Investors use the income statement to understand a company’s key metrics, revenue, expenses, profit, and operating costs.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

It is one of the most important documents investors use to understand a company’s financial performance.

If you understand the income statement, you have the foundation to build high-quality fundamental investing strategies, like growth, value, and dividend investing.

Key Takeaways

• Income statements are valuable financial documents that provide investors insight into a company’s performance.

• Investors should analyze the different line items, interpret the data, conduct ratio analysis, and compare income statements over time to gain valuable insights into a company’s financial health.

• Qualitative factors such as management effectiveness, competitive position, and industry trends should also be considered when assessing a company’s financial health.

• Comparing the income statement over time can provide valuable insight into how the company has been performing, and comparing it to other companies in the same industry can give investors a competitive advantage.

Income Statement: How to Read It Like a Pro InvestorThe income statement or profit and loss (P&L) is one of the three primary financial statements investors use when assessing a company’s financial health and performance. It shows a business’s revenues, expenses, and net income (or loss) during an accounting period. Companies report income statements quarterly in the USA or annually in Europe.

Why is the income statement important for investors?

The income statement is important for investors because it provides key information about a company’s profitability. It shows whether the company is generating profits or losses, how well it controls costs, and how efficiently it generates revenues. Investors use this data to decide whether or not to buy or sell a stock. The income statement also helps them assess how well management is running the company.

What is an Income Statement?

An income statement is a financial document that shows how much money a company made, spent, and earned over a period of time. It shows the revenue generated from sales activities and expenses incurred to produce those sales. The net income figure reported on the income statement is what’s left after all other expenses are accounted for and represents the company’s profits or losses.

Components of an income statement

The components of an income statement include revenues, expenses, gains, and losses. Revenues are the money a company makes from selling goods and services. Expenses are costs incurred to generate revenue, such as salaries, taxes, and other operating costs. Gains and losses refer to non-operating activities or extraordinary items such as investments or legal settlements.

The bottom line of an income statement is the net income figure, which is the result of subtracting all expenses from revenues.

Reading and Understanding an Income Statement

To read and understand an income statement, it is important to look at the individual components and how they relate to each other. It is also important to compare the financials of different periods – such as quarters or years – to track trends and any changes that may have occurred.

How to read an income statement

An income statement typically has several components, including revenues, costs of goods sold, operating expenses, other expenses, and net income. Some companies may have additional line items such as extraordinary gains/losses or discontinued operations. Understanding each item is important so you can properly interpret the financial data.

Revenues

This is the total amount a company earns from its business activities, such as sales, services, and interest income. This is usually the top line on an income statement.

Costs of goods sold (COGS)

These are the direct costs associated with producing and selling a product. This includes materials, labor, shipping, and other manufacturing costs.

Operating expenses

These are the costs associated with running the day-to-day operations of a business. This may include salaries, rent, advertising, utilities, and more.

Other expenses

This is where companies can account for additional expenses or losses not included in the operating expenses section. This could include legal fees, foreign exchange losses, or write-downs.

Net income

The bottom line on an income statement is net income, which investors use to gauge a company’s financial health. Net income is calculated by subtracting all expenses from revenues. A company has a net loss if there are more expenses than revenues.

Gross profit (GP)

Gross profit is the difference between revenue and cost of goods sold. This figure shows how much money a company makes after subtracting the costs of producing products or services.

Operating profit (OP)

Operating profit is the amount of money a company earns after subtracting all operating expenses from revenue. This figure excludes non-operating income or losses such as taxes, interest, and dividends.

Net profit (NP)

Net profit is the amount of money a company earns after subtracting all costs, including non-operating expenses, from revenue. This figure is called net income or “bottom line” on an income statement and represents the company’s actual profit or loss.

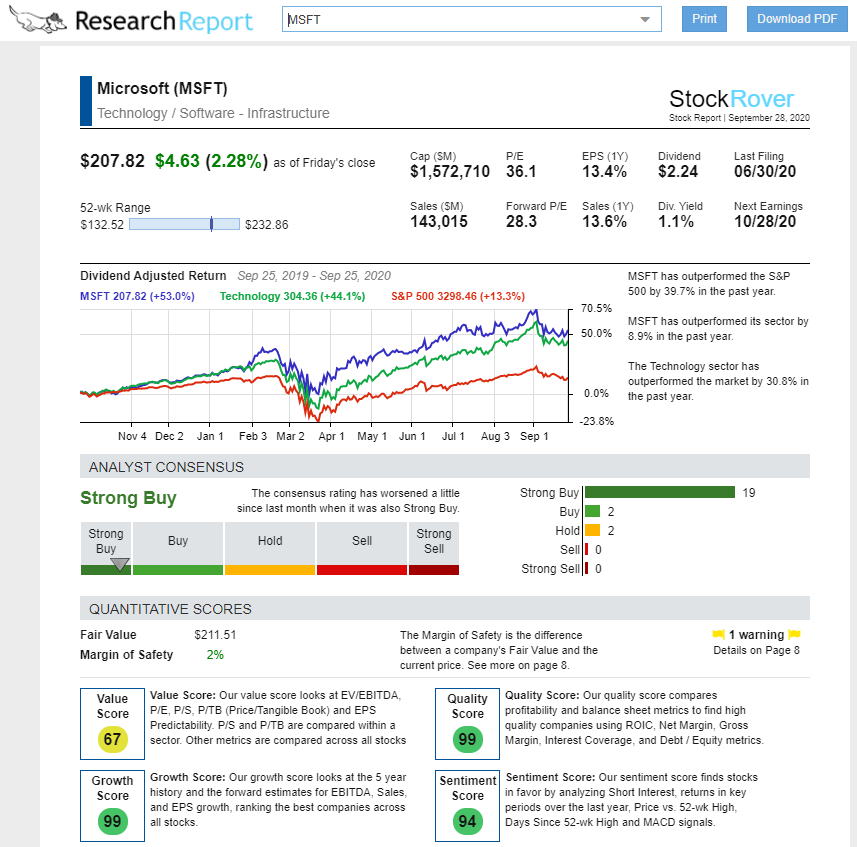

What software is best for financial research?

Stock Rover is our top pick for comprehensive financial research on all US companies. This platform provides robust analytics and real-time research reports and identifies any issues in company accounts. Offering superior stock screening and portfolio management functionality, Stock Rover is the ultimate software we recommend for your investment needs.

Get a Free Stock Rover Research Report

Related Articles: Finding Great Stocks With Stock Rover

- 12 Legendary Strategies to Beat the Market That [Really] Work

- Our Beat the Market Screener [Actually] Beats the Market

- 4 Easy Steps to Build The Best Buffett Stock Screener

- All Value Investing Strategies & Articles

- Use a CANSLIM Stock Screener Strategy To Beat the Market

The Importance of an Income Statement for Investors

The income statement is important for investors because it shows how well a company does financially. It provides key information on how much money a company is making or losing, how efficiently it controls costs and generates revenues, and how effective management is at running the business. Investors use this data to inform their buy/sell decisions and assess a company’s financial health.

Income statements also help investors compare a company’s performance to its competitors. This can help them determine which company is better positioned to generate long-term returns and which are at risk for future losses. It also helps investors identify potential areas of improvement within the business.

How it helps in assessing a company’s financial health

The income statement gives investors a snapshot of a company’s financial performance. It helps them assess the company’s profitability and operating efficiency, which are key indicators of its financial health. By analyzing the income statement, investors can identify revenue, expenses, and net income trends over time and any one-time or extraordinary items that may have impacted the company’s financial performance. This helps them assess whether or not the company is a good investment opportunity.

The income statement also provides investors with an indication of how well the company’s management team is running the business. It shows whether they control costs and generate revenue efficiently, which can be key to determining whether to invest.

Role in making informed investment decisions

The income statement provides investors with critical information to make informed investment decisions. It shows how much money a company makes or loses, what costs are associated with running the business, and whether management effectively controls expenses and generates revenues. By closely examining an income statement, investors can identify potential areas of improvement within the business and any extraordinary items that may have impacted the company’s performance. All of this is essential in determining whether or not to invest in a company.

Understanding and analyzing an income statement carefully can give investors valuable insights into a company’s financial health and help them make more informed investment decisions.

Try Powerful Financial Analysis & Research with Stock Rover

Analyzing an Income Statement

To analyze an income statement, investors must first understand the different line items and how they measure a company’s performance. They should pay particular attention to the revenue, cost of goods sold, operating expenses, other expenses, and net income figures.

Interpreting the data

When reading an income statement, investors should look for trends in key performance metrics over time, such as total revenue, cost of goods sold (COGS), operating expenses, other expenses, and net income. They should also look for unexpected or extraordinary items, such as one-time gains/losses, discontinued operations, etc., which can impact the company’s financial performance.

Ratio analysis

Ratio analysis is a common tool investors use to compare a company’s performance with its peers. This involves calculating ratios such as gross profit margin, operating expense ratio, and return on equity (ROE) from data provided in the income statement. These ratios help investors identify areas of strength or weakness within the business and give them an indication of how efficiently the company is operating.

Comparing income statements over time

Investors should also compare income statements over time to identify any trends in key performance metrics. This will help them understand how the company’s financial performance has changed over time and if there are any potential areas of improvement or risks associated with investing in the business. Comparing income statements of competing companies can also give investors valuable insights into how their investments might stack up against their peers.

Income statements are an important tool for investors to assess a company’s financial health and make informed decisions about investing. By understanding the different line items, interpreting the data, conducting ratio analysis, and comparing income statements over time, investors can gain valuable insights into a company’s performance and determine whether or not it is a good investment opportunity.

Understanding trends and patterns

Understanding the trends and patterns in a company’s income statement can help investors identify potential risks or opportunities with their investments. For example, if revenue is steadily increasing while operating expenses remain flat, this could indicate that management is becoming more efficient at controlling costs and generating revenues. Similarly, if COGS are steadily rising while net income remains stable, this could indicate that management is effective at controlling costs despite increasing input prices.

Real-World Examples of Income Statement Analysis

Analyzing an income statement in a real-world context involves examining a company’s financial performance over a specific period. The income statement, or P&L, provides a detailed overview of a company’s revenues, costs, gross profit, selling and admin expenses, and other income and expenses.

| Income Statement For XYZ Corp |

| (Figures USD) | Year 1 | Year 2 |

| Net Sales | 1,000,000 | 1,200,000 |

| Cost of Sales | (400,000) | (450,000) |

| Gross Profit | 600,000 | 750,000 |

| Operating Expenses (SG&A) | (200,000) | (250,000) |

| Operating Income | 400,000 | 500,000 |

| Other Income (Expense) | (20,000) | (20,000) |

| Extraordinary Gain (Loss) | – | – |

| Interest Expense | (5,000) | (5,000) |

| Net Profit Before Taxes (Pretax Income) | 375,000 | 475,000 |

| Income Taxes | (75,000) | (85,000) |

| Net Income | 300,000 | 390,000 |

For instance, let’s consider a hypothetical company, XYZ Corporation. We can evaluate the company’s financial health and operational efficiency by examining its income statement. Let’s look at year one.

- Revenue is the total amount of money the company makes from selling its goods or services. Let’s assume XYZ Corporation generated $1 million in sales revenue.

- Cost of Goods Sold (COGS): These are the direct costs associated with producing the goods the company sells. Suppose XYZ Corporation’s COGS amounted to $400,000.

- Gross Profit: This is calculated by subtracting COGS from Revenue. In this case, XYZ Corporation’s gross profit would be $600,000 ($1 million – $400,000).

- Operating Expenses: These include selling and administrative expenses. Let’s say XYZ Corporation’s operating expenses totaled $200,000.

- Operating Income: This is calculated by subtracting operating expenses from gross profit. XYZ Corporation’s operating income would be $400,000 ($600,000 – $200,000).

- Net Income: This is the company’s total earnings, calculated by subtracting all expenses, including taxes and interest, from the operating income. If XYZ Corporation’s taxes and interest amounted to $100,000, its net income would be $300,000 ($400,000 – $100,000).

By analyzing these figures, we can gain insights into XYZ Corporation’s profitability, cost efficiency, and operational effectiveness. For instance, the high gross profit margin indicates that the company is efficiently managing its production costs. However, the relatively lower net income suggests that the company may need to address substantial tax liabilities or interest expenses.

Comparing XYZ Corp.’s Income statement with Year 2 data.

Comparing these figures with data from year two can reveal company financial performance trends. Net sales have increased 20% from $1M to $1.2M. Additionally, we can see the net income has increased from $300K to $390K, a 30% increase. This highlights that while increasing sales by 20%, the company has increased net income by 30%, meaning it is becoming more efficient.

Remember, comparing a company’s income statement with those of other companies in the same industry is crucial. This comparative analysis can provide valuable insights into the company’s competitive position and industry performance.

6 Items Investors Should Look For in Income Statements

- Take a look at the revenue. The higher it is, the more profitable and successful the company will likely be. It should be increasing quarter on quarter, year on year.

- Analyze the gross profit margin to determine how efficiently the company manages its production costs. A low gross profit margin can indicate opportunities for cost savings or improved pricing strategies. Profit margins should be stable or increasing.

- Calculate the operating income to assess how effectively the company controls its day-to-day expenses.

- Compare net income figures from previous years for a better understanding of trends in profitability.

- Identify any red flags, such as high taxes and interest costs, which could pressure the company’s bottom line and affect future performance.

- Always look for anything marked as special items or extraordinary expenses. These are allowed for in the generally accepted accounting principles (GAAP) but only as one-off charges for restructuring or closing business units, such as redundancy payments. These may be significant enough to alter the post-tax profit figure from a healthy profit to a minor loss. You should consider these in your valuation of a company.

By understanding these key insights, investors can quickly analyze an income statement and gain valuable insights into a company’s financial performance.

It is important to note that other financial statements should also be considered when assessing a company’s financial health, like the balance sheet and cash flow statement.

When making investment decisions, investors should also consider qualitative factors such as management effectiveness, competitive position, industry trends, and future growth prospects.

Conclusion

Income statements are important documents that provide investors with insight into a company’s financial performance. By understanding the different line items, interpreting the data, conducting ratio analysis, and comparing income statements over time, investors can gain valuable insights into a company’s performance and determine whether or not it is a good investment opportunity.

Final thoughts

The income statement is a valuable tool for investors to understand a company’s financial performance and make informed investment decisions. By analyzing the different income statement components, investors can gain insights into the company’s profitability, cost efficiency, and operational effectiveness. Moreover, comparing these figures with those of other companies in the same industry can provide valuable insights into the company.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What is the best software for analyzing company financial statements?

The best software to quickly and accurately analyze the income statement, balance sheet and cash flow, is Stock Rover. Stock Rover produces detailed analyses and charts of all the critical elements of a company's financials. Plus, it has powerful stock screening and portfolio management tools.

What is the most important part of the P&L statement?

The most important part is the net earnings section. It shows the profit or loss the business made in a given period. Comparing current profit figures with previous ones can reveal trends and indicate whether the business is growing or struggling.

What questions are answered by the income statement?

The income statement answers essential questions about a company's financial performance, such as how much revenue it generated, what expenses it incurred, and what net earnings it achieved. It provides insights into the company's business model and competitive position within its industry.

What information can be found on a P&L statement?

A P&L statement contains details about a company's revenue, which is the total income from the sale of products or services from the company's operations. It also shows the company's business expenses, including rent, cost of goods sold (COGS), freight, and payroll.

How frequently are financial statements prepared?

Financial statements can be prepared monthly, quarterly, or annually. The frequency depends on the company's needs and regulatory requirements.

What is the difference between operating and non-operating revenue?

Operating revenue is generated from a company's core business operations, while non-operating revenue comes from secondary sources, like investments or asset sales.

What’s the difference between a balance sheet and an income statement?

The balance sheet shows a company's financial position at a specific time; the income statement shows the company's financial performance over a period.

What is Deferred Tax Liability?

Deferred Tax Liability is a tax that a company owes but has not yet paid. It typically occurs due to differences in depreciation rules between the IRS and GAAP.

How is the income statement used in financial analysis?

Analysts use the income statement to evaluate a company's profitability, operational efficiency, and cost management. They compare these metrics with other companies in the same industry to assess the company's competitive position.

What should investors look for in an income statement?

Investors should primarily look at four main factors: revenue, profitability, debt level, and cash flow. These elements can provide insights into a company's financial health and prospects.

Which financial statement contains the most important information for investors?

While all financial statements are essential, the income statement is often considered the most accurate. It provides a detailed overview of a company's financial performance over a specific period.

What is the relationship between the income statement and the balance sheet?

The income statement and balance sheet are closely related. The net income from the income statement is used to increase the equity section of the balance sheet, reflecting the increase in the company's net assets.

Why is the income statement important for shareholders?

The income statement is crucial for shareholders because it provides information about the company's profitability. This can influence the company's share price and the dividends it can distribute to shareholders.

What does a negative net income indicate on an income statement?

A negative net income on an income statement indicates that the company's expenses exceeded its revenues. This could signal financial difficulties and potential risks for investors.

How do changes in the income statement impact the company’s cash flow?

Changes in the income statement can significantly impact a company's cash flow. For instance, increased net income typically results in higher cash flows from operating activities.

How are earnings per share calculated using the income statement?

Earnings per share (EPS) is calculated by dividing the net income by the number of outstanding shares. It represents the portion of a company's profit allocated to each share of common stock.