Index funds are the best thing to happen to individual investors since the inception of the stock market.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

Find out more about index fund and their extensive benefit and negative traits.

What is an index fund?

An index fund brings diversification and simplicity to investing by enabling investors to buy an entire stock market index, such as the S&P500 or the Russell 3000. Index funds allow investors to share in the profits of all companies in an index while reducing volatility and risk.

An index is a portfolio or list of equities, commodities, or securities, usually stocks, that form the basis of an index fund. An index fund is an investment fund that only owns equities, securities, or commodities on a specific index. For example, an S&P 500 index fund only invests in Standard & Poor’s 500 stocks.

The difference between an index fund and a traditional investment fund is that there is no active management. Instead, the fund manager reads the index and buys its stocks. When stocks leave the index, the manager sells them.

Today, index funds need no team of researchers; algorithms and artificial intelligence can read an index and buy and sell stocks. There are now index funds that manage themselves.

A significant advantage of index funds is the low fees they charge. Some index funds charge management fees as low as 0.04%. The costs are low because index funds do not have celebrity fund managers with high salaries and large staff. Instead, computer programs manage an index fund.

The true advantage of index funds is their simplicity. You need no expert knowledge to invest in an index fund, and the fund enables you to reap nearly the entire profits of the index.

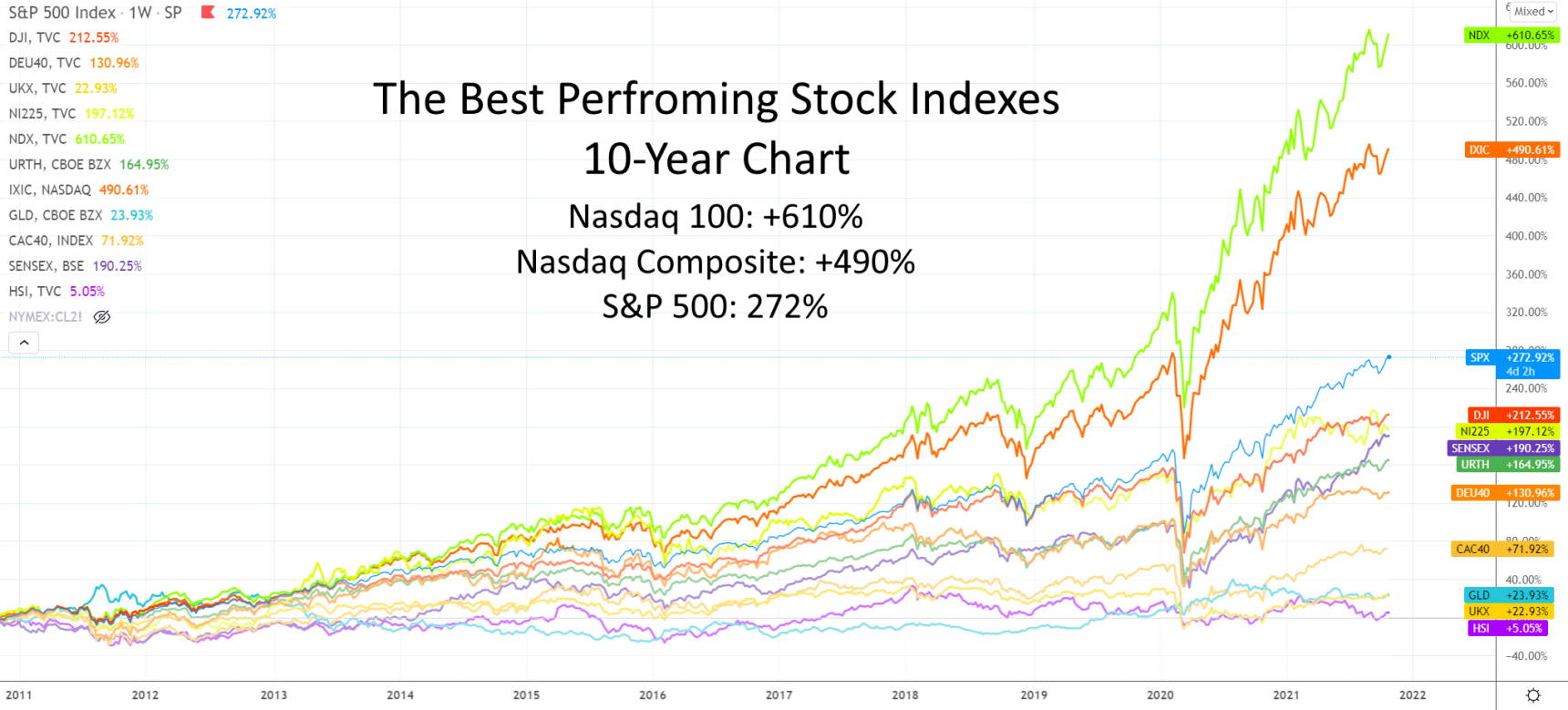

Index funds are popular because of the low cost and the high growth rates some can deliver. According to Stock Rover, the Vanguard S&P 500 ETF offered a one-year growth rate of 30%, a five-year growth rate of 16.88%, and a 10-year growth rate of 16.59% to 2022. $10,000 invested in a Vanguard S&P 500 ETF in 2011 would have grown to $46,426 on January 01, 2022.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

Many people buy index funds because they do not need to think about them or deal with managers or brokers. Others prefer a high rate of growth that is in line with the market growth.

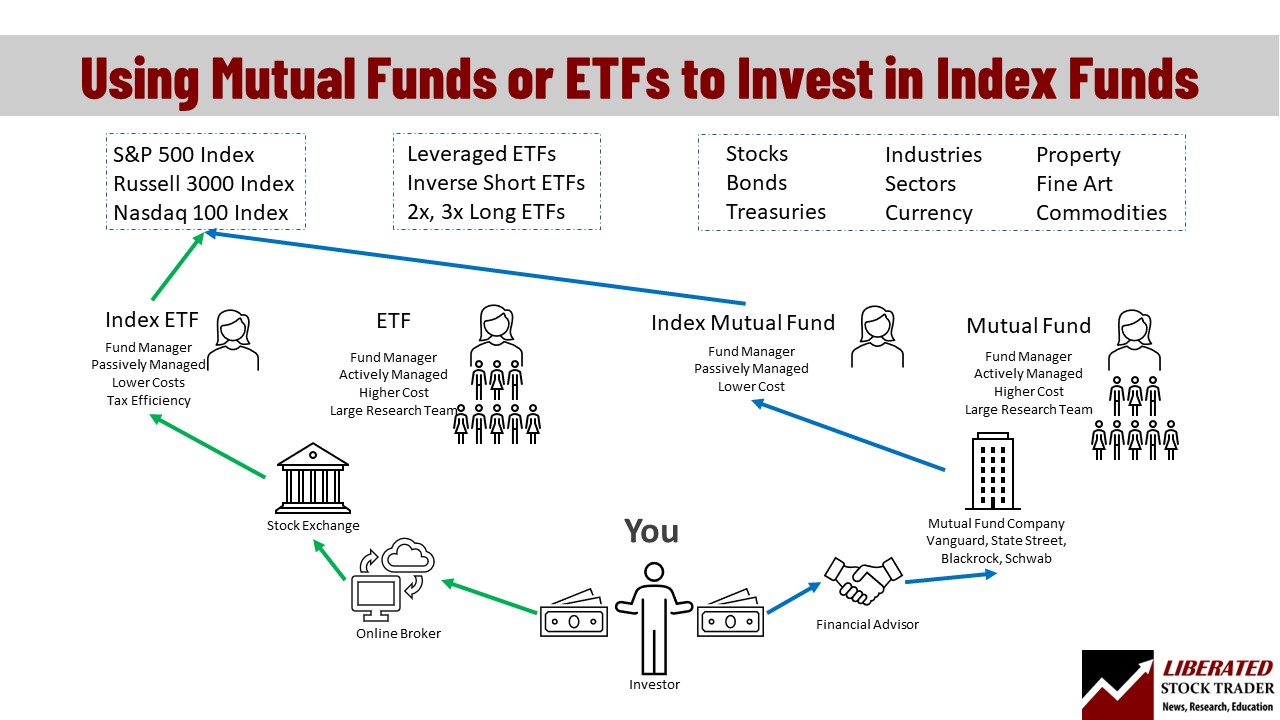

Any investment fund can be an index fund. Today, there are indexed mutual funds and exchange-traded funds (ETFs).

The best-known variety of index funds is mutual funds; Statista estimates there were 490 indexed mutual funds in the United States in 2020.

Exchange-traded funds, which you can trade through stock exchanges, are gaining popularity. Stock Rover estimates 2,024 ETFs in the United States in 2021, up from 123 in 2001.

How do index funds work?

Index funds work by replicating the price movement of the benchmark index. When an investor purchases shares in an index-tracking ETF, the fund must purchase the equivalent amount of all stocks in the index to ensure the total value of its assets has parity with the index.

This process is automated for passive index-tracking ETFs; machines buy and sell the equivalent investments in the index, typically achieving 99% parity with the benchmark index.

5 Broad Market Index Funds Worth Investing In

Vanguard Total World Stock Index (VT)

The Vanguard Total World Stock Index is a low-cost fund that invests in companies across the globe, including both developed and emerging markets. It offers broad diversification and has a track record of strong performance.

The fund is managed passively to maintain a diversified portfolio of developed and emerging market stocks based on market cap weighting. It excludes frontier markets like Vietnam and Kuwait, similar to other peer funds.

Fidelity Nasdaq Composite Index ETF (ONEQ)

This fund seeks to provide investment results corresponding to the total return of the NASDAQ Composite stock market. ONEQ tracks solely Nasdaq-listed companies, excluding those on the NYSE or other exchanges. The index of the underlying funds includes both domestic and international companies listed on Nasdaq.

Schwab Fundamental U.S. Broad Market Index ETF (FNDB)

An index fund that follows the US Total Stock Market’s performance. FNDB begins with the well-known Russell 3000, a market-cap-weighted total market index, and uses fundamental screens to select and weigh its stocks.

iShares Core S&P Total U.S. Stock Market ETF (ITOT)

This ETF aims to mirror the performance of the S&P Total Market Index, providing extensive market coverage in a cost-effective and liquid fund. ITOT is tailored to follow the broad US equity market, encompassing large, mid-, small-, and micro-cap stocks.

SPDR Portfolio MSCI Global Stock Market ETF (SPGM)

An ETF seeking to mirror the investment performance of the Dow Jones U.S. Total Stock Market Index. SPGM contains global stocks that follow a wide-ranging, market-cap-weighted index spanning 23 developed and 27 emerging market countries.

The benefits of index funds

The five benefits of investing in index funds are diversification, steady returns, minimal time investments, beating inflation, and it is relatively easy.

The five major benefits of investing in index funds.

- Diversification

- Steady High Returns

- Little Work or Research is Necessary

- Index Funds Beat Inflation

- Investing in Index Funds is Easy

Diversification & risk reduction

Indexing is a risk management tool that reduces risks through diversification. Diversification means buying many investments to reduce risks.

The theory behind diversification is that you can lose all your money if you concentrate your investment in one sector. For example, a tech sector crash could wipe out a person who owns only technology stocks.

Diversification tries to protect a nest egg by putting money into different sectors or investments. The theory is that diversifying your investments makes you less likely to lose your money. Experts recommend diversification for people saving for retirement.

Advocates believe the more diversification, the higher the margin of safety. Indexing is an effort to achieve a high level of diversification. An S&P 500 Index Fund includes 500 stocks in many industries and is one of the most diversified investments available.

People who purchase index funds are buying a diversification strategy. They design funds such as the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) to offer a high margin of safety. The hope is that SPY will retain value because it holds equity in the 500 most successful companies in the USA.

They base the diversification of Index Funds on Modern Portfolio Theory. Economist Harry Markowitz created It in the 1952 Journal of Finance paper Portfolio Selection. The theory was so influential that Markowitz won a Nobel Prize in Economics.

Modern Portfolio Theory teaches that the right mix of investments can offer higher returns and lower risks. When fund managers create an index, they try to apply this theory.

Steady Returns

Index funds are popular because many of them offer high rates of return on a steady basis. The S&P 500 offered an 18.4% annual rate of return in 2020 and a 31.49% annual rate of return in 2019, according to Stock Rover. The S&P 500 offered an average long-term return of 9.64% in the period ending on February 1, 2021.

One belief behind indexed funds is that the regular high rate of return will cancel out losses. FOR EXAMPLE, the S&P 500’s 31.49% return in 2019 and 21.83% return in 2017 made up for the -4.38% loss in 2018.

Many investors believe that high returns and steady growth reduce risk. The constant growth offsets losses in declining industries and reduces the risks from economic downturns and market losses.

One risk indexing reduces is technological progress. Constant technological change destroys companies and industries by making products and services obsolete. Owning an S&P 500 Index fund ensures investors own stock in companies offering new technologies. An index investor does not have to worry about the death of traditional television because Disney (DIS) is part of the S&P 500.

An S&P 500 index fund, such as the SPY or the Vanguard S&P 500, will hold stock in technology companies such as Apple (AAPL) and rising businesses like Tesla (TSLA). The S&P 500 investor theoretically enjoys the benefits of technology stocks without the risks.

Screen for ETFs on TradingView

Little Work or Research is Necessary

One reason for the popularity of index funds is that investing in them often requires little work or research. Index fund investors do not have to spend hours researching individual stocks or companies. No knowledge of the markets, the economy, technology, products, or politics is necessary. All the investors need to do is put money in the fund.

When you own an S&P Index Fund, you do not have to follow the market daily or individual stocks. The fund will buy stocks based on their market caps.

Index funds are popular with investors who do not have time for research. Professionals with full-time jobs and families like index funds because they make investing fast and simple.

Many advisors recommend index funds because they require little investor education. The advisor does not need to spend hours explaining an investment or the markets to someone who dislikes discussing financial matters. Index funds are popular because they require little thought, work, time, or research.

Index Funds Beat Inflation

Many buy investment funds because they beat inflation in an age of low savings account returns.

The US annual inflation typically oscillates between 2% and 3%, while the S&P 500 offers a long-term annual return of 7% and 9%, which means an inflation-adjusted return of 6%.

The average interest rate for a US savings account is 0.06%, and Index Funds also beat government debt as the daily yield curve on a 30-year US Treasury Bond is 2.04%. The daily yield curve on a 20-year Treasury bond was 1.99%, and the return on a 10-year treasury bond was 1.48%.

Indexed funds are among the few investments that beat inflation that investors can easily access.

Investing in index funds is easy.

Index funds are popular because they are simple and easy to invest in. You can buy fractional shares of index exchange-traded funds (ETFs) through Robinhood, the Cash App, Interactive Brokers, Gemini, and WeBull for as little as 1¢.

A fractional share is a tiny percentage of a stock or ETF. For example, you could buy $5 worth of the SPDR S&P 500 ETF Trust (NYSEARCA: SPY). People who cannot afford to pay several hundred dollars for a SPY share can invest in SPY with fractional shares.

Anyone with money can purchase index mutual funds from companies such as Vanguard and Fidelity. To begin the purchase process, go to the company’s website.

Many organizations allow employees to purchase mutual funds and ETFs through 401k and other investment plans. The advantage of these tax-deferred investments is that they take the funds from your salary. Many organizations’ human resources departments make it easy to enroll in 401k plans.

The drawbacks of index funds

Index funds have drawbacks that make them poor investments for some. The investment media, financial advisors, and fund companies often hide these drawbacks to make index funds more appealing. All investors need to understand index funds’ limitations.

Individual stocks can grow faster than index funds.

According to Stock Rover, Amazon.com’s 5-year return is 325% versus the S&P 500 index fund’s return of 112%. Individual stocks could better serve people who want high growth rates and cash-flowing investments. Individual stocks can offer higher rates of growth and return and are also better for speculation. The tough challenge is picking the right growth stocks that will beat the market in the future.

Individual stock risks are far greater than those from index funds. Diversification reduces risk, but it often leads to lower overall returns.

Everybody who buys an index fund must realize that they are forgoing other opportunities that could be far more profitable but that those opportunities will carry far higher levels of risk.

There is no guarantee of index growth and returns.

The great attraction of indexes is the long-term margin of safety and steady growth that indexes offer. Index funds can suffer enormous short-term losses, however.

The S&P 500 lost 38.49% of its value during the financial crisis crash of 2008, but in 2009, it recovered when it grew by 23.45%.

The S&P 500 can suffer multi-year losses during a stock market crash. According to Stock Rover, the S&P 500 shrank in 2000, 2001, and 2002 and fell by 10.14% in 2000, 12.04% in 2001, and 23.37% in 2001.

History shows that steady index growth is not guaranteed. There have been periods of losses. Index recovery can come fast; Stock Rover estimates the S&P 500 grew by 26.38% in 2003.

Investors need a system to help them avoid stock market crashes when investing in index funds.

Index investors have no control over the fund holdings

Many people love index funds because they do not have to research or pick stocks. This lack of control can create moral and other hazards for investors.

An index fund could hold stocks in companies in which investors have moral or philosophical objections. An S&P 500 fund could own tobacco companies, gambling companies, distillers, brewers, companies that distribute offensive entertainment programs, oil companies, defense contractors, and companies that build weapons. An index could also hold stock in companies that engage in union-busting and outsourcing or companies that donate money to politicians people object to. Many large American companies donate to individual politicians and organizations, such as the Republican and Democratic parties.

A new type of index fund is emerging based on Environmental, Social, and Governance (ESG). ESG indexes refuse to invest in oil companies, for example. There are also indexes based on Christian and other religious values. They design some indexes to fit moral criteria.

The proposed Alpha Architect ETF Trust will only hold stock in companies run by what its creators call “high-character” CEOs, a Securities & Exchange Commission (SEC) filing claims. The high character could mean CEOs with high ethical standards or exemplary behavior.

You will be stuck with the index’s strategy.

Managers design index funds to implement a strategy automatically; an S&P 500 Fund will sell any stock that leaves the Standard & Poor’s 500, no matter how good that stock is.

Research Affiliate analysts allege Apartment Investment and Management (AIV) outperformed Tesla (TSLA) in July 2021, Yahoo! News reports. Tesla Motors replaced Apartment Investment and Management on the S&P 500 in December 2020.

Most S&P 500 fund owners invest in risky stocks they would normally avoid because those stocks are in the index. They base the S&P 500 Index only on the market capitalization of companies. Nobody evaluates S&P 500 stocks for their performance.

Index fund investors must be comfortable with the index’s strategy because they are stuck with it.

- Related Article: 13 Top Stock Portfolio Examples & How To Implement Them

Top 5 tips for investing in index funds

Index funds are not rocket science. Any literate person can learn how to invest in indexes.

- Conduct as much research as possible. The more you know about index funds, the easier it will be to make money and avoid losses.

- Understand your tax situation. Many investors face a large tax bill because they do not understand strategies such as tax-loss harvesting and asset location.

- Read the fee table and the prospectus. Many index funds contain hidden fees that take 10% to 25% of your investment. Study the fine print carefully because fund managers have many euphemisms for fees.

- Don’t become obsessed with watching funds or the market. The primary advantage of index funds is that they manage themselves. There’s no reason to check the market or the fund’s performance every day.

- Monitor your funds. The advantage of index funds is that you do not have to watch them constantly. Smart investors check fund performance monthly or bi-monthly. Sometimes, you will have to sell funds due to tax loss harvest.

Index funds are among the best long-term investments for smart investors.

The history of index funds

Despite their popularity, indexed funds are a relatively new variety of investments. In a 1960 paper, University of Chicago students Edward Renshaw and Paul Feldstein proposed a theoretical model for an investment company.

Walton D. Dutcher Jr. and Richard A. Beach registered the first known index fund, the Qualidex Fund Inc., with the Securities and Exchange Commission (SEC) in 1970. Qualidex, which tracked the Dow Jones Industrial Average, became active on July 31, 1972.

In 1975, the man who popularized index funds, John Bogle, entered the business. Bogle started the First Index Investment Trust, the predecessor to today’s Vanguard Index 500 Fund (VOO). The First Index was one of the earliest S&P 500 funds.

The First Index Investment Trust received little love from the investment industry. Analysts and brokers mocked it as “Bogle’s Folly” and labeled it “un-American.” Bogle, however, had the last laugh.

Bogle’s Folly is going strong 45 years after its birth. The Vanguard S&P 500 had total net assets of $720.2 billion on October 15, 2021.

The size of the index fund market is huge; in April 2021, index funds held $11 trillion in assets, nearly 30% of the market capitalization of the S&P 500, which is valued at $36.54 trillion.

Index funds are the biggest single stockholders in 90% of the companies in the S&P 500. Index funds comprised 20% to 30% of the US equities market in 2018, Harvard Law School Professor John C. Coats estimates.*

The index fund market is so large that it inspires hysteria. Bloomberg Businessweek warned its readers of The Hidden Dangers of the Great Index Fund Takeover in 2020. Businessweek called the three largest index fund operators, BlackRock, Vanguard, and State Street, “the most important players in corporate America.”

If Bloomberg is correct, three index fund companies controlled $15.5 trillion in assets in January 2020. BlackRock, the owner of iShares, managed $7 trillion in assets in January 2020, Vanguard Group held $5.6 trillion in assets, and State Street Corp held $2.9 trillion in assets. State Street, Vanguard, and BlackRock manage 80% of all index fund capital.

Bloomberg claims that the giant index fund companies held 22% of the shares of the typical S&P 500 company. Critics fear index funds could have a disproportionate influence over companies because of the number of stocks they hold and that index funds could trigger a stock market crash by selling enormous shares.

One fear is individual investors have less influence over the market because of the size of index funds.

Index funds are an important feature of the market. Understanding index funds is critical for understanding the stock markets, even for individual stock investors.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters