Portfolio diversification is a crucial aspect of sound investment management. By properly implementing this strategy, investors can balance risk and reward, ultimately positioning themselves for long-term financial success.

Few concepts are as universally accepted as that of portfolio diversification. The timeless advice of not putting all your eggs in one basket certainly holds in finance.

But what does it truly mean to diversify one’s portfolio? How can investors effectively employ this strategy? This article aims to answer these questions and more.

Understanding Portfolio Diversification

Portfolio diversification refers to spreading investments across various types of assets to limit exposure to any single asset or risk1. A diversified portfolio may include a mix of stocks, bonds, mutual funds, and potentially alternative investments like real estate or cryptocurrency2.

The underlying principle of portfolio diversification is the concept of complementarity. This principle describes the degree to which two or more assets move in relation to each other3. By investing in a wide range of securities, investors ensure their overall return doesn’t rely excessively on the performance of a single asset.

Why is Portfolio Diversification Important?

The primary purpose of portfolio diversification is to mitigate risk. Investing in a single asset or a group of similar assets can expose an investor to significant risk if the asset or sector underperforms. Diversification, by contrast, spreads out this risk among various investments, thereby reducing the potential for loss4.

Furthermore, diversification can also enhance potential returns. Since different asset classes can perform well at different times, having a variety of investments can provide more growth opportunities.

Benefits of Portfolio Diversification

Diversification offers several benefits to investors. Firstly, it provides a safety net against market volatility. By owning a variety of investments, you’re less likely to suffer significant losses if one of them declines in value5.

Secondly, diversification allows for more consistent returns. Since you’re not relying on a single investment or asset class, the chances of experiencing extreme highs or lows are reduced. Instead, your portfolio’s performance tends to be more stable over time6.

Try Powerful Financial Analysis & Research with Stock Rover

Investment Portfolio Diversification

Investment portfolio diversification involves spreading your investments among and within different asset classes. Investing in a mix of stocks, bonds, and alternative investments like real estate or commodities7.

Moreover, diversification can also occur within an asset class. For instance, if you’re investing in stocks, you might spread your investments across different sectors, industries, or even geographical regions.

What Does A Well Correlated Stock Portfolio Look Like?

A well-diversified stock portfolio should have a low correlation to the broader market. This means that your portfolio won’t necessarily follow suit when the broad market goes down.

For instance, if you own several stocks from different industries or sectors, their performance will be determined by the strengths and weaknesses of each company’s fundamentals rather than just the overall market sentiment.

The idea is to reduce risk by having a portfolio that won’t be affected as much when the stock market goes through its inevitable ups and downs. This way, even if one or two of your investments decline in value, they will likely be offset by gains from other stocks in your portfolio.

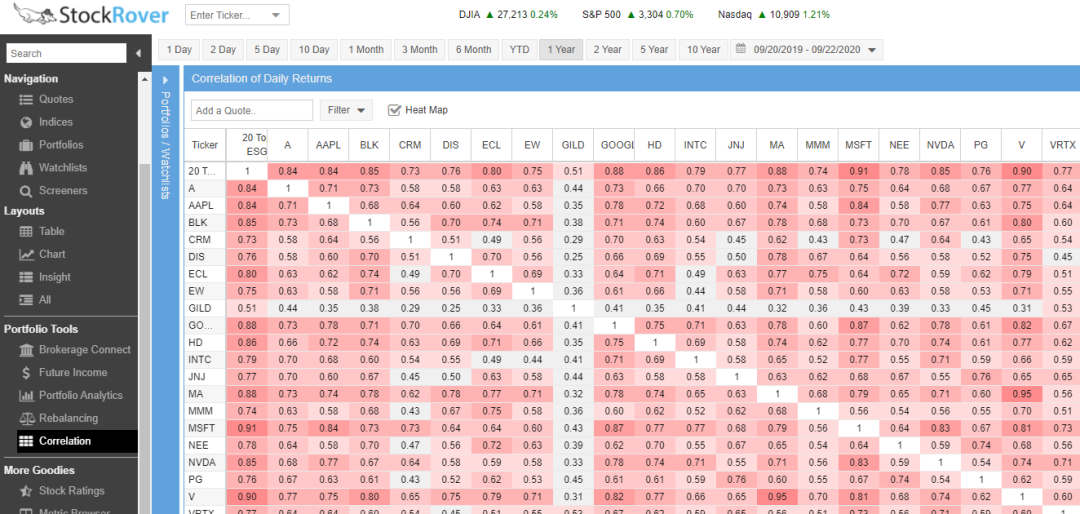

A Portfolio Diversification Calculator

Stock Rover enables investors to calculate how correlated and diverse a stock portfolio is. This helps them determine how much risk they are taking when investing in a certain portfolio and whether or not the reward is worth it.

By inputting your current holdings or connecting it to your brokers, Stock Rover will generate a graphical representation of how diverse your investments are across different sectors, industries, and asset classes. This feature allows investors to assess potential new stocks to add to their portfolios that would help balance the overall risk and reward of their investments.

Portfolio Correlation, Balancing & Analytics in Stock Rover

Get Portfolio Management & Research Free in Stock Rover

It can also alert investors when their portfolio has become too heavily concentrated in a certain sector or asset class, enabling them to take appropriate action if necessary. Overall, this feature helps ensure that your investments are not overly exposed to any single investment that might hurt your total return.

This tool is especially useful for beginners who may not be familiar with the intricacies of portfolio management. Stock Rover’s portfolio analysis feature can help them quickly identify areas that need to be improved and make changes before their portfolio becomes too concentrated or imbalanced.

Portfolio Diversification Examples

Let’s consider a diversified portfolio example. Suppose you have an investment portfolio that includes debt assets like Fixed Deposits (FDs), bonds and equity assets like stocks and ETFs. You might also opt to include more types of assets in your portfolio, such as real estate, land, gold, etc.

What Types of Portfolios Are There?

When it comes to portfolio diversification, several types of portfolios can be created. The most common types are Growth Portfolios, Income Portfolios, and Value Stocks Portfolios. Each portfolio type has unique benefits regarding risk-reward ratios, and each is suitable for a different investor based on their goals and risk appetite.

Growth Portfolio

This type of portfolio consists of stocks expected to produce capital growth over the long term. This portfolio is typically constructed with a focus on high-growth companies, which often carry higher levels of risk than other investments.

A growth stocks portfolio consists of companies with strong fundamentals, high profit margins, and a potential for rapid growth. These stocks are usually more volatile than other investments but can allow investors to earn substantial returns over the long term.

Income Portfolio

An income portfolio is focused on investments that provide consistent dividend payments or interest income. This type of portfolio typically consists of large, well-established companies with a track record of paying dividends and can be expected to continue paying them in the future.

An income stocks portfolio comprises companies with a track record of generating consistent cash flow from dividends. These stocks are typically less volatile than growth and value stocks. However, investors should still be aware of the risks associated with investing in dividend-paying stocks, such as changes to the company’s payout policy or an economic downturn.

Value Stocks Portfolio

A value stocks portfolio consists of stocks currently trading at a discounted price relative to their intrinsic value. Investors often look for undervalued companies and search for long-term capital appreciation opportunities.

Portfolio Diversification Formula

While there’s no definitive formula for portfolio diversification, a common approach is the 60/40 rule. This rule suggests allocating 60% of the portfolio to stocks and 40% to fixed-income investments like bonds. However, this allocation can be adjusted based on the individual’s risk tolerance, financial goals, and investment horizon.

What Asset Diversification is Recommended for People Over 50?

People over 50 are generally advised to invest in a more conservative portfolio. They should invest more in debt-based assets like bonds rather than riskier equity assets like stocks or ETFs. Moreover, they should strive for a balanced asset allocation between different debt and equity investments. Additionally, it is recommended that people over 50 should diversify their assets further by including other types of investments such as real estate, gold, and land.

This will help reduce the risk associated with investing in any asset class and ensure a steady return on investment. In addition, this approach also helps to create a more stable portfolio that is less prone to volatility caused by market fluctuations.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

What Asset Diversification is Recommended for People Under 30?

People under 30 should focus on building a portfolio with higher growth potential, which means taking more risks by investing in stocks, ETFs, and other equity assets. It is important to diversify across different asset classes and industries while managing the risk associated with each investment.

For example, investments for people under 30 may include small-cap stocks, international stocks, REITs, and bonds. Doing so will diversify the portfolio and help manage risk as investments are spread across different types of assets.

It is also important to note that people under 30 should have a longer investment horizon, allowing more time for potential growth and greater flexibility when making decisions about individual investments.

Whatever your age, speaking with a financial advisor to assess your risk tolerance and develop a personalized investment strategy tailored to your needs is important. They can help you understand the different types of asset classes, factors that affect their performance, and how they fit into your larger financial plan. A financial advisor can also provide ongoing support and guidance regarding making tactical adjustments when needed.

How Does Diversification Strengthen an Investor’s Portfolio?

Diversification strengthens an investor’s portfolio by reducing risk and enhancing potential returns. When investments are adequately diversified, the poor performance of a single investment is less likely to significantly impact the overall portfolio. As a result, the investor’s risk of substantial financial loss is reduced.

How to Track a Diversified Portfolio

Tracking a diversified portfolio can be done regularly to ensure the investments perform as expected. Regular reviews of performance and adjustments to allocation amounts should be performed to maintain balance and optimize returns. Additionally, research should be conducted, and trends should be monitored to stay informed of risks or opportunities related to different asset classes.

Diversification and Portfolio Risk

While diversification can significantly reduce portfolio risk, it’s essential to remember that it doesn’t eliminate risk. All investments carry some risk, and a diversified portfolio can lose value. Therefore, investors should consider their personal risk tolerance, financial goals, and time horizons before making investment decisions.

FAQ

What is portfolio diversification?

Portfolio diversification is an investment strategy that seeks to reduce investment risk by allocating assets across different asset classes, industries, and geographic regions. The overall portfolio risk is reduced by spreading out investments over a range of products and asset classes.

How does portfolio diversification work?

Portfolio diversification creates a mix of investments to spread the risk across a range of asset classes, industries, and geographic regions. This method attempts to reduce the volatility of an investment portfolio, as well as provide more stable returns over time.

What are the benefits of portfolio diversification?

The primary benefit of portfolio diversification is reducing overall risk. By spreading investments across different products and markets, investors can help protect their portfolios against the impact of sudden market fluctuations. Additionally, diversifying can help increase overall returns in the long run by allowing investors to take advantage of growing markets when other markets decline.

Is it possible to have too much portfolio diversification?

Yes, it's possible to have too much portfolio diversification if there is not enough overlap between investments with similar expected returns or risk profiles. In this case, it may be difficult for an investor to create sufficient liquidity in their portfolio without taking significant losses on some investments to free up capital for other investments.

Should I always try to achieve maximum diversification?

No, you should only pursue maximum diversification if it aligns with your financial goals and meets your risk tolerance level. If you prefer higher-risk/higher-reward scenarios or want quick returns on short-term investments, you may not need as much diversity in your portfolio as someone who favors a buy-and-hold approach or has longer-term goals such as retirement savings.

What assets should I include in my portfolio when I want to practice good diversification?

When attempting good diversification, there are numerous options available depending on your preferences and financial goals; however, common choices include stocks (both domestic and international), bonds (government bonds and corporate bonds), mutual funds/ETFs (index funds or sector funds), real estate (REITs or rental properties) and cash equivalents (savings accounts).

Can I use leverage when practicing portfolio diversification?

It depends on an investor's circumstances and preferences, but leveraging should be used cautiously within a well-balanced investment strategy if done properly. Leverage can potentially magnify profits but simultaneously increase potential losses.

How often should I rebalance my investment portfolio for optimal diversification?

The rebalancing frequency will vary depending on each investor's individual goals; however, most experts suggest at least once per year or whenever market conditions significantly change so that portfolios remain properly balanced according to predetermined target allocations for each asset class included in the overall strategy.

Is there any pitfalls with practicing good diversification techniques?

The downside of portfolio diversification is the need for continuous monitoring. Unchecked assets may become overly weighted, necessitating frequent rebalancing. To minimize the effort in managing a diversified portfolio, we recommend Stock Rover.

Does having a diverse investment portfolio guarantee positive results?

No, regardless of how well an investor has constructed their portfolio, having a diverse set of holdings does not guarantee positive results. All markets experience ups and downs; no matter how prepared an investor may be, they can still suffer losses.

Summary

In conclusion, portfolio diversification is a crucial aspect of sound investment management. By properly implementing this strategy, investors can balance risk and reward, ultimately positioning themselves for long-term financial success.

How Many Stocks Should You Own According to Academic Research