Investing in the total stock market through global index funds can be an excellent strategy for long-term investors seeking broad market exposure, low costs, and impressive diversification.

In this article, we’ll explore the total stock market, how it works, and why it’s a great investment option.

We’ll also provide a step-by-step guide to investing in the total stock market using global index funds, covering important considerations such as asset allocation and risk management.

Additionally, we’ll discuss five Total Stock Market Index funds, their tickers, descriptions, pros, and cons, and analyze their performance in recent years. Finally, we’ll provide recommendations and tips for investors considering this strategy.

We are not receiving compensation for any of the funds mentioned in this article.

Understanding the Total Stock Market

The total stock market represents a country’s entire universe of publicly traded companies. It includes large, mid, and small-cap stocks across various sectors. The goal of investing in the total stock market is to capture the market’s overall performance rather than individual stocks or sectors.

Why Invest in the Total Stock Market?

Investing in the total stock market offers several advantages, including diversification, growth, lower costs, and efficiency.

- Diversification: By investing in the total stock market, you gain exposure to a wide range of companies across different industries, reducing your reliance on any single stock or sector.

- Long-Term Growth Potential: Historically, the stock market has shown long-term growth, and by investing in the total stock market, you can participate in this growth over time.

- Lower Costs: Index funds generally have lower expense ratios than actively managed funds, which means more of your investment goes towards growing your wealth.

- Efficiency: Investing in index funds allows you to benefit from the expertise of professional fund managers who aim to replicate the performance of a specific index.

What is the total value of the world’s stock markets?

According to recent research, the value of the global domestic equity market has increased significantly over the years. As of 2023, the value of the global domestic equity market was approximately $98.5 trillion. This represents a substantial growth from $65.04 trillion in 2013

The United States holds a substantial portion of the global stock market. As of 2024, the US stock market represents nearly 60% of the total value of equities worldwide, amounting to an estimated $60 trillion.

Step-by-Step Investing in the Total Stock Market

- Set Your Investment Goals: Determine your investment objectives, time horizon, and risk tolerance. This will help you determine the appropriate asset allocation.

- Choose a Global Index Fund: Select a Total Stock Market Index fund that aligns with your investment goals.

- Open an Investment Account: Choose a brokerage firm, such as Firstrade, that offers access to the selected total stock market index funds and open an investment account.

- Determine Your Asset Allocation: Consider your risk tolerance and diversify your portfolio by allocating a portion of your investment funds to the chosen Total Stock Market Index fund.

- Monitor and Rebalance: Regularly review your investment portfolio and rebalance if necessary to maintain your desired asset allocation.

5 Total Stock Market Funds Worth Investigating

Vanguard Total World Stock Index (VT)

The Vanguard Total World Stock Index is a low-cost fund that invests in companies across the globe, including both developed and emerging markets. It offers broad diversification and has a track record of strong performance.

The fund is managed passively to maintain a diversified portfolio of developed and emerging market stocks based on market cap weighting. It excludes frontier markets like Vietnam and Kuwait, similar to other peer funds.

Fidelity Nasdaq Composite Index ETF (ONEQ)

This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market. ONEQ tracks solely Nasdaq-listed companies, excluding those on the NYSE or other exchanges. The index of the underlying funds includes both domestic and international companies listed on Nasdaq.

Schwab Fundamental U.S. Broad Market Index ETF (FNDB)

An index fund that follows the US Total Stock Market’s performance. FNDB begins with the well-known Russell 3000, a market-cap-weighted total market index, and uses fundamental screens to select and weigh its stocks.

iShares Core S&P Total U.S. Stock Market ETF (ITOT)

This ETF aims to mirror the performance of the S&P Total Market Index, providing extensive market coverage in a cost-effective and liquid fund. ITOT is tailored to follow the broad US equity market, encompassing large, mid-, small-, and micro-cap stocks.

SPDR Portfolio MSCI Global Stock Market ETF (SPGM)

An ETF seeking to mirror the investment performance of the Dow Jones U.S. Total Stock Market Index. SPGM contains global stocks that follow a wide-ranging, market-cap-weighted index spanning 23 developed and 27 emerging market countries.

Researching & Managing an ETF Portfolio

Stock Rover is a good choice for researching and managing an ETF portfolio. It offers a simple-to-use platform that provides data on current market conditions, fund performance, dividend history, and more. Stock Rover also allows you to set up watchlists, rebalance your portfolio, and ensure optimal diversification.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

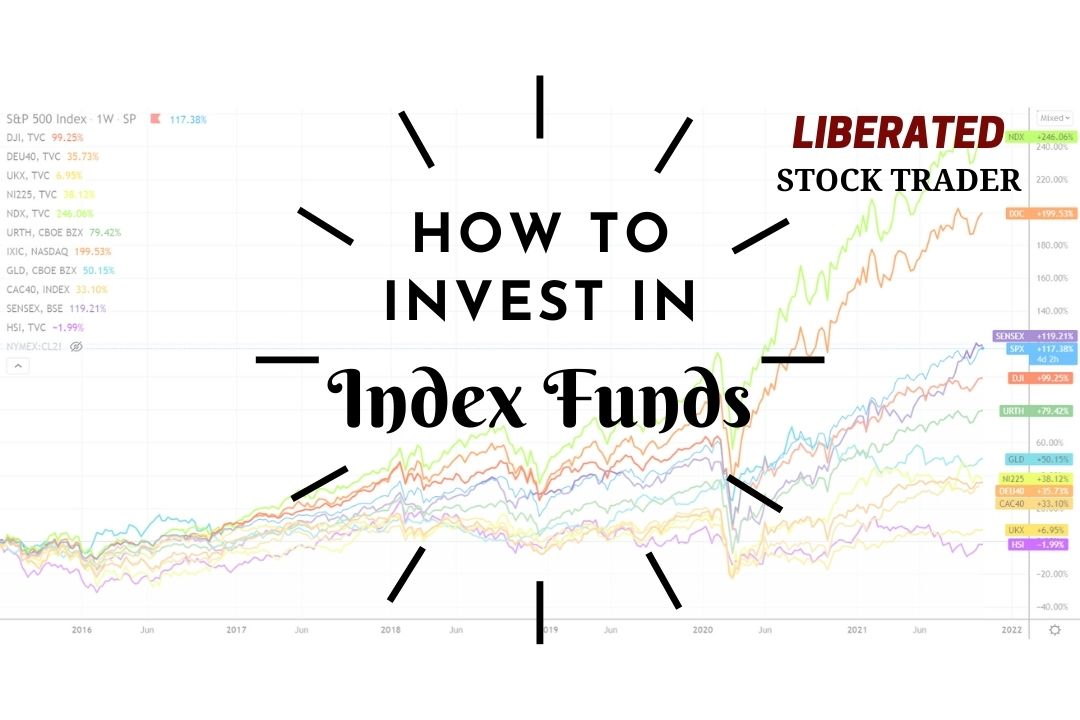

Total Stock Market Index Performance

In the past five years, several index funds have generated varying returns based on the performance of their respective stock market indices. Let’s take a look at the performance of the CAC 40, S&P 500, SENSEX, NASDAQ 100, DAX, and Russell 3000 index funds:

6 Broad Market Country ETFs Worth Considering

S&P 500

The S&P 500 is considered to be one of the most popular and widely followed indices in the world. It tracks the performance of 500 large-cap companies listed on US exchanges. In the past five years, it has shown strong growth with a return of over 70%. This makes it an attractive option for those looking for long-term investments in the US stock market. Over the last five years, the S&P 500 has experienced substantial growth, with a return of 54%.

NASDAQ 100

The NASDAQ 100 (QQQ) is a market capitalization-weighted index that includes the top 100 non-financial companies listed on the NASDAQ stock exchange. It represents a wide range of industries, including technology, retail, and biotechnology. Over the past five years, it has shown impressive growth with a return of over 80%. This makes it a popular choice for investors interested in high-growth sectors and innovative companies.

Russell 3000

The Russell 3000 is a market capitalization-weighted index that represents the top 3,000 publicly traded companies in the United States. It covers approximately 98% of the total US equity market and includes large, mid, and small-cap stocks across all major industries. This broad representation makes it a popular benchmark for many investors. Over the past five years, it has exhibited solid growth, with a return of 47%.

DAX

The DAX (Deutscher Aktienindex) is Germany’s primary stock market index. It consists of the 30 largest and most actively traded German companies on the Frankfurt Stock Exchange. In recent years, it has seen strong growth, with a return of over 60% in the last five years.

SENSEX

The SENSEX is India’s oldest and most widely tracked stock market index. It consists of 30 well-established and financially sound companies representative of various sectors in the Indian economy. In the past five years, it has shown steady growth of over 50%, making it an attractive option for investors looking to diversify their portfolio with exposure to emerging markets. The SENSEX has shown a positive upward trend in the last five years, with an average return of approximately 70%.

CAC 40

The CAC 40 is a benchmark French stock market index. Over the last five years, it has experienced reasonable growth, with a return of 32.5%. This index tracks the 40 largest and most active stocks listed on Euronext Paris, making it a good representation of the French stock market as a whole.

FAQ

What is the best software for researching total stock market funds?

Stock Rover is a top choice for in-depth research and streamlined ETF portfolio management. Its user-friendly platform offers current market data, fund performance, dividend history, and more. Simplify your investment journey with Stock Rover's robust features and seamless user experience.

What are total stock market index funds?

Total Stock Market Index Funds aim to track the performance of a broad market index, such as the CRSP US Total Market Index, providing investors with exposure to a wide range of stocks across different sectors and market capitalizations.

What are the key features of total stock market index funds?

Total stock market index funds offer diversification by holding many stocks and lower expense ratios than actively managed funds. They also provide easy access to the entire stock market in a single investment.

How do total stock market index funds work?

Total stock market index funds use a passive investment approach, aiming to replicate the performance of the underlying index. They typically hold the same stocks in the same proportions as the index they track.

Who should invest in total stock market index funds?

Total stock market index funds are suitable for long-term investors seeking broad market exposure, diversification, and a low-cost investment strategy.

What factors should I consider before investing in total stock market index funds?

Consider your investment goals, risk tolerance, and time horizon. Review the fund's expense ratio, tracking error, and historical performance. Confirm the fund's diversification and ensure it aligns with your desired exposure.

What are the advantages of investing in total stock market index funds?

The advantages of total stock market funds are low costs and expense ratios, diversification across the entire stock market, and simplicity and ease of investing.

How have Total Stock Market Index Funds performed historically?

Historical performance has shown that Total Stock Market Index Funds tend to deliver returns in line with the overall stock market performance over the long term.

How do Total Stock Market Index Funds compare with actively managed funds?

According to the S&P 500 SPIVA reports, Total Stock Market Index Funds generally outperform a significant percentage of actively managed funds due to their low fees and broad market exposure.

How can I start investing in Total Stock Market Index Funds?

- Open an investment account with a reputable brokerage firm.

- Choose a Total Stock Market Index Fund that aligns with your investment goals.

- Invest by purchasing shares of the fund through your brokerage account.