Most people believe the difference between mutual funds and ETFs is that ETFs are index-tracking funds, and mutual funds are actively managed funds.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

While this is true in many cases, it does not tell the entire story. The flow of capital is the deciding factor to consider when comparing these two investment options.

Let’s start with what ETFs and mutual funds have in common.

ETF and mutual funds commonalities

Both ETFs and mutual funds can be index-tracking and passively managed funds. Additionally, mutual funds and ETFs can be actively managed with a team of researchers and a nominated fund manager.

| ETFs vs. Mutual Funds | ETF | Mutual Fund |

| Index Funds | ✔ | ✔ |

| Actively Managed | ✔ | ✔ |

| Passively Managed | ✔ | ✔ |

| Fund Managers | ✔ | ✔ |

| Research Teams | ✔ | ✔ |

Table: ETFs vs. Mutual Funds Similarities

ETFs and mutual funds can both passively track an index, sector, or industry and be actively managed funds trading in exotic assets like currencies, property, bonds, derivatives, and swaps.

The difference between ETFs and mutual funds

The difference between ETFs and mutual funds is ETFs are normally sold and bought on an exchange, while mutual funds are valued, traded, and priced at the end of a trading day. ETFs have lower fees, averaging 0.35%, and Mutual fund fees are over 1%.

Mutual funds usually have higher fees than ETFs due to their complex structure and trading mechanism.

Additionally, ETFs have lower taxes compared to mutual funds, as some of the ETFs are tax-exempt. Finally, mutual funds have a higher minimum investment requirement than ETFs.

The three big differences between ETFs and mutual funds are that ETFs are traded openly on an exchange, have better tax efficiency, and generally have lower costs. Mutual funds are bought and sold directly or via a financial advisor through the fund company.

When you sell your shares of a mutual fund, the fund manager sells the stocks, and you typically incur capital gains tax; this is generally avoided with ETFs.

Benefits of ETFs over Mutual Funds

ETFs offer benefits over Mutual Funds, including lower costs, transparency in holdings and pricing, greater tax efficiency, and the ability to trade intraday. They have become increasingly popular as investors look for cost-effective ways to diversify their portfolios.

Benefits of Mutual Find over ETFs

Mutual funds offer distinct advantages over ETFs, including access to actively managed portfolios and diversification without buying multiple stocks or ETFs. In addition, mutual funds often have higher costs than ETFs, but they provide professional management that some investors may find valuable. Mutual Funds also allow investors to invest in a wide range of investment strategies and asset classes, including international markets, emerging markets, high-yield bonds, and more.

Additionally, mutual funds often offer various tax advantages over ETFs due to their longer holding periods. Because mutual funds are sold at fixed prices and can be held for an extended time frame, investors may benefit from long-term capital gains taxes.

Table: ETFs vs. Mutual Funds Comparison

| ETFs vs. Mutual Funds | ETF | Mutual Fund |

| Index Funds | ✔ | ✔ |

| Actively Managed | ✔ | ✔ |

| Passively Managed | ✔ | X |

| Fees | 0% – 0.6% | 1% – 3% |

| Trade like stocks | ✔ | X |

| Fund Pricing | Real-time | End of Day |

| Tax Advantages | ✔ | X |

Table: ETFs vs. Mutual Funds Comparison

- Related Article: How to Invest in Index Funds to Maximize Long-term Profits

ETF and mutual funds differ primarily in capital flow.

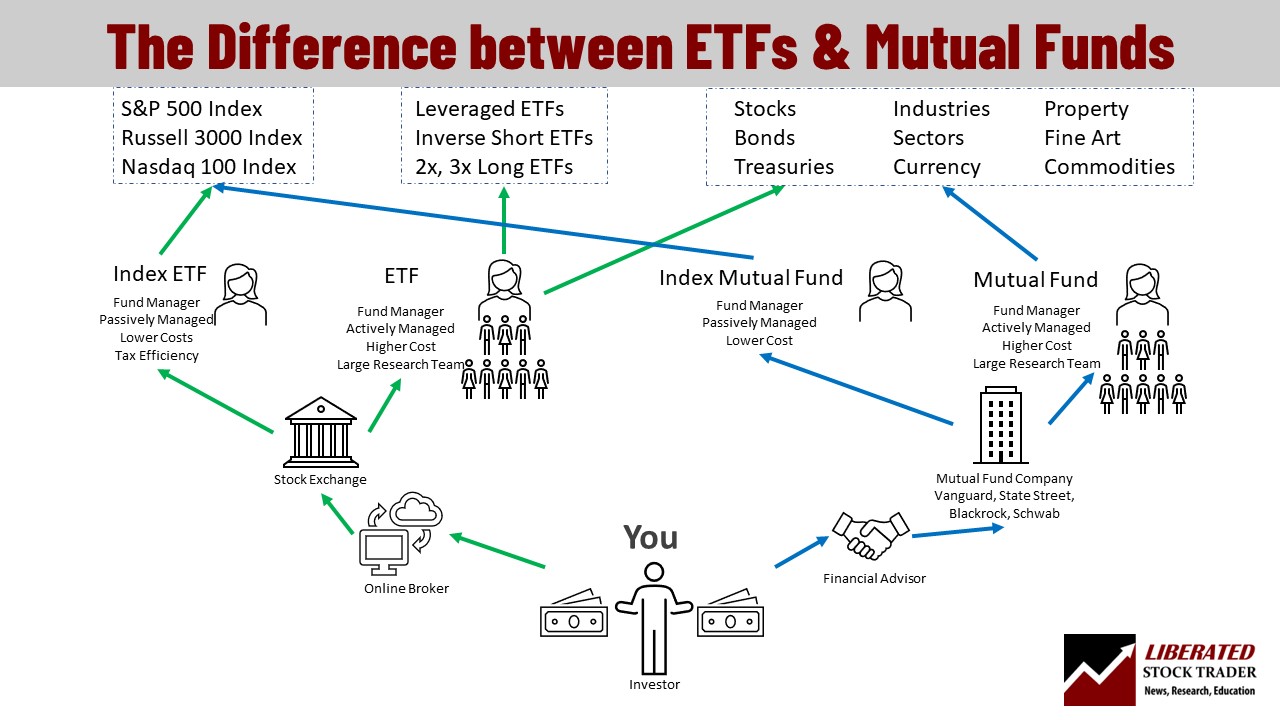

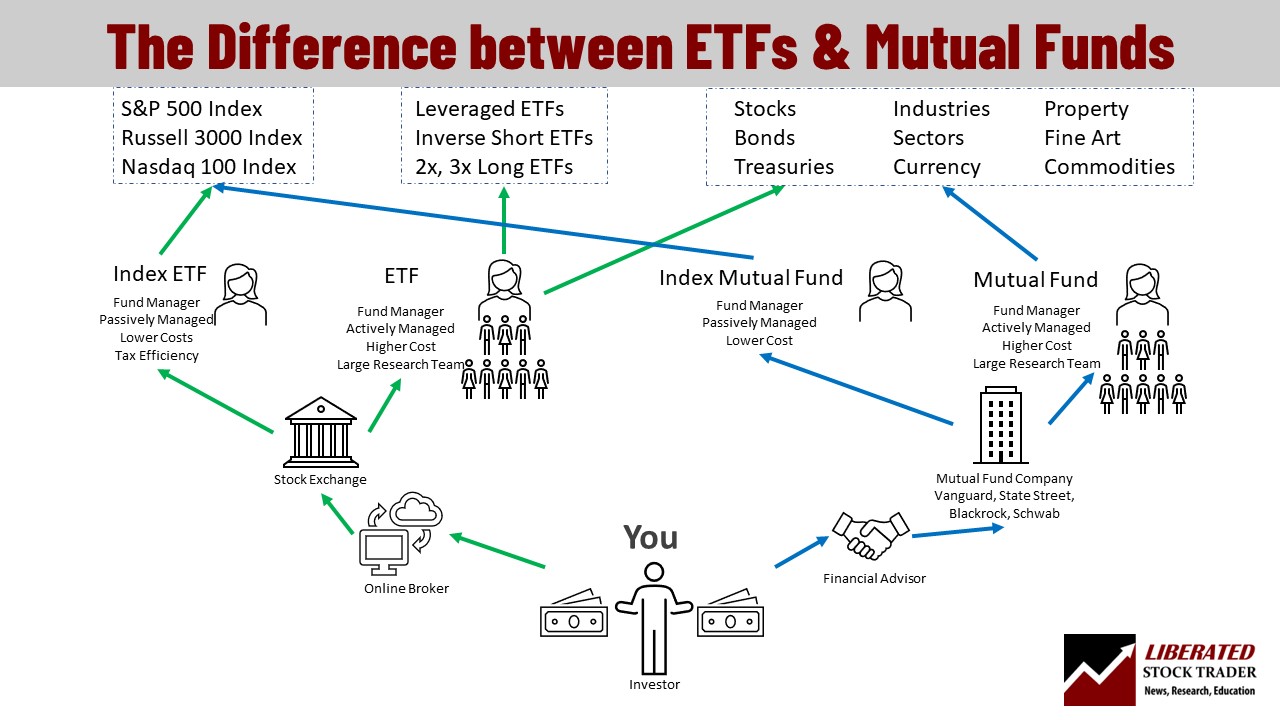

The biggest difference between ETFs and mutual funds is how capital flows from you, the investor, into the stocks and assets you are purchasing.

When you purchase an ETF, you transfer money to an online broker and then purchase the ETF through an exchange. If someone is selling the ETF, you are matched with them for the trade; if not, the capital is treated as an inflow to the fund, and the fund manager purchases extra assets.

When you purchase a mutual fund through a financial advisor, they will handle the paperwork and manage your investment portfolio and reporting. For this service, the financial advisor receives a commission from the mutual fund, which is usually a cut of your annual fee; this is why fees are usually higher for mutual funds.

Example: The Difference between ETFs and Mutual Funds

The image below shows your capital flow into the assets purchased.

In ETFs, capital flows directly from you to the market maker, who then purchases the underlying assets. In mutual funds, capital is routed to a financial advisor and then to the fund manager, who buys more assets—this extra layer of handling costs money in terms of fees, commissions, and other expenses.

Also, with ETFs, you get faster trading execution because trades are executed directly in the market. Mutual funds can take a few days or even weeks to settle trades, depending on the size of the orders.

Capital flow when purchasing an ETF

- You open an account with an online broker

- You transfer money into your brokerage account

- You purchase an ETF, and your broker routes the trade through an exchange

- Your ETF purchase is exchanged with someone selling the ETF or routed to the fund who purchases more equities or assets

- When you sell your ETF, the transaction is with someone buying the ETF on the exchange (which avoids capital gains tax), or the fund liquidates the assets, meaning you incur capital gains tax.

Capital flow when purchasing mutual funds

- You purchase a mutual fund through your financial advisor or directly with the fund management company, Vanguard, Schwab, Blackrock, etc.

- The fund management company purchases extra securities, stocks, derivatives, bonds, or currencies.

- When you sell shares in a mutual fund, the fund management team liquidates the assets, and you incur capital gains tax.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

How Mutual Fund Expense Ratios Eat Away Your Investment.

When you buy and sell mutual funds, the fund management company charges an expense ratio for its services. This fee is removed from your investment, reducing your returns over time. Some mutual funds have higher expense ratios than others, so it’s important to check the fees before investing in a particular fund.

The higher the fee, the more money deducted from your investment and the lower your returns will be. Mutual fund expense ratios can take a huge bite out of your profits, so it’s important to be aware of them when making decisions about investing in mutual funds.

Example: How Mutual Fund Expenses Hurt Compounding in the Long Term

For example, if you purchase a mutual fund with an expense ratio of 1.20%, $1.20 of every $100 invested is taken out of your account to cover the fund’s expenses. Over time, this can have a big impact on your returns. Let’s look at an example. If you invest $10,000 in a mutual fund with an expense ratio of 0.90% and it earns an 8% return each year, after ten years, you would have $20,483.

However, if the same mutual fund had an expense ratio of 2.20% and earned the same 8% return each year, you would have $18,852 after ten years. That’s a difference of $1,631!

Choosing the right mutual fund with low expenses is important for long-term compounding and, ultimately, higher investment returns. Additionally, when considering which mutual funds to invest in, it’s important to research factors such as the fund’s performance history and strategy.

How Do Actively Managed Mutual Funds Perform

The Standard & Poor’s SPIVA report is an annual study done on mutual funds. It compares the performance of actively managed mutual funds to a relevant index over different time horizons.

Unfortunately, the results consistently show that most actively managed mutual funds underperform their benchmark indices. For example, the 2022 S&P 500 SPIVA US Scorecard revealed that 93.4% of large-cap actively managed mutual funds underperformed the S&P 500 index over the last 15 years. The last five years reveal underperformance of 86%

Ultimately, the difference between index ETFs and Mutual Funds is:

Most actively managed funds underperform their benchmark indices, and you will pay much higher fees that eat into your compounded profits. Choose index-tracking ETFs over Mutual Funds.

In the words of the famous investor John C. Bogle:

“Taxes, Broker Costs, Mutual Fund Manager Costs, and Financial Advisor costs will severely eat away at the long-term compounding power of your investments.” – John C. Bogle

FAQ

What is the best software for ETF and mutual fund investing?

Stock Rover is the best software for ETF and mutual fund investing. It provides in-depth analytics, portfolio tracking, and research capabilities to help you gain better insight into your investments.

What are ETFs and Mutual Funds?

ETFs (Exchange-Traded Funds) and mutual funds are pooled investments, giving investors a diversified portfolio. ETFs trade like stocks, while mutual funds are valued based on their net asset value.

How do ETFs and Mutual Funds differ?

The primary difference lies in how they're traded and their expanses. ETF prices are determined by market forces and can be bought/sold throughout the day. Mutual funds are traded only at the end of the day at their net asset. ETFs average 0.35% expenses per annum, but mutual funds average 1.55%; this added expense eats into your long-term compounding profits.

Are ETFs more cost-effective than Mutual Funds?

Yes, ETFs are generally more cost-effective than mutual funds. Because ETFs are traded like stocks, they have lower expenses. This allows you to keep a larger portion of your profits over the long term instead of paying out money in fees.

Which is more tax-efficient, ETFs or Mutual Funds?

ETFs tend to be more tax-efficient than mutual funds because they have lower turnover rates. When mutual funds sell their underlying stocks, this triggers capital gains taxes that are passed onto investors. Because ETFs don't need to sell holdings as often, they can keep more of the returns instead of having to pay out money in taxes.

Can Mutual Funds and ETFs serve similar purposes for investors?

Yes, both mutual funds and ETFs provide exposure to a wide variety of asset classes and can serve similar investment goals.

How flexible are ETFs compared to Mutual Funds?

ETFs offer more flexibility as they can be traded throughout the day, like stocks, while mutual fund transactions are processed only at the end of the trading day.

Which is better for long-term investment, ETFs or Mutual Funds?

ETFs are better for long-term investment as they provide lower cost and tax efficiency. Mutual funds tend to be less tax efficient due to their structures, which can result in more capital gains taxes being paid out when the fund manager needs to rebalance or sell holdings.

What are the minimum investment requirements for ETFs and Mutual Funds?

ETFs can be bought in single shares, while mutual funds often have a minimum investment requirement ranging from $500 to thousands of dollars.

Are ETFs more liquid than Mutual Funds?

ETFs are typically more liquid than mutual funds, as they can buy and sell shares throughout the day. Mutual fund transactions are processed only at the end of the trading day.

Can I trade International ETFs and Mutual Funds?

Yes, both ETFs and Mutual Funds offer access to international markets. ETFs like the Vanguard Total World Stock ETF (VT) and Mutual Funds like the Fidelity International Discovery Fund (FIGSX) can give you exposure to international markets.

Are ETFs and Mutual Funds suitable for short-term investing?

Mutual funds are not recommended for short-term investing, as they have higher fees and lack real-time liquidity. Some leveraged ETFs are ideal for day trading, like the ProShares Ultra S&P500 (SSO) or the ProShares Ultra (QQQ).

Can I buy ETFs and Mutual Funds with small amounts of money?

Yes, ETFs can typically be purchased with relatively small amounts of money. Mutual funds usually require a minimum of $500 to $1,000 for investment. Additionally, some brokerage firms offer no-transaction fees and no-minimum mutual funds that are suitable for small investments.

Do ETFs have higher liquidity than Mutual Funds?

Yes, ETFs have higher liquidity than mutual funds, as they can be bought and sold on the stock exchange in real-time. ETFs also generally have lower fees than mutual funds.

How transparent are ETFs and Mutual Funds?

ETFs are more transparent than mutual funds, providing daily real-time information about their portfolio holdings. Mutual funds only disclose their holdings once a quarter.

Can ETFs be short-sold?

Yes, unlike mutual funds, ETFs can be short-sold; there is a huge selection of inverse ETFs out there that you can use to short the market.

Don’t Invest In Index ETFs Until You Read These 13 Pro Tips!

More articles related to funds

- ETFs vs. Mutual Funds: The Difference Impacts Your Gains

- What is an Index Fund, and How Do They Work?

- How to Invest in Index Funds to Maximize Long-term Profits

- ETFs vs. Mutual Funds vs. Index Funds: Explained

- Investing in Index Funds: Everything You Need to Know

- ETFs vs. Stocks. 7 Reasons ETFs Are Better