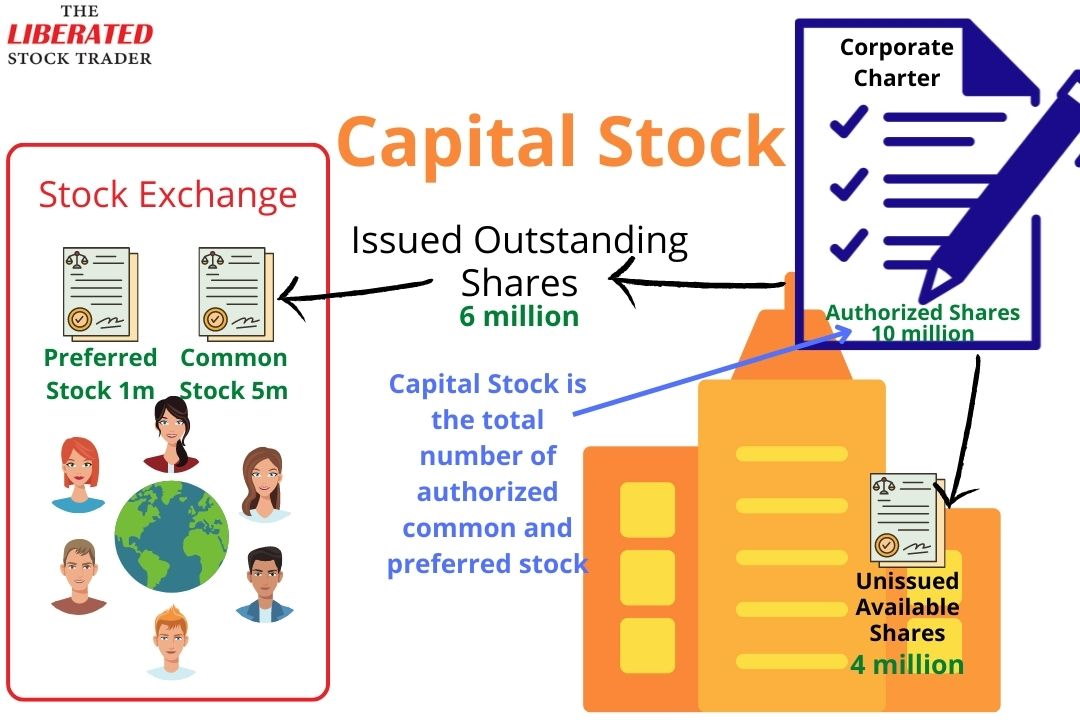

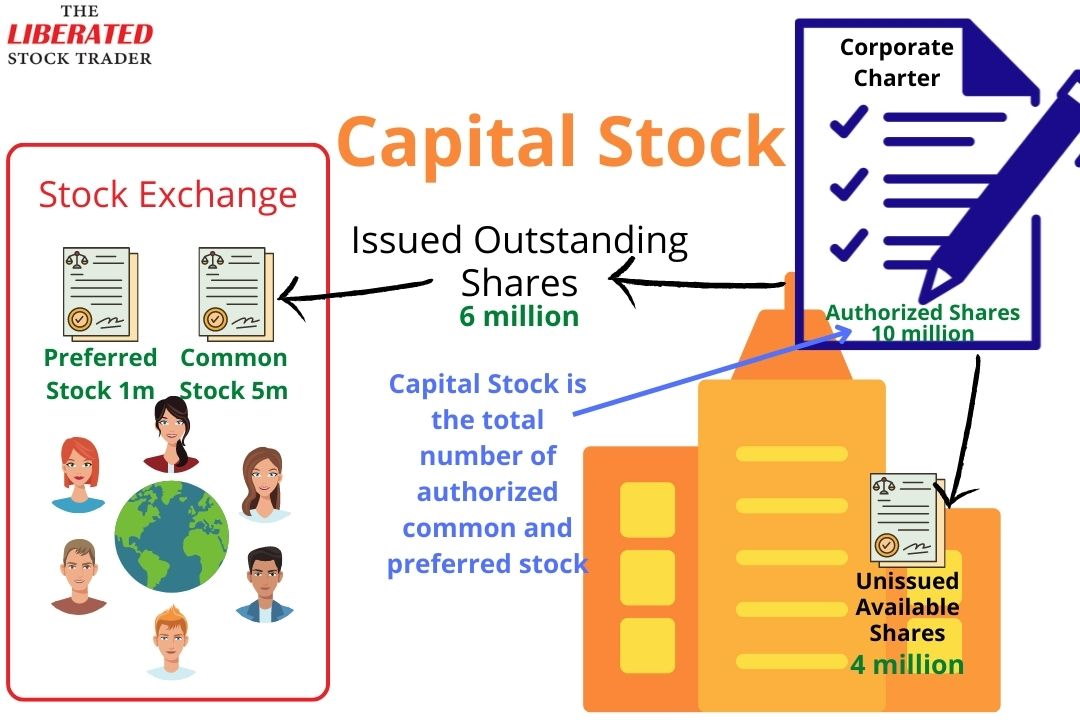

Capital stock is the maximum number of shares a company is authorized to issue to investors. Capital stock is declared in the company’s corporate charter, so a business cannot dilute share value by overissuing stock to shareholders.

Capital Stock Definition

Capital stock, also called authorized shares or authorized capital, is the maximum number of shares a company can issue to shareholders. A corporation’s charter declares the number and type of stock it can issue, so no more than this amount can be issued.

Capital stock includes both common stock and preferred stock.

Why is Authorized Capital Stock Important

Capital stock is important because it caps authorized shares via the corporate charter. It protects investors by preventing companies from diluting stock value by issuing too many shares.

Capital stock often confuses people, as it has multiple definitions. Capital stock refers to the total amount of a company’s outstanding shares. Capital stock can be used to calculate the value of a company, and investors often use it to research potential investments.

This article will provide an in-depth definition of capital stock, discuss its calculation, and give examples of its use. We hope that this information will help you better understand this important term!

Try Powerful Financial Analysis & Research with Stock Rover

Types of Capital Stock

There are two main types of capital stock: common stock and preferred stock. Common stock is the most common type of capital stock, representing the ownership interests that shareholders have in a company. Preferred stock is a more senior type of capital stock, typically paying higher dividends than common stock.

How is Capital Stock Calculated?

When calculating capital stock, all authorized shares of common and preferred stocks are included. In addition to the outstanding shares of both types of securities, capital stock includes treasury stock (shares previously issued but subsequently reacquired by the issuer), unissued shares in reserve for future offerings, and options or warrants held by current shareholders.

The total value of the capital stock is determined by multiplying the total number of authorized shares by the par value per share.

The Formula for Calculating Capital Stock?

The formula for calculating capital stock is the following:

CS = OS + TRS + RFS – OH

Where:

- CS stands for total Capital Stock, which includes all authorized shares of common and preferred stocks.

- OS stands for Outstanding Shares, or those issued currently to shareholders.

- TRS stands for Treasury Stock, which was previously issued but subsequently reacquired by the issuer.

- RFS stands for Reserved for Future Shares, or unissued shares in reserve for future offerings.

- OH stands for Options or Warrants held by current shareholders.

This formula can be used to calculate a company’s total value of capital stock.

Capital stock is an important metric for investors, as it can provide insights into a company’s financial health and growth potential. It is also one of the key inputs in many financial models, so it is important to understand how it is calculated and used.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Capital Stock Example

Suppose a company is authorized to issue 10 million shares via its corporate charter. It has issued 5 million common and 1 million preferred stocks to shareholders. The company has 4 million unissued stocks in reserve, which it can issue later to raise capital without incurring debt.

Authorized vs. Outstanding vs. Issued Capital Stock

The authorized capital stock is the number of shares a company is legally allowed to issue, as stated in its articles of incorporation. The outstanding capital stock is the number of shares issued and currently owned by shareholders. The issued capital stock is the number of shares that have been issued by the company, regardless of whether they are currently outstanding or not.

Using Capital Stock In Investing Research

Capital stock is important information for investors because it can help calculate market capitalization, financial health, and stock price dilution.

Market Capitalization

Investors can use capital stock to research a company and get an idea of how many shares are available for trading. They can also use it to calculate a company’s market capitalization, the total value of all outstanding shares. To do this, they multiply the current share price by the number of outstanding shares.

Financial Health

Capital stock can also be used to measure a company’s financial health. For example, if a company has a lot of authorized but unissued capital stock, it may indicate that it is expanding and does not need to issue more stock to fund growth.

On the other hand, if a company keeps issuing more stock, diluting its share price, it could indicate it cannot fund growth through earnings.

Stock Price Dilution

Capital stock can be used to determine the potential for dilution in a company’s stock price. Companies sometimes increase their authorized shares to raise additional capital, such as issuing new stock to the public. This can dilute current shareholders’ investments, and investors need to be aware of the potential dilution when considering a stock purchase.

Valuation

Finally, understanding a company’s capital stock can help investors determine if it is overvalued or undervalued relative to its peers. By comparing the market capitalization (number of shares multiplied by stock price) to the capital stock, investors can get an idea of how much premium the market is paying for a company. If the market capitalization exceeds the capital stock significantly, it could indicate that the company’s stock is overvalued.

However, if a company continually issues new stock and dilutes its share price, it could indicate that the stock is undervalued.

Calculating Capital Stock

To calculate capital stock, you will need the company’s balance sheet. You can find this on the company’s website or its annual report. The balance sheet will list the company’s assets and liabilities. Look for the line item “Total Equity.” This is the company’s capital stock.

Another way to calculate capital stock is to subtract a company’s liabilities from its assets. This will give you the book value of equity, which is another term for capital stock.

The Problems with Capital Stock

Capital stock can be a useful tool for research, but it has limitations. For example, capital stock does not consider the value of a company’s assets or liabilities, so it may not give an accurate picture of a company’s financial situation.

Another problem with using capital stock for research is that it does not always reflect the current value of a company’s shares. For instance, if a company’s share price has been rising steadily over the past year, its capital stock may not have increased.

Investors should consider these limitations when using capital stock to research a company. While capital stock can be a helpful tool, it should not be the only factor considered when making investment decisions.

Capital stock is a good metric to research if you’re considering investing in a company. By understanding capital stock and its calculation, you can better understand a company’s financial health and how it compares to its competitors. With this information, you can make more informed investment decisions.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

FAQ

What is the best software to research capital stock?

Stock Rover is an excellent software for conducting thorough research on capital stock, company financial metrics, and performance. It offers an extensive suite of portfolio optimization and analysis tools, along with interactive charts for effective visualization of your results.

What is Capital Stock?

Capital stock refers to the total number of shares a company can issue. It represents ownership in a corporation and constitutes a source of funding for the business.

How does Capital Stock differ from Treasury Stock?

While capital stock is the total number of shares a company can issue, treasury stock is the portion of shares a company retains or repurchases.

What are the types of Capital Stock?

There are two primary types of capital stock: common stock and preferred stock. Common stock offers voting rights but has a lower priority regarding assets and dividends. On the other hand, preferred stock does not provide voting rights but takes precedence regarding assets and dividends.

How is the value of Capital Stock determined?

The value of capital stock is determined by multiplying the par value by the total number of issued shares.

Can a company increase its Capital Stock?

Yes, a company can increase its capital stock through a process called a stock split or by amending the corporate charter. This requires approval from the board of directors and shareholders.

What is the role of Capital Stock in a balance sheet?

Capital stock is listed under the shareholders' equity section on a balance sheet. It represents the initial investment in the company.

What is Stock Par Value?

Par value is the nominal or face value of a stock as determined by the corporation at the time of issuance.

What is a Stock Split?

A stock split is a corporate action that increases the number of shares in circulation, reducing the price per share but not the total market cap.

How does Capital Stock affect shareholders?

Capital stock can affect shareholders through dividends, voting rights, and changes in the stock's price.

What is No Par Value Stock?

No par value stock is issued without a specific face value. Instead, the market determines its value.

What does it mean when Capital Stock is "paid-in"?

Paid-in capital stock refers to the amount of money an investor pays to buy shares from the company's initial offering.

Does increasing Capital Stock dilute ownership?

Yes, if a company issues more shares, the percentage of ownership for existing shareholders can be diluted.

Can a company reduce its Capital Stock?

Yes, a company can reduce its outstanding capital stock through a process called share buyback or repurchase.

Can a company have negative Capital Stock?

No! Negative capital stock is impossible, as it implies the company owes shares. However, a company can have negative retained earnings if it has more losses than profits.

What is the difference between Authorized and Issued Capital Stock?

Authorized capital stock is the maximum amount of shares a company can issue, as specified in its corporate charter or articles of incorporation. Issued capital stock is the actual number of shares a company has issued to its shareholders.