Our ten-year research reveals the best stock market sectors outperforming the S&P 500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These three sectors significantly beat the market averages.

Find out which stock sectors are best for investors and which stocks are the best in each sector. This research report will provide the most in-depth overview and understanding of the 11 stock market sectors and every top-performing stock and ETF in each sector.

We also provide ideas on how to invest in each sector.

How We Do Sector Analysis

To perform this detailed analysis, we used our partner’s software, Stock Rover, which is, in our opinion, the best screening, analysis, and research tool available.

Stock Sectors are a means of breaking down and simplifying an enormous and complex stock market. Analysts and portfolio managers use the GICS sector classification for better portfolio structuring, risk management, and reporting.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Stock Market Sectors enable more granular performance reporting, analysis, and comparison of the industries and companies in each sector.

Sectors give investors metrics to measure and evaluate company performance. For example, an investor can compare Exxon-Mobil’s (NYSE: XOM) and BP’s (BP) performance within the Energy Sector.

The GICS Sector Classification

The Global Industry Classification Standard (GICS) is the industry-standard stock classification system. The GICS divides the market into 11 sectors. Using the GICS makes it easy for investors to find information about stocks and sectors. Investors can analyze the sectors’ past performance to understand which industries are growing/declining and the best-performing stock in each sector and industry.

Buying the best-performing stocks in the highest-performing industries, often known as sector rotation, is a staple strategy for fund managers.

Analyzing each sector and the best ETFs and Stocks in each sector is exactly what we will cover in this article. If you are interested, you can learn more about investing in index funds.

The 11 Standard Stock Market Sectors:

- Basic Materials

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

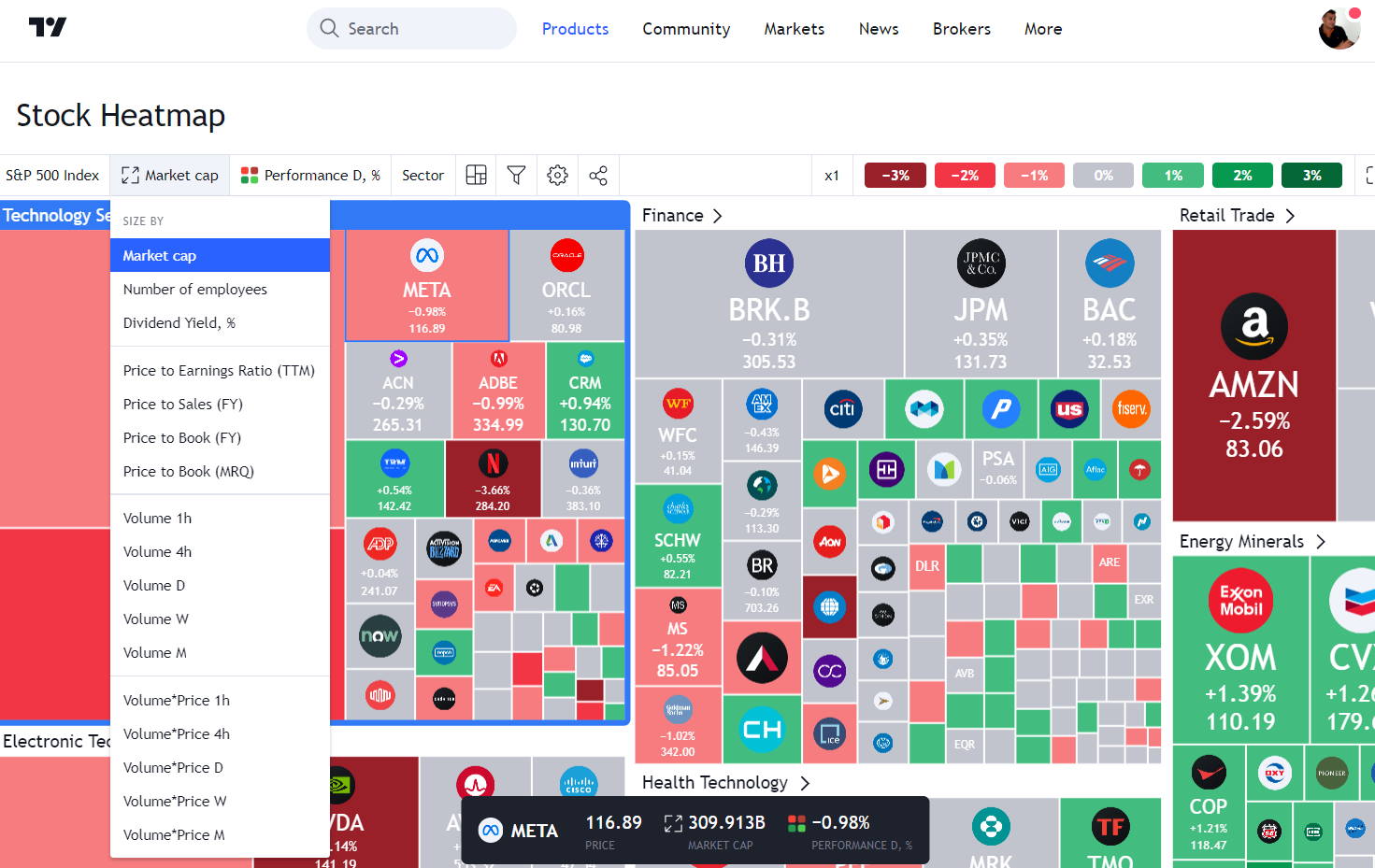

Try TradingView’s Sector Rotation Heatmaps

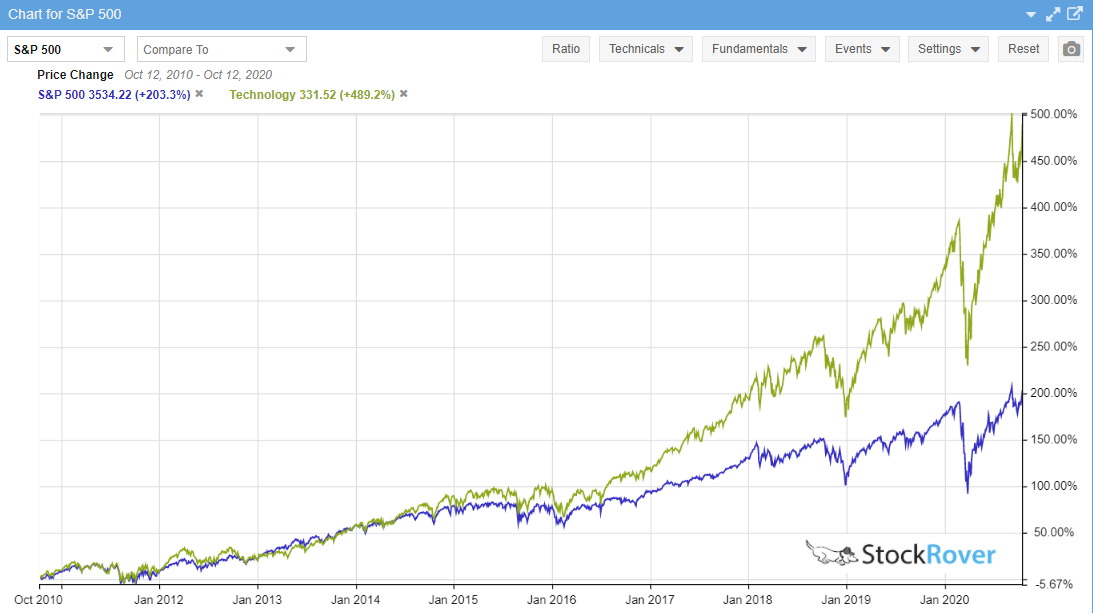

Stock Sector 10-Year Performance vs. S&P 500

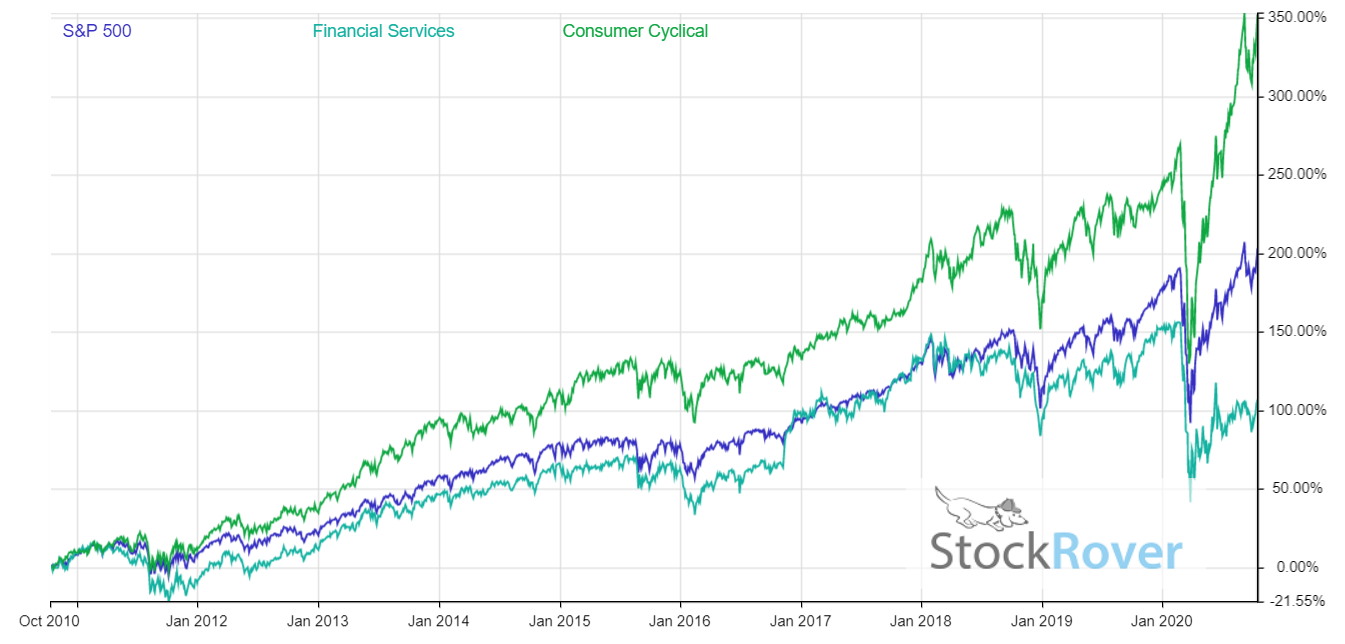

Only three sectors have outperformed the S&P 500 index over the previous ten years. The technology sector beat the S&P 500 by 381%, the consumer cyclical sector by +181%, and healthcare by 34%.

| Sector | 10-Year Return vs. S&P 500 |

| Technology | +381.90% |

| Consumer Cyclical | +181.40% |

| Healthcare | +34.20% |

| Financial Services | -27.60% |

| Industrials | -78.30% |

| Basic Materials | -140.70% |

| Consumer Defensive | -147.60% |

| Real Estate | -167.60% |

| Communication Services | -179.10% |

| Utilities | -180.70% |

| Energy | -355.20% |

Data Stock Rover

Please Note: This site is provided to you for informational purposes only and should not be construed as an offer to buy or sell a particular security or a solicitation of offers to buy or sell a particular security. The authors & contributors are not registered financial advisors and do not give any personalized portfolio or stock advice.10-Year Technology Sector Chart

The technology sector has been a top performer for the last ten years, but the 2022 bear market brought the sector back down to earth. Technology peaked at a 550% gain in 2021 but dropped to 300% in 2024.

View Chart Live on TradingView

Stock Sector 2, 5 & 10-Year Performance vs. S&P 500

Of the 11 stock sectors, only the technology and consumer cyclical sectors have outperformed the S&P 500 over a 2, 5, and 10-year period.

| Sector Name | 2Y Return vs. S&P 500 | 5-Year Return vs. S&P 500 | 10-Year Return vs. S&P 500 |

| Technology | 36.70% | 166.80% | 381.90% |

| Consumer Cyclical | 35.10% | 55.40% | 181.40% |

| Healthcare | -10.50% | -9.40% | 34.20% |

| Financial Services | -19.00% | -51.10% | -27.60% |

| Industrials | -19.30% | -50.90% | -78.30% |

| Basic Materials | 0.10% | -44.30% | -140.70% |

| Consumer Defensive | -20.50% | -64.50% | -147.60% |

| Real Estate | -17.40% | -65.20% | -167.60% |

| Communication Services | -5.70% | -85.10% | -179.10% |

| Utilities | -35.00% | -64.90% | -180.70% |

| Energy | -44.90% | -142.00% | -355.20% |

Research Performed Using Stock Rover: Our Review Winning Software for Screening, Portfolio Management & Reporting & In-Depth Stock, ETF, & Sector Research. Get Stock Rover Free Now

S&P 500 Health Care Sector 10-Year Performance

The healthcare sector has performed well from 2013 to 2024, with a 200% return, and it has not suffered too badly in the 2022 bear market.

View Chart Live on TradingView

Stock Sector Performance Analysis

Looking across the stock market sectors, we can see that the technology sector is the best-performing sector in the US economy. The technology sector has beaten the S&P 500 by 36% over 2 years, 166% over 5 years, and an incredible 381% over 10 years. Consumer discretionary sector stocks have also done well over 10 years, beating the S&P 500 by 181%.

Surprisingly, healthcare has not performed well over the last two and five years, but it has managed to outperform the market over the past ten years.

The other sectors have ranged from a 60% to 307% loss against the S&P 500 over 10 years, suggesting that you focus on stock and ETF investments in the Technology and Consumer Discretionary sectors as an individual investor.

The Best Sectors to Invest in

According to ten years of data, the best sectors to invest in are the technology, consumer cyclical, and healthcare sectors. These sectors have all outperformed the S&P 500 index from 2012 to the present. The Technology sector is the best, with an annualized 10-year return of 23.8% and a total return of 744%.

| Sector Name | 2Y Return vs. S&P 500 | 5-Year Return vs. S&P 500 | 10-Year Return vs. S&P 500 |

| Technology | 36.70% | 166.80% | 381.90% |

| Consumer Cyclical | 35.10% | 55.40% | 181.40% |

| Healthcare | -10.50% | -9.40% | 34.20% |

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

11 Stock Market Sectors

1. Basic Materials Sector

Companies involved in extracting, acquiring, developing, processing, and marketing raw materials make up the basic materials sector. It is confusing because it includes everything from gold mining to cement, lumber, and paint manufacturing.

Basic materials include metals, chemicals, wood, paint, coatings, finishes, and plastics. Value investors buy basic materials stocks because they are unsexy, often ignored by the media, and sometimes cheap.

Basic Materials Index Chart

View Chart Live on TradingView

Many people use the basic materials sector to indicate the economy’s overall health and performance. The theory is that a greater demand for basic materials indicates manufacturing growth and rising consumer spending.

Determining what constitutes a basic material can be tough because sectors overlap. Most analysts consider paints to be a basic material, for example. However, they categorize some paint additives as cleaning products or pharmaceuticals.

Top Performing Basic Materials Sector Stocks

According to 5 years of data, the best Basic materials sector stocks to invest in are Lightwave Logic, Lithium Americas, Sherwin-Williams, Linde, and Albemarle outperformed the S&P 500 index and had a 5-year return of 194% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| SHW | Sherwin-Williams | 39.50% | 295.80% | 161.60% |

| LIN | Linde | 30.40% | 217.70% | 83.50% |

| ALB | Albemarle | 61.70% | 194.90% | 60.70% |

| JHX | James Hardie Industries | 41.00% | 184.00% | 49.90% |

| WFG | West Fraser Timber | 48.20% | 179.90% | 45.70% |

| UFPI | UFP Industries | 64.60% | 179.50% | 45.30% |

| OLN | Olin | 131.60% | 158.20% | 24.00% |

| MTRN | Materion | 46.60% | 143.70% | 9.50% |

Research Performed Using Stock Rover: Our Review Winning Software for Screening, Portfolio Management & Reporting & In-Depth Stock, ETF, & Sector Research.

Linde Plc Basic Materials Chart

View Chart Live on TradingView

How to Trade the Basic Materials Sector

The easiest way to trade the basic materials sector is to identify profitable companies. Identifying basic materials companies can be tough because many industrial and energy companies supply basic materials.

For instance, energy companies such as Chevron (NYSE: CVX) manufacture many chemicals that can be classified as basic materials. Conglomerates such as Berkshire Hathaway (NYSE: BRK.B) often own subsidiaries that supply basic materials. Precious metals such as gold and silver are considered investments and basic materials.

Monitoring the prices of basic materials can sometimes point to companies that will expand. Falling basic materials prices could show falling demand and dropping profits and revenues at some companies while rising prices can indicate rising demand and economic growth.

Investors must be careful in the basic materials sector because other factors affect corporate profits. Labor and equipment costs, interest rates, energy, and insurance can all offset basic materials costs.

High costs for software and technology make basic materials irrelevant in some businesses. The main expenses in manufacturing an iPhone are Apple’s (AAPL) operating system and brand system, not the materials.

Examining the ProShares Short Basic Materials ETF (SBM) is a great way to monitor the basic materials sector. This exchange-traded fund’s benchmark is the daily performance of the Dow Jones US Basic Materials Index, which can give you a snapshot of prices and demand.

Many modern investors ignore this sector because of the cost of technology. Basic materials are no longer the powerful market sector they were in the 20th Century.

2. Communications Services Sector

The communications services sector is the new name for the telecommunications stock sector. The best way to think of communications stocks is as companies that transmit data electronically.

The definition of communications services is broad. Standard & Poor’s (S&P) defines Facebook (FB), Netflix (NFLX), and the Walt Disney Company (DIS) as communications stocks. The S&P includes Verizon Communications (VZ) and AT&T (T) in the Communications Sector. Some fund managers will classify video game makers, such as Activision Blizzard (ATVI), as communications stocks.

The communications sector includes telecoms, social media, and entertainment companies. They include many technology stocks and some consumer discretionary stocks in the communications sector.

Many value investors buy these stocks because some generate enormous amounts of what Warren Buffett calls float. Float is a steady stream of cash a company generates from subscription payments.

AT&T and Verizon generate float from wireless subscriptions. Netflix and Disney generate float from streaming video subscriptions.

Top Performing Communications Services Sector Stocks

According to five years of data, the best communications services sector stocks to invest in are TechTarget, Avid Technology, Live Nation Entertainment, Cogent Comms, and Alphabet. These stocks all outperformed the S&P 500 index and had a 5-year return of 265% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| TTGT | TechTarget | 63.90% | 1036.10% | 901.90% |

| AVID | Avid Technology | 99.30% | 618.90% | 484.70% |

| LYV | Live Nation Entertainment | 64.90% | 355.40% | 221.20% |

| CCOI | Cogent Comms Hldgs | 26.90% | 346.40% | 212.20% |

| GOOGL | Alphabet | 65.50% | 265.90% | 131.70% |

| IDT | IDT | 259.10% | 211.30% | 77.10% |

| VG | Vonage Hldgs | 61.30% | 203.20% | 69.00% |

| NXST | Nexstar Media Group | 43.20% | 168.70% | 34.60% |

Research Performed Using Stock Rover: Perform Your Own Up-To-Date Analysis & Manage Your Investment Portfolio Get Stock Rover Free Now.

How to Invest in the Communications Stock Sector

Some people use FANG stocks as a guide to the communications sector. Others buy diversified companies such as Disney (DIS), Comcast Corporation (CMSCA), and AT&T (T).

Disney owns streaming services, Disney+ and Hulu, Marvel Comics, Lucasfilm (Star Wars), theme parks, resorts, and movie studios. Comcast owns television networks, the Peacock streaming service, and cable television networks. AT&T owns a wireless company, an internet provider, the Warner Brothers movie studio, HBO, the HBO Max streaming service, DirecTV satellite television, and DC Comics.

Select Sector Communications Services ETF Chart

View Chart Live on TradingView

The largest ETF in the sector is the Communication Services Select Sector SPDR Fund XLC. The XLC’s holdings include Facebook (FB), AT&T, Comcast, T-Mobile US (TMUS), Netflix (NFLX), and video game maker Electronic Arts (EA).

3. Consumer Cyclical Sector

Analysts classify consumer cyclical stocks as shares in companies they consider non-essential for consumers.

Consumer cyclical stocks include everything from electronics to vacations to fashion, luxury goods, and automobiles. The consumer discretionary sector includes retailers such as Amazon (AMZN) and The Home Depot (HD), automakers including Toyota (TM) and McDonald’s (MCD), and other fast-food operators.

Many people consider consumer discretionary stock economic indicators because their performance can reflect consumer demand.

Rising sales of automobiles and smartphones show consumers have more disposable income, which indicates a good economy. Falling sales of cruise ship tickets or video games can show consumers have less money, indicating a bad economy.

Rising sales at McDonald’s (MCD) can indicate that consumers have less money while falling luxury goods sales like Nike (NKE) can indicate cash-strapped consumers.

Top Performing Stocks in the Consumer Cyclical Sector

According to 5 years of data, the best consumer cyclical sector stocks to invest in are Tesla, Crocs, GameStop, Pool,

and Skyline Champion, who all outperformed the S&P 500 index and had a 5-year return of 416% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| TSLA | Tesla | 70.00% | 2707.30% | 2573.10% |

| CROX | Crocs | 110.80% | 1825.80% | 1691.60% |

| GME | GameStop* | 711.30% | 644.00% | 509.80% |

| POOL | Pool | 48.70% | 454.70% | 320.50% |

| SKY | Skyline Champion | 151.90% | 416.10% | 282.00% |

| SGMS | Scientific Games | 61.60% | 378.80% | 244.60% |

| AMZN | Amazon.com | 4.60% | 354.50% | 220.30% |

Research Performed Using Stock Rover: Perform Your Own Up-To-Date Analysis & Manage Your Investment Portfolio Get Stock Rover Free Now.

Plenty of great stocks in the consumer discretionary sector have strong 5-year and 10-year performance. *Reddit traders manipulated GameStop, a stock I would not recommend for long-term investments.

With the lowest expense ratio and the best 5-year performance versus the S&P 500, the Fidelity MSCI Consumer Discretionary Index ETF is worth a closer look. You can conduct deep-dive research into every ETF on the US stock market with Stock Rover.

How to Trade Consumer Discretionary Stock Sector

Some consumer discretionary investors follow Warren Buffett’s lead and seek products consumers always need or want.

Others purchase companies that reflect changing lifestyles. Many investors buy home-improvement companies such as Home Depot (HD) and Lowe’s (LOW) because those retailers sell tools and building supplies for remodeling projects. Many people are remodeling their homes because they have lots of free time because of the coronavirus pandemic.

Amazon (AMZN) is a popular consumer-discretionary stock because it offers a wide variety of products. Some consumer discretionary investors track indicators such as automobile sales, retail foot traffic, and retail revenues.

The iShares Global Consumer Discretionary ETF (RXI) offers a snapshot of worldwide consumer demand. The RXI invests in the S&P Global 1200 Consumer Discretionary (Sector) Capped Index stocks. The RXI’s performance can show whether global consumer demand is rising or falling.

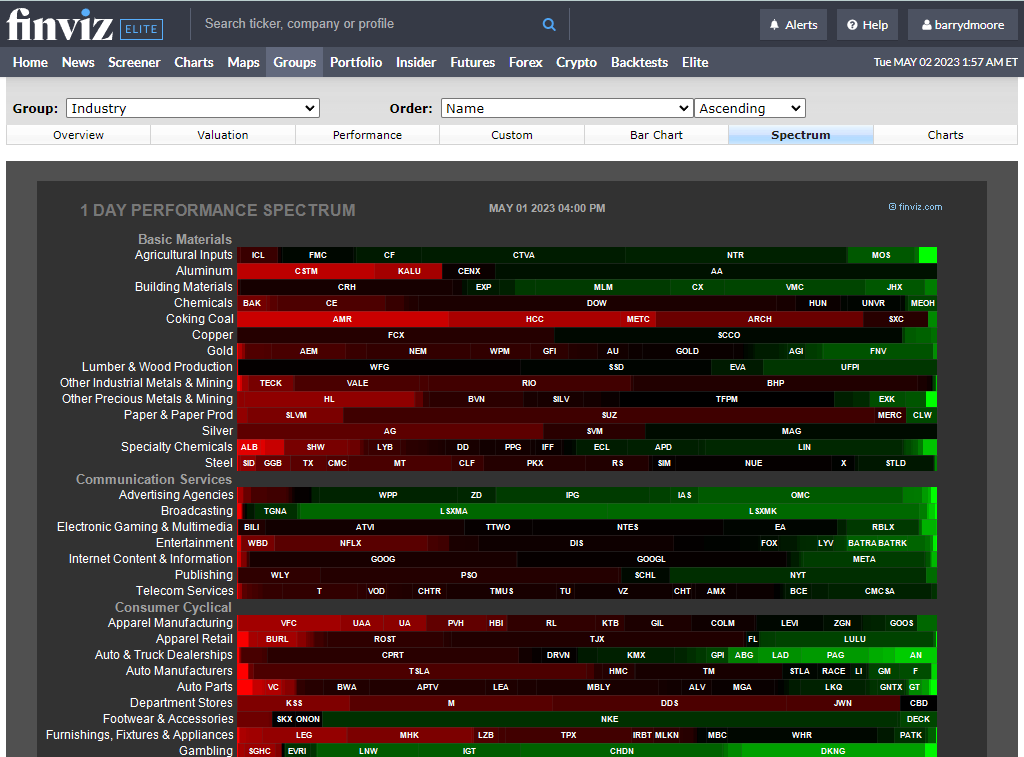

Get Finviz – The Perfect Tool For Sector Rotation Analysis

4. Consumer Defensive

Consumer defensive stocks are essential products people need to survive. The classic example of a consumer defensive is food.

Warren Buffett buys consumer staples because people must buy those products in any economy. Berkshire Hathaway (BRK.B) owns large amounts of the grocer Kroger (KR) and the food manufacturer Kraft Heinz (KHC).

Revenues and profits at consumer staples companies can show how much money people have, and the market volumes can show how much faith investors have in the economy.

Popular consumer staples include Procter & Gamble (PG), Walmart (WMT), Costco Wholesale Corp (COST), and Amazon (AMZN). Investors put retailers like Amazon (AMZN) in this sector because Amazon sells enormous amounts of Consumer Staples. Some analysts strangely consider soda pop makers such as Coca-Cola (KO) and tobacco companies such as Philip Morris International (PM) as consumer staples.

Top Consumer Defensive Stocks

According to 5 years of data, Celsius Holdings, Darling Ingredients, Estee Lauder, Costco, and Target are the best consumer defensive sector stocks to invest in. They all outperformed the S&P 500 index and had a 5-year return of 269% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| CELH | Celsius Holdings | 49.30% | 2964.90% | 2830.70% |

| DAR | Darling Ingredients | 21.10% | 441.00% | 306.80% |

| EL | Estee Lauder Cos | 40.10% | 408.30% | 274.10% |

| COST | Costco Wholesale | 51.60% | 296.50% | 162.30% |

| TGT | Target | 33.20% | 269.20% | 135.00% |

| COKE | Coca-Cola Consolidated | 132.40% | 252.50% | 118.30% |

| IPAR | Inter Parfums | 78.90% | 250.00% | 115.80% |

Research Performed Using Stock Rover: Perform Your Own Up-To-Date Analysis & Manage Your Investment Portfolio Get Stock Rover Free Now.

All the companies above have produced excellent market-beating returns over the last 5 and 10-year periods.

How to Trade Consumer Staples Stocks

Many consumer staples investors look at the products in their pantries and refrigerators to learn the manufacturers’ identities. Then, they buy the companies’ stocks.

Others look for companies that make purchasing consumer staples easy and convenient. Those companies include Amazon (AMZN), Walmart (WMT), and Costco (COST).

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

5. Energy Stock Sector

The term energy stock sector is misleading because this classification excludes solar, wind, and other renewable energy companies. The GCIS, instead, puts renewable energy companies in the utility sector.

The energy stock sector includes any company that extracts or makes burnable fuels. Most are fossil fuel makers, including oil and gas companies and coal miners. Companies that own oil wells and oil refinery operators are energy sector stocks.

Energy sector stocks are companies that make biofuels such as ethanol and fuels from plants such as grain. The GCIS also lists companies that provide equipment and services for fossil fuel producers as energy stocks. That includes companies that make oil and gas drilling equipment.

Energy Select Sector Index 3-Year Performance Chart

View Chart Live on TradingView

Analysts usually consider energy stocks as value investments and defensive stocks. Value investors buy energy stocks because they often generate enormous amounts of cash. Because they pay high dividends, analysts classify them as Widows’ and Orphans’ stocks.

Many investors have moral objections to energy stocks because of global warming. In recent years, the energy sector has become unstable and has made less money because of falling prices and the growing popularity of electric vehicles and solar energy.

Top Performing Energy Sector Stocks

According to 5 years, the best energy sector stocks to invest in are Texas Pacific Land, Calumet Specialty, Denison Mines, and Cheniere Energy, which all outperformed the S&P 500 index and had a 5-year return of 148% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| TPL | Texas Pacific Land | 76.80% | 359.70% | 225.50% |

| CLMT | Calumet Specialty | 381.20% | 276.50% | 142.30% |

| DNN | Denison Mines | 133.40% | 193.40% | 59.20% |

| LNG | Cheniere Energy | 71.30% | 148.20% | 14.00% |

| CCJ | Cameco | 69.90% | 128.60% | -5.60% |

| EQNR | Equinor | 67.00% | 80.50% | -53.70% |

| CNQ | Canadian Natural Res | 86.80% | 71.50% | -62.70% |

Research Performed Using Stock Rover: Perform Your Own Up-To-Date Analysis & Manage Your Investment Portfolio

As you can see, the energy sector is a complete disaster. As planet earth moves to clean energy, the energy sector (which does not track clean energy) suffers. However, the near-collapse of the traditional energy sector is leading to a surge in investment and capital inflows into Ethical, Social, and Governance (ESG) investing and ETFs.

How to Trade Energy Stocks

Most energy sector traders monitor the price of oil and natural gas. Oil prices can show how much money oil producers can make.

Oil and gas suppliers often make more money when oil prices are high. Companies buy more drilling rigs and exploration equipment to increase production and take high oil prices. Oil and gas companies and suppliers make less money when oil prices fall.

Some energy sector investors monitor events in the Middle East and other oil-producing regions. War and unrest in the Middle East have historically disrupted oil production, driving prices.

Other investors examine the overall economy. The belief is that the demand for fuel increases when the economy is good.

Many value investors shop for stocks when oil prices are low or the economy is bad. Other investors sell energy sector stocks when oil prices rise.

A good way to explore this sector is with the Energy Select Sector SPDR Fund (XLE) ETF. The Energy Select exchange-traded fund provides a good snapshot of the Energy Sector because it invests in large-cap US energy producers.

Many growth investors now avoid the energy sector because some technology stocks grow faster and generate more cash than energy stocks. Thus, information technology sector companies such as Apple (AAPL) and Alphabet (GOOG) have replaced Exxon-Mobil (XOM) and other oil companies as blue-chip leaders.

6. Financial Services

Many people think of the financial sector as banking. The sector includes banks, investment firms, stock brokerages, money managers, and some insurance and real estate firms.

Some definitions put financial technology (FinTech) stocks such as PayPal (PYPL) and Square (SQ) in the financial sector. Wall Street is a popular term many Americans use to describe the financial sector.

Many investors avoid financial stocks because finance is more volatile than other sectors. Others monitor financial stocks because it can indicate a strong economy. Similarly, a weak financial sector indicates a weak economy.

Buffett liked the financial sector because it generated and accumulated enormous amounts of cash. The financial sector is vulnerable to interest rates because banks rely on loans for revenue.

Some investors love financial stocks because the government could bail out some large banks and financial companies because they are “too big to fail.” Several governments bailed out large financial institutions after the 2008 Financial Meltdown. This offers a higher margin of safety.

Top Performing Stocks in the Financial Services Sector

According to five years of data, the best financial services sector stocks to invest in are Atlanticus Holdings, B. Riley Financial, Blackstone, CorVel, and KKR & Co. These stocks all outperformed the S&P 500 index and had a 5-year return of 432% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| ATLC | Atlanticus Holdings | 182.20% | 2347.90% | 2213.70% |

| RILY | B. Riley Financial | 136.30% | 585.90% | 451.70% |

| BX | Blackstone | 102.70% | 507.60% | 373.40% |

| CRVL | CorVel | 98.00% | 473.30% | 339.20% |

| KKR | KKR & Co | 83.30% | 432.10% | 298.00% |

| WD | Walker & Dunlop | 65.10% | 419.90% | 285.70% |

| LPLA | LPL Finl Hldgs | 57.20% | 396.50% | 262.40% |

| APO | Apollo Global Management | 51.30% | 387.50% | 253.30% |

| MORN | Morningstar | 45.60% | 376.90% | 242.70% |

| SPGI | S&P Global | 41.40% | 349.70% | 215.60% |

| SIVB | SVB Finl Gr | 77.40% | 300.90% | 166.70% |

Research Performed Using Stock Rover: Perform Your Own Up-To-Date Analysis & Manage Your Investment Portfolio.

Interestingly, some of the financial world giants have still not recovered from the financial crisis in 2008. Household names such as Bank of America, Berkshire Hathaway, American Express, and Goldman Sachs Group have failed to keep up with the performance of the S&P 500.

From our research, we see that investing in a broad financial sector ETF is not in your best interest. The best-performing financial sector ETF, the iShares US Financial Services ETF, lost out significantly to the market by a whopping -84%.

10-Year Financial Services & Consumer Discretionary Stock Sectors Chart

Get Advanced Sector Charting on Stock Rover

How to Trade the Financial Stock Sector

Some financial sector investors seek large, cash-rich financial institutions because they offer high margins of safety. Others invest in smaller, duller, less risky regional banks and similar institutions.

Many investors avoid finance because the industry can be deceptive. Several supposedly healthy giant financial institutions, including Lehman Brothers, Northern Rock, American Home Mortgage, Bear Stearns, Merrill Lynch, and American International Group (AIG), collapsed or nearly collapsed during the 2008 Financial Crisis.

Buying a diversified index of financial stocks is the best way to limit risks. The SPDR S&P Bank ETF (KBE) invests in the S&P Banks Select Industry Index, which invests in giant banks like JPMorgan Chase (JPM) and smaller institutions like First Republic Bank (FRC).

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

7. Healthcare

The healthcare sector includes all businesses that manufacture and market medical goods and services.

The healthcare sector includes drug and pharmaceutical manufacturers, hospital and clinic operators, nursing home operators, and health insurance companies. Analysts classify drugstore operators such as Walgreens (WBA) as healthcare companies.

A growing trend in healthcare is consolidation. For example, the American company CVS (CVS) now owns an insurance company and an enormous drugstore chain.

Many investors like the healthcare sector because customers have no choice but to buy many of its products and services. For example, many people will die without drugs, surgeries, and medical devices.

Healthcare is appealing because governments and insurance companies pay many of the bills. In the United States, almost everybody over 65 uses the Medicare single-payer health insurance program. The National Health Service (NHS) pays for healthcare for all British subjects.

Healthcare is one of the fastest-growing sectors because of an aging population and rising ill-health rates in some nations. The US Census Bureau estimates that 54 million Americans were over 65 in 2019. The US Centers for Disease Control and Prevention (CDC) estimates that 30% of Americans could suffer from Metabolic Syndrome. Metabolic Syndrome is a precursor to serious diabetes and heart disease problems.

Top Performing Stocks in the Healthcare Sector

According to 5 years of data, the best healthcare sector stocks to invest in are OptimizeRx, DexCom, Repligen, Codexis, and

Align Tech, which all outperformed the S&P 500 index and had a 5-year return of 574% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| OPRX | OptimizeRx | 101.90% | 2488.90% | 2354.70% |

| DXCM | DexCom | 40.90% | 772.30% | 638.20% |

| RGEN | Repligen | 34.60% | 737.00% | 602.80% |

| CDXS | Codexis | 46.30% | 594.10% | 459.90% |

| ALGN | Align Tech | 21.30% | 574.10% | 440.00% |

| HZNP | Horizon Therapeutics | 47.60% | 567.20% | 433.10% |

| ARNA | Arena Pharmaceuticals | 21.30% | 556.30% | 422.10% |

| EVO | Evotec | 27.90% | 502.70% | 368.50% |

| MOH | Molina Healthcare | 48.80% | 483.40% | 349.20% |

| NVAX | Novavax | 28.10% | 467.10% | 332.90% |

| IDXX | IDEXX Laboratories | 26.20% | 438.10% | 303.90% |

| WST | West Pharmaceutical Servs | 57.70% | 437.30% | 303.20% |

Research Performed Using Stock Rover

Healthcare is one of the fastest-growing sectors because of an aging population and rising ill-health rates in some nations. The US Census Bureau estimates that 54 million Americans were over 65 in 2019. The US Centers for Disease Control and Prevention (CDC) estimates that 30% of Americans could suffer from Metabolic Syndrome. Metabolic Syndrome is a precursor to serious diabetes and heart disease problems.

ETFs covering the healthcare sector usually focus on specific sub-industries, so you must pick the ETF to invest wisely. The ARK Genomic Revolution ETF, iShares US Medical Devices ETF, Invesco DWA Healthcare Momentum ETF, and SPDR S&P Health Care Equipment ETF have performed exceptionally well against the S&P 500.

How to Invest in the Healthcare Stock Sector

Many healthcare investors seek companies developing treatments, drugs, or vaccines for widespread diseases. In 2020, they bought stocks such as Regeneron (REGN) and BioNTech (BNTX). Regeneron is testing a possible coronavirus treatment they call REGN-COV2, and BioNTech is testing a potential COVID-19. Others invest in companies, such as Abbott Laboratories (ABT), that manufacture coronavirus tests.

One interesting healthcare ETF is the ARK Genomic Revolution ETF (ARKG). The ARKG invests in emerging biotechnology research companies such as Compugen (CGEN). Its managers try to identify biotech companies that are developing products for fast-growing diseases.

8. Industrials

Industrial stocks were the backbone of the US, Japanese, and European stock markets throughout the 20th Century.

Industrials manufacture machinery, tools, aircraft, weapons, and munitions. Analysts often classify transportation and logistics companies that serve the heavy industry as Industrial Stocks.

Industrial stocks are confusing because the sector includes railroads such as Union Pacific (UNP), technology companies such as Siemens AG (SIE.DE), and defense contractors such as Raytheon Technologies Corp (RTX). It can also include chemical companies such as 3M (MMM), delivery services such as UPS (UPS), and vehicle manufacturers, including Caterpillar (CAT).

Industrial stocks drove stock market performance until the 1980s. Technology stocks have replaced industrials as the most-watched stocks in modern markets.

Many investors use industrial stocks as an economic indicator. Rising revenues and profits at industrial companies indicate increased production and economic growth. Falling revenues and profits for Industrials can indicate a downturn.

Top Performing Stocks in the Industrials Sector

According to five years of data, the best industrial sector stocks to invest in are CryoPort, Ameresco, Generac, Trex Co, and Builders FirstSource. These stocks all outperformed the S&P 500 index and had a 5-year return of 661% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| CYRX | CryoPort | 29.30% | 1650.60% | 1516.40% |

| AMRC | Ameresco | 57.20% | 1392.90% | 1258.70% |

| GNRC | Generac Hldgs | 53.00% | 754.00% | 619.80% |

| TREX | Trex Co | 57.70% | 719.90% | 585.80% |

| BLDR | Builders FirstSource | 104.60% | 661.10% | 526.90% |

| SAIA | Saia | 74.10% | 613.00% | 478.80% |

| CWST | Casella Waste Systems | 35.00% | 574.10% | 439.90% |

| AXON | Axon Enterprise | 24.80% | 530.70% | 396.50% |

| ODFL | Old Dominion Freight Line | 78.00% | 516.90% | 382.70% |

| SHYF | Shyft Group | 74.40% | 452.60% | 318.40% |

| CAR | Avis Budget Gr | 442.10% | 451.30% | 317.10% |

Research Performed Using Stock Rover

Stocks such as Copart (CPRT), Cintas (CTAS), CSX (CSX), Fastenal (FAST), and Global Payments (GPN) have posted outstanding performance on both a 5-year and 10-year history against the S&P 500. Additionally, both CSX and Global Payments still have a 10% margin of safety, which is interesting to investors looking for growth and a value play.

Investing in an industrial sector ETF would be unwise, and the table above shows that even the best-performing ETFs lose out on the overall market.

How to Trade the Industrials Stock Sector

The best way to trade and monitor the industrial sectors is to track an exchange-traded fund like the iShares Global Industrials ETF (EXI).

This fund invests around 90% of its assets in the S&P Global 1200 Industrials Index. The advantage of the iShares Global Industrials ETF is that it offers a snapshot of global industrial performance and the world’s economy.

9. Real Estate

Real Estate Stocks include companies that own, manage, market, finance, and construct properties.

Analysts traditionally divide the real estate sector into residential, commercial, and industrial categories. Residential real estate includes all forms of housing. Commercial real estate includes retail and office properties. Industrial real estate includes factories, plants, power plants, utility infrastructure, warehouses, fulfillment centers, and other industrial infrastructure.

Other real estate investments include mortgage companies, real estate sales organizations, and organizations selling property-related goods and services. Examples of such stocks include real estate agencies like RE/Max Holdings (RMAX) and Zillow’s real estate company (ZG). Other real estate-related stocks include mortgage providers such as Rocket Mortgage (RKT).

Real estate stocks are risky due to volatility. The 2007-2008 market collapse occurred because financial companies invested in risky mortgage-backed securities.

Best Stocks in the Real-Estate Sector

According to 5 years of data, the best real-estate sector stocks to invest in are Colliers Intl, Arbor Realty Trust, Prologis, EastGroup Properties, and CBRE Group outperformed the S&P 500 index and had a 5-year return of 245% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| CIGI | Colliers Intl Gr | 65.40% | 303.60% | 169.40% |

| ABR | Arbor Realty Trust | 41.50% | 297.80% | 163.60% |

| PLD | Prologis | 68.80% | 256.40% | 122.20% |

| EGP | EastGroup Properties | 66.20% | 246.90% | 112.70% |

| CBRE | CBRE Group | 73.30% | 245.10% | 110.90% |

| EXR | Extra Space Storage | 94.30% | 237.00% | 102.80% |

| TRNO | Terreno Realty | 46.90% | 231.10% | 97.00% |

Research Performed Using Stock Rover

We highlight five key stocks in the real-estate sector for an outstanding performance against the benchmark S&P 500 index. Equinix provides data center spec globally, and American Tower provides the infrastructure and real estate for cellular communications.

The five largest ETFs in the real estate sector have failed to beat the market over five or ten years. The sector as a whole cannot keep up with the performance of the S&P 500 or the NASDAQ 100.

How to Invest in the Real Estate Stock Sector

Most real estate stocks are Real Estate Investment Trusts (REITs). A REIT is a publicly traded company that owns and manages real estate.

A REIT usually specializes in owning one type of property. The Simon Property Group (SPG) specializes in mall ownership, and ProLogis (PLD) owns warehouses and fulfillment centers. Digital Reality (DLTR) owns data centers that support the internet, social media, and cloud computing. Some REITs invest in mortgage-backed securities and mortgages, which can generate high risks.

Investors like REITs because they often pay high dividends. REITs can be unstable because they are not diversified investments. Shopping center owners like Simon Property Group can collapse fast if retailers stop paying rent due to an economic downturn.

Industrial REITs such as ProLogis (PLD) and the Digital Realty Trust (DLR) offer a cheaper means of investing in e-commerce. ProLogis can lease warehouses and fulfillment centers to online retailers like Amazon (AMZN), and the Digital Realty Trust can lease space to social media giants like Facebook (FB) and many other organizations.

The Schwab U.S. REIT ETF (SCHH) is a diversified investment in REITs. The SCHH owns stocks on the Dow Jones Equity All REIT Capped Index. The SCHH invests in office building companies such as the American Tower Corporation (AMT), ProLogis (PLD), and the Digital Realty Trust (DLR).

10. Technology

The term information technology stocks is misleading because it is a catchall phrase that includes a wide variety of technological goods and services. The information technology stock sector includes everything from software to consumer electronics, cloud services, social media, streaming video, business services, and e-commerce.

Many information companies operate in other sectors. For example, Amazon (AMZN) sells cloud services and consumer staples. Netflix (NFLX) is a technology company that sells consumer discretionary products (videos).

Plus, Disney (DIS) operates video-streaming services, resorts, theme parks, a consumer products business, and movie studios. Thus, you can classify Disney as an information technology company and a consumer discretionary business.

Analysts classify many technology companies, including Ford (F) and Toyota (TM), as consumer discretionary stocks. However, Ford and Toyota are now investing heavily in information technology through their autonomous vehicle projects.

Even the investment bank Goldman Sachs (GS) can be considered a technology company. Goldman Sachs CEO David Solomon claims his bank employs 9,000 engineers, comprising one-third of its workforce.

Best Technology Sector Stocks

According to 5 years of data, the best technology sector stocks to invest in are Camtek, Advanced Micro Devices, NVIDIA, Nova, and Fortinet, which all outperformed the S&P 500 index and had a 5-year return of 1006% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| CAMT | Camtek | 120.50% | 1457.60% | 1323.40% |

| AMD | Advanced Micro Devices | 63.80% | 1224.90% | 1090.70% |

| NVDA | NVIDIA | 130.90% | 1043.60% | 909.50% |

| NVMI | Nova | 108.40% | 1017.90% | 883.70% |

| FTNT | Fortinet | 124.30% | 1006.00% | 871.80% |

| LSCC | Lattice Semiconductor | 71.40% | 967.30% | 833.10% |

| CALX | Calix | 161.10% | 909.10% | 774.90% |

| NOVT | Novanta | 47.00% | 727.50% | 593.30% |

| VICR | Vicor | 34.40% | 721.10% | 586.90% |

| ENTG | Entegris | 44.40% | 693.80% | 559.60% |

| ASML | ASML Holding | 64.40% | 646.20% | 512.00% |

| LRCX | Lam Research | 55.00% | 643.60% | 509.40% |

| CDNS | Cadence Design Systems | 34.30% | 626.20% | 492.10% |

| PRFT | Perficient | 163.30% | 617.20% | 483.00% |

| ZBRA | Zebra Technologies | 51.90% | 580.90% | 446.70% |

| TER | Teradyne | 39.00% | 575.60% | 441.50% |

| AAPL | Apple | 38.00% | 567.80% | 433.60% |

Research Performed Using Stock Rover

10-Year Technology Stock Sector Performance vs. S&P 500 Chart

Over the last ten years, the top 3 performing companies in the technology sector are Broadcom +1799%, Adobe +1477%, and Cadence Design Systems +1123%. With a market capitalization of $2.9 trillion, it comes in 4th place with a market-beating 980%.

Get Advanced Sector Charting on Stock Rover

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

How to Trade Information Technology Stocks

Today, many call the information technology sector “Tech,” “Technology,” or “Silicon Valley.”

Many investors love technology stocks because of their high growth rates. Many people buy the so-called FANG and FAANG stocks because those shares offer high growth rates.

FANG stands for Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG). They now call Google Alphabet (GOOGL). The FAANG stands for Facebook (FB), Apple (AAPL), Netflix (NFLX), and Google (GOOG).

Buffett invests in Apple (AAPL), for example. Many people consider Apple’s smartphones essential to their lifestyle.

One of the best ways to invest in information technology stocks is to invest in a tech stock index. The simplest way to invest in an index is to buy a technology ETF such as the NYSE Technology ETF (XNTK). Fund managers invest 80% of XNTK’s assets in the NYSE Technology Index, which includes 35 top US technology companies.

Top Performing Technology Sector ETFs

| Ticker | Company | Expense Ratio | Net Assets ($M) | 5-Year Return vs. S&P 500 | 10Y Return vs. S&P 500 |

| ARKW | ARK Next Generation Internet ETF | 0.76% | $2,436 | 442.80% | – |

| SOXX | iShares PHLX Semiconductor ETF | 0.46% | $3,684 | 218.40% | 404.70% |

| SMH | VanEck Vectors Semiconductor ETF | 0.35% | $2,733 | 198.80% | 382.30% |

| ARKQ | ARK Autonomous Technology & Robotics ETF | 0.75% | $633 | 167.80% | – |

| XSD | SPDR S&P Semiconductor ETF | 0.35% | $534 | 164.10% | 277.70% |

| PSI | Invesco Dynamic Semiconductors ETF | 0.57% | $266 | 163.50% | 298.70% |

| IGV | iShares Expanded Tech-Software Sector ETF | 0.46% | $5,315 | 144.10% | 285.40% |

| VGT | Vanguard Information Technology Index Fund ETF Shares | 0.10% | $41,473 | 140.70% | 289.40% |

| FTEC | Fidelity MSCI Information Technology Index ETF | 0.08% | $4,589 | 131.80% | – |

| IYW | iShares US Technology ETF | 0.43% | $6,080 | 130.10% | 228.20% |

| XNTK | SPDR NYSE Technology ETF | 0.35% | $501 | 130.10% | 232.30% |

| XLK | Technology Select Sector SPDR Fund | 0.13% | $34,141 | 127.50% | 249.00% |

Research Performed Using Stock Rover

Overall, 28 ETFs have beaten the S&P 500 over the last five years. The technology sector is simply the best-performing sector in the US stock market. The top 3 high-performing ETFs are the ARK Next Generation Internet ETF, iShares PHLX, Semiconductor ETF, and the VanEck Vectors Semiconductor ETF.

11. Utilities

The utilities sector consists of companies providing essential home and business services. Those services include electricity, natural gas, water, and sewer.

Most utility stocks are energy providers, such as electric companies. Many utility companies operate infrastructure that delivers those services. Some electric companies, for example, own power lines but no generating plants.

The GCIS defines companies that own generating plants as utility companies. Thus, most “Green Energy” companies that own solar farms, wind farms, and other renewable energy plants are utility stocks.

Utilities have a sector because the government regulates utilities more extensively than normal companies. In the United States, special state agencies and cities regulate many utilities.

Analysts define this because utility stocks are stable and unsexy and generate large amounts of float from monthly bills. Because of the float, Warren Buffett owns many utilities, including Nevada Energy, through Berkshire Hathaway (NYSE: BRK.B).

Evidence shows that utilities are no longer widows and orphans’ stocks because of global warming. Pacific Gas & Electric (NYSE: PCG), a massive gas and electric utility in California, declared bankruptcy in 2019 because of losses from Climate Change that caused fires.

Best Utility Sector Stocks

According to 5 years of data, the best technology sector stocks to invest in are NRG Energy, NextEra Energy, Middlesex Water, American Water Works Co, and Brookfield Infrastructure Partners outperformed the S&P 500 index and had a 5-year return of 155% or better.

| Ticker | Company | 1-Year Return | 5-Year Return | 5-Year Return vs. S&P 500 |

| NRG | NRG Energy | 18.20% | 280.00% | 145.80% |

| NEE | NextEra Energy | 21.10% | 245.40% | 111.20% |

| MSEX | Middlesex Water | 66.40% | 202.90% | 68.70% |

| AWK | American Water Works Co | 21.70% | 178.10% | 43.90% |

| BIP | Brookfield Infr Partners | 28.40% | 155.90% | 21.70% |

| AWR | American States Water | 31.40% | 146.00% | 11.80% |

Research Performed Using Stock Rover

The utility sector is the place to go if you seek regular income through dividend payments. However, the lack of growth could hurt your investments in the long term. However, a few companies have managed solid performance against the market, especially American Water Works Co. +475% and CMS Energy +115% over ten years.

You would be well advised to avoid all Utility Sector ETFs, and none come close to matching the market performance.

How to Invest in the Utilities Stock Sector

One safe way to invest in the Utilities Sector is to buy stocks in companies that own energy transmission infrastructure. That includes grid operators, distribution network owners, energy traders, and marketers.

Another strategy is to buy companies making massive investments in solar energy, wind, nuclear, and other sources that do not produce greenhouse gases. Solar energy companies include Berkshire Hathaway (BRK.B) and other utilities that build solar farms and equipment manufacturers, such as Tesla (NYSE: TSLA). An advantage of such a clean energy investment is that many governments offer huge incentives to green energy companies.

An interesting alternative to traditional Utility Stocks is the Invesco WilderHill Clean Energy ETF (PBW). PBW invests in stocks on the WilderHill Clean Energy Index of US-listed Green Energy companies.

Those seeking a traditional Utility Stock ETF can examine the Vanguard Utilities ETF (VPU). VPU invests in the stocks on the MSCI US Investable Market Index Utilities. The VPU’s holdings include Duke Energy (DUK), Dominion Energy (D), the Southern Company (SO), and Xcel Energy Inc. (XEL). The VPU owns many traditional utility stocks that are heavily exposed to global warming.

Stock Sectors Summary

Only three stock sectors have outperformed the S&P 500 over the last ten years. The technology sector beat the S&P by +381%, the consumer discretionary sector outperformed by +181%, and healthcare performed well over ten years by +34%.

Understanding the 11 stock sectors can show you where and how to invest and how the economy and the markets work.

Other Interesting Stock Market Listings

Thank you for the information. It was user friendly yet very informative. I will be using all your insights and analytical tools on my Trading Journey.