Everyone has heard the phrase “Buy the Rumor, Sell the News,” but what does it actually mean, and can you use it as a trading strategy?

“Buy the Rumor, Sell the News” means being one step ahead of other traders by reading the price and volume action leading up to a news or earnings announcement.

What Does It Mean?

The adage “buy the rumor, sell the news” is a contrarian trading strategy predicated on anticipating market reactions to rumors and news announcements.

Investors aim to capitalize on price movements by acting before the masses widely disseminate and process the information. The strategy suggests that when rumors surface about an event that might positively impact a company’s stock price, savvy traders may buy stocks based on the speculation.

When the news breaks, if the market has already priced in the anticipated scenario, a sell-off may follow, allowing the early investors to realize profits.

Key Takeaways

- “Buy the rumor, sell the news” is a trading tactic based on market anticipation and subsequent reaction to the news.

- Implementing the strategy involves timing the market based on speculation and investor psychology.

- Market familiarity and interpretation of news relevance are crucial for traders using this approach.

You can observe this phenomenon in various instances where security experiences a significant price movement before an official announcement or event, such as a geopolitical development, an earnings report, or a regulatory decision.

For example, a trader might have observed stock prices inching upwards on unconfirmed rumors of a company’s innovative product launch and bought shares in anticipation.

Conversely, these shares could then be sold after the official product announcement, securing possible gains from the post-announcement price drop as other investors’ expectations have already been met or exceeded.

The effectiveness of this strategy relies heavily on market sentiment, timing, and the ability to correctly interpret how other traders will react to actual news against what has already been speculated.

Understanding ‘Buy the Rumor, Sell the News’

The “Buy the Rumor, Sell the News” phenomenon is a testament to speculation and market psychology’s sway over trading strategies in the financial markets. This adage captures a common market behavior pattern in which traders act on expectations and respond to news releases.

The concept of “Buy the Rumor, Sell the News” revolves around the actions of traders who base their decisions on speculation before an expected announcement. They often buy assets on rumors or speculation about future events that they believe will lead to a positive market reaction.

Once the anticipated event occurs and the news is public, traders may sell their positions regardless of whether the news is positive. This counterintuitive aspect reflects market psychology: by the time the news is released, it might already be priced in, and the market may not move as much as it did on the rumor.

- Buy: Acting on speculation before news is released.

- Sell: Realizing potential gains when the news breaks, often leading to a price drop.

Historical Background

“Buy the Rumor, Sell the News” is relatively recent in its printed origins, first documented in 1986. However, the trading strategy it describes predates this initial recording and is embedded in the stock market’s history.

This strategy highlights the nuanced understanding that traders have developed over time regarding the interplay between rumors, news dissemination, and subsequent market movements. They have learned to navigate the waves that anticipation creates within financial markets, capitalizing on other market participants’ emotional and reactive nature.

Psychology Behind the Strategy

The “Sell the News, Buy the Rumor” strategy in trading hinges on market participants’ psychological patterns and the collective impact these have on asset prices before and after anticipated news events.

Anticipation and Reaction

Market sentiment is closely tied to anticipated news. Traders typically try to predict how the news will affect the market, leading to adjustments in asset prices before the actual event.

The strategy stems from the tendency of asset prices to increase on the expectation of positive news and then adjust or decrease when the news is released and absorbed by the market as traders react to the news’ implications.

Herding Behavior in Trading

Herding behavior is another key component of investor psychology. It refers to traders’ tendency to follow the crowd, which can exacerbate market movements. In news trading, if a majority anticipates positive news, they may buy en masse, driving prices up before the actual news arrives.

Conversely, traders might sell off their assets once the news hits the market, a reaction that can sometimes be amplified by market manipulation strategies that prey on these predictable responses.

Analyzing Market Reactions to News

The financial markets often exhibit swift reactions to various forms of news, ranging from earnings reports to economic data releases. Understanding the nuances of these reactions is pivotal for traders and investors.

The Best Tool for Trading Real-time News

Benzinga Pro is our review-winning platform for trading real-time news. Designed for day traders, it delivers real-time market-moving news to give you a trading edge.

| Benzinga Pro Highlights | Details |

| Features | Best Real-time News, Calendar, Charts, Screening |

| Unique Features | Stock & Options Squawk Box, News Sentiment, News Rating, Options Alerts |

| Best for | US Stock, Fx, Commodity & Bond Traders |

| Premium Trial | 14 Day Free Trial |

| Benzinga Pro Discount | -25% Code "SMARTER" |

| Markets Covered | North America |

Types of Market-Relevant News

Several types of news events can affect market sentiment and price action.

- First are economic reports, such as GDP growth rates and unemployment figures, which can indicate the health of an economy and influence central bank decisions.

- Another category is earnings reports from publicly traded companies, providing insights into their financial health, which can lead to significant price movements around the release time.

- Additionally, breaking news involving geopolitical events or policy changes can create immediate and unpredictable market volatility.

Price Action and News Events

The anticipation of news events can increase trading volume and create a departure from typical price action. Analysts may attempt to predict outcomes, but actual news events can still trigger large-scale shifts in liquidity and price.

For example, a more dovish tone than expected from a central bank can weaken the currency, while a positive surprise in an earnings report might lead to a swift stock appreciation. It’s crucial to monitor the news event and the market’s reaction, as the two can often diverge.

Examples

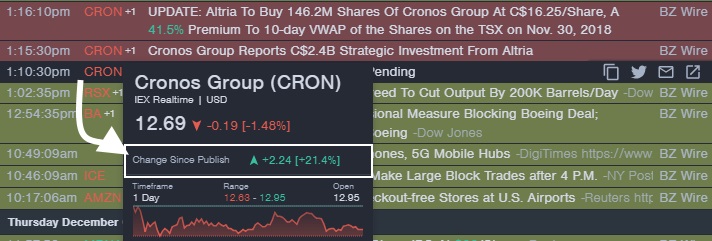

In the financial markets, the adage “buy the rumor, sell the news” comes to life when traders and investors react to speculation before an official announcement and adjust their positions after the actual event occurs.

Equity Markets

In the stock market, traders often buy stocks ahead of anticipated positive earnings releases or beneficial events like a stock split. For example, if rumors suggest that a certain tech company’s earnings will surpass expectations, the stock prices may rise as a speculation-driven surge occurs.

Once the earnings are publicly released, whether they meet, exceed, or fall short of expectations, traders may sell the stock to capitalize on the heightened interest. This often leads to a price decrease as the market fully digests the news.

See this chart live on TradingView

Currency Markets

Currency pairs in the forex market frequently exhibit this behavior. For instance, if it’s rumored that the central banks plan to change interest rates, traders might start buying or selling the GBP/USD pair based on their speculation. When the news is confirmed, significant price movement can occur in the direction opposite to the rumors, as forex traders adjust their positions to reflect the new reality, showing the culmination of a strategic investment decision based on anticipated future results.

Commodity Markets

In commodity markets, prices of assets like oil or gold can fluctuate due to geopolitical tensions or supply concerns based on rumors. Traders might employ a trading strategy involving buying these commodities when speculation about potential disruptions could drive prices up. Once the news hits and details are clear, they might sell to capitalize on the price movements. This approach requires careful risk management as commodities can be particularly volatile and sensitive to news releases.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

Strategies

The effectiveness of ‘Buy the Rumor, Sell the News’ hinges on precise timing and astute risk management. This trading strategy takes advantage of market sentiment leading up to news announcements, with traders aiming to capitalize on price trends that result from speculative activity.

Technical Analysis Approaches

Technical analysis is integral to implementing the ‘Buy the Rumor, Sell the News’ strategy. Traders scrutinize trading volume and price trends to identify patterns that could signal an upcoming change in market sentiment. By employing technical indicators like moving averages, traders seek to ascertain the optimal timing for entry and exit points before a news release. This strategy often relies heavily on the past performance of assets to predict how they will respond to similar scenarios in the future.

Event-Driven Trading Tactics

Event-driven trading tactics require insight into the economic calendar to pre-emptively position news announcements. Traders specializing in this approach focus on events such as earnings reports, product launches, or regulatory updates. They buy assets on rumors and anticipate that heightened interest will drive up prices once the news breaks. Then, ideally, before the market can adjust to the new information, they sell, often making this approach attractive to day traders.

Risk Management for Rumor-Based Trading

‘Rumor-based trading’ is inherently risky, making robust risk management practices critical. Traders should use stop-loss orders to manage potential losses and protect investment capital. Consulting with an investment adviser can provide additional strategies to mitigate risks. Diversification of assets may also temper the potentially volatile swings associated with trading on rumors, ensuring a trader’s portfolio is not overly exposed to any single market move.

Challenges and Risks

The “Buy the Rumor, Sell the News” strategy involves navigating a landscape fraught with unpredictability and psychological complexity. Traders must critically assess the integrity of market whispers and perfectly time their entry and exit into trades, all while managing the psychological stress accompanying such high-stakes decision-making.

Accuracy of Rumors

Market rumors can be a double-edged sword. On the one hand, they serve as the cornerstone of the Buy the Rumor, Sell the News strategy, potentially leading to profitable trades when accurate. On the other hand, the risk lies in the accuracy of the rumor. An investment decision based on speculation that turns out to be unfounded can lead to significant losses, as markets swiftly re-adjust once the truth is revealed.

Timing the Market

A trader’s ability to time the market is crucial. Precise timing of trades around news releases is often the difference between profit and loss. This trading decision must factor in the news release, market psychology, and how other traders might react. Too early, and the market may not yet have shifted; too late, and the opportunity may have already passed.

Managing Emotional Trades

Market psychology and personal emotion play significant roles in day trading activity. Trading decisions are often influenced by human emotion, which can cloud judgment. Adhering to a disciplined trading plan and maintaining a neutral stance is important for managing the emotional whirlwind of rapid speculation and trading activity. Even when facing unexpected market turns, a successful trader remains steadfast in their approach, avoiding impulsive actions that deviate from strategic planning.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

FAQ

How do news-based trading strategies work in forex?

News-based trading strategies in forex revolve around making currency trades based on anticipated news events or economic data releases. Traders might act on expectations before the release, affecting currency values due to speculation.

Can you explain the concept of 'Buy the Rumor, Sell the News' with real market examples?

'Buy the Rumor, Sell the News' refers to traders buying assets based on anticipated favorable news and then selling once the news is public. For instance, if rumors about a government's fiscal stimulus are circulating, traders may buy the currency before the official announcement, selling it once the information is released and priced into the market.

What are the potential risks and rewards of trading based on market news?

Trading based on market news risks misinterpreting information or being caught off guard by unexpected outcomes, which can result in rapid and significant losses. Conversely, the rewards can be substantial if predictions are correct and trades are executed effectively ahead of market movements.

What techniques do news traders use to forecast forex market movements?

News traders often rely on economic calendars, historical data, and technical analysis to forecast market movements. They analyze patterns, use indicators to predict how news releases influence forex markets, and then plan trades accordingly.

How can traders effectively read and interpret forex news for trading decisions?

Traders can read and interpret forex news effectively by staying informed about global economic indicators, political events, and central bank decisions. Understanding the nuances of how varying news can affect currency pairs is crucial for making informed trading decisions.

What is a contrarian approach to news trading, and how does it operate?

The contrarian approach to news trading involves taking positions opposite the prevailing market sentiment. Contrarians might sell when the majority are buying on optimistic news, or buy when most are selling on pessimistic news, often capitalizing on overreactions or corrections in the market.