To calculate the intrinsic value of a stock, estimate a company’s future cash flow, discount it by the compounded inflation rate, and divide the result by the number of shares outstanding. The result is a stock’s fair value.

The Intrinsic Value or Fair Value of stock estimates a stock’s value without regard for the stock market’s valuation. Firstly, we will uncover how Warren Buffett calculates Intrinsic Value using the Discounted Cash Flow Model (DCF).

I will show you the most effective way to automatically calculate the intrinsic value for all the stocks in the USA.

The Intrinsic Value of Stock

The intrinsic value of a stock is calculated by estimating a business’s future cash flow (FCF), usually for the next ten years. This cash flow is discounted in each future year based on variables such as interest or inflation. The total discounted cash flow (DCF) is then divided by the number of shares outstanding to give the per-share intrinsic value.

If, for example, a stock’s intrinsic value is 30% higher than its current market price, that means a share of the company has a 30% margin of safety.

Intrinsic Value Calculation Formula

Intrinsic Value = [FV0 /(1+d)0] + [FV1 /(1+d)1] + [FV2 /(1+d)2] + …..+ [FVn /(1+d)p

- FVx = Net cash flow (inflow or outflow) for the jth period (for the initial “Present” cash flow, x = 0)

- d = Discount Rate – Annual rate of interest or inflation

- p = Number of periods to be included

This looks rather complicated, so let’s examine how the calculation works.

How To Calculate Intrinsic Value – Buffett Model

- Take the free cash flow of the first year and multiply it by the expected growth rate.

- Calculate the NPV of these cash flows by dividing it by the discount rate.

- Project the cash flows ten years into the future and repeat steps one and two for all those years.

- Add up all the NPVs of the free cash flows.

- Multiply the 10th year with 12 to get the sell-off value.

- Add up the values from steps four and five and Cash & short-term investments to arrive at the intrinsic value for the entire company.

- Divide this number by the number of shares outstanding to arrive at the intrinsic value per share.

Warren Buffett, the greatest investor of all time, prefers to use this model, also known as the Discounted Cash Flow Model.

By taking the current and estimated net income for the next ten years, reducing its value to the present value (Net Present Value) due to inflation, and dividing that by the outstanding number of shares, you get the intrinsic value per share. This calculation is the price you should pay for a stock, not what the stock market says you should pay.

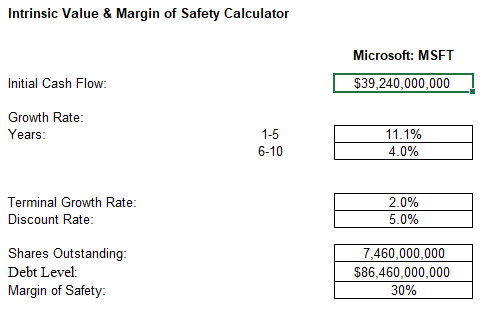

Calculate Intrinsic Value Using Excel – Download

An easy way to calculate intrinsic value and the famous Warren Buffett Margin of Safety is to use an Excel spreadsheet.

We have done the work for you; our simple-to-use Excel Sheet provides all the information and calculations you need to determine a company’s stock’s intrinsic value easily.

Download the Intrinsic Value & Margin & Safety Excel Calculator .xls

The Best Intrinsic Value Calculator

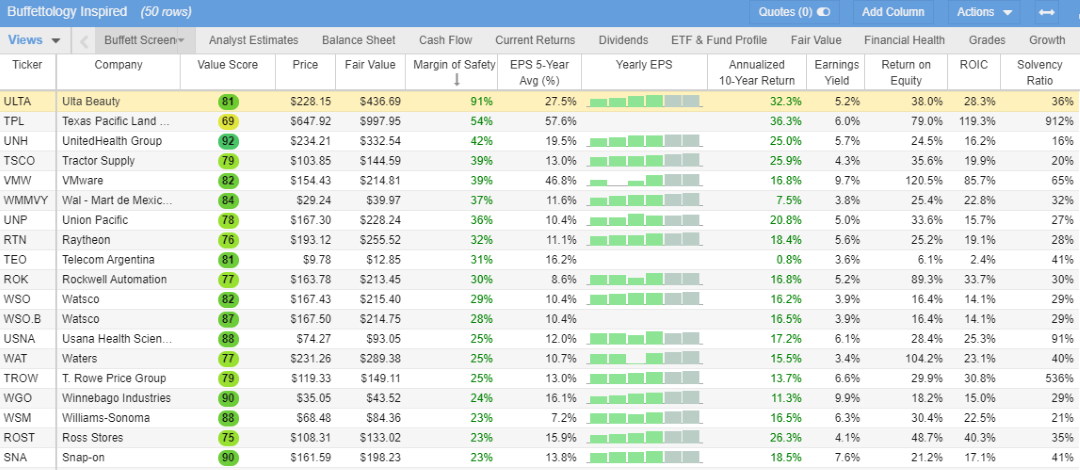

Stock Rover is the best intrinsic value calculator, automatically calculating Fair Value, Academic Fair Value, Intrinsic Value, Intrinsic Value to Sales, and the intrinsic Value Exit Multiple for all US stocks.

Stock Rover: The Best Intrinsic Value Calculator

| ⚡ Features |

Value Investing, Fair Value Screener, Charts, News, Watchlists, Broker Integration |

| 🏆 Exceptional Features |

Screening, Portfolio, 10-Year Financial Database |

| 🎯 Best for | Growth, Dividend & Value Investors |

| 🆓 Free | Try Stock Rover Free |

| 🎮 Trial | 14-Day Free |

| ✂ Discount | 25% During Premium Trial Period |

| 🌎 Region | USA |

| 📰 Read the Review | Stock Rover Review |

While using an Excel sheet to calculate Intrinsic Value and Margin of Safety for an individual stock is easy and free, it is not very productive. You need to enter the values for each company individually. You will need a stock screener to scan through thousands of stocks to find investments that meet Warren Buffett’s or Ben Graham’s criteria.

The Best Stock Screener for Intrinsic Value

Stock Rover automatically calculates Intrinsic Value and Fair Value, a key Benjamin Graham and Warren Buffett criteria, in 5 different ways:

- Fair Value – using a discounted cash flow analysis to determine the Intrinsic Value

- Fair Value (Academic) – uses a discounted cash flow analysis that forecasts cash flows into perpetuity.

- Intrinsic Value (Academic) – is determined by adding the Net Present Value of Cashflows and the Terminal Value (Academic)

- Intrinsic Value EV to Sales – is determined by comparing its EV / Sales ratio vs. industry norms.

- Intrinsic Value Exit Multiple – A company’s intrinsic value is determined by adding the Net Present Value of Cashflows and the Terminal Value Exit Multiple.

Stock Rover has over 150 pre-built screeners, and the Premium Plus service unlocks the Warren Buffett and Benjamin Graham metrics.

Stock Rover, our review-winning recommended software, is the best stock screener that automatically calculates Fair Value, Intrinsic Value, Margin of Safety, and hundreds of other important fundamental financial calculations.

Related Articles: Finding Great Stocks With Stock Rover

- 12 Legendary Strategies to Beat the Market That [Really] Work

- Our Beat the Market Screener [Actually] Beats the Market

- All Value Investing Strategies & Articles

- Use a CANSLIM Stock Screener Strategy To Beat the Market

The Margin of Safety – What You Should Pay for A Stock

Now that you know the intrinsic value per share, you can compare that to the actual share price. If the intrinsic value exceeds the actual share price, that will constitute a value investment.

Warren Buffett likes a margin of safety of over 30%, meaning the stock price could drop by 30%, and he would still not lose money.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Alternative Intrinsic Value Calculations

There are many formulas for calculating Intrinsic Value because Intrinsic Value is a matter of opinion.

Analysts and investors disagree on intrinsic value and how to calculate it. For example, value investors look at cash, assets, and cash flows. However, growth investors may examine intangible assets like patents, intellectual properties, strategies, business plans, brand names, reputations, and copyrights.

For example, many people regard copyrighted fictional characters, like Luke Skywalker, Darth Vader, Spider-Man, Iron Man, and Captain America, as part of the Walt Disney Company’s (NYSE: DIS) Intangible Value. In addition, most of Procter & Gamble’s (NYSE: PG) potential value comes from popular brands like Tide.

Intrinsic Value vs. Book Value

A company’s Book Value is the value of all its physical, financial, and legal assets. For example, the money in the company’s accounts, accounts receivable, inventory, real estate, patents, assets, equipment, etc.

Book Value is a good way to think of the number of money creditors could receive if a bankruptcy court liquidates the company. However, Book Value does not consider such factors as management, corporate culture, business plans, and consumer loyalty. Also, Market Capitalization is not part of book value.

The easiest way to estimate Book Value is to subtract a company’s liabilities from its assets. For instance, Apple (NASDAQ: AAPL) had assets of $341.998 billion and liabilities of $93.772 billion in March 2019. Consequently, you can estimate Apple’s Book Value at $248.226 billion.

Comparing Book Value to your estimates for Intrinsic Value can give you an idea of how other people are pricing a company.

Price to Earnings Ratio vs. Intrinsic Value

Many people use the Price to Earnings (P/E) Ratio or Price Multiple, but it is not an estimate of stock value. Instead, the PE Ratio estimates the value of a stock’s earnings.

Generally, analysts use the P/E Ratio to compare the earnings of different stocks. You can also compare current and historical P/E Ratios to learn the consistency of a stock’s earnings.

A classic P/E Formula is the stock price divided by the Earnings Per Share (EPS). You must pay attention to the P/E Ratio because it is the most popular stock analysis formula.

However, the P/E Ratio is a short-term analysis tool with little effect on Intrinsic Value. On the other hand, speculators watch the P/E Ratio because it can affect short-term market prices. Hence, the P/E Ratio can indicate a stock’s future market performance.

Formulas for Calculating Intrinsic Value

However, several formulas can give you a rough estimate of the Intrinsic Formula. Understanding and utilizing these formulas can make valuing and understanding stocks easier.

1. The Dividend Discount Model

The simple idea behind the Dividend Discount formula for estimating Intrinsic Value is that cash is king.

A simple means of calculating the Dividend Discount is to use the Time Value of Money method. To calculate the Time Value, add the number of future dividends to the current stock price.

To determine Walmart’s (NYSE: WMT) Intrinsic Value next year, you would add four quarters of dividends to Walmart’s stock price ($100.04 on May 15, 2019). Since Walmart will pay a 53₵ divided on June 3, 2019, its Intrinsic Value could be $102.28.

Hence, a dividend investor will spend $100.04 to get $2.24 in dividends. Thus, you can determine if $2.24 is worth $100.04 if you purchase Walmart stock for the dividend.

The Problems with the Dividend Discount Model

The Dividend Discount Model’s problem is that a company’s management can end or change the dividend at any time. For instance, a company that pays a quarterly dividend could switch to annual dividends. Moreover, some companies will occasionally issue big bonus dividends.

Unfortunately, the Dividend Discount Model only works with stocks that pay dividends. Hence, the Dividend Discount Model is useless for companies such as Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), and Berkshire Hathaway (NYSE: BRK.B), which refuse to pay dividends.

2. Discounted Cash Flow Model – How Warren Buffett calculates Intrinsic Value.

Buffett bases his intrinsic value calculations on future free cash flows. To explain, Buffett thinks cash is a company’s most important asset, so he tries to project how much future cash a business will generate.

The formula for estimating future Free Cash Flows is the Discounted Cash Flow Method. Here is an example of a simple Discounted Cash flow Method

- Take the free cash flow of the first year and multiply it by the expected growth rate.

- Then, calculate the NPV of these cash flows by dividing it by the discount rate.

Note: NPV refers to the Net Present Value, or the present value of money. You calculate the Net Present Value by subtracting the discount rate from the money’s future value and multiplying it by the number of years you measure.

- Project the cash flows ten years into the future and repeat steps one and two for all those years.

- Add up all the NPVs of the free cash flows.

- Multiply the 10th year with 12 to get the sell-off value.

- Add up the values from steps four and five and Cash & short-term investments to arrive at the intrinsic value for the entire company.

- Divide this number by the number of shares outstanding to arrive at the intrinsic value per share.

The advantage of the Discounted Cash Flow Method is that it is simple. The problem with this method is that Free Cash flows can vary dramatically from year to year. Thus, the final figure from this method is guesswork.

Invest in yourself! Get all our courses & strategies for 50% off

★ Liberated Stock Trader Pro Stock Investing & Trading Course ★

★ M.O.S.E.S. Market Outperforming ETF Strategy ★

★ LST Beat the Market Stock Picking Strategy ★

★ Exclusive Bonus Course – The Stock Market Crash Detector Strategy ★

★ Fully Guided Videos, eBooks & Lifetime Email Support ★

★ 108 Videos + 3 Full eBooks + 5 Scripts for TradingView & Stock Rover ★

The Limits of Intrinsic Value

Intrinsic Value is an estimate in the final analysis because there is no guarantee that future numbers will match the ones you use.

Intrinsic Value estimates are often wrong because they exclude outside factors that can change a company’s price. For instance, the oil price determines the value of an oil company like Exxon-Mobil (NYSE: XOM).

Consequently, any change in oil prices can cause Exxon-Mobil’s free cash flow to fluctuate. Thus, calculating the Intrinsic Value of oil companies is challenging.

Therefore, Intrinsic Value is just one of many tools you should use to analyze stocks. Over-reliance on Intrinsic Value can cost you money by giving you an unrealistic picture of stock values.

Summary

Understanding Intrinsic Value is important for all value investors, but calculating it manually is labor-intensive and counter-productive. Using our Screener Review Winning Stock Screener, Stock Rover will enable you to effectively find the most undervalued companies on the NYSE or NASDAQ exchanges.

FAQ

What is intrinsic value?

Intrinsic value is the inherent value of an asset or investment. Intrinsic value represents what an investor believes is the true economic worth of an asset beyond its market price. Generally, intrinsic value considers tangible and intangible factors such as a company's balance sheet, growth prospects, future earnings potential, and return on investment.

What is the intrinsic value of a stock?

The intrinsic value of a stock is the expected real or economic value of a company's shares based on fundamental factors such as financial performance, management quality, competitive advantage, and prospects. Intrinsic value is often determined by analysis of a company's financial statements with a qualitative assessment of its long-term potential. Although public markets determine the market price for a stock, the intrinsic value is based on the investor's estimate of what it is worth.

The intrinsic value of a stock is the expected real or economic value of a company's shares based on fundamental factors such as financial performance, management quality, competitive advantage, and prospects. Intrinsic value is often determined by analysis of a company's financial statements with a qualitative assessment of its long-term potential. Although public markets determine the market price for a stock, the intrinsic value is based on the investor's estimate of what it is worth.

How to calculate the intrinsic value of a stock?

The intrinsic value of a stock can be calculated by considering various factors such as the company's underlying fundamentals, financial performance, growth prospects, future earnings potential, and return on investment. A company's balance sheet provides a detailed view of its financial position, which should be used to calculate the intrinsic value of a stock. It is also important to look at the company's competitive position and long-term growth potential. Additionally, investors should consider external factors such as market conditions, political risks, and industry trends to get a more comprehensive view of the stock's intrinsic value. Finally, investors should assess the stock's current market price and compare it to their assessment of its intrinsic value.

How to find the intrinsic value of stocks?

To find the intrinsic value of stocks, investors need to thoroughly analyze a company's underlying fundamentals, such as financial performance and growth prospects. Finding a company's intrinsic value is automated when using software like Stock Rover.

How does Warren Buffett calculate intrinsic value?

Warren Buffett believes that the market price of a stock may not reflect its true value. Buffett looks at four main elements when calculating intrinsic value: the company's earnings potential, the quality of management and competitive advantage, and the return on investment a company can generate over its lifetime. Buffett also considers external factors such as market conditions and industry trends.

How to calculate intrinsic value?

Calculating intrinsic value is a complex process that involves analyzing various internal and external factors to determine the true worth of an asset, investment, or project. It is often subjective and can be difficult to calculate accurately. Generally speaking, investors use quantitative and qualitative methods to assess intrinsic value.

Quantitatively, investors rely on financial ratios and industry metrics to calculate the intrinsic value by considering factors such as cash flow, debt-to-equity ratio, profitability, and return on investment.

Qualitatively, investors look at external factors such as market conditions, political risks, and industry trends to better understand the company's long-term potential. Investors also look at a company's competitive position, management quality, and expected future earnings to determine the intrinsic value of a stock.

What is an example of an intrinsic value?

A company named ABC is currently trading at $50 per share. An investor may find that the company's current assets and liabilities, with its future growth prospects, cash flow and competitive position, give it an intrinsic value of $60 per share. In this case, the stock trades at a discount to its intrinsic value, indicating that it might be a good investment opportunity.

What is the importance of intrinsic value?

The importance of intrinsic value lies in being able to accurately assess the true worth of an asset, investment, or project. Knowing the intrinsic value can help investors make more informed decisions and reduce their exposure to risks related to overpaying for an investment. It also allows investors to identify potential opportunities that may be undervalued in the market.

What are some risks associated with calculating intrinsic value?

One risk associated with calculating intrinsic value is that it can be subjective. Since it involves making assumptions and judgments, investors may place too much or too little importance on certain factors, leading to an inaccurate calculation. External conditions such as market volatility and economic uncertainty can also affect a company's perceived worth. As a result, investors must be aware of the potential risks associated with calculating intrinsic value and take steps to mitigate them.

Are You Looking For Stock Investing & Trading Software? Here Are My Favorites.

My favorite software for trading is TradingView because it does everything well. It has backtesting, great charts, stock screening, and an active community of over 3 million people sharing ideas, plus a free plan available globally.

My favorite software for investing is Stock Rover, as it specializes in deep fundamental financial screening, research, and portfolio management. It is the ideal platform for dividend, value, and growth investing.

My favorite software for stock market news is Benzinga Pro, with its super-fast real-time news engine, squawk box, and news impact ratings.

My favorite AI trading software is TrendSpider which enables automatic pattern recognition for Trendlines, Candlesticks, and Fibonacci levels. Trade Ideas uses AI to generate high probability daily trading signals for auto-trading.

My favorite stock-picking service is Motley Fool Stock Advisor, which has a proven track record of beating the market with excellent stock research reports.

Read the Full Top 10 Stock Market Software Testing & Review

Hi Barry,

I’ve Modeled your IV Calculator in Excel.

It matches your results beautifully.

My question is: Where do you get your data from to feed the IV Calculator ?

I’m having difficulty finding reliable data to evaluate for example, a company like BRK.B.

Greatly appreciate your time in responding.

Phil

Hi Philip, thanks for the great question.

That is where the art in the science kicks in. In the section “How To Calculate Intrinsic Value” you need to estimate the company’s cash growth rate and then discount it into the future. It is the toughest part of the calculation, because that is the prediction you have to make. Try running models with different growth rates. How long will the company’s market dominance last, what are the competitive threats?

Barry

Hi, is initial cash flow referring to FCF?

Yes the first year

Hi, for the initial cash flow, are you referring to the latest financial year Free Cash Flow?

Hi Daren, Yes see “1. Take the free cash flow of the first year and multiply it with the expected growth rate”

How is the discount rate calculated? This is not the WACC discount rate right?

Hi Elliott, it is similar, just one is weighted the other not.

In the sample excel spreadsheet for MSFT, how did you calculate the “Value” column and what does the “Value” column represent? Thanks.

Hi Mike, Value is calculated as the discounted cash flow of the business over the next 10 years combined.

Hi Thibaud, Well, this is the art of using this strategy, do you expect the company to continue growing or expect growth to slow. You can input different expectations into the calculation to envisage different scenarios. You need to estimate these figures yourself.

Barry

Hi there,

I do not understand how you find your estimate growth rate, especially for years 6-10.

Thanks for your reply