Our stock advisor testing shows the best stock picking services are Motley Fool Stock Advisor, Morningstar, AAII, and Zacks. Stock Rover is the best stock research tool and an alternative to stock picking services.

Each of the seven stock advisor services in this review is a major player in the stock-picking and research arena.

While there is no single best stock advisor, we have selected seven well-known companies and tested their services. Have a read, and decide which best suits your needs and budget.

Test Results & Ratings

| Research/Stock Picking Service | Rating |

Price Per Year |

| Motley Fool Stock Advisor | ★★★★★ | $199 |

| Morningstar Premium | ★★★★★ | $249 |

| Stock Rover Premium Plus | ★★★★★ | $279 |

| AAII Plus Membership | ★★★★☆ | $97 |

| Zacks Ultimate | ★★★★☆ | $2995 |

| IBD Leaderboard | ★★★☆☆ | $828 |

| Seeking Alpha Pro | ★★★☆☆ | $2400 |

Advisory Comparison Table

Motley Fool and Zacks claim a yearly return of 24%, Seeking Alpha a 36% return, and MorningStar provides no track record. Motley Fool and Seeking Alpha offer similar services at $199, But Zacks Ultimate costs $2,999 for the same claimed performance.

| Stock Advisor | Motley Fool | Stock Rover | Morningstar | AAII | Zacks | IBD | Seeking Alpha |

| Service | Stock Advisor | Premium Plus | Premium | Plus | Zacks Ultimate | Leaderboard | SA Quant |

| Rating |

★★★★★ | ★★★★★ | ★★★★★ | ★★★★☆ | ★★★☆☆ | ★★★☆☆ | ★★★☆☆ |

| Research Reports Stocks | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Real-Time Research Reports | ❌ | ✅ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Analyst Research Reports | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Fund Research Reports | ❌ | ❌ | ✅ | ✅ | ✅ | ❌ | ❌ |

| Long-Term Investing | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Stock Ratings | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Portfolio Mgt Tools | ❌ | ✅ | ❌ | ✅ | ❌ | ❌ | ❌ |

| Short-Term Trading | ❌ | ❌ | ❌ | ❌ | ✅ | ✅ | ✅ |

| Buy Signals | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ✅ |

| Price Per Year | $199 | $279 | $199 | $97 | $2995 | $828 | $2400 |

| Visit | Motley Fool | Stock Rover | Morningstar | AAII | Zacks | IBD | SA |

The Best Stock Research Tool

Stock Rover is the best stock research tool we tested. It offers excellent research reports and elite stock screening for value, growth, and income investors. Stock Rover is the best choice if you want to independently research stocks, construct diversified portfolios, and implement powerful screening strategies.

The Best Stock Picking Service

Our research reveals that the best stock picking service is Motley Fool’s Stock Advisor, which is based on value for money and independently tested track record data. Motley Fool provides clear audited stock picks and outperforms the S&P500.

Our testing also shows that the Zacks Ultimate stock advisor and Seeking Alpha Quant services claim a 24% annual gain. In contrast, Morningstar offers the broadest selection of analyst research stock and ETF research reports.

1. Motley Fool Stock Advisor: Winner Best Stock Advisor

Motley Fool’s Stock Advisor service is the best stock-picking service because it has a proven track record of outperforming the market. Motley Fool selects only stocks with a high probability of significantly beating the underlying market index. The service is easy to use and has a track record of significantly outperforming the market over the last 18 years.

| Motley Fool Stock Advisor Rating |

4.7/5.0 |

| ⚡ Stock Research Tools |

❌ |

| 📰 Stock Research Reports | ✅ |

| 🕵️♂️ Analyst Research Reports | ✅ |

| 📈 ETF Research Reports | ❌ |

| 📡 Screening |

✅ Basic |

| 👉 Stock Picking Service | ✅ Excellent |

| 📚 Portfolio Mgt Tools |

❌ |

| 🚦Buy & Sell Signals |

✅ Excellent |

| 🏆 Exceptional Features |

Stock Picking Performance Track Record 24% PA |

| 🎯 Best for | Growth Investors |

| 🗺 Strategy | Long-term Investing |

| 🆓 Free | ❌ |

| 💰 Price |

$199/year |

| 🎮 Trial | 30 Day |

| ✂ Discount | 50% Discount or $99 |

| 🌎 Region | USA |

One of the first books I read on investing was the Motley Fool Investment Guide in 1997. The Motley Fool investment team has not looked back since. While I love to perform my own research and not be influenced by others, I have found the Motley Fool Stock Advisor Service incredibly useful.

Motley Fool offers 32 premium services, from the most popular Stock Advisor and Rule Breakers to advice on real estate investing. Stock Advisor and Rule Breakers are the only services sharing market-beating performance.

The Motley Fool premium stock research reports are clear and precise, focusing on the company’s financials but, most importantly, the industry’s future and business outlook. This is important because if you want market-beating results, you must select companies that are potential industry disruptors and market dominators.

I have subscribed to Motley Fool Premium for four years because I value their qualitative analysis. My initial reason for subscribing to the service was to test whether it was legitimate or a scam. I was amazed at how simple and successful their service is.

I am a paying subscriber and recently partnered with Motley Fool because I can wholeheartedly recommend their service.

Unlike Morningstar, Motley Fool does not try to perform research on every stock and fund in the USA. The team focuses on stocks that will significantly beat the S&P 500 over the long term. They then provide lightweight, easy-to-read research reports and recommend why they feel the stock will be a superior long-term investment.

You can manage your favorite stocks through their simple-to-use portfolio tracker, although, unlike Stock Rover, they cannot connect to your broker. Motley Fool is the first in this list to provide its audited track record of performance against the underlying benchmark. This is unique about the service; they try to beat the market and help you succeed in the long term. You could give them a try and follow their advice.

Motley Fool Stock Advisor Portfolio Performance 20-Year Results

- Motley Fool Stock Advisor 421%

- S&P 500 85%

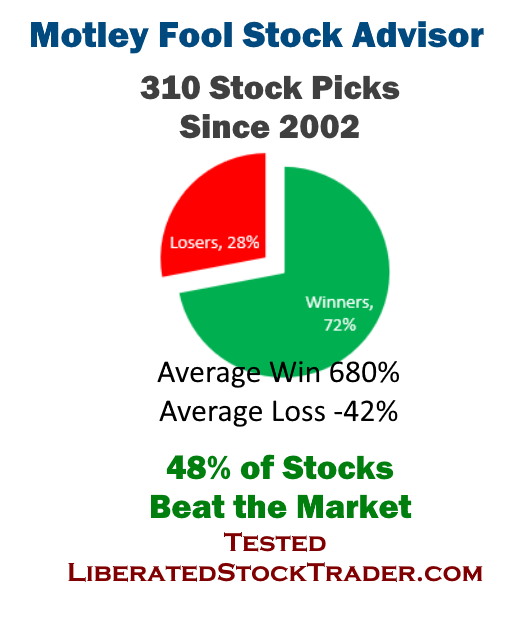

My independent analysis of the stock advisor service’s audited results reveals that since 2002, 48% of the stocks beat the S&P 500. The average winning stock outperformed the S&P 500 by 780%. 28% of the stocks recommended lost 42% on average, while 62% made a profit averaging 640%.

What does this mean? You still have a 28% chance of losing money on any stock recommendation. However, at current performance levels, you have a 72% chance of investing in a company that will make you a profit.

The Stock Advisor service is well-priced at only $199 and provides an audited track record of successful stock selection. The research reports are easy to read and act upon and target long-term investors. They provide specific buy and sell signals on stocks they recommend, but the service does not include fund ratings.

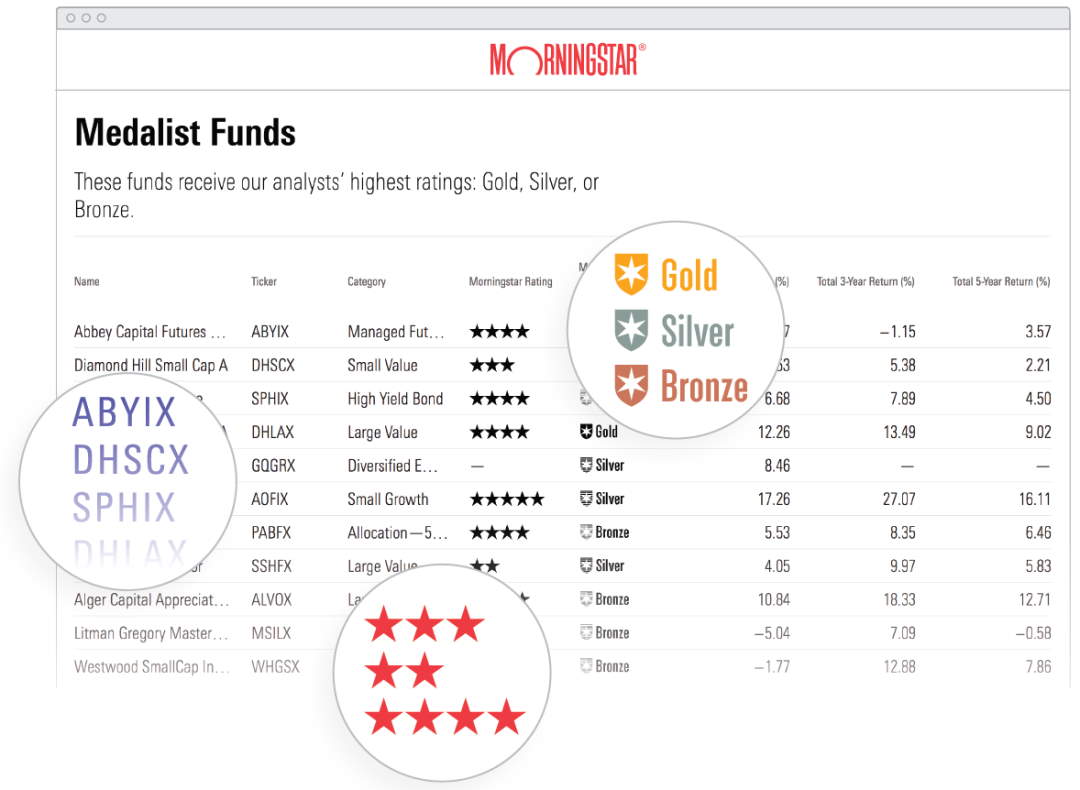

2. Morningstar: Best for Stock & ETF Ratings & Research

MorningStar is one of the best mainstream stock research sites, with over 250 analysts providing research reports for all stocks and funds in the USA. MorningStar analysts use a proprietary methodology to rate each stock based on the industry’s competitiveness, the company’s financial health, earnings growth, and fair value.

| Morningstar Premium Rating |

4.6/5.0 |

| ⚡ Stock Research Tools |

✅ |

| 📰 Stock Research Reports | ✅ Quarterly |

| 🕵️♂️ Analyst Research Reports | ✅ |

| 📈 ETF Research Reports | ✅ |

| 📡 Screening |

✅ Basic |

| 👉 Stock Picking Service | ✅ No Performance Track Record |

| 📚 Portfolio Mgt Tools |

❌ |

| 🚦Buy & Sell Signals |

✅ No Performance Track Record |

| 🏆 Exceptional Features |

Stock Picking Performance Track Record 24% PA |

| 🎯 Best for | Growth Investors |

| 🗺 Strategy | Long-term Investing |

| 🆓 Free | ❌ |

| 💰 Price |

$249/year |

| 🎮 Trial | 14 Day |

| ✂ Discount | $100 Discount – $149 |

| 🌎 Region | USA |

Morningstar’s research reports are curated, meaning they are human-written reports by analysts. They have also popularized the idea of an “Economic Moat,” meaning that if a company has a wide moat, it has a sustainable competitive advantage over its rivals.

Morningstar is a leader in ETF and Mutual Fund ratings, so if you invest heavily in ETFs for diversification, this service could be ideal. Additionally, Morningstar provides portfolio management tools to enable you to evaluate and balance your portfolio.

Unlike Stock Rover’s research reports, which are generated in real-time and change quickly based on daily financial events, Morningstar reports are updated only quarterly. MorningStar research reports are great for a qualitative view of stocks, whereas Stock Rover excels at quantitative analysis of the financials.

Morningstar is easy to use and packed with great features and ratings. Add to this the fact that it costs only $249 per year and that you have a well-balanced service.

Morningstar Premium is a competitively priced service targeted at long-term investors. It provides detailed curated analyst reports and stock rankings to help improve your overall stock picking. The service does provide overall buy and sell signals but does not divulge the performance of its stock recommendations.

Get a 14-Day Free Trial + $100 Discount at MorningStar

3. Stock Rover: The Best Alternative to Stock Advisors

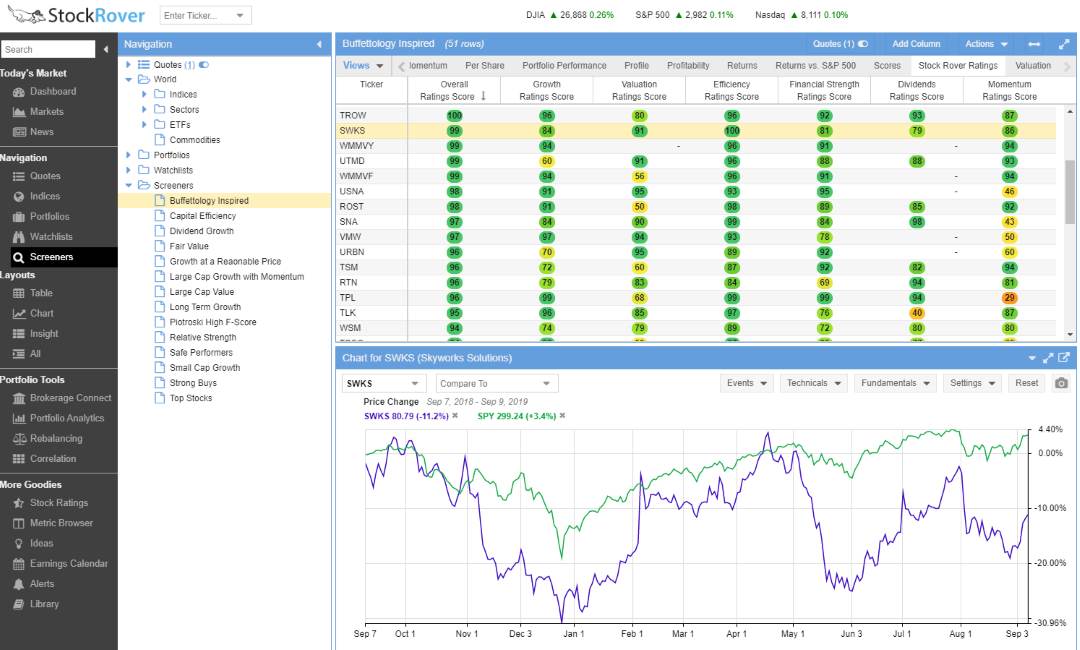

Stock Rover is the best stock research website for self-directed investors because it allows you to research and implement powerful dividend, value, and growth strategies. Stock Rovers’ screening engine and filters offer an industry-leading 650 data points and a huge 10-year historical financial/fundamental database.

| Stock Rover Premium Plus Rating |

4.6/5.0 |

| ⚡ Stock Research Tools |

✅ |

| 📰 Stock Research Reports | ✅ Real-time |

| 🕵️♂️ Analyst Research Reports | ❌ |

| 📈 ETF Research Reports | ❌ |

| 📡 Screening |

✅ Powerful |

| 👉 Stock Picking Service | ❌ |

| 📚 Portfolio Mgt Tools | ✅ Excellent Rebalancing & Correlation |

| 🚦Buy & Sell Signals |

❌ |

| 🏆 Exceptional Features |

Powerful Growth & Value Screening Strategies |

| 🎯 Best for | Growth, Dividend & Value Investors |

| 🗺 Strategy | Long-term Investing & Independent Research |

| 🆓 Free | Try Stock Rover Free |

| 💰 Price |

$0-$28/mo |

| 🎮 Trial | 14-Day Free |

| ✂ Discount | 25% During Premium Trial Period |

| 🌎 Region | USA |

Stock Rover is a powerful, mature stock screening, portfolio management, and stock research platform. The list of fundamentals you can scan & filter on is truly huge. Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can set the watchlists and filters to refresh every minute.

Video: Stock Rover Research Tool

Stock Rover’s Ratings Engine

Stock Rover has implemented great functionality; I particularly like the roll-up view for all the scores and ratings. Below, you can see I have imported a Warren Buffett portfolio, which includes his top 25 holdings. I have also selected the “Stock Rover Ratings” tab. This tab rolls all analyses into a simple-to-view ranking system, saving time and effort while providing a wealth of insight.

Stock Rover has over 150 pre-built screeners that you can import and use. You need to have the Premium Plus service to take advantage of this. I have reviewed many of them, and they are very thoughtfully built. One of my favorites is the Buffettology screener.

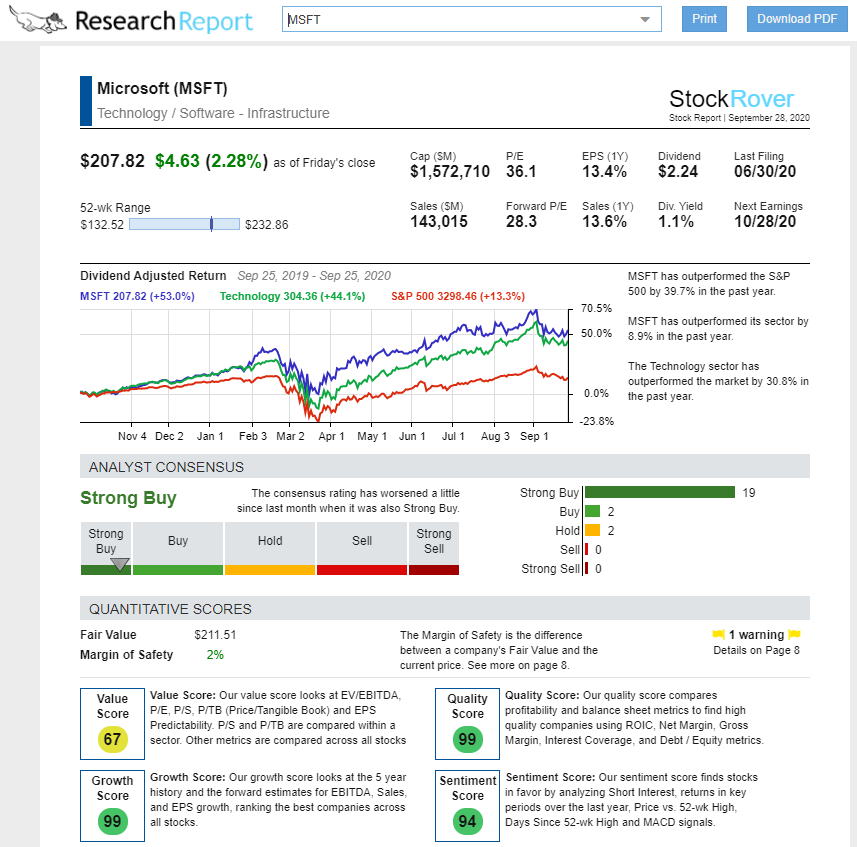

Stock Rover Research Reports

One of the best features of the Stock Rover platform is the Dynamic Research Report. This service generates a professional, readable PDF report on any stock’s current and historical performance.

The research report creates something new: a human-readable, real-time report highlighting a company’s competitive position, market position, and historical and potential dividend and value returns. The image below shows the dividend-adjusted commentary on Microsoft, a company I invested in because I found its excellent potential using my Buffett Stock Screener.

The best thing about Stock Rover’s Research Reports is they are Real-time, so the information is always up-to-date.

The research reports provide a genuinely comprehensive summary of any of the 10,000+ stocks in Stock Rover on the US and Canadian exchanges. They can be viewed in the browser and produced in PDF format for portability and sharing.

- Download a complimentary Stock Rover Research Report Now

Stock Rover Summary

Stock Rover provides the best software for value and income investors. It has a 10-year financials and fundamentals historical library plus incredible scanners, including Warren Buffett and Ben Graham’s favorite criteria: Fair Value, Margin of Safety, and so much more. Even better, there are so many curated screeners and portfolios to import and use that you are instantly productive. It’s impressive how user-friendly Stock Rover is, given its numerous powerful scoring and analysis systems.

Finally, Stock Rover also includes Morningstar fund ratings in its database, enabling you to build a portfolio of 5-star rated Morningstar funds without buying a Morningstar subscription.

Stock Rover is the software for you if you are a long-term investor.

4. AAII: Model Portfolios & Research For Stock Picking

The American Association of Individual Investors (AAII) provides model portfolios and stock-picking advice for independent investors. AAII is an independent nonprofit corporation. AAII functions as an association that makes money by selling membership dues or subscriptions.

| AAII Rating |

4.4/5.0 |

| ⚡ Stock Research Tools |

✅ |

| 📰 Stock Research Reports | ✅ |

| 🕵️♂️ Analyst Research Reports | ✅ |

| 📈 ETF Research Reports | ✅ |

| 📡 Screening | ✅ |

| 👉 Stock Picking Service | ❌ |

| 📚 Portfolio Mgt Tools |

✅ |

| 🚦 Buy & Sell Signals |

❌ |

| 🏆 Exceptional Features |

Model Portfolios, AAII Sentiment Survey |

| 🎯 Best for | Investors |

| 🗺 Strategy | Long-term Investing & Independent Research |

| 🆓 Free | No |

| 💰 Price |

$97/year Plus Membership |

| 🎮 Trial | 14-Day Free |

| ✂ Discount | 1 Month of Access for $2 |

| 🌎 Region | USA |

The AAII membership gives subscribers access to a wide variety of information and digital products. The AAII information products are portfolios, news, and advice. The AAII delivers most of those products digitally through its website and app.

AAII’s main product offerings include The AAII Journal, the Top ETFs Guide, the Top Funds Guide, the AAII Investor Sentiment Survey, and free reports. Other products include classes, videos, and advice.

The AAII Journal is a monthly investment magazine that features educational articles and market commentary.

The AAII Journal often focuses on one aspect of investing. For example, the March 2021 issue contained two articles on bond ratings. There are also articles on insights, ETFs, dividends, and portfolios.

AAII Plus Tools Highlights

- Daily Top and Bottom Stock Lists by Rating

- Daily Stock Ideas

- A Portfolio Diversification Analyzer

- Daily Stock Guru Screens

- Stock Guru Strategies

- Daily Stock Factor Screens

- Stock Rating Upgrade and Downgrade Alerts

- Stock Screen Power Rankings

- Reports on Analyst Ratings and Recommendations

- Stock Factor Screens

Screens and screeners are computer screens that offer specific data about stocks. For instance, Daily Stock Screens evaluate stocks for value, growth, momentum, EPS, and quality. Screeners can show investors if a stock meets their criteria.

The My Stocks and My Screens allow investors to monitor customized lists of stocks. The Stock Grades Screener allows investors to grade “stocks” using the grading system used in most American schools. The system is the A to F grades, with A being the best and F the worst.

Screen Power Rankings rank stocks by various criteria, including guru strategies. Other tools allow investors to identify top and bottom ETFs and Consistent Performers.

The A+ Investor Toolkit is a package of premium investor tools from the AAII. The A+ Investors offer in-depth analysis and tracking of professional fund managers and evaluation of management teams.

The A+ Investor Toolkit aims to give investors one place to monitor the performance of all their stocks, mutual funds, and ETFs. It also offers fast access to most of AAII’s investing tools and screens.

AAII Portfolios

The AAII offers many popular tools, including the AAII Model Shadow Stock Portfolio.

They designed the Model Shadow Stock Portfolio to offer maximum gains from investments without a significant time or work commitment. The AAII claims the Model Shadow Stock Portfolio has outperformed market benchmarks by a four-to-one ratio for the last 20 years.

The AII Dividend Investing Portfolio is designed to maximize income and growth from a diversified portfolio of dividend-paying US companies. The Stock Superstars Portfolios share the suggestions and strategies of rockstar investors, such as William O’Neil, Dreman, James O’Shaughnessy, and John Neff.

5. Zacks: A High Performing & Costly Service

The Zacks Ultimate stock advisor plan covers all its services, including Short Selling Lists, Value Investing, ETF Investing, and Zacks’s Top 10 Stocks. Zacks claims a 24.4% annual return for the service.

To access Zacks’s research reports, you must purchase the ZACKS Ultimate service, which costs $2995 annually. This is one of the highest-priced stock research & reporting services for individual investors in the USA. However, for this investment, you get a comprehensive service covering trade recommendations for short-term trading through income and longer-term growth investing strategies.

It is probably better to decide if you want to invest or trade before you buy a Zacks subscription. If you want to invest, the Zacks Premium service, priced at a reasonable $249 per year, will give you access to their top 50 stock recommendations and the Zacks #1 Rank List research reports.

Zacks claims one of the highest yearly returns of all research services, with a +24.4% average yearly gain.

6. IBD Leaderboard: Growth Stock Picking Service

The Investors Business Daily (IBD) Leaderboard service provides research and ratings using the CANSLIM method to evaluate their stock picks. IBD’s highest-rated stocks are ranked using the following criteria: Current Earnings, Annual Earnings, New Products, Supply, Leaders, Institutional Sponsorship, and Market Direction.

| IBD Leaderboard Rating |

3.9/5.0 |

| ⚡ Stock Research Tools |

✅ |

| 📰 Stock Research Reports | ❌ |

| 🕵️♂️ Analyst Research Reports | ❌ |

| 📈 ETF Research Reports | ❌ |

| 📡 Screening |

✅ |

| 👉 Stock Picking Service | ✅ 36.6% Claimed Performance |

| 📚 Portfolio Mgt Tools | ❌ |

| 🚦 Buy & Sell Signals |

✅ |

| 🏆 Exceptional Features |

CAN SLIM |

| 🎯 Best for | CANSLIM Strategy |

| 🗺 Strategy | Long-term Investing |

| 🆓 Free | ❌ |

| 💰 Price |

$828/year – Expensive |

| 🎮 Trial | 30 days |

| ✂ Discount | ❌ |

| 🌎 Region | USA |

Investors Business Daily (IBD) has driven its business to become digital-first over the past few years. However, it still provides a print newspaper service. Investors Business Daily is available as a digital and print subscription.

The Leaderboard services cost $828 per year, which is more expensive than Motley Fool, Stock Rover, and MorningStar. To justify this additional cost, IBD claims that they have a performance record of an average 36.6% profit per year. If this is the case, it could be well worth the investment. You can track watchlists, a regular market commentary email, and excellent charts with buy and sell signals overlayed as part of the service.

- Related Article: How to Analyze a Stock Like a Pro

7. Seeking Alpha: High-Performing Stock Picking Service

With over 8 million users exchanging stock advice and research, Seeking Alpha (SA) provides a constant source of ideas. Registration is free, but there is also a premium marketplace for stock advisory services.

What I like about Seeking Alpha is the user community’s experience level. If someone posts a substandard research article, the users will point it out in no uncertain terms.

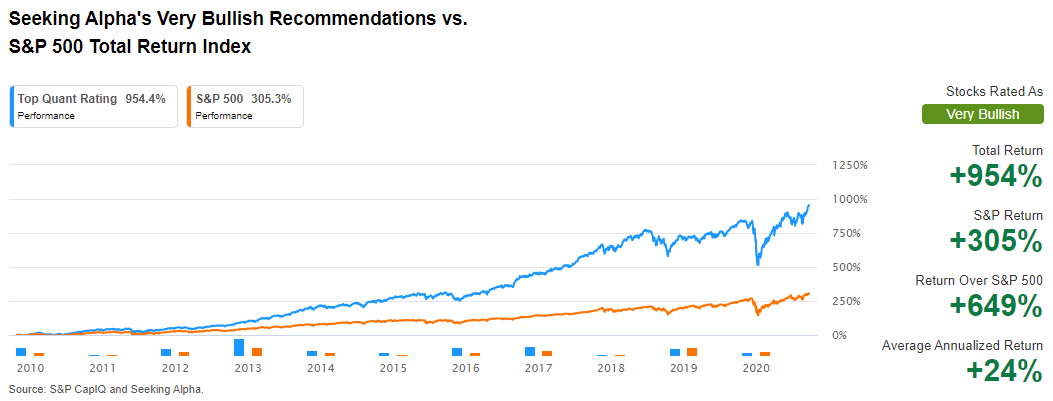

The real benefits to Seeking Alpha are with the Pro Service, which gives you access to all the Investing Ideas and Seeking Alpha’s Premium Ideas. Seeking Alpha PRO includes screening, portfolio management tools, and their crown jewel, the Quant Rating, for $239 annually. The Quant Rating system claims to have an average annualized return of 24%

SA also makes money by allowing others to sell their stock investing strategies through their marketplace, with monthly prices ranging from $25 to $300.

Summary

Stock Rover’s stock and ETF screening is the best I have ever used. It allows you to implement growth, value, and dividend strategies effortlessly. Stock Rover also has excellent real-time research reports and connects to your broker to deliver excellent portfolio management services. The Motley Fool Stock Advisor Service has a proven track record of stock selection that beats the S&P 500 index.

I personally subscribe to Stock Advisor and am a passionate user of Stock Rover. Combining the Motley Fool team’s Stock-Picking talents with Stock Rover’s powerful analysis is, for me, the best approach to building a market-beating portfolio.

FAQ

How to pick stocks for the long term?

A good strategy to pick stocks for long-term investments is to research companies in breakthrough industries with high sales growth and accelerating earnings per share. Ideally, long-term investments will be first to market and have little competition.

Who has the best stock-picking record?

According to our in-depth research, Motley Fool's Stock Advisor service has the best stock picking record, with 48% of stock picks beating the market with an average gain of 680 percent. Only 28 percent of stocks made a loss averaging 42%, since 2002.

How to pick stocks to invest in?

You can independently pick stocks using growth, dividend, or value investing strategies. To implement these strategies, we recommend Stock Rover. Alternatively, you can opt for a stock picking service like Motley Fool, which has a winning track record in-stock selection.

Are Motley Fool stock picks good?

Yes, Motley Fool stock picks are very good; based on our 20 years of testing, Motley Fool's stock advisor service came out number one, above Morningstar, Zacks, and Seeking Alpha.

Does stock picking work?

Yes, stock picking does work, but it can be extremely time-consuming. We have developed detailed backtesting of stock picking systems like the Beat the Market system, but for many novice investors, it makes sense to use the Motley Fool Stock Advisor service to save time.

How accurate are motley fool stock picks?

Motley Fools Stock Advisor Service is very accurate; based on our testing, Motley fool has a 72 percent win ratio, with an average win of 680% since 2002. 28 percent of their stock picks made a loss averaging 42 percent.

How do I successfully pick stocks?

To pick stocks successfully, you must learn stock investing, particularly fundamental and technical analysis. Fundamental analysis covers financials, industry products, and competition. Technical analysis is stock charts and supply and demand. Alternatively, use a stock picking service like Motley Fool.

How does Warren Buffett pick stocks?

Warren Buffett picks stocks using a value investing methodology and a bespoke investing ideology. Buffett's primary value investing criteria in stock selection are intrinsic value and margin of safety, combined with product and competitive landscape analysis.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★