Investing in index funds is a great low-cost way to diversify your portfolio and reduce risk.

Index funds are a type of passively managed investment that aims to replicate the performance of a specific market index. Instead of trying to beat the market by picking individual stocks, index funds hold a diverse portfolio of securities that match the underlying index. Index funds track the performance of major stock market indices, such as the S&P 500, Nasdaq 100, or even the global stock market.

Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.

Read on to learn more about the benefits of investing in index funds and how you can get started.

What is an index fund?

An index fund is an exchange-traded fund (ETF) or a mutual fund that seeks to match the performance of a benchmark index like the S&P 500 or the Nasdaq 100. The index fund achieves parity with an index by ensuring it owns a representative sample of all the equities in the index.

Buying a share of an index fund means you buy a portion of all of the stocks in the underlying index being tracked by the fund.

An index is a portfolio or list of equities, commodities, or securities, usually stocks, that form the basis of an index fund. An index fund is an investment fund that only owns equities, securities, or commodities on a specific index. For example, an S&P 500 index fund only invests in Standard & Poor’s 500 stocks.

Index ETFs vs. mutual funds

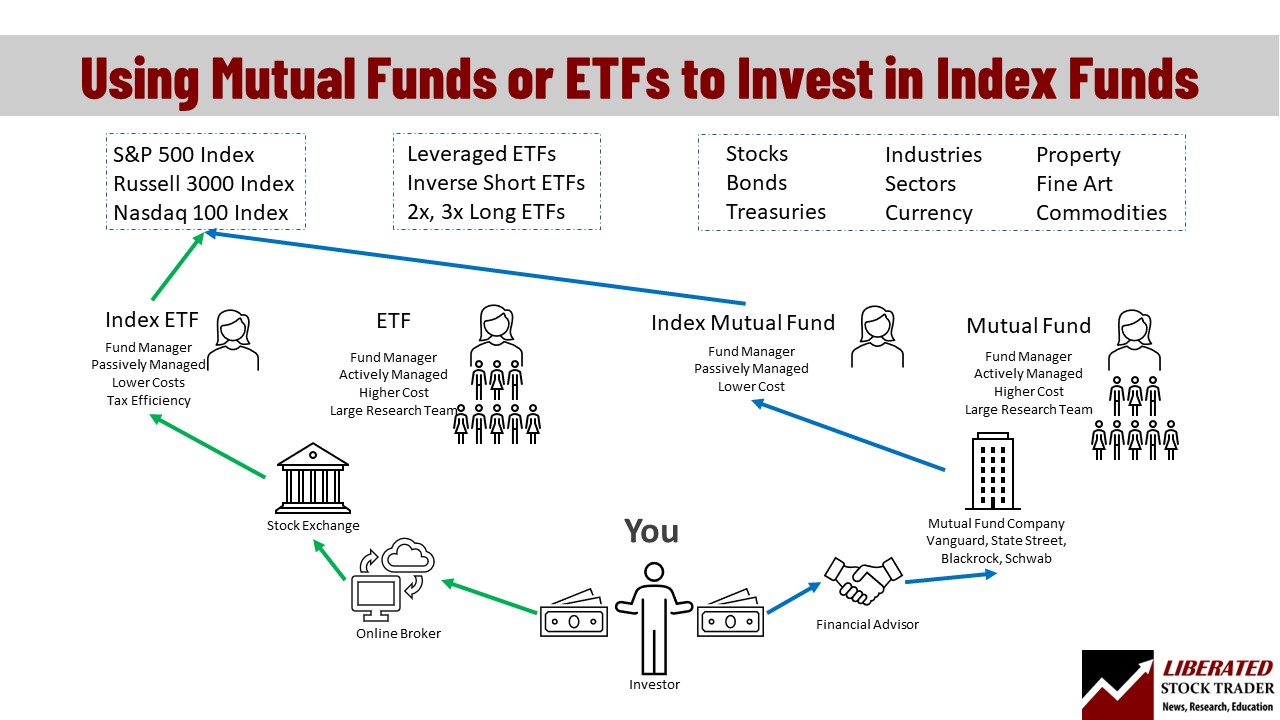

ETFs hold many advantages over mutual funds when investing in an index, such as tax efficiency, lower costs, and better liquidity. ETFs are traded openly on an exchange and are passively managed, meaning they cost less and are tax-efficient by allowing investors to trade directly with each other, thus avoiding redemption and, therefore, capital gains tax.

When deciding on an Index Fund, you need to consider the type of fund: a mutual fund or an exchange-traded fund. Exchange-traded funds are growing wildly in popularity due to their structure and benefits.

| ETFs vs. Mutual Funds | ETFs | Mutual Fund |

| Index Funds | ✔ | ✔ |

| Actively Managed | X | ✔ |

| Passively Managed | ✔ | X |

| Fees | 0% – 0-6% | 1% – 3% |

| Traded Like Stocks on Exchanges | ✔ | X |

| Can be traded: | Intraday | End of day |

| Tax Advantages | ✔ | X |

Table: ETFs vs. Mutual Funds Comparison

For independent investors seeking to maximize compounding by keeping costs low, paying less tax on gains, and wanting to sell their investments whenever they want without penalties, index ETFs are clearly the better option.

Key Takeaways

- Mutual funds are generally actively managed by teams dedicated to beating the market, but only 17% succeed in their goal.

- Passively managed ETFs track a specific stock market index to at least equal market returns; in the long term, this beats 82.5% of mutual funds.

- Passively managed index-tracking ETFs usually incur much lower management fees than actively managed mutual funds. A fee saving of 2% per year compounded for 20 years could mean an extra 48% extra in your investment.

- ETFs are exchange-traded funds, meaning they can be purchased on the open market during trading hours and typically reflect the stock index price. ETFs can also be shorted and allow options trades.

Index ETFs – The Cornerstone of a Portfolio

As a certified professional market analyst, investor, and trader for over two decades, I can tell you I have over 80% of my stock portfolio invested in index funds. Stock trading is for short-term high-risk gains, and investing in long-term index ETF strategies is for a happy and comfortable retirement.

What is the best index fund?

While there is no “best index fund,” well-managed funds have low costs and are large enough to guarantee longevity. The best index funds have over $1 billion in assets under management, expense ratios under 0.2%, and are with 1% of the performance of the underlying benchmark index.

What are the best index funds to invest in?

Here is a list of the ten largest index funds ranked by most assets under management (AUM) and lowest expense ratios.

| Ticker | Best Index ETF | Expense Ratio |

| VTI | Vanguard Total Stock Market Index Fund ETF Shares | 0.03% |

| VOO | Vanguard S&P 500 ETF | 0.03% |

| SPY | SPDR S&P 500 ETF Trust | 0.09% |

| IVV | iShares Core S&P 500 ETF | 0.03% |

| VIG | Vanguard Dividend Appreciation Index Fund ETF Shares | 0.06% |

| ITOT | iShares Core S&P Total U.S. Stock Market ETF | 0.03% |

| VV | Vanguard Large-Cap Index Fund ETF Shares | 0.04% |

| SCHX | Schwab U.S. Large-Cap ETF | 0.03% |

| IWB | iShares Russell 1000 ETF | 0.15% |

| USMV | iShares MSCI USA Min Vol Factor ETF | 0.15% |

Table: Best Index ETF Funds 2024

Screen for ETFs on TradingView

5 Total Stock Market Funds Worth Investigating

Vanguard Total World Stock Index (VT)

The Vanguard Total World Stock Index is a low-cost fund that invests in companies across the globe, including both developed and emerging markets. It offers broad diversification and has a track record of strong performance.

The fund is managed passively to maintain a diversified portfolio of developed and emerging market stocks based on market cap weighting. It excludes frontier markets like Vietnam and Kuwait, similar to other peer funds.

Fidelity Nasdaq Composite Index ETF (ONEQ)

This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market. ONEQ tracks solely Nasdaq-listed companies, excluding those on the NYSE or other exchanges. The index of the underlying funds includes both domestic and international companies listed on Nasdaq.

Schwab Fundamental U.S. Broad Market Index ETF (FNDB)

An index fund that follows the US Total Stock Market’s performance. FNDB begins with the well-known Russell 3000, a market-cap-weighted total market index, and uses fundamental screens to select and weigh its stocks.

iShares Core S&P Total U.S. Stock Market ETF (ITOT)

This ETF aims to mirror the performance of the S&P Total Market Index, providing extensive market coverage in a cost-effective and liquid fund. ITOT is tailored to follow the broad US equity market, encompassing large, mid-, small-, and micro-cap stocks.

SPDR Portfolio MSCI Global Stock Market ETF (SPGM)

An ETF seeking to mirror the investment performance of the Dow Jones U.S. Total Stock Market Index. SPGM contains global stocks that follow a wide-ranging, market-cap-weighted index spanning 23 developed and 27 emerging market countries.

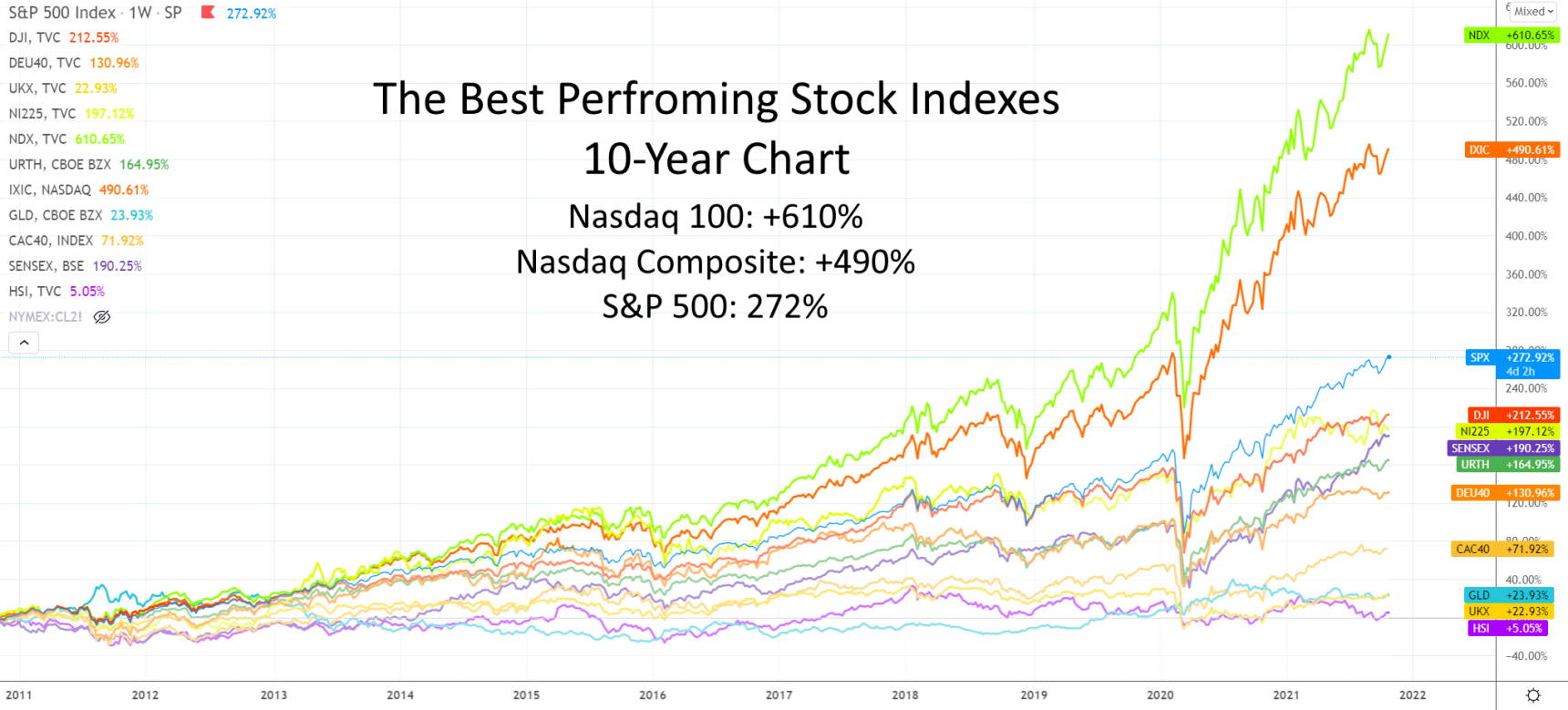

What are the best-performing index funds?

The best index funds to invest in track the highest-performing indices. The three best-performing indices over the past 10 years are the Nasdaq 100 +610%, the Nasdaq Composite +490%, and the S&P 500 +272%.

Source: TradingView

Screen for ETFs on TradingView

Mutual Funds & ETFs are Index Funds

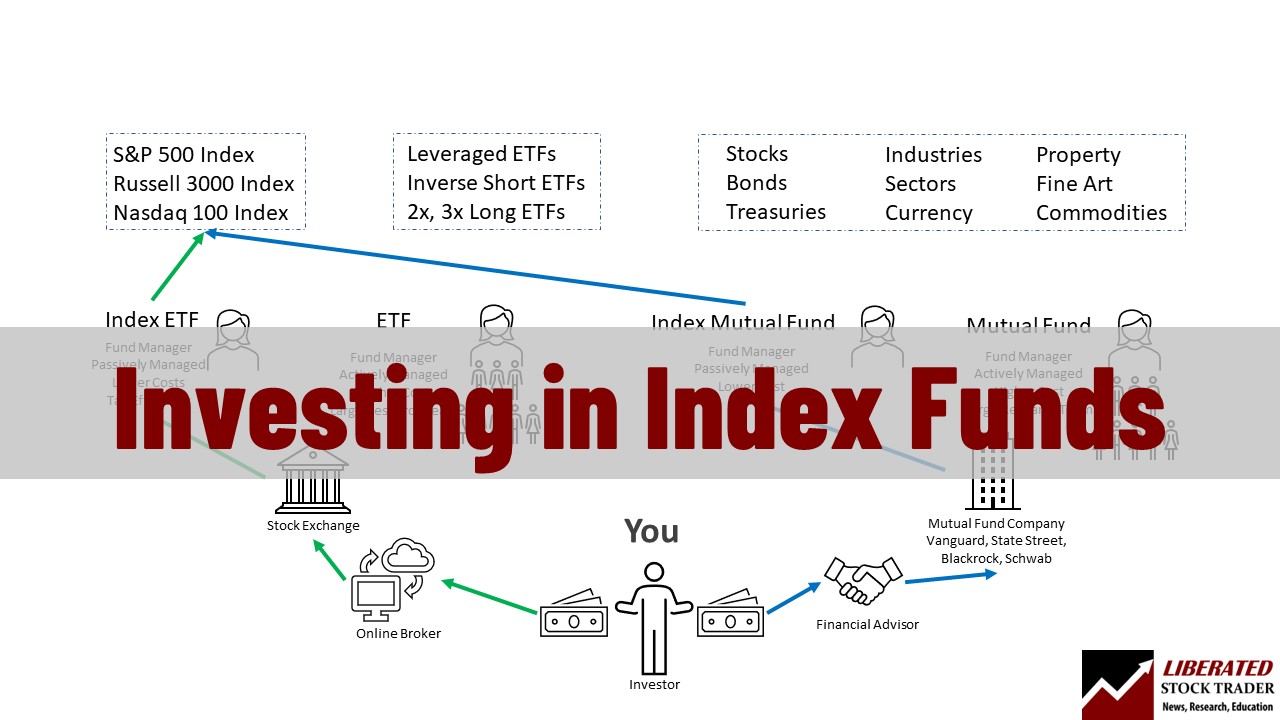

Whether you use a mutual fund or an ETF, you can still invest in an index. The difference is the process in which you invest your capital. A mutual fund index investment flows through a financial advisor or your retirement fund, and an index ETF investment flows from you straight to the stock exchange.

Why index ETFs are better than mutual funds

An index-tracking ETF trades like a stock on an exchange and attempts to mimic the movement of a particular stock index, such as the S&P500, as closely as possible while keeping fees to an absolute minimum. Low management fees and performance close to that of the underlying index are the hallmarks of an index fund.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Why invest in index funds?

There are four important benefits when investing in index funds: diversification, steady inflation-beating returns, little research is required, and buying an index ETF is as simple as buying a stock.

Index fund diversification

Index funds are naturally more diversified than investing in an individual stock or commodity. An index consists of at least 100 stocks for the Nasdaq 100, 500 stocks for the S&P 500, or even 3,000 stocks for the Russell 3,000.

For example, owning an individual stock could mean that you experience regular price fluctuations of 5 or 10% in one trading day, whereas owning an index such as the S&P 500 means you may experience a price fluctuation of 5% only once every five years.

Indexing is a risk management tool that reduces risks through diversification. Diversification means buying many investments to reduce risks.

The theory behind diversification is that you can lose all your money if you concentrate your investment in one sector. For example, a tech sector crash could wipe out a person who only owns a few technology stocks.

Diversification tries to protect a nest egg by putting money into different sectors or investments. The theory is that diversifying your investments makes you less likely to lose your money. Experts recommend diversification for people saving for retirement.

Advocates believe the more diversification, the higher the margin of safety. Indexing is an effort to achieve a high level of diversification. An S&P 500 Index Fund includes 500 stocks in many industries and is one of the most diversified investments available.

People who purchase index funds are buying a diversification strategy. They design funds such as the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) to offer a high margin of safety. The hope is that SPY will retain value because it holds equity in the 500 most successful companies in the USA.

They base the diversification of Index Funds on Modern Portfolio Theory (MPT). Economist Harry Markowitz created MPT in the 1952 Journal of Finance paper Portfolio Selection. The theory was so influential that Markowitz won a Nobel Prize in economics.

Modern Portfolio Theory teaches that the right mix of investments can offer higher returns and lower risks. When fund managers create an index, they apply the Modern Portfolio Theory.

Steady Inflation Beating Returns

Index funds are popular because they offer high rates of return on a steady basis. The S&P 500 offered an 18.4% annual rate of return in 2020 and a 31.49% annual rate of return in 2019, according to Stock Rover. The S&P 500 offered an average long-term return of 9.64% in the period ending on February 1, 2021.

One belief behind indexed funds is that the regular high rate of return will cancel out losses. FOR EXAMPLE, the S&P 500’s 31.49% return in 2019 and 21.83% return in 2017 made up for the -4.38% loss in 2018.

Many investors believe that high returns and steady growth reduce risk. The constant growth offsets losses in declining industries and reduces the risks from economic downturns and market losses.

An S&P 500 index fund, such as the SPY or the Vanguard S&P 500, will hold stock in technology companies such as Apple (AAPL) and rising businesses like Tesla (TSLA). The S&P 500 investor theoretically enjoys the benefits of technology stocks without the risks.

Little Work or Research is Necessary

One reason for the popularity of index funds is that investing in them often requires little work or research. Index fund investors do not have to spend hours researching individual stocks or companies. No knowledge of the markets, the economy, technology, products, or politics is necessary. All the investors need to do is put money in the fund.

When you own an S&P Index Fund, you do not have to follow the market daily or individual stocks. The fund will buy stocks based on their market caps.

Index funds are popular with investors who do not have time for research. Professionals with full-time jobs and families like index funds because they make investing fast and simple.

Many advisors recommend index funds because they require little investor education. The advisor does not need to spend hours explaining an investment or the markets to someone who dislikes discussing financial matters. Index funds are popular because they require little thought, work, time, or research.

Try Powerful Financial Analysis & Research with Stock Rover

Investing in Index Funds is Easy

Index funds are popular because they are simple and easy to invest in. You can buy fractional shares of index exchange-traded funds (ETFs) through apps such as Robinhood, the Cash App, Interactive Brokers, Gemini, and WeBull for as little as 1¢.

A fractional share is a tiny percentage of a stock or ETF. For example, you could buy $5 worth of the SPDR S&P 500 ETF Trust (NYSEARCA: SPY). People who cannot afford to pay several hundred dollars for a SPY share can invest in SPY with fractional shares.

Index mutual funds from companies such as Vanguard and Fidelity can be purchased by anyone. To begin the purchase process, go to the company’s website.

Many organizations allow employees to purchase mutual funds and ETFs through 401k and other investment plans. The advantage of these tax-deferred investments is that they take the funds from your salary. Many organizations’ human resources departments make it easy to enroll in 401k plans.

Why should you avoid index funds?

Index funds have drawbacks that make them poor investments for some. The investment media, financial advisors, and fund companies often hide these drawbacks to make index funds more appealing. All investors need to understand index funds’ limitations.

Individual stocks can grow faster than indexes.

According to Stock Rover, the 5-year return of Amazon.com is 325% versus the S&P 500 return of 112%. Individual stocks could better serve people who want high growth rates and investments they can sell for cash. Individual stocks can offer higher rates of growth and return. Stocks are also better for speculation. The tough challenge is picking the right growth stocks that will beat the market in the future.

Individual stock risks are far greater than those from index funds. Diversification reduces risk, but it often leads to lower overall returns.

Everybody who buys an index fund must realize that they are forgoing other opportunities that could be far more profitable but that those opportunities will carry far higher levels of risk.

There is no guarantee of index growth and returns.

The great attraction of indexes is the long-term margin of safety and steady growth that indexes offer. Index funds can suffer enormous short-term losses, however.

The S&P 500 lost 38.49% of its value during the financial crisis crash of 2008, but in 2009, it recovered when it grew by 23.45%.

The S&P 500 can suffer multi-year losses during a stock market crash. According to Stock Rover, the S&P 500 shrank in 2000, 2001, and 2002 and fell by 10.14% in 2000, 12.04% in 2001, and 23.37% in 2001.

History shows that steady index growth is not guaranteed every year. There have been periods of losses. Index recovery can come fast; Stock Rover estimates the S&P 500 grew by 26.38% in 2003.

Investors need a system to help them avoid stock market crashes when investing in index funds.

Index investors have no control over the fund holdings

Many people love index funds because they do not have to research or pick stocks. This lack of control can create moral and other hazards for investors.

An index fund could hold stocks in companies in which investors have moral or philosophical objections. An S&P 500 fund could own tobacco companies, gambling companies, distillers, brewers, companies that distribute offensive entertainment programs, oil companies, defense contractors, and companies that build weapons. An index could also hold stock in companies that engage in union-busting and outsourcing or companies that donate money to politicians people object to. Many large American companies donate to politicians and organizations like the Republican and Democratic parties.

The proposed Alpha Architect ETF Trust will only hold stock in companies run by what its creators call “high-character” CEOs, a Securities & Exchange Commission (SEC) filing claims. The high character could mean CEOs with high ethical standards or exemplary behavior.

You will be stuck with the index’s strategy.

Managers design index funds to implement a strategy automatically; an S&P 500 Fund will sell any stock that leaves the Standard & Poor’s 500, no matter how good that stock is.

Most S&P 500 fund owners invest in risky stocks they would normally avoid because those stocks are in the index. They base the S&P 500 Index only on the market capitalization of companies. Nobody evaluates S&P 500 stocks for their performance.

Index fund investors must be comfortable with the index’s strategy because they are stuck with it.

- Related Article: 13 Top Stock Portfolio Examples & How To Implement Them

How do index funds work?

Index funds work by replicating the price movement of the benchmark index. When an investor purchases shares in an index-tracking ETF, the fund must purchase the equivalent amount of all stocks in the index to ensure the total value of its assets has parity with the index.

This process is automated for passive index-tracking ETFs; machines buy and sell the equivalent investments in the index, typically achieving 99% parity with the benchmark index.

What are low-cost index funds?

A low-cost index fund is typically an index-tracking fund like the SPDR S&P 500 ETF Trust (Ticker: SPY), a passive fund that replicates the performance of the S&P 500 but charges less than 0.2% per year in management fees.

The equivalent actively managed S&P 500 mutual fund could charge up to 3% per year in fees.

What happens to index funds when the market crashes?

Over the last 100 years, there have been six major stock market crashes, with an average loss of 57%. If the stock index drops 57%, you can expect the index fund to lose approximately 57%. In the 2020 Covid crash, the S&P 500 lost 38% of its value in 4 weeks, and so did the SPDR S&P 500 index-tracking fund.

How do you prepare for a stock crash if you are investing in index funds?

To prepare for a stock crash while owning index funds, you have two options: First, you must own a large, highly liquid index-tracking ETF that can be quickly sold on the open market. Secondly, you could decide not to sell but employ dollar-cost averaging to buy more positions as the stock prices decrease.

Selling your index fund during a crash is known as market timing. No one knows the duration of a stock market crash or how much the market will decline. You could sell at the bottom of the crash and miss out on the market recovery.

Using dollar-cost averaging, you could decide not to sell during a crash but accumulate more stock for lower prices as the market declines. This strategy requires you to have sufficient cash funds and the time to let the market recover.

- Learn more about how to invest in index funds practically

A strategy for beating the market with index funds.

One of the best strategies to invest in index funds and outperform the market is to avoid major stock market crashes. To avoid crashes requires you to be a master of technical analysis or have a rigorous, backtested system that has worked on all previous stock market crashes.

I have developed an ETF index investing system that beats the underlying benchmark index and lowers your risk at the same time. I achieve this by avoiding major stock market crashes.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters