A short squeeze is a stock market phenomenon where investors who bet against the stock (short sellers) are forced to buy back their shares at a higher price, causing a surge in the stock’s price.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

The term “squeeze” refers to the pressure put on short sellers as they scramble to cover their positions before prices continue to rise.

Our testing shows that a high short-interest float greater than 20% and a short-interest ratio (days to cover) over 19 days are the keys to finding potentially explosive short-squeeze stocks.

Find out everything you need about short squeezes, real-world examples, how they work, and how to find the next big squeeze.

What is a Short Squeeze?

A short squeeze occurs when stock prices surge to a level where short-selling investors scramble to buy back the stock to minimize losses. This additional influx of buying exponentially drives up the price.

What Does a Short Squeeze Mean?

A short squeeze means the SHORTS (traders shorting the stock) get their margins SQUEEZED. When there is an extreme level of short selling on a stock, the stock liquidity is reduced, meaning there are fewer stocks to buy. So, a relatively small and concentrated buying pressure causes a large stock price surge. This price surge causes the short sellers to panic and start buying the stock, which catapults it to a short-term exponential rise.

How does a short squeeze work?

When many people sell a stock they do not own (short sell,) the stock price can decrease. But if the stock price goes up, these people have to buy the stock to return it to the person who owns it. This can push the stock price even higher. This is called a short squeeze.

The stock price decreases when more people sell a stock than buy it. This is called ‘selling short.’

When the stock price increases, traders might have to buy the stock to cover their position. This can push the price up even more, causing a ‘short squeeze.’ Short squeezes can also occur in options trading; this is called a Gamma squeeze.

A Short Squeeze Practical Example

Let’s say you have a company trading at $50 per share. Many investors decide to short-sell this stock, betting the price will decrease. But then news comes out about the company, and everyone decides they want to buy it – suddenly, there are more buyers than sellers, driving up the stock price. The people who were short selling might be forced to buy back the stock at a higher price, resulting in a ‘short squeeze.’

Short squeezes can be caused by good news about a company or market conditions where traders are betting on the same outcome. They can lead to sharp price increases and large losses for those who were wrong. Thus, paying attention to news and market movements is important when deciding whether to enter a short position. By doing so, investors can protect themselves from the unexpected and minimize losses in the event of a short squeeze.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

6 Ways to Find Short Squeeze Stocks

The best way to find future short-squeeze stocks is to use a stock screener to scan for high levels of short interest over 20% and short interest ratios longer than 19 days. Combine these two financial measures with bearish chart patterns and increasing volume, and you may find success.

1. Look for Stocks with a High Short Interest.

A stock with high short interest is one with many shares sold short by investors. This information is important because it can indicate how bearish or bullish investors are on a particular stock. For example, if the short interest is high, this could indicate that many investors believe that the stock price will fall in the future.

What is Considered a High Short Interest?

Most investors consider a high short interest greater than 5%, but our data suggest that the 90th percentile of US stocks has a short interest of >5.7%. This means the highest shorted 10% of US stocks have a short interest of 5.7% or more.

2. Use Finviz to Find Short Squeeze Stocks.

The quickest way to find stocks with high short interest and a long short interest ratio is to use the Finviz stock screener; use this link to jump straight to a list of high short interest stocks. Alternatively, follow this easy 5-step process.

5 Steps to Find High Short Interest Stocks Using Finviz

- Visit Finviz and click on Screener

- Select Descriptive Filters

- Select Float Short > 20%

- Select Short Ratio > 10

- Select Charts

(See image below.)

Alternatively, you can see all stocks on Finviz with a float short > 20% here.

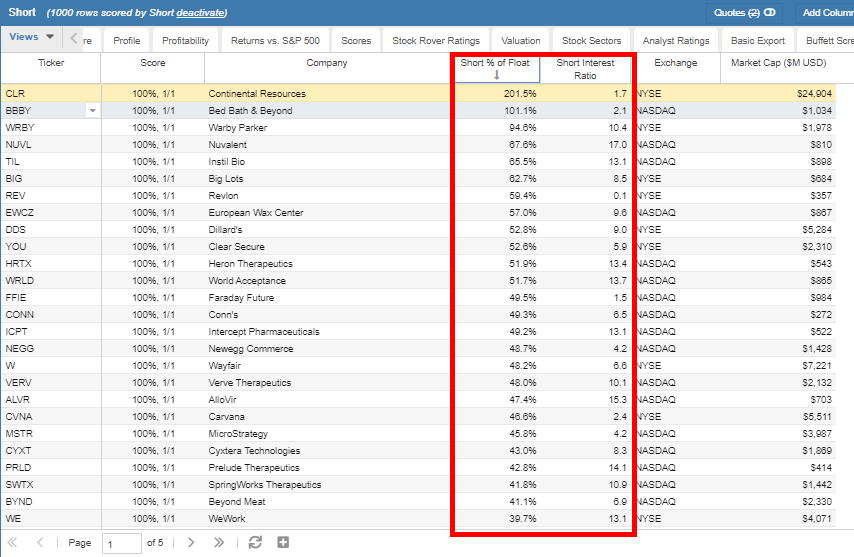

3. Use Stock Rover to Find Short Squeeze Stocks

Stock Rover allows scanning the entire US stock market for short selling and short interest information. The image below shows the depth of short trading screening possible, 4,500 stocks to be exact.

Register for free with Stock Rover and import this screener code to get a complete list of stocks in the USA with a short interest ratio and short interest percent.

Stock Rover Screen 1.0

Short

{“description”:” “}

{“name”: “Short”, “filterData”:[{“data”:[], “field”: “short_pct”, “excluded”:false},{“data”:{}, “field”: “short_interest_ratio”, “excluded”:false},{“data” :{ “type”: “list”, “value” :[ “NA”, “NY”]}, “field”: “exchange”, “excluded”:false},{“data”:[], “field”: “cap”, “excluded”:false}], “description”:” “, “equityType”: “Stock”, “limit” :0, “universe”:3}

*===================================================*

Short

Criteria:

Short Interest Ratio

Exchange: NASDAQ, NYSE

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

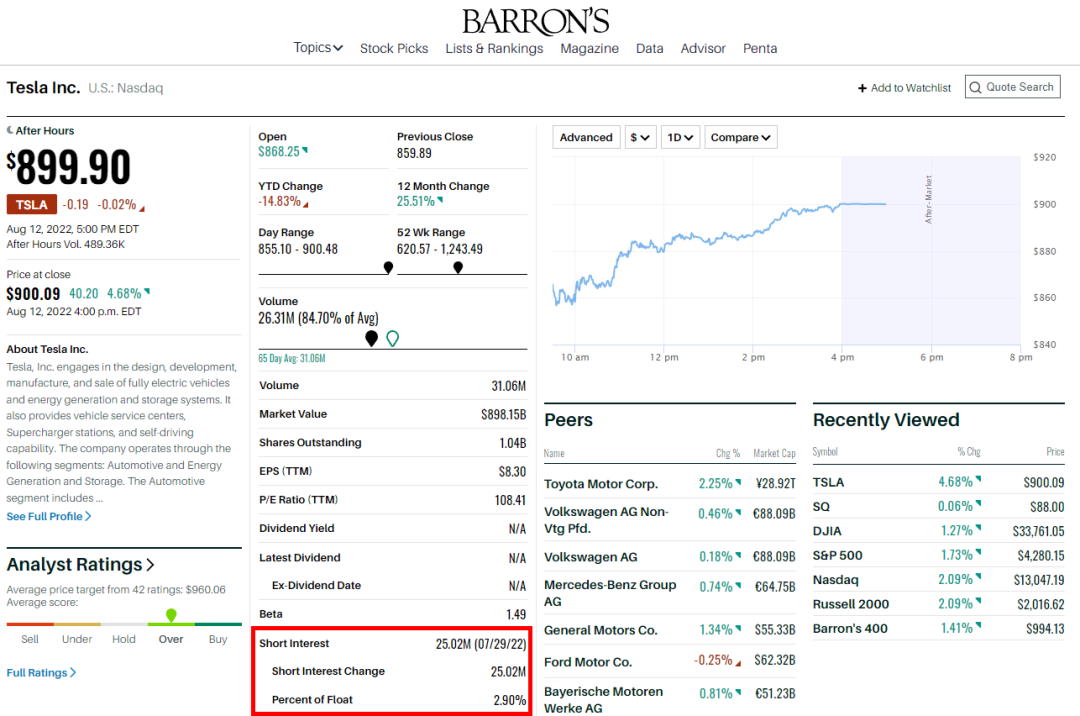

4. Visit Barron’s for Short Interest Data

Barron’s provides a simple way to see the short interest for a stock. Here is a link to Barron’s page for Tesla, where you can see the company’s short interest information.

5. Use WallStreetBets to Find Short Squeezes.

You can sift through the WallStreetBets Reddit forum to find out what they are planning next. But be prepared; it could take many hours. One way to save time on this forum is to use this link, which filters WallStreetBets on mentions of a squeeze.

6. Find a Short Squeeze Using Bullish Chart Patterns

In a bear market, spotting high probability bullish chart patterns could be a sign of a potential short squeeze when combined with our recommended short interest and short interest ratios.

Get Automatic Pattern Recognition Free with TradingView

The Gamma Squeeze

A Gamma squeeze occurs when the gamma of an option — which measures how quickly its value changes with respect to changes in the underlying stock’s price — increases. This can lead to a short squeeze if more people buy the option than sell it, pushing the price and forcing those who sold it to buy back at a higher price.

Gamma measures the rate of change in an option’s delta in response to moves in the underlying stock. Delta measures how much the price of an option contract will move in relation to changes in the underlying stock. If an option has a delta of 0.50, it will move $0.50 for every dollar the underlying stock moves. If the underlying stock increases by $1, the option will increase by $0.50. The gamma of an option tells us how much the delta will change in response to a $1 move in the underlying stock price.

A Gamma Squeeze Practical Example

Let’s look at how gamma squeeze can affect a stock. Suppose XYZ company is trading at $50 with a 30 delta call option (meaning the option will move $0.30 for each dollar XYZ moves) and 0.40 gamma (meaning the delta will change by 0.40 if the stock price moves by one dollar). If traders were to buy this call option expecting XYZ to increase in price, they would need to buy more options if the stock started moving in their desired direction. The option’s delta will also rise and accelerate as the underlying stock moves higher. As more traders pile into the trade, it causes a gamma squeeze where buyers must continue buying more options to keep up with the increasing delta. This is an example of how a gamma squeeze can cause a stock price to move in one direction.

The effects of the gamma squeeze can be amplified if other traders who are not involved with the original trade also start taking positions. For instance, if they see that XYZ has been rising and believe it will go higher, they may also begin buying call options, which will further increase the delta and gamma of the option. This causes an even bigger move in the stock price, and it can be hard to stop once it has started.

The Big Squeeze

A Big Squeeze is when a stock’s buying or selling pressure becomes so great that it causes an even bigger move than expected. It happens when the option traders begin to pile into a trade en masse, and there is no longer enough time for the sellers to react, leading to an exaggerated move in the stock price. This can often be seen at the end of strong trends when many traders are piling into long or short positions in anticipation of further gains. The Big Squeeze can exhaust buying power quickly and cause prices to skyrocket or plummet as more traders enter the market.

A “big squeeze” is a more intense version of a short squeeze, in which even more short sellers are forced to buy shares to cover their positions. This can increase the stock price by a greater percentage than a normal short squeeze.

A Real-World Example of a Big Squeeze

One prominent example of a big squeeze occurred in 2012 with Herbalife Ltd. (HLF) stock. The activist investor Bill Ackman had made short bets against the company, causing shares to fall. Soon after, billionaire investor Carl Icahn entered the picture and bought large blocks of HLF shares. This forced Ackman to cover his short positions, which created a big squeeze on the stock. The result was that the stock of HLF rocketed up more than 50%.

Investors should be aware that big squeezes are not always successful and can backfire because they rely heavily on momentum to succeed. Furthermore, any money made from a big squeeze will likely come from other investors caught in the squeeze. For this reason, big squeezes should be used with caution and only when there is a strong indication that a stock will continue to rise. Otherwise, investors may find themselves in an even bigger mess than before they started.

Are Short Squeezes Legal?

Yes, short squeezes are legal, but they can be manipulated. For example, investors may not use false or misleading information to create a squeeze on a stock. The SEC has issued several warnings about this type of market manipulation.

Investors should always do their due diligence before participating in any big squeeze and ensure they invest in a legitimate stock. Additionally, investors should be aware of the risks of short squeezes and ensure they can afford to hold onto their positions if the market turns against them.

A Big Squeeze Bordering Illegal

The SEC investigated Kieth Gill, also known as Roaring Kitty on YouTube, for participating in the GameStop short squeeze in 2021. He and others were accused of manipulating GameStop’s stock price by promoting it on social media platforms such as Reddit.

Short Squeezes & Reddit WallStreetBets

Since the start of the Covid pandemic, the short squeeze has been brought to mass popular attention through the Reddit forum WallStreetBets. With hundreds of thousands of members, this forum worked as a single team to push multiple short squeezes, bringing many hedge funds and institutions to their knees.

I have to admire the work these independent retail investors did to play Wall Street at their own game.

If you are willing to filter through the millions of trash messages, you can find some real gold in this forum. Find them at WallStreetBets.

Short Squeeze Stock Chart Examples.

AMC, GME, OverStock, and VW have all been subjected to high-profile short squeezes in the past. We examine what happened and share charts of their explosive growth.

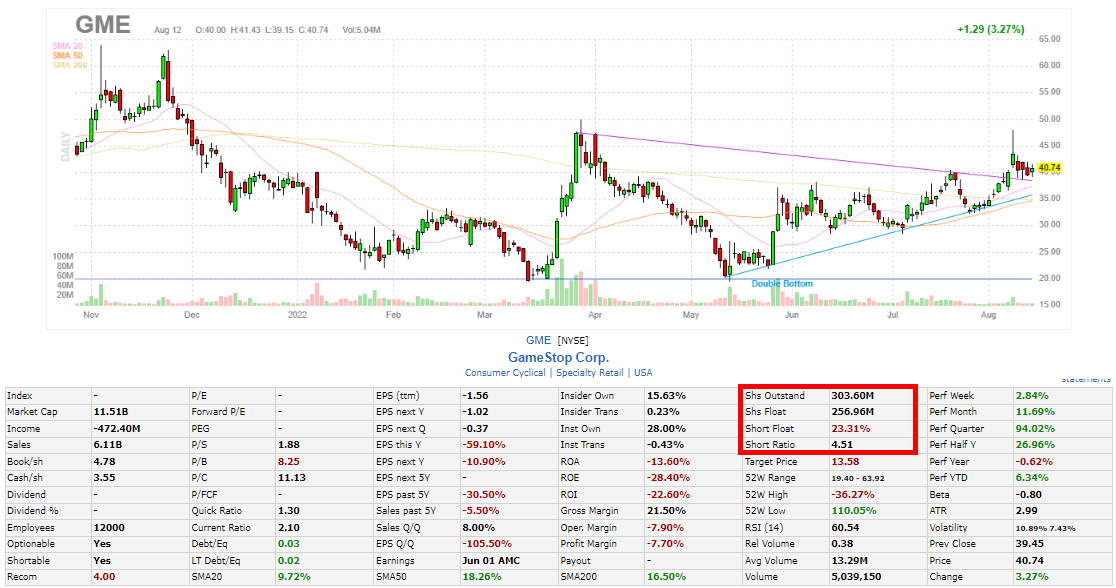

GameStop Short Squeeze Chart

The most famous example of a short squeeze occurred in February 2021, when GameStop shares spiked over 1900% from $4.75 to $86. The rally was fueled by Reddit users trying to force hedge funds to cover their positions by buying back the stock at a higher price. This caused the share price to increase dramatically, resulting in a short squeeze.

GameStop Chart Live on TradingView

The GME stock price remains 400% higher than in 2020. Hedge funds and institutional investors claimed that Reddit users on the WallstBets forum were manipulating the markets, which resulted in a hearing before the House Committee on Financial Services.

AMC Short Squeeze Chart

AMC Entertainment Holding Inc. experienced an incredible short squeeze in May 2021, again fueled by the Wallstbets Reddit forum. This big squeeze caused the stock price to increase by 520% in 6 weeks from $5.50 to $38.

See AMC Chart Live on TradingView

Bed Bath & Beyond Short Squeeze Chart

Another notch on the belt of the Reddit folks was BBBY, which in January 2021 catapulted 120% in three weeks. BBBY is being constantly played for the short squeeze, with a move of 70% in November 2021 and 400% in August 2022.

See Bed Bath & Beyond Chart Live on TradingView

But beware, many Redditors have lost a lot of money on these short squeezes because they did not time their trades properly or get out quickly enough. WallStreetbets is no guarantee of success.

Volkswagen VW Short Squeeze Chart

VW was the victim of a serious short squeeze that peaked in 2008, sending the stock from $210 to $1,000. Due to the business environment and VW’s share price collapse after the global financial crisis, VW was heavily sold short. Believe it or not, not all short squeezes are created by the folks at WallStreetBets. The share price rocketed when Porsche announced it would take a controlling stake in VW. Hedge funds had to panic cover their short positions and buy back shares they had sold short. Further details are here.

See VW Short Squeeze Chart Live on TradingView

OverStock Short Squeeze Chart

Overstock is a stock known to have experienced short squeezes in the past. Starting in May 2020, the stock had a high short interest. By August 2020, the stock price had grown from $22 to $120, over a 350% increase.

See Overstock Chart Live on TradingView

Conclusion

Short squeezes can benefit investors long on a stock because they can help push the price even higher. However, keeping an eye on short interest levels is important because they indicate that a stock is overvalued and is due for correction.

FAQ

What is the best software for finding short squeeze stocks?

Our testing shows Finviz and Stock Rover are the best platforms for finding the best short squeeze stocks. Finviz has filtering criteria for float short, option/short, short interest, and bearish chart patterns, which are essential for short sellers.

What is a short squeeze?

A short squeeze is a rapid increase in the price of a stock that occurs when there is a lack of supply and an excess demand for the stock. Short sellers are forced to close their positions by buying the stock, which drives the price up further.

What triggers a short squeeze?

A short squeeze can be triggered by any positive news about the company that causes other investors to buy the stock or in a coordinated social media push, as evidenced in the Reddit GameStop short squeeze. This increased demand can cause the stock price to rise rapidly, forcing short sellers to buy to cover their positions.

How can I identify a potential short squeeze?

Our testing shows identifying a potential short squeeze involves looking at a short interest over 20% and a short interest ratio over 19 days. High values in these areas could indicate a potential short squeeze.

What does 'short interest' mean?

Short interest is the total number of shares sold short but have not yet been covered or closed out. It's often used as an indicator of market sentiment.

What is 'days to cover'?

Days to cover is a measure of a company's issued shares that are currently shorted, divided by the average daily trading volume.

How is short squeeze related to 'short ratio'?

The short ratio, or "short float," is the percentage of shares held short relative to the available float. A higher short ratio can indicate a higher potential for a short squeeze.

Is it possible to predict a short squeeze?

While it's impossible to predict with certainty, traders often look at high short interest and days to cover ratios as potential indicators of a forthcoming short squeeze.

How can a short squeeze impact the stock market?

A short squeeze can cause significant volatility in the stock market, as it can lead to rapid and unexpected price movements.

What is a 'gamma squeeze'?

A gamma squeeze is a market phenomenon that occurs when large traders strategically buy or sell options to increase the underlying security's price. It can lead to significant volatility and short squeezes as the option prices become too expensive for shorts to cover their positions.

How can I profit from a short squeeze?

Traders can potentially profit from a short squeeze by buying stocks with high short interest ratios above 19 days and holding them until the price rises.

What are the risks of betting on a short squeeze?

The main risk is that the stock may not experience a short squeeze, and its price could decline as expected by the short sellers.

How long does a short squeeze last?

Our analysis shows that a short squeeze typically lasts 3 days to 3 weeks. Rarely a short squeeze lasts longer than 3 months.

What happened during the GameStop short squeeze?

In January 2021, GameStop experienced a massive 10X short squeeze driven by retail investors coordinating on social media, which forced many institutional investors to cover their short positions at substantial losses.

Are short squeezes legal?

Yes, short squeezes are legal. However, any coordinated effort to manipulate a stock's price is illegal.

What are some famous examples of a short squeeze?

A few notable instances of short squeezes include:

- GameStop in 2021: In an unprecedented event, retail investors banded together to drive the price, causing massive losses for short sellers.

- Volkswagen in 2008: Porsche's attempt to take over Volkswagen led to a short squeeze that briefly made Volkswagen the world's largest company by market cap.

What tools can I use to track potential short squeezes?

Based on our comprehensive testing, Finviz and Stock Rover are the leading platforms for identifying the most promising short squeeze stocks. Finviz boasts an array of filtering criteria, including float short, option/short, and short interest. Stock Rover enables deep fundamental research into a stock's financial history.

Can short squeezes occur in other markets beyond stocks?

Yes, short squeezes can occur in any market where short selling is allowed, including futures, options, and Forex markets. However, they are most commonly associated with the stock market due to its accessibility and the availability of information.