Trading news events is an essential skill for day traders. News events such as economic data releases, political developments, and company announcements can have a significant impact on stock price volatility, creating trading opportunities.

Timing is critical in news trading. You must know when specific news will be released so that you can position yourself accordingly. For example, if you are trading stocks, it may be wise to avoid holding positions during major economic data releases like the monthly jobs report or the Federal Reserve’s interest rate decision.

From my experience in trading real-time news events, you should seek to gather and interpret the financial newsfeed as quickly as possible to initiate short-term trades to take advantage of profitable situations.

Depending on the news, traders are typically ready to go long or short on stock.

What is news trading?

News trading is the act of making a trade based on news events. This can be anything from economic data releases to political news. The key with news trading is identifying which news events will likely have the biggest impact on the markets and then making trade accordingly.

1. Understand free news is delayed

You cannot trade the news without a reliable and lightning-fast newsfeed. The typical delay between the announcement of breaking news and that news reaching the free news feeds like Yahoo, CNN, CNBC, and even Bloomberg TV is typically 30 minutes. In quickfire trading, 30 minutes is essentially 29 minutes too long.

2. Know that real-time news costs money

If you are trading news by investing in stocks as soon as the news is released, thereby gaining a short-term swing in the stock price, you need to pay for a real-time news subscription. Your online broker may also provide real-time news included with your service; see our review of the top 10 real-time news and analysis sources.

Trading the news can be profitable, but there is a cost to that profit: a premium subscription to a real-time financial news feed. Four key news services produce, report, and broadcast real-time news.

There is one free real-time news source. Benzinga Pro offers a free real-time newsfeed.

Benzinga vs. Bloomberg, Reuters & MetaStock

| News Service | Benzinga Pro | MetaStock R/T | Reuters Eikon | Bloomberg Terminal |

| Real-time News | ✔ | ✔ | ✔ | ✔ |

| Price /month | $0-$117* | $250* | $1,833** | $2,000** |

| Price /year* | $1,440 | $3,000 | $22,000 | $24,000 |

| Powerful Chart Analysis | ✘ | ✔ | ✔ | ✔ |

| Dedicated Hardware | No | No | No | Yes |

| Visit News Service | Benzinga | MetaStock | Refinitiv | Bloomberg |

Table 1: Benzinga vs. Bloomberg vs. Reuters Price Comparison *North America Data **Global Data

As you can see, in terms of pricing for real-time news, Benzinga Pro premium is half the price of its nearest competitor, MetaStock R/T. However, MetaStock does come with very powerful stock chart analysis, backtesting, and forecasting.

So, you can see that Benzinga costs 1/10th of the cost of a Bloomberg Terminal or Thomson Reuters Eikon service for North American traders.

3. Get a low-cost real-time newsfeed

Benzinga Pro is a real-time news service designed for day traders. It costs a fraction of the cost of a Bloomberg Terminal.

Benzinga delivers value with real-time market-moving news to give you a trading edge. Significant advantages include a squawk box, direct access to the news desk, and original reporting.

Benzinga is a credible news source established in 2010 by Jason Raznik. Benzinga is a major newswire that employs many reporters and operates a live newsdesk.

Benzinga provides data to brokerages such as TradeStation, MarketWatch, Bloomberg, Thomson Reuters, and many more.

4. Buy the rumor, sell the news

On Wall Street, there is a saying that you “buy the rumor, sell the news.” It would be great if you mingle in the rumor circles, which might pay off, such as being friends with insiders, employees, and good buddies with the CEO. However, we mere mortals might not have these advantages. I have also heard too many rumors that have backfired, tips from a friend in the industry, and the nod from the supplier to a new startup company with a bright future.

Besides being illegal, insider trading, especially when second-hand, is completely unreliable.

5. Economists are often wrong

But to some extent, we all play the news. One way or another, it gets us. Turn on any news channel, and the reporters constantly overstate the meaning of things. We should not believe everything we read. One of my favorite headlines was from USA Today.

“Gas price decline may spur inflation.”

Honestly, can you believe that?

Of course, economists can rationalize anything, but I am not buying it. It can be useful to take the news with a pinch of salt and make our minds up about its real meaning. But too much news can drag you in with the sheep on the road to the slaughterhouse.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

6. Learn how to analyze trading news

Some trade the news with some success. The problem with trading the news is it is not hard and cold facts; it is feelings, interpretation, and an abstract appreciation of how the public interprets news events. There are three key variables to the news impact equation.

7. The news trading formula

For a financial news trader, the three factors influencing stock prices are the speed at which the news is delivered, its impact on the company, and the market’s perception of the news.

Speed of News + Impact on Company + Perception of Traders = Price Fluctuation

Speed of News

When breaking news hits the market, it can take time, usually the first 30 minutes, for the stock price to start to move; this is why free news services are typically delayed; this enables companies to sell real-time news feeds at a premium to professional traders. If you get the news quickly, you can react before others; this is a distinct market edge.

Impact on Company

You need to decide if the news’s impact on the company is high or negligible. The news might sound shocking, but will it impact a company’s profits or future outlook? Let’s take a look at an example.

The Tide Pods Challenge

At the start of 2018, there was an idiotic internet meme and YouTube phenomenon where teenagers challenged each other to eat Tide pods. Tide Pods, manufactured by Proctor & Gamble (Ticker: PG), are great for washing clothes but are deadly when consumed by humans. This madness resulted in 6 people’s deaths.

How would you interpret this news?

In the three months leading up to April 2018, P&G stocks dropped 15% and took nine months to recover. But in the same period, the S&P500 dropped 9% and took eight months to recover. So, overall, while this potentially bad news had some impact, it did not impact P&G.

This is because the bad news did not dent P&G’s bottom-line profit. The Tide brand only makes up a small proportion of the overall P&G product portfolio.

Perception of traders

Market news is not your perception, but how others perceive the news.

Trading the news can be very difficult; there is a strong emphasis on Fundamentals and Technical Analysis.

The news is completely open to interpretation; you must try to understand how others will interpret it, not how you interpret it. Viewing news with a contrarian attitude or making your own decisions on what that news means is critical.

But when trading the news, it is most important that you understand the following:

What effect will the news have on the market participants because those investors will push the price up or down?

Benzinga Pro, our review-winning news service, provides helpful bullish, bearish, and sentiment ratings to help you assess what impact that news might have on a stock; it is well worth looking into.

8. The market prices in the future

Most people forget that the market always tries to price in the future; it does not try to price in the now. Let’s take, for example, the Coronavirus pandemic.

Even though the virus outbreak is crippling world economies, causing mass unemployment and widening the distribution of wealth and inequality, the stock market recovered quickly.

The news can have a big impact on the stock market. Political news, for example, can cause uncertainty and make investors sell stocks. Other news, like positive economic reports, can cause investors to buy stocks.

When analyzing the news, it’s important to consider how it will affect different companies and sectors. For example, a trade war could hurt export-oriented companies, while increasing tariffs on imported goods could benefit domestic producers.

Looking at the news this way can help you make better investment decisions. Based on your analysis, you can buy or sell stocks by understanding how news events affect different companies and sectors. This can help you make money in the stock market.

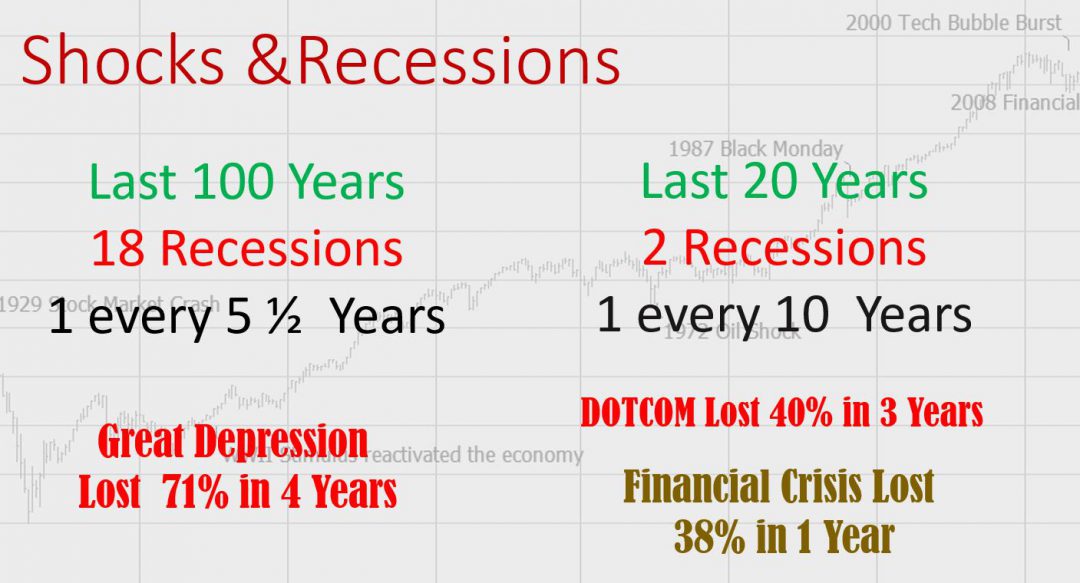

9. Macroeconomic news affects the entire market

As you have seen in the example above, macroeconomic news can affect the broader economy, stock markets, and all the companies on those stock markets. The history of stock market crashes started with news of seismic proportions.

10. Earnings surprises are not always surprises

So you are waiting to trade an earnings release for a high-growth company with a PE Ratio of over 100.

This means the company has a very high valuation compared to its current earnings. In this example, positive earning surprises are expected from this company. So do not expect a huge and immediate surge in stock price when there is an earnings beat or upside surprise.

Don’t forget that the market will price in the future.

But if a high-growth company has a significant miss, this is where the real profits come in, shorting the stock. To short the stock on time, you need a real-time news feed.

11. Buy the rumor, sell the news.

“Buy the rumor and sell the news” is a common trading strategy many professional traders use. This strategy aims to buy into a rumor before it is officially announced and then sell once the news is made public. If executed correctly, this can be a lucrative strategy, as you can profit from the price difference between buying and selling.

However, it is important to note that this strategy carries a higher risk than others, as there is always the potential for the news to be less favorable than expected.

If you consider using this strategy, there are a few things you need to keep in mind. First, it is important to pay attention to rumors and try to understand which ones are likely to pan out. There are many sources of rumors, so it is important to research and find the most reliable ones.

Second, you need an exit plan before entering a trade. This means knowing what price you will sell if the news is good and having a stop-loss if the news is not as favorable as expected.

Finally, it is important to remember that this strategy carries a higher risk than others, so you should only use it with money you are comfortable losing.

If you follow these guidelines, news trading can be a profitable strategy. Remember to pay attention to rumors, have an exit plan, and don’t risk more than you are comfortable with.

12. Know the news you trade defines your profits

They are deciding what area of the news you want to trade is important. Many professional traders profit from Mergers and Acquisitions News, New Contracts, and Food & Drug Administration (FDA) approvals.

How? Because these news topics tend to be incredibly important to the companies affected, the importance of the news and the impact dictate the price swing. This is where a premium newsfeed needs to excel.

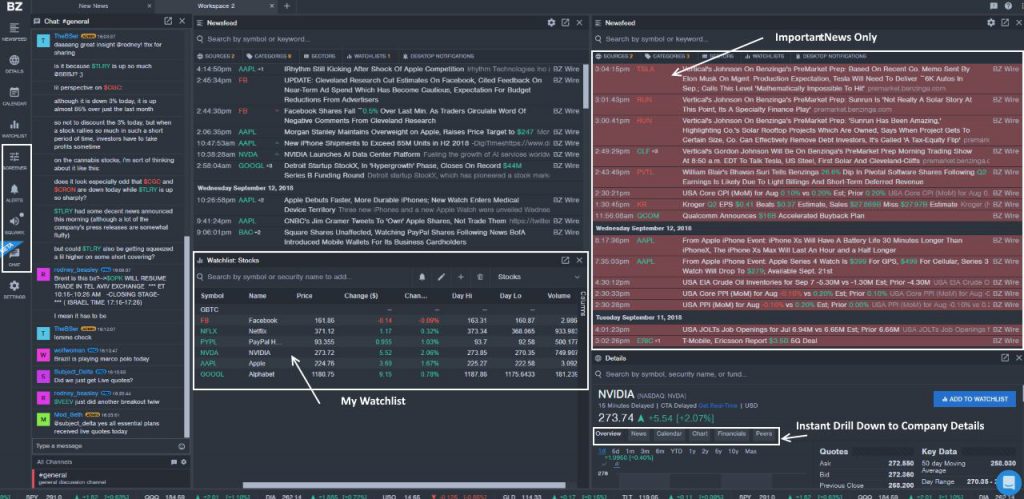

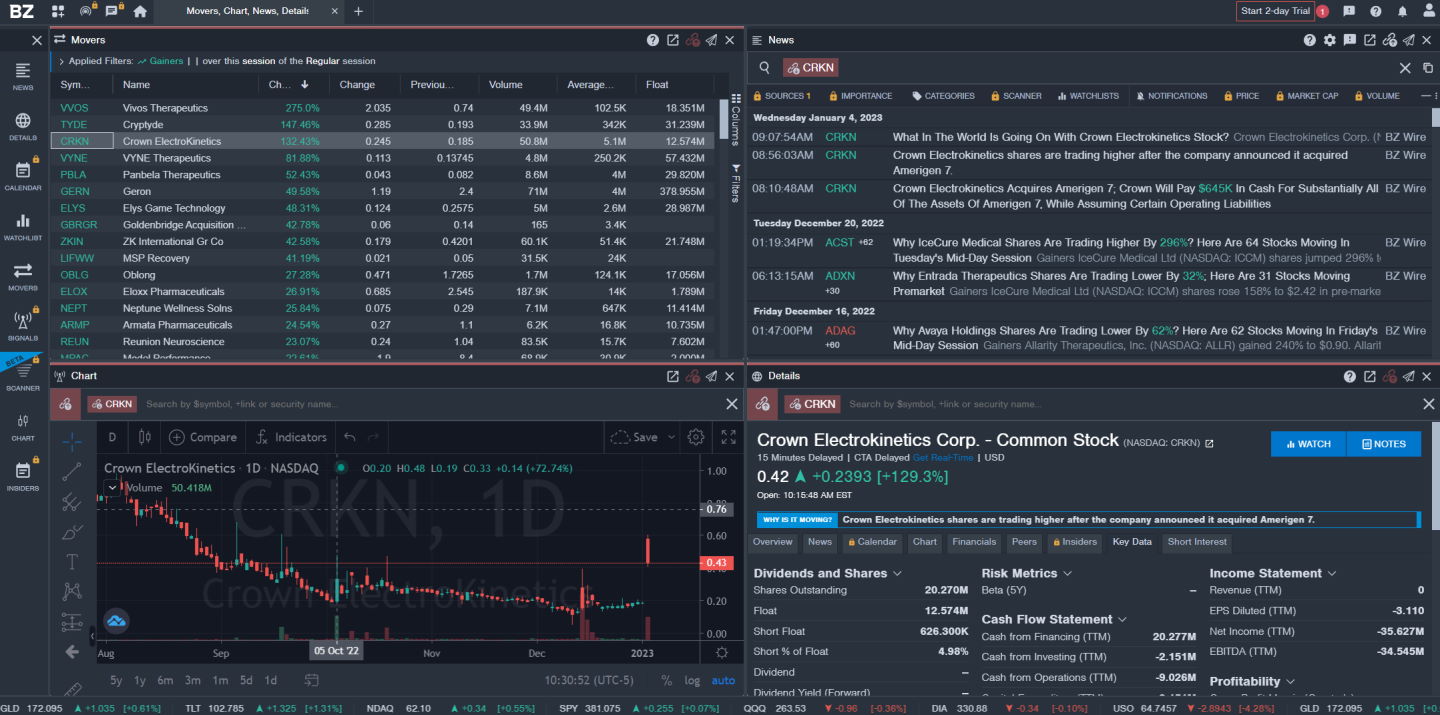

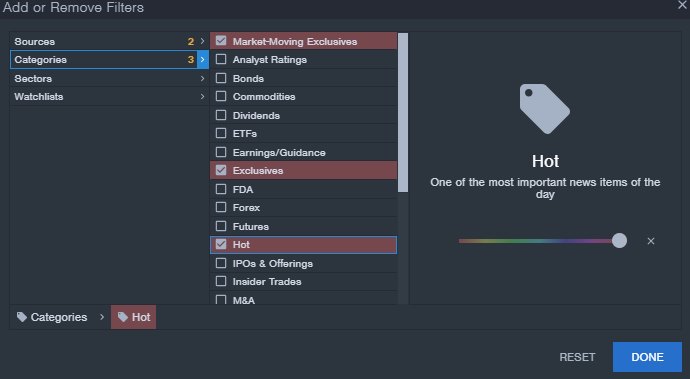

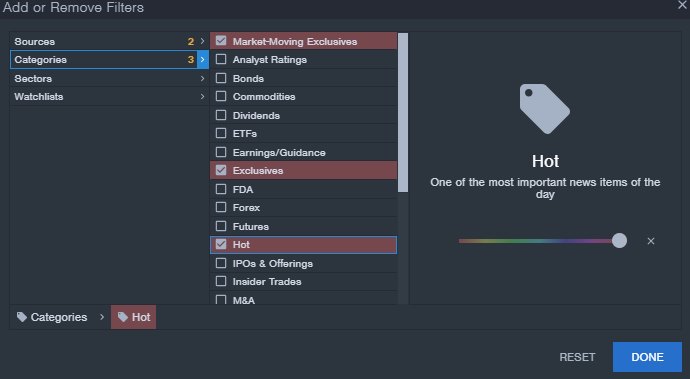

Benzinga Pro Newswire Enables Granular News Trading

Benzinga Pro allows you to configure your newsfeed based on your trading preferences.

|

|

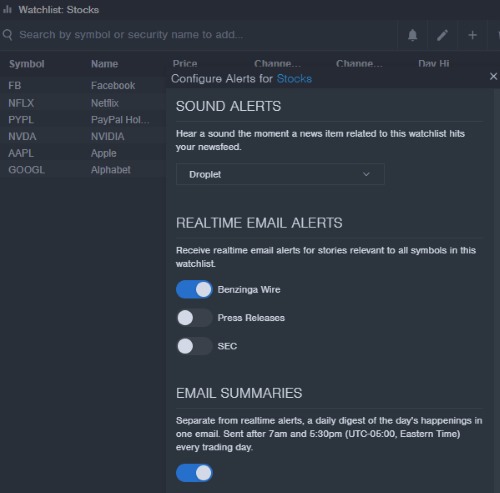

Benzinga Pro Newsfeed Alerts

You can also choose to be alerted to specific categories in your newsfeed. For example, you can select to be alerted via email or a desktop pop-up and sound if any hot news or market-moving news is announced.

Any of the categories above can be flagged for alerts. This hugely benefits the trader, so you do not need to watch the newsfeed constantly; you can be trading and hear the alarm as a call to action.

WatchList Trade Alerts

Another bonus is that you can set up as many watchlists as you wish and receive alerts on stocks in the watchlist that matter to you.

You can get real-time email alerts, sound notifications, and even summary emails for your watchlist.

Benzinga Options Alert

Benzinga offers stock options alerts when they see anomalies or opportunities for options traders. This specific upgrade for all service tiers is not included in the basic price.

13. Trading insider news

If you’re interested in following the news on insider trading, you should know a few things. First, it’s important to be able to analyze the news and not just take it at face value.

There are many news sources out there, and not all of them are equally reliable. It’s important to critically evaluate information before making decisions based on it.

Second, it’s also important to keep up with the latest news. Insider trading is always changing; new information can come to light anytime. By staying up-to-date, you’ll be better positioned to make informed decisions.

14. Financial news trading strategy

A good strategy for trading financial news is to be aware of the release schedule for economic data and monitor the markets in the lead-up to these releases. By doing this, you can anticipate how the market will likely react to the release of certain data and position yourself accordingly.

In addition, it is important to pay attention to the overall market trend. If you see that the market is generally trending upwards, then positive news is more likely to have a strong impact and push prices higher. Conversely, negative news is more likely to cause prices to fall if the market trends downward.

Finally, it is also important to remember that not all news events are created equal. Some data releases are more important than others and will have a greater impact on prices. As such, it is important to pay attention to the market reaction to news events and use this information to help you make better trading decisions.

15. Tune Your skills in interpreting the news

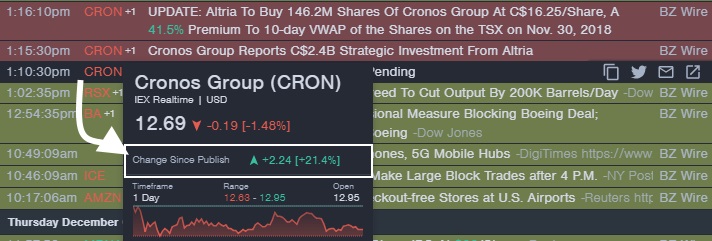

Interpreting the news is a skill in its own right, and Benzinga Pro helps you do that by categorizing the perceived impact of the news and enabling you to see how much the stock price has moved since the news went public. This is one of the single best features of any real-time news provider.

Introducing Benzinga’s Price Changed Since Published feature.

Price Change Since Published

Benzinga prides itself on releasing news in time so you can react to a market move and profit. To prove this point, they have added a great new feature called Change Since Published. It is a simple upgrade to the existing newsfeed, demonstrating their continual innovation.

If you hover your mouse over any stock ticker in the newsfeed, a mini-chart will appear, enabling you to see if the news positively impacted the stock price. This a very nice feature that I am sure will be further developed.

In the example above, you can see an announcement that Cronos Group will receive a strategic investment from Altria; the stock moved 21% over the next two trading days.

Here is another example of how real-time news can impact the market. On December 11th, President Trump announced that the Farm Bill was in “good shape.” Benzinga has categorized all potential companies that would benefit from a positive farm bill and grouped them into a “Change Since Published” report. Inside the chart, you will see a vertical line or a Change Since Publish label; this vertical line is the exact time the news broke on the Benzinga newswire.

As you can see, of the six stocks targeted by Benzinga analysts, four have gained since the news was released. That is an edge in the market.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

FAQ

What is trading the news?

Trading the news is a strategy in which traders base their decisions on the impact of news events on the financial markets. It involves analyzing news releases, economic reports, and other significant events to identify potential trading opportunities.

How does trading the news work?

When trading the news, traders monitor the release of important news events and analyze their potential impact on the market. They look for opportunities to enter or exit trades based on the market's reaction to the news. This strategy requires staying informed about current events and understanding how they can influence market sentiment.

What types of news can be traded?

Various types of news can be traded, including economic indicators (such as GDP, employment data, and inflation reports), corporate earnings announcements, central bank decisions, geopolitical events, and major policy changes. Traders focus on news that has the potential to significantly affect the market and create volatility.

What are the advantages of trading the news?

Trading the news can offer several advantages. Firstly, it allows traders to capitalize on short-term market fluctuations caused by news events. Secondly, news trading provides opportunities for long and short trades, depending on the market reaction. Lastly, by staying informed about news events, traders can gain a competitive edge and make more informed trading decisions.

What are the risks associated with trading the news?

Trading the news carries certain risks. Market reactions to news can be unpredictable, leading to unexpected price movements. Traders must be prepared for increased volatility and potential slippage during news releases. Moreover, misinformation or misinterpretation of news can also lead to erroneous trading decisions.

How can I stay updated with news relevant to trading?

You can utilize various sources to stay updated with news relevant to trading. These include financial news websites, news aggregators, real-time news feeds, economic calendars, and social media platforms. Following reliable financial news sources and ensuring the information is accurate and up-to-date is essential.

What strategies can I use for trading the news?

Several strategies for trading the news include breakout trading, fading the news, and trading based on market sentiment. Each strategy has its own set of rules and risk management techniques. It is crucial to thoroughly understand and practice the chosen strategy in a demo account before applying it with real money.

Nice post

I gained lot of information about trading through reading this article. Keep posting such articles in future.

Nowadays an average investor get news a minute later than those who pay to bloomberg and reuters. Of course, it is pretty difficult to trade news when somebody is ahead of you, but I think trading technically enables one to go with those big dogs that drive financial markets.

Thanks for the article. Some good stuff here.

Hi Vytas, exactly right, reading the technicals and fundamentals is the key. thanks for the comment

This is a really good article. I enjoyed reading it. I gained a lot of information reading your post. I really loved it.