I first discovered Finviz over 14 years ago, so when I began testing the platform again, I was eager to see if it held any exciting surprises.

Finviz has significantly enhanced its tools with major upgrades in charting, pattern recognition, and backtesting capabilities. Despite these advancements, it continues to provide an outstanding free stock screening service.

Finviz Review & Verdict

After hands-on testing, I found Finviz to be a powerful free stock screener, swift market heatmaps and impressive stock chart pattern recognition.

Thanks to ongoing enhancements to its charting capabilities, Finviz remains a relevant and powerful tool in stock analysis. Through my testing, I found Finviz to be an exceptional free resource, offering intuitive heatmaps, speedy stock screening, and seamless chart pattern recognition.

For those seeking more advanced features, Finviz Elite delivers excellent value at $299 per year, providing real-time data and robust backtesting tools.

Finviz’s elite service provides real-time market data and allows you to perform up to 24 years of backtesting on multiple combinations of 102 technical indicators.

Finviz is targeted at individual investors and institutions and enables investors to screen for stocks and see stocks on the move.

Pros

✔ 67 stock screening metrics

✔ 33 Chart Patterns Recognized

✔ Intraday (1-minute) data with Finviz Elite

✔ One of the best free stock screeners

✔ Good insider trading/news service

✔ Fast heatmaps for sector & industry visualizations

✔ Integrated news aggregation

✔ Backtesting recognizes 102 chart patterns

Cons

✘ Elite Backtesting Could Be More Flexible

✘ 21 chart indicators

✘ No app for Android or iPhone

Key Features

| ⚡ Finviz Features | Screening, Heatmaps, Charts |

| 🏆 Exceptional Features | Patterns, Signals, Auto-Trendlines |

| 🎯 Best for | Beginner Investors/Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $39.50/mo or $25/m annually |

| 🆓 Free Plan | Yes. Try the Free Version |

| 💻 OS | Web Browser |

| 🎮 Trial | 30-Day Money-Back |

| ✂ Discount | -40% With Annual Plan |

| 🌎 Region | US |

Finviz vs. the Competition

Comparing Finviz to TradingView, Stock Rover, and TrendSpider, my tests show that for automated stock chart analysis, backtesting, and automated bot trading, TrendSpider is our top pick. TradingView is better for a global trading community. Stock Rover is better than Finviz for long-term growth, dividend, and value investors. For AI-driven robotic day trading, Trade Ideas is better. For trading real-time news, Benzinga Pro is a better alternative.

| Features | Finviz | Stock Rover | TrendSpider | TradingView | Portfolio123 |

| Rating | 4.3 | 4.7 | 4.7 | 4.5 | 4.4 |

| Best for: | Investors | Investors | Traders | Traders | Investors |

| Free Plan | ✔ | ✔ | ✘ | ✔ | ✔ |

| Pricing | $39.50/mo or $25/m annually | Free or $28/m or $23/m annually | $107/m or $48/m annually | Free | $13/m to $49/m annually | Free or $83/m annually |

| Financial Screening | ✔ | ✔ | ✔ | ✔ | ✔ |

| 10-Year Financials | ✘ | ✔ | ✘ | ✘ | ✔ |

| Portfolio Management | ✘ | ✔ | ✘ | ✘ | ✔ |

| Research Reports | ✘ | ✔ | ✘ | ✘ | ✘ |

| Chart Pattern Scanning | ✔ | ✘ | ✔ | ✔ | ✘ |

| AI Stock Screening | ✘ | ✘ | ✔ | ✘ | ✘ |

| Financial News | ✔ | ✔ | ✔ | ✔ | ✘ |

| Stocks & ETFs | ✔ | ✔ | ✔ | ✔ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ | ✔ |

| FX/Commodity | ✘ | ✘ | ✔ | ✔ | ✘ |

| USA & Canada | ✔ | ✔ | ✔ | ✔ | ✔ |

| Global Market Data | ✘ | ✘ | ✘ | ✔ | ✘ |

Pricing

Finviz has three pricing plans; the Free plan is free to use without registering. Registered users can also use the service for free and save their settings. Finally, the Elite service costs $39.99/mo or $24.96/mo annually, saving you 37%.

You can have Finviz for free; however, the real power of Finviz is unleashed with the Elite service, which provides real-time data and maximum flexibility.

Free

Finviz’s free plan is ad-supported but provides great value for beginner investors. Without registering, you can scan and screen over 10,000 stocks and use the delayed charts and news stream. The free plan is ideal for beginner investors who want to check the markets fuss-free.

Registered

If you like Finviz, I highly recommend registering for free. It saves your settings, and you can also configure 50 portfolios, 50 stocks per portfolio, and 50 screener configurations.

Elite

Finviz Elite costs $39.99/mo or $24.96/mo on an annual plan with a 40% discount. The big bonus of the Elite subscription is the real-time data, customizable alerts, fundamental charts, correlation charts, and backtesting capabilities. You can also export your screener results and access eight years of company financial statements.

Finviz Coupon Code Discount

Finviz does not offer coupon codes for its stock research software. However, Finviz does offer a 1-year subscription with a 40% discount for new customers who start an Elite subscription.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Platform

Finviz runs on PCs, Macs, Tablets, and Smartphones through a browser and requires zero installation; it simply works. When you register with Finviz and log in, you are greeted with the home screen dashboard, which gives you an instant view of market performance for the current trading day, plus the top moving stocks, news, and big insider trades.

Mobile App

There is no Android Play Store or Apple Store App for Finviz. People might mistakenly install the FINWIZ app, but it is not the same company. Finviz is best accessed via a PC, Mac, or tablet browser.

Finviz Tutorial

During this Finviz review testing, I started to appreciate the platform’s real benefits and how to use it. I will now run you through how to use Finviz so it becomes less confusing. The best way to start using Finviz is from the Heatmaps or the Screener. We will start with the heatmap.

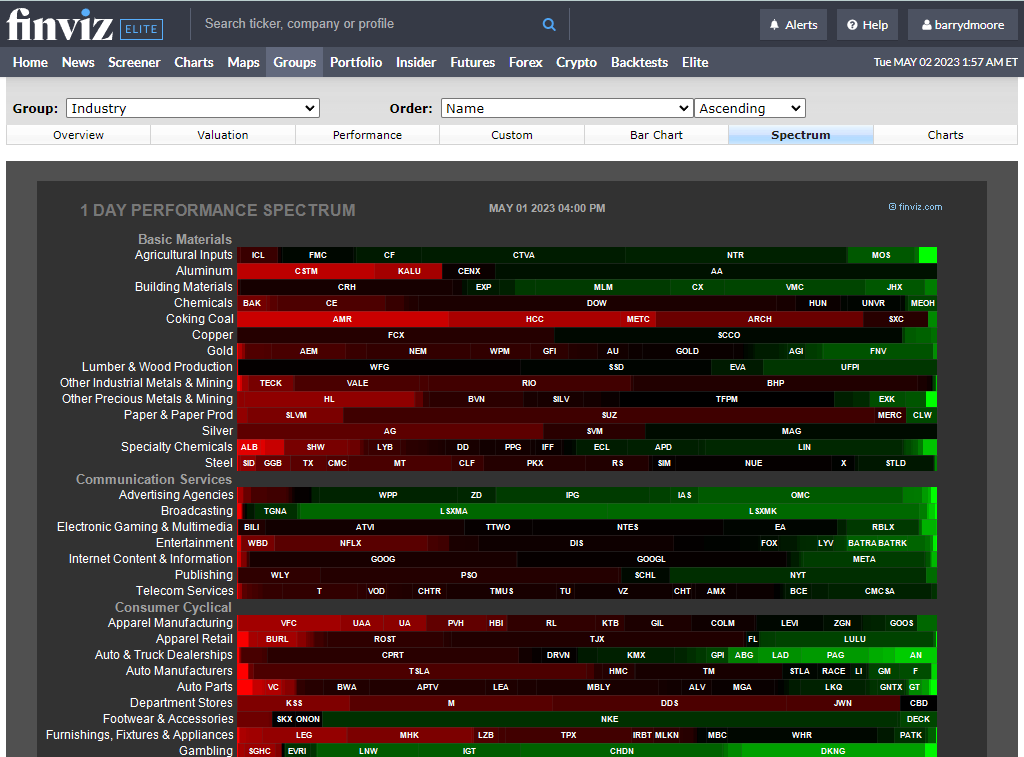

Heat Maps

The Finviz heatmaps visualize the US and world stock market performance, which is great for finding trading opportunities. Finviz manages to cram the entire world’s moving stocks onto a single-page heatmap at lightning speed, which is very impressive. Hovering your mouse over a ticker symbol shows the stock’s current performance, a mini line chart, and the company’s direct competitors.

Viewing the Finviz stocks heatmaps based on analyst recommendations shows how biased institutional analysts are, as 70% of stocks are flagged as positive.

Finviz allows you to visualize markets based on stock price performance, volume, P/E, PEG, Dividend Yield, Float, EPS, and even analyst recommendations. You can click on a stock and jump directly to the individual company data and chart. The whole process is extremely fast and efficient.

Stock Screener

The Finviz screener allows for rapid filtering of 8,500+ major stocks and ETFs. However, this is not all the stocks in the world; it is just the major stocks, as there are over 10,000 stocks in the USA alone.

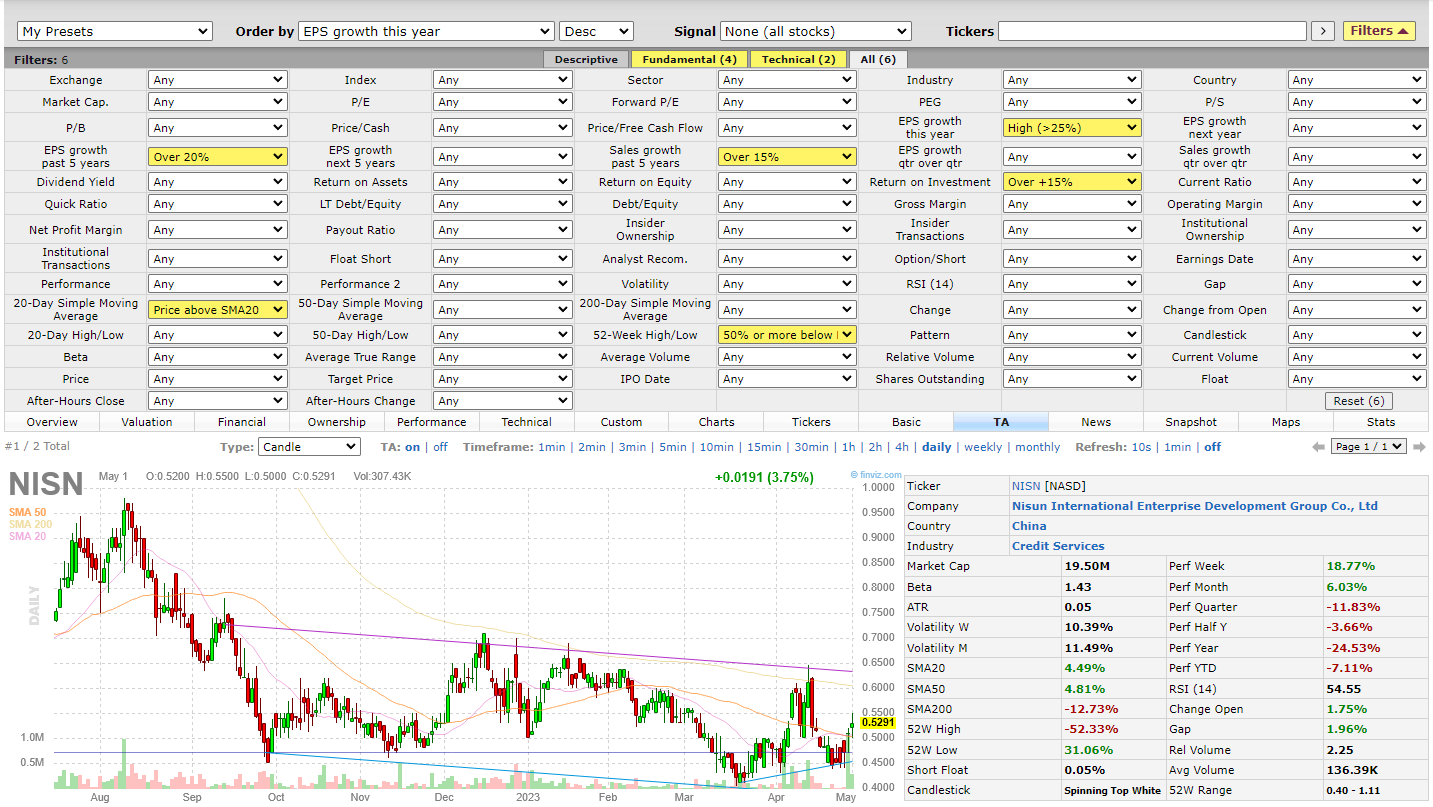

The Finviz stock screener is extremely fast and allows you to filter on 67 fundamental and technical criteria. You can filter the stocks on specific chart-based signals such as new highs, lows, oversold, analyst upgrades, insider buying, or even chart patterns like double tops and head-and-shoulders.

Finviz allows you to scan for a mix of 67 fundamental criteria and combine it with 30 different trading signals. That may seem like a huge choice, but TradingView offers over 168 criteria, Portfolio123 has 470 filters, and Stock Rover provides over 650 options.

Finviz also shines where the others do not because you can also screen on ten major candlestick patterns and 30 stock chart patterns. This mix of fundamental screening criteria for investors, technical charts, and candlestick pattern recognition for traders makes Finviz a good match for short-term and medium-term investors.

In the screenshot below, I have highlighted the key interesting Finviz stock screener fields in red. To test the Finviz screener, I built a growth stocks screening strategy to demonstrate using high EPS growth, sales growth, ROI, and price above the 20-day moving average.

Are there Pre-Built Screeners Integrated into Finviz?

No, with nearly all of the best stock screening software, the companies endeavor to pre-build stock screeners as examples or inspiration; this is not the case with Finviz. Stock Rover provides over 150 pre-built curated screening strategies to import and use immediately.

Groups, Industry & Sector Analysis

The Finviz Groups tab allows you to visualize the price performance of US stock sectors or industries based on daily, weekly, quarterly, or yearly performance. This lets you see which sectors are performing well and drill down to individual stocks to look for trading opportunities.

Charting Test

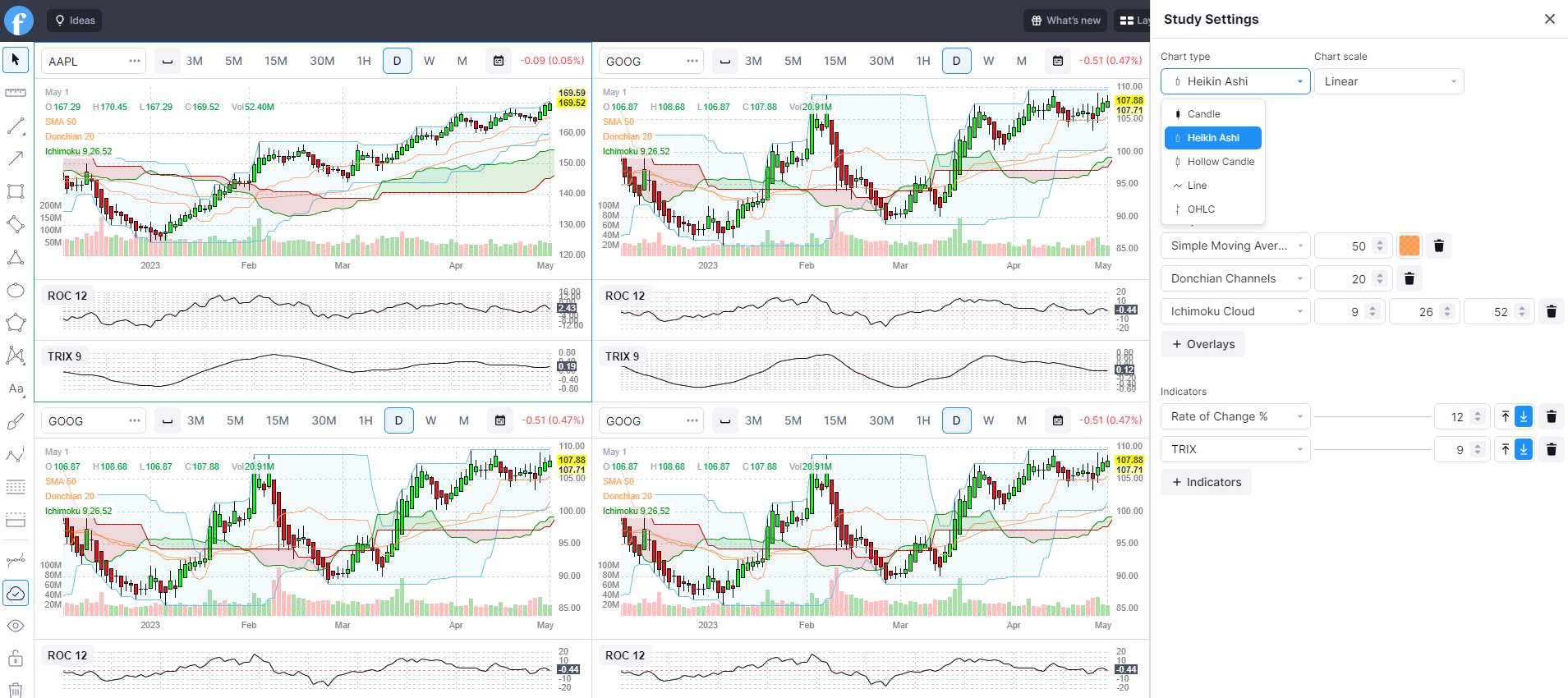

Looking at stock charts with Finviz is different from using other stock software products. Whereas MetaStock and TradingView charts provide hundreds of fundamental technical analysis indicators, Finviz provides basic pattern recognition on daily charts and a small but growing handful of overlays and indicators.

I like Finviz’s automatic trendline recognition and its ability to identify price patterns like wedges, triangles, double bottoms, and rectangles; this is a big advantage for pattern traders.

Finviz has 13 chart overlays, including Bollinger Bands, VWAP, and 21 chart indicators. Finviz now auto-saves interactive charts, and your trendlines and annotations are replicated throughout the platform; this recent improvement benefits the users immensely.

Finviz Elite Stock Charts

The Finviz Elite interactive charting is being continuously developed, and now the charts are very good. Integration of Heiken Ashi charts is a welcome improvement. Additionally, more overlays and indicators are being added. Charts now auto-save, and your annotations are available throughout Finviz’s platform.

At the time of writing, there is no watchlist, so you cannot flick through your portfolio of stocks and analyze the chart; you need to enter the tickers manually.

Alerts (Elite Plan)

Finviz can alert you about any individual stock or portfolio. Alerts can be triggered by financial news, price changes, analyst rating changes, or insider trading. These alerts are interesting because I do not know any other stock software that provides such alerts on the news or insider trading, except for Benzinga Pro.

Portfolio Management

The Finviz portfolio management functionality is basic. While you can easily export the results of a screener directly into a portfolio for monitoring and see any aggregated news on that portfolio, calling it a portfolio is a stretch. The portfolio functionality is more like a simple watchlist.

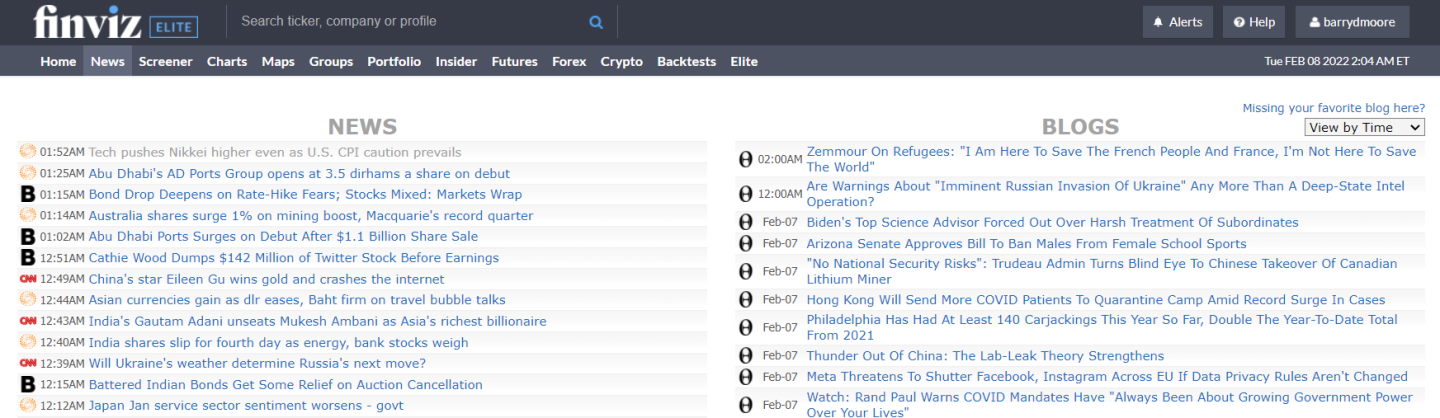

News & Social

Finviz aggregates news from many outlets, including MarketWatch, Bloomberg, WSJ, CNBC, Fox, and the New York Times. If you only want to read the headlines, this is a good service to get an idea of the latest market action. But of course, the NYT and Bloomberg articles are all behind a paywall, so you cannot get into too much detail. On the upside, Finviz will alert you if there is news on a stock in your portfolio, which is very useful.

If you want to trade real-time news, I recommend Benzinga Pro. Alternatively, read our test of the 13 Best Financial Stock Market News Sources and Feeds.

Unlike TradingView, Finviz does not have social trading, chat, or a community of traders.

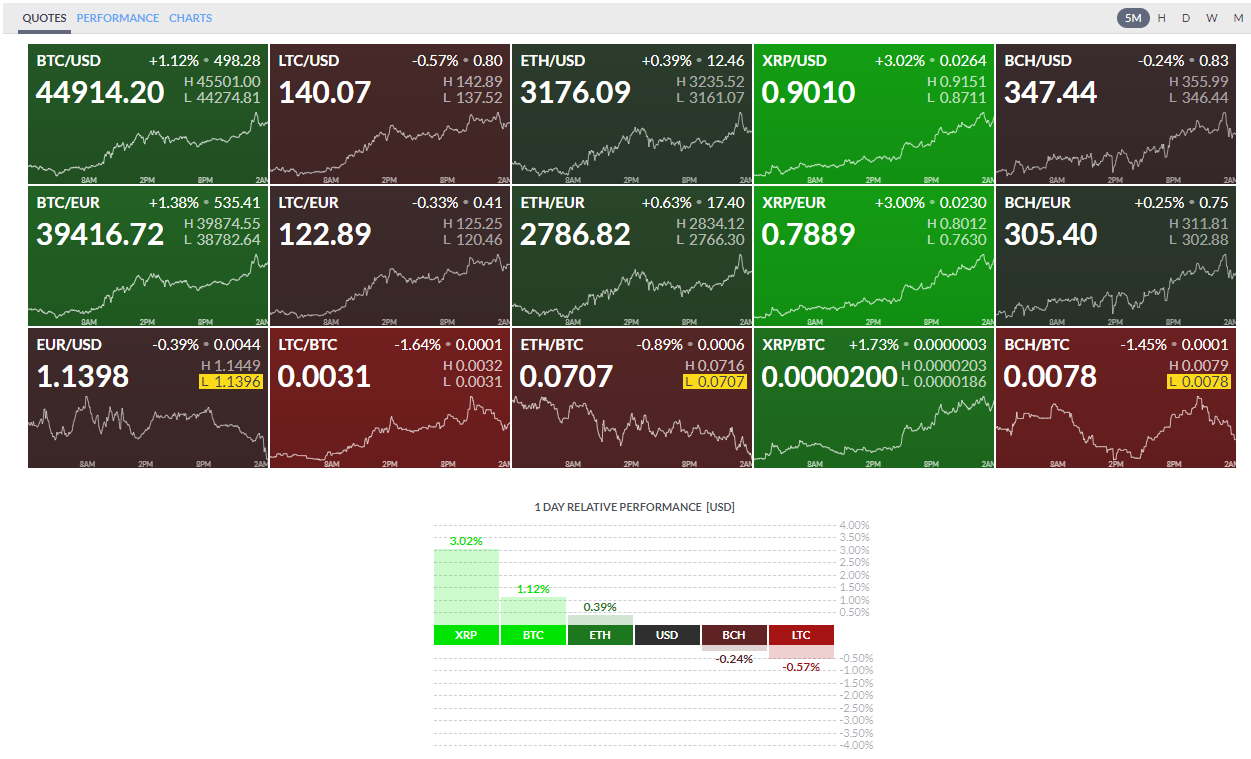

Finviz Crypto & Forex Heatmaps

The Finviz analysis for cryptocurrency covers only 15 coins and provides charting but no performance information. Finviz tracks 12 foreign exchange pairs but no background analysis or news. You can click on any chart (see the image below) and jump to an interactive chart, but you cannot save annotations or settings.

Finviz Elite Review

Our research and testing of Finviz Elite reveal three key reasons to upgrade: the real-time data flow, the interactive charts, and the powerful 24-year backtesting service. A free 30-day money-back trial is available so you can test these features yourself.

Finviz Real-time Data Test

When I upgraded to FinViz Elite, I expected the heatmaps to flicker and glow to show stock prices moving visually. I expected the industry sectors to show me the ebb and flow of entire industries being bought and sold. I expected the interactive stock charts to be buzzing with real-time tick-by-tick data. I got none of that.

You cannot set a refresh rate on the heatmaps or the industry grouping visualizations, so there was no dynamic element. Additionally, the interactive stock charts do not provide tick-by-tick real-time data; the lowest level of granularity is 1 minute. As I mentioned before, you cannot add indicators or save your settings on the Finviz Elite charts, which makes them a disappointment.

But there are many good reasons to upgrade to Finviz Elite, especially the simple yet incredibly powerful backtesting tool with 24 years of data.

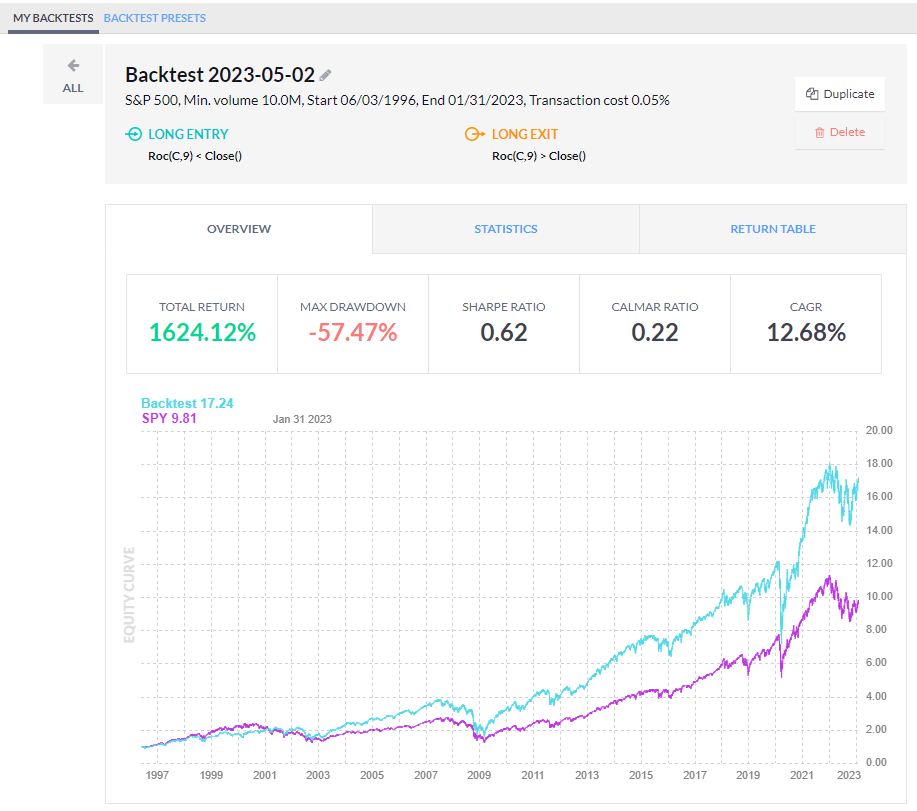

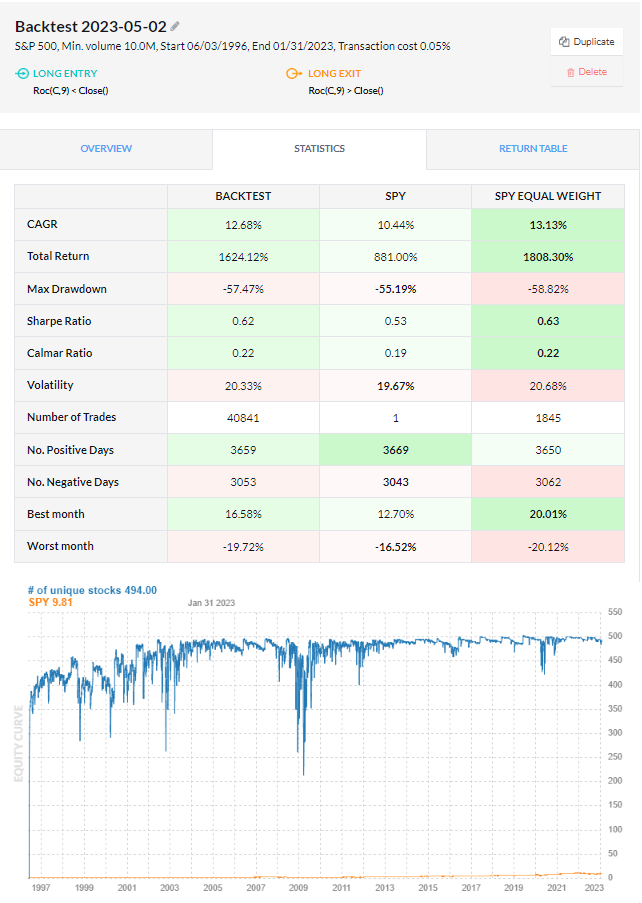

Elite Backtesting

The Finviz Backtester offers over 100 unique indicators and automatically detects stock chart patterns to help build a truly unique system. Backtesting requires no coding skills, which is a huge benefit.

As an experienced author of successful backtested strategies, including the Liberated Stock Trader, Beat the Market System on Stock Rover, the MOSES Market Outperforming Stock ETF System on TradingView, and the Stock Market Crash Detector, I know what I am doing. So, I was very excited to try the Finviz backtesting service.

How to Build a Successful Backtest In Finviz

I was impressed after one hour of working on strategies with the Finviz backtester. The backtester offers over 100 unique indicators and automatically detects stock chart patterns to help you build a truly unique system.

After all this work, I created a system based on the Price Rate of Change that has handsomely outperformed the S&P 500 index over the last 25 years.

The system returned a profit of 1,624%, with a compounded annual return (CAGR) of 12.68% versus the S&P 500’s 10.44% (See the proof below).

Try Super Fast Entire Market Backtesting with Finviz

The Finviz backtesting is solid, fast, and incredibly flexible and is listed in our detailed review of the best stock backtesting software.

Is Finviz Easy to Use?

Yes, Finviz is incredibly easy to use, especially when you become more experienced with the software. However, there are some user experience limitations: you cannot easily save chart annotations, you cannot have interactive charts and watchlists together, and you lose your work if you do not save it on every page.

Is Finviz Worth It?

Yes, the free Finviz service is worth using. It has excellent heat maps, a free stock screening service, good news aggregation, and insider trading information. What more do you expect for free?

Is Finviz Elite Worth it?

Yes, Finviz Elite is worth it, as the real-time stock market visualizations and pattern recognition help you quickly identify trading opportunities. If you expect a world-beating backtesting platform and excellent real-time charting, look at TradingView instead.

Alternatively, Finviz Elite may not be worth it because the backtesting service does not provide adequate data for system reporting. The real-time chart data is accurate only to one minute, not tick-by-tick real-time charting. Finally, the Elite interactive charting does not allow you to add indicators or save annotations.

Finviz Testing Summary

Finviz provides fast stock screening, heatmaps, and stock chart pattern recognition for free. If you want to visualize a large amount of stock data and find investments quickly, Finviz is definitely worth it.

FAQ

How to use Finviz to find breakout stocks?

A great way to find breakout stocks in Finviz is to select two criteria from its stock screener. Select "Price crossed MA50 above" and "Gap Up 5%." These two criteria show stocks that were in a downtrend but are now breaking up through the 50-day moving average with a 5% daily gap.

Does Finviz have a mobile app?

No, Finviz does not have a mobile app. Despite the world's internet users moving to mobile, Finviz lags behind in mobile-first development. The Finviz.com website is fast on mobile but not user-friendly.

Does Finviz scan premarket?

Yes, Finviz does scan premarket and extended hours, but only with the Elite service. The Finviz free service does not allow access to premarket or extended-hours data.

How much is Finviz Elite?

Finviz Elite costs $39.99/mo, but if you choose an annual plan, that price drops to $25/mo because of the 40 percent annual discount.

How often does Finviz update?

Finviz Elite will provide up-to-date data with 1-minute accuracy. Finviz Free updates with a 12-15 minute delay. Testing the Apple Inc. stock price, the Finviz Free plan pricing is delayed by 12 minutes, but the free TradingView service is nearly real-time with only a 1-minute delay.

How to find good stocks on Finviz?

Finding a good stock on Finviz depends on what you define as a good stock. If high earnings make a good stock for you, then screen for "EPS growth 5 next years" or "EPS growth qtr over qtr".

How to find low-float stocks on Finviz?

Finviz makes it easy to find low-float stocks, select "Float Short Over 20% in the stock screener, and you will have a list of 50 stocks with a low float.

How to find short-squeeze stocks on Finviz?

To find short squeeze stocks on Finviz, go to the stock screener and select "Float Short Over 30%" and "Option/Short - Optionable." This will provide a list of 10-20 short-squeeze stocks.

How to find undervalued stocks on Finviz?

Finviz does not have the ability to find undervalued stocks. An undervalued stock sells at a discount to its 10-year projected discounted forward cash flow (FCF). The only stock screener that allows you to find undervalued stocks is Stock Rover's Premium+ Plan. Stock Rover has accurate FCF, Fair Value, and Margin of Safely criteria for those seeking value stocks.

How to find value stocks on Finviz?

Finviz does not enable investors to find value stocks. Value stocks are defined by a low stock price versus future cash flows and profits. Value investors should look at Stock Rover, which provides vital value investor criteria such as Fair Value and Margin of Safely.

Is Finviz free?

Yes, Finviz is free; in fact, 80 percent of Finviz customers use the free version of Finviz. Finviz free has many benefits; it is fast, simple to use, and has built-in stock chart pattern recognition. Unfortunately, the free version of Finviz is inundated with adverts, which can spoil the user experience. You can remove the adverts and get real-time data with Finviz Elite.

Is Finviz legit?

Finviz has been online since 2005, but does that make it a legitimate company? Surprisingly there is very little public information about Finviz and no reference to the ownership, corporate structure, or goverance. Deeper research shows Finviz has a 2.9-star rating on Trustpilot, and the website provides no legitimate address, phone number, or corporate contacts.

Who owns Finviz?

According to very few online sources, the owner of Finviz is Slokavian Juraj Duris. Surprisingly there is no reference to the ownership or corporate structure of Finviz on its website or anywhere else on the internet.

Is Finviz reliable?

The Finviz service is reliable and fast. However, my testing has found issues in the Elite charting and backtesting service results.

Are Finviz charts real-time?

Finviz charts are real-time with an accuracy of 1 minute only with the Finviz Elite service. Finviz Elite costs $25/mo with a 40 percent annual discount.

Are Finviz stock quotes delayed or in real-time?

Finviz quotes are both delayed and real-time. With the free Finviz service, quotes are delayed between 12-15 minutes. With Finviz Elite, the data is close to real-time with only a 1 minute day. Real-time data, like with TradingView, is with only a 1-5 second delay.

Can Finviz chart Elliott waves?

No, Finviz does not have Elliott Wave charting capabilities. With Finviz Elite, it is possible to plot Elliott waves on charts, but TradingView Pro has automated Elliott Waves analysis algorithms that do the hard work for you.

Can Finviz scan for float?

Yes, Finviz can scan for a float with two screening criteria. "Float Short" allows you to scan for float less than 5% or over 30%, and the "Float" criteria enables you to select the number of shares float between -1 million and plus 1,000 million.

- Related Article: Portfolio 123 An Excellent Alternative To Finviz.

- Related Article: StockCharts vs. TradingView: Head-to-Head Comparison

- Related Article: TC2000 vs. TradingView: We Do The Test To See Who’s Best?

- Related Article: TradingView vs. TrendSpider: 9 Epic Tests To See Who’s Best?

- Related Article: Finviz vs. Tradingview: Rated & Ranked, Who Gets Spanked?

Finviz Review: Is It Worth Using in 2025? I Test It!

After hands-on testing, I found Finviz to be a powerful free stock screener, swift market heatmaps and impressive stock chart pattern recognition.

Price: 25

Price Currency: USD

Operating System: Web Browser

Application Category: Investing

4.3

Pros

- 67 stock screening metrics

- 33 Chart Patterns Recognized

- Intraday (1-minute) data with Finviz Elite

- One of the best free stock screeners

- Good insider trading/news service

- Fast heatmaps for sector & industry visualizations

- Integrated news aggregation

- Backtesting recognizes 102 chart patterns

Cons

- Elite Backtesting Could Be More Flexible

- 21 chart indicators

- No app for Android or iPhone