Imagine having a trading platform that does all the charting, scanning, backtesting, and thinking for you. That’s exactly what TrendSpider does.

My testing awards Trendspider 4.8/5 stars due to its innovation. Its powerful algorithms recognize trendlines, chart patterns, and candlesticks automatically. It also has automated trading bots, real AI LLMs, and powerful point-and-click back-testing.

I have used TrendSpider for seven years to automate my chart technical analysis and develop cutting-edge trading strategies. I have backtested over 100 indicators and strategies with TrendSpider, and in this review, I share the results of my testing.

TrendSpider Test Ratings & Verdict

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

Trendspider is innovative and separates itself from the crowded stock chart analysis software market. It solves the problem of too much time spent analyzing, drawing trendlines, tweaking indicators, and analyzing timeframes.

I am a huge fan and believe it has a bright future ahead. We start with an overview of some of the exciting features.

Key Features

| ⚡ Features | Charts, Watchlists, Screening, Free Real-time Data |

| 🏆 Unique Features | AI Automated Trendlines, Fibonacci, Candlestick Pattern Recognition, Auto-Bot Trading, Code-free Powerful Backtesting, Launch and Train Personal AI Models with Strategy Lab. |

| 🎯 Best for | Stock, Options, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $107/m or $48/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Region | USA |

Most Powerful Features

TrendSpider’s most powerful features are automated candlestick, trendline, and chart pattern recognition. Point-and-click backtesting and strategy development automatically plot buy and sell signals onto the chart. TrendSpider now has financial news, analyst estimates, rating changes, insider trading, and seasonality charts. Finally, the AI-powered trading assistance and automated trading Bot execution are the icing on the cake.

TrendSpider is arguably the most complete trading software on the market today.

What is TrendSpider?

TrendSpider is an innovative trading software company founded by Dan Ushman in 2016 to create a service that automates the technical analysis of stock charts. Unlike anything I have seen before, TrendSpider employs artificial intelligence to detect trends not seen by humans. I have met Dan and his team, and I can assure you this platform is the most innovative in the industry, led by a man with great integrity.

Pricing Plans

TrendSpider has radically simplified its pricing model for 2025. All plans include real-time data, futures, AI-powered pattern recognition, backtesting, news, options, crypto, and even automated bot trading with broker integration.- The standard price is $107 per month, and Enhanced costs $197. The best deal is opting for an annual prepaid plan, which offers a 50% discount on all services.

- Adding our partner code LST30 during checkout will save an additional 30% on your first year.

- Using our partner link will grant you an exclusive 7-day discounted trial with TrendSpider.

| TrendSpider Pricing | Monthly Subscription | Annual Subscription |

| Standard (Casual Traders) | $107 | $53.50 |

| Enhanced (Active Traders) | $197 | $98.50 |

| Professional (Professionals) | $397 | $198.50 |

| Additional Year 1, 30% Discount | -30% With Code LST30 | |

TrendSpider Coupon Code Discount

Trendspider discount coupon code "LST30" is verified and valid for 2025. It grants a 30% discount on all plans. Use coupon code "LST30" at checkout.

Using this coupon on a TrendSpider monthly subscription could save you over $2,400.- Read this article for a step-by-step guide to claiming your 30% TrendSpider Discount.

Real AI Trading Models

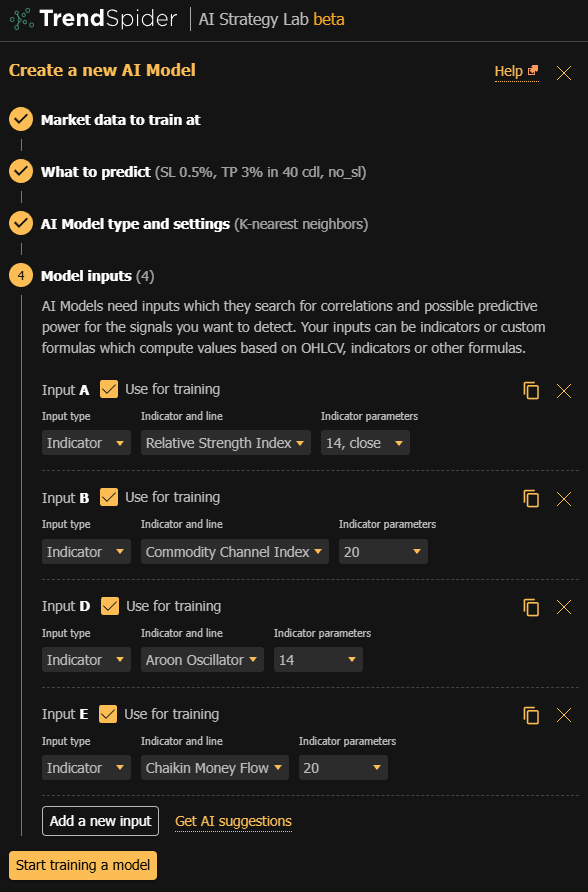

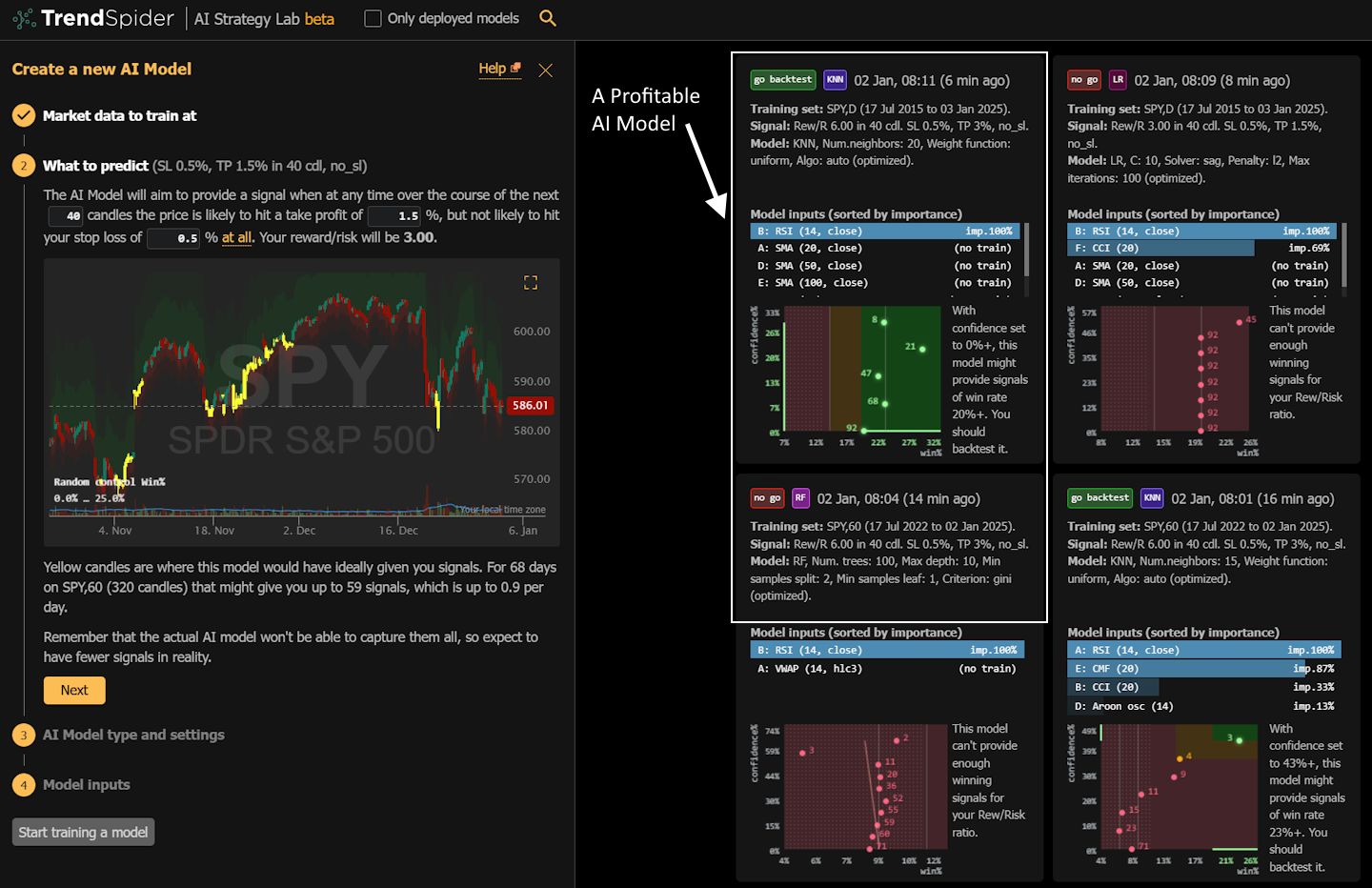

I recently tested TrendSpider’s AI Strategy Lab, and I must say, it has revolutionized how I approach trading. Through its advanced AI capabilities, I was able to analyze multiple indicators and timeframes simultaneously, which gave me a more comprehensive view of the market. This tool saved me countless hours that I would have otherwise spent manually backtesting different strategies across various conditions.

One of the standout features of the AI Strategy Lab is its ability to create custom trading algorithms. I found this particularly useful because it allowed me to tailor strategies to suit my unique trading style. The flexibility and control it provided me over the backtesting process were unmatched, enabling me to refine my strategies with precision.

The tool’s user-friendly interface made it easy for me to experiment with various scenarios and optimize my strategies. The visual representations of data and outcomes were clear and helped me quickly understand a strategy’s potential success before deploying it.

In addition to strategy development, the AI Strategy Lab provided powerful risk management tools. These were crucial in helping me set appropriate stop-loss levels and position sizes, which are vital for protecting my portfolio against significant losses. The peace of mind I gained from having these safeguards in place was invaluable.

Furthermore, I was impressed by the AI Strategy Lab’s backtesting speed and accuracy. It processed historical data rapidly, which meant I could test multiple strategies in a short amount of time. This efficiency allowed me to iterate and improve my trading approaches swiftly, keeping me ahead in a fast-paced market environment.

Overall, TrendSpider’s AI Strategy Lab has been an essential tool in enhancing my trading performance. Its combination of advanced AI technology, user-friendly design, and comprehensive risk management has empowered me to trade with confidence and achieve better results. I genuinely believe this tool is a game-changer for anyone looking to elevate their trading strategies.

Compare to Similar Products

Comparing TrendSpider versus TradingView, MetaStock, and Trade Ideas, our tests show that TrendSpider is the best overall stock analysis software passing 10/12 tests. For automated stock chart analysis, backtesting, and automated bot trading, TrendSpider is our top pick. TradingView is better for a global trading community. Stock Rover is better than TrendSpider for long-term growth, dividend, and value investors. For AI-driven robotic day trading, Trade Ideas is better. For trading real-time news, Benzinga Pro is a better alternative.

| Features | TrendSpider | TradingView | Trade Ideas | MetaStock |

| Rating | 4.8 | 4.8 | 4.6 | 4.4 |

| Awards | ||||

| Pricing | $107/m or $48/m annually | Free | $13/m to $49/m annually | $254/m or $178/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | USA | ✔ | USA | ✔ |

| Powerful Charts | ✔ | ✔ | ✘ | ✔ |

| Stocks | ✔ | ✔ | ✔ | ✔ |

| Futures | ✔ | ✔ | ✘ | ✔ |

| Forex | ✔ | ✔ | ✘ | ✘ |

| Cryptocurrency | ✔ | ✔ | ✘ | ✘ |

| Social Community | ✘ | ✔ | ✔ | ✘ |

| Real-time News | ✘ | ✘ | ✘ | ✔ |

| Screeners | ✘ | ✔ | ✔ | ✔ |

| News Scanning | ✔ | ✘ | ✘ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ |

| Code-Free Backtesting | ✔ | ✘ | ✘ | ✘ |

| Automated Analysis | ✔ | ✔ | ✔ | ✔ |

Trading

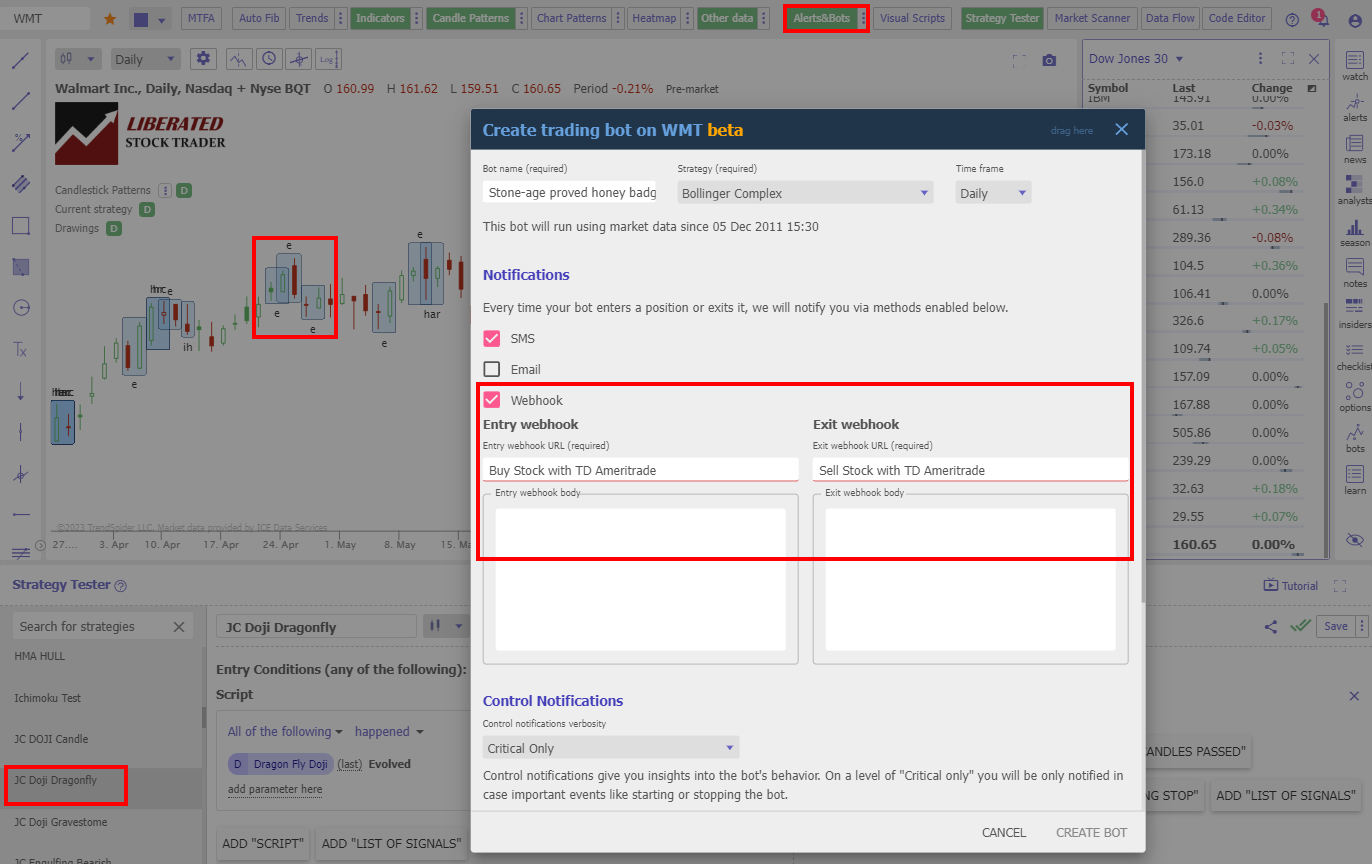

TrendSpider enables automated trade execution via its “Alerts & Bots” system (image below); traders can connect to their broker’s API to buy and sell stocks automatically based on the strategy they create with the strategy tester.

| Trading | Brokers Integrated | Exchanges | Ranking |

| TradingView | 50 | Global | #1 |

| TrendSpider | 5 | USA | #2 |

| Trade Ideas | 2 | USA | #3 |

| MetaStock | 0 | Global | #4 |

Technical Analysis & Charts

TrendSpider’s automated chart trendline detection and plotting do a better job than a human can; using algorithms, the system can detect thousands of trendlines and flag the most important ones with the highest backtested probability of success.

Multi-timeframe analysis means viewing multiple timeframe charts on a single chart with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtly integrated chart heatmap.

| Technical Charting | Rank | Chart Types | Indicators |

| TrendSpider | #1 | 6 | 206 |

| TradingView | #1 | 17 | 160 |

| MetaStock | #2 | 10 | 150 |

| Finviz | #3 | 5 | 22 |

| Trade Ideas | #4 | 6 | 16 |

Table: TrendSpider vs. The Competition – Charting. Read the In-depth Best Technical Analysis Charting Software Review

Packed with innovative technical analysis tools, TrendSpider is for serious market analysts because it helps you find trading opportunities quickly.

Automated Trendline Detection

TrendSpider’s automated trendline detection saves traders a lot of time, speeds up morning trade review preparation, and improves accuracy. Its algorithm correlates all the bars on a chart and draws the trendlines automatically, ready for your review.

As a technical analyst, this is how you should do it; the more times a price touches the trendline and reverses, the stronger the trend. Therefore, it is more predictive if a price breaks through strong support and resistance areas.

If you dislike a trend the AI has used, you can manually delete it or fine-tune it. This capability lets you quickly complete a trendline analysis on any chart.

Using the drop-down selector “S/R Trends” enables a heat map, which shows hundreds of potential trendlines. The darker the red area, the more touches and concentration of trendlines there are. See the chart below for reference.

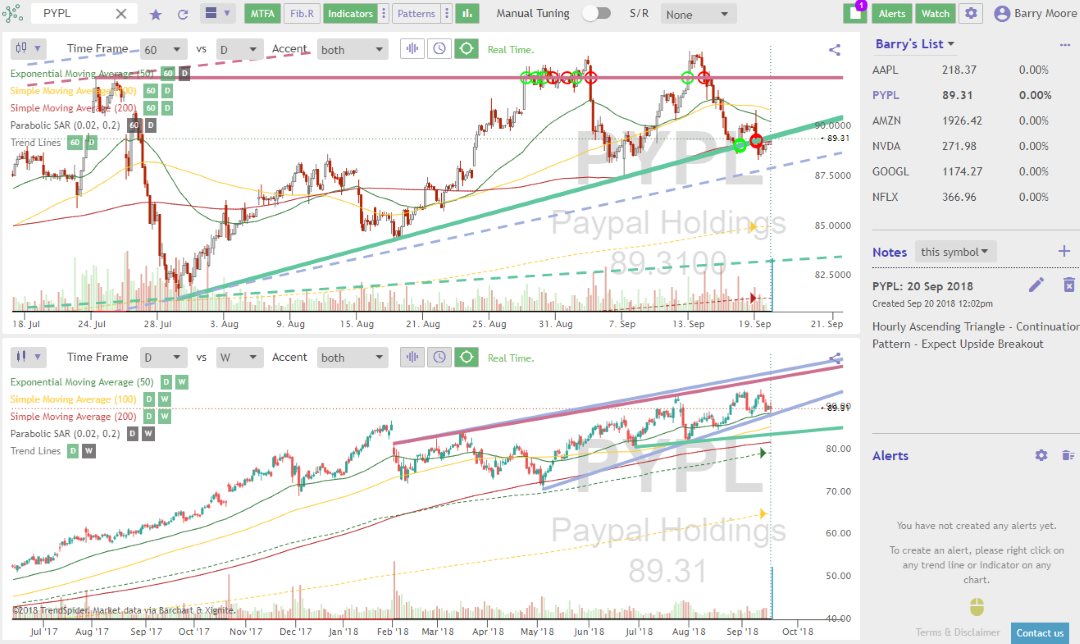

Multi-Timeframe Chart Analysis

It gets even more interesting here: the multi-timeframe analysis can superimpose trendlines or indicators from different timeframes onto a single chart. It may seem a little complex initially, but it makes sense when you get used to it. Instead of continually switching timeframes and redrawing trendlines, it is simply there.

The multi-timeframe analysis is not just for trendlines; it works with all stock chart indicators to ensure you do not miss anything. Dan Ushman, the company founder, uses it in his trading, especially with indicators like Bollinger Bands and trendlines that help expose things other traders miss when focused on one timeframe or indicator at a time.

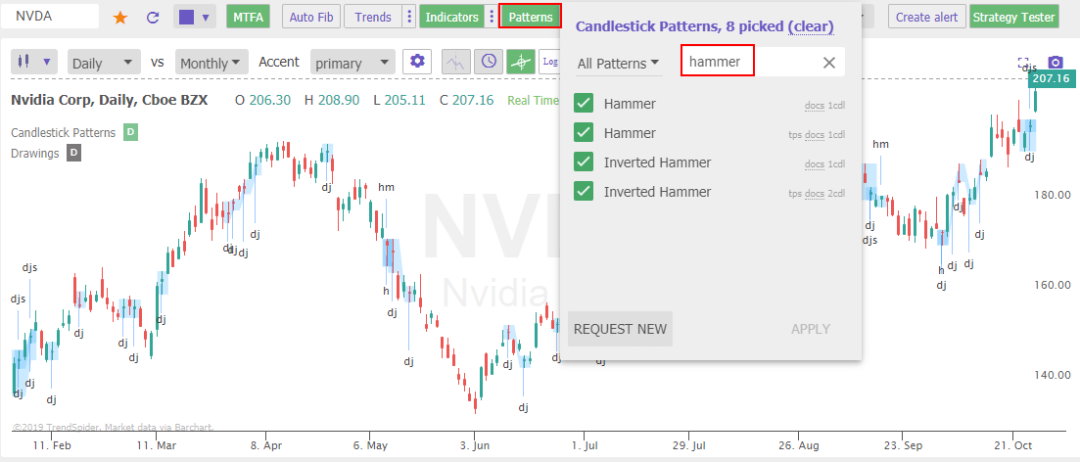

I also like the price indicator analysis; you can let the application plot, name, and highlight your candlestick patterns of choice. Want to find Evening Doji Stars, Hammers, or Engulfing Patterns? Just turn on the pattern recognition; it is that easy.

How Does Automatic Trendline Detection Work in TrendSpider?

Multi-Timeframe Analysis and Auto Trendlines

To show the power of the software, I set up two charts. The top pane shows the 60-minute versus the daily chart, and the bottom pane shows the daily versus the weekly chart for Netflix (Ticker: NFLX). The first thing that grabbed my attention was that you could immediately see that Netflix’s shorter-term trend is an ascending triangle. This is a continuation pattern, so we expect the price to break out of the triangle upwards. Trendspider nailed the trendlines perfectly on this.

While reviewing the lower pane, you can see the trend for the last year, and Netflix is still in a solid uptrend on both the daily and weekly timeframes, four timeframes compared in seconds.

Automatic Candlestick Pattern Recognition

As I mentioned, Trendspider is designed to do the hard work for you; if you want to use candlesticks correctly, you must learn hundreds of candlestick formations and understand if they are bullish or bearish.

Learning this can take years, or you can use TrendSpider to detect over 150 candlestick patterns automatically.

To enable candlestick pattern recognition in TrendSpider is easy. Click patterns, select your pattern, and click apply.

On the chart, you can see the annotated candlestick pattern DJ for Doji. Now, you do not need to spend months learning every pattern or spend hours on a chart trying to locate the patterns; it is all seamlessly done for you.

| Pattern Recognition Software | TrendSpider | TradingView | Finviz |

| Rating | 4.9 | 4.6 | 4.4 |

| # Candle Patterns Recognized | 150 | 40 | 11 |

| # Chart Patterns Recognized | 18 | 10 | 12 |

| Trendline Recognition | ✔ | ✘ | ✔ |

| Backtesting Patterns | ✔ | ✔ | ✔ |

| Read the Review | TrendSpider | TradingView | Finviz |

Table: TrendSpider vs. The Competition – Pattern Recognition. See the In-depth Best Pattern Recognition Software Review

Dynamic Price Alerts

Dynamic price alerts on indicators and trendlines free you from staring at charts waiting for them to set up. They also help you avoid emotional traps like trading out of boredom rather than choosing the exact time to trade. The alarms can be configured on indicator or trendline breakthroughs, bounces, or touches on any timeframe.

Backtesting

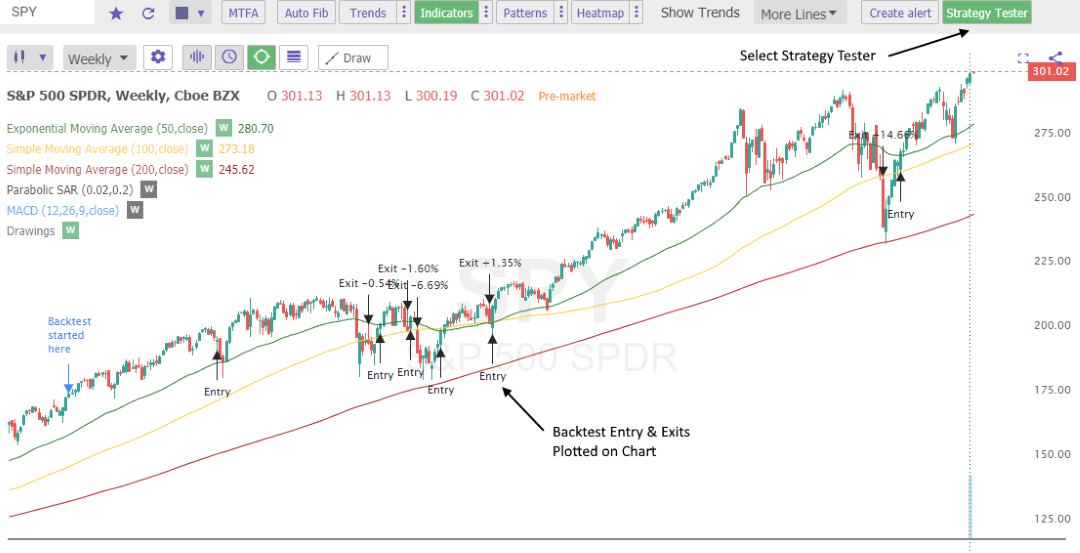

TrendSpider takes a unique approach to backtesting because the platform is built from the ground up to automate technical analysis. Therefore, backtesting Is already built into the heart of the code.

The highest probability trendlines are automatically flagged, and you can adjust the algorithm’s sensitivity to show more or fewer lines.

They have also implemented an AI-powered strategy tester that allows you to type what you want to test freely, and the AI will do the coding for you. This smooth and simple implementation allowed me to develop a strategy in minutes.

Integrated backtesting of automated trendlines, showing win rate, profitability, and drawdown, is a new addition and warmly welcome; the team has propelled TrendSpider into one of the leading technical analysis packages in the industry.

| Backtesting Software | Backtesting | No-Code Backtesting | Auto-Trading | Rating |

|---|---|---|---|---|

| TrendSpider | ✔ | ✔ | ✔ | 4.9 |

| Trade Ideas | ✔ | ✔ | ✔ | 4.7 |

| TradingView | ✔ | ✘ | ✔ | 4.6 |

| Stock Rover | ✔ | ✘ | ✘ | 4.5 |

| MetaStock | ✔ | ✘ | ✘ | 4.4 |

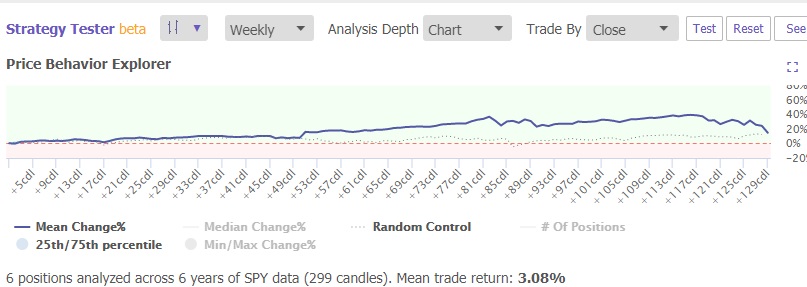

I like the ability to adjust your backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update. You can jump into coding if you want to, but the key here is that you do not have to.

TrendSpider Backtesting Video

Ichimoku Cloud Analysis

The latest TrendSpider innovation is the multi-timeframe Ichimoku Cloud indicator. As a certified technical analyst, I have studied Ichimoku, so I was interested in testing its effectiveness and profitability when backtested.

In the chart below, you can see Ichimoku in action. I have plotted it on a weekly chart, but I am also using the multi-time-frame analysis to overlay the monthly data simultaneously.

This backtest on NVIDIA (Ticker: NVDA) ran in under 1 second for five years of data from January 2014. The timing was good as the system secured a 756% win over the 4.5 years.

I also like how you can instantly see the system’s performance versus a buy-and-hold strategy. In this instance, simply holding the stock over the entire period would have yielded 1,188%. So, in the blink of an eye, you can see that Ichimoku on a weekly chart would not have been the best system for this stock. TrendSpider helped me to identify that Ichimoku Cloud charts are not profitable.

This is the beauty of backtesting: you can test multiple technical indicators on multiple timeframes and see which works best.

Here is how I implemented the TrendSpider Ichimoku backtest.

- Select Strategy Tester

- Entry Condition: Weekly Price Close Greater than Weekly Ichimoku Senkou B

- Exit Condition: Weekly Price Close Less than Weekly Ichimoku Senkou B

With TrendSpider backtesting is a breeze.

Screening

Another innovation from the TrendSpider team is the “Market Scanner.” This enables you to scan a specific stock and the entire market for stocks matching your technical criteria; combining AI trend detection and analysis with the ability to scan the whole stock market is powerful.

TrendSpider wins due to its multilayered point-and-click scanning interface. It is so smart that it can scan for financials, chart patterns, analyst estimates, and even news events. TrendSpider scanning takes it to a new level.

| Stock Screeners | Rating | Best for: | Free Version |

| TrendSpider | 4.8 | Traders | ✘ |

| TradingView | 4.5 | Traders | ✔ |

| Trade Ideas | 4.4 | Day Traders | ✘ |

| Finviz | 4.2 | Investors | ✔ |

| Tickeron | 4.2 | Investors | ✔ |

| MetaStock | 4.1 | Traders | ✘ |

Mobile App

Trendspider’s mobile app is fast and harnesses about 80% of the functionality of a desktop. TrendSpider is the hottest and most powerful new Android app for serious stock analysis.

It includes stock chart pattern recognition, scanning, insider trades, options flow, news, seasonality charts, and dynamic watchlists. No other mobile app has all these high-end features.

Is TrendSpider Easy To Use?

Customers can request free personal training sessions from the TrendSpider team, which are unique in the industry and help you get up to speed quickly.

TrendSpider’s innovations mean you will need a little time to understand what the software tells you. For example, seeing hourly, daily, and weekly trend lines plotted on the same chart might be confusing initially.

However, after applying a little effort, you might find you cannot live without them—still an excellent score on usability.

I have tested the customer support and confirmed it is excellent, and you have a human to chat with during US office hours.

Final Thoughts

TrendSpider leverages AI and machine learning to revolutionize trading, saving time and giving traders a competitive edge. Its innovative platform offers unparalleled capabilities for analysis and strategy testing, setting a new standard in the industry.

Watch The Video Review: TrendSpider Review, AI & Automation Test & Rating Video

TrendSpider Review 2025: Is AI-Powered Trading Worth It?

My testing awards Trendspider 4.8/5 stars due to its innovation. Its powerful algorithms recognize trendlines, chart patterns, and candlesticks automatically. It also has automated trading bots, real AI LLMs, and powerful point-and-click back- testing.

Price: 48

Price Currency: USD

Operating System: Windows, Web Browser, OSX

Application Category: Investing

4.8

Pros

- Automated Candlestick, Chart Pattern & Trendline Recognition The Best Point-and-Click Backtesting & Strategy Development Auto-trading Bots 150+ Different Candlestick Patterns Recognized 220+ Charts & Indicators Multi-Timeframe Analysis Real-time Exchange Data Included in Price Stocks, ETFs, Forex, Crypto, Indices & Futures Seasonality Charts News & Analyst Ratings Change Scanning 1-on-1 Training Included

Cons

- No Social Network

TrendSpider kind of sucked IMO. I hated the scanners. Tradingview, Marketsmith, and Stockcharts all better in my opinion.

Hi. I tried signing up for the annual membership through your affiliate link today, and used the coupon code “Lib40”. It works now. It applied the discount after placing the order. I guess they must have fixed the glitch with the code. Just an FYI, the discount is not reflected on the initial order page. It is reflected on the confirmation page after placing the order. Thanks!

Hi Karim, great I am happy it is working for you now :) FYI the code is LIB40 in all caps.

Barry

I tried using this link and discount code to sign up for Trendspider and it didn’t work. When I contacted Trendspider about this, they replied “I don’t see this code in our system.”. Please fix this. Thank you.

I have contacted trendspider to resolve the issue. I will let you know as soon as they reply.

thanks for letting me know.

Barry

I have verified with TrendSpider that the 40% discount code is fully working and valid. In fact it is used by our readers multiple times every single day.

Try again.

Thanks

Barry

interested in grain & livestock futures only, what is cost for system information and all data.

Hi Larry. TradingView covers commodites

Barry