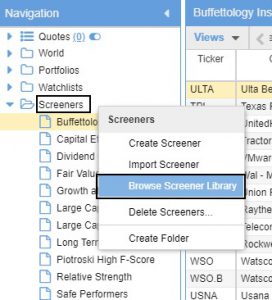

Once you have registered and logged in to Stock Rover, locate Screeners from the navigation menu, hover over it with your mouse, select the drop-down arrow, and select Browse Screener Library.

Screeners -> Browse Screener Library.

This will take you to a huge selection of expertly curated Stock Screener templates.

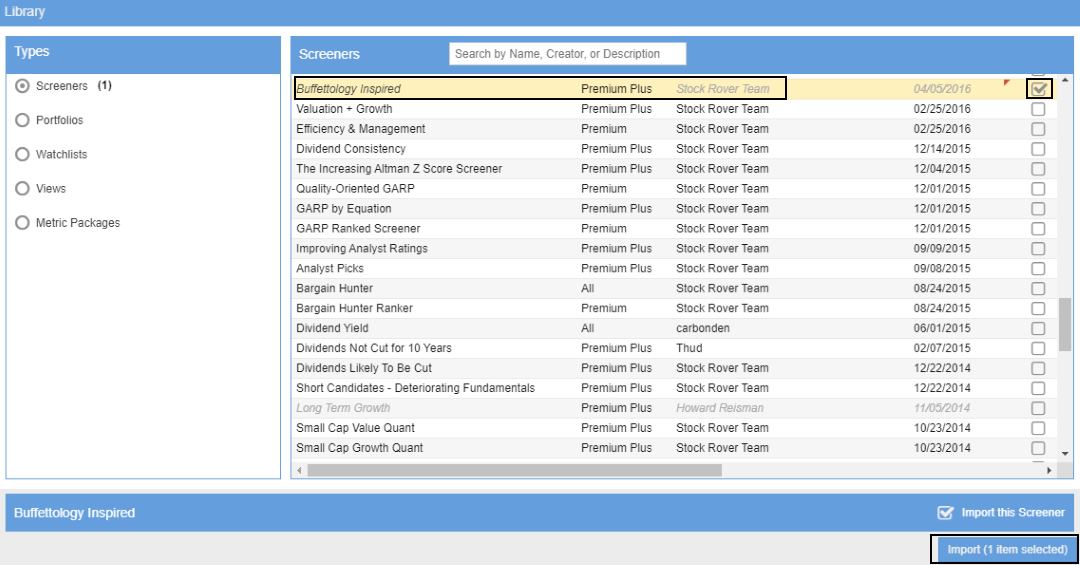

Step 3 – Import The Buffettology Screener

Scroll down to the Buffettology Inspired screener, select the Checkbox to the right, and click the Import Item Selected Button.

Locate Buffettology Inspired -> Click Checkbox -> Import Items

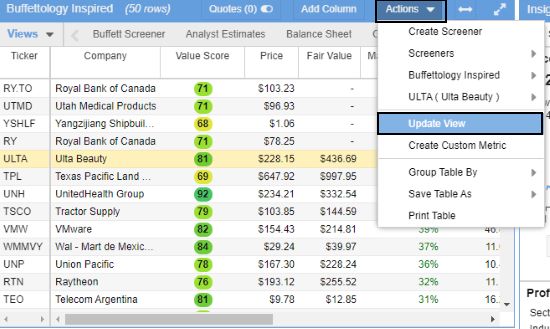

Step 4 – Setup Your Buffett-Specific Columns View

Now, your screening criteria are already set up. Still, you need to see the columns directly relevant to the methodology outlined in section 1 of this article.

Click on Actions at the top of the application and select Update View.

Actions -> Update View

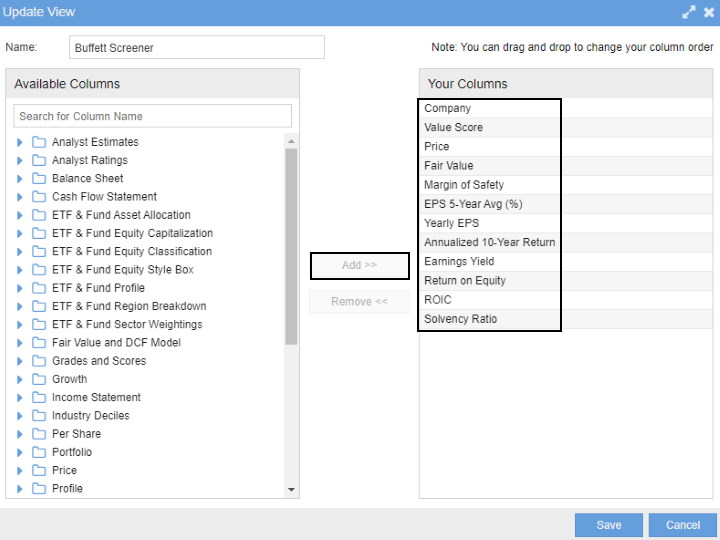

Step 5 – Configure The Columns For Your Buffett Stock Screener

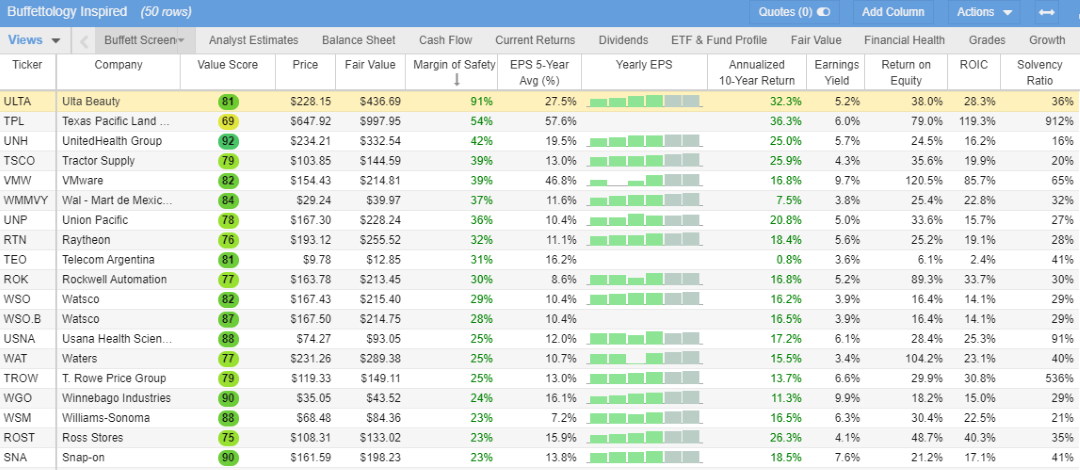

The screenshot above shows you exactly which columns to select. Remove any unneeded columns. Finally, click Save.

Complete – You Now Have The Perfect Warren Buffett Stock Screener

This single view allows you to see all the stocks that meet the Warren Buffett test and perform your own further investigation.

I have sorted this view on the Margin of Safety to see the safest stock first.

Now, you are ready to perform some final checks; to do this, you need to understand how Warren thinks about business.

3. Evaluate Your Buffett & Graham Screener Results

Here are the companies selected by the Stock Rover Screener, sorted on the highest margin of safety.

| Ticker | Company | Margin of Safety | P/E Ratio |

| ABGSF | ABG Sundal Collier Hldg | 180% | 3.3 |

| BMA | Banco Macro | 52% | 2.8 |

| BBAR | Banco BBVA Argentina | 48% | 20.2 |

| GGAL | Grupo Financiero Galicia | 46% | 4.6 |

| CMGGF | Comml Intl Bank (Egypt) | 44% | 9 |

| KAOOY | Kao | 44% | 28.7 |

| NVZMY | Novozymes | 43% | 31.7 |

| PHM | PulteGroup | 42% | 8.9 |

| AHCHY | Anhui Conch Cement Co | 39% | 6.5 |

| TTAPY | TTW | 37% | 15.6 |

| NVO | Novo Nordisk | 34% | 24.9 |

| NVR | NVR | 31% | 18.4 |

| SPXCF | Singapore Exchange | 31% | 22.4 |

| REGN | Regeneron Pharmaceuticals | 31% | 19 |

| CTXS | Citrix Systems | 31% | 28.4 |

| HLTEF | Hilan | 30% | 26 |

| PRKA | Parks! America | 29% | 10.7 |

| FIZN | First Citizens Bancshares | 29% | 2 |

| AVSFY | Avi | 29% | 11.4 |

| RWWI | Rand Worldwide | 28% | 26.2 |

| MMM | 3M | 28% | 19.4 |

| LMT | Lockheed Martin | 27% | 14.8 |

| ANCUF | Alimentation Couche-Tard | 26% | 12.1 |

| CIBEY | Comml Intl Bank (Egypt) | 25% | 9.5 |

Get Your Buffett Screener exclusively at Stock Rover

4. Understand How Buffett Evaluates The Business & Industry

Buffett considers certain factors that are not found in the balance sheet or financials. They are the business and competition-related questions that need a further deep dive. Now that you have your potential target stocks in your screener window above. Select a stock you like the look of, and ask the following Buffett questions as outlined in the Buffettology book.

Does the company have an identifiable, durable competitive advantage?

The competitive advantage over others in the industry might be better technology, products, patents, or even a captive market. Does the company’s industry have high entry barriers, e.g., a microchip maker or a telecoms company? Also, do not forget that a competitive advantage must be durable, meaning it will last at least ten years.

Do you understand how the product works?

Buffett always says that if he does not understand how the product or service works, he will not invest. If you cannot understand the business, you will not accurately assess potential threats or competition. He wants to only invest money in companies he can understand.

If the company has a durable competitive advantage and you understand how it works, then what is the chance it will become obsolete in the next twenty years?

Does the company allocate capital exclusively in the realm of its expertise?

Is the company free to raise prices with inflation?

If the company has severe competition, which pushes product or service prices downward, this may be a stock to avoid. If prices cannot increase with inflation, you may need to factor this into the valuation and Margin of Safety.

Are large capital expenditures required to update plant and equipment?

This question is aimed at companies that must invest heavily in plant and equipment to remain competitive, such as carmakers or telecom companies. These infrastructure upgrades can greatly affect debt and free cash flow.

Is the company’s stock price suffering from a market panic, a business recession, or an individual calamity that is curable?

This is the magic question and the question that leads to Buffett’s famous quote.

Be fearful when others are greedy, and be greedy when others are fearful

If the market is going through panic, a stock with great company fundamentals (financials), low competition, and a solid competitive advantage could see its stock price fall dramatically. This would be a great time to buy, as you will see a higher Margin of Safety.

Is the company actively buying back its shares?

One sign Mr. Buffett looks for is companies buying back their shares. This usually means that the company’s management sees a bright future and believes the stock market seriously undervalues the company. This is often a good sign.

5. Select The Stocks From Your Screener & Invest In Them

Now, you have narrowed down the stocks you want to buy to build your portfolio. Remember, Warren always says:

The best time to sell is never

Although not a strict rule, it pertains more to the fact that you must buy and hold long-term. If you have done your job well, you will not need to sell for the foreseeable future.

If you do not already have a broker, I recommend Firstrade.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Warren Buffett doesn’t own these stocks. Berkshire Hathaway (BRK) does. Warren Buffett has the majority of his wealth in BRK stock. Interestingly, BRK has never paid dividends to its shareholders. BRK shareholders don’t have the drag of taxes on dividends yet see their wealth grow through total return and appreciation.

So as I see it, Warren Buffett is a value investor when it comes to his personal finances.

You are correct, he does not personally own them, they are purchased under his guidance through BRK.

Hi Barry,

You have created a handy website. Thanks for sharing it with the community. Please note that Mary Buffett is not Warren Buffett’s daughter. She is ex Buffett’s daughter- in-law.

Cheers

W

Great Article. Thanks for sharing.

Good evening Barry I am a school teacher looking to trade during the summer brake, I have thoughtfully read your analyses. I have decided to use Stock Rover software, however, my question is that if I am using the Stock Rover, what is the need to use brokers to purchase shares/stocks? Will the Stock Rover work on the platform provided by a broker/s?

Hi Idowu, Stock Rover have a connection to all the major brokers. You will need a broker to execute your trades, stock rover will connect to your brokerage and imports and synch the details into your stock rover dashboard.

Thanks for the great question.

Barry

Hello, I did not know any broker has $0 commissions, are firsttrade any good?

Hi Derek, from my students feedback they are very happy. Also I am myself in the process of moving my funds over to them.

Barry

This is exactly what I have been looking for. I implemented your recommendations and all is sweet. However, are there any columns for dividend yield…

Hi Devon, there are many different dividend scany you can use, dividend yield, dividend per share, dividend 1,3,5 years, dividend cashflow and 10 others. With dividend scans you are covered.

thanks for the question

Barry

Oh this is a great read, I just signed up for stock rover, it is really cool. Barry, I went for premium plus service, is that what you use?

Hi Ethan, yes I use the premium plus service of stock rover because it has all the magic, like fair value, margin of safety and so much more. There is so much to play with, it is great.