Our 102 original, unique, fun facts about the stock market and investing include jaw-dropping, deeply researched stock market statistics. This is not a copy and paste; these are original statistics.

3 Incredible Stock Market Facts

- Microsoft is worth more than Brazil’s stock market.

- Microsoft, Apple, and Google are worth more than the Chinese stock market.

- Apple is worth more than India’s entire GDP.

This research will give you an eye-opening perspective on the stock market, its size, and who invests in it, and highlights the sheer strength of the US stock exchanges and technology companies.

If you reuse this original research, please link to this page.

6 Stock Market Stats – Editors’ Choice

- The US stock market is 46% of the entire world’s stock market capitalization in 2022.

- The US Stock Market is worth $117 trillion, more than the next seven stock exchanges combined.

- Microsoft is worth more than the Brazilian stock market.

- Over the last ten years, 82% of fund managers failed to beat the stock market.

- The 12 largest companies in the USA are worth more than the entire Chinese stock market in 2023.

- In 2023, Apple is worth more than the entire GDP of Canada or India.

Financial Market Statistics

The total world stock market capitalization is $116.78 trillion.

The total value of the world’s stock markets at the start of 2022 is $116.78 trillion. The world’s stock markets have grown 464% in 11 years, up from $25 trillion in 2009.

Source: Statista & LiberatedStockTrader

The US stock market is 46% of the entire global stock market value.

The US NYSE & NASDAQ stock exchanges combined are 54% of the entire global stock market value, with a market capitalization of $41 Trillion.

Source: Visual Capitalist & LiberatedStockTrader

The US Stock Market is worth more than the next seven stock exchanges combined.

The USA is the most valuable and powerful place to trade stocks. The NYSE and NASDAQ are worth more than the next seven stock exchanges combined: Japan, China, Euronext, London, Hong Kong, Saudi Arabia, and Canada.

Source: Visual Capitalist & LiberatedStockTrader

The NYSE & NASDAQ dominate the world’s stock markets.

The two goliaths in the global stock markets are the New York Stock Exchange and the NASDAQ; they host the majority of the world’s largest companies and technology giants, such as Microsoft, Apple, Google, Tesla, and Facebook.

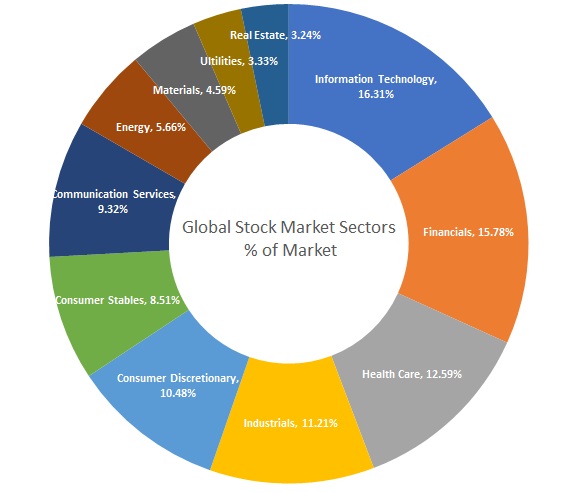

Information Technology, Financials, Communication, and Healthcare make up over 52% of the world’s companies by value.

Information Technology companies dominate all other industries at 16.31% 1 Real Estate accounts for a surprisingly low 3.24% of the global stock market (as weighted by MSCI)

| Stock Market Sector Statistics | % of the market |

| Information Technology | 16.31% |

| Financials | 15.78% |

| Health Care | 12.59% |

| Industrials | 11.21% |

| Consumer Discretionary | 10.48% |

| Consumer Stables | 8.51% |

| Communication Services | 9.32% |

| Energy | 5.66% |

| Materials | 4.59% |

| Utilities | 3.33% |

| Real Estate | 3.24% |

The fastest-growing stock sectors are Energy, Healthcare, and Technology in 2023

2024 is shaping up to be the year of Energy and Healthcare. The Energy sector is usually lagging, but there is now a huge push into clean energy stocks; Solar and Electric Power are fueling the rise, while oil companies are dropping.

Source: LiberatedStockTrader & TradingView Data

Investing Statistics

The Nasdaq 100 has returned 907% over 20 years to 2022. The India Sensex exchange grew by 1792%, while the UK FTSE only increased by 46%.

A NASDAQ 100 Index Tracking ETF would have made you 907% in 20 years.

Many say the stock market is too risky, and individual stock ownership is even riskier. Owning an index fund on a major world index, especially in the USA, is proven to yield a good profit over the long term.

- In the last 20 years, from 2002 to 2022, the best-performing major stock market index has been the NASDAQ 100, with a meteoric return of 907%.

- The next best are the Nasdaq Composite, with 665%, the S&P500, with 307%, and the German DAX, with 216%.

- The UK FTSE has grown by a meager 46.48% over the last twenty years, while the Nikkei 225 has returned 172%.

- The best-performing index in the world for 20 years to 2022 is the Indian Sensex, with a 1792% increase.

Source: LiberatedStockTrader & TradingView Data

You have a 1 in 3 chance of selecting a stock that beats the market, and the US stock market goes up 55% of trading days.

You have a 32% chance of selecting a stock that will beat the S&P500

According to my research, out of 4,000 major US stocks, only 1,299 companies beat the S&P 500 index from January 2021 to January 2022. The average increase of these stocks was 38.4%. This means you have a 32% chance of selecting a stock that will beat the market.

Source: LiberatedStockTrader, StockRover, TradingView Data

The S&P 500 goes up 55% and down 45% of the time.

My research shows that the S&P 500 increased 55% of the time over the last ten years by, on average, 0.2% per day, and the longest uninterrupted uptrend was eight days.

Source: LiberatedStockTrader Pro

The best month to buy stocks is April.

The best month to buy stocks is April, as the S&P500 has increased an average of 2.4% in 15 of the last 20 years. October and November are also good months to buy stocks, increasing by 1.17% and 1.08%, respectively, increasing 75% of the time.

Source: The Best Month to Buy Stocks – 40 Years of Analysis

The worst time to buy stocks is September.

Our data research shows that from 2000 to 2020, the worst month for stocks was September, with an average loss of -0.83%.

Source: The Best & Worst Times to Buy Stocks

The US Stock Markets Have Always Made a Profit Over a 10 Year Period

You should invest in the stock market for a minimum of 10 years, as the US markets have always made a profit over a ten-year period since 1955.

Source: LiberatedStockTrader Pro

Investment Facts

Robotic algorithms comprise 90% of all stock trades, and 10% of Americans own 84% of the US stock market.

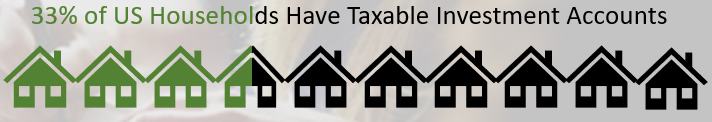

33% of US households have taxable investment accounts

A taxable account is any active mutual fund or passive index-tracking fund that resides outside an IRA/401K retirement fund, including self-directed investors or traders.

Percent of US Households Investing

In 1998, 60% of US Adults were invested in the stock market through mutual funds, retirement plans, or directly. In 2007, the number of invested adults reached 65%.5 The 2000 Dotcom crash & 2008 financial crisis have damaged American adults’ trust in the markets, and the percentage of adults invested trended downwards to a multi-decade low of 52% in 2016.

Approximately 33% of US households have taxable investment accounts in 2022.

Robots make 90% of stock trades

The largest uptrend over the last 20 years is the growth of algorithmic trading. It is estimated that 90% of trade volume in the stock market today is robotic quantitative and computer algorithms.

Source: CNBC

Stock Investor Statistics

More men than women are active stock investors, and Millennials are the least invested of all generations.

10% of Americans own 84% of the stock market

It may sound shocking, but it is in line with the Pareto Principle that the wealthiest 10% of Americans own 84% of the stock market.

Source: National Bureau of Economic Research

21% of women and 24% of men actively invest in the USA.

In the US, 21% of women & 24% of men have taxable investment accounts. 46% of married couples without dependents have taxable investment accounts, and 36% of couples with dependents. 27% of single males with or without dependents have investment accounts.

Source: FINRA

More single females invest in stocks than single females with dependents.

23% of single females without dependents have investment accounts compared to 15% of single females with dependents.

Source: FINRA

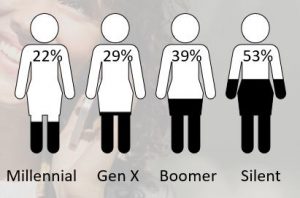

Only 22% of millennials actively invest, compared to 39% of Boomers.

Only 22% of millennials have taxable investment accounts, compared to 29% of Gen Xers, 39% of Boomers, and 53% of the Silent Generation.

The most significant factors for people actively investing are an income higher than $50K, a college degree, high levels of financial literacy, and higher risk tolerance.

Source: FINRA

Investing knows no color.

Race factors play a minor role in whether a person decides to invest actively, with only a 4% difference.

Source: FINRA

Stock Statistics

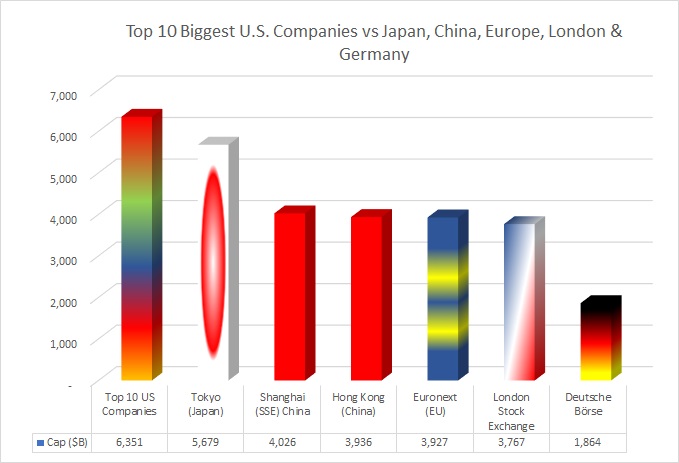

US Technology firms are powerful. Apple, Microsoft, Alphabet, and Meta combined are worth more than any other stock exchange outside the USA.

Apple is the most valuable company globally, worth $2.8 trillion.

US companies still dominate the world’s stock markets. In 2022, Apple Inc. regained the title of the world’s largest company with a total capitalization of $2.8 trillion.

Source: LiberatedStockTrader & TradingView Data

Microsoft is worth more than the entire Brazilian stock market.

In 2022, Microsoft Corp lost its position as the world’s largest company to Apple Inc. but is still valued at $2.32 trillion. Microsoft is now worth more than the entire Brazilian Stock Market, worth $938 Billion, or the Taiwan Stock Exchange, valued at $866 Billion.

Source: LiberatedStockTrader & TradingView Data

Microsoft, Apple & Google combined are worth more than the entire Chinese stock market.

As unbelievable as it may seem, Microsoft is valued at $2.2 trillion, Apple at $2.8 trillion, and Alphabet Inc. (Google) at $1.8 trillion; their combined value is $6.8 trillion. In January 2022, the value of the Hang Seng and Shenzhen stock exchanges was $6.7 trillion.

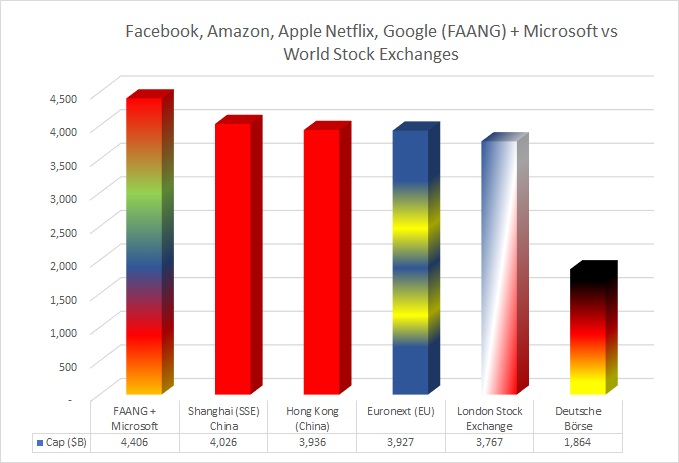

Facebook, Amazon, Apple, Google & Meta are worth more combined than any other stock market outside the USA.

The Power of the FAANGs: The combined value of Microsoft Corp., Amazon.com Inc., Apple Inc., Alphabet Inc., Netflix, and Meta Inc. is worth more than any other stock exchange.

| 6 USA Tech Stocks vs. China & European Stock Markets | Cap ($B) |

| 6 Largest Companies in the USA Combined | 8,722 |

| Shanghai (SSE) China Exchange | 3,900 |

| Hong Kong (China) Exchange | 6,070 |

| Euronext (EU) Exchange | 5,500 |

| London Stock Exchange | 3,880 |

Source: LiberatedStockTrader 2022 & Statista

The six most valuable companies in the USA are US technology stocks.

The six largest companies in America are American-owned technology companies, Apple, Microsoft, Amazon, Google, Tesla, and Facebook, worth a combined $9.64 trillion.

The six giant US technology stocks combined are worth more than the GDP of Germany or the UK.

The incredible strength of US technology stocks Apple, Microsoft, Amazon, Google, Tesla, and Meta means they have a larger market capitalization ($9.64 trillion) than the GDP of Germany, $3.7 trillion, or the UK, $2.638 trillion.

Source: LiberatedStockTrader

Apple is worth more than the entire GDP of Canada or India.

My American friends will love this fact. Apple was valued at a market capitalization of $2.8 trillion in January 2022; the GDP of Canada for 2020 is $1.64 trillion. Apple is bigger than India’s GDP, which is $2.6 trillion.

Source: LiberatedStockTrader & World Bank

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Stock Market Statistics Video

Wall Street Facts

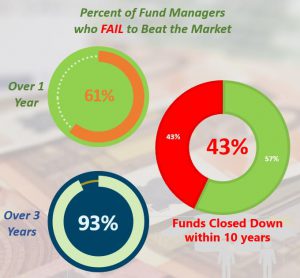

Over the last ten years, 82.23% of active fund managers have failed to beat the market index, and in any single year, 60% failed to outperform the S&P 500.

60% of highly paid fund managers fail to beat the S&P500 benchmark.

Here, we examine the performance of actively managed funds (Mutual Funds). Fund managers are excellent at making profits for themselves but not so good at making profits for their clients.

Over the last ten years, 82% of fund managers failed to beat the market.

Source: SPIVA S&P

Over any 15 years, 82.23% of fund managers fail to beat the market index.

21% of managed stock market funds are closed after five years due to poor performance.

21.22% of actively managed funds are closed down after five years, and 42.87% are closed down within ten years.

Source: SPIVA S&P

The vast majority of mutual funds do not beat the underlying index.

As most mutual funds do not beat the underlying index and incur much higher costs than passive index-tracking funds, we can assume that at least 2% less compounding of your wealth will occur.

Over 50 years, your share of the market’s cumulative return will reduce from 100% to a horrific 39% when using costly mutual funds.

Low-cost index fund expenses typically eat up 4% of your dividend yield.

Actively managed growth funds consume 100% of your dividend yield, with value funds taking 58%.

Source: The Little Book of Common Sense Investing – John C. Bogle

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Stock Market Crash Statistics

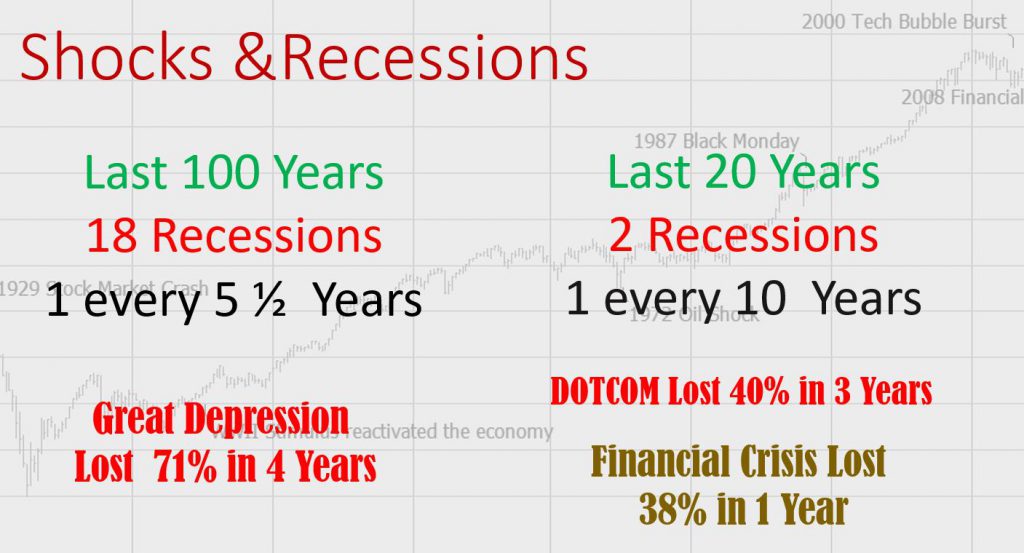

In the last 100 years, we have had a recession every five years, and the 2008 financial crisis caused a 38% loss in one year.

For over 100 years, we have had an economic recession every five years

The fear of the boom and bust is always there for anyone with money in the market. However, overall, for the long-term investor, recessions and crashes can be lived through by staying invested. Let’s take a look at history.

In the past 100 years, we have had 18 economic recessions, averaging one every 5.5 years, which aligns roughly with the business cycle of 4 years.

In the last 24 years (1998 to 2022), we have had three stock market crashes, in 2000, 2008, and 2020, averaging one every eight years.

Source: LiberatedStockTrader Stock Market Crashes

The 2000 Dotcom Crash wiped out 40% of the stock market’s value.

The 2000 Dotcom Recession wiped out 40% of the value of the S&P500 in three years, while the Financial Crisis of 2008-2009 wiped out 38% of market value in a single year.

Source: LiberatedStockTrader Stock Market Crashes

The 1929 Great Depression wiped out 71% of the stock market’s value.

Comparatively, the Great Depression wiped out 71% over four years, and the 1974 Shock took out 32% in two years.

Stock Market Yearly Returns – The Best and the Worst

It was the best of times; it was the worst of times. Investing in a low-cost stock market index tracking fund is one of the simplest and lowest-risk ways to expose yourself to the dynamic wealth creation of the USA or any other major developed world economy.

As only 39% of the world’s population is considered free, this limits our choice of safe country indices in which to invest. The US, UK, Europe, and Canada are still solid bets.

For this analysis of the best and worst years, we will use the S&P500, the broad US bell weather index, as a solid basis.

Source: LiberatedStockTrader Stock Market Crashes

1933 was the best year in the stock market ever, gaining 46%

The Best Stock Market Years [of the last 90 Years]

First, we will look back fondly at the rip-roaring years of joy. Coming off the back of the great depression, we have 1933 with a joyous 46.59%

Following 1953’s -6.62%, we have 1954 with a 45.02% gain.

Again, another great depression rebound rally we have 1935 with 41.37%

After 1957’s loss of 14.31%, we got 1958 with 38.06%. 1927’s pre-depression madness and leverage produced a 37.88% increase.

Finally, the Reagan and Thatcher years yielded Clinton and Blair, which produced 1995’s 34.11% jump. In fact, from 1995 to 1999, we had one of the best Bull Markets ever, yielding an average of 26.3% per year for five years.

Source: LiberatedStockTrader Stock Market Crashes

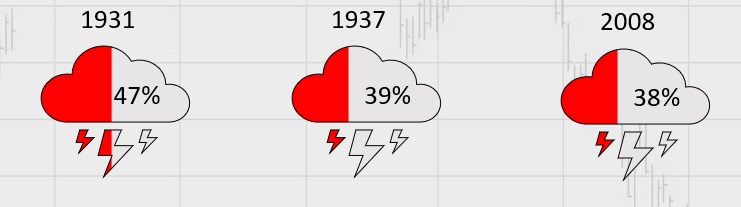

In 1931, the US stock market lost 47%; it was the worst year ever recorded.

The Worst Stock Market Years [of the last 90 Years]

- 1931 was the worst stock market year ever, with a 47% loss.

- 1937 has a double-dip crash with a 38.59% loss

- The modern-day financial crisis of 2008 claimed a 38.59% loss

- In 1974, the market crashed by 29.72%

- 1930 saw a -28.48% drop in stock prices

On average, a 10% drop in the stock market occurs once every two years.

Source: LiberatedStockTrader Stock Market Crashes

Stock Market Trend Statistics

A daily drop of 5% in US stock markets occurs 1.5 times yearly, and a 10% drop once every two years.

- A daily stock market drop of 5% occurs 1.5 times per year

- 10% single-day stock market declines occur once every two years.

- The average serious bear market, with a decline of over 20%, occurs every seven years

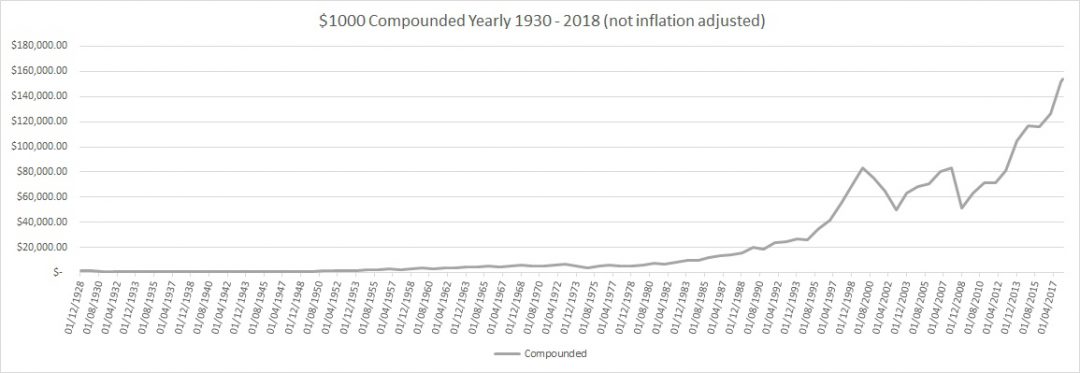

Compounded Gains of the S&P 500 – Last 90 Years to January 2022

- With a $1,000 investment in 1930, you have yielded $563,000

- This equates to a 56,350% return

Automated Robo Advisors are now mainstream, managing over $2 trillion in assets.

Trends in New Services Offered To Investors: The Rise of The Robots

A Robo Advisor is a digital application that offers users financial advice created by algorithms, artificial intelligence, or mathematical formulas. The term Robo Advisor is short for robot advisor. However, the phrase Robo Advisor is inaccurate. To explain, a Robo Advisor is a digital construct, usually an algorithm or artificial intelligence (AI) rather than an actual robot. By 2022, Statista estimates that Robo Advisors will be managing $1.787 trillion in assets.

Government agencies like the Nevada State Treasurer turn to Robo Advisors to manage public investments. The amount of funds controlled by Robo Advisors is growing dramatically. Algonest estimates Robo Advisors worldwide could manage over $2 trillion in assets by 2022.

Robo Advisors do not try to beat the market; they aim to simplify investing.

Most Robo Advisors do not claim to beat the market returns; they aim to simplify investments.

Commission Free Trading & Brokerage Services

You must change brokers if you do not get free stock trades in the USA.

The Stock Brokerage Industry had its first shake-up in the late 1990s with the emergence of the first discount online stock brokerage houses. These new brokerages forced competition in commissions and services, dramatically reducing commission costs.

Commissions went from $100 per phone call trade to $9.99 for online trades. These commission costs continued to reduce to 2018, with Interactive Brokers offering $1.- trades.

Robinhood was the first brokerage with a straightforward app that allows you to trade for free.

The first major brokerage to make a move to Commission Free Trading was Firstrade in 2018

Frequently Asked Questions

How are statistics used in the stock market?

In the stock market, statistics are used to put history in perspective and try to rationalize the future. Unfortunately, it does not always work out. The economy and stock market history are incomplete without detailing the black swan events that help tell its story.

How many times has the stock market crashed?

In the last 100 years, the stock market has crashed 7 times. 1929 (Great Depression), 1973 (Oil Crisis), 1987 (Black Monday), 2000 (Dotcom), 2008 (Financial Crisis), 2020 (Covid Crash), and 2022.

What chance do I have of picking a winning stock?

You have a 32% chance of selecting a stock that will beat the S&P500. My research shows only 1,299 companies beat the S&P 500 index from January 2021 to January 2022. The average increase of these stocks was 38.4%. This means you have a 32% chance of selecting a stock that will beat the market.

How often does the stock market go up?

My research shows that the S&P 500 increased 55% of the time over the last ten years by, on average, 0.2% per day, and the longest uninterrupted uptrend was eight days.

Statistically, what were the worst stock market crashes?

The worst stock market crash of all time was in 1929; the US Dow Jones dropped 89% and took 23 years to recover. The next worst crash was in the US NASDAQ, with an 83% drop and 16 years to recover. The 2008 financial crisis was bad, dropping 65% and lasting 5 years, but luckily central banks stepped in to stop the depression.

Are Wall Street fund managers profitable?

No, professional active fund managers are not as successful as you think. On average, over the last 10 years, 82% of fund managers failed to beat the market. In fact, 21% of managed stock market funds are closed after five years due to poor performance.

What is the most unbelievable stock market statistic?

US Technology firms are powerful. Apple, Microsoft, Alphabet, and Meta combined are worth more than any other country's stock exchange outside the USA.

What is a crazy stock market fact?

Microsoft is worth more than the entire Brazilian stock market. In 2022 Microsoft Corp is valued at $2.32 trillion. Microsoft is now worth more than the entire Brazilian Stock Market, worth $938 Billion, or the Taiwan Stock Exchange, valued at $866 Billion.

Right to Reuse this Research.

Dear Media, Reporters, and Bloggers, if you would like to share this research with your audience, all we ask is a link to this page as the source. For Further Information, please contact us here. Thank You

Use This Infographic on Your Site

Embed Our Infographic Code <blockquote class=”embedly-card”><h4><a href=”https://www.liberatedstocktrader.com/wp-content/uploads/2018/02/39-stock-market-statistics.jpg”>null</a></h4><p>null</p></blockquote>

<script async src=”//cdn.embedly.com/widgets/platform.js” charset=”UTF-8″></script>

Now it’s over to you, dear reader. Did you enjoy this article? Did it blow your mind? Share your view with us below.

One data I failed to find anywhere I looked- What is the percentage (by volume, or total assets) of index funds vs Actively managed funds in the overall market…

Could you elaborate on that if you have the data??

Hi Erik, that is indeed a difficult question. The only research we can refer to is a Moody’s report featured on Reuters. https://www.reuters.com/article/us-funds-passive/index-funds-to-surpass-active-fund-assets-in-u-s-by-2024-moodys-idUSKBN15H1PN it suggests that by 2024 Index Tracking Funds will be worth more that Actively Managed Funds.

I hope this helps.

I think the stats about each generation and the likelihood of having an investment account is as expected. The younger the generation the less likely they are to have an investment account. This is probably because they’ve got less disposable income.

This is great research, I had no clue that so many fund managers fail to beat the market, I must think about managing my own investments. I guess it really pays to be invested for long time in market.

Thanks for the facts. I have now retired and am living primarily off the distributions from our closed-end stock funds. Unearned income is king! For any of you thinking about your retirement out there, investing for the long term is the way to go. It’s not glamorous, it does involve sacrifice, but it is the surest way to build a nest egg. Don’t try to get rich quickly; get rich slowly.

Words coming from a true wise investor, thanks Christopher.