The market is an auction where traders and investors trade company stocks through bids and offers. The spread, the difference between these prices, represents the exchange’s profit.

The stock market works by rewarding and punishing all parties involved: Wall Street, Investment Banks, Public Companies, Investors, Trader and Brokers.

Brokers profit from commissions, investors benefit from stock price growth, and companies benefit from cheap financing.

Keep reading to learn how the market really works!

Listen to this article via our Podcast.

How Does the Stock Market Work?

The stock market is a platform where investors buy and sell stocks, also referred to as shares, of publicly traded companies. When an individual acquires a share, they assume ownership in the company, entitling them to a portion of its profits and assets.

Trading on the stock market occurs between buyers and sellers, who both need to be registered with a stock exchange. Buyers place orders for stocks they want to buy, and sellers place orders for stocks they want to sell. The stock price is determined by supply and demand, meaning that it changes constantly based on the number of buyers and sellers in the market.

What is the Stock Market?

The term Stock Market generically describes one or more stock exchanges. Stock exchanges exist to facilitate the buying and selling of company shares between investors and traders. A stock exchange like the NYSE is operated by a company that maintains the infrastructure to allow the fair exchange of shares.

In other words, the Stock Market facilitates the exchange of company shares through buying and selling company stock.

This is why they are called Stock Exchanges. The Stock Market is a generic word that collectively describes all stock exchanges. A specific stock exchange, for example, the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE), is run by a company that maintains the infrastructure to allow the fair exchange of company shares.

How Does the Stock Options Market Work?

Some exchanges, such as the Chicago Board of Options Exchange (CBOE), facilitate the buying and selling of Options Contracts. This unique exchange enables people to buy and sell stocks, with the option of purchasing or selling stocks at some time in the future.

How Do Stock Market Indexes Work?

If we drill one level deeper, inside each stock exchange, there is an Index. So, inside the NASDAQ Exchange, you have the Nasdaq 100 (NDX), a listing of the 100 biggest companies (by capitalization) on the NASDAQ exchange. On the NYSE, you have the S&P500, a listing of the 500 biggest companies.

The Stock Market Works in Many Different Ways.

The stock market works differently depending on your role in the economy. There are benefits for individual investors, stock traders, investment banks, brokerage houses, and, of course, corporations themselves. We will now explore how the market works for everyone involved.

How Stock Markets Work for Investors

As an investor, you can benefit from increases in stock prices from the shares you own. You can also benefit from the regular dividend payments (usually up to 3% per year) companies make to shareholders. Investors also benefit from investing in stocks through an IRA or pension funds to build wealth for retirement.

How Stock Markets Work for Traders

The market works for stock traders by enabling them to buy and sell stocks based on short-term stock price fluctuations—the more volatile the stock price, the better for traders. Although riskier than investing long-term, traders must balance risk and reward with the hope of profiting over multiple trades.

How Markets Work for Investment Banks

The market works for investment banks by enabling them to sell services like initial public offerings (IPO), company mergers, acquisitions, takeovers, or corporate divestments/spin-offs. Finally, investment banks can also design bespoke investment vehicles for pension funds, such as derivatives or funds.

How the Market Works for Brokerages

The market works for brokerages by enabling them to provide individual investors with access to the stock exchanges. For a commission, Brokerages offer a trading account and a secure place to deposit money for investing. They also supply a complete trading platform, stock chart analysis, and screening software.

How It Benefits Corporations

Companies will float on a stock exchange to access a large amount of money to help finance their business expansion. Access to capital or the capital markets enables companies to raise money to fund expansion, research & design, innovation, and ongoing operations.

For example, let’s say I started a company that helps people buy and sell Bitcoins. Let’s call the company “BitSwap.” Business is booming; I am getting a lot of demand for the services. But my problem is I cannot fulfill all that demand because I do not have enough money or capital in the business to finance the expansion of the I.T. infrastructure. I have four choices to get money.

- A Bank Loan – The Bank will only lend on existing secured assets.

- Private Investors – may want a large share of your company for a small amount.

- Issue Corporate Debt – I can only do this when I have enough equity in my business.

- Get Public Money by Floating on a Stock Exchange through an Initial Public Offering (IPO)

The IPO is a great way to secure money while retaining business control. This is a significant source of income for Wall Street Investment Banks.

It Enables Company Takeovers

Another huge benefit for corporations is that if a company’s stock price is very high, it can use the value of the stock it owns to acquire weaker companies. A Stock Stock Merger allows the investors in the weaker target company to swap their shares for the more valuable shares in the acquiring company.

What Are Stocks?

Stock or shares are the right to own part of a business and its future profits. When launching an IPO, the company will decide what percentage of the business to sell and how many shares to issue. So, for my BitSwap company, I want to raise $100 million and issue 10 million shares at $10 each. For that $100 million, I will give up a stake of 50% of my business or issue shares. That essentially values my business at $200 million in total.

If my IPO succeeds, my corporate balance sheet will gain $100 million, which I will use to invest in infrastructure, staff, and premises.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Why Buy Shares of a Company?

The benefit to you as a shareholder is that you should profit from your investment. You can gain from:

- the increase in the price of a stock – commonly called growth investing

- a share of profits issued through dividends – called income investing

If you hold ordinary shares, you will also be able to vote on the company’s leadership and be invited to annual shareholder meetings.

The Difference Between Traders and Investors

Traders make money by buying and selling stocks on a short-term basis, potentially holding a stock for minutes to days; this is known as Day Trading. Traders also utilize leverage to turn the potentially small gain on a short-term holding into a more substantial profit. The problem is that leverage can also turn a small loss into a significant one. This means the majority of traders lose over the long term.

Investors hold their stocks for a longer period and seldom use leverage. According to our stock market statistics, the stock market’s overall long-term direction is up; over any 20 years in history, the buy-and-hold strategy has never been lost.

How Wall Street Makes Money

Wall Street Investment banks make money from the following activities:

- Initial Public Offerings – helping companies get access to capital markets

- Mergers, Acquisitions, and spin-offs help companies buy other companies, merge with other companies, or even split up large companies.

- Fund Management – Administering Funds such as Exchange Traded Funds (ETFs) or Mutual Funds.

- Derivative Investments are establishing innovative ways to enable high-net-worth (HNW) individuals or money managers to invest in exotic financial instruments—see Financial Crisis.

Contrary to popular belieF Wall Street Investment Banks & Brokerage Houses do not make their profits from having super talented money managers that beat the stock market returns. In fact, most fund managers cannot beat the market.

Why 92% of Fund Managers Fail to Beat The Market

Investment Banks and Brokers make money by:

- Take a slice of your total investment with them – e.g., Management Charges, whether or not they make you a profit.

- They are charging you per Stock Trade – e.g., a trading commission.

Should I Fear Losing Money?

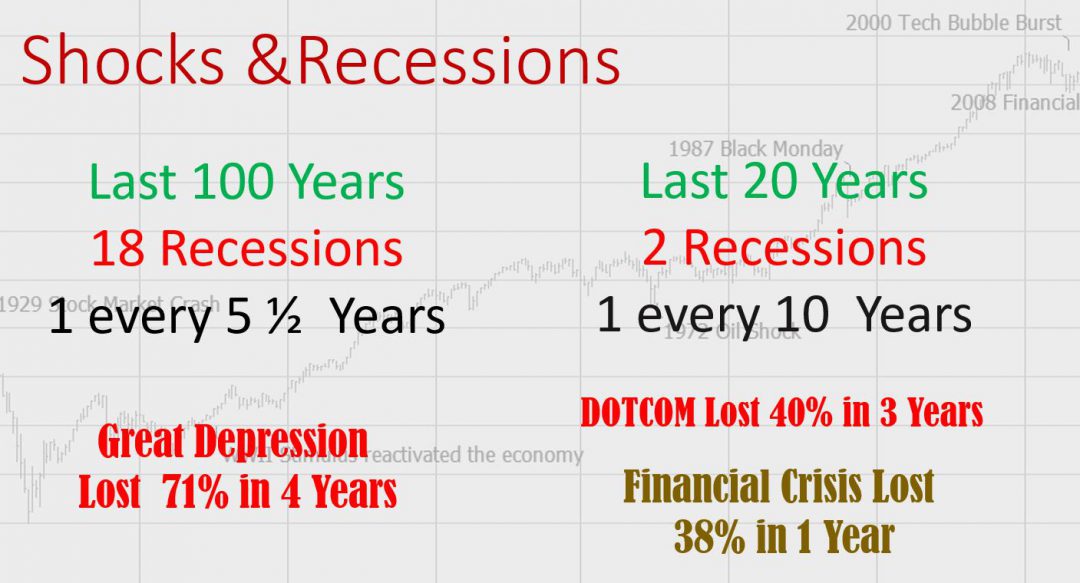

In the past 100 years, we have had 18 economic recessions, so it is normal to fear losing money in the stock market. The terms Fear and Greed certainly represent the emotions of the market participants. Fear is the panic people feel when the stock market value decreases; the natural emotion is to sell and stop losing.

Greed refers to when the stock market is rising, and people naturally want to buy more because they get greedy. If the stock market is overpriced and everyone feels greedy, this can fuel booms and busts. As Warren Buffett says, those who make the most money in the stock market tend to “Be Greedy when others are fearful and be fearful when others are greedy.”

People lose money in the stock market but also make money. It largely depends on the difference between investors and traders.

FOMO is the opposite. Fear of Missing Out usually occurs when the stock market is booming, and people are unable to resist the fear that they will miss out on making money.

In conclusion, while there are many risks associated with investing in stocks, understanding and using the concepts of fear, greed, FOMO, and other emotional triggers can help you make smarter decisions and reduce your chances of losses.

Lastly, as a long-term investor, you will still want to understand whether the market is in a Bull Market or Bear Market so you can take action to secure your investments as prices go down. For precisely this reason, we have created the Stock Market Crash Detector System to help you understand if and when the next crash will happen.

You can also stay up to date with our Level Headed Stock Market Commentary & Analysis – Stock Market Today

5 Ways to Make Money in the Stock Market

Those who make money in the stock market do these things:

- Use a Hold Strategy to accumulate assets over the long term.

- Incorporate Income Investing in your strategy.

- Invest in low-cost broad market Exchange Traded Funds (ETFs) or Index Tracking Funds

- Invest for the long-term – In any given 20-year period, the stock market has made money

- Invest through a tax-reduced or tax-free vehicle, like an IRA or DRIPS account

3 Ways to Lose Money in the Stock Market

Those who lose money in the stock market generally:

- Do not take the time to educate yourself in investing.

- Try to trade stocks in the short term, e.g., Day Trading and Swing Trading.

- Get caught up in Investing Scams or follow Penny Stock Promoters.

How do I start Investing in the Stock Market?

An excellent way to start investing is to educate yourself in the stock market basics by taking a Free Stock Market Training Course. Then, it would be best to have a higher level of stock investing education to understand how the market works.

Is there a Guide for Stock Market Investing?

Read our Learn Stock Trading Guide for a complete guide to learning about Stock Market Investing, including selecting an investing vehicle, broker, and software platform.

The 3 Big Problems with the Stock Market

Should you believe Wall Street Analyst observations of company performance, or do you suspect a conflict of interest? Get the surprising inside scoop.

There are many Stock Markets globally, and they have primarily been established to allow businesses to get cheap financing to aid rapid expansion in exchange for a slice of the business and an opportunity to profit from it.

The largest stock markets are located in the wealthiest countries; this enables the business to access the wealth and capital available in these countries to finance growth.

By purchasing stock in a company, you can benefit in two ways:

- Firstly, you can benefit from share price appreciation and stock price movement.

- Secondly, you can benefit if the company issues dividend payments. Dividend payments are a cash distribution of profits to reward shareholders for holding the stock.

Wall Street analysis firms provide ratings of the companies and their stocks; however, they can be quite misguided and are often more bullish than they should be.

1. Institutional Stock Analysis – Don’t Believe the Wall Street Analysts

Most investment banks and brokerage houses employ stock market analysts.

Their job is to research the firms in the industry to which they are allocated to assess if they are worth investing in.

You can purchase the “Analyst Reports” from S&P, Moodys, The Street, Credit Suisse, or other information providers. The analysts usually attend the shareholder meetings for the companies they cover and probe the management team for further information.

Wall Street analysts are constantly scrutinized for the meaningless jargon and inaccurate ratings they put on stocks.

There is no aligned meaning across the research houses as to the meaning of ratings, such as:

- Strong Buy, Hold, Sell, Strong Sell

- Outperform, Perform, Underperform

- Overweight, Underweight

- Long, Neutral, Avoid

- Accumulate, Hold, Distribute

This means it is all open to loose interpretation, which is inherently less meaningful.

You need to read between the lines when interpreting analyst reports.

The analysts tend to avoid negative opinions as they tend to receive flack from the management teams and pressure that they may lose access to the companies they cover; this represents an institutional conflict of interest.

Analysts are not paid for their stock ratings’ performance; therefore, they have limited motivation to be truthful.

2. Investing Scams

Investment scammers took $8.8 billion from unsuspecting consumers in 2022, marking a significant 30% increase from the previous year.

Don’t be caught in NFT, Crypto, Forex, Ponzi, or offshore scams. Learn how to identify and avoid these fraudulent schemes!

Scammers thrive in financial markets, so stay alert. Protect yourself from investment fraud and common scams online. In 2022, consumers reported losing $8.8 billion to scams, a 30% increase from the previous year, with many falling victim to investment scams.

Discover why Penny Stocks are not the best option in our article on Cheap Stocks.

3. Alternative or Private Market Conflicts of Interest

If you decide to invest in alternative markets, such as Pink Sheets, “Over the Counter” (OTC), or even specific derivative markets like CFDs, the operators of those markets may have a conflict of interest.

Sometimes, they directly need to take the opposite side of your trade and can manipulate the Bid and ask prices accordingly. A high-quality, mature company will have a Risk Mitigation department to resolve and avoid conflicts.

I hope this has given you an insight into how the stock market works from inside Wall Street.

For more revelations and insights into this topic, see the Book Full of Bull on our Top 20 Books List.

How the Stock Market Works – Podcast

How Does the Stock Market Work In Reality? Should you believe Wall Street Analysts? Why Do People Lose Money or Make Money in the Stock Market & What are the BIG RISKS?

- Published: Tue, 04 Jun 2019 13:00:00 GMT

- Duration: 00:15:44

Video: Learn How the Stock Market Works With Great Books

Summary

The stock market works by providing a marketplace for buyers and sellers of shares in a company to safely exchange those shares for the right price. Brokers and exchanges make money from the fees and commissions they charge per transaction. Those fees fund the security and infrastructure to make the fair stock exchange possible.