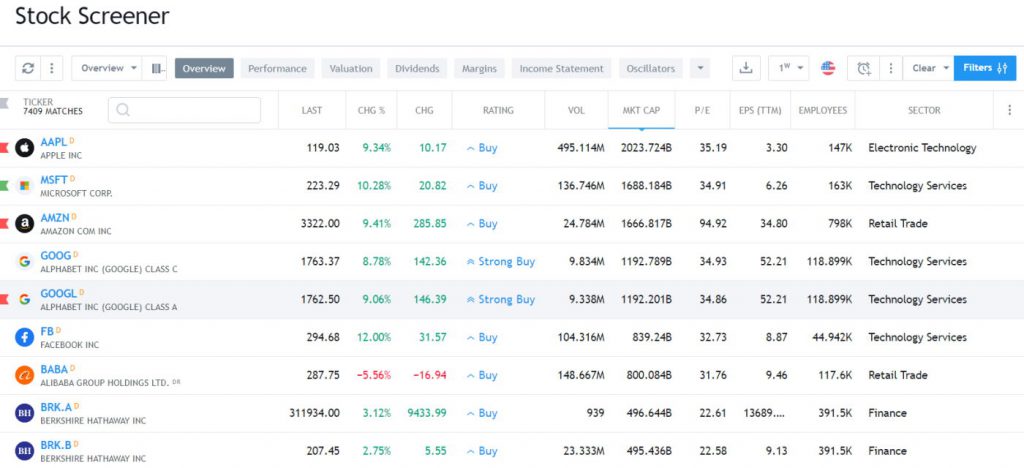

Our up-to-date NASDAQ 100 companies lists included ticker, sector classification, market capitalization, PE Ratio, EPS, and employee count. We also show you how to export this list to Excel.

NASDAQ 100 Index

The NASDAQ 100 Index comprises the 100 largest capitalized non-financial companies listed on the NASDAQ Stock Exchange. Statistics confirm that the NASDAQ 100 is the best-performing US index, growing by 468% over the last 20 years.

NASDAQ 100 Stocks

Contrary to popular belief, the NASDAQ 100 index is not exclusively for technology stocks. 20 NASDAQ 100 component stocks are from the Retail Trade, Consumer Non-Durables, and Utility Sectors.

Lucid Group, Inc. is the smallest component stock of the NASDAQ 100, with a market capitalization of just $14 billion. Apple Inc. is the largest component stock with a value of close to $3 trillion.

| S&P 500 by Market Cap | S&P 500 by Employees | S&P 500 by Sector, Cap & PE | S&P 500 Alphabetically |

Get the Free Interactive Nasdaq 100 Companies List on TradingView Now

NASDAQ 100 Companies List by Sector & Market Cap

The NASDAQ 100 index is made up of the 100 largest publicly traded companies listed on the Nasdaq Stock Exchange. It is composed mainly of technology stocks but also includes companies from other sectors such as retail, consumer non-durables, and utilities. Below, you will find a list of all the component stocks of the NASDAQ 100 sorted by sector and market capitalization.

| Ticker | Company | Sector | Market Capitalization ($B) |

| AAPL | Apple Inc. | Electronic Technology | 2,962,062 |

| MSFT | Microsoft Corporation | Technology Services | 2,441,866 |

| GOOG | Alphabet Inc. | Technology Services | 1,717,286 |

| GOOGL | Alphabet Inc. | Technology Services | 1,717,286 |

| AMZN | Amazon.com, Inc. | Retail Trade | 1,417,160 |

| NVDA | NVIDIA Corporation | Electronic Technology | 1,198,172 |

| TSLA | Tesla, Inc. | Consumer Durables | 777,660 |

| META | Meta Platforms, Inc. | Technology Services | 762,758 |

| AVGO | Broadcom Inc. | Electronic Technology | 360,076 |

| ASML | ASML Holding N.V. – New York Registry Shares | Electronic Technology | 263,703 |

| ADBE | Adobe Inc. | Technology Services | 256,711 |

| PEP | PepsiCo, Inc. | Consumer Non-Durables | 241,342 |

| COST | Costco Wholesale Corporation | Retail Trade | 241,184 |

| CSCO | Cisco Systems, Inc. | Technology Services | 235,701 |

| AZN | AstraZeneca PLC | Health Technology | 208,725 |

| NFLX | Netflix, Inc. | Technology Services | 194,931 |

| CMCSA | Comcast Corporation | Consumer Services | 188,642 |

| AMD | Advanced Micro Devices, Inc. | Electronic Technology | 176,835 |

| TMUS | T-Mobile US, Inc. | Communications | 161,563 |

| TXN | Texas Instruments Incorporated | Electronic Technology | 154,200 |

| INTU | Intuit Inc. | Technology Services | 153,921 |

| INTC | Intel Corporation | Electronic Technology | 153,323 |

| AMGN | Amgen Inc. | Health Technology | 137,314 |

| PDD | PDD Holdings Inc. | Retail Trade | 137,230 |

| AMAT | Applied Materials, Inc. | Producer Manufacturing | 128,818 |

| QCOM | QUALCOMM Incorporated | Electronic Technology | 128,770 |

| HON | Honeywell International Inc. | Electronic Technology | 125,084 |

| SBUX | Starbucks Corporation | Consumer Services | 112,249 |

| BKNG | Booking Holdings Inc. Common Stock | Consumer Services | 111,177 |

| ISRG | Intuitive Surgical, Inc. | Health Technology | 109,064 |

| ADP | Automatic Data Processing, Inc. | Technology Services | 105,366 |

| GILD | Gilead Sciences, Inc. | Health Technology | 95,507 |

| MDLZ | Mondelez International, Inc. | Consumer Non-Durables | 94,808 |

| LRCX | Lam Research Corporation | Producer Manufacturing | 93,018 |

| ADI | Analog Devices, Inc. | Electronic Technology | 92,283 |

| VRTX | Vertex Pharmaceuticals Incorporated | Health Technology | 90,617 |

| REGN | Regeneron Pharmaceuticals, Inc. | Health Technology | 90,266 |

| ABNB | Airbnb, Inc. | Consumer Services | 84,704 |

| MU | Micron Technology, Inc. | Electronic Technology | 77,098 |

| PANW | Palo Alto Networks, Inc. | Technology Services | 74,237 |

| MELI | MercadoLibre, Inc. | Retail Trade | 71,214 |

| SNPS | Synopsys, Inc. | Technology Services | 70,027 |

| PYPL | PayPal Holdings, Inc. | Commercial Services | 69,802 |

| KLAC | KLA Corporation | Electronic Technology | 69,320 |

| CDNS | Cadence Design Systems, Inc. | Technology Services | 66,197 |

| WDAY | Workday, Inc. | Technology Services | 65,104 |

| CHTR | Charter Communications, Inc. | Consumer Services | 63,209 |

| CSX | CSX Corporation | Transportation | 61,454 |

| MAR | Marriott International | Consumer Services | 61,384 |

| MNST | Monster Beverage Corporation | Consumer Non-Durables | 59,237 |

| ORLY | O’Reilly Automotive, Inc. | Retail Trade | 57,092 |

| NXPI | NXP Semiconductors N.V. | Electronic Technology | 54,128 |

| LULU | lululemon athletica inc. | Retail Trade | 53,215 |

| TEAM | Atlassian Corporation | Technology Services | 52,761 |

| CTAS | Cintas Corporation | Consumer Services | 51,406 |

| MRVL | Marvell Technology, Inc. | Electronic Technology | 49,999 |

| FTNT | Fortinet, Inc. | Technology Services | 47,803 |

| ODFL | Old Dominion Freight Line, Inc. | Transportation | 47,627 |

| ADSK | Autodesk, Inc. | Technology Services | 47,032 |

| KDP | Keurig Dr Pepper Inc. | Consumer Non-Durables | 46,878 |

| MCHP | Microchip Technology Incorporated | Electronic Technology | 44,793 |

| JD | JD.com, Inc. | Retail Trade | 44,743 |

| PAYX | Paychex, Inc. | Technology Services | 44,131 |

| PCAR | PACCAR Inc. | Producer Manufacturing | 43,665 |

| CPRT | Copart, Inc. | Commercial Services | 43,181 |

| ON | ON Semiconductor Corporation | Electronic Technology | 42,894 |

| MRNA | Moderna, Inc. | Health Technology | 42,840 |

| IDXX | IDEXX Laboratories, Inc. | Health Technology | 42,443 |

| ROST | Ross Stores, Inc. | Retail Trade | 41,458 |

| KHC | The Kraft Heinz Company | Consumer Non-Durables | 40,018 |

| AEP | American Electric Power Company, Inc. | Utilities | 39,936 |

| EXC | Exelon Corporation | Utilities | 39,799 |

| DXCM | DexCom, Inc. | Health Technology | 39,522 |

| TTD | The Trade Desk, Inc. | Technology Services | 39,182 |

| SGEN | Seagen Inc. | Health Technology | 39,024 |

| BIIB | Biogen Inc. | Health Technology | 38,692 |

| CRWD | CrowdStrike Holdings, Inc. | Technology Services | 38,190 |

| BKR | Baker Hughes Company | Industrial Services | 37,165 |

| CTSH | Cognizant Technology Solutions Corporation | Technology Services | 36,227 |

| VRSK | Verisk Analytics, Inc. | Technology Services | 35,218 |

| CEG | Constellation Energy Corporation | Utilities | 34,504 |

| CSGP | CoStar Group, Inc. | Technology Services | 33,716 |

| FAST | Fastenal Company | Distribution Services | 32,726 |

| EA | Electronic Arts Inc. | Technology Services | 32,656 |

| DDOG | Datadog, Inc. | Technology Services | 31,763 |

| GEHC | GE HealthCare Technologies Inc. | Health Technology | 31,498 |

| XEL | Xcel Energy Inc. | Utilities | 31,167 |

| GFS | GlobalFoundries Inc. | Electronic Technology | 30,368 |

| ALGN | Align Technology, Inc. | Health Technology | 28,692 |

| WBD | Warner Bros. Discovery, Inc. – Series A | Consumer Services | 28,176 |

| ANSS | ANSYS, Inc. | Technology Services | 27,689 |

| FANG | Diamondback Energy, Inc. | Energy Minerals | 27,656 |

| ILMN | Illumina, Inc. | Health Technology | 26,667 |

| DLTR | Dollar Tree, Inc. | Retail Trade | 26,123 |

| EBAY | eBay Inc. | Retail Trade | 24,000 |

| ZS | Zscaler, Inc. | Technology Services | 23,106 |

| ZM | Zoom Video Communications, Inc. | Technology Services | 21,340 |

| WBA | Walgreens Boots Alliance, Inc. | Health Technology | 20,226 |

| ENPH | Enphase Energy, Inc. | Electronic Technology | 17,553 |

| SIRI | Sirius XM Holdings Inc. | Consumer Services | 17,291 |

| LCID | Lucid Group, Inc. | Consumer Durables | 14,518 |

Data TradingView 2023

Get this NASDAQ 100 List Live at TradingView

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

📈Nasdaq 100 Index Performance Chart

Nasdaq 100 Company List By Market Cap, Employees, PE Ratio & EPS

| Ticker | Company | Market Cap $B | #Employees | Basic EPS | PE Ratio |

| AAPL | Apple Inc. | 2,962,062 | 164,000 | 6.0 | 31.8 |

| MSFT | Microsoft Corporation | 2,441,866 | 221,000 | 9.7 | 33.9 |

| GOOG | Alphabet Inc. | 1,717,286 | 190,234 | 4.8 | 28.9 |

| GOOGL | Alphabet Inc. | 1,717,286 | 190,234 | 4.8 | 28.7 |

| AMZN | Amazon.com, Inc. | 1,417,160 | 1,541,000 | 1.3 | 109.8 |

| NVDA | NVIDIA Corporation | 1,198,172 | 26,196 | 4.2 | 117.2 |

| TSLA | Tesla, Inc. | 777,660 | 127,855 | 3.9 | 69.5 |

| META | Meta Platforms, Inc. | 762,758 | 86,482 | 8.6 | 34.5 |

| AVGO | Broadcom Inc. | 360,076 | 20,000 | 33.5 | 26.9 |

| ASML | ASML Holding N.V. – New York Registry Shares | 263,703 | 39,086 | 19.7 | 33.7 |

| ADBE | Adobe Inc. | 256,711 | 29,239 | 10.5 | 53.8 |

| PEP | PepsiCo, Inc. | 241,342 | 315,000 | 5.7 | 30.7 |

| COST | Costco Wholesale Corporation | 241,184 | 304,000 | 13.5 | 40.3 |

| CSCO | Cisco Systems, Inc. | 235,701 | 3.1 | 18.8 | |

| AZN | AstraZeneca PLC | 208,725 | 83,500 | 2.0 | 34.5 |

| NFLX | Netflix, Inc. | 194,931 | 12,800 | 9.5 | 46.8 |

| CMCSA | Comcast Corporation | 188,642 | 186,000 | 1.6 | 29.0 |

| AMD | Advanced Micro Devices, Inc. | 176,835 | 25,000 | 0.0 | |

| TMUS | T-Mobile US, Inc. | 161,563 | 71,000 | 5.0 | 27.3 |

| TXN | Texas Instruments Incorporated | 154,200 | 33,000 | 8.4 | 20.4 |

| INTU | Intuit Inc. | 153,921 | 18,200 | 8.5 | 65.2 |

| INTC | Intel Corporation | 153,323 | 131,900 | -0.2 | |

| AMGN | Amgen Inc. | 137,314 | 25,200 | 14.9 | 17.3 |

| PDD | PDD Holdings Inc. | 137,230 | 12,992 | 4.5 | 25.4 |

| AMAT | Applied Materials, Inc. | 128,818 | 33,000 | 7.6 | 20.3 |

| QCOM | QUALCOMM Incorporated | 128,770 | 51,000 | 7.7 | 15.1 |

| HON | Honeywell International Inc. | 125,084 | 97,000 | 8.1 | 23.3 |

| SBUX | Starbucks Corporation | 112,249 | 402,000 | 3.3 | 29.8 |

| BKNG | Booking Holdings Inc. Common Stock | 111,177 | 21,600 | 116.4 | 26.9 |

| ISRG | Intuitive Surgical, Inc. | 109,064 | 12,120 | 4.1 | 77.9 |

| ADP | Automatic Data Processing, Inc. | 105,366 | 63,000 | 8.2 | 31.2 |

| GILD | Gilead Sciences, Inc. | 95,507 | 17,000 | 4.4 | 17.6 |

| MDLZ | Mondelez International, Inc. | 94,808 | 91,000 | 3.0 | 23.1 |

| LRCX | Lam Research Corporation | 93,018 | 17,200 | 33.2 | 21.2 |

| ADI | Analog Devices, Inc. | 92,283 | 24,450 | 7.4 | 24.8 |

| VRTX | Vertex Pharmaceuticals Incorporated | 90,617 | 4,800 | 13.1 | 27.1 |

| REGN | Regeneron Pharmaceuticals, Inc. | 90,266 | 11,851 | 40.2 | 22.0 |

| ABNB | Airbnb, Inc. | 84,704 | 6,811 | 3.6 | 38.9 |

| MU | Micron Technology, Inc. | 77,098 | 48,000 | -2.7 | |

| PANW | Palo Alto Networks, Inc. | 74,237 | 13,948 | 1.4 | 191.4 |

| MELI | MercadoLibre, Inc. | 71,214 | 40,548 | 15.1 | 96.2 |

| SNPS | Synopsys, Inc. | 70,027 | 19,000 | 6.8 | 69.0 |

| PYPL | PayPal Holdings, Inc. | 69,802 | 29,900 | 3.6 | 17.8 |

| KLAC | KLA Corporation | 69,320 | 15,000 | 24.2 | 21.0 |

| CDNS | Cadence Design Systems, Inc. | 66,197 | 10,200 | 3.3 | 74.9 |

| WDAY | Workday, Inc. | 65,104 | 17,700 | -0.5 | |

| CHTR | Charter Communications, Inc. | 63,209 | 101,700 | 30.2 | 14.2 |

| CSX | CSX Corporation | 61,454 | 22,500 | 2.0 | 15.4 |

| MAR | Marriott International | 61,384 | 377,000 | 8.9 | 23.2 |

| MNST | Monster Beverage Corporation | 59,237 | 5,296 | 1.4 | 41.8 |

| ORLY | O’Reilly Automotive, Inc. | 57,092 | 87,745 | 36.4 | 26.3 |

| NXPI | NXP Semiconductors N.V. | 54,128 | 34,500 | 10.7 | 19.9 |

| LULU | lululemon athletica inc. | 53,215 | 34,000 | 7.9 | 51.2 |

| TEAM | Atlassian Corporation | 52,761 | 8,813 | -2.1 | |

| CTAS | Cintas Corporation | 51,406 | 44,500 | 13.2 | 38.9 |

| MRVL | Marvell Technology, Inc. | 49,999 | 7,448 | -0.4 | |

| FTNT | Fortinet, Inc. | 47,803 | 12,595 | 1.4 | 45.7 |

| ODFL | Old Dominion Freight Line, Inc. | 47,627 | 23,471 | 11.6 | 37.9 |

| ADSK | Autodesk, Inc. | 47,032 | 13,700 | 4.1 | 54.5 |

| KDP | Keurig Dr Pepper Inc. | 46,878 | 28,000 | 1.1 | 29.7 |

| MCHP | Microchip Technology Incorporated | 44,793 | 22,600 | 4.4 | 19.0 |

| JD | JD.com, Inc. | 44,743 | 450,679 | 2.0 | 17.2 |

| PAYX | Paychex, Inc. | 44,131 | 16,600 | 4.3 | 28.5 |

| PCAR | PACCAR Inc. | 43,665 | 31,100 | 7.0 | 12.0 |

| CPRT | Copart, Inc. | 43,181 | 9,500 | 1.2 | 37.6 |

| ON | ON Semiconductor Corporation | 42,894 | 31,109 | 4.5 | 22.8 |

| MRNA | Moderna, Inc. | 42,840 | 3,900 | 3.1 | 41.4 |

| IDXX | IDEXX Laboratories, Inc. | 42,443 | 10,780 | 9.5 | 54.2 |

| ROST | Ross Stores, Inc. | 41,458 | 101,000 | 4.7 | 25.8 |

| KHC | The Kraft Heinz Company | 40,018 | 37,000 | 2.6 | 12.7 |

| AEP | American Electric Power Company, Inc. | 39,936 | 16,974 | 3.9 | 20.1 |

| EXC | Exelon Corporation | 39,799 | 19,063 | 2.1 | 18.8 |

| DXCM | DexCom, Inc. | 39,522 | 7,600 | 0.9 | 118.9 |

| TTD | The Trade Desk, Inc. | 39,182 | 2,770 | 0.3 | 309.1 |

| SGEN | Seagen Inc. | 39,024 | 3,256 | -3.9 | |

| BIIB | Biogen Inc. | 38,692 | 8,725 | 18.5 | 14.5 |

| CRWD | CrowdStrike Holdings, Inc. | 38,190 | 7,273 | -0.4 | |

| BKR | Baker Hughes Company | 37,165 | 55,000 | 1.1 | 32.5 |

| CTSH | Cognizant Technology Solutions Corporation | 36,227 | 355,300 | 4.3 | 16.7 |

| VRSK | Verisk Analytics, Inc. | 35,218 | 7,000 | 3.3 | 73.4 |

| CEG | Constellation Energy Corporation | 34,504 | 13,370 | 2.4 | 45.0 |

| CSGP | CoStar Group, Inc. | 33,716 | 5,653 | 1.0 | 86.9 |

| FAST | Fastenal Company | 32,726 | 22,386 | 2.0 | 29.2 |

| EA | Electronic Arts Inc. | 32,656 | 13,400 | 3.2 | 37.3 |

| DDOG | Datadog, Inc. | 31,763 | 4,800 | -0.3 | |

| GEHC | GE HealthCare Technologies Inc. | 31,498 | 50,000 | ||

| XEL | Xcel Energy Inc. | 31,167 | 11,982 | 3.2 | 17.9 |

| GFS | GlobalFoundries Inc. | 30,368 | 14,000 | 2.7 | 20.5 |

| ALGN | Align Technology, Inc. | 28,692 | 23,165 | 4.1 | 92.3 |

| WBD | Warner Bros. Discovery, Inc. – Series A | 28,176 | 37,500 | -2.8 | |

| ANSS | ANSYS, Inc. | 27,689 | 5,600 | 6.0 | 53.2 |

| FANG | Diamondback Energy, Inc. | 27,656 | 972 | 19.3 | 8.0 |

| ILMN | Illumina, Inc. | 26,667 | 11,500 | -26.7 | |

| DLTR | Dollar Tree, Inc. | 26,123 | 207,500 | 5.5 | 21.6 |

| EBAY | eBay Inc. | 24,000 | 11,600 | 2.5 | 18.2 |

| ZS | Zscaler, Inc. | 23,106 | 4,975 | -1.9 | |

| ZM | Zoom Video Communications, Inc. | 21,340 | 8,484 | 0.5 | 159.2 |

| WBA | Walgreens Boots Alliance, Inc. | 20,226 | 325,000 | -3.8 | |

| ENPH | Enphase Energy, Inc. | 17,553 | 2,821 | 4.2 | 32.6 |

| SIRI | Sirius XM Holdings Inc. | 17,291 | 5,869 | 0.3 | 15.3 |

| LCID | Lucid Group, Inc. | 14,518 | 7,200 | -1.4 |

Get this NASDAQ 100 List Live at TradingView

How to Export This Nasdaq 100 List to Excel

- Drag Your Mouse Over the Table

- Right Click -> Select Copy

- Open Excel

- Right Click the First Cell A1 -> Click Paste