To build a balanced investment portfolio, determine your investment amount, risk tolerance, portfolio allocation, and investing strategy.

Next, screen and research the ideal stocks and ETFs to enable you to manage your portfolio effectively.

This eight-step practical and proven process for building a stock portfolio will help you take a structured approach to achieve your investing goals.

This article contains many researched and tested portfolio strategies, systems, and tools to help you achieve your goals, but this work does not constitute specific financial advice. I am not a financial advisor but a certified financial market technical analyst. I cannot provide financial advice and accept no liability for any losses incurred. By using this work, you agree to our terms and conditions.

8 Steps to Build a Balanced Stock Portfolio

This eight-step process for building a stable, diversified stock portfolio draws on years of research by the author and external academics and provides many practical examples.

1. Allocate how much to invest

The first step in building a stock portfolio is establishing how much money you have to invest. A good rule of thumb is determining how much of your income you need to live on, then investing half the money you do not need in stocks. It is good to reassess your investment when your income changes, e.g. when you change jobs. Another excellent piece of advice is to invest any windfall income, such as bonuses or inheritances.

How to calculate how much to invest

Calculating how much to invest is simple. Take your total income after tax and deduct your living expenses (including vacations, rent, and mortgage). Next, deduct your emergency fund, and ensure you build an emergency fund that covers surprise expenses like illness, auto repair, or home damage.

Investment Capital = Income – Living Expenses – Emergency Fund

| Income | Living Expenses | Emergency Fund | Investment Capital |

| $50,000 | $35,000 | $5,000 | $10,000 |

| $100,000 | $60,000 | $10,000 | $30,000 |

| $200,000 | $120,000 | $15,000 | $65,000 |

Regularly contribute to your portfolio

The most powerful word in investing is compounding. Investing in your new stock portfolio should not be a one-time capital injection but more like a regular contribution. A regular contribution to your portfolio will compound over time to yield rich results 20 or 30 years from now. Always add to your portfolio even if you can only afford $200 monthly.

2. Decide how to manage your portfolio

Before you create your portfolio, it is important to decide how you will manage it. To have maximum control, you might want to manage your portfolio through a broker or use an automated advisor to manage trading, portfolio construction, and tax loss harvesting. The final option is to use a financial advisor.

Table: Pros, Cons & Costs of Managing a Portfolio

| How to Manage Your Portfolio | Pros | Cons | Costs |

| Self Management | You Have Total Control Chance to Outperform the Market Easy to Liquidate |

Takes More Time | Very Low Transaction Costs Portfolio Management Software |

| Robo Advisor | Time-Saving Maintain Control |

Generic Advice No Chance to Outperform the Market |

Medium – <1% of capital |

| Financial Advisor | Time-Saving | Expensive Lack of Control Difficult to liquidate Assets |

High – 5% of capital |

Self-Manage Your Stock Portfolio

The most rewarding yet time-consuming way of managing your portfolio is to do it yourself. You must research and screen for the stocks that meet your investing criteria. You will need to perform portfolio rebalancing and tax-loss harvesting yourself. But with care and attention, you can learn to build a portfolio of stocks that you believe in, which has a chance to potentially beat the market.

The benefits of self-managing your portfolio include a sense of achievement and the ability to dissolve your assets quickly during an emergency. If a self-managed portfolio is your path, you will need to choose a portfolio and research tool and decide on a low-commission or commission-free broker to execute your trades.

Table: Tools for a Self-Managed Portfolio

| Tools for a Self-Managed Portfolio | Recommended Tools |

| Portfolio Tracking, Research & Management Software | Stock Rover, Portfolio123, Tickeron |

| USA Commission Free Brokers | Firstrade, Interactive Brokers |

| International Brokers | Firstrade, Interactive Brokers |

Use an Automated Investment Robo-Advisor

A Robo-advisor is a service designed to automate the job of a financial advisor by automating the buying and selling of stocks or ETFs and structuring an investment portfolio based on the investor’s risk tolerance. These services are provided directly to investors online or via a smartphone app.

I strongly believe that Robo-Advisors offers a superb blend of portfolio transparency, user-friendliness, and cost-effectiveness. In addition, they often entail lower maintenance expenses than human financial advisors.

For example, our review-winning automated financial advisor, M1 Finance, has many advantages over other robo-advisors.

Overall, M1 Finance allows you to have granular control over your portfolio or take advantage of the M1 expert portfolios; this is an excellent approach. M1, like the industry, is growing fast, and it offers a full suite of services, including checking accounts and borrowing. But when it comes to automated investment, M1 is one of the pack’s leaders and the only one offering automated investing for free with zero trading commissions.

Use a Financial Advisor

A financial advisor can help you plan a portfolio, and most will receive a commission from your investment funds. You can also opt for a zero commissions advisor who will charge you for their time only. A zero-commission broker can be a good way to eliminate any perceived conflict of interest between your advisor and the funds they promote.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

3. Determine your risk profile and asset allocation

It would be best to determine your risk profile before you invest any money in your portfolio; this helps you understand your asset allocation and investing strategy. It would be best to be honest about how much risk you can take.

We match your risk profile, tolerance, potential risk/reward, and portfolio asset allocation in the table below.

Table: Risk Profile, Tolerance, Risk/Reward & Portfolio Allocation

| Risk Profile | Your Risk Tolerance | Risk/Reward* | Portfolio Asset Allocation |

| Conservative | Your main priority is the safety of your capital, and you are willing to accept a maximum of 3% loss in a year. | -1% to + 1% | Stocks & ETFs: 10%.Corporate Bonds, CDs & Treasuries: 90% |

| Moderately Conservative | You will accept small levels of risk for some potential returns over the medium to long term. | -2% to +3% | Stocks & ETFs: 30%Corporate Bonds, CDs & Treasuries: 70% |

| Moderate | You can accept a moderate level of risk in an increase in returns over the medium to long term. | -2% to +4.5% | Stocks & ETFs: 50%Corporate Bonds, CDs & Treasuries – 50% |

| Moderately Aggressive | You want to accept higher risk to maximize potential returns over the medium to long term. | -4% to +6% | Stocks & ETFs: 75%Bond & Treasuries – 25% |

| Aggressive | You accept significant risks to maximize potential returns over the long term and know that the stock market can crash up to 30% in one year in 8. | -5 % to +9% | Stocks & ETFs: 100%Bond & Treasuries – 0% |

| Actively Aggressive | You are willing to invest time and effort into actively managing your portfolio to maximize your return and potentially outperform the stock market benchmark performance. This entails significant risk and reward. | -10% to +20% | Stocks: 100% |

*Risk reward is calculated using Liberated Stock Trader Stock Market Statistics, dating back to 1929. I used a 20-year average S&P 500/Nasdaq Composite return of 9% and a current negative bond yield to a maximum bond yield of 1%. Stock market crashes occur every 8 to 10 years, with a maximum loss of 30% lasting two years.

A conservative risk profile means you want to have as little risk as possible and try to protect your capital from inflation. The other end of the scale is the aggressive risk profile, which means you are willing to expose yourself to higher risks, assuming you will see higher rewards over time.

The highest-risk strategy is the actively aggressive profile, meaning you want to actively day trade opportunities to maximize income. I recommend only using high-performing AI systems to assist you; Trade Ideas is the ideal choice.

Your Age Equals Safe Asset Allocation

Another simple way that many financial advisors suggest for calculating asset allocation in investment portfolios is to use the age equals safe assets equation. Suppose you are 30 years old; that would mean you should have 30% of your capital in safe assets and 70% in stocks.

Your Age = Percent of Portfolio in Safe Assets (Bonds, Treasuries, Cash Accounts)

4. Define a portfolio goal and strategy

After assessing your risk tolerance, it is time to define the goals for your portfolio; this will help you decide on an investing strategy. A mix of treasuries, corporate bonds, and defensive stocks ETFs might be a good choice for a conservative portfolio designed primarily to protect your assets from inflation.

Once you have the goal, you can decide what type of portfolio you want. If your goal is capital growth, a portfolio of growth stocks could serve your needs. If a steady income is your goal, a dividend portfolio will meet your needs. A mix of value, growth, and ETF investing might be suitable if you build long-term retirement wealth. Finally, active day trading and 100% growth stock portfolios are the most aggressive and risky strategies.

The table below lets you associate potential portfolio investing strategies with your portfolio goal and risk tolerance.

Table: Portfolio Goal, Risk Tolerance, and Investing Strategy

| Portfolio Goal | Risk Tolerance | Portfolio Strategy |

| Protect assets from inflation | Conservative | Treasuries & Corporate Bonds Defensive Stocks |

| Long-term investing for retirement | Moderate | Value Investing Growth Stock Investing ETF Investing |

| Provide a steady source of regular income | Moderate | Dividend Income Strategy |

| Long-term steady growth | Aggressive | Growth Stock Investing ETF Investing |

| Long-term maximum growth | Actively Aggressive | Growth Stock Investing AI Portfolio AI Trading |

I have conducted extensive research into portfolio investing and trading strategies and developed numerous original investing systems, such as the Market Outperforming Stock ETF System (MOSES) and the LST Beat the Market System. Here is another great article that provides inspiration and detailed examples of winning portfolio strategies.

5. Choose the right software for your portfolio strategy

Once you understand your portfolio investment strategy, you must select the best software to achieve your goal. Stock analysis software, brokers, and stock trading platforms have made incredible steps forward in the last few years.

We now see commission-free brokers, incredible portfolio management software, Robo-Advisor platforms, stock analysis tools, and even the advent of AI-powered trading software. Choosing the right tool for your strategy can be very complex.

The table below makes choosing a portfolio investing strategy and the associated tool incredibly easy. Simply choose your strategy and read the recommended tool review.

Table: Portfolio Strategies, Tools, and Implementation Guides

| Portfolio Strategy | Recommended Tool Review | Portfolio Strategy Implementation & Tool Guide |

| Treasuries & Corporate Bonds | Brokerage Account | Invest in Treasuries & Corporate Bonds using a commission-free broker |

| Defensive Stocks | Robo Advisor | Use a Robo Advisor to construct a defensive stock & ETF portfolio |

| ETF Investing | Stock Rover | Perform deep ETF research and construct your strategy with Stock Rover |

| Value Investing | Stock Rover | Our ultimate guide to value investing, a guide to value screening criteria, and our Warren Buffett value strategy pair perfectly with Stock Rover. |

| Dividend Income Strategy | Stock Rover | Implement our 6 Steps to Build Your Dividend Stock Screener & Strategy, How to Find High Dividend Yield Stocks, and Dividend Growth Stock Screener: 5 Step Timeless Strategy with Stock Rover |

| Growth Stock Investing | Stock Rover | Try our LST Beat the Market System with Stock Rover. |

| Growth Stock Investing | Tickeron | Use Tickeron’s AI-powered portfolios to construct a high-performing growth stock portfolio. |

| Index ETF Investing | TradingView | Use our Market Outperforming Stock ETF System (MOSES) designed specifically for TradingView. |

| Growth & ETF Investing | Portfolio 123 | Build and backtest your own growth or ETF portfolio with Portfolio 123. |

| AI Growth Portfolio | Tickeron | Construct an artificial intelligence-powered growth portfolio with audited performance track records using Tickeron. |

| AI Day Trading | Trade Ideas | Day trade using Trade Ideas cutting-edge AI algorithms that generate high probability trades and enable auto-trading. |

6. Find the right stocks for your portfolio

To build a first-class stock portfolio, you will need the best software to screen for stocks, research the companies, and eventually manage your portfolio.

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

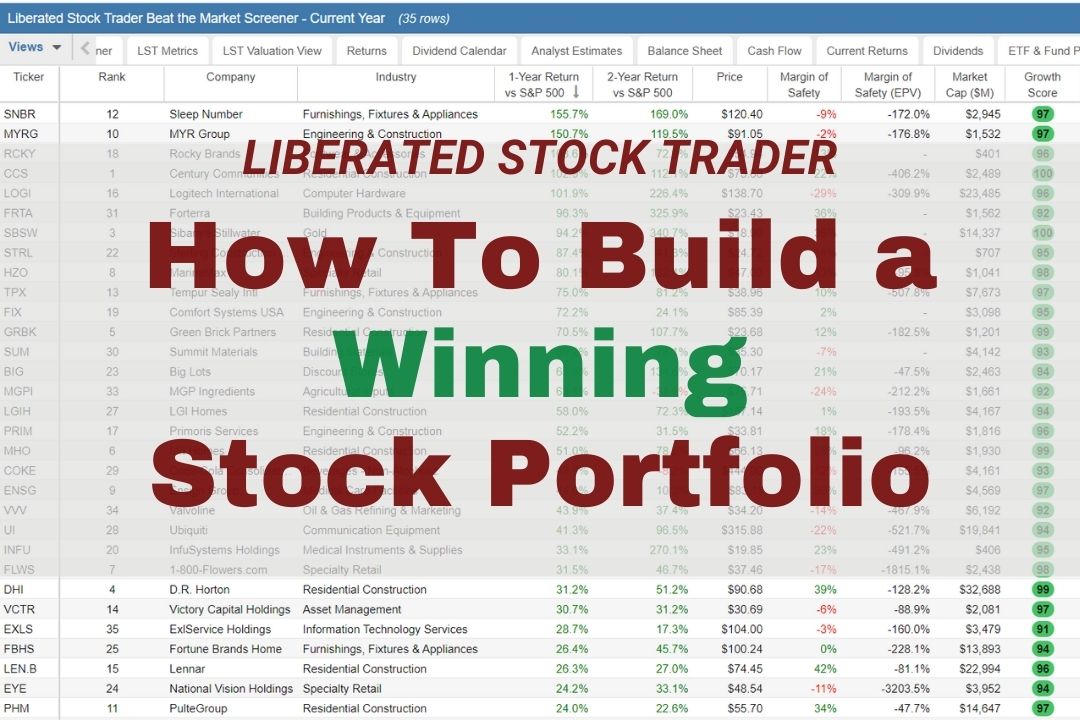

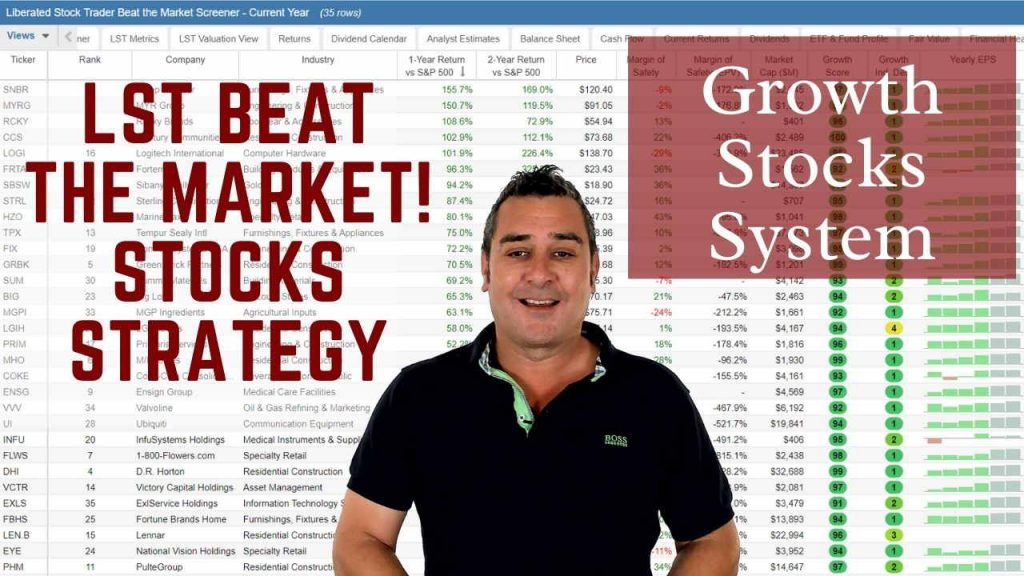

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Stock Rover is the best platform for managing and maintaining a balanced and profitable stock portfolio. I use Stock Rover daily, working with Stock Rover to develop portfolio strategies and screeners to beat the market.

Stock Rover won our Best Stock Screener and Portfolio Software Review and is a winner in our Top 10 Best Stock Market Analysis Platforms Review.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

7. Make your investments

A crucial step in constructing a portfolio is initiating your stock market entry. An ideal way to commence this journey is by starting with a modest investment and purchasing select stocks that align with your preferences. By acquiring a manageable number of shares, you gain firsthand experience with the intricacies of the stock-buying process and lay a solid foundation for future learning and growth.

Once you become comfortable buying stock, you can research and build your portfolio. A final piece of advice is to keep the portfolio as simple as possible to avoid complications and problems.

Ideally, you should not have more than 5% to 10% of your portfolio in any single stock. This means you should have at least 10 to 20 stocks in your investment. Of course, you can diversify much more.

When managing your stocks, you need to ensure you are using a zero-commission broker. This means you can buy or sell your stocks without incurring any trading fees.

Firstrade vs. E-Trade, Schwab & Fidelity: Full Test & Comparison

8. Monitor and maintain your portfolio

You must monitor the portfolio to see if it is achieving your goals. You also need to decide whether you want investments other than stocks in your portfolio.

Some people will create a hybrid portfolio that contains 10% or 20% mutual funds or ETFs as a cushion. This is to diversify the portfolio and give it a margin of safety. The drawback of this strategy is that it can limit growth potential.

The key elements in managing your portfolio include:

- Analyzing Portfolio Performance

- Portfolio Rebalancing

- Calculating Stock Portfolio Weighting

- Planning Future Portfolio Income

- Using Correlation to Ensure Good Diversification

All of these we cover in the article: How to Manage a Stock Portfolio: 7 Steps of Pro Portfolios Managers

How to create a stock portfolio

Developing a stock portfolio requires evaluating your financial objectives and risk tolerance and selecting an appropriate strategy. Thoroughly researching and analyzing potential investments to construct a diversified stock portfolio can maximize your potential returns while mitigating risks.

It’s also important to consider how much diversification you want in your stock portfolio. Investors should generally diversify across multiple sectors and industries to reduce the risk of investing in just one or two stocks.

Once you have identified which stocks to include in your portfolio, it is important to rebalance the holdings periodically. Rebalancing helps maintain a desired stock weighting within your portfolio based on your risk tolerance.

Many people fail to start portfolios because they fail to conduct the research and planning necessary to create a successful portfolio. Others fail at portfolios because they make the process too complex, expensive, and intimidating. Many people fail because they think they need expensive expert help or special knowledge to build a stock portfolio.

All you need to start a stock portfolio is money and knowledge. If you need to learn more about investing, try our PRO Stock Market Training to fast-track your knowledge.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

Before launching the portfolio, you must understand basic investing strategies and philosophies. Understanding value investing, growth investing, defensive investing, aggressive investing, income investing, and speculative investing will give you the basic knowledge to build a portfolio.

FAQ

What is the best software for creating a portfolio?

Our testing shows Stock Rover is the best software for creating a balanced portfolio of ETFs, stocks, and bonds. It provides in-depth analytics, portfolio tracking, and research capabilities to help you gain better insight into your investments.

What is an investment portfolio?

An investment portfolio is a collection of assets such as stocks, bonds, commodities, currencies, cash equivalents, and real estate. The purpose is to diversify risk and increase the potential for returns.

How do I start building an investment portfolio?

The first step is understanding your financial goals and risk tolerance. Then, research various asset classes and choose investments that align with your objectives. Consider seeking advice from a financial advisor.

What should be included in a stock portfolio?

A well-diversified stock portfolio should include a mix of companies from different sectors, sizes (small-cap, mid-cap, and large-cap), and geographical locations. The exact mix depends on your investment strategy and risk tolerance.

How many stocks should I have in my portfolio?

According to Modern Portfolio Theory (MPT), an established guideline is to hold between 20 and 30 stocks to achieve adequate diversification. Too many stocks can make the portfolio difficult to manage, and too few introduce too much risk.

How should I allocate my portfolio investments?

Investment allocation depends on risk tolerance, investment horizon, and financial goals. A common strategy is the 60/40 rule: 60% in stocks and 40% in bonds. However, this can vary based on individual circumstances.

What software is best for portfolio diversification and rebalancing?

The software best suited for portfolio diversification and rebalancing is Stock Rover. It provides detailed portfolio correlation reporting to help identify correlated assets and target asset classes for diversification. Additionally, it provides portfolio rebalancing tools to help maintain strategic allocations and Monte Carlo testing to help forecast risk.

What strategies can reduce portfolio risk?

The most effective strategy for reducing risk is a well-diversified, low-correlation portfolio, including stocks, bonds, and other asset classes. Portfolio rebalancing is an essential component of risk reduction as it helps to realign the portfolio's weightings with strategic targets.

What is rebalancing, and why is it important?

Portfolio rebalancing involves adjusting your portfolio to maintain your desired asset allocation. It's crucial as it helps manage risk and ensures your investments are aligned with your goals.

What is a diversified portfolio?

A diversified or low-correlation portfolio holds a variety of investments to reduce risk. If one investment performs poorly, others may perform well, balancing potential losses.

How can I manage risk in my portfolio?

Risk can be managed through diversification, asset allocation, rebalancing, and investing in different types of investments, such as stocks, bonds, and cash equivalents.

Should I invest in international stocks?

Investing in international stocks can provide additional diversification and exposure to growth in other economies. However, they also come with additional risks, such as currency risk.

What is the difference between active and passive investing?

Active investing entails the frequent buying and selling of securities driven by market research. Conversely, passive investing involves holding a portfolio of ETFs replicating a market index performance.

How does inflation impact my portfolio?

Inflation erodes the purchasing power of money over time. Therefore, your investments need to earn a return higher than the inflation rate to increase in real terms.

What is a financial advisor, and do I need one?

A financial advisor offers financial planning, investing, and wealth management expertise. Whether you need one depends on your comfort level in managing your investments and financial situation.