TradingView wins our head-to-head testing vs. Finviz due to its superior charting, pattern recognition, community, and global exchange data. Finviz is better for index backtesting and pattern scanning.

As a certified market technical analyst, active trader, and investor, I am uniquely positioned to compare TradingView and Finviz accurately and honestly.

Finviz vs. Tradingview Ratings

This test of Finviz vs. TradingView reveals that TradingView wins in our testing because it does almost everything better than Finviz. TradingView is better for charting, trading, community, backtesting, and usability. Finviz excels at fundamental screening and insider trading information.

🏅Finviz vs. Tradingview Results

TradingView scores 4.5/5.0 because it does everything well, and Finviz scores 3.6/5.0 because it lacks a community, live trading and has inferior charts. However, Finviz excels at rapidly visualizing vast stock market data on a single screen.

TradingView and Finviz offer charts, pattern recognition, scanning, and heat maps. TradingView has a global community and data, but Finviz is US-only. TradingView is a powerful stock, Fx, and Crypto trading platform, and Finviz is extremely quick and easy to use.

Let’s take a look at the outstanding features head to head.

⚡Features

Both TradingView and Finviz cover stocks and indexes globally. Finviz’s coverage of forex, futures, and cryptocurrency is weak. TradingView features a news stream and a 20 million active social community sharing charts and ideas. Finviz has no social component.

| Features | TradingView | Finviz |

| ⚡ Features |

Charts, News, Watchlists, Screening | Screening, Heatmaps, Charts |

| 🏆 Unique Features |

Trading, Backtesting, Community | Patterns, Signals |

| 🎯 Best for | Stock, Fx & Crypto Traders | Beginner Investors/Traders |

| ♲ Subscription | Monthly, Yearly | Monthly, Yearly |

| 💰 price | Free | $13/m to $49/m annually | $39.50/mo or $25/m annually |

| 🆓 Free Plan | Yes | Yes |

| 💻 OS | Web Browser | Web Browser |

| 🎮 Trial | Free 30-Day Premium | 30-Day Money-Back |

| 🌎 Region | Global (Stocks, Crypto, FX, Futures) | Global (Stocks Only) |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial | -37% With Annual Plan |

| 🏢 Visit | Try TradingView Free | Try Finviz Free |

💸 Pricing

Both Finviz and TradingView offer good value for money. Finviz has an excellent free service, while TradingView’s Pro+ plan is 30% cheaper than Finviz’s Elite plan.

TradingView pricing starts at $0 for the basic ad-supported plan: Pro costs $14.95, Pro+ $29.95, and Premium costs $59.95 monthly. Opting for a yearly subscription will reduce those costs by 16%, representing a significant saving. There is an additional $2 cost per exchange if you want real-time data. I recommend the Pro or Pro+ services to strike the right balance of power and price.

Finviz has a good free plan. Pricing starts at $39.99/mo for the Elite service or $24.96/mo on an annual plan, saving you 37%.

TradingView Discounts

You can get up to a 60% discount on TradingView by following simple steps. Find out more in our dedicated TradingView discounts article.

Finviz Coupon Code

Finviz does not offer coupon codes for its stock research software. However, Finviz does offer a 1-year subscription with a 37% discount for new customers who start an Elite subscription.

💾 Software & Platform

Both TradingView and Finviz offer excellent, stable, and reliable platforms that are easy to use. Both companies offer HTML 5 software that lives in the cloud, so you do not need to install software or configure exchange data stream downloads; they work across multiple devices.

| Key Features | TradingView | Finviz |

| Global Market Data | ✔ | ✔ |

| Powerful Charts | ✔ | ✘ |

| Stocks | ✔ | ✔ |

| Futures | ✔ | ✘ |

| Forex | ✔ | ✘ |

| Cryptocurrency | ✔ | ✘ |

| Social Community | ✔ | ✘ |

| Real-time News | ✘ | ✘ |

| Screeners | ✔ | ✔ |

| Backtesting | ✔ | ✔ |

| Automated Analysis | ✔ | ✔ |

🚦 Trading

When it comes to stock trading, TradingView beats Finviz. TradingView has full broker integration, so you can trade directly from charts, but Finviz has no broker integration.

TradingView supports 27 high-quality brokers, meaning tight integration, so you can directly trade from charts and view your profit and losses directly in TradingView. Finviz does not have broker integration, so you must manually enter trades with your current broker.

🎥 TradingView Video

📡 Stock Screening

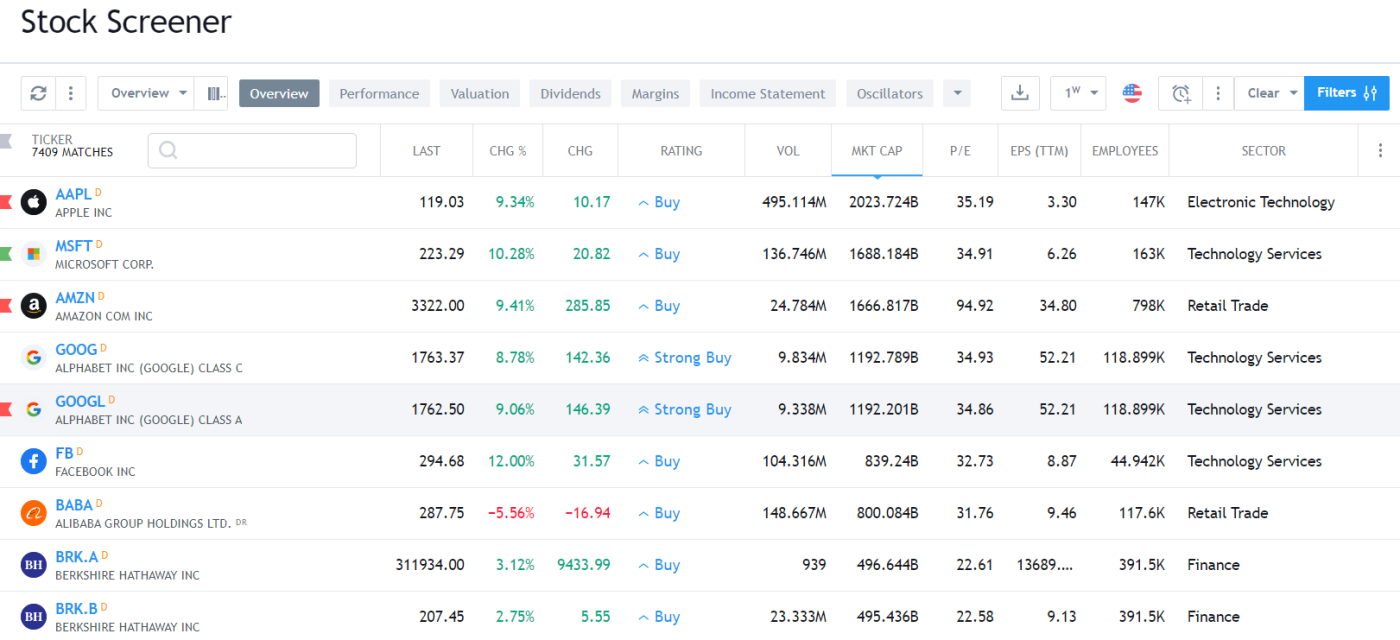

Both Finviz and TradingView have excellent stock screening and market scanning capabilities. The Finviz screener is famous and often deemed the gold standard, but TradingView’s screening capabilities are more powerful.

Finviz allows you to scan for a mix of 67 fundamental criteria and combine it with 30 different trading signals. That may seem like a huge choice, but TradingView offers over 168 criteria, Portfolio123 has 470 filters, and Stock Rover provides over 575 options.

TradingView Screening & Scanning

TradingView has integrated stock, forex, crypto screeners, and heatmaps, covering fundamental analysis and price/volume indicator scanning. Finviz primarily focuses on technical price, volume, and indicator screening, including analyst rating changes and earnings announcements.

The TradingView stock screener comes complete with 160 fundamental and technical screening criteria. All the usual criteria are there, such as EPS, Quick Ratio, Pre-Tax Margin, and PE Ratio. But it also goes into more depth with more esoteric criteria, such as the number of employees, goodwill, and enterprise value.

Finviz Screening & Scanning

The Finviz screener allows for rapid filtering of 8,500+ major stocks and ETFs. However, this does not include all the stocks in the world; it is just the major stocks, as there are over 10,000 stocks in the USA alone.

The Finviz stock screener is extremely fast and allows you to filter on 67 fundamental and technical criteria. You can filter the stocks on specific chart-based signals such as new highs, lows, oversold, analyst upgrades, insider buying, or even chart patterns like double tops and head-and-shoulders.

Finviz shines where the others do not because you can also screen on ten major candlestick patterns and 30 stock chart patterns. This mix of fundamental screening criteria for investors, technical charts, and candlestick pattern recognition for traders makes Finviz a good match for short-term and medium-term investors.

💡 Chart Pattern Recognition

Finviz and TradingView offer solid implementations of pattern recognition; the kings of automated AI pattern recognition are Trade Ideas, TrendSpider, and Tickeron, who lead the industry.

Finviz provides automatic trendline recognition, identifying price patterns like wedges, triangles, double tops, and channels on daily charts; this is a big advantage for pattern traders. The scanner also has 33 automated stock chart signals. TradingView is also no slouch, providing automated candlestick recognition and thousands of community-developed indicators.

📰 News & Social

TradingView beats Finviz for social trading and community ideas, indicators, and backtesting scripts, as Finviz offers nothing in this area.

TradingView is built with social at the forefront and is best for social sharing and learning. Forget StockTwits; TradingView is the best. Its fully integrated chat forum and publishing system are excellent ways to share your charts and ideas. Finviz does not have a social community.

Check out my published ideas on TradingView and follow me for stock market and stock analysis ideas and commentary.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

I think Finviz and TradingView offer similar services when it comes to financial news streams. Both aggregate news from major outlets. Finviz has the advantage of detailed reporting on insider buying and selling, meaning CEOs and executives buying and selling stocks and options.

📈 Chart Analysis

TradingView beats Finviz by a long way on stock charting. Finviz charts are a complete letdown, with a clunky, non-interactive interface, limited indicators, and annotation tools.

TradingView Charting Is Excellent

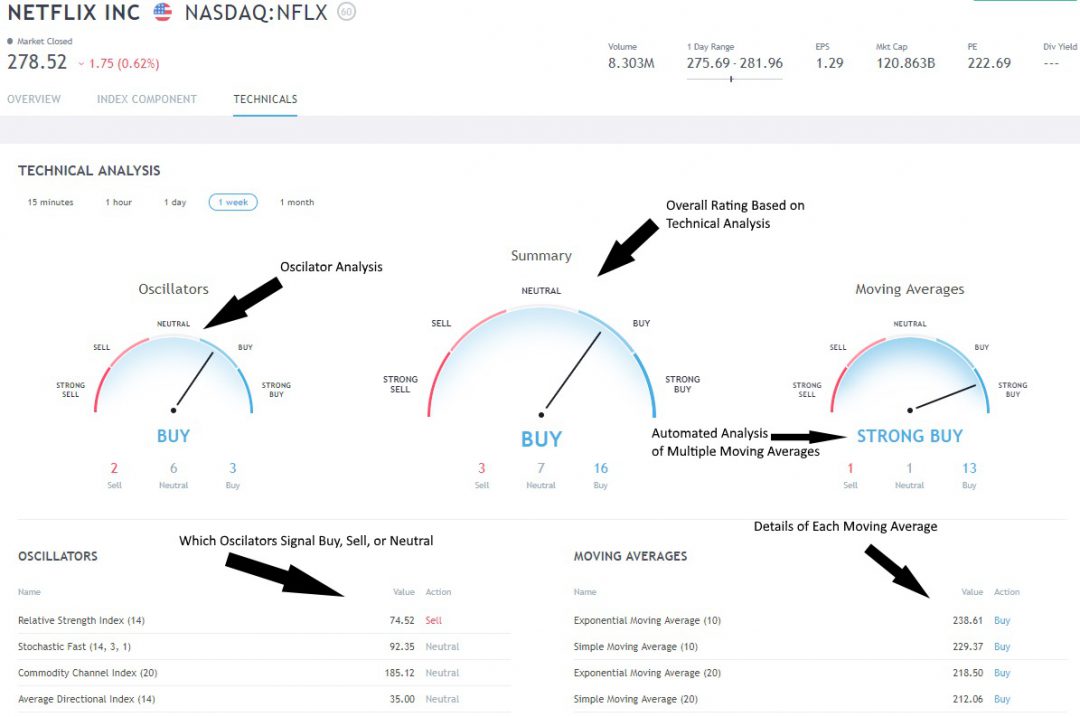

TradingView has 160 indicators and unique specialty charts such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko.

TradingView has an exceptional selection of chart drawing tools, including tools unavailable on other platforms like extensive Gann & Fibonacci tools, 65 drawing tools, and hundreds of icons for your charts, notes, and ideas. Finviz offers only 15 different chart annotation tools.

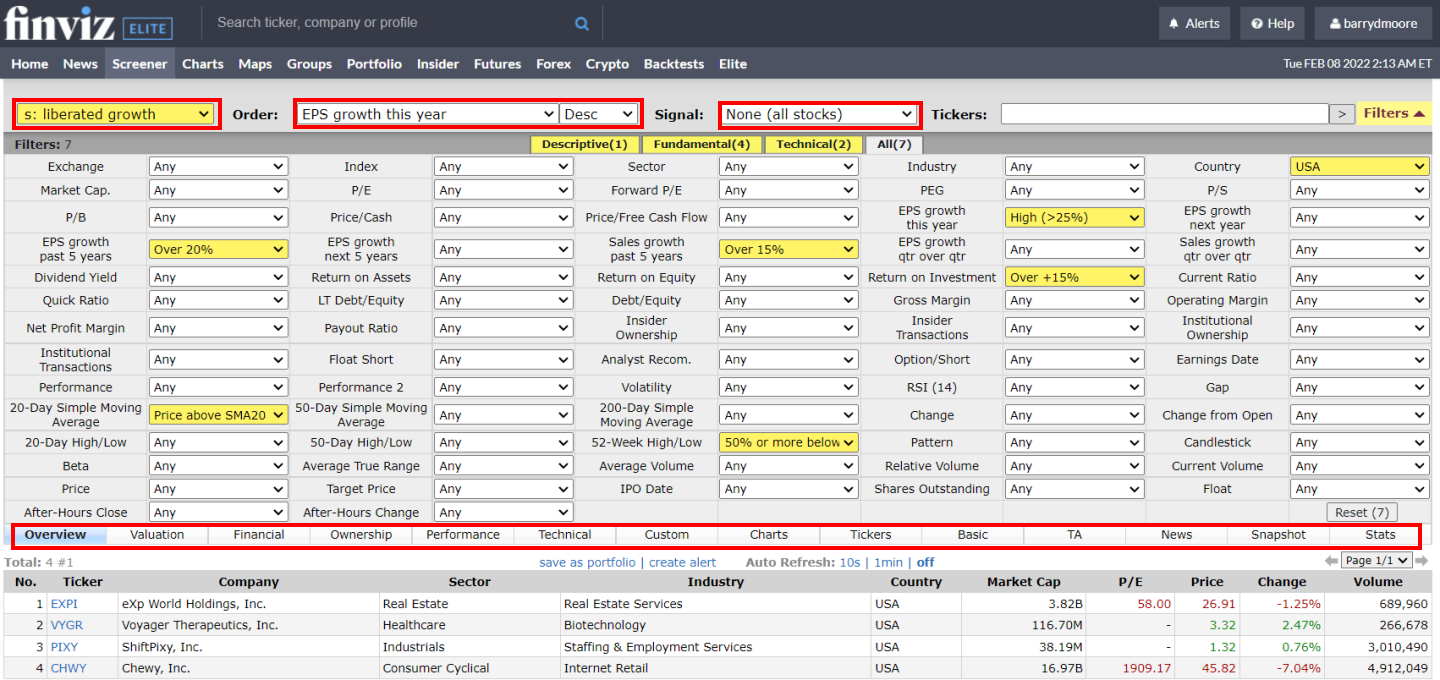

TradingView’s innovative Buy and Sell gauges save you time by providing an instant readout of which stocks are bullish, bearish, or neutral.

TradingViews’s stock indicator ratings are well implemented because there are two critical technical analysis indicators: moving averages based on price and oscillators based on price and volume. Based on my observations, the TradingView buy and sell indicators are a good measure of sentiment and are featured in my Fear & Greed Index Dashboard.

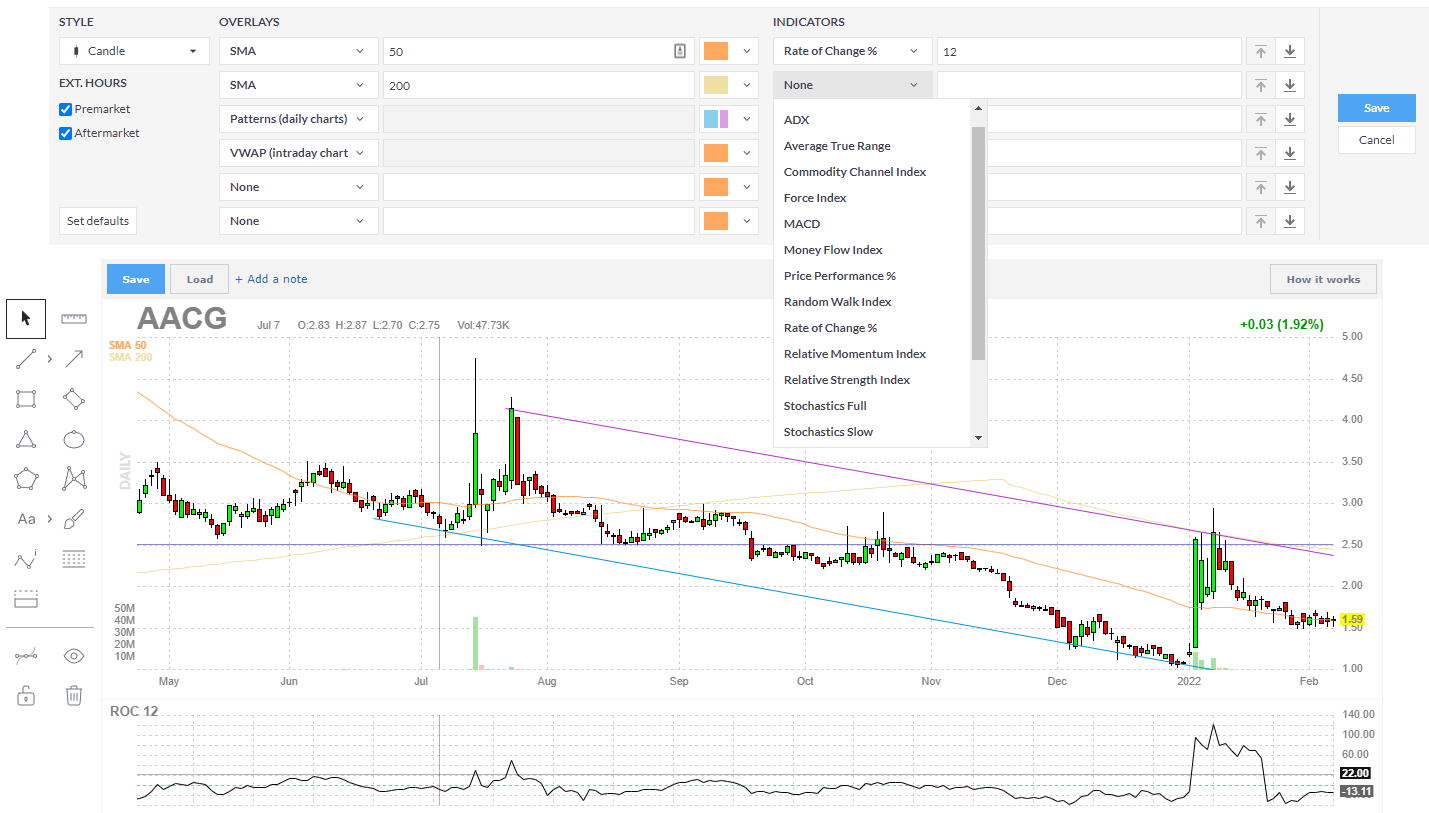

Finviz Charting Is Poor

Finviz has only 9 chart overlays, including Bollinger Bands and VWAP, and 17 chart indicators. Thus, the stock charting experience with Finviz is weak. You cannot simply right-click and add an indicator or study; you have to open settings, select the indicators, and then click save. Finviz does not have an effective interactive workflow experience for the user.

Additionally, throughout Finviz, you need to click SAVE constantly. There is no auto-save for your screening criteria, chart annotations, or backtests. If you mistakenly move to the next chart, you lose your configuration; this is frustrating and a very old-fashioned user experience.

🔍 Strategy Backtesting

TradingView beats Finviz when it comes to backtesting. TradingView offers exceptional backtesting for systems and strategies with endless flexibility, whereas Finviz backtesting is unintuitive, restrictive, and lacks any usable reporting.

TradingView Backtesting

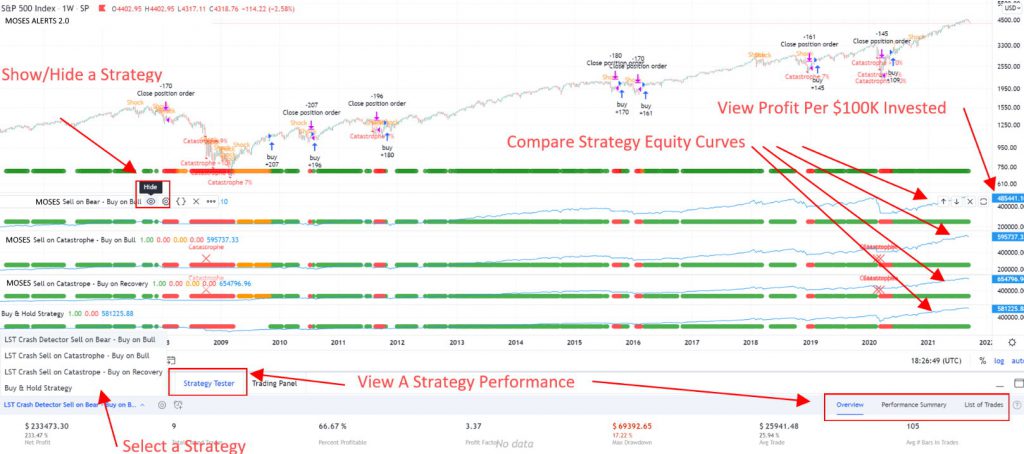

TradingView has a backtesting system called Strategy Tester, but you must develop some scripting skills using the proprietary Pine code to develop original backtesting systems. I have even implemented my MOSES ETF Trading strategy into TradingView; I am no developer, but the Pine Script language is so natural anyone can do it.

Finviz Backtesting

With the Finviz Elite plan, you get a backtesting service, but after extensive testing, I can reveal it is a very poor service indeed.

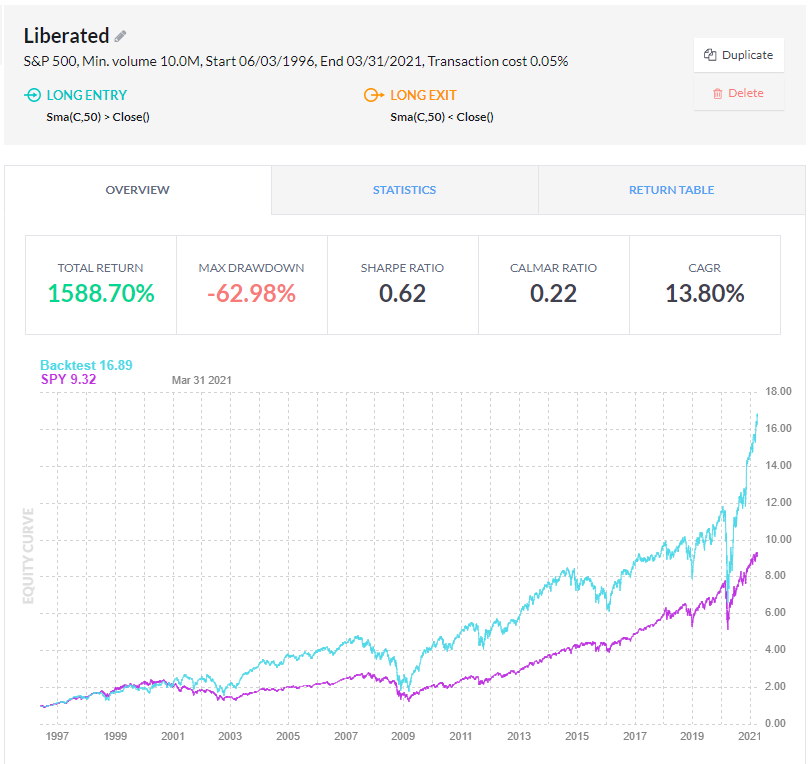

The Finviz Backtester offers over 100 unique indicators and automatically detects stock chart patterns to help build a truly unique system. After all this work, I created a system based on the Money Flow Index that has handsomely beat the S&P 500 index over the last 24 years.

The system returned a profit of 1,588%, with a compounded annual return (CAGR) of 15.24% versus the S&P 500’s 10.86% (See the proof below).

So, the next step is to look at all the trades, the buy signals, the sell signals, the drawdown, the max win/loss, and the win/loss ratio. But there is none of that. The reporting for the backtesting service is poor and not thought through. I could not see which trades were executed or what stocks were purchased.

One cannot believe the backtest results when there is no evidence of every trade and the entry and exit points. If you want a good backtesting service, please read my detailed review and test of the best stock backtesting software.

🖱 Usability

TradingView beats Finviz on usability, simplicity, and workflow by a large margin. While Finviz and TradingView are easy to use, the different Finviz components, like screening, portfolio, charting, and backtesting, do not work together. The Finviz interface is ancient, whereas the TradingView user experience is seamless and a dream to use.

Both TradingView and Finviz require zero installation or configuration. Finviz makes visualizing large amounts of big-picture financial data very easy, and the screener is simple to use, but the core components of Finviz do not work together.

🏁 Final Thoughts

TradingView is the best overall stock analysis and trading software. It is perfect for beginner and experienced traders, with a vibrant community and excellent charts, backtesting, scanning, and screening globally. If you want simple and good free screening software, then Finviz is a great choice.

If you need real-time news, the best backtesting, and stock chart indicators, I recommend MetaStock. Stock Rover is the best software if you seek to build long-term value, income, and growth portfolios. Finally, if you want to use the power of AI for short-term day trading, then Trade Ideas is the best choice.