My research reveals the leading candlestick and chart pattern recognition software are TrendSpider, TradingView, and Finviz.

After rigorous testing, I recommend TrendSpider, TradingView, and FinViz as the top pattern recognition tools. They surpass humans in scanning, identifying, and analyzing charts, trendlines, and candlestick patterns.

Serious traders are now using automated backtesting and AI pattern-scanning software to develop unique trading strategies that have proven to withstand the test of time. This gives them a trading advantage. Read on to get your edge in trading.

5 Best Candlestick & Pattern Recognition Tools

- TrendSpider: Winner Best Pattern Recognition Software

- TradingView: Best Free Candle Pattern Analysis Software

- Finviz: Best Free Stock Chart Pattern Scanner

- Tickeron: AI Stock Chart Pattern Recognition

- MetaStock: Top Candle Pattern Trading Strategy

Winners Head-to-head Comparison

| Pattern Recognition Software | TrendSpider | TradingView | Finviz |

| Rating | 4.8 | 4.8 | 4.4 |

| Price/m | $107/m or $48/m annually | Free | $13/m to $49/m annually | $39.50/mo or $25/m annually |

| # Candle Patterns Recognized | 150 | 40 | 11 |

| # Chart Patterns Recognized | 18 | 10 | 12 |

| Trendline Recognition | ✔ | ✘ | ✔ |

| Pattern Backtesting | ✔ | ✔ | ✔ |

| Jump to Test Results | TrendSpider | TradingView | Finviz |

In-Depth Comparison

TrendSpider offers excellent automated trend, chart, and candlestick pattern recognition in multiple timeframes. TradingView has the best free candlestick chart recognition globally. MetaStock offers a powerful candlestick trading system with win/loss probabilities.

| Pattern Recognition Software | TrendSpider | TradingView | Finviz | Tickeron | MetaStock |

| Rating | 4.8 | 4.8 | 4.4 | 4.4 | 4.3 |

| Free | ✘ | ✔ | ✔ | ✔ | ✘ |

| Exchanges | USA | Global | USA | USA | Global |

| Fundamental Screening | ✔ | ✔ | ✔ | ✔ | ✔ |

| Trading Community | ✘ | ✔ | ✘ | ✘ | ✘ |

| Automated Trendlines | ✔ | ✘ | ✔ | ✔ | ✘ |

| Multi Timeframe Analysis | ✔ | ✘ | ✘ | ✘ | ✘ |

| Candlestick Pattern Recognition | ✔ | ✔ | ✔ | ✔ | ✔ |

| Market Scanning | ✔ | ✔ | ✔ | ✔ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ | ✔ |

| Patterns Recognized | 150 | 44 | 40 | 40 | 56 |

| News Feed | ✘ | ✔ | ✔ | ✘ | ✔ |

| Real-Time News Feed | ✘ | ✘ | ✘ | ✘ | ✔ |

| Visit | TrendSpider | TradingView | Finviz | Tickeron | MetaStock |

Automatic pattern recognition software uses algorithms to detect patterns in numbers. There are two types of chart patterns: price patterns, such as a Double Top, or candle patterns, like a Doji.

Candlestick patterns are particularly difficult to spot; our five highlighted platforms perform this task better than humans and are available to retail investors.

Japanese candlestick charting theory attempts to predict the future price moves of assets by interpreting the market’s supply and demand. Hundreds of candlestick patterns are difficult to learn and identify, so pattern recognition algorithms are important.

1. TrendSpider: Winner Best Pattern Recognition Software

TrendSpider wins because it provides automated scanning and recognition for trendlines, candlesticks, price patterns, and Fibonacci. Plus, you can backtest and trade these patterns with automated bots and broker integration.

TrendSpider instantaneously detects stock chart support and resistance trendlines, 150 candlesticks, and Fibonacci numbers on multiple timeframes. Its automation allows automated market scanning, news scanning, and financial and technical screening across entire exchanges.

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

- The standard price is $107 per month, and Enhanced costs $197. The best deal is opting for an annual prepaid plan, which offers a 50% discount on all services.

- Adding our partner code LST30 during checkout will save an additional 30% on your first year.

- Using our partner link will grant you an exclusive 7-day discounted trial with TrendSpider.

| TrendSpider Pricing | Monthly Subscription | Annual Subscription |

| Standard (Casual Traders) | $107 | $53.50 |

| Enhanced (Active Traders) | $197 | $98.50 |

| Professional (Professionals) | $397 | $198.50 |

| Additional Year 1, 30% Discount | -30% With Code LST30 | |

TrendSpider Coupon Code Discount

Trendspider discount coupon code "LST30" is verified and valid for 2025. It grants a 30% discount on all plans. Use coupon code "LST30" at checkout.

Using this coupon on a TrendSpider monthly subscription could save you over $2,400.- Read this article for a step-by-step guide to claiming your 30% TrendSpider Discount.

TrendSpider’s most powerful features are automated candlestick, trendline, and chart pattern recognition. Point-and-click backtesting and strategy development automatically plot buy and sell signals onto the chart. TrendSpider can even scan and backtest financial news, analyst estimates, rating changes, and insider trading.

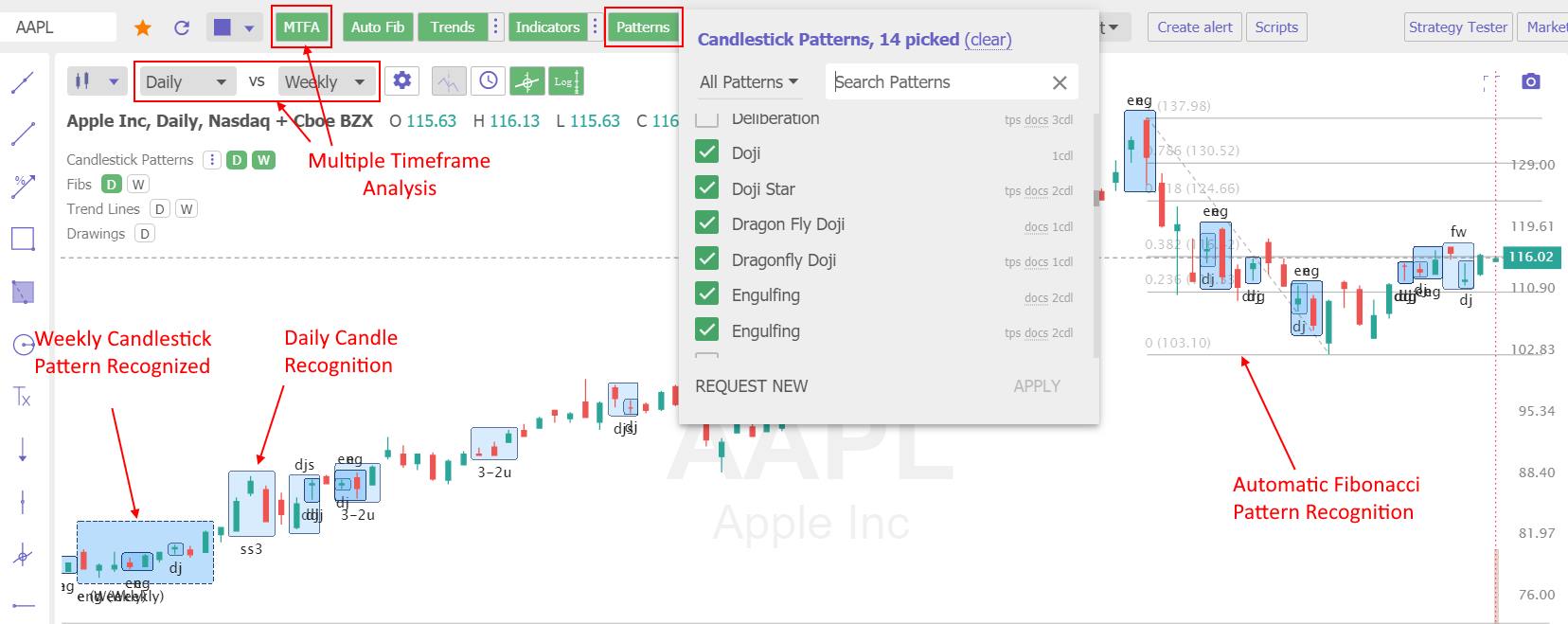

Real-time Candlestick Charts Pattern Recognition

TrendSpider’s real-time candlestick charts tool recognizes 150+ patterns, which can be used for backtesting and auto-trading with Bots. It is designed to do the hard work for you, but what makes it special is that it can detect these patterns automatically and on multiple timeframes, on intra-day or daily/weekly charts.

TrendSpider shows you candlestick patterns by highlighting the pattern with a description on a chart. Select Patterns -> All Patterns -> Candlesticks.

These are enough to start with and are very powerful candlestick reversal signs. On the chart above, you can see the annotated candlestick Pattern DJ for Doji, etc.

In the image above, you can see the patterns recognized on a weekly chart versus the daily Candlestick patterns. Of course, TrendSpider allows you to change the timeframes to 1 minute versus 1 hour or any other combination if you prefer to trade in short timeframes.

You do not need to spend months learning every pattern or spending hours on a chart to locate the patterns; it is all seamlessly done for you.

Trendline Pattern Recognition With TrendSpider.

TrendSpider’s automated trendline detection and plotting do a better job than a human can; using algorithms, the system can detect thousands of trendlines and flag the most important ones with the highest backtested probability of success.

Multi-time-frame analysis means viewing multiple timeframe charts on a single chart with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap.

Packed full of innovative technical analysis tools, TrendSpider is catapulted to the top of this list. If you are a serious market analyst, TrendSpider will help you do the job quicker, with better quality, and not miss an opportunity.

Finally, Raindrop Charts are a unique and intuitive way to visualize volume profile or volume at price action.

Strategy Backtesting.

TrendSpider is our winner for integrated trendline, pattern, and indicator backtesting. It shows the win rate, profitability, and drawdown. The team has propelled TrendSpider into one of the leading technical analysis packages in the industry.

I have personally backtested hundreds of indicators and chart patterns with TrendSpider, and you can see the analysis and techniques I have used.

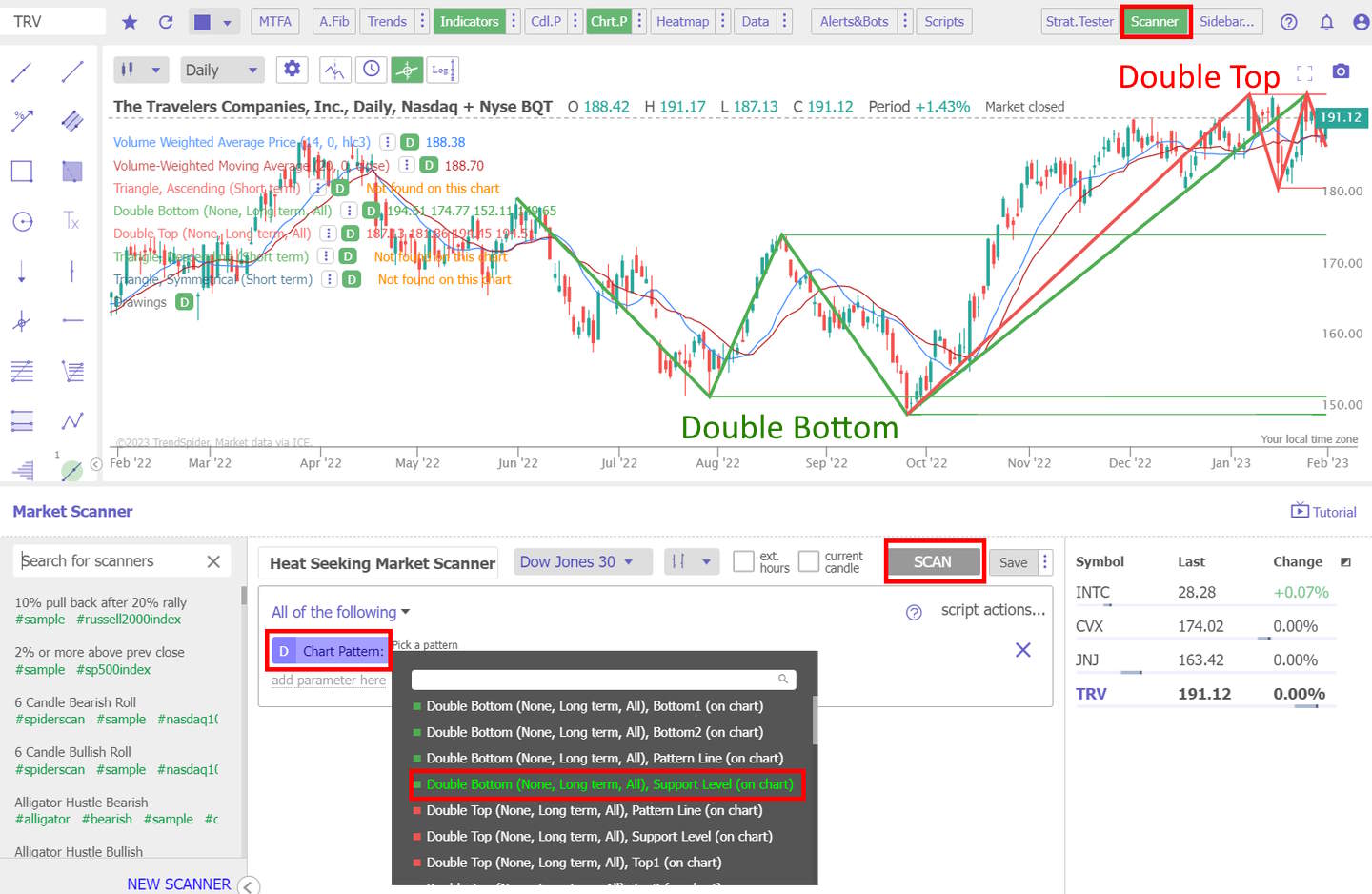

Market Scanner

TrendSpider’s market scanner lets you scan the entire market for stocks matching your technical criteria (see screenshot below). This is a significant step forward, combining AI trend detection and analysis with the ability to scan the whole stock market.

The market scanner is a very powerful feature that lets you scan the Nasdaq 100 for a double-top stock chart pattern, Doji candlestick pattern, or any mix of multiple patterns.

2. TradingView: Best Free Candle Pattern Analysis

TradingView offers free automated candlestick chart recognition for 39 patterns. The candlestick pattern recognition works globally on stocks, ETFs, Forex, and cryptocurrencies. TradingView has the largest trading community and powerful backtesting, which is a perfect combination.

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

I love TradingView and use it every single day. I regularly post charts, ideas, and analyses and chat with other traders. You can scan for patterns and backtest on TradingView for free; however, there are limitations.

Also, a huge benefit is that the data speed and coverage are mind-blowing. They cover literally every stock market on the planet, including stocks, ETFs, mutual funds, futures, forex, bonds, and cryptocurrencies, AT NO EXTRA COST.

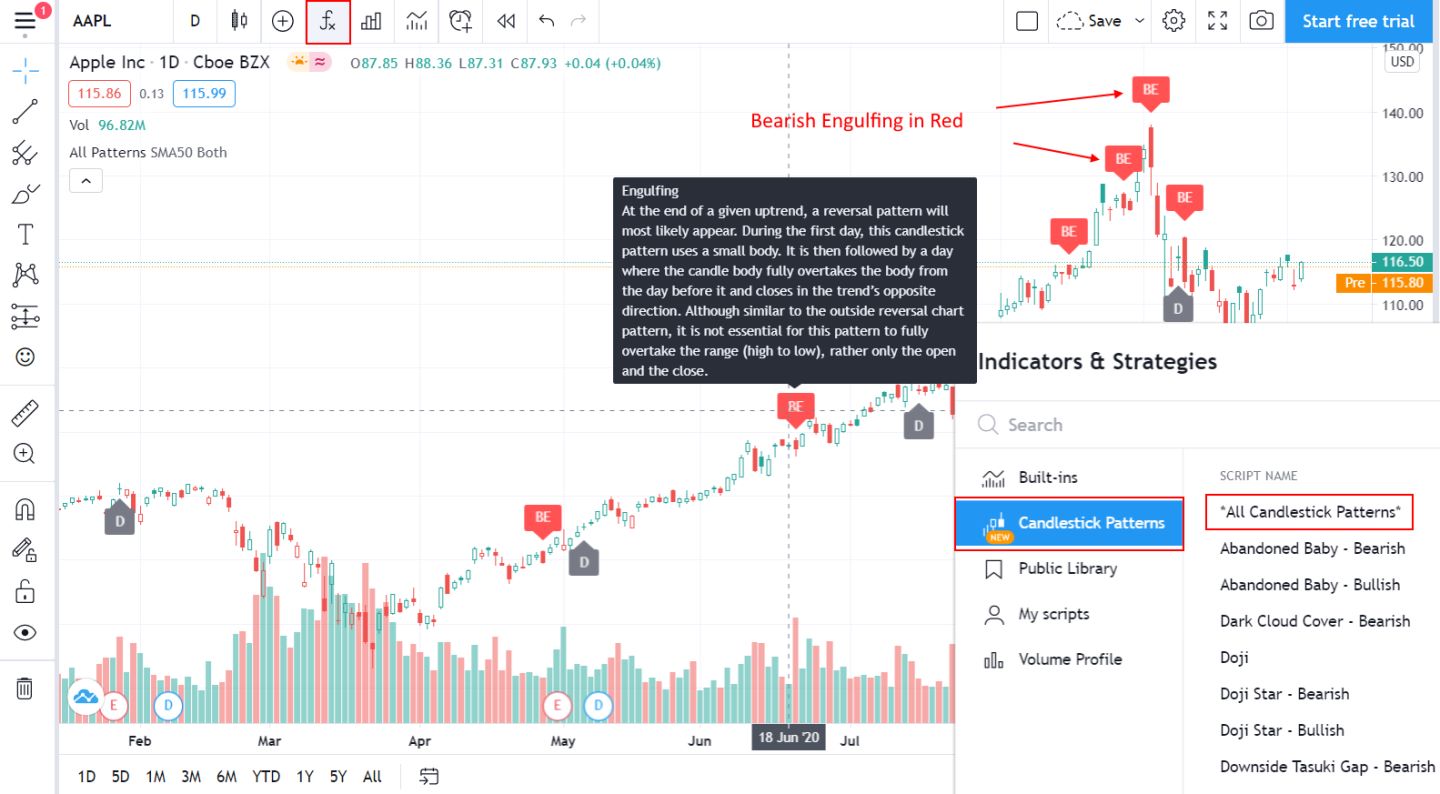

Candle Pattern Recognition

Candlestick pattern recognition is a core component of TradingView, which means you do not have to pay anything extra for a plugin; it is simply there. Because TradingView has a free service tier, you get candlestick analysis for free.

In the image below, you can see that pattern recognition is intelligently implemented. The Bearish Engulfing (BE) patterns are highlighted in Red, with an arrow pointing downward, suggesting that this candle is a bearish sign. You can also observe that the Doji (D) patterns are grey and pointing upwards, indicating a possible price direction change.

Finally, I like that you can hover your mouse over the pattern and get a full and detailed explanation of its meaning.

How to Enable Candlestick Recognition in Tradingview.

- Click on the Fx (Function Symbol) at the top of the page.

- Select Candlestick Patterns

- Select All Patterns or the specific patterns you want to see

Fundamental Scanning & Screening. TradingView hits the mark on real-time scanning, filtering, and fundamental watchlists. The list of fundamentals you can scan and filter on is genuinely huge. Any idea you have based on fundamentals will be covered. They even have enormous amounts of economic data like Federal Funds Rates and World Economic Growth, thanks to a connection to the QUANDL database.

News & Social Community. As soon as you connect to TradingView, you realize this has also been developed for the community. You can look at community ideas, post your charts and ideas, and join countless groups covering everything from bonds to cryptocurrency. The news feeds are fully integrated, including Kiplinger, DailyFX, Futures Magazine, FXStreet, and StockTwits. Add that to the social network, and you have a great solution. The news service is only second to MetaStock with their Reuters Feeds.

Technical Analysis. With over 160 different indicators and unique specialty charts, such as LineBreak Charts, Kagi Charts, Heikin Ashi Charts, Point & Figure Charts, and Renko Charts, you have everything you will need as an advanced trader. With the Premium membership, you also get fully integrated Level II insight.

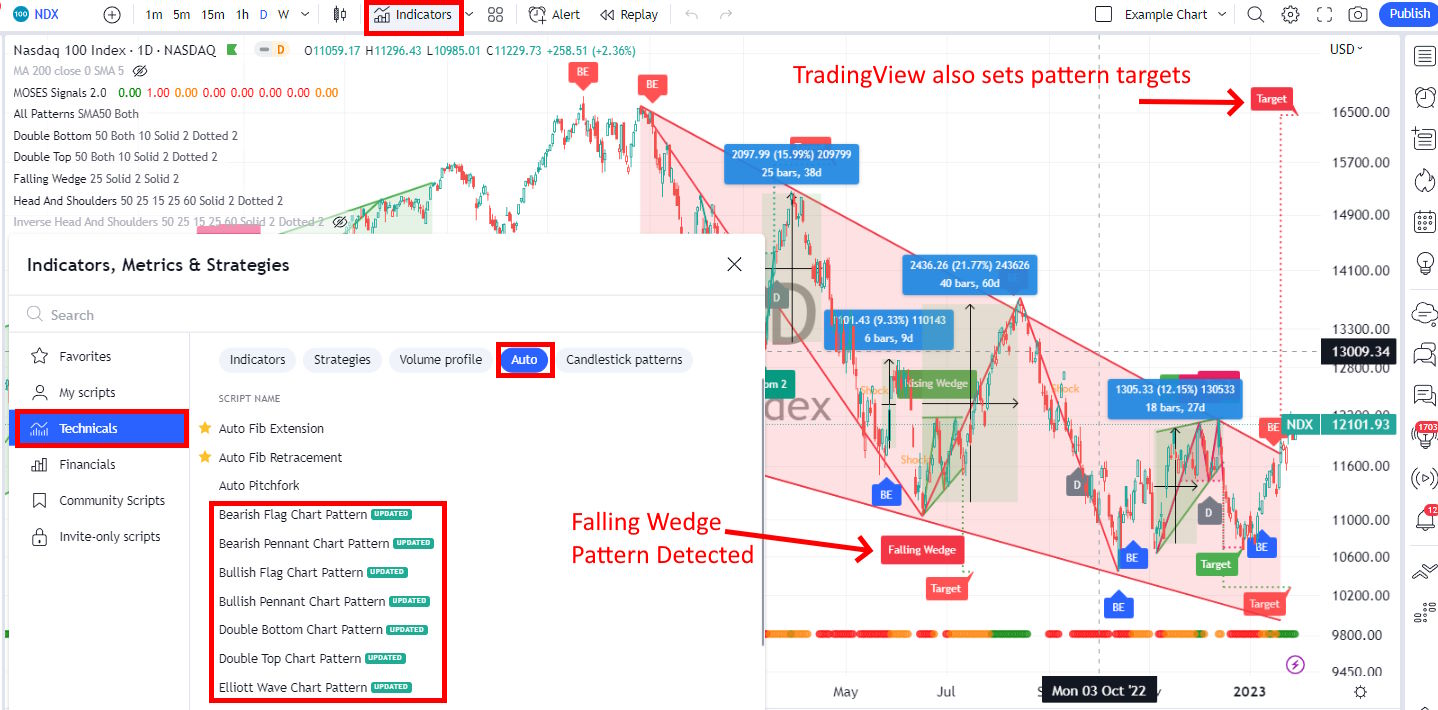

How to Enable TradingView Price Pattern Recognition

- Click on Indicators -> Technicals -> Auto -> Select one or more chart patterns.

Systems, BackTesting & Automated Trading.

TradingView has an active community of people developing and selling stock analysis systems. With the premium-level service, you can create and sell your own. The community also offers many indicators and systems for free.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

The only thing you cannot do is forecast and implement robotic trading automation. For forecasting, you are better off with MetaStock. Within 5 minutes, I used TradingView; no credit card, installation, or configuration of the data feed was required; it was just there. TradingView works with a single click.

3. Finviz: Best Free Stock Chart Pattern Scanning

Finviz provides good heatmaps, stock screening, and chart pattern recognition for free. Finviz uniquely lets investors visualize vast stock market data on a single screen.

After hands-on testing, I found Finviz to be a powerful free stock screener, swift market heatmaps and impressive stock chart pattern recognition.

Thanks to ongoing enhancements to its charting capabilities, Finviz remains a relevant and powerful tool in stock analysis. Through my testing, I found Finviz to be an exceptional free resource, offering intuitive heatmaps, speedy stock screening, and seamless chart pattern recognition.

For those seeking more advanced features, Finviz Elite delivers excellent value at $299 per year, providing real-time data and robust backtesting tools.

Finviz’s elite service provides real-time market data and allows you to perform up to 24 years of backtesting on multiple combinations of 102 technical indicators.

Finviz is targeted at individual investors and institutions and enables investors to screen for stocks and see stocks on the move.

Pros

✔ 67 stock screening metrics

✔ 33 Chart Patterns Recognized

✔ Intraday (1-minute) data with Finviz Elite

✔ One of the best free stock screeners

✔ Good insider trading/news service

✔ Fast heatmaps for sector & industry visualizations

✔ Integrated news aggregation

✔ Backtesting recognizes 102 chart patterns

Cons

✘ Elite Backtesting Could Be More Flexible

✘ 21 chart indicators

✘ No app for Android or iPhone

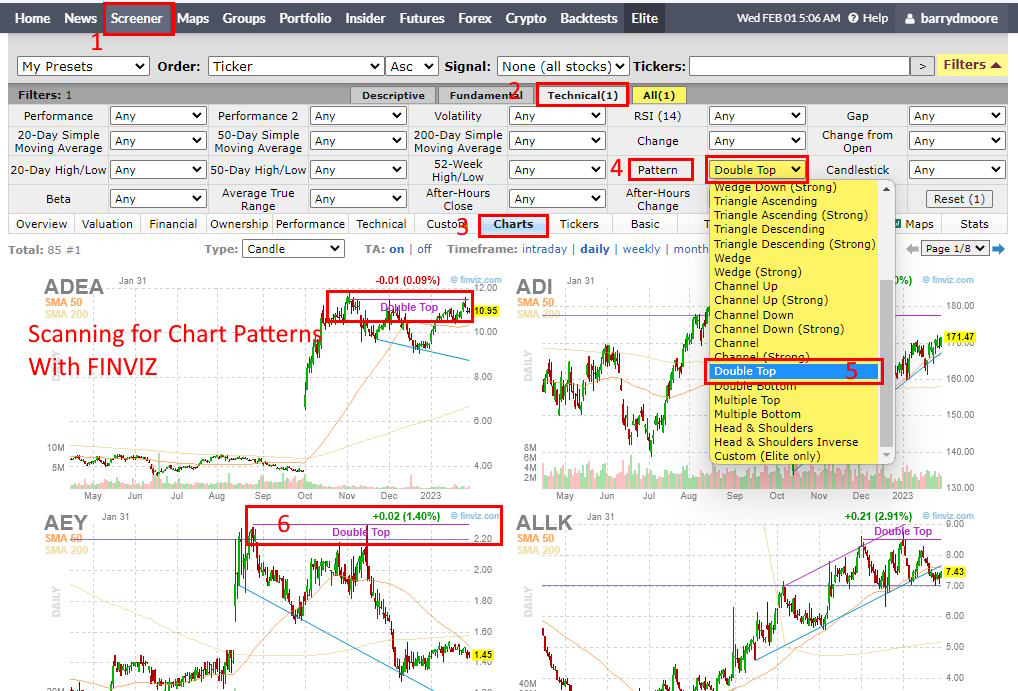

Finviz enables you to scan for 40 different stock chart patterns and candlesticks. Finviz is easy to use, and with a few clicks, you can screen for stock chart patterns across the US stock markets.

To scan for chart patterns with Finviz, follow these steps.

- Visit Finviz > 1. Click Screener -> 2. Select Technicals -> 3. Click Charts -> 4. Open Patterns Drop Down Menu -> Select Your Patterns

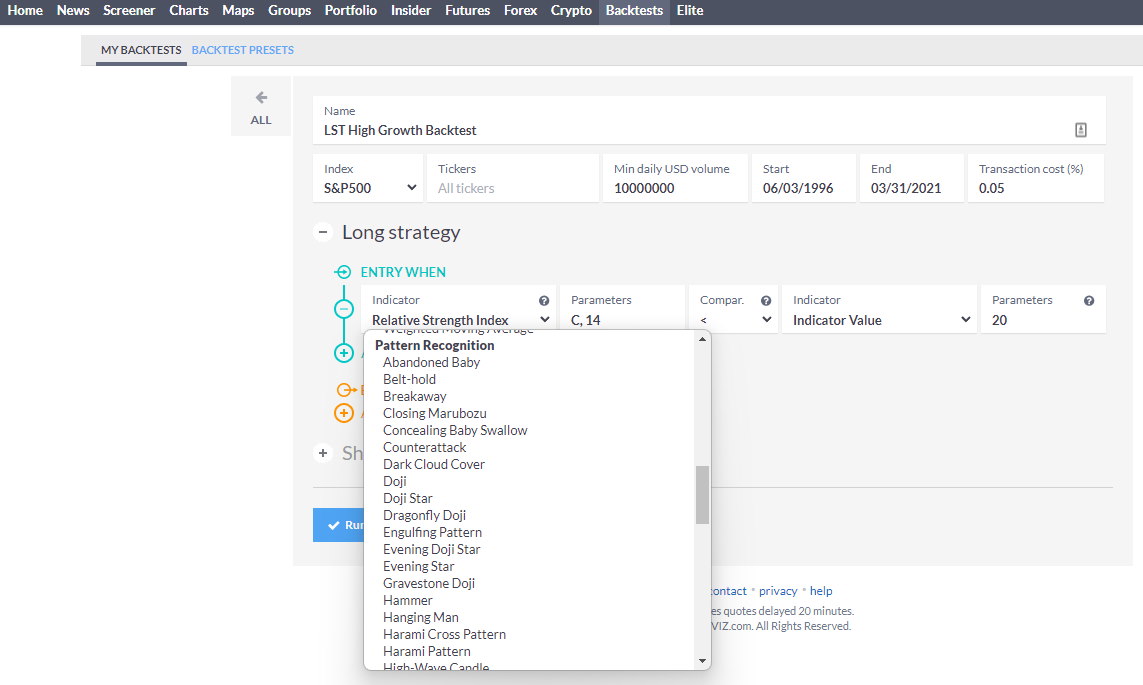

I was very excited to try the Finviz backtesting service, and after six hours of working on strategies with the Finviz backtester, I was impressed. The backtester offers over 100 unique indicators and automatically detects stock chart patterns to help you build a truly unique system. The screenshot below shows a snippet of the available pattern recognition criteria. Now I am excited.

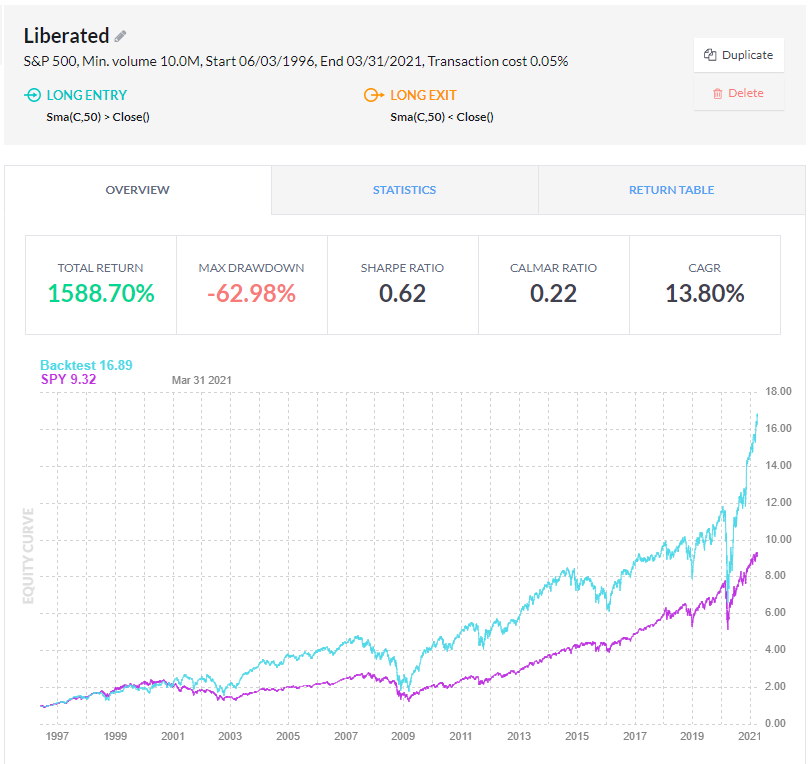

Finviz Elite Review: Building a Successful Backtested System

The Finviz Backtester offers over 100 unique indicators and automatically detects stock chart patterns to help build a truly unique system. After all this work, I created a system based on the Money Flow Index that has handsomely beat the S&P 500 index over the last 24 years.

The system returned a profit of 1,588%, with a compounded annual return (CAGR) of 15.24% versus the S&P 500 of 10.86%. See the proof below.

In any case, Finviz Free provides excellent stock chart pattern recognition, and FinViz Elite provides powerful backtesting.

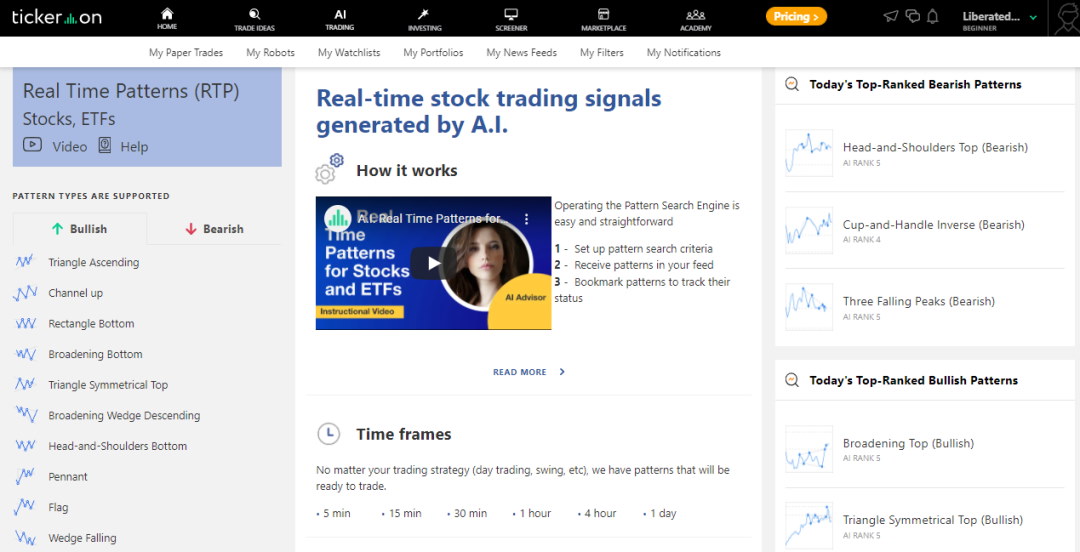

4. Tickeron: AI Stock Chart Patterns Recognition

Tickeron has impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Crypto. Tickeron also has thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

My Tickeron testing confirms impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron provides reliable thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

Tickeron is designed for day traders, swing traders, and investors.

Pros

✔ 45 Streams of Trade Ideas

✔ Real-Time Pattern Recognition for Stocks, ETFs, Forex, and Crypto

✔ AI Trend Prediction Engines

✔ Investing Portfolios with Audited Track Records

✔ Build Your Portfolios with AI

Cons

✘ Custom Charting Limited

✘ Cannot Plot Indicators

✘ Complicated Pricing

At the heart of Tickeron is its AI algorithms’ ability to spot 40 different stock chart patterns in real-time. You can select which pattern you want to trade, and it will filter stocks, forex, or cryptocurrencies that currently show it. Patterns are split into bullish patterns for long trades or bearish patterns for those who wish to go short.

Tickeron’s real-time pattern recognition is particularly useful for swing or day traders, where market timing is the top priority. Tickeron can also scan the entire market and suggest which patterns work best on a particular day. In the screenshot above, you can see “Today’s Top Ranked Patterns,” which rates the potential success of the patterns based on the market’s current trading activity.

Ultimately, pattern recognition saves pattern traders a lot of work hunting for potential trade setups because it does all the work for them.

Trading Signals & Prediction

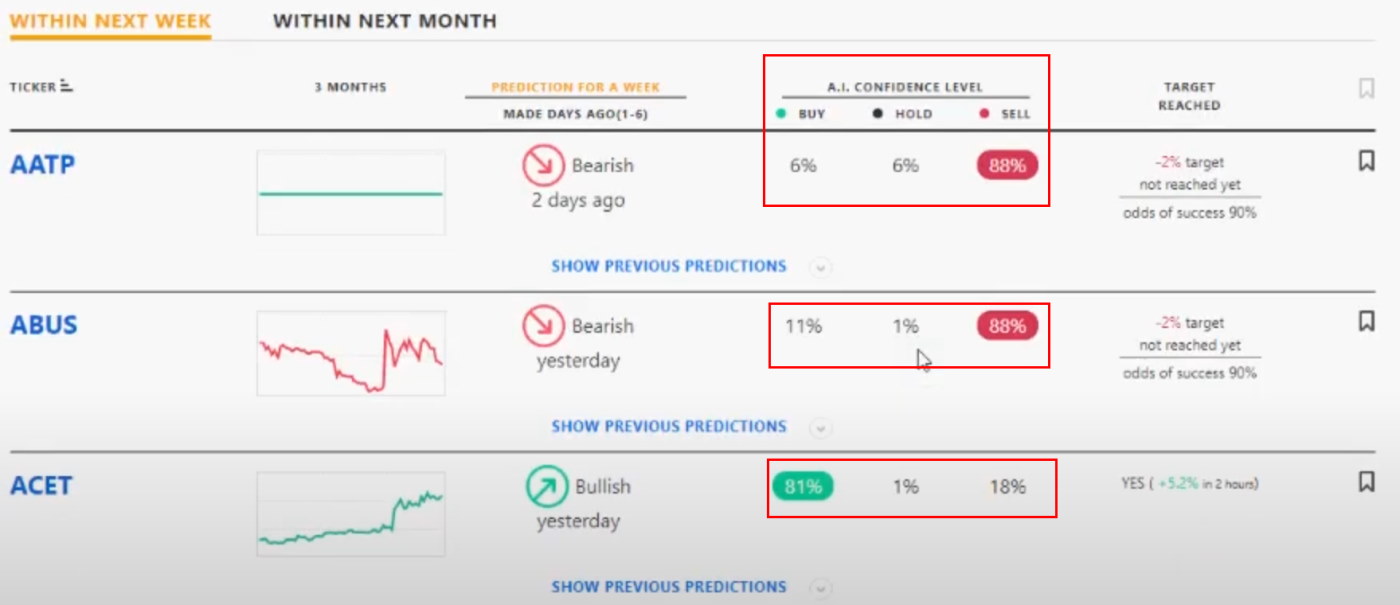

Tickeron has implemented a powerful feature called AI Confidence Level. Based on the stock’s history, the success rate of a particular pattern, and the market’s current direction, Tickeron can assign a confidence level to a trade prediction.

The screenshot below shows that the Tickeron AI predicts that ABUS has an 88% chance of declining in value and ACET has an 81% chance of increasing in value.

The outstanding feature of the Tickeron prediction engine is that you can click “Show previous predictions” to check if the AI has done a good job in the past with a particular pattern on specific stocks. The prediction engine provides the right level of clarity and granularity so you can make informed trading decisions.

Tickeron AI Pattern Recognition Video

Tickeron presents users with charts that already have patterns mapped and directions predicted; this is the single biggest benefit of the service. You will be disappointed if you want to perform your own technical analysis, configure your own indicators, or make chart annotations. Using AI in this platform means you will rely more on the algorithms than your creativity, which is probably good for most people.

5. MetaStock: Candlestick Pattern Trading Tool

Combining MetaStock’s powerful technical analysis charting with Greg Morris’s candlestick pattern recognition add-on enables a stock trading system that predicts the probable win ratio of every pattern. This combination means a systematic trading strategy for buying and selling candlestick patterns.

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex. MetaStock R/T excels with its advanced backtesting and forecasting features, alongside real-time news updates and efficient screening tools.

MetaStock is best for traders who need excellent real-time news, exceptional technical analysis, a vast stock systems marketplace with global data coverage, and excellent customer service.

However, the full Metastock suite costs $265/m. It rivals the Bloomberg terminal in functionality but lacks the new AI trading features of TrendSpider and Trade Ideas, such as AI Bot trading and pattern recognition.

Pros

✔ Great Selection of Automated “Expert Advisors”

✔ Excellent Deep Backtesting

✔ Unique Stock Price Forecasting

✔ Large Library of Add-on Professional Strategies

✔ Best Charts, Indicators & Real-Time News

✔ Xenith Add-On Rivals Bloomberg Terminals

✔ Works Online & Offline

Cons

✘ Takes Time To Learn

✘ Old School Windows App Design

✘ Too Many Add-ons

MetaStock is one of the biggest names in stock market analysis software. It offers fast global data and broad market coverage, including equities, futures, forex, ETFs, and options.

Candlestick Pattern Trading System in MetaStock

Metastock is different from other vendors because their software runs locally on your PC, and you can buy one-off licenses and avoid monthly payments. They also operate a marketplace where professional traders sell their stock trading systems and signals as add-ons to MetaStock.

MetaStock does not natively provide candlestick recognition, so you will need to buy the add-on “Greg Morris’ Japanese Candle Recognition” for a one-off payment of $349. Greg Morris is seen as one of the global authorities on Japanese candlestick trading and has published on the topic.

The Accuracy of Candlestick Patterns

This add-on has a very sophisticated trading system, with full candlestick backtesting, analysis, and signals. It forecasts the next move in stock price and the probability of the Candlestick signal being successful.

The probability rating of the candlestick recognition success is critical, and no other software offers this level of a professional trading system.

In the image below, this signal (highlighted in yellow) predicts a 77% chance of success.

You get forecasting of the direction of the next move in stock price and also the probability of the candlestick signal being successful

Fundamental Scanning and Screening.

Using Refinitiv Xenith, you can see an in-depth analysis of company fundamentals, from debt structure to top 10 investors, including level II. Excellent watch lists featuring fundamentals and powerful market scanning get a perfect 10. MetaStock has full Xenith integration with institutional-level news, analysis, and outlook. This is the fastest global news service available, including translations into all major languages.

Stock Systems Back Testing & Forecasting.

Another area where MetaStock excels is what they call expert advisors. MetaStock harnesses many inbuilt systems to help you understand and profit from technical analysis patterns and well-researched systems as a beginner or intermediate trader. This is a key area of advantage. The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd.

MetaStock still feels like a collection of separately developed applications requiring users’ education to make them work together. However, the vast selection of automated “expert advisors” you can deploy on the range of stocks in your purview makes MetaStock well worth the investment.

Japanese Candlestick Recognition Video

Quick Summary

TrendSpider offers robust backtesting, candlestick analysis, and interpretation on multiple timeframes. TradingView has the best free candlestick charting and recognition for global stock/Forex markets. Finally, MetaStock offers a powerful candlestick trading system with buy signals and win probabilities for professional traders. They are all excellent solutions; the choice is yours.

FAQ

How can I predict candlestick charts?

Many experts have run backtests to predict candlestick chart outcomes. Success rates vary from 50-50 to 63 percent success rates. Therefore it is important to test candlestick pattern success on specific stocks. You can perform this analysis using TradingView or TrendSpider.

How to read stock candles for beginners?

Beginners must decide whether to learn 147 candlestick patterns or use automated candlestick pattern recognition software. TrendSpider recognizes 147 candlestick patterns and TradingView 47. Both systems allow screening for candlestick patterns across markets and backtest the success rate.

How to recognize stock patterns?

To recognize stock patterns, you first need to memorize the many variations, then review each chart to spot the patterns. Alternatively, use automated pattern recognition using TrendSpider's Market Scanner or the Finviz Screener.

How to predict the next Candlestick?

Predicting the next Candlestick is not as easy as you might think. Candlestick patterns, at best, offer only a 65% chance of predicting correctly, and at worst, they can be misleading. The best way to predict the next candle is to use bullish patterns in an up-trending market. Also, using candle patterns on an hourly or daily timeframe is more predictive than per minute.

How to recognize candlestick patterns?

Manually recognizing candlestick patterns is laborious work, both to memorize the patterns and then examine the chart. This is why TradingView, FinViz, and TrendSpider have powerful algorithms to detect these patterns and save you time.

How many chart patterns are there in the stock market?

There are 20 major stock chart patterns defined by leading technical analysts like Murphy and Pring. Chart patterns range from the very predictive Head & Shoulders and Double Top reversals to the less predictive Wedges and Pennants. All 20 chart patterns are covered in this article.

How to easily identify stock chart patterns?

The quickest and easiest way to identify stock chart patterns is to scan for patterns using the FinViz Stock Screener. 1. Click Screener -> 2. Select Technicals -> 3. Click Charts -> 4. Open Patterns Drop Down Menu -> Select Your Patterns

How to learn stock chart patterns?

To learn stock chart patterns, you need to understand supply and demand and then memorize each pattern. We have a lesson on the 20 most predictive chart patterns here, or you can purchase the book Technical Analysis Explained by John J. Murphy.

How to programmatically find patterns in stock charts?

Programmatically finding patterns in stocks is the future of technical analysis for traders. TrendSpider's Market Scanner, FinViz's Stock Screener, TradingView's Auto-Indicators, and Tickeron's Pattern Engine have already fully programmatically automated the process.

How to screen for stocks with a given chart pattern?

The easiest way to screen for stocks with a specific chart pattern is using the FinViz screener. 1. Select the [Technical] tab. 2. Select [Pattern]. 3. Choose the chart pattern. For more powerful pattern screening, try TrendSpider's Market Scanner.

What is the best software to identify stock chart trendlines?

The best software to identify stock chart trendlines is TrendSpider because it fully identifies all trendlines on all timeframes on a single chart. TrendSpider was created specifically to identify trendlines.

What is the best software for Candlestick Pattern Recognition?

TrendSpider and TradingView are both excellent software for candlestick pattern recognition. While TradingView's Candlestick recognition is more intuitive, TrendSpider enables powerful scanning and backtesting of 168 patterns.

What software has automatic Fibonacci patterns on stock charts?

The best software for automatic Fibonacci pattern recognition on stock charts is TrendSpider's AutoFibs function and TradingView's Auto Fib Extention and Retracement indicators. Automated Fibonacci pattern recognition is rare in charting services because it is so algorithmically complex.

What software is best for chart pattern backtesting?

TrendSpider has by far the best stock chart pattern backtesting, covering 123 candlestick patterns and 28 stock chart patterns. TrendSpider's backtesting is powerful yet elegant, requiring no coding skills.

What are the most predictive candlestick chart patterns?

No candlestick pattern is 100 percent predictive. The most predictive candlestick patterns are bullish candlesticks in a primary stock market uptrend. You must combine market timing and the primary market trend with the right bullish pattern to get the highest win probability. TrendSpider's point-and-click backtesting or MetaStock's candlestick expert advisor can help you test the outcomes.

thanks for the excellent work testing these charts. I tried both tradingview and trendspider. I preferred trendspider due to backtesting.

Hi Tom, you are welcome, I use Trendspider for all my pattern testing it is excellent.