Stock Rover and Finviz are well-known stock screening platforms that help you find investment opportunities based on financial criteria. While both tools offer powerful features and a vast database of stocks to analyze, there are some key differences that may influence your decision on which one to use.

I am uniquely positioned to compare the key differences between Finviz and Stock Rover. I personally pay for a subscription to both services.

Stock Rover vs. Finviz Ratings

My comparison of Stock Rover vs. Finviz reveals that Stock Rover is best for screening, stock research, and portfolio management. Finviz is better at stock pattern recognition and heat maps. I wholeheartedly recommend Stock Rover.

| Stock Rover vs. Finviz Ratings | Stock Rover | Finviz |

| 🏅 Rating |

4.5/5.0 | 3.5/5.0 |

| 💸 Pricing |

★★★★★ | ★★★★✩ |

| 💻 Software |

★★★★★ | ★★★★✩ |

| 🚦 Trading |

★★★★✩ | ★★✩✩✩ |

| 📡 Screening |

★★★★★ | ★★★★✩ |

| 💼 Portfolio Management & Research |

★★★★★ | ★★✩✩✩ |

| 💡 Pattern Recognition |

★✩✩✩✩ | ★★★★✩ |

| 📰 News |

★★★✩✩ | ★★★✩✩ |

| 📈 Chart Analysis |

★★★★✩ | ★★★★✩ |

| 🔍 Backtesting |

★★★★✩ | ★★★★✩ |

| 🖱 Usability |

★★★★★ | ★★★★✩ |

| 📑 Read the Full Review | Stock Rover | Finviz |

Stock Rover allows you to filter stocks based on over 650 fundamental and technical metrics, including financial ratios, valuation measures, growth rates, and more. On the other hand, Finviz stands out for its simple interface and visual data representation. Its stock screener offers over 60 filters to screen for stocks based on various parameters such as market capitalization, sector/industry classification

🏅Verdict: Stock Rover or Finviz

Stock Rover scores 4.5/5.0 because it is a far better screener, integrates with brokers for portfolio reporting, has integrated stock research reports, and allows for excellent backtesting. Finviz scores 3.5/5.0 because its user experience is lacking and has very poor stock charts. But Finviz excels at visualizing vast stock market data on a single screen.

Let’s take a look at the outstanding features head to head.

⚡Features

Both Stock Rover and Finviz cover stocks and indexes. Stock Rover is targeted at dividend, growth, and value investors. Finviz is targeting investors and traders with a mix of features.

| Features | Stock Rover | Finviz |

| ⚡ Features |

Screening, Watchlists, Portfolios | Screening, Heatmaps |

| 🏆 Unique Features |

Backtesting, 10-Year Fundmanetal History | Patterns, Signals |

| 🎯 Best for | US Stock & ETF Investors | Beginner Investors/Traders |

| ♲ Subscription | Monthly, Yearly | Monthly, Yearly |

| 💰 Price | Free or $28/m or $23/m annually | $39.50/mo or $25/m annually |

| 🆓 Free Plan | Yes. Use Stock Rover Free | Yes. Use Finviz Free |

| 💻 OS | Web Browser | Web Browser |

| 🎮 Trial | Free 14-Day | 30-Day Money-Back |

| 🌎 Region | USA | USA |

| ✂ Discount | 25% During Premium Trial Period | -37% With Annual Plan |

💸 Pricing

Stock Rover pricing starts at $0 for the Free plan, Essentials costs $7.99, Premium $17.99, and Premium Plus costs $27.99 per month with a 26% discount for a 2-year plan. Finviz has a good free plan, and pricing starts at $39.99/mo for the Elite service or $24.96/mo on an annual plan, saving you 37%.

Get Stock Rover Discounts

You can get a 25% discount on any Stock Rover plan by signing up for a free 14-day premium or premium plus trial. Towards the end of the 30-day trial period, you will receive an email from Stock Rover offering you a 25% discount on any premium plan.

Finviz Coupon Code

Finviz does not offer coupon codes for its stock research software. However, Finviz does offer a 1-year subscription with a 37% discount for new customers who start an Elite subscription.

💾 Software

Stock Rover enables a more end-to-end investing toolkit than Finviz. Stock Rover has a slick user experience, enabling investors to screen and research stocks and build growth, income, and value portfolios. Finviz enables you to screen stocks and see trends and heatmaps, but the tools do not work well together.

Both Stock Rover and Finviz offer stable and reliable platforms that are easy to use. Both companies offer cloud software, so you do not need to install software or configure exchange data stream downloads; they work across multiple devices.

| Key Features | Stock Rover | Finviz |

| Global Market Data | ✘ | ✔ |

| Powerful Charts | ✘ | ✘ |

| Stocks | ✔ | ✔ |

| ETFs | ✔ | ✘ |

| Screener | ✔ | ✔ |

| Backtesting | ✔ | ✔ |

| Automated Analysis | ✔ | ✔ |

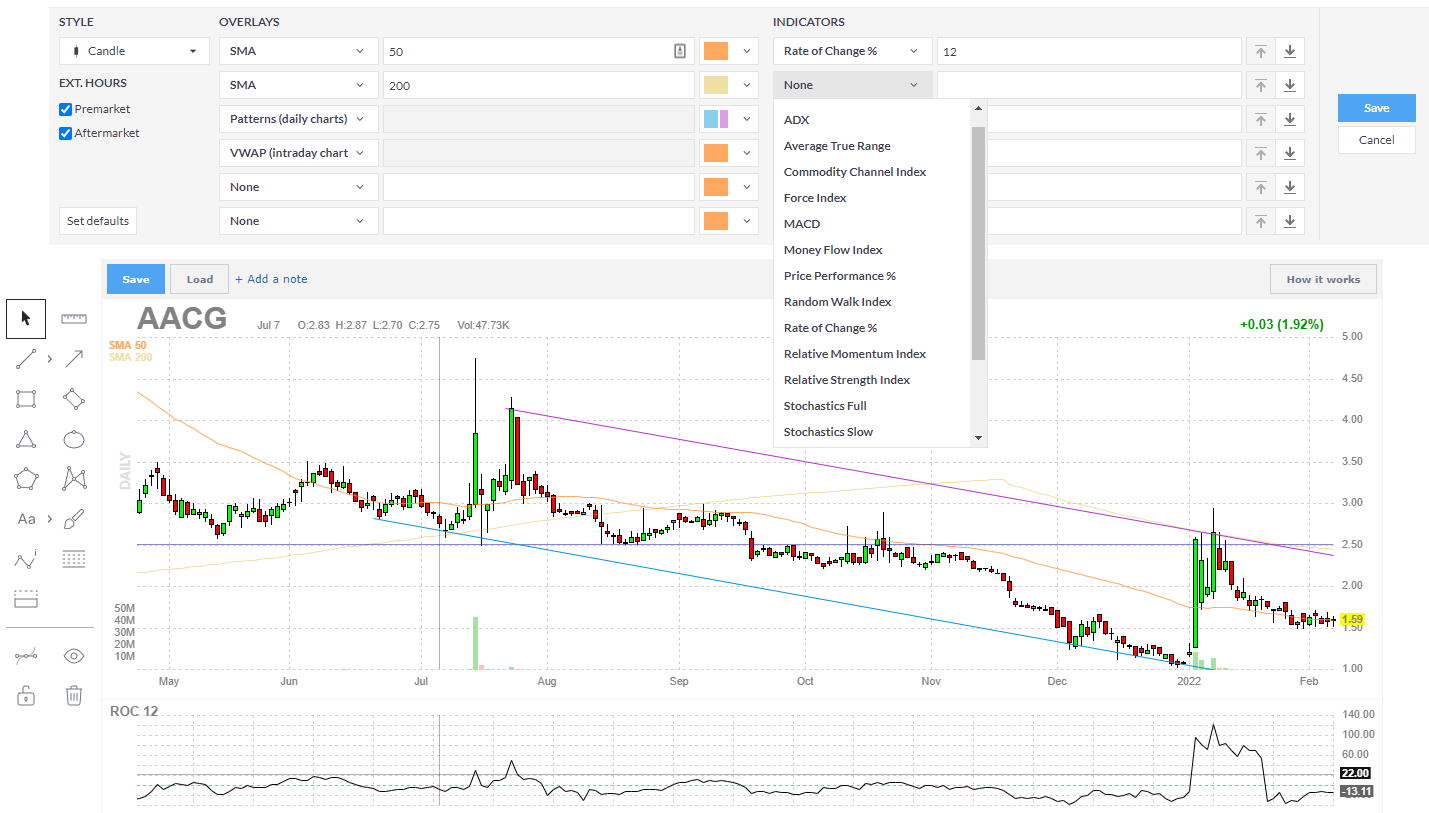

🚦 Trading

You cannot trade from stock charts with Finviz or Stocks Rover. But with Stock Rover, you get broker integration with practically every major broker, including profit and loss reporting, portfolio correlation, and rebalancing recommendations. Finviz has none of the functionality.

Stock Rover is a unique package that includes dividend reporting and scoring. It is not for day traders; it is for longer-term investors who want to maximize their portfolio income and take advantage of compounding and a margin of safety to manage a safe and secure portfolio.

🎥 Video:10 Reasons Stock Rover Rules

📡 Screening Results

When it comes to stock screening, Stock Rover beats Finviz. Both Finviz and Stock Rover have excellent stock screening and market scanning capabilities. The Finviz screener is often seen as the gold standard, but the reality is Stock Rover’s screening capabilities are much better.

Finviz allows you to scan for a mix of 67 fundamental criteria and combine it with 30 different trading signals. That may seem like a huge choice, but Portfolio123 has 470 filters, and Stock Rover provides over 575 options.

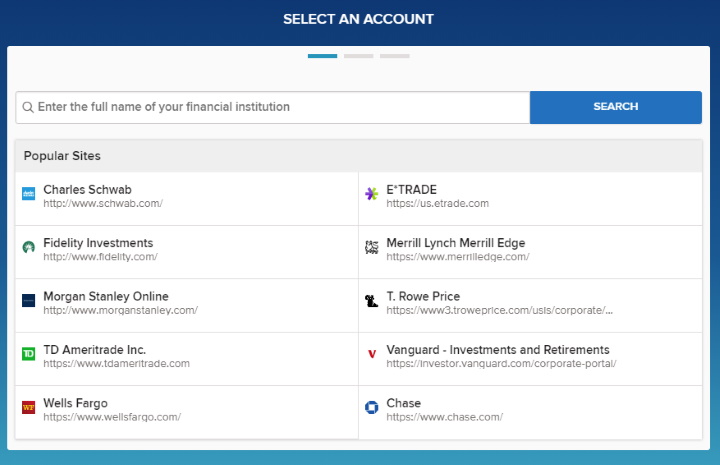

Stock Rover Screening & Scanning

The Stock Rover screener allows for rapid filtering of 10,000 stocks and 44,000 ETFs to help you find investments that match your exact criteria. Stock Rover also has ranked screening, which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful.

The list of fundamentals you can scan & filter on is genuinely huge. Any idea based on fundamentals will be covered with over 650 data points, stock scoring systems, and a further 96 criteria for ETFs.

Unique to Stock Rover is the ability to screen stocks on their performance relative to the S&P500. You could develop a strategy to select stocks based on their historical performance versus the benchmark.

Building your Stock Rover screener is easy: select Create Screener, give it a name, select the equity type, choose your universe of large, medium, or small-cap stocks, and then add your criteria. No programming skills are required.

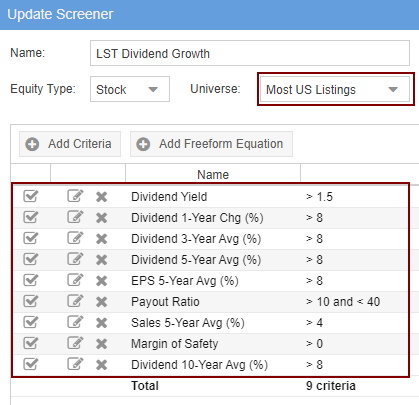

Finviz Screening & Scanning

The Finviz screener allows for rapid filtering of 8,500 major stocks across 60 countries. However, this is not all the stocks in the world; it is just the major ones, as there are over 10,000 stocks in the USA alone.

The Finviz stock screener is extremely fast and allows you to filter on 67 fundamental and technical criteria. You can also filter the stocks on specific chart-based signals such as new highs, lows, oversold, analyst upgrades, insider buying, or even chart patterns like double tops and head and shoulders.

Finviz shines where Stock Rover does not; it can also screen on ten major candlestick patterns and 30 stock chart patterns. This mix of fundamental screening criteria for investors, technical charts, and candlestick pattern recognition for traders makes Finviz a good match for short-term and medium-term investors.

💡 Pattern Recognition

Finviz beats Stock Rover when it comes to pattern recognition. Finviz provides automatic trendline recognition, identifying price patterns like wedges, triangles, double tops, and channels on daily charts; this is a big advantage for pattern traders. The scanner also has 33 automated stock chart signals.

Stock Rover allows screening for 22 technical indicators, which is not the same as pattern recognition.

Finviz offers a solid implementation of pattern recognition, but the kings of automated AI pattern recognition are Trade Ideas, TrendSpider, and Tickeron, who lead the industry.

📰 News & Social

Neither Stock Rover nor Finviz has a social community component. Both offer a similar service for financial news streams, aggregating news from major outlets. Finviz has the advantage of detailed reporting on insider buying and selling, meaning CEOs and executives buying and selling stocks and options.

📈 Chart Analysis

Stock Rover beats Finviz by a long way on stock charting. Finviz charts are a complete letdown, with a clunky, non-interactive interface, limited indicators, and annotation tools.

Stock Rover, The Master of Fundamental Charting

Looking at charts with Stock Rover, one can see that it differs from all the other software vendors on the market. Whereas MetaStock and TradingView focus on hundreds of technical analysis (price/volume) indicators, Stock Rover focuses on charting the fundamental financial strength indicators.

Stock Rover excels at fundamental charting, with over 240 financial and 16 technical analysis indicators. It is not the best technical analysis or frequent trading service; it is by far the complete package for fundamental income, growth, and value investors. Currently, Stock Rover does not allow you to draw trendlines or annotate charts, but this functionality is coming soon.

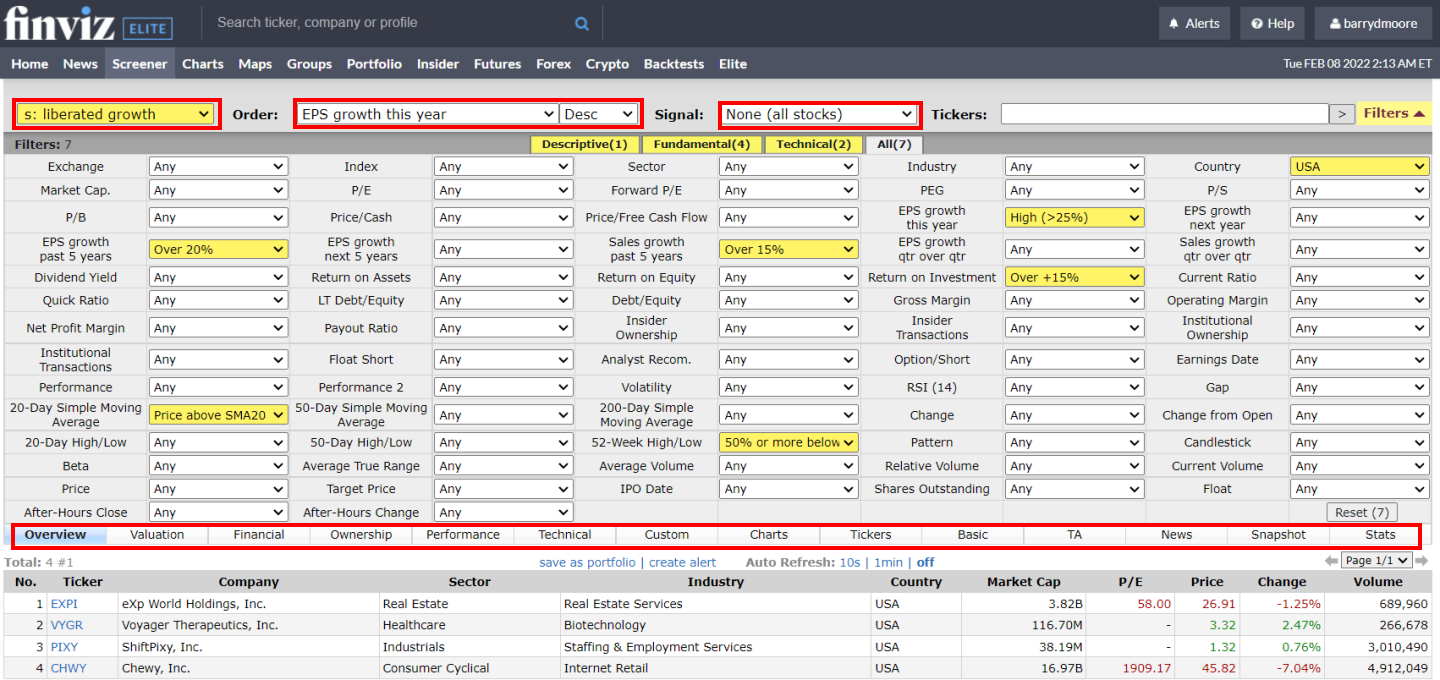

Finviz Charting Is Poor

Finviz has only nine chart overlays, including Bollinger Bands, VWAP, and 17 chart indicators. Thus, the stock charting experience with Finviz is weak. You cannot simply right-click and add an indicator or study; you have to open settings, select the indicators, and then click save. Finviz does not have an effective interactive workflow experience for the user.

Additionally, throughout Finviz, you need to click SAVE constantly. There is no auto-save for your screening criteria, chart annotations, or backtests. If you mistakenly move to the next chart, you lose your configuration; this is frustrating and a very old-fashioned user experience.

🔍 Backtesting

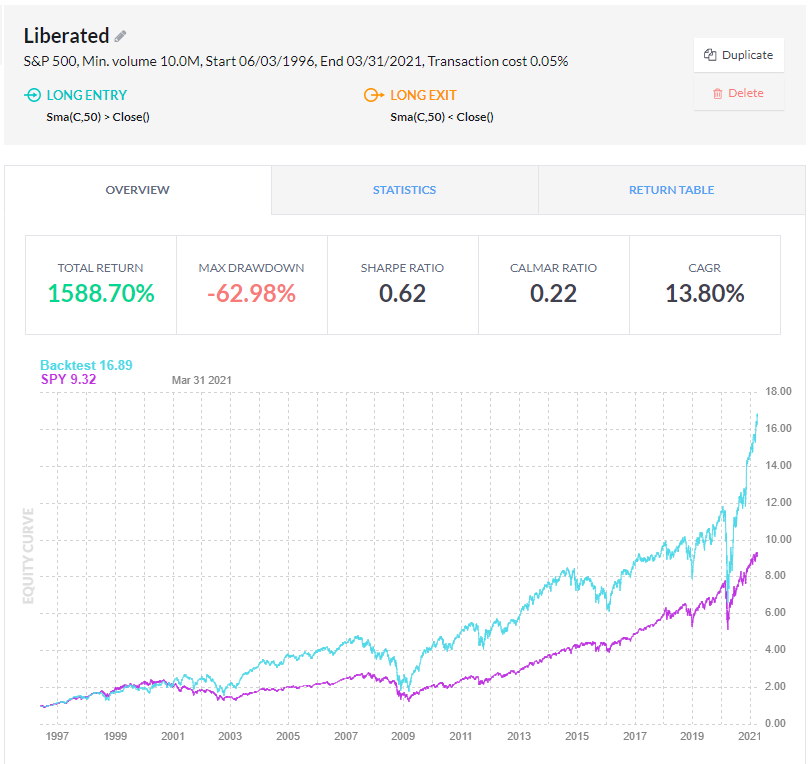

Stock Rover beats Finviz when it comes to backtesting. Stock Rover provides ten years of backdated financial information and scanning possibilities, better than nearly every other stock screening package.

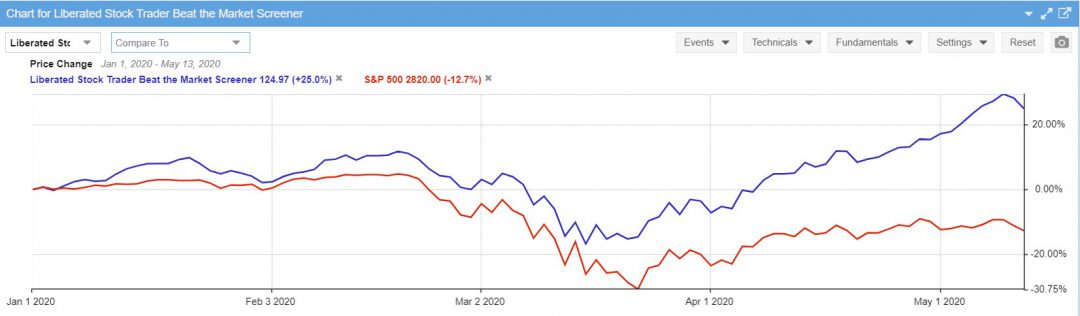

Below, I share the “The Liberated Stock Trader Beat the Market Strategy,” which focuses on growth and financial stability. I used Stock Rover to backtest the strategy for the previous seven years.

Stock Rover offers exceptional backtesting for systems and strategies with endless flexibility, whereas Finviz backtesting is unintuitive, restrictive, and lacks any usable reporting.

Finviz Backtesting

With the Finviz Elite plan, you get a backtesting service, but after extensive testing, I can reveal it is a very poor service indeed. The Finviz Backtester offers over 100 unique indicators and automatically detects stock chart patterns to help build a truly unique system. After all this work, I created a system based on the Money Flow Index that has handsomely beat the S&P 500 index over the last 24 years.

The system returned a profit of 1,588%, with a compounded annual return (CAGR) of 15.24% versus the S&P 500’s 10.86% (See the proof below).

So, the next step is to look at all the trades, the buy signals, the sell signals, the drawdown, the max win/loss, and the win/loss ratio. But there is none of that. The reporting for the backtesting service is poor and not thought through. I could not see which trades were executed or what stocks were purchased.

One cannot believe the backtest results when there is no evidence of every trade and the entry and exit points. If you want a good backtesting service, please read my detailed review and test of the best stock backtesting software.

🔦 Stock Research

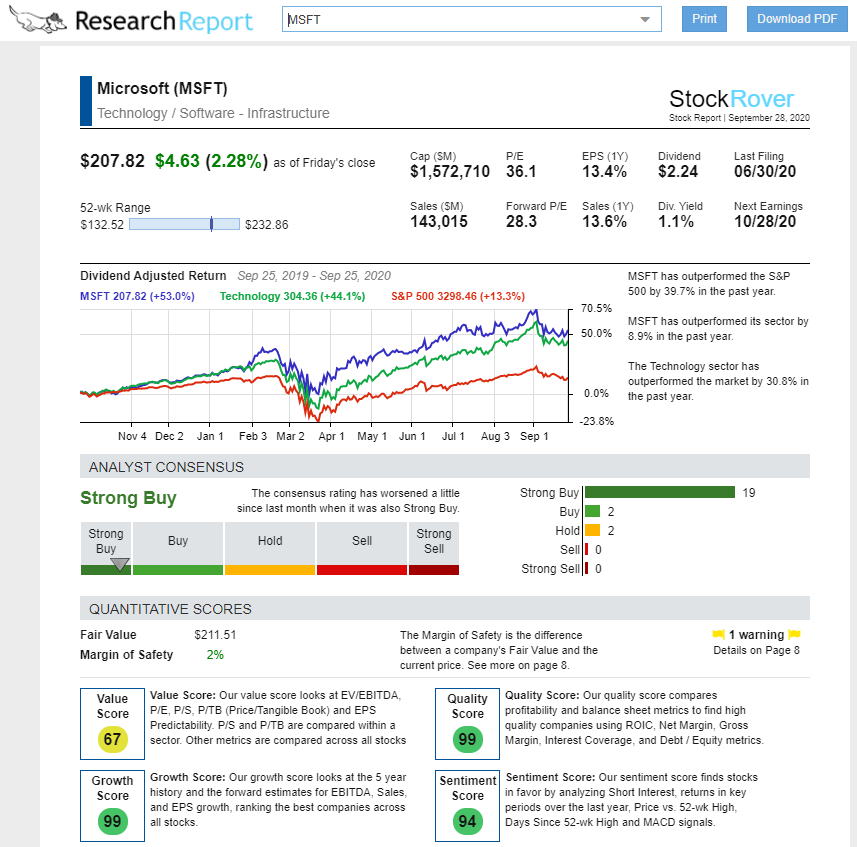

Stock Rover beats Finviz when it comes to deep fundamental financial stock research. While Finviz offers incredible financial information, it is simply a data table. Alternatively, Stock Rover turns that data into information and insight using its Research Reports functionality.

The Stock Rover Research Reports enable you to generate a professional, readable PDF report on any particular stock’s current and historical performance. The reports are unique as they are real-time research reports, meaning they are generated with the latest data highlighting a company’s competitive position, market position, and historical and potential dividend and value returns.

The image below shows the dividend-adjusted commentary on Microsoft, a company I invested in because I found its excellent potential using my Buffett Stock Screener.

The best thing about Stock Rover’s Research Reports is they are Real-time, so the information is always up-to-date.

The Research Reports provide a genuinely comprehensive summary of any of the 10,000+ stocks in Stock Rover on the US and Canadian exchanges. Research reports can be viewed in the browser and produced in PDF format for portability and sharing.

🖱 Usability

Stock Rover beats Finviz on usability, simplicity, and workflow by a large margin. While both are easy to use, the different Finviz components, like screening, portfolio, charting, and backtesting, do not work together. The Finviz interface is ancient, whereas the Stock Rover user experience is seamless.

Both Stock Rover and Finviz require zero installation or configuration. Finviz makes visualizing large amounts of financial data very easy, and the screener is simple to use, but the core components of Finviz do not work together.

🏁 Final Thoughts

Stock Rover beats Finviz in screening, backtesting, portfolio management, and stock research. If you want a simple and good free screening software, then Finviz is still a reasonable choice.

If you need real-time news, the best backtesting, and stock chart indicators, I recommend MetaStock. Stock Rover is the best software for building long-term value, income, and growth portfolios. Finally, if you want to use the power of AI for short-term day trading, Trade Ideas is the best choice.

Invest in yourself! Get all our courses & strategies for 50% off

★ Liberated Stock Trader Pro Stock Investing & Trading Course ★

★ M.O.S.E.S. Market Outperforming ETF Strategy ★

★ LST Beat the Market Stock Picking Strategy ★

★ Exclusive Bonus Course – The Stock Market Crash Detector Strategy ★

★ Fully Guided Videos, eBooks & Lifetime Email Support ★

★ 108 Videos + 3 Full eBooks + 5 Scripts for TradingView & Stock Rover ★