To successfully trade leveraged ETFs, you must understand the importance of ETF decay, liquidity, volume, fees, assets under management, and potential risks.

We illuminate the 16 fundamental aspects of leveraged ETF trading for those seeking to navigate this complex market.

What are Leveraged ETFs?

Leveraged ETFs are exchange-traded funds that enable you to bet against or with the direction of a market, sector, or index. Leveraged ETFs enable you to magnify your profits or losses using leverage without the complexity of Options contracts.

Leveraged ETFs usually have built-in leverage of 2x or 3x leverage. If you buy a 3x Leveraged ETF on any market day, and the index moves up 2%, you can expect a 6% profit. Conversely, if the market moved down 2% on that day, the 3x leveraged ETF would ensure you incur a loss of 6%.

16 Leveraged ETF Trading Insights

1. Understand Leveraged ETF Decay

Leveraged ETFs are designed to track a specific benchmark index. They achieve this using various derivatives, such as swaps, futures, and options contracts. While these methods can help magnify potential returns for investors, they also increase the risk of losses due to time decay, known as leveraged ETF decay.

All Leveraged ETFs have warnings that they should only be traded on a daily basis. Of course, you can hold them for longer than one day, but you will see mismatches in the return of the short ETF vs. the actual index over time. This is known as leveraged ETF decay.

Why leveraged ETFs do not match the index’s performance:

- The underlying contracts supporting the leveraged ETFs need to be rebalanced at the end of the trading day; this causes slippage.

- The volatility of an index will affect compounding, which affects the inverse ETF. For more information, see this Leveraged ETF FAQ.

- Related Article: Leveraged ETF Trading Strategy

2. Only Trade Leveraged ETFs daily

Due to the time decay discussed above, it is important to remember that leveraged ETFs are best used as a short-term trading vehicle and should not be held for longer periods. Investors should only buy and sell them daily to minimize their exposure to leveraged ETF decay.

3. Choose ETFs with Liquidity & Volume

When choosing leveraged ETFs, it is important to consider their liquidity and volume. Liquidity refers to how easily an ETF can be bought or sold without significantly impacting its price, while volume refers to the number of shares that change hands on a given day.

Generally speaking, higher liquidity and volume mean lower spreads (the difference between the bid and ask price of an ETF) and lower commissions. Therefore, looking for leveraged ETFs with high liquidity and volume is advisable before investing.

If you purchase leveraged ETFs, you must sell them when you want to, for a price close to your target price. There are 257 Leveraged ETFs on the US exchanges, and the average median trading volume is $34 million per day. You will want to choose ETFs that average at least $50 million per day. The largest ETF, the Proshare Ultra Pro QQQ, trades 4.2 billion daily.

Analyze this Leveraged ETF on TradingView

4. Choose ETFs With Higher AUM

The amount of assets under management (AUM) in an ETF can be a good indicator of liquidity and the trust people have in the fund. A larger asset base means more shares to buy and sell, resulting in lower spreads. While $50 million AUM is the median for leveraged ETFs in 2023, you should select ETFs with at least $100 million; this helps with liquidity and the fund’s stability.

5. Choose a Good ETF Trading Platform

TradingView is a great platform for trading ETFs, and you should make sure you use it if possible; it offers a variety of tools to help traders identify trends, analyze data, and place orders.

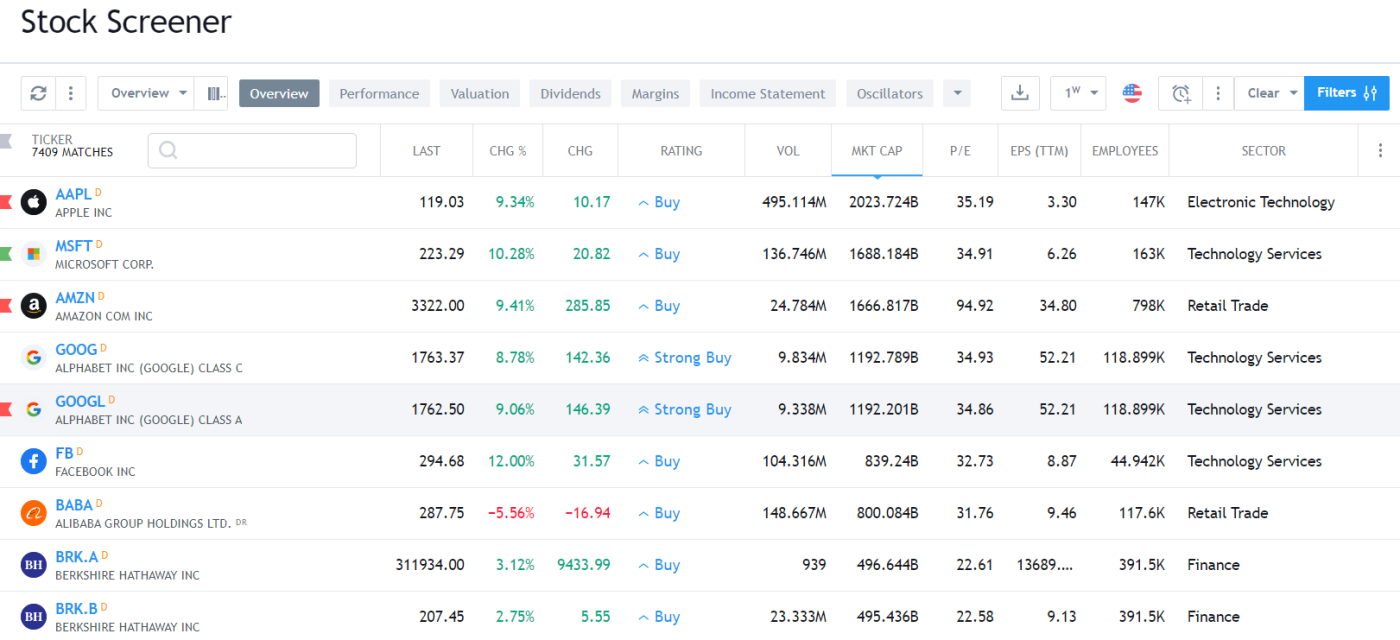

TradingView’s Excellent ETF Screener

Try TradingView’s ETF Screener

6. ETFs Should Have Low Expenses

Any Inverse or Leveraged ETF you trade should have lower expense ratios. Of the 257 ETFs in this study, the average expense ratio is 1.09%, but the range of expenses spanned from 0.64% for the Direxion Daily S&P 500 Bull 2X Shares to 2.42% for the Hamilton Enhanced US Covered Call ETF.

The largest, most liquid funds with over $500 million in AUM have an expense ratio of 0.99%, which is acceptable.

7. Research the Underlying Assets

Understand the assets that the leveraged ETF tracks. This could be anything from equities and bonds to commodities and currencies. The performance of these assets will directly affect the performance of the ETF.

For example, if you’re trading a 3x Leveraged Oil ETF, you should understand the fundamentals driving oil prices.

MicroSectors U.S. Big Oil Index 3X Leveraged ETN

View the Big Oil Leveraged ETF on TradingView

8. Understand the Risks Involved

Inverse and leveraged ETFs are designed as short-term trading vehicles due to their enhanced exposure and potential for greater volatility. These funds can be significantly more volatile than traditional investments, and the market may move against your investment quickly.

Understanding the risks associated with leveraged ETFs before investing is critical. Review any prospectus or related disclosure documents before investing in a leveraged ETF.

9. Utilize Proper Position Sizing

Position sizing is an essential tool for the successful trading of leveraged ETFs. The aim is to reduce overall volatility and protect against catastrophic losses.

It is important to use position sizing properly when trading leveraged ETFs to maximize returns while limiting risk exposure. Proper position sizing will help you manage the inherent risks of trading leveraged ETFs and ensure that your capital remains intact should market conditions move against you.

An example of proper position sizing when trading leveraged ETFs could include allocating a smaller portion of your capital to leveraged ETFs than traditional stocks or funds. For instance, if you typically allocate 10% of your capital to other investments, you might want to allocate only 5% to leveraged ETFs. This will help ensure minimal losses incurred from investing in leveraged ETFs. Additionally, it is important to regularly adjust position sizes based on changing market conditions and risk tolerance.

10. Be Mindful of Overnight Trades

Holding leveraged ETFs overnight can expose you to additional risk due to potential price gaps at the market opening. It’s crucial to carefully consider this risk before deciding to hold positions overnight. It’s best to assume that your positions may gap up or down and adjust the stop loss order accordingly when in doubt.

11. Monitor Leveraged ETFs Closely

Due to their complex structure, leveraged ETFs require frequent daily monitoring as prices can swing significantly even during a single trading session. It is important to keep an eye on the price of the ETF and its underlying holdings. This will help ensure that you remain on top of any sudden changes in market conditions and can react accordingly.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

12. Leveraged ETFs as a Hedging Tool

Leveraged ETFs can be used to hedge risk in a portfolio as they allow investors to take long or short positions in volatile markets. This lets you offset potential losses from unprofitable trades and minimize your portfolio risk. However, Leveraged ETFs should not be relied heavily upon as a hedging tool, as their volatility can lead to large gains and losses over a short period. Be sure to understand the risks associated with leveraged ETFs before investing in them.

13. Stay Up-To-Date With Market News and Analysis

Finally, staying up-to-date on market news and analysis is important as this can help you make informed decisions when trading ETFs. Watch for news and reports from financial institutions, industry experts, and reputable publications.

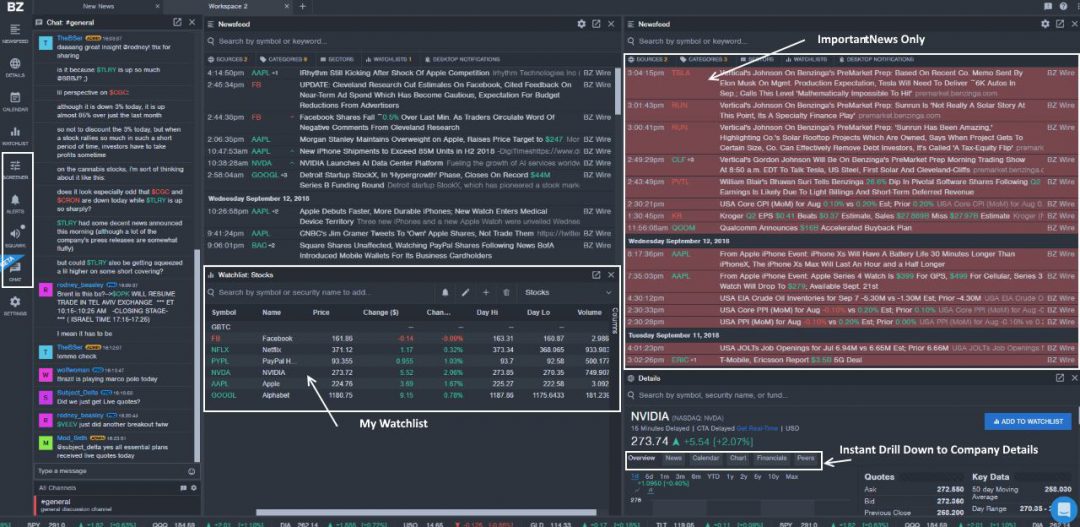

Benzinga Pro’s Excellent Real-time News for Traders

Try Benzinga Pro Real-time News for Free

Benzinga helps you stay informed of market trends and potential investment opportunities. Using the right research tools can also help you identify the best ETFs. With the right information, you’ll be well-equipped to make profitable trades.

14. Avoid Over-Leveraging

Leveraged ETFs offer the potential for higher returns but expose you to greater risk. Take a conservative approach and limit your leverage exposure to minimize losses. Diversify your portfolio, and don’t invest too much in any one leveraged ETF. Monitor your position closely, as the value of leveraged ETFs can quickly change due to short-term market movements.

15. Ony Use for Short-Term Trading

Leveraged ETFs are unsuitable for long-term investments due to their structure and expense ratio costs, which can erode returns over time. Stick with short-term trading strategies designed to leverage products.

16. Set Stop Losses and Limit Orders

Don’t forget to set stop losses and limit orders on leveraged ETFs, as they can be very volatile. Also, pay close attention to the fact that leveraged ETFs are reset daily, so if you hold them for more than one day, your return will not necessarily reflect the leverage multiple.

Always consider the risks before investing and research your investments thoroughly. Finally, ensure you understand the fees charged by ETFs since they can greatly impact returns.

FAQ

What software is best for trading leveraged ETFs?

The best software for ETF investing is TradingView. It offers a wide range of tools that help you manage and analyze your leveraged ETF portfolio. You can view charts in real time, get instant notifications when market prices move, set alerts for specific stocks or funds, and even track your portfolio performance.

What is a leveraged ETF?

A leveraged ETF is a financial derivative that utilizes innovative financial techniques to magnify the returns of an underlying index. These instruments can generate daily performance that is 2x or 3x that of the tracked index.

Can you lose more than you invested in a Leveraged ETF?

No, it is not possible to lose more than your invested amount in a leveraged ETF. Your potential loss is limited to the amount you have invested.

Can Leveraged ETFs go to zero or negative?

It is theoretically possible for a leveraged ETF to go to zero if the team managing the fund seriously mismanages to derivative and hedging investments. This is why it is important to choose ETFs managed by reputable companies like Vanguard or iShares.

Are leveraged ETFs suitable for long-term investing?

Leveraged ETFs are generally not suitable for long-term investing due to the effects of ETF decay. They are designed to achieve their stated objectives on a daily basis.

What happens if I hold a leveraged ETF longer than one trading day?

Holding a leveraged ETF for more than one day can lead to performance that differs significantly from the multiple of the index return over the same period. This is due to the daily reset feature of leveraged ETFs.

What are the risk of trading leveraged ETFs?

Trading leveraged ETFs involves substantial risk. The use of leverage can magnify gains, but it also magnifies losses. Additionally, the effect of daily compounding can lead to results that differ from the expected return over longer periods.

What mistakes should I avoid when trading leveraged ETFs?

Some common mistakes include holding leveraged ETFs overnight, not understanding how decaying works, and not paying attention to the reset period.

What is the reset period of a leveraged ETF?

The reset period of a leveraged ETF is typically one day. This means the ETF aims to achieve its stated objective (such as 2x or 3x the return of an index) on a daily basis.

How can I trade Leveraged ETFs?

Leveraged ETFs can be bought and sold like regular stocks through a brokerage account. It's essential to understand their structure, risks, and how they fit into your investment strategy before trading.

What is the difference between leveraged ETFs and ETNs?

Leveraged ETFs use derivatives such as swaps and futures contracts to achieve their stated objectives. On the other hand, Exchange Traded Notes (ETNs) are debt instruments that do not track an underlying index or asset. ETNs are unsecured debt obligations of the issuer and thus involve additional credit risk.