Stock Rover stands out as my top-rated stock screener, offering an impressive 650 financial metrics on 10,000 stocks and 44,000 ETFs.

My review testing awards Stock Rover 4.7 stars. Its advanced screening, research, and portfolio tools are ideal for US value, income, and growth investors.

As a premium subscriber to Stock Rover for the last six years, I can help you decide if this platform is right for you. I use Stock Rover daily and will show you all the service’s important benefits and limitations.

My Ratings & Verdict

My testing shows Stock Rover is best for long-term dividend, value, and growth investors. Its exceptional features are in-depth screening of a 10-year financial database, research reports, and broker-integrated portfolio management.

| Stock Rover Rating | 4.7/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 Portfolio & Research | ★★★★★ |

| 📰 News & Social | ★★★✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 🖱 Usability | ★★★★★ |

Stock Rover is an industry-leading platform that enables the development of intricate dividend, value, and growth investing strategies.

With Stock Rover, I have developed incredible value strategies using its unique fair value, discounted cash flow, and margin of safety data. Its extensive growth investing data, such as performance versus the S&P 500 and industry growth and earnings rankings, make Stock Rover the best choice for serious investors.

Stock Rover’s key benefits include portfolio correlation and balancing and screening for dividends, value, and growth stocks. Its 10-year historical dataset allows you to backtest your screening criteria, which means you can see if your scans were profitable in the past.

Pros

✔ 650+ Financial Screening Metrics

✔ Potent Stock Scoring Systems

✔ Unique 10-Year Historical Financial Data

✔ Warren Buffett Value Screeners & Portfolios

✔ All Important Financial Ratios

✔ Real-time Research Reports

✔ Portfolio Management & Rebalancing

✔ Broker Integration

✔ Winner: Best Value Investing Screener

Cons

✘ No Social Community

✘ Not for Traders

✘ No Cryptocurrency or Forex Data

✘ US Markets Only

Key Features

| ⚡ Stock Rover Features | Charts, News, Watchlists, Broker Integration |

| 🏆 Exceptional Features | Financial Screening, Portfolio Mgt & Rebalancing, 10-Year Database |

| 🎯 Best for | Growth, Dividend & Value Investors |

| ♲ Subscription | Monthly, Yearly |

| 🆓 Free | Try Stock Rover Free |

| 💰 Price | Free or $28/m or $23/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | 14-Day |

| ✂ Discount Code | 25% During Premium+ Trial Period |

| 🌎 Region | USA |

Stock Rover is for long-term investors who want to grow and manage a stock portfolio. While products like TrendSpider and TradingView have investing features, they are more focused on trading features, like AI pattern recognition and technical scanning. Portfolio 123 is a direct competitor, but Stock Rover is better for price, research reports, news, and financial screening.

What is Stock Rover?

Founded in 2008 by Howard Reisman and Andrew Martin, Stock Rover is a US-based company providing stock screening, research, and portfolio management software. Targeted at individual investors, Stock Rover enables value, income, and growth investors to target their investments and manage their portfolios of stocks. Stock Rover customers manage over $10 billion in assets through its brokerage connection service.

Compare to Similar Products

| Features | Stock Rover | TrendSpider | TradingView | Portfolio123 | MetaStock |

| Rating | 4.7 | 4.7 | 4.5 | 4.4 | 4.1 |

| Best for: | Investors | Traders | Traders | Investors | Traders |

| Free Plan | ✔ | ✘ | ✔ | ✔ | ✘ |

| Pricing | Free or $28/m or $23/m annually | $107/m or $48/m annually | Free | $13/m to $49/m annually | Free or $83/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Financial Screening | ✔ | ✔ | ✔ | ✔ | ✔ |

| 10-Year Financials | ✔ | ✘ | ✘ | ✔ | ✘ |

| Portfolio Management | ✔ | ✘ | ✘ | ✔ | ✘ |

| Research Reports | ✔ | ✘ | ✘ | ✘ | ✘ |

| Chart Pattern Scanning | ✘ | ✔ | ✔ | ✘ | ✘ |

| AI Stock Screening | ✘ | ✔ | ✘ | ✘ | ✔ |

| Financial News | ✔ | ✔ | ✔ | ✘ | ✔ |

| Stocks & ETFs | ✔ | ✔ | ✔ | ✔ | ✔ |

| FX/Commodity | ✘ | ✔ | ✔ | ✘ | ✔ |

| USA & Canada | ✔ | ✔ | ✔ | ✔ | ✔ |

| Global Market Data | ✘ | ✘ | ✔ | ✘ | ✔ |

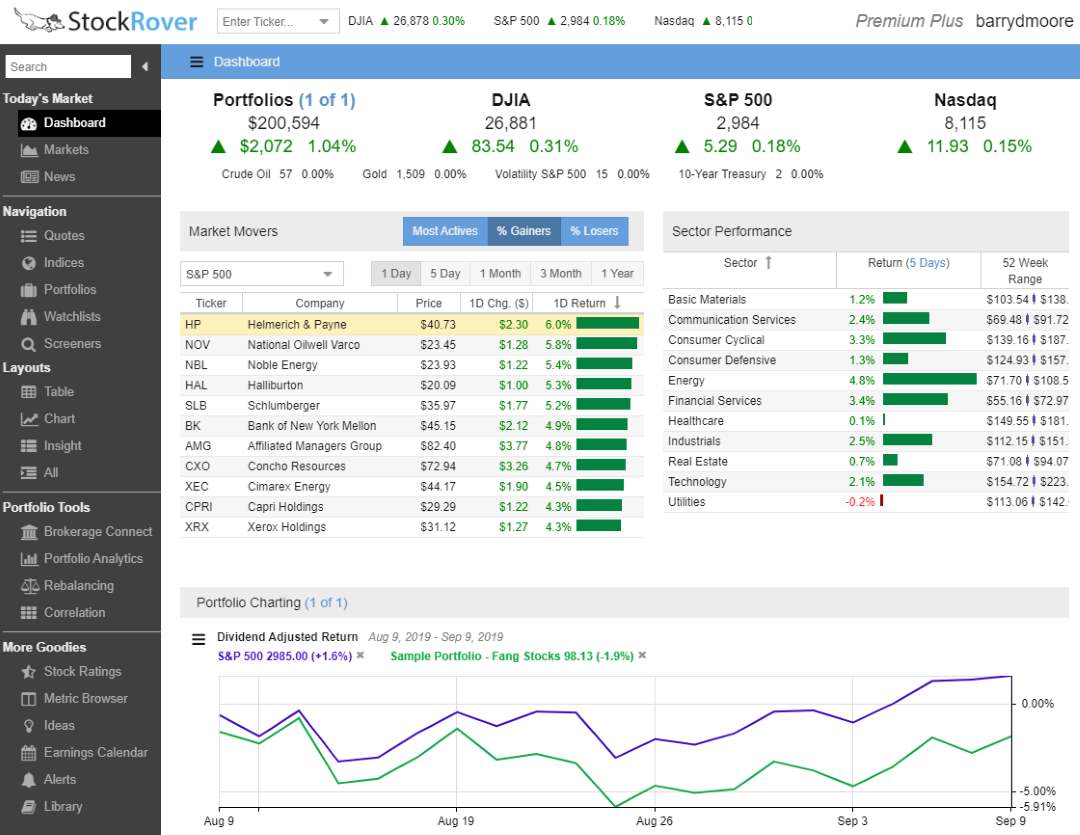

Software

Stock Rover runs on PCs, Macs, Tablets, and Smartphones and requires zero installation; it simply works. The market data, scoring, ranking, and analysis are for the USA & Canadian markets only. When you register with Stock Rover and log in, you are greeted with the dashboard, which gives you an instant market performance breakdown and shows you your portfolio and dividend performance.

Stock Rover Download

Stock Rover is a modern cloud-based architecture with no client software to download and install. All the stock exchange data resides on the vendor’s servers in the cloud. The charting and visualization are also stored and computed in the cloud; any chart you want to visualize is streamed to your client’s device.

Mobile App

Currently, there is a mobile-friendly Stock Rover App accessible via a special link: https://www.stockrover.com/mobile. However, to have full power on Stock Rover, you should use a PC, Mac, or tablet.

Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market.

Why I Rate Stock Rover 4.7/5 Stars

Try a Stock Rover 30-Day Free Trial

Screening

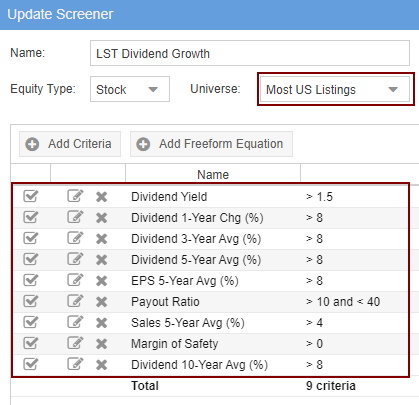

The Stock Rover screener allows for rapid filtering of 10,000 stocks and 44,000 ETFs to help you find investments that match your exact criteria. Stock Rover also has ranked screening, which enables you to rank the stocks that best match your criteria and filter a list from hundreds of stocks to a handful.

The list of fundamentals you can scan and filter on is genuinely huge. Any idea you have based on fundamentals will be covered with over 650 data points, scoring systems for stocks, and 96 criteria for ETFs.

Unique to Stock Rover is the ability to screen stocks on their performance relative to the S&P500. You could develop a strategy to select stocks based on their historical performance versus the benchmark.

Building your Stock Rover screener is easy: select Create Screener, give it a name, select the equity type, choose your universe of large, medium, or small-cap stocks, and then add your criteria. No programming skills are required.

Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can even set the watchlist and filters to refresh every single minute if you wish.

With a screening and research tool, the critical magic ingredient is the database, and boy, is this an enormous database. There are over 650 selectable metrics, and 228 contain ten years of historical data. That historical data can be selected as Trailing Twelve Months (TTM) or historic calendar year data.

Some of my very favorite ratios and calculations are:

- Margin of Safety / Fair Value

- Greenblatt Earnings Yield and ROC

- Return vs. S&P500

- Piotroski and Altman-Z scores

- The Stock Rover Growth and Value Scores.

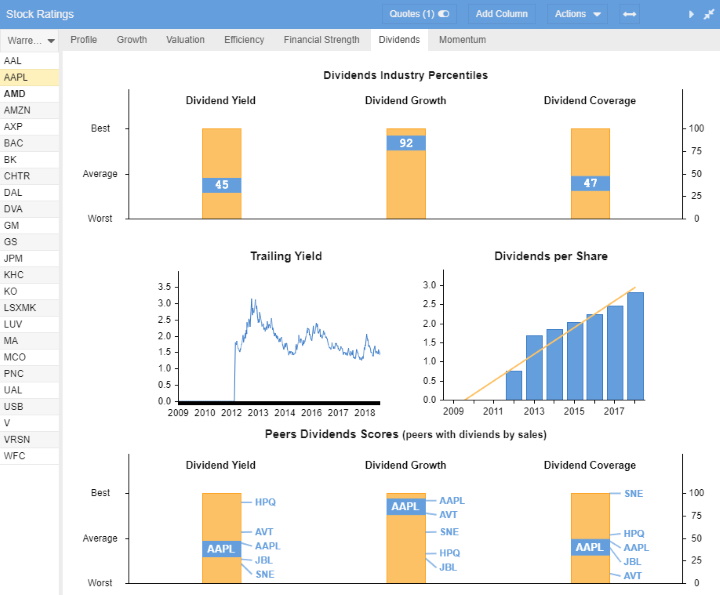

Stock Ratings

Stock Rover provides a rating engine that meticulously ranks stocks based on important metrics like growth, valuation, financial strength, dividends, and momentum. These ratings enable you to develop strategies to find stock with strong financials, cash flow, and efficiency, greatly simplifying strategy development.

I particularly like the roll-up view for all the scores and ratings. In the screenshot below, I have imported the Warren Buffett portfolio, which includes his top 25 holdings. I have also selected the “Stock Rover Ratings” tab, which rolls up all analyses into a simple-to-view ranking system, saving tremendous time and effort while providing a wealth of insight.

In the screenshot above, Stock Rover scores stocks on growth, valuation, efficiency, financial strength, dividends, and momentum. It also has overall ratings that place stocks in the top 20% of all rankings, making finding good investments easy.

Pre-Built Screeners

Stock Rover has over 150 pre-built screeners that you can import and use. You need to have the Premium Plus service to take advantage of this. I have personally reviewed many of them, and they are very thoughtfully built. One of my favorites is the Buffettology screener.

Buffettology Screener

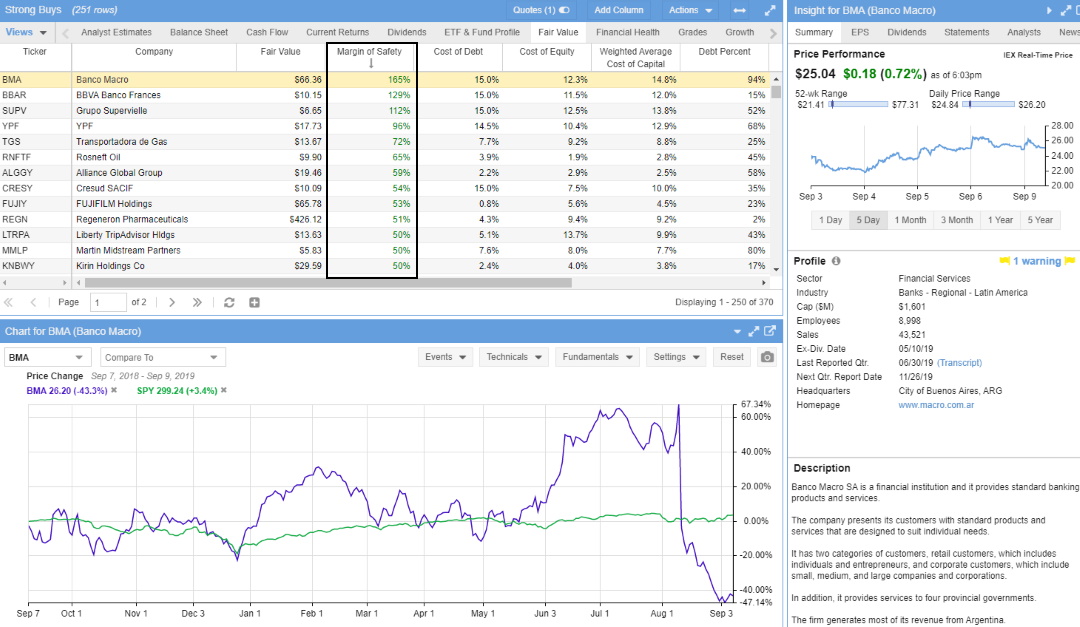

Fair Value & Margin of Safety Rankings

One of Stock Rover’s killer features is the ability to view any watchlist, portfolio, or screener results using the Fair Value view. Fair Value enables value investors to assess whether the stocks in a portfolio are undervalued or overpriced compared to their forward discounted cash flow; this is a dream feature for value investors.

The Fair Value and Margin of Safety analysis and rankings are a nightmare to calculate, but they more than justify the price of the Stock Rover Premium plan.

[Related Tutorial: Setup Your Own Warren Buffett Stock Screener With Stock Rover]

Dividend Income Analysis

Stock Rover provides dividend analysis to visualize a stock’s dividend yield, growth, and coverage versus its competitors. It analyzes any portfolio or watchlist to predict future dividend income based on current and future estimated dividends, making it ideal for income investors.

As all smart investors know, you need to accrue your dividends to have a chance at excellent market-beating returns. Stock Rover provides intelligent analysis to enable you to do just that.

Financial News

Stock Rover consolidates news from over 20 news sources, including Forbes, MarketWatch, and The Wall Street Journal, providing a time-saving way to view events that may impact your stocks or the market. The news feeds are not real-time, but they are useful.

As a long-term investor, real-time news is not a priority. If real-time is your priority, you can subscribe to Benzinga Pro News separately. Finally, there is no social chat and community within Stock Rover.

Charts

When it comes to stock charts, Stock Rover differs from all the other software vendors on the market. Whereas MetaStock and TradingView focus on hundreds of technical analysis (price/volume) indicators, Stock Rover focuses on charting the fundamental financial strength indicators.

Stock Rover excels at fundamental charting with over 240 financial and 16 technical analysis indicators. It is not the best technical analysis or frequent trading service, but it is the complete package for fundamental income, growth, and value investors. Currently, Stock Rover does not allow you to draw trendlines or annotate charts, but this functionality is coming soon.

Stock Rover alerts are configurable to provide instant SMS or email notifications when a stock meets your custom criteria. For example, “Alert me if Netflix crosses up through $200 up”. You can place alerts on fundamental indicators or prices; it is quite flexible.

Research Reports

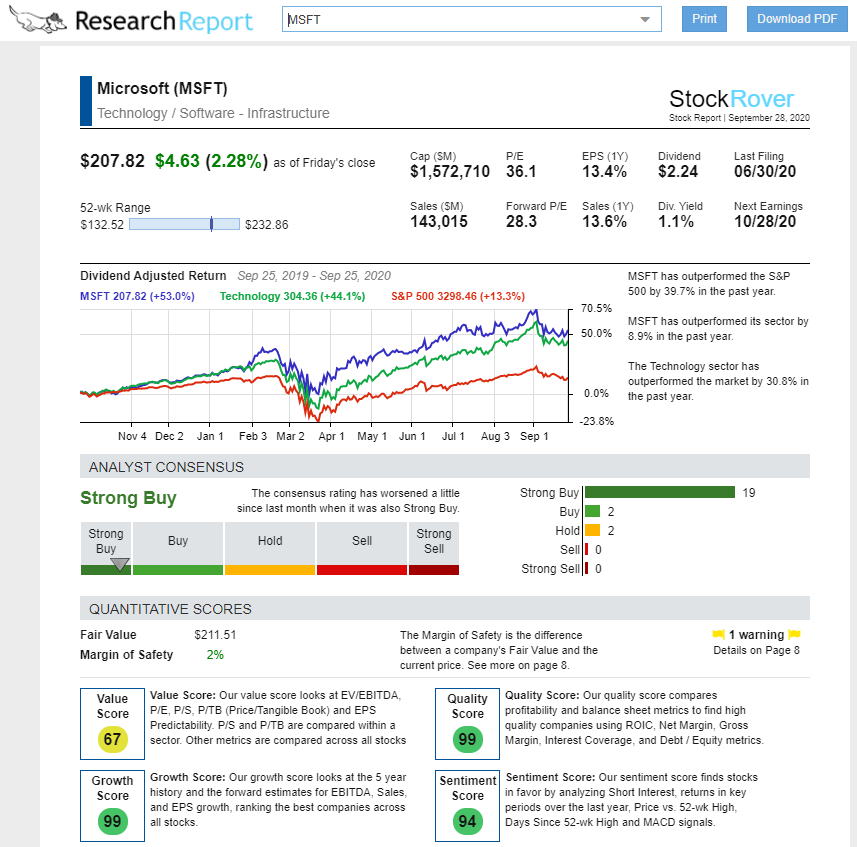

The Stock Rover Research Reports enable you to generate a professional, readable PDF report on any particular stock’s current and historical performance. The reports are unique as they are real-time research reports. They are generated with the latest data highlighting a company’s competitive position, market position, and historical and potential dividend and value returns. The image below shows the dividend-adjusted commentary on Microsoft.

Get Free Stock Rover Research Reports

The best thing about Stock Rover’s Research Reports is they are Real-time, so the information is always up-to-date.

The Research Reports provide a genuinely comprehensive summary of any of the 10,000+ stocks in Stock Rover on the US and Canadian exchanges. Research reports can be viewed in the browser and produced in PDF format for portability and sharing.

I am very visual, and I like that a large amount of the data is thoughtfully represented in charts and graphically appealing tables. The integrated Research Reports functionality takes the visualization to the next level. With the visual representations of data, you can absorb and understand a lot of data exceptionally quickly, saving you time and effort. When you have Stock Rover, scanning a company’s quarterly financial reports is a thing of the past.

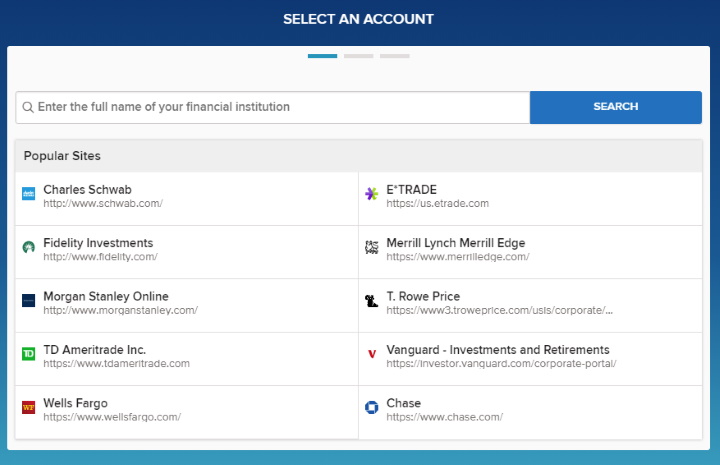

Portfolio Management

With Stock Rover, you get broker integration with practically every major broker, including Firstrade, Schwab, and Interactive Brokers. You cannot place trades from charts, but it will cover your portfolio’s profit and loss reporting and provide portfolio rebalancing recommendations.

Stock Rover is a unique package that includes dividend reporting and scoring. It is not for day traders but for longer-term investors who want to maximize their portfolio income and take advantage of compounding and a margin of safety to manage a safe and secure portfolio.

Finally, I really like portfolio analytics, which enables you to compare your portfolio returns for a given period. You can also see the portfolio correlation to the S&P500, the risk-adjusted return, and the Sharpe ratio.

| Stock Rover Portfolio Features | Stock Rover |

| Watchlist Tracking | ✔ |

| Research & News | ✔ |

| Profit & Loss Reporting | ✔ |

| Performance Reporting | ✔ |

| Portfolio Rebalancing | ✔ |

| Portfolio Asset Allocation | ✔ |

| Broker Integration | ✔ |

| Future Dividend Reporting | ✔ |

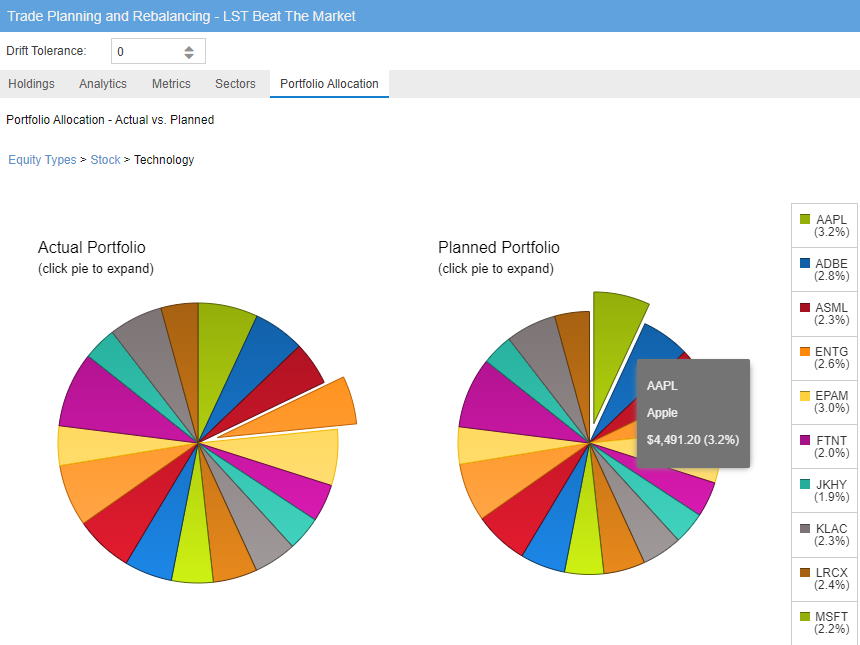

One of Stock Rover’s standout features is the ability to view your existing and future asset allocation based on your weighting and distribution parameters.

Backtesting

The ability to backtest using a fundamental screener is advantageous. It can help you prove that your stock selection methodology has worked in the past, as you hope it will work in the future.

Stock Rover provides ten years of backdated financial information and scanning possibilities, better than nearly every other stock screening package. What is unique is that you can backtest screening results. Using Stock Rover, I developed my Beat the Market Screener, which focuses on growth and financial stability, and I could backtest the strategy for the previous seven years.

The Liberated Stock Trader Beat the Market Screener seeks to select stocks with a significant chance of beating the S&P500 returns. The screener uses growth in free cash flow and explosive EPS growth. Combining this with Joel Greenblatt’s ROC and Earnings Yield formulas, “the Magic Formula,” we have a selection of stocks that have significantly beaten the market 5 in the last 7 years.

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Pricing

Stock Rover pricing starts at $0 for the Free plan, Essentials costs $7.99, Premium costs $17.99, and Premium Plus costs $27.99 monthly. Opting for a yearly subscription reduces the costs by 16%, and a 2-year subscription reduces the price by 26%, representing a significant saving.

You can have Stock Rover for free; however, the real power is unleashed with the Premium Plus service. Moreover, their top service tier is inexpensive compared to the competition.

Stock Rover’s Free plan allows ad-free screening for 10,000 stocks. Broker integration, portfolio analysis, and stock market news are included for free. The Free plan is ideal for investors who use simple screening strategies and want to manage multiple stock portfolios in one place.

Stock Rover’s Essentials plan costs $7.99 monthly and provides five years of historical company financials, screening on over 44,000 ETFs, MorningStar Ratings, and 260 financial metrics, enabling granular stock screening.

Stock Rover Premium Plus (Recommended) costs $27.99 per month, but with a 2-year subscription, the price reduces to $16.40 monthly. I recommend Premium Plus for all experienced growth, income, and value investors because it unlocks unlimited fair value and margin of safety ratings, stock ratings, and investor warnings—additionally, access to 650 metrics and screening on historical data.

I even told Ken over at Stock Rover that their product pricing is too low; for this much value, they should charge more.

Stock Rover 25% Discount

Stock Rover does not offer coupon codes; however, new customers who start a free premium or premium plus trial receive a 1-year 25% discount. You can save 28% if you sign up for a two-year subscription.

Sign up for a free 14-day premium trial for a 25% discount on Stock Rover. Toward the end of the trial period, you will receive an email from Stock Rover offering a 25% discount on any paid plan.

FAQs

Is Stock Rover real-time?

Yes, when stock screening, Stock Rover provides up-to-the-minute data in the scan results. However, the stock charts in Stock Rover are not real-time. Stock Rover is not designed as a tool for real-time trading but for medium and long-term investing.

Is stock Rover good for value investing?

Yes, our testing shows that Stock Rover is the best screener and research tool for all value investing strategies. Stock Rover provides important criteria all value investors need, with 7 Fair Value metrics , 6 Forward Cash Flow (FCF) calculations, and 4 Margin of Safety calculations.

Is Stock Rover free?

Yes, Stock Rover is free, and we rate it number 1 for free and paid stock screeners. For free, Stock Rover provides broker integration, portfolio reporting, screening, and analyst ratings.

How much does stock Rover cost?

Stock Rover costs $7.99/mo for Essentials, $17.99/month for Premium, and $27.99/mo for Premium Plus. Their prices drop by 18% for an annual subscription and even 25% if you follow our Stock Rover discount guide.

Is Stock Rover good for growth investing?

Yes, Stock Rover is an excellent tool for long-term growth investing. In my testing, I developed the Liberated Stock Trader Beat the Market Growth Strategy, which beat the S&P 500 8 out of the last 10 years. Stock Rover's 10-year historical financial information combined with Greenblatt ratios is the only screener that can enable this growth strategy.

Who are Stock Rover's competitors?

Stock Rover's competitors are TradingView, Finviz, Trade Ideas, and Portfolio 123. For US value, growth, and dividend stock screening, Stock Rover is the clear leader. But for AI day trading, Trade-Ideas is the best, and for international screening, charting, and community TradingView is the better choice.

Does Stock Rover have an app?

Stock Rover does not have an app on the Apple or Google Play Store. The HTML 5 design of Stock Rover will detect your platform and automatically adjust to tablets of mobile. Additionally, I spoke with the head of business development at Stock Rover, and he said a dedicated mobile app is in development.

Can Stock Rover make you profitable?

Yes, Stock Rover can help you implement a profitable investing strategy, but no stock market software can instantly make you profitable. With experience and knowledge, you can implement profitable strategies. The Liberated Stock Trader BTM system is a profitable strategy implemented directly into Stock Rover for Premium+ subscribers.

Is stock rover good for dividend investing?

Our testing shows that Stock Rover is an industry leader in dividend investing strategies. Stock Rover has 22 unique dividend financial metrics covering everything an income investor needs. Additionally, Stock Rover can predict your portfolio's future dividend income, enabling you to adjust your investments to maximize dividends and minimize risk.

Is stock Rover Trustworthy?

Stock Rover is a legitimate and trustworthy company. As a partner, we have an exemplary business relationship. I have worked with the head of product development and the Stock Rover team actively develop the product based on customer requests. I have also verified their data come from reputable sources like Zacks, Intrinio, and Quandl.

Is Stock Rover good for day traders?

No, Stock Rover is not good for day traders or swing traders. Stock Rover is for medium to long-term investors who want to manage a portfolio of stocks and implement first-class investing strategies. My recommendation for day traders is Trade-Ideas for AI Auto Trading or TradingView for the world's best stock charts and trading community.

Is Stock Rover Easy to Use?

Yes, Stock Rover is easy to use, it is up and running with a single click of the login button. Even better, there are so many curated screeners and portfolios to import and use; that you are instantly productive.

Hi there,

Love Stock Rover,but I don’t see how one can run backtests.Are you manually running them??

Thanks,

Allan

Hi Allan, the trick is to select data from the historical database in a screener. Then plot the results on the chart and set the chart timeframes back to see the performance. For example use performance versus the S&P 500 for 2 calendar years ago. And set the chart timeframe for 1 year ago. Then you can see how the portfolio performed. More details here.

https://www.liberatedstocktrader.com/lst-beat-the-market-screener/