Sector rotation is a dynamic investment strategy that involves shifting funds from one industry sector to another based on anticipated market and economic trends.

The objective behind this approach is to capitalize on the economy’s cyclical nature, thereby potentially achieving superior returns.

Sector rotation theory and research into market cycles have been around for over 200 years. But is it profitable, and should you implement sector rotation in your stock portfolio?

What is Sector Rotation?

Sector rotation is based on the principle that some industries will benefit more during different periods of the economic cycle than others. Mutual funds and managers of large portfolios practice sector rotation to attempt to outperform the stock market and reduce risk.

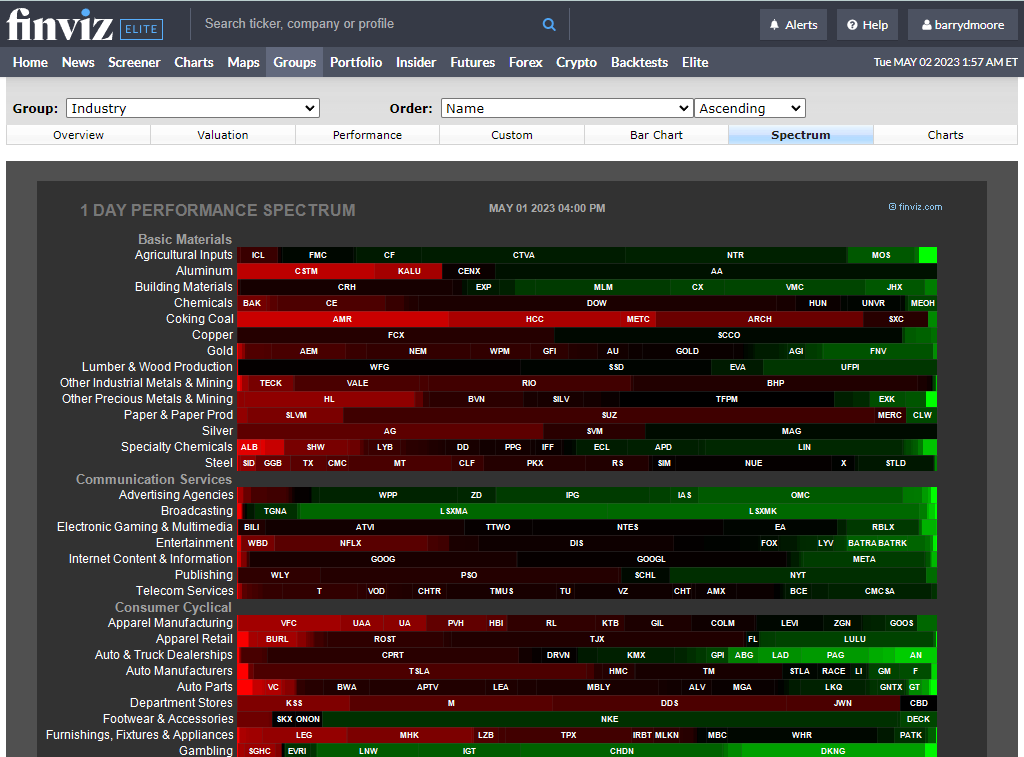

Get Finviz – The Perfect Tool For Sector Rotation Analysis

5 Stages of Sector Rotation:

To effectively implement a sector rotation strategy, we need to understand that the economic cycle is split into four stages:

1. Expansion Phase

This is when the economy is growing, and many industries are thriving. Investors should focus on stocks in strong sectors such as technology, consumer discretionary, and industrials to benefit from the growth in these areas.

2. Peak Phase

This phase of the economic cycle signals that it is time to start rotating out of certain positions and into lower-risk investments. Investors should look for opportunities in defensive sectors, such as healthcare and utilities, with more stable performance during this time.

3. Contraction Phase

This is the time to avoid high-risk stocks as the stock market and economy slow down. Investors could consider investing in cyclical sectors such as energy or transportation to benefit from any possible rallies.

Growth is starting to slow down, and the pace of expansion cannot continue. The move to more secure investment categories starts to happen. Bonds come back into favor, and the business sectors that may see improved performance are utilities (water, gas, electricity) and specific cyclical industries.

4. Recession Phase

This cycle phase is characterized by economic activity slowing drastically, and investors should take a defensive approach to stock picking. Stocks with steady cash flow and low debt levels should be favored, as well as sectors such as consumer staples, which are less volatile now.

In a full recession, the economy is bad, unemployment is higher, and interest rates are reduced in a dovish policy to stimulate growth. During the bust, it is best not to be in stocks. But if you feel you must, good sectors provide the goods and services people cannot live without, such as food, heating, energy, and health. Precious metals such as gold or silver do well during this economic cycle.

5. Recovery

When the economy starts to recover, investors should look for stocks with good growth potential. Cyclical sectors such as technology and industrial companies will often outperform during this period. Investors could also consider investing in value stocks or those the market has beaten down.

Early recovery occurs after a recession. During the early stages of recovery from a downturn, you may see that transportation companies are seeing more profits and starting to move around more products to market. Auto manufacturers who have been crushed to near bankruptcy are recovering.

The industrial sector starts to pick up. As growth begins to emerge from the ruins, good sectors to potentially invest in are recruitment and improving industrial conglomerates that have avoided bankruptcy and are undervalued by the market.

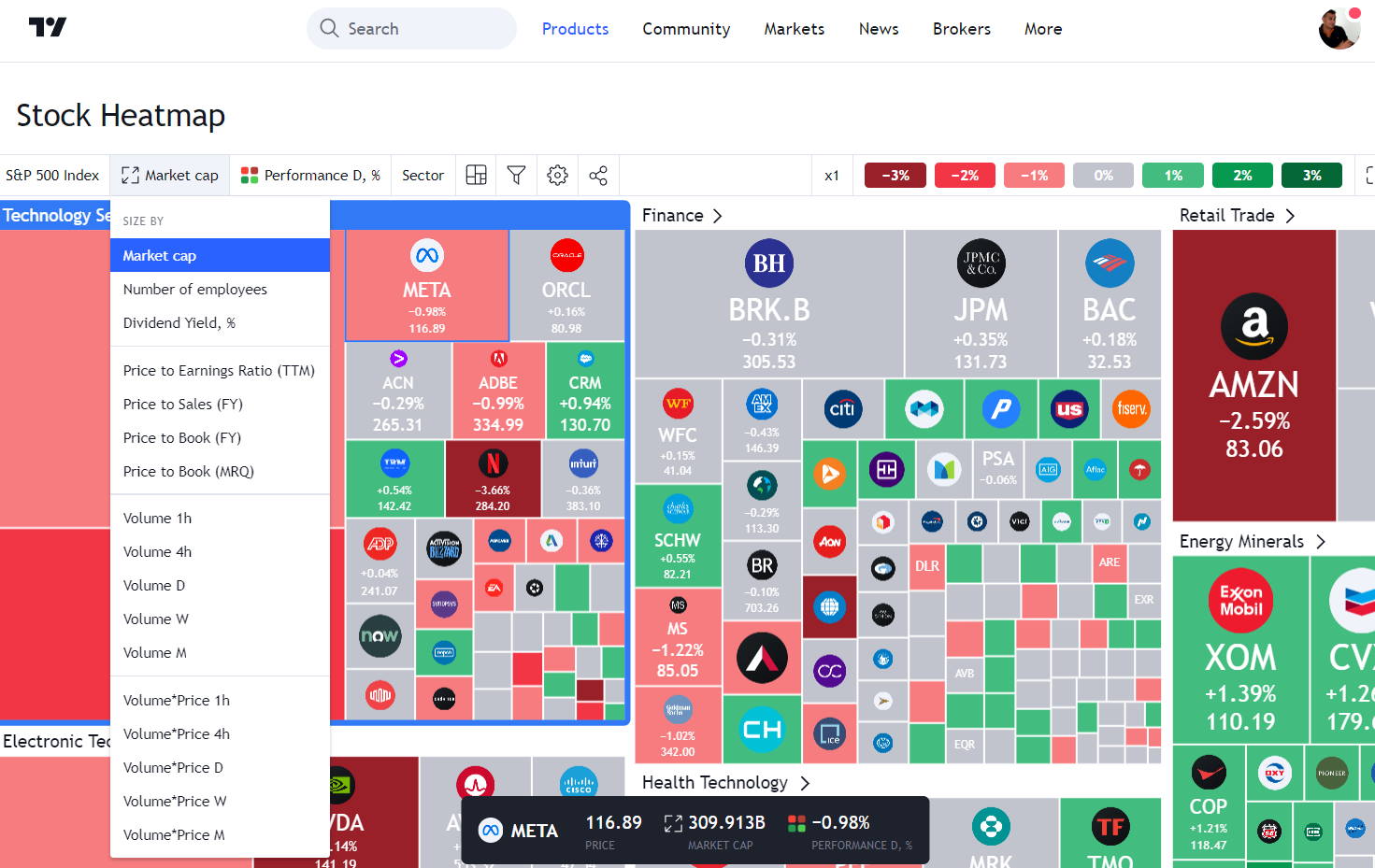

Try TradingView’s Sector Rotation Heatmaps

Is Sector Rotation Profitable?

Sector rotation has no solid evidence of profitability for the individual investor, but given specific conditions, it can prove to be a lucrative strategy.

Its profitability hinges on the investor’s capacity to accurately forecast the next phase of the economic cycle and align their investments accordingly. By successfully identifying these transitions, investors have the potential to achieve superior returns compared to a static investment approach.

The Challenges of Sector Rotation

While sector rotation may offer potential advantages, it also comes with its fair share of challenges. First and foremost, accurately predicting the timing and direction of market and economic shifts is no easy feat. Even experienced investors and economists struggle with this taskctions.

Additionally, sector rotation necessitates active portfolio management, which translates to monitoring market and economic events regularly. This can be quite time-consuming and may not suit all investors’ preferences.

Does Sector Rotation Work?

No, sector rotation has not been proven to outperform the stock market averages. Unfortunately, there is scant evidence that sector rotation can be consistently implemented to produce outsize market-beating returns for investors.

Sector rotation can provide some shielding against economic ups and downs. If done correctly, it can reduce risk and increase profits.

To use sector rotation to your advantage, you need to deeply understand economics and understand where the economy is in the business cycle; even top economists struggle with this.

Even if you practice sector rotation, it does not mean you will be successful or select the best company or vehicle to invest in.

Sector Rotation Duration

The duration of each stage of the economic cycle depends on the state of the economy. Two key theories on cycles can affect sector rotation.

Clement Juglar was among the first to develop an economic theory of business cycles. The Juglar Cycle is approximately 9.2 long and fluctuates between 7 and 11 years.

This highlights the concept of nominality, meaning each larger wave detected seems twice the size of the next smaller wave. The Juglar Cycle is similar in wavelength to the 10-year stock market cycle.

On average, the length of each sector rotation would be from 2 to 2.5 years.

The Effort to Maintain a Sector Rotation Strategy

Regularly evaluating the economic situation and having a good grasp of all tools and companies can be time-consuming. Plus, you will need to assess and rotate out of each stock and rotate into more favorable stocks.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Performing a Sector Analysis

Big money circulates through different sectors. For example, suppose the news is announced that the U.S. or China will invest heavily in green energy over the next few years. In that case, the market participants will seek to invest in this area as the companies in the energy sector will seek additional revenues because of the investments. So you may see a surge in investment in the sectors or ETFs (Exchange Traded Funds) that contain those types of companies; for Solar Panel Manufacturers, the ETF (Ticker: GRNSOLAR); or for Wind Energy, the ETF (Ticker: GRNWIND).

Finding Stocks in Winning Industry Sectors

Investing in a sector experiencing a high influx of capital can be a good investment decision. You need to follow this process.

- Is the stock market moving upwards? Perform a market analysis.

- What are the leading industry sectors? Perform a sector analysis.

- What are the leading companies in those sectors?

- Research the companies in the leading sectors.

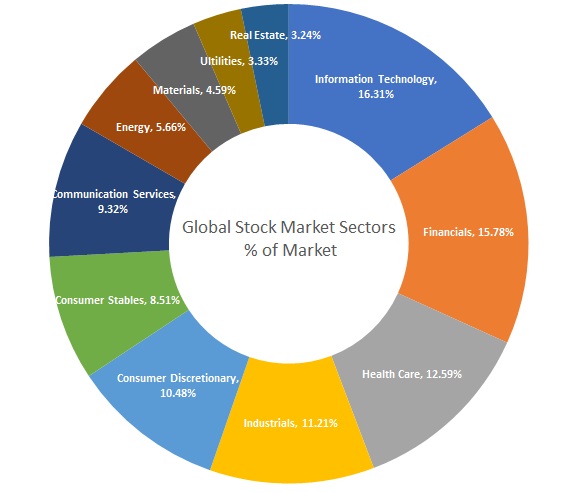

How Are Industry Sectors Defined?

There are many types of industrial classification systems to pigeonhole businesses into a certain classification, such as the Standard Industrial Classification (SIC), International Standard Industrial Classification (ISIC), or the Global Industry Classification Standard (GICS) created by Morgan Stanley and Standard & Poors. They are all designed to achieve the same goal.

The Best Software For Sector Rotation

The software must provide the following functionality when selecting the software for a sector rotation strategy.

- Easily perform research on industries, sectors, and stocks.

- Provide powerful financial and fundamental screeners across all sectors.

- Provide comparisons of companies in the same sector and industry.

- Enable easy portfolio management and rebalancing.

- Connect to your broker to perform detailed portfolio correlation and analytics.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Out of our Top 10 Stock Market Analysis Software Review, only one program fulfills these criteria. Stock Rover is the leading stock research, screening, and portfolio management tool on the market today, and I use the service daily.

- Learn more about the best-performing stock sectors over the last ten years.

Why would you offer software to help with sector rotation when you have said that sector rotation doesn’t work? This seems a bit hypocritical.

Hi Nick

The point here is that there is no evidence that sector rotation beats the market.

thanks Barry

You bought a penny stock; its about par for the cusore. Like many stocks in the OTC market it is a mess and subject to non-market forces like pump & dump and insider transactions.References :

Real tough market to use sector rotations. These days it seems to rotate from high beta to high dividend.