After thoroughly evaluating Motley Fool’s stock-picking performance, I’ve uncovered the key details about their Stock Advisor service. This review highlights its genuine advantages and drawbacks, helping you decide if it’s a worthwhile investment.

I have closely followed the Motley Fool, observing its highs and lows. Over the last four years, I took a deeper dive by downloading their stock pick database and conducting an independent audit using my preferred stock screener, Stock Rover. The findings have been nothing short of remarkable.

Motley Fool Stock Advisor Ratings

After four years of independent testing, I confirm Motley Fool Stock Advisor has an excellent performance track record of stock selection that outperforms the market. Motley Fool provides an impressive stock advisor service for long-term growth investors.

I subscribe to and invest in the Motley Fool Stock Advisor service using my own funds, as I genuinely believe it offers excellent value for money.

| Motley Fool Rating | 4.6/5.0 |

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Stock Picking | ★★★★★ |

| 📡 Screening | ★★★✩✩ |

| 📰 News | ★★★✩✩ |

| 📈 Charts Analysis | ★★★✩✩ |

| 🔍 Portfolio Research | ★★★★★ |

| 🖱 Usability | ★★★★★ |

My independent Motley Fool tests confirm that Motley Fool Stock Advisor outperforms the S&P 500; they are a mature stock advisory service with a proven track record.

Since the Motley Fool team reorganized its approach to stock investing advice in 2002, it claims an excellent record of beating the market with its Stock Advisor service.

Pros

✔ Proven to beat the market consistently over 20 years

✔ Ability to build watchlist & entire portfolios

✔ Very Cost-effective service

✔ Fully transparent auditing of stock-picking performance

✔ A straightforward and intuitive website

✔ A passionate and loyal community of 700,000 people

Cons

✘ Stock Screener is basic.

✘ It can be tricky to find the original research reports.

✘ Charting is very basic.

Features

| ⚡ Motley Fool Features | Stock Selection, Live Webinars |

| 🏆 Unique Features | Proven Winning Track Record |

| 🎯 Best for | Stock Investors |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $199-$299/mo |

| 💻 OS | Web Browser |

| 🎮 Trial | 30 Day |

| ✂ Discount | 50% Discount $99 |

| 🌎 Region | Global |

What is the Motley Fool?

Motley Fool is a privately held company owned by brothers Tom and David. For over 20 years, the Gardners have provided sensible investing advice, popularising investing in index funds and high-growth stocks. Motley Fool became a household name with the “Motley Fool Investment Guide,” published in 1997. This book inspired me to start investing.

Stock Advisor Track Record

Motley Fool offers 32 premium services, from the most popular Stock Advisor and Rule Breakers to advice on real estate investing. Stock Advisor and Rule Breakers are the only services sharing market-beating performance.

The Motley Fool premium stock research reports are clear and precise, focusing on the company’s financials but, most importantly, the industry’s future and business outlook. This is important because if you want market-beating results, you must select companies that are potential industry disruptors and market dominators.

I have subscribed to Motley Fool Premium for four years because I value their qualitative analysis. My initial reason for subscribing to the service was to test whether it was legitimate or a scam. I was amazed at how simple and successful their service is.

I am a paying subscriber and recently partnered with Motley Fool because I can wholeheartedly recommend their service.

Motley Fool Stock Advisor Features

| Company | Motley Fool |

| Product Name | Stock Advisor |

| Research Reports Stocks | ✔ |

| Real-Time Research Reports | ✘ |

| Analyst Research Reports | ✔ |

| Fund Research Reports | ✘ |

| Long-Term Investing | ✔ |

| Stock Ratings | ✔ |

| Portfolio Mgt Tools | ✘ |

| Short-Term Trading | ✘ |

| Buy Signals | ✔ |

| Price Per Year | |

| Visit | 50% Off Motley Fool |

Performance Track Record

The Motley Fool Stock Advisor claims a performance track record of 421% profit since 2002 versus the S&P 500 increase of 85%. This track record is impressive, but is it true? We put it to the test.

Motley Fool does not try to perform research on every stock and fund in the USA. The team focuses on stocks that will significantly beat the S&P 500 over the long term. They then provide lightweight and easy-to-read research reports and recommend why they feel the stock will be a superior long-term investment.

Motley Fool Stock Advisor Portfolio Performance 20-Year $10,000 Investment

| Motley Fool Stock Advisor | S&P 500 |

| $325,000 | $55,000 |

The Motley Fool team claims outstanding market-beating performance. But is this true? In the next section, I perform an independent analysis to verify the facts.

Stock Picks Performance

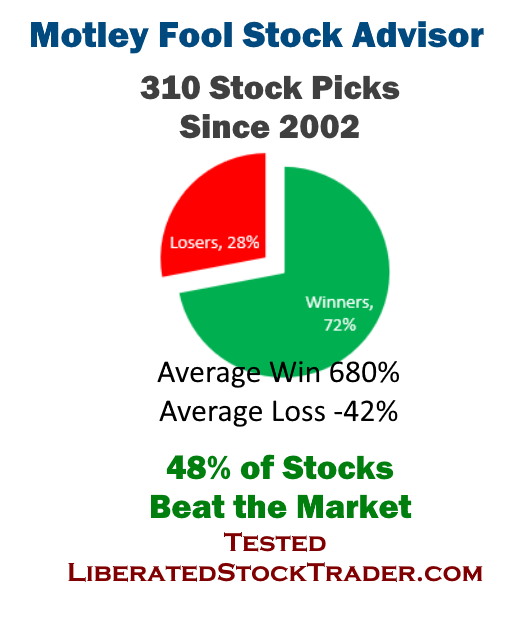

My independent analysis of the stock advisor service’s audited results reveals that since 2002, 48% of the stocks beat the S&P 500. The average winning stock outperformed the S&P 500 by 780%. 28% of the stocks recommended lost 42% on average, while 82% of the stocks made a profit averaging 640%.

What does this mean? You still have a 28% chance of losing money on any stock recommendation. However, at current performance levels, you have a 72% chance of investing in a company that will make you a profit.

Stock Advisor Returns

I independently verified the Motley Fool Stock Advisor returns and confirmed a 46.3% profit. This is exceptional performance, recommending 310 stocks, of which 48% outperformed the S&P 500 with an average return of 680%. The average loss was 48%.

- They recommended 310 individual stock picks to investors.

- 72% of the stocks made a profit.

- 48% of the recommendations beat the market.

- The average winning stock beat the market by 780%.

- The average profit of each profitable stock was 680%.

- The average loss was -42%

- The best recommendation was Netflix in 2004, which made a 29,990% profit.

Independent Performance Test

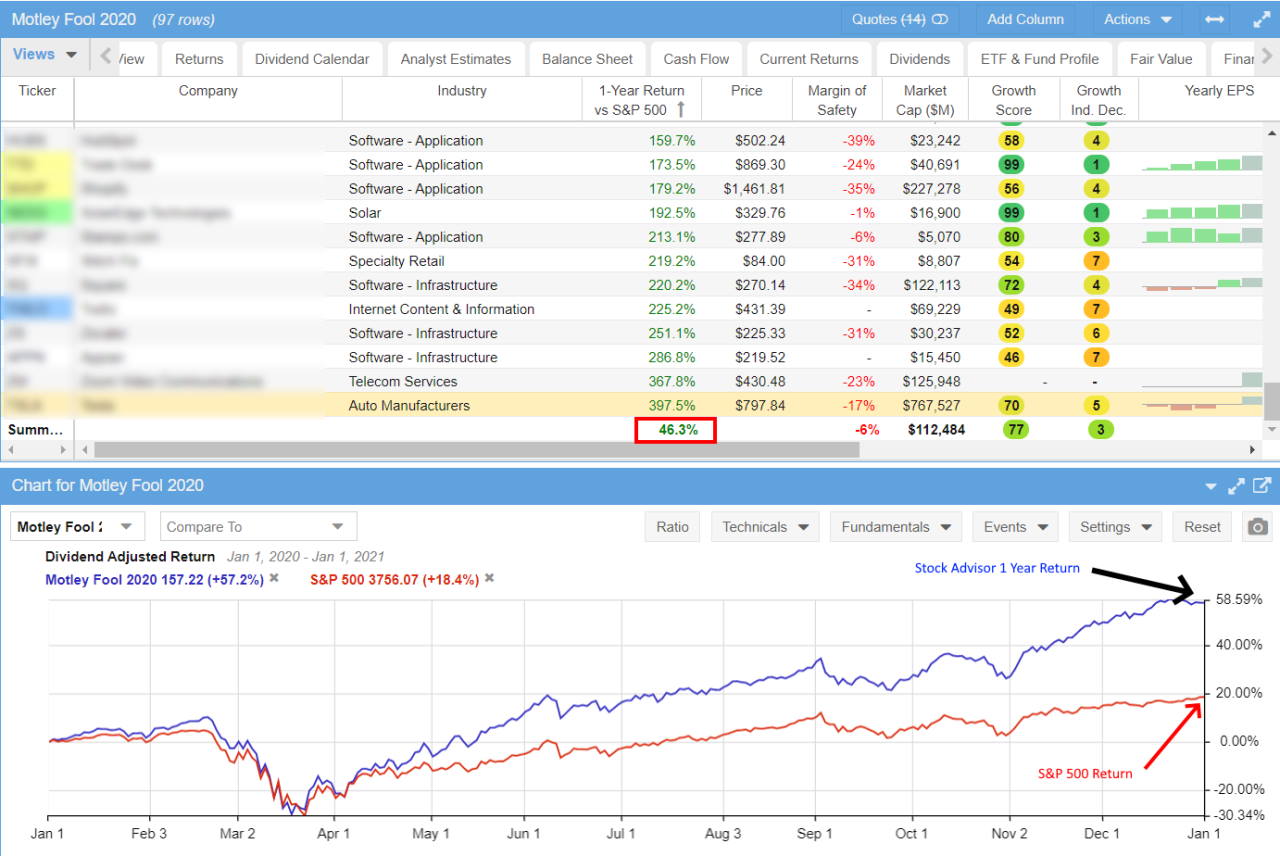

I downloaded the full list of Motley Fools Stock Advisor recommendations. I have independently analyzed the stock picks in Stock Rover, and I can confirm that last year, the Motley Fool Stock Advisor service made a profit of +52.7% vs. the S&P 500 return of +18.4%. Motley Fool beat the S&P 500 by 34.3% for the year to January 1, 2021.

For the full year 2020, Motley Fool Stock Advisor picked 97 stocks. 62 stocks beat the S&P 500 by an average of 83%. 35 stocks did not beat the market, losing an average of 20% against the S&P 500. As you can see in the screenshot above, the average return vs. the S&P 500 was 46.3% across all stocks. This is an impressive result.

Does Motley Fool Beat the Market?

Yes, according to detailed auditing, the Motley Fool Stock Advisor service has returned 612% vs. the S&P 500 return of 120%. Motley Fool has significantly beaten the market since its inception in 2002; in real terms, the S&P 500 averaged 6.13% per year, and the Stock Advisor service averaged a 32.2% annual gain.

As a Motley Fool premium member, I can access all open and closed trades audited since 2002. In the next section, I will share my research on performance.

Is Motley Fool Legit?

Yes, The Motley Fool LLC is a legitimate business that has been providing stock advice and educating investors since 1993. Employing over 300 people and headquartered in Virginia, the Motley Fool has never been involved in any complaints or litigation with the SEC.

Also, the Motley Fool has testified in Congress on four occasions to support individual investors’ rights.

Is Motley Fool Reliable?

Yes, the Motley Fool is a reliable service. Like any stock advisory service, it has made a few mistakes in its 27 years. The Foolish Four recommendations in the early 2000s nearly bankrupted the company. More recently, their recommendation to buy Luckin Coffee backfired for investors, as the Chinese stock plummeted 90% on fraud news.

“The Motley Fool deserves a great deal of credit for openly supplying a vast amount of information on a timely basis. While many investment industry participants offer model portfolios or other forms of advice, few maintain real-money accounts in public view (in effect, putting their money where their mouths are).” Source: Journal of Business & Economics Research

Key Features Test

When signing up to Motley Fool, you get more than a list of stocks to buy. You get support, encouragement, and regular emails with suggestions for structuring your portfolio. They also provide sound advice on investing and what to expect from the market.

Buy 15 Stocks

The service recommends you buy at least 15 stocks and hold those stocks for 3 to 5 years. This is wise advice because, as we know, the stock market goes down and up, and according to my research, you can expect that 30% of their stock recommendations will not be big winners. Buying a larger basket of stocks helps diversify your portfolio and reduces the risk of being over-exposed to a single company. Additionally, holding stocks for longer allows stocks the time they need to develop outsized profits.

Help Building Your First Portfolio

The service assists you in constructing your initial portfolio by recommending ten starter stocks for purchase. This will set you on the right path to build your portfolio effectively and efficiently. This is a great help to any new investor or anyone looking to refresh their investing performance.

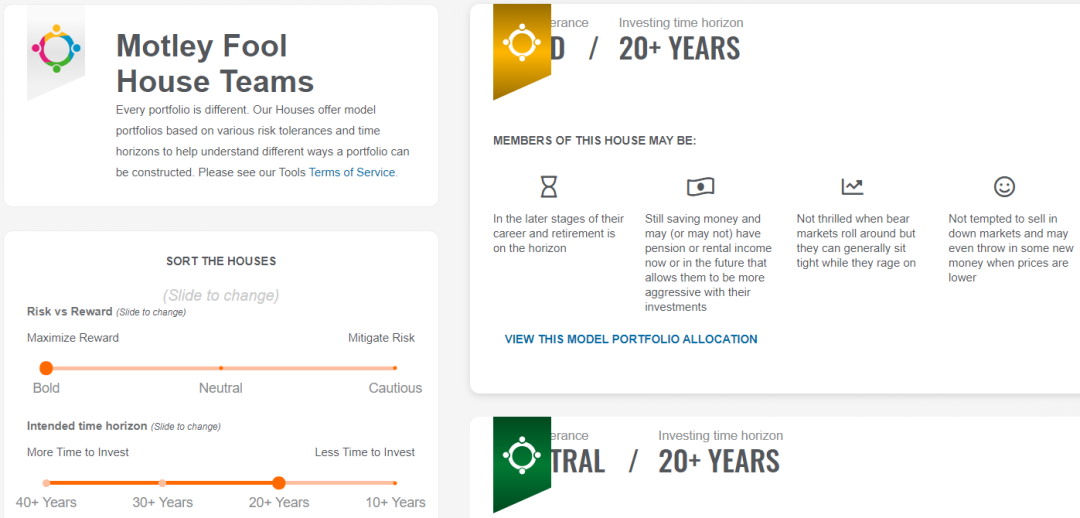

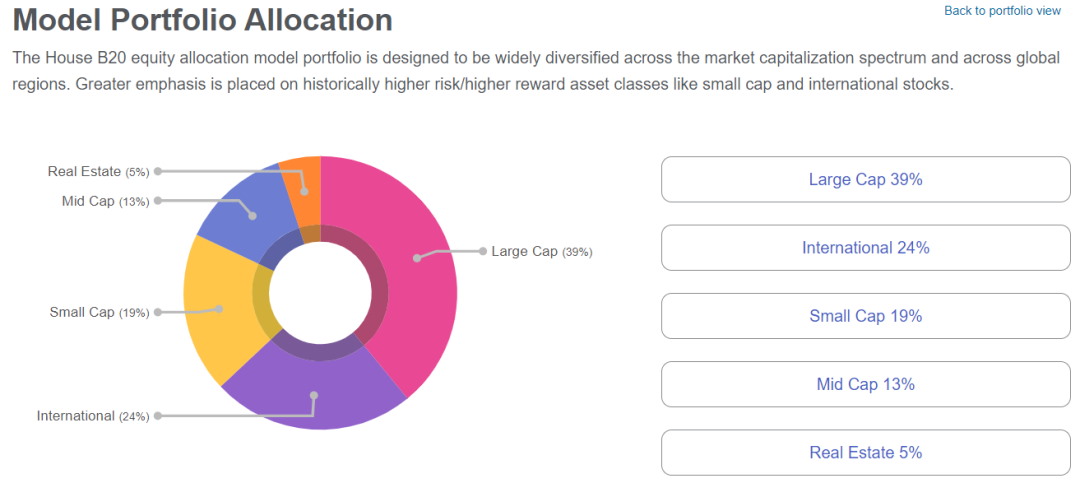

Portfolio Allocator Tool

The Portfolio Allocator tool is powerful yet simple; it will help you build a portfolio based on your risk profile and investing timeframe. From the Tools menu, select Allocator to be presented with a list of potential portfolio structures. You can select your Risk/Reward and Time to Invest preferences, and they will recommend a portfolio that might meet your needs. See the Screenshot Below.

Try Stock Advisor with a 50% Discount

Your Model Portfolio With Stock Recommendations

When you open your recommended portfolio, you are presented with a Pie that suggests your investment allocation between stocks, ETFs, bonds, and real estate. You can then drill down to see the specific stocks they advise you to buy.

This is a great tool if you need this structured approach to building a well-rounded, diversified portfolio.

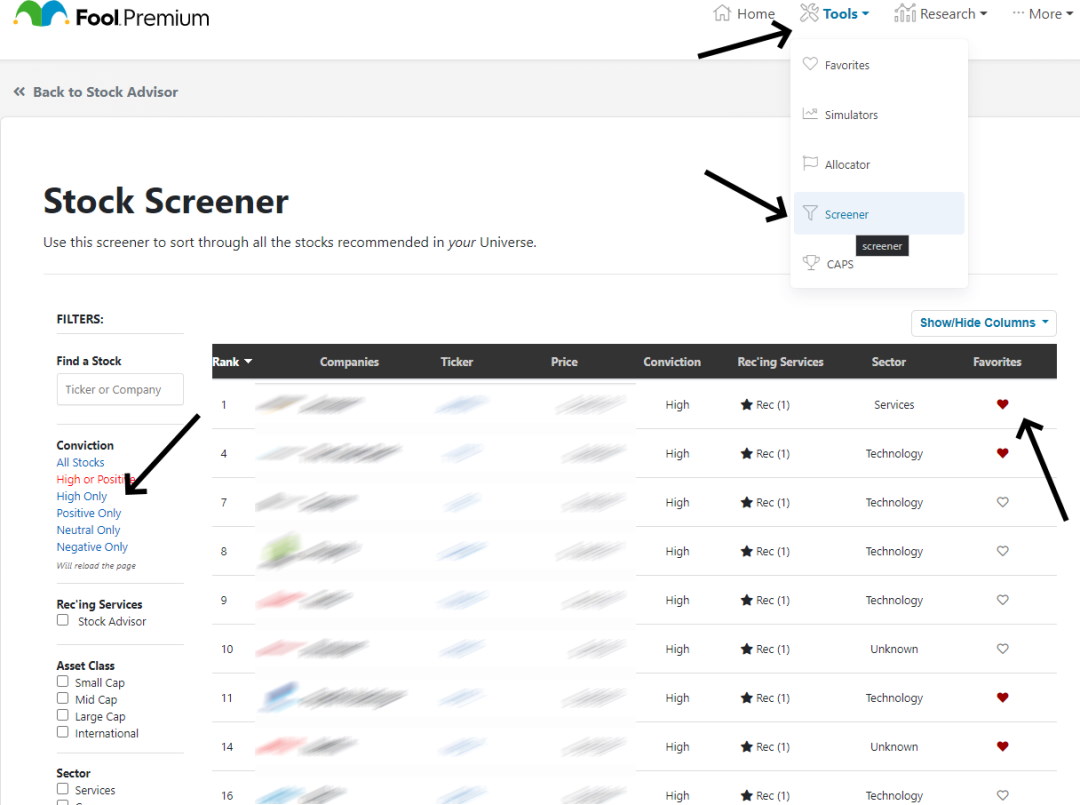

Stock Screener

The Motley Fool stock screener is simple and effective, allowing you to screen for their stock pick recommendations. I get my stock selections using the Fool Premium Stock Screener. Click on Tools -> Screener, then select High Only to get a list of their High Conviction Stock Picks. These are the stocks they rate the best of the best for potential future growth.

You can then click each stock to get a full research report on the company and understand why they selected it. What is also great is that you can see the entire audit of when the stock was first recommended and every time they have re-iterated their buy recommendation.

This stock screener does not screen the entire stock market; it is limited to the stocks that the Motley Fool team has recommended, meaning you will have a total universe of about 900 stocks.

Discount Pricing

Motley Fool offers 32 services ranging in price from $199 per year for Stock Advisor to $13,999 per year for ONE Access to all their services. I recommend the Stock Advisor at $199 or the Rule Breakers at $299 per year for stocks. I paid for the Stock Advisor Service, and I am delighted with it.

You might think $199 per year is expensive. But for the chance to select high-performing stocks and beat the market, this service is an absolute bargain, and I am happy to pay for it.

New Motley Fool Premium Client Discount

Luckily, through my new partnership with Motley Fool, all visitors to LiberatedStockTrader.com can get 50% off their first year of Stock Advisor or a 66% discount on Rule Breakers.

| Stock Advisor | Rule Breakers |

| Two New Stocks Per Month | Two New Stocks Per Month |

| 10 Best Stocks to Buy Now | 5 Best Stocks to Buy Now |

| List of Starter Stocks | List of Starter Stocks |

| Community Access | Community Access |

| Regular Exclusive Videos & Podcasts | Regular Exclusive Videos & Podcasts |

| $199 or $99 For New Clients | $299 or $99 For New Clients |

Table: Motley Fool Stock Advisor vs. Rule Breakers

As you can see, the only real difference is in the Best Stocks to Buy Now, where the list of the 5 best stocks is smaller companies with considerable potential. However, the service with the best, proven track record is the Motley Fool Stock Advisor.

Is Motley Fool Stock Advisor Worth It?

Yes, Motley Fool Premium services are worth it, as they improve your chances of investing in profitable stocks. In 2020, only 13% or 815 US stocks performed better than the S&P 500. This means you have only a 13% chance of picking an outstanding stock. Motley Fool Stock Advisor helps increase your chance of beating the market, as 48% of their recommendations outperform the S&P 500.*

*According to my research using Stock Rover, out of 7,500 US stocks, only 851 companies with a market capitalization greater than $1 billion beat the S&P 500 index in 2020.

How Do I Use Stock Advisor?

For 20 years, I have preferred to perform my own stock research, but having used Motley Fool’s Stock Advisor for four years, I have found that it saves me a lot of time and provides me with unique insights and ideas.

I typically review the Motley Fool’s High Conviction recommendations and then add them to Stock Rover. Stock Rover lets me analyze the financials, analyst ratings, future revenues, and earnings in depth. It also allows me to connect to my Broker, access their research reports, rebalance my portfolio, and screen the entire market for stocks. I have even developed my own Beat the Market Growth Stocks Strategy, now available for all Stock Rover customers.

Summary

I was skeptical about the Motley Fool Stock Advisor service for many years, but having been a subscriber for four years, I can recommend it for the following reasons. Their stock picking is excellent, and they have a proven track record of significantly beating the market. They support you with continual updates and new stock alerts. Motley Fool is a great place to start if you want to be one of the 10% of people who beat the market.

The Motley Fool Stock Advisor service has significantly beat the market since its inception in 2002. According to its detailed auditing, Stock Advisor has returned 612% vs. the S&P 500 return of 120%. In real terms, the S&P 500 averaged 6.13% per year, and the Stock Advisor service averaged a 32.2% annual gain.

FAQ

What is Motley Fool Stock Advisor?

Stock Advisor is The Motley Fool's flagship investment service, providing stock recommendations and investment advice for both new and experienced investors.

How often does Stock Advisor release new stock recommendations?

Stock Advisor releases two new stock recommendations each month.

What other features does Stock Advisor offer besides stock recommendations?

In addition to stock picks, Stock Advisor provides in-depth research, educational content, live market commentary, and a community of investors for members to engage with.

Can I see past performance of Stock Advisor picks?

Yes, the past performance of Stock Advisor picks is available for members to view and is often highlighted as a part of the service's track record.

How are stocks chosen for Stock Advisor?

Stocks are chosen for Stock Advisor based on a variety of criteria including business quality, growth potential, and valuation, among other factors, as outlined by The Motley Fool's investment philosophy.

How much does Stock Advisor cost?

Stock Advisor costs $199 annually, but varies depending on promotional rates and subscription terms. As a new subscriber you can have your first year for $99.

Can I manage a portfolio within Stock Advisor?

Yes. Stock Advisor offers features to track your portfolio, allowing you to add stocks to 'My Portfolio' and monitor their performance.

Does Stock Advisor provide advice on when to sell a stock?

Yes, Stock Advisor does provide sell recommendations when they believe it's no longer advantageous to hold a stock.

Barry, Stock Advisor has a rather loosely defined method for buying and selling the recommended stocks. Can you give us more information on number of stocks you held and how you determined when to sell them?

Hi Michael, thanks for the question. You are correct, Motley Fool do not have a published defined set of rules for the buy or sells. However, for each recommendation they do justify why it is a buy or sell. The reasons are usually fundamental (earnings/sales are down) or business conditions (industry turmoil). In the famous case of luckin coffee it was because the company filed false accounts.

My testing involved adding all their recommendations into a Stock Rover portfolio, and and removing them when Motley Fool signalled a sell.

I think it is important to follow their guidance on buy if you want to emulate their performance numbers.

thanks

Barry

How could 72% of the stocks recommended by Motley Fool have made a profit but did not beat the market, while 48% of the recommendations beat the market. That’s over 100% of the stocks recommended which does not compute.

Hi Frank, thanks for pointing out the error. This has been corrected; it now reads – 72% of the stocks made a profit.

48% of the recommendations beat the market.

Where can I find all the stocks recommended by Motley from 2002. Under fool.com I don’t see PERFORMANCE tab anymore.

I would Contact fool.com