Algorithmic trading software is revolutionizing the way individuals and institutions invest. By utilizing flexible algorithms, these platforms allow for testing and automating trading strategies that can execute orders with precision, speed, and minimal human intervention.

Investors and traders can now design, test, and run trading models that systematically make decisions based on data analysis, historical trends, and quantitative techniques.

My testing shows that TrendSpider, Trade Ideas, TradingView, and Tickeron are the most effective software for creating, testing, and executing trading algorithms.

The right algorithmic trading software aligns with individual trading needs, supports various strategies, and integrates seamlessly with market data feeds while ensuring reliability and efficiency in trade execution.

Our Top-Rated Algo Trading Software

- TrendSpider: Point & Click Algo Creation, Backtesting & Execution

- Trade Ideas: Leading Pre-Build Algorithmic Trading Solution

- TradingView: Global Stocks & Crypto Algo Trading Platform

- Tickeron: Hundreds of Tested Trading Algo’s & Strategies

- VectorVest: Algo Signals for Stock Traders

To harness the full potential of algo trading software, traders must look beyond basic features and consider advanced functionalities, ease of use, customization options, and the robustness of the support infrastructure. Whether one opts for a ready-made system or seeks to build a custom solution, it is essential to comprehend the implications of different software components, including programming languages, historical data access, real-time market data, and the quality of backtesting environments.

Algo Trading Software Ratings & Features

Selecting the right algorithmic trading software can play a pivotal role in executing effective trade strategies. With multiple platforms available, traders can choose software that aligns with their needs, whether they are looking for user-friendliness or advanced technical capabilities.

| Algo Trading Software | TrendSpider | TradeIdeas | TradingView | Tickeron | VectorVest |

| Awards |  |

|

|||

| Algo Software Rating |

4.8 | 4.7 | 4.6 | 4.4 | 4.0 |

| Trading Signals |

✅ | ✅ | ✅ | ✅ | ✅ |

| Alerts |

✅ | ✅ | ✅ | ✅ | ✅ |

| Algo Pattern Recognition |

✅ | ✅ | ✅ | ✅ | ✅ |

| Structured Algo Strategies |

✅ | ✅ | ✅ | ✅ | ✅ |

| Backtesting |

✅ | ✅ | ✅ | ✅ | ❌ |

| Point & Click Backtesting |

✅ | ❌ | ❌ | ❌ | ❌ |

| Automated Trading Bots |

✅ | ✅ | ✅ | ❌ | ❌ |

| 1-on-1 Training |

✅ | ❌ | ❌ | ❌ | ❌ |

Table 1: Algo Trading Software Comparison Table & Ratings

Unlike other websites, we test everything we recommend.

1. TrendSpider: Best Algo Trading Software Overall

TrendSpider is lauded for its comprehensive technical analysis tools, which can appeal to both novice and seasoned traders. Offering automated analysis and graphical tools, it stands out as a robust choice for market participants focused on algorithmic technical trading.

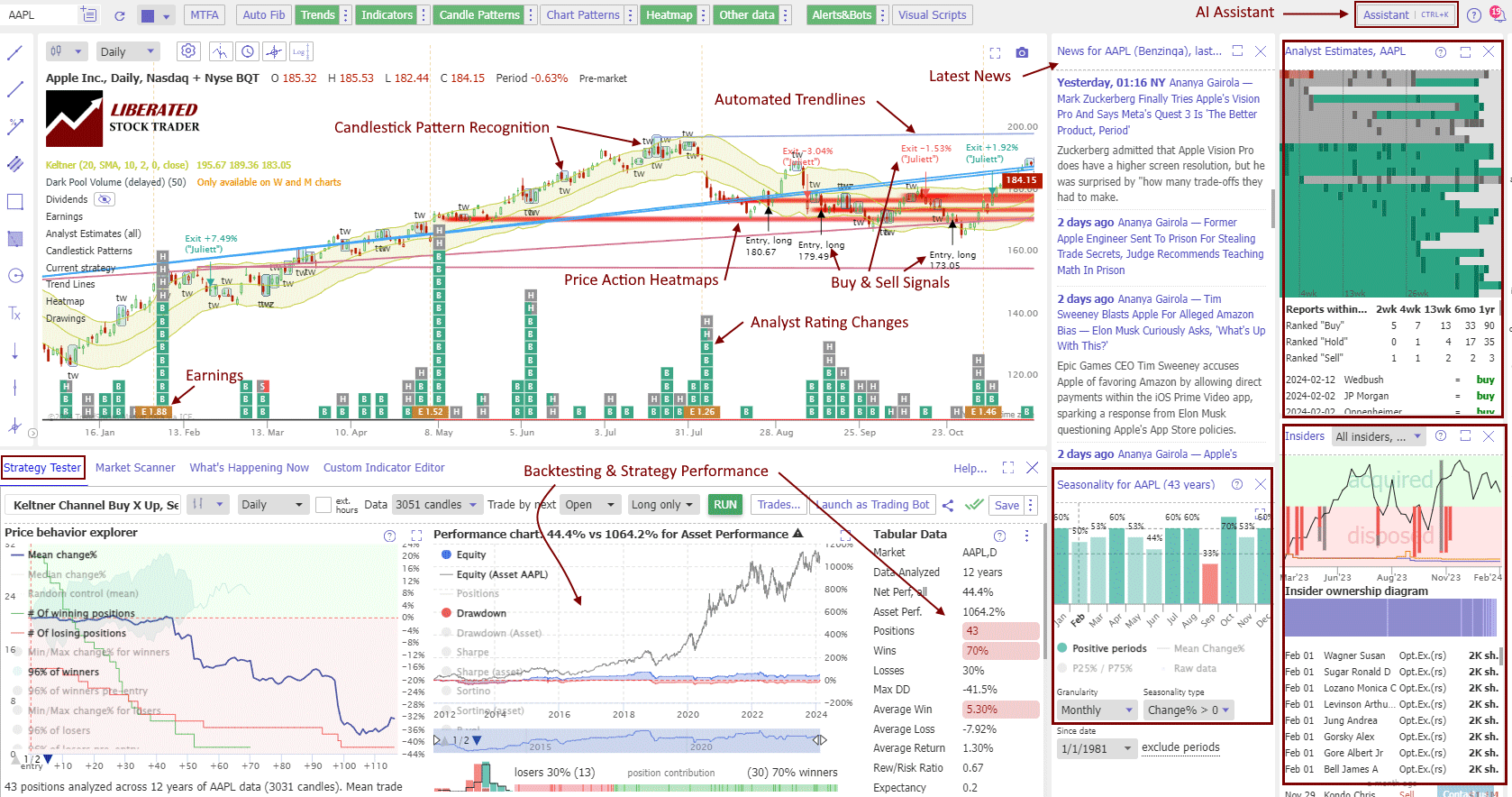

TrendSpider is the ultimate tool for complete algorithmic stock chart pattern recognition and intelligent point-and-click backtesting. It empowers users to rapidly and effectively identify high-probability trading opportunities.

| TrendSpider Rating |

4.8/5.0 |

| ⚡ Algo Trading Features |

Pattern & Candlestick Recognition, Auto-Trendlines & Fibonacci |

| 🏆 Unique Features |

Auto-Bot Trading, Code-free Powerful Backtesting, Free Real-time Data |

| 🎯 Best for | Stock, Forex, Futures & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price |

$107/m or $48/m annually |

| 💻 OS | Web Browser |

| 🎮 Free Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Region | USA |

TrendSpider’s platform revolutionizes stock analysis, automating trend line detection and multi-time-frame analysis; it offers a holistic view of the market, aiding in strategy formulation.

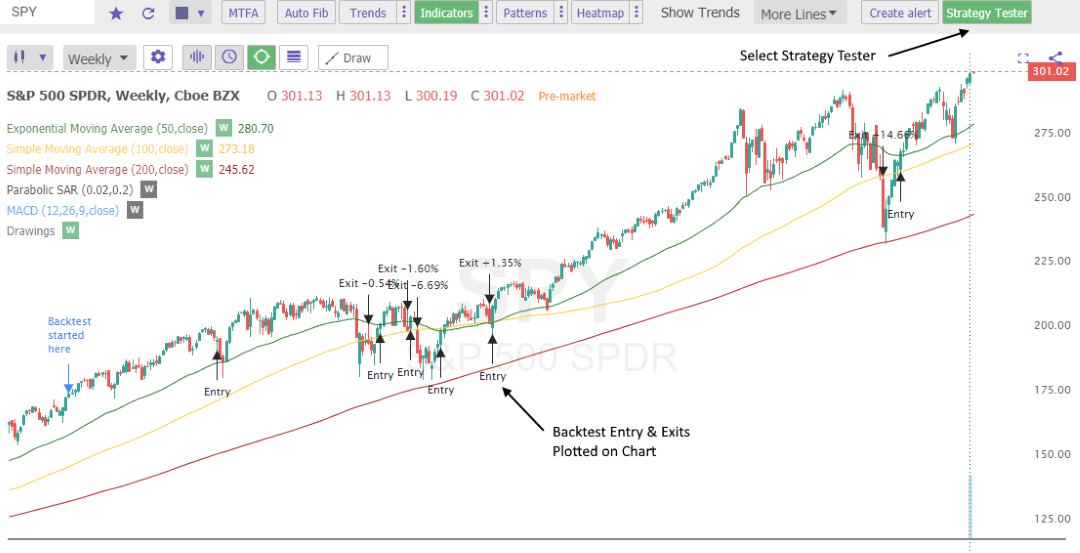

Backtesting is simple yet powerful, and real-time exchange data (included in all subscriptions) ensures up-to-the-minute information. The tool’s automatic Fibonacci trend detection identifies significant price levels. Supporting stocks, ETFs, forex, crypto, indices, and futures makes TrendSpider a go-to tool for traders.

TrendSpider has fully automated trendlines, Fibonacci, and multi-timeframe analysis on all tradable assets. Add a powerful script or point-and-click backtesting engine, and you will have a great algorithm analysis platform.

TrendSpider takes a different approach to backtesting. The platform is built from the ground up to detect trendlines and Fibonacci patterns automatically; it already has an element of backtesting built into the code’s heart.

The highest probability trendlines are automatically drawn, and you can adjust the algorithm’s sensitivity, which controls whether or not the detection shows more or fewer lines.

TrendSpider has also implemented a strategy tester that allows you to freely type what you want to test, and it will do the coding for you. It is a smooth and simple implementation that had me up and running in minutes. I like the ability to adjust backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update. You can jump into coding if you want to, but the key here is that you do not have to.

Integrated backtesting of automated trendlines, showing win rate, profitability, and drawdown, is a welcome addition; the team propels TrendSpider into one of the industry’s leading technical analysis packages.

They have also implemented an AI assistant that allows you to type what you want to test freely, and it will do the coding for you.

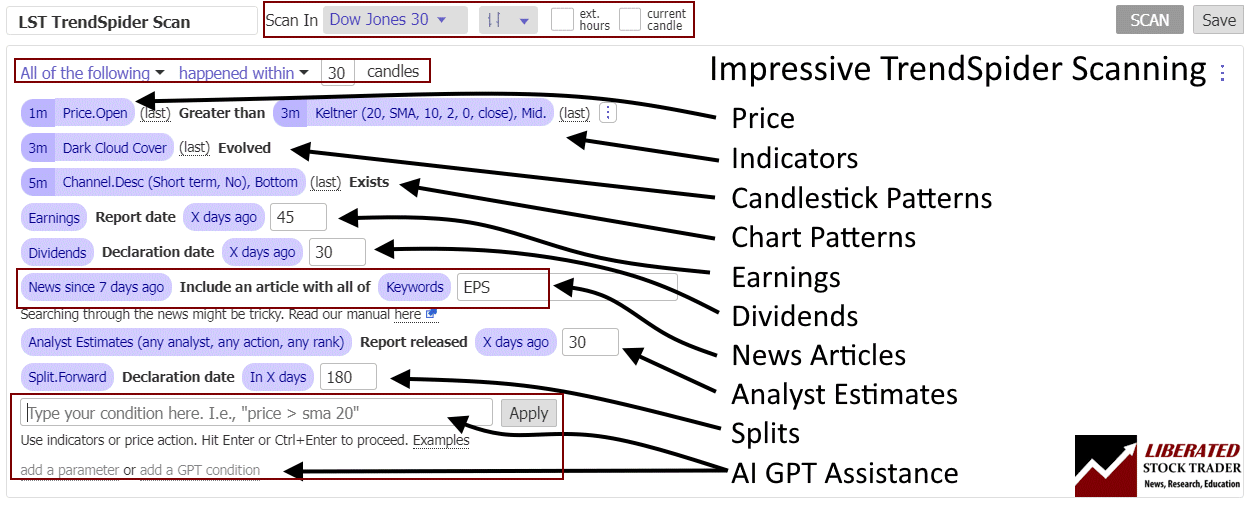

In the screenshot below, you can see the point-and-click algorithmic scanning and screening in TrendSpider.

It is a smooth and straightforward implementation that had me up and running in minutes. I like the ability to adjust your backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update. You can jump into coding if you want to, but the key here is that you do not HAVE to.

TrendSpider Backtesting Video

In summary, TrendSpider’s algorithms recognize 150 candlestick patterns and work with 220 chart indicators. They also work on multiple timeframes and in real time. You can also algorithmically scan news announcements and analyst ratings. Finally, personal 1-on-1 training is included for every customer.

2. Trade Ideas: Best Black Box Algo Software

Trade Ideas employs three proprietary algo engines that identify trading opportunities in real time. It caters to traders who favor a hands-off approach but still demands high-quality, actionable stock market insights.

| Trade Ideas Rating |

4.7/5.0 |

| ⚡Algo Trading Features |

3 Algorthimths, Pattern Recognition |

| 🏆 Unique Features |

Real-time Trading Signals, Auto-Trading, Trading Room |

| 🎯 Best for | US Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price |

$254/m or $178/m annually |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | Try the Live Trading Room Free |

| ✂ Discount | -15% Discount Code “LIBERATED” |

| 🌎 Region | USA |

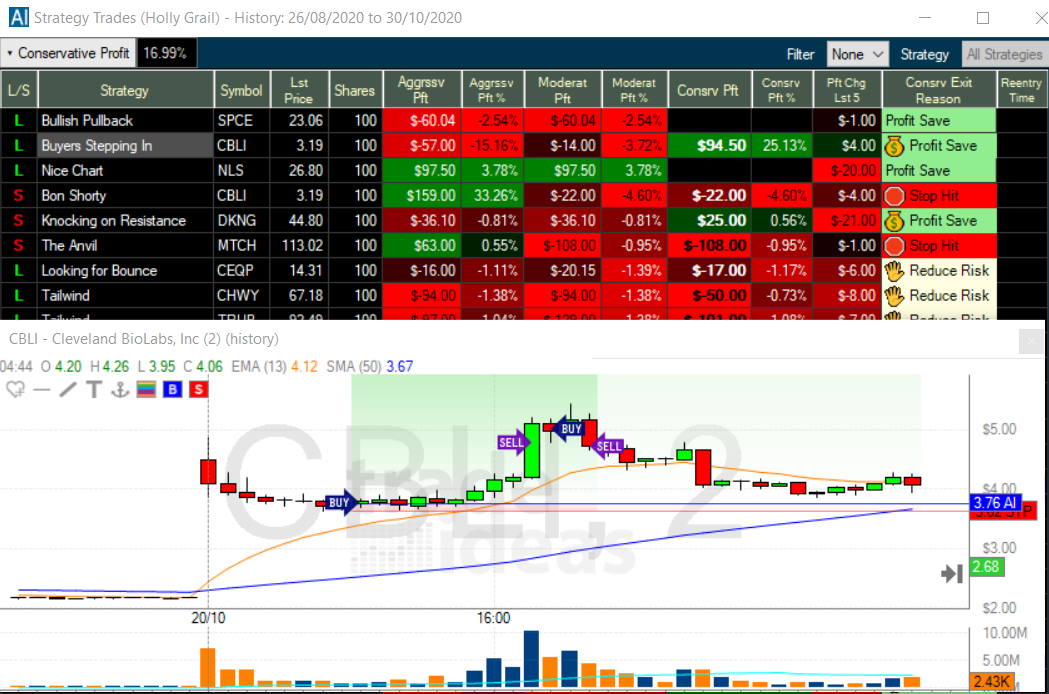

The main reason for signing up for Trade Ideas is the trading algorithms (AIs) they have developed. I had a long meeting with a senior strategist at Trade Ideas to understand how the Holly algorithms work, and I was very impressed. This company is focused on providing traders with the best data-supported trading opportunities. Currently, three algo systems in operation apply over 70 different strategies.

Holly Algorithms

Holly is their original trading algorithm employing 70 distinct strategies across all US stock exchanges. With 70 strategies applied to 8,000+ stocks, millions of backtests are conducted daily. Only strategies showing a backtested success rate exceeding 60% and an estimated risk-reward ratio of 2:1 are recommended as potential trades for the next day.

Holly 2.0 is a newer algorithm that presents more aggressive day trading scenarios. Trade Ideas operates three key trading strategies: Conservative, Moderate, and aggressive. According to our research, Holly 2.0 is the most aggressive stock trading Bot and provides the best trading returns.

Holly Neo

Holly NEO, Trade Ideas’ latest algorithm, focuses on trading real-time chart patterns using a blend of key day trading technical analysis tactics. These include trading stock price pullbacks and breakouts, both long and short.

- Pullback Long Strategy: This approach aims to spot trades where the stock price is dipping and showing signs of upward movement with increased volume.

- Breakout Long Strategy involves identifying instances in which the stock price surpasses a critical resistance level or reaches new highs.

- Pullback Short Strategy: Seeks to pinpoint short opportunities during price pullbacks.

- Breakdown Short Strategy: Identifies opportunities for short positions when the upward momentum weakens.

Buy & Sell Signals

A significant benefit of Trade Ideas is that it visually shows you every buy and sell signal on a chart. I have highlighted a trade Holly Grail recommended in the chart below. This trade for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within 4 hours. Not how the buy and sell signals are depicted on the chart.

Algorithmic Trade Execution

Trade Ideas is one of the few services that offer fully end-to-end algo stock trading. It lets you connect to eTrade or Interactive Brokers for automated trade execution. Trade signals generated from Holly cannot be autotraded, but alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan).

3. TradingView: Best Algo Software for Global Markets

TradingView is known for its exceptional charting capabilities and a wide range of indicators. Its social community aspect allows traders to share strategies and insights, making it a top pick for those who want to engage with global financial markets.

Tradingview is the most developed global algo trading platform for international stock, FX, and Crypto traders. It automatically detects chart patterns and candlestick patterns and enables auto-trading.

| TradingView Rating |

4.6/5.0 |

| ⚡ Algo Trading Features |

Chart Pattern & Candlestick Recognition, Full Broker Integration |

| 🏆 Unique Features |

Global Stock, FX & Crypto Markets, Webhook Algo Trading Integration |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price |

Free | $13/m to $49/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | Free 30-Day |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Region | Global |

TradingView automatically identifies and scans for numerous chart patterns like double tops, rectangles, as well as bullish and bearish candle patterns such as Harami, Doji, and Marubozu. This functionality improves the platform’s usability, providing users with advanced market analysis tools.

Moreover, TradingView boasts robust backtesting capabilities that can automatically pinpoint intricate trading configurations and send Webhook alerts to systems like SignalStack for execution. To use backtesting, you must learn basic Pine scripting, which can take some time. There is no code-free backtesting or indicator development engine.

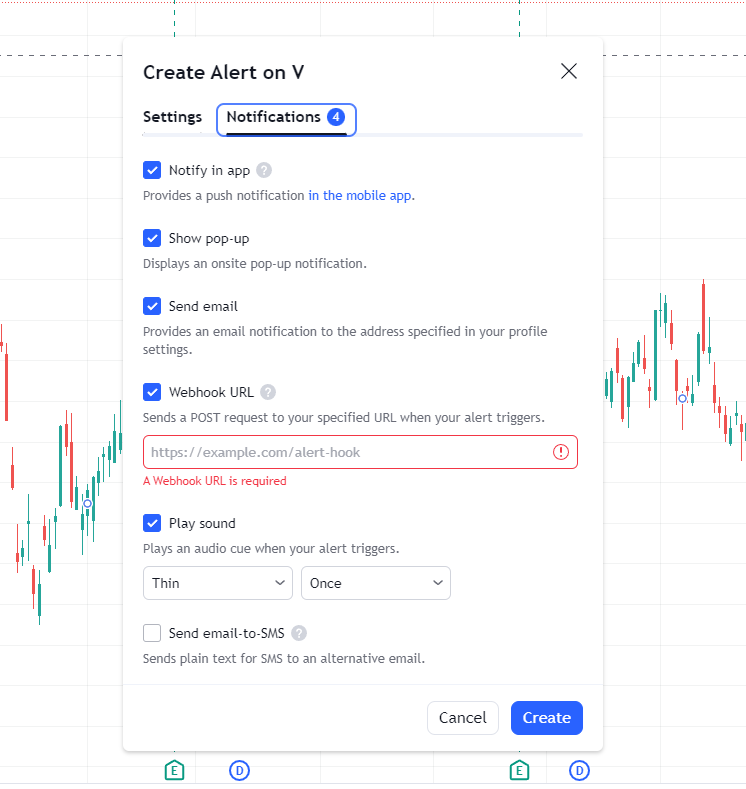

Algo Trading Through Alerts

Enabling algo trading on TradingView is easy: Right-click a chart, Select “Add Alert,” Click “Notifications,” and add a Webhook URL. (See my screenshot image below.)

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

TradingView stands out for its wide array of integrated Brokers, ensuring access to reputable brokers worldwide for seamless trade execution. Additionally, it hosts the largest global community of traders and holds the title of the world’s leading investing website. Offering global coverage across stocks, ETFs, Forex, and Crypto exchanges, TradingView stands as the go-to platform for traders on a global scale.

4. Tickeron: Good Selection of Pre-Made Algos

Tickeron provides a suite of pre-made algorithms that can help traders with varying levels of expertise make informed decisions. The platform also includes artificial intelligence features to help refine investment strategies.

Tickeron uses algorithmic stock chart pattern recognition to predict future trends, providing 45 streams of trading ideas.

| Tickeron Rating | 4.4/5.0 |

| ⚡ Algo Trading Features | 45 Streams of Trade Ideas, Pattern Recognition |

| 🏆 Unique Features | Real-time Trading Signals for ETF, Forex & Crypto |

| 🎯 Best for | Short-term Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free or $250/m or $125/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | 14-Day Free Trial |

| ✂ Discount | -50% Off All Annual Plans |

| 🌎 Region | USA |

Tickeron, a subsidiary of SAS Global, a prominent figure in data analytics trusted by numerous Fortune 500 firms, leverages algorithmic principles to craft trading concepts through pattern recognition. Initially, the platform sifts through a pool of technical analysis patterns to pinpoint stocks in sync with these patterns via its pattern search engine. Each identified pattern boasts a proven track record, integrated into the forecast through its Trend Prediction Engine for optimal accuracy and reliability.

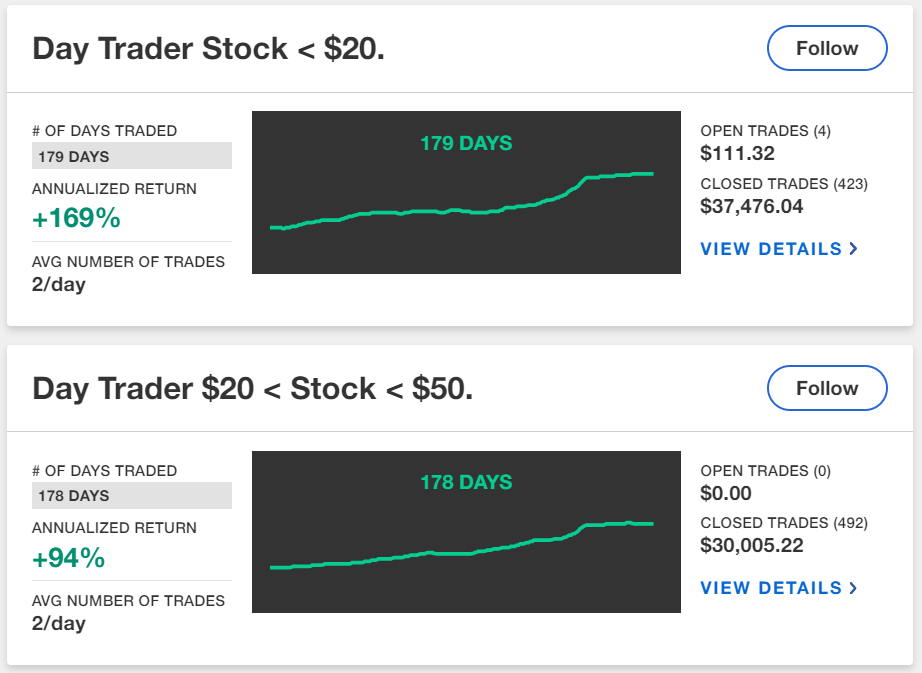

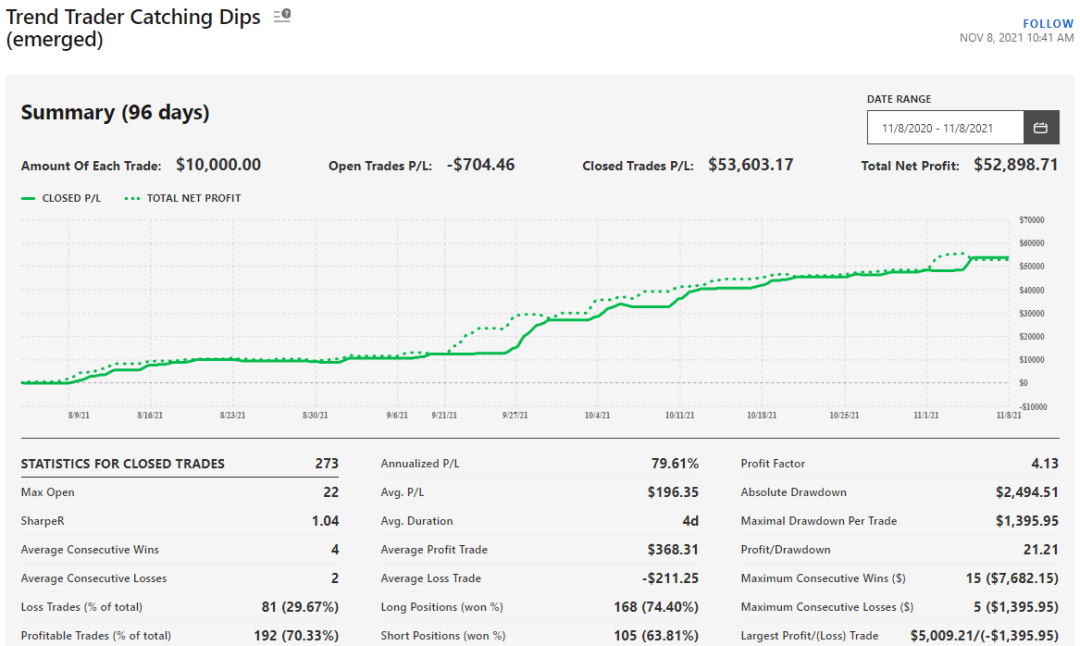

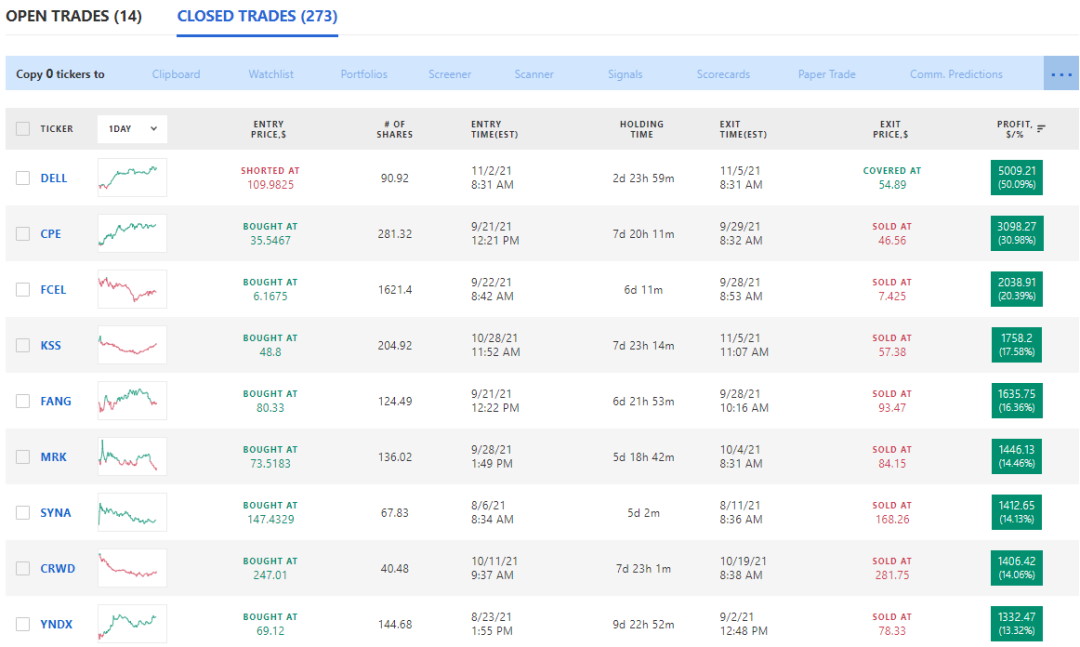

Tickeron presents its proven success record. Out of the 34 Trading Bots assessed, merely two reported under a 30% annualized gain, while the rest boasted annualized gains ranging from 40% to 169%, as depicted in the image below. Tickeron asserts remarkable returns and meticulously audits all trades for transparency and accuracy.

The Day Trader Stock >$20 Algo claims a Win Rate of 61.64%, which is very high, especially when put into the context of this report from Fast Company.

Auditing the individual historical trade alert issued by the software is also important. Trade Ideas and Tickeron allow you to see all historical trades, whether they win or lose; transparency is the key here.

Tickeron leverages its algorithmic engine to deliver precise stock selections. The algorithm can analyze a specific index or watchlist to identify trading prospects across chosen stocks. Moreover, Tickeron provides cutting-edge portfolios to ensure attributes like diversification and high returns.

Having tested Tikeron, I have to say that Tickeron is a very professional, sophisticated, and easy-to-use stock market algo software that delivers results. Tickeron is well worth trying.

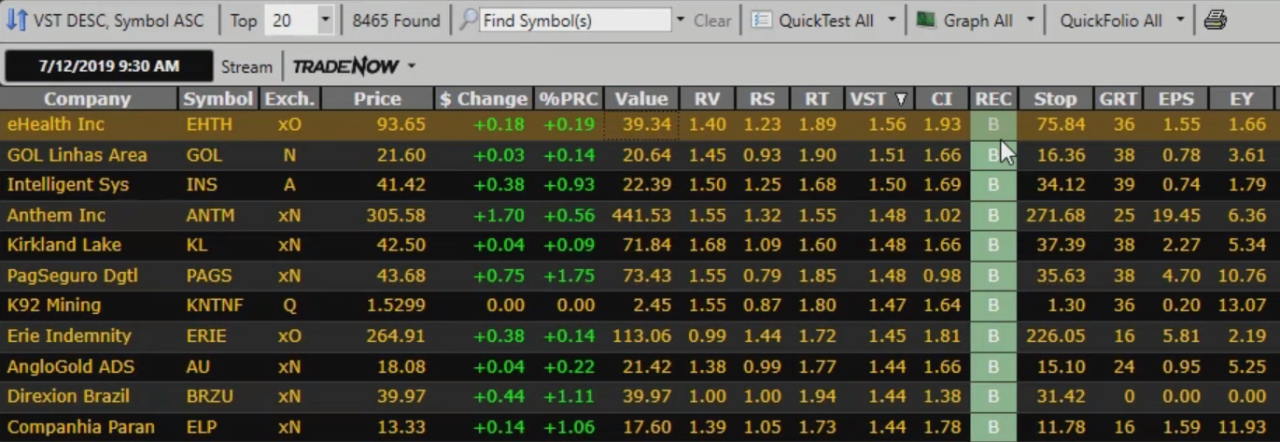

5: VectorVest: Tested Algo Trading Strategies

VectorVest combines fundamental and technical analysis, offering a rich selection of automated trading strategies. With built-in market timing signals, it is suitable for traders looking for software to help streamline their decision-making process.

Vectorvest offers algorithmic trading signals, options analysis, and strategic insights. Despite its premium cost, VectorVest asserts that its stock recommendation system has surpassed the S&P 500’s performance by an impressive tenfold in the last 22 years. Given these exceptional outcomes, it is certainly worth exploring.

| VectorVest Rating |

4.0/5.0 |

| ⚡ Algo Features |

Market Timing Gauges |

| 🏆 Unique Features |

Buy & Sell Signals, Auto-trading |

| 🎯 Best for | Beginner Investors |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price |

$58 to $125/m annually |

| 💻 OS | Web Browser |

| ✂ Discount | 1st Month $0.99 |

| 🌎 Region | USA |

VectorVest benefits traders and investors, primarily simplifying finding stocks based on the VectorVest proprietary system and providing general bullish and bearish signals.

Dr. DiLiddo established VectorVest over four decades ago with the vision of offering a user-friendly system that recommends buy and sell signals to investors. This system is built on a proprietary stock-rating methodology centered on Value, Safety, and Timing.

VectorVest software is designed to simplify trading by focusing on the core principles of the Value, Safety, and Timing system. By reducing the number of stock market indicators to the essentials required for trading within the VST system parameters, VectorVest provides a straightforward approach to investing.

VectorVest continually evaluates every stock on the exchanges they cover to provide their proprietary algo ratings.

- RV Relative Value shows the estimated return versus a AAA Corporate Bond.

- RS Relative Safety measures the consistency of a company’s financials.

- RT Relative Timing is a technical indicator that defines the short-term stock trend.

- VST Value-Safety Timing indicator aggregates RV, RS, and RT into one number.

Ultimately, VectorVest advises trading stocks with strong fundamentals that align with the market’s uptrend. This strategy resonates with me and forms the bedrock of my stock investment approach.

Choosing the Right Algo Software

Choosing the right algorithmic trading software depends on factors like your skills, user-friendliness, target markets, assets, and API compatibility.

Criteria for Selection

Technology Adaptability: The right software should match a trader’s technological proficiency. For those comfortable with programming, platforms like TradingView, which offers support for algo strategies with its proprietary scripting language Pine script, represent a fitting option.

User Experience: Traders without a programming background should seek platforms offering a user-friendly interface. Criteria include intuitive design and the provision for building algorithms without delving into code, such as TrendSpider, which allows strategy automation using plain English commands.

Financial Instrument Coverage: A software’s adaptability to various market types is crucial. While some platforms may specialize in equities, others might favor Forex or cryptocurrencies. TrendSpider covers crypto, stocks, and futures. TradingView covers them all globally.

Cost Efficiency: Pricing models vary, from subscription-based to one-time fees or cost-free if using partnered brokers. Traders must consider the long-term financial implications of the software use.

Performance Reliability: A platform that executes trades with minimal downtime and offers real-time data can significantly impact trading outcomes.

Support and Community: Access to a robust support network and an active user community can enhance a trader’s experience and ability to resolve issues quickly. TradingView has a great global trading community, while TrendSpider offers personalized one-to-one training.

Key Features of Algo Trading Software

Selecting the right algorithmic trading software is essential for effectively harnessing the capabilities of automated trading strategies. Investors should prioritize robust technical analysis, swift execution, and versatile development tools when choosing their platforms.

Technical Indicators and Charts

The best algo trading software is equipped with a wide array of automated technical indicators and charting tools. These features enable traders to scan for and analyze market trends and price movements with precision. Utilizing indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) is pivotal for developing informed trading decisions. For this criteria, TradingView and TrendSpider are the leaders.

Backtesting Capabilities

Backtesting is a critical feature, allowing traders to test their strategies against historical data before risking capital in live markets. Effective backtesting provides insights into a strategy’s potential performance, highlighting its profitability and risk management efficacy under various market conditions. In this category, TrendSpider is clearly the best.

Automation and Execution Speed

Automation ensures trades are executed according to predefined criteria without the need for manual intervention. Optimal execution speed is crucial as it can significantly affect a strategy’s success, especially in volatile markets where prices change rapidly. The best software for trade execution is TrendSpider and Trade Ideas.

Building Your Own Trading Bots

For those who can code, the ability to build custom trading bots is a valuable feature. It allows traders to tailor their strategies using programmable frameworks, which can include anything from simple scripts to complex algorithms.

APIs and Compatibility

The integration of Application Programming Interfaces (APIs) enhances trading software’s versatility by facilitating compatibility with various data feeds, brokerage accounts, and other trading tools. A robust API is the cornerstone for implementing custom strategies and extending the platform’s functionality. SignalStack is the leading trading software that masterfully integrates these features.

FAQ

What are the top algorithmic trading platforms for beginners?

Our tests show platforms such as Trade Ideas, TrendSpider, and TradingView are recommended for those new to algorithmic trading due to their user-friendly interfaces and supportive resources for individuals.

How does algorithmic trading software integrate with brokers?

Algorithmic trading software typically integrates with brokers through APIs that allow the software to execute trades automatically on behalf of users. This connection enables real-time data exchange and seamless execution of trading strategies.

What are the standout features to look for in algorithmic trading software?

Key features to consider include the ability to backtest strategies, the presence of a comprehensive data feed, ease of strategy implementation, and robust security measures. High-speed processing and AI-powered analysis tools are also significant advantages for many traders.

Can you find effective algo trading software that is available for free?

Yes, some platforms offer free versions of their algo trading software, though they may have limitations in terms of features or data access. TradingView, for example, provides a platform for algorithmic trading strategy customization that could potentially be explored at no cost.

What is the cost of premium algo trading software?

Premium algorithmic trading software can vary greatly in price, from $50 to $200/mo, with costs influenced by factors such as the depth of features, data quality, and level of customer support. Traders must assess the potential return on investment and consider whether the added features justify the expense.