There are many differences between swing and day trading. While both involve buying and selling stocks, the strategies and timeframes used in each approach are distinct.

Swing trading is a strategy where traders hold onto stocks for several days to weeks. They typically base their decisions on technical analysis, looking at charts and patterns to identify potential entry and exit points. The goal of swing trading is to capture short-term price movements, aiming for profits of 5-10% per trade.

Day trading involves buying and selling stocks within the same day. Day traders rely heavily on market volatility and use technical indicators such as candlestick charts and level II quotes to make quick trades. Their ultimate goal is to capitalize on small price fluctuations throughout the day, often aiming for profits of less than 1%.

Swing Trading and Day Trading differ in timeframe, strategy, tools, and leverage. Day traders trade intraday using leverage, while swing traders hold positions for days or weeks.

Swing traders use real-time news, patterns, and indicators to make decisions, whereas day traders typically look for volatility to enable price scalping.

Let’s dive into the tools and techniques used in these two trading techniques.

What is Swing Trading?

Swing trading is a strategy in which traders buy and sell stocks over a few days or weeks. They take advantage of short-term trends to make profits on their trades. Unlike day traders, swing traders may hold onto their positions overnight so they can see how the market moves.

Swing trading is a strategy that involves holding onto stocks for a few days to a few weeks to take advantage of longer-term price movements. Swing traders often use technical analysis to find stocks ripe for a price move.

An Example of Swing Trading

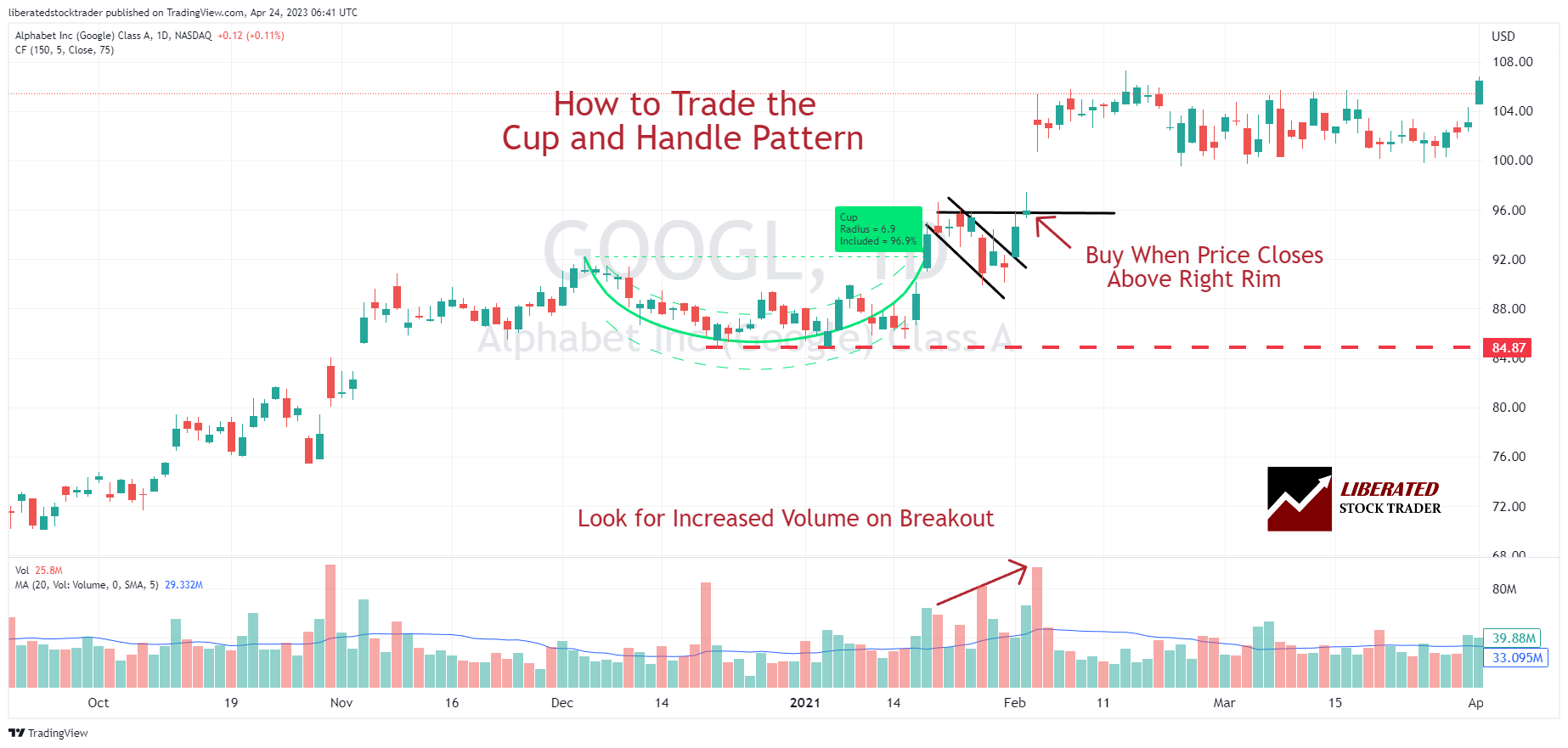

Good swing traders will use high-performing chart patterns and tested indicators to identify momentum breakouts. This example highlights a 95% predictive cup-and-handle pattern.

Get Pattern Recognition with TradingView

Video: Swing Trading a Cup and Handle Pattern

Swing trading is a strategy that involves holding a stock for some time, typically one to six weeks, profiting from price changes or ‘swings.’ Swing traders generally buy stocks showing signs of momentum and buying pressure. They then hold the stock until it reaches its peak and sell it.

What do swing traders look for:

- High-performance chart patterns

- Relative strength index (RSI) readings below 50 but increasing.

- Increasing volume on days when the stock price is rising.

- Stocks with high short-interest ratios.

By following these simple rules, swing traders can profit from price swings in both directions.

Swing trading is a great strategy for investors who want to take advantage of short-term price movements but don’t have the time or patience to day trade. It can also be used as a complement to other, longer-term investing strategies.

What is Day Trading?

Day trading is a strategy that involves buying and selling stocks within the same day. You must monitor the market throughout the day to take advantage of any short-term opportunities. Day traders typically don’t hold onto their positions overnight, believing the market can change quickly and unexpectedly.

An Example of Day Trading

This example highlights the Price Rate of Change (ROC) indicator smart day traders will utilize. Our testing shows ROC was the most profitable indicator we tested when used on a Heikin Ashi chart. ROC allows day traders to gauge the speed and direction of price movements. As its name suggests, it measures the rate at which a security’s price changes over time by comparing current prices with those from the recent past.

Get World Class Strategy Testing With TrendSpider

☆ Swing vs. Day Trading Tools & Strategy Table ☆

The key differences between swing and day trading are the time frames, chart types, indicators deployed, and patterns used to identify trade opportunities.

The table below highlights the exact difference between the trading styles with links to valuable research and testing we have conducted.

| Differences | Swing Trading | Day Trading |

|---|---|---|

| Timeframe | Days to weeks | Intraday (minutes to hours) |

| Charts | 5 minutes to daily | Tick to 1 min |

| Goal | Larger price swings | Small wins using leverage |

| Risk | High | Extremely High |

| Trade Frequency | Lower frequency | Higher frequency |

| Analysis | Technical Analysis Fundamental Analysis Real-time News |

Technical Analysis Real-time News |

| Tools | Charting Software Real-time News Services |

AI Bot Trading Tools Automated Trading Platforms Real-time Charts |

| Chart Types | Heikin Ashi Candlestick |

Candlestick Renko |

| Patterns | Chart Patterns | Candlestick Patterns |

| Capital Requirement | Lower capital requirement | Higher capital requirement |

| Stress Level | Lower stress | Higher stress |

Swing Trading vs. Day Trading: Strategies

Due to the strategies used, swing trading is more effective and profitable than day trading. Due to the short timeframes, day traders have a maximum win chance of 60%, but swing traders can get up to 90%. Shorter timeframes are more unpredictable, and longer timeframes are more trustworthy.

Let me explain.

Our research shows day traders using intraday candle patterns have, at best, a 60% success rate over ten days, using, for example, the Inverted Hammer pattern. You can see from the candlestick tests that the probabilities are only up to 60%.

A swing trader using chart longer-term patterns like the double bottom and triple bottom have up to a 90% profit probability. Our bullish chart pattern research shows this.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

Swing Trading: Capturing Larger Price Moves

Swing trading involves holding positions for days to weeks, capitalizing on medium-term price fluctuations. Traders in this style aim to capture larger price moves by identifying and riding market trends. They typically rely on technical analysis to identify entry and exit points, using indicators like moving averages and chart patterns.

One advantage of swing trading is that it suits those with limited time to actively monitor the market throughout the day. It allows traders to take advantage of potentially significant price swings while avoiding the intensity and stress of day trading.

Read the Full Bullish Chart Pattern Research

Day Trading: Seizing Quick Profits

On the other hand, day trading involves executing trades within the same day, aiming to profit from short-term market fluctuations. Day traders capitalize on intraday volatility, buying and selling stocks, options, or other financial instruments for quick profits.

Day trading requires close attention to the market and fast decision-making. Traders often utilize technical analysis to identify opportunities. Scalping, a technique commonly employed in day trading, involves making numerous quick trades to exploit small price movements. Arbitrage, another term worthy of mention, refers to taking advantage of price discrepancies between markets or exchanges.

The biggest problem with day trading is that you are competing with machines and AI algorithms. To be a successful day trader, you must use AI trading platforms, like our recommended review winning Trade Ideas.

High-Frequency Trading (HFT): Lightning-Fast Execution

High-frequency trading (HFT) is a subcategory that utilizes sophisticated algorithms and technological infrastructure to execute many trades within fractions of a second. Unlike swing and day trading, which are manual strategies, HFT relies on speed and automation to generate profits from small price differentials.

HFT firms often seek to exploit market inefficiencies by executing trades at lightning-fast speeds. They aim to capture small but frequent gains over a large volume of trades. HFT requires significant investment in technology and infrastructure to achieve the desired speed advantage.

Retail investors like us cannot compete with HFT trading deployed by hedge funds like Renaissance Technologies, Citadel, and Two Sigma. Therefore, it is important to understand the basics of HFT trading to better protect ourselves from its potential negative impacts.

Swing Trading vs. Day Trading: Tools

A key difference between day and swing trading is the choice of tools. Our research shows the best software for swing trading is TradingView and TrendSpider (both offer pattern recognition and backtesting), combined with the real-time news provided by Benzinga Pro.

Due to the timeframes, the choice of tools for day trading needs to be different. To be competitive, day traders should use predictive AI algorithmic software like Trade Ideas or TrendSpider (both have integrated Auto-trading via Bots), combined with Benzinga Pro real-time news.

The Alternatives to Swing & Day Trading

There are three main alternatives to traditional swing and day trading strategies: value, dividend, and growth investing.

These strategies involve buying and holding stocks for an extended period, usually years or even decades. Investors typically believe that the underlying companies are sound and have long-term potential for growth.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Value Investing

Value investing is an investment strategy that involves buying stocks currently undervalued by the market and holding onto them until they reach their full potential.

Investors who practice value investing believe that the key to making money in the stock market is to find undervalued companies and wait for the market to realize their true worth.

Value investors often use fundamental analysis to find stocks they believe are underestimated by the market.

Fundamental analysis involves examining a company’s financial statements to determine its intrinsic value.

Value investors typically have a long-term outlook and are patient enough to wait for the market to catch up to their assessment of a stock’s true worth.

Value Investing Example

One well-known value investor is Warren Buffett. Buffett is Berkshire Hathaway’s CEO and one of the most successful investors in history.

He follows a value investing strategy, which has led him to amass a fortune of over $80 billion.

To find stocks he believes are undervalued, Buffett looks for companies with strong fundamentals trading at a discount to their intrinsic value.

Once he has found these companies, he buys their stock and holds onto it until the market catches up to his assessment.

This can sometimes take years, but Buffett’s patience has paid off in a big way.

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Dividend Investing

Income investing is a type of value investing that focuses on buying stocks with a high dividend yield. Dividend yields are calculated by dividing a company’s annual dividend payments by its stock price.

Income investors are attracted to high dividend yields because they provide a regular income stream. Many income investors are willing to take on more risk to collect a higher dividend yield.

Dividend Investing Example.

One example of income investing is finding high-yield stocks offering a secure and reliable income stream.

The approach is to buy stocks trading at a discount to their intrinsic value and have a solid track record of paying dividends.

Growth Investing

A growth investor looks to invest in companies that are growing rapidly, whether in sales, earnings, or some other metric. Growth investors are willing to pay a premium for these companies because they believe the growth will continue.

An Example of Growth Investing.

An example of a growth investor would be someone who buys shares in a company experiencing rapid sales growth. They are willing to pay a higher price for the stock because they believe the company will continue to grow quickly.

Growth investors tend to be more aggressive and have a higher risk tolerance than other investors. They are also more likely to hold onto their investments for longer.

If you’re thinking about becoming a growth investor, it’s important to remember that you’re buying into a company with high expectations. The key is to find companies that you believe have the potential to meet or exceed those expectations.

Growth investing can be a great way to make money, but it’s not without risks. Make sure you do your research before investing in any company. And always remember to invest with caution.

Final Thoughts

Swing and day trading are strategies that cater to different investment styles and time commitments. Swing trading focuses on capturing larger price moves over days to weeks, while day trading aims to secure quick profits within the same day. Both approaches require careful analysis, risk management, and discipline.

Additionally, terms like scalping, arbitrage, and HFT are associated with specific techniques or subcategories within the broader realm of trading, each with its unique characteristics and considerations.

FAQ

What is the best software for day trading?

Trade Ideas is the best software for day trading with a market scanner that uses cutting-edge AI technology to target potential trading opportunities. With 150 built-in strategies, three AI algorithms, auto-bot trading, and a trading room, we recommend Trade Ideas.

What is the best software for swing trading?

For swing trading, the optimal software based on my testing is TrendSpider and TradingView. TrendSpider offers AI pattern recognition, powerful backtesting, and automated trading. TradingView has these features, global market coverage and a community of traders.

What is swing trading?

Swing trading involves holding positions for days to weeks, capitalizing on medium-term price fluctuations. Traders aim to capture larger price moves by identifying and riding market trends.

What is day trading?

Day trading involves executing trades within the same day, aiming to profit from short-term market fluctuations. Day traders capitalize on intraday volatility, buying and selling securities for quick profits.

How long do swing trades typically last?

Swing trades can last from a few days to several weeks, depending on the trader's strategy and the extent of the targeted price move.

Can swing trading be done part-time?

Yes, swing trading is suitable for individuals with limited time who can't actively monitor the market throughout the day. Traders can analyze charts and identify potential setups during their free time.

Is day trading more profitable than swing trading?

If you adjust for risk and effort, swing trading is more profitable than day trading. Our researched and tested probabilities of swing trading chart patterns and indicators versus the success rates of day trading candlestick patterns prove swing trading is a better option.

Do swing traders use technical analysis?

Yes, swing traders rely on technical analysis and real-time news to identify entry and exit points. They use indicators like moving averages, chart patterns, and trend lines to identify potential price reversals or continuations.

What is scalping in day trading?

Scalping is a technique commonly used in day trading. It involves making quick trades to exploit small price movements. Day traders aim to capture small profits multiple times throughout the trading day. Scalping is high-risk and unprofitable for 98% of day traders because they cannot compete against the HFT algorithms of hedge funds.

Can swing trading be combined with fundamental analysis?

Yes, some swing traders incorporate fundamental analysis alongside technical analysis. Fundamental analysis involves evaluating a company's financial health and industry trends. This is particularly successful when trading earnings announcement swings.

Is high-frequency trading the same as day trading?

No, high-frequency trading (HFT) is a separate trading style that relies on advanced algorithms and technology to execute many trades within fractions of a second. HFT aims to profit from small price discrepancies. Day traders cannot compete with HFT machines.

Is day or swing trading better for beginners?

For beginners and experienced investors swing trading is always a better option due to the strategies, timeframes and proven pattern probabilities involved. Swing trading and day trading require knowledge, practice, and risk management skills.