Our regularly updated S&P 500 companies list shows you which companies are currently in the S&P 500 index and provides their ticker symbol, industry sector, and market capitalization.

The S&P 500 CompaniesThe companies listed on the S&P 500 index are the largest and most successful in the USA. The Index is managed by the Standard & Poors rating agency. A company only becomes a constituent of the S&P 500 when its market capitalization (total outstanding shares X share price) is ranked among the top 500 companies on the US stock exchanges.

Our regularly updated S&P 500 Companies List shows you which companies are currently in the S&P 500 index and provides their ticker symbol, industry sector, and market capitalization.

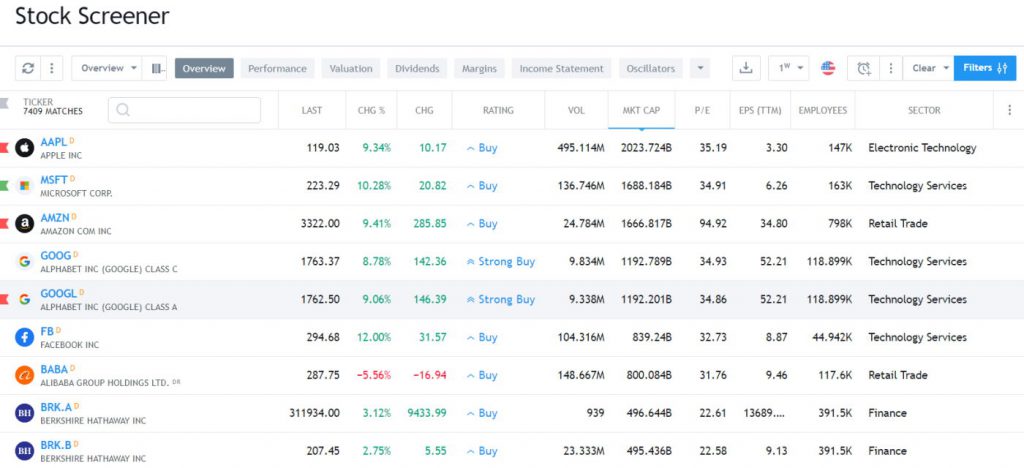

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

The S&P 500 Index

The S&P 500 Index lists the largest 500 companies (by market capitalization) traded on the U.S. Stock Exchanges, including companies traded on both the Nasdaq and the New York Stock Exchange (NYSE). It is typically used as the benchmark against which all US investments are measured. The term beat the market usually refers to an investment that returns better results than the S&P 500. Learn more about how to invest in index funds.

S&P 500 Companies List by Sector & Market Cap

Get the Free Interactive S&P 500 Companies List on TradingView Now

| Ticker | Description | Sector | Market Capitalization |

| AAPL | Apple Inc. | Electronic Technology | 2,728,017,215,293 |

| MSFT | Microsoft Corporation | Technology Services | 2,351,371,643,107 |

| GOOG | Alphabet Inc. | Technology Services | 1,611,856,497,958 |

| GOOGL | Alphabet Inc. | Technology Services | 1,610,343,852,181 |

| AMZN | Amazon.com, Inc. | Retail Trade | 1,366,884,251,763 |

| NVDA | NVIDIA Corporation | Electronic Technology | 1,069,485,293,976 |

| BRK.B | Berkshire Hathaway Inc. New | Finance | 768,891,898,463 |

| META | Meta Platforms, Inc. | Technology Services | 728,967,239,293 |

| TSLA | Tesla, Inc. | Consumer Durables | 683,964,053,782 |

| LLY | Eli Lilly and Company | Health Technology | 518,723,331,656 |

| V | Visa Inc. | Commercial Services | 485,525,515,662 |

| UNH | UnitedHealth Group Incorporated | Health Services | 461,707,513,407 |

| JNJ | Johnson & Johnson | Health Technology | 448,296,231,871 |

| XOM | Exxon Mobil Corporation | Energy Minerals | 440,511,349,736 |

| JPM | JP Morgan Chase & Co. | Finance | 432,919,527,223 |

| WMT | Walmart Inc. | Retail Trade | 425,279,432,050 |

| MA | Mastercard Incorporated | Commercial Services | 369,364,486,503 |

| PG | Procter & Gamble Company (The) | Consumer Non-Durables | 359,583,481,922 |

| AVGO | Broadcom Inc. | Electronic Technology | 340,812,095,959 |

| HD | Home Depot, Inc. (The) | Retail Trade | 329,129,972,182 |

| ORCL | Oracle Corporation | Technology Services | 316,102,599,449 |

| CVX | Chevron Corporation | Energy Minerals | 306,932,521,814 |

| MRK | Merck & Company, Inc. | Health Technology | 277,097,314,775 |

| ABBV | AbbVie Inc. | Health Technology | 265,004,108,705 |

| KO | Coca-Cola Company (The) | Consumer Non-Durables | 263,568,843,499 |

| PEP | PepsiCo, Inc. | Consumer Non-Durables | 245,279,121,127 |

| COST | Costco Wholesale Corporation | Retail Trade | 241,489,319,696 |

| ADBE | Adobe Inc. | Technology Services | 231,605,653,875 |

| BAC | Bank of America Corporation | Finance | 231,318,896,391 |

| CSCO | Cisco Systems, Inc. | Technology Services | 224,291,209,687 |

| PFE | Pfizer, Inc. | Health Technology | 206,980,864,752 |

| TMO | Thermo Fisher Scientific Inc | Health Technology | 205,471,945,947 |

| MCD | McDonald’s Corporation | Consumer Services | 205,321,797,459 |

| ACN | Accenture plc | Technology Services | 201,246,616,516 |

| CRM | Salesforce, Inc. | Technology Services | 199,504,416,416 |

| CMCSA | Comcast Corporation | Consumer Services | 188,766,086,139 |

| DHR | Danaher Corporation | Health Technology | 185,629,109,809 |

| LIN | Linde plc | Process Industries | 183,028,485,644 |

| ABT | Abbott Laboratories | Health Technology | 179,973,982,046 |

| NFLX | Netflix, Inc. | Technology Services | 179,266,158,431 |

| AMD | Advanced Micro Devices, Inc. | Electronic Technology | 170,372,551,712 |

| NKE | Nike, Inc. | Consumer Non-Durables | 160,367,096,321 |

| TMUS | T-Mobile US, Inc. | Communications | 160,162,887,737 |

| DIS | Walt Disney Company (The) | Consumer Services | 157,075,139,070 |

| WFC | Wells Fargo & Company | Finance | 155,498,290,602 |

| TXN | Texas Instruments Incorporated | Electronic Technology | 151,167,305,708 |

| PM | Philip Morris International Inc | Consumer Non-Durables | 146,479,296,866 |

| UPS | United Parcel Service, Inc. | Transportation | 146,457,435,764 |

| MS | Morgan Stanley | Finance | 140,659,902,525 |

| COP | ConocoPhillips | Energy Minerals | 140,453,676,582 |

| AMGN | Amgen Inc. | Health Technology | 140,047,831,256 |

| CAT | Caterpillar, Inc. | Producer Manufacturing | 139,677,186,754 |

| VZ | Verizon Communications Inc. | Communications | 139,490,054,291 |

| UNP | Union Pacific Corporation | Transportation | 137,286,101,364 |

| NEE | NextEra Energy, Inc. | Utilities | 137,268,524,235 |

| INTC | Intel Corporation | Electronic Technology | 137,157,007,708 |

| BA | Boeing Company (The) | Electronic Technology | 136,716,081,029 |

| INTU | Intuit Inc. | Technology Services | 136,097,826,356 |

| BMY | Bristol-Myers Squibb Company | Health Technology | 129,649,721,909 |

| IBM | International Business Machines Corporation | Technology Services | 128,825,393,714 |

| LOW | Lowe’s Companies, Inc. | Retail Trade | 128,534,892,552 |

| RTX | RTX Corporation | Electronic Technology | 124,883,190,494 |

| HON | Honeywell International Inc. | Electronic Technology | 123,881,919,976 |

| QCOM | QUALCOMM Incorporated | Electronic Technology | 122,871,602,043 |

| GE | General Electric Company | Producer Manufacturing | 121,669,808,694 |

| SPGI | S&P Global Inc. | Commercial Services | 121,552,406,207 |

| AMAT | Applied Materials, Inc. | Producer Manufacturing | 119,798,366,106 |

| AXP | American Express Company | Finance | 118,002,804,852 |

| DE | Deere & Company | Producer Manufacturing | 116,403,156,028 |

| PLD | Prologis, Inc. | Finance | 113,828,796,051 |

| LMT | Lockheed Martin Corporation | Electronic Technology | 113,339,268,033 |

| SBUX | Starbucks Corporation | Consumer Services | 111,367,244,022 |

| NOW | ServiceNow, Inc. | Technology Services | 110,628,454,634 |

| BKNG | Booking Holdings Inc. Common Stock | Consumer Services | 109,161,968,068 |

| ELV | Elevance Health, Inc. | Health Services | 109,053,095,545 |

| MDT | Medtronic plc. | Health Technology | 108,454,644,596 |

| SCHW | Charles Schwab Corporation (The) | Finance | 108,392,664,416 |

| GS | Goldman Sachs Group, Inc. (The) | Finance | 107,120,020,932 |

| SYK | Stryker Corporation | Health Technology | 105,544,181,735 |

| ADP | Automatic Data Processing, Inc. | Technology Services | 103,429,305,077 |

| TJX | TJX Companies, Inc. (The) | Retail Trade | 102,879,833,860 |

| ISRG | Intuitive Surgical, Inc. | Health Technology | 100,469,864,749 |

| T | AT&T Inc. | Communications | 100,443,451,641 |

| BLK | BlackRock, Inc. | Finance | 100,070,096,351 |

| MDLZ | Mondelez International, Inc. | Consumer Non-Durables | 96,766,517,287 |

| GILD | Gilead Sciences, Inc. | Health Technology | 94,547,572,998 |

| MMC | Marsh & McLennan Companies, Inc. | Finance | 93,278,220,336 |

| VRTX | Vertex Pharmaceuticals Incorporated | Health Technology | 88,996,253,919 |

| ADI | Analog Devices, Inc. | Electronic Technology | 88,903,581,159 |

| REGN | Regeneron Pharmaceuticals, Inc. | Health Technology | 88,178,356,962 |

| LRCX | Lam Research Corporation | Producer Manufacturing | 86,522,191,352 |

| CVS | CVS Health Corporation | Retail Trade | 85,810,704,307 |

| ETN | Eaton Corporation, PLC | Producer Manufacturing | 85,645,351,950 |

| ZTS | Zoetis Inc. | Health Technology | 83,579,740,494 |

| SLB | Schlumberger N.V. | Industrial Services | 82,471,424,751 |

| AMT | American Tower Corporation (REIT) | Finance | 82,187,878,166 |

| CB | Chubb Limited | Finance | 82,105,914,715 |

| CI | The Cigna Group | Health Services | 81,693,476,157 |

| C | Citigroup, Inc. | Finance | 81,360,929,490 |

| BDX | Becton, Dickinson and Company | Health Technology | 79,399,811,792 |

| PGR | Progressive Corporation (The) | Finance | 78,393,735,374 |

| MO | Altria Group, Inc. | Consumer Non-Durables | 76,148,513,926 |

| EOG | EOG Resources, Inc. | Energy Minerals | 76,060,734,193 |

| SO | Southern Company (The) | Utilities | 73,949,967,038 |

| BSX | Boston Scientific Corporation | Distribution Services | 73,489,363,770 |

| CME | CME Group Inc. | Finance | 73,291,701,083 |

| FI | Fiserv, Inc. | Finance | 73,202,554,483 |

| HCA | HCA Healthcare, Inc. | Health Services | 73,175,649,258 |

| ITW | Illinois Tool Works Inc. | Producer Manufacturing | 71,297,588,138 |

| ATVI | Activision Blizzard, Inc | Technology Services | 71,181,646,046 |

| EQIX | Equinix, Inc. | Finance | 70,532,986,440 |

| DUK | Duke Energy Corporation (Holding Company) | Utilities | 70,288,528,982 |

| MU | Micron Technology, Inc. | Electronic Technology | 69,650,232,522 |

| SHW | Sherwin-Williams Company (The) | Process Industries | 69,468,699,540 |

| FDX | FedEx Corporation | Transportation | 66,059,205,171 |

| AON | Aon plc | Finance | 65,741,012,217 |

| KLAC | KLA Corporation | Electronic Technology | 65,346,729,935 |

| PYPL | PayPal Holdings, Inc. | Commercial Services | 65,245,385,101 |

| NOC | Northrop Grumman Corporation | Electronic Technology | 65,084,593,072 |

| SNPS | Synopsys, Inc. | Technology Services | 64,823,017,177 |

| WM | Waste Management, Inc. | Industrial Services | 64,351,801,621 |

| PANW | Palo Alto Networks, Inc. | Technology Services | 64,134,694,722 |

| ICE | Intercontinental Exchange Inc. | Finance | 63,734,283,637 |

| APD | Air Products and Chemicals, Inc. | Process Industries | 63,272,413,581 |

| CHTR | Charter Communications, Inc. | Consumer Services | 62,932,140,344 |

| CSX | CSX Corporation | Transportation | 61,935,406,680 |

| CL | Colgate-Palmolive Company | Consumer Non-Durables | 61,629,853,437 |

| GD | General Dynamics Corporation | Electronic Technology | 61,276,213,340 |

| HUM | Humana Inc. | Health Services | 60,762,631,654 |

| TGT | Target Corporation | Retail Trade | 60,561,239,513 |

| MAR | Marriott International | Consumer Services | 60,271,239,997 |

| MNST | Monster Beverage Corporation | Consumer Non-Durables | 60,085,650,293 |

| MCO | Moody’s Corporation | Commercial Services | 60,008,170,000 |

| CDNS | Cadence Design Systems, Inc. | Technology Services | 59,943,285,720 |

| MPC | Marathon Petroleum Corporation | Energy Minerals | 57,825,449,488 |

| MCK | McKesson Corporation | Distribution Services | 56,717,006,874 |

| OXY | Occidental Petroleum Corporation | Energy Minerals | 56,681,568,220 |

| ORLY | O’Reilly Automotive, Inc. | Retail Trade | 56,522,324,456 |

| USB | U.S. Bancorp | Finance | 56,474,449,436 |

| EL | Estee Lauder Companies, Inc. (The) | Consumer Non-Durables | 56,003,044,623 |

| ANET | Arista Networks, Inc. | Electronic Technology | 55,891,684,799 |

| FCX | Freeport-McMoRan, Inc. | Non-Energy Minerals | 55,682,405,984 |

| PXD | Pioneer Natural Resources Company | Energy Minerals | 55,454,957,524 |

| MMM | 3M Company | Producer Manufacturing | 55,204,764,744 |

| EMR | Emerson Electric Company | Electronic Technology | 54,743,986,919 |

| ROP | Roper Technologies, Inc. | Technology Services | 51,684,358,159 |

| ECL | Ecolab Inc. | Process Industries | 51,120,832,419 |

| PH | Parker-Hannifin Corporation | Producer Manufacturing | 51,031,053,903 |

| CMG | Chipotle Mexican Grill, Inc. | Consumer Services | 51,015,016,997 |

| PSX | Phillips 66 | Energy Minerals | 50,869,691,865 |

| APH | Amphenol Corporation | Electronic Technology | 50,835,765,835 |

| NXPI | NXP Semiconductors N.V. | Electronic Technology | 50,676,169,200 |

| VTR | Ventas, Inc. | Finance | 50,551,953,047 |

| CTAS | Cintas Corporation | Consumer Services | 49,389,425,174 |

| PNC | PNC Financial Services Group, Inc. (The) | Finance | 49,064,967,725 |

| NSC | Norfolk Southern Corporation | Transportation | 48,152,211,047 |

| PSA | Public Storage | Finance | 47,892,431,291 |

| F | Ford Motor Company | Consumer Durables | 47,866,618,001 |

| HES | Hess Corporation | Energy Minerals | 47,766,412,551 |

| AJG | Arthur J. Gallagher & Co. | Finance | 47,529,846,652 |

| TDG | Transdigm Group Inc. | Electronic Technology | 47,299,142,061 |

| VLO | Valero Energy Corporation | Energy Minerals | 47,171,490,774 |

| KDP | Keurig Dr Pepper Inc. | Consumer Non-Durables | 47,157,502,166 |

| STZ | Constellation Brands, Inc. | Consumer Non-Durables | 47,126,533,141 |

| MET | MetLife, Inc. | Finance | 46,820,918,533 |

| EW | Edwards Lifesciences Corporation | Health Technology | 46,554,232,956 |

| MSI | Motorola Solutions, Inc. | Electronic Technology | 46,378,007,432 |

| RSG | Republic Services, Inc. | Industrial Services | 46,272,159,042 |

| GM | General Motors Company | Consumer Durables | 45,569,980,121 |

| TT | Trane Technologies plc | Producer Manufacturing | 44,982,944,153 |

| FTNT | Fortinet, Inc. | Technology Services | 44,889,857,888 |

| HSY | The Hershey Company | Consumer Non-Durables | 44,733,542,105 |

| CARR | Carrier Global Corporation | Producer Manufacturing | 44,720,954,523 |

| AZO | AutoZone, Inc. | Retail Trade | 44,634,454,686 |

| SRE | DBA Sempra | Utilities | 44,501,454,004 |

| AFL | AFLAC Incorporated | Finance | 44,465,578,484 |

| ADM | Archer-Daniels-Midland Company | Process Industries | 44,405,297,970 |

| PCAR | PACCAR Inc. | Producer Manufacturing | 44,260,681,014 |

| PAYX | Paychex, Inc. | Technology Services | 43,438,555,136 |

| KMB | Kimberly-Clark Corporation | Consumer Non-Durables | 43,368,862,403 |

| CCI | Crown Castle Inc. | Finance | 43,276,780,689 |

| MCHP | Microchip Technology Incorporated | Electronic Technology | 43,225,585,100 |

| ODFL | Old Dominion Freight Line, Inc. | Transportation | 42,995,898,919 |

| ADSK | Autodesk, Inc. | Technology Services | 42,676,891,922 |

| WELL | Welltower Inc. | Finance | 42,426,850,696 |

| WMB | Williams Companies, Inc. (The) | Industrial Services | 42,294,976,607 |

| NUE | Nucor Corporation | Non-Energy Minerals | 41,869,944,440 |

| CPRT | Copart, Inc. | Commercial Services | 41,460,875,531 |

| KHC | The Kraft Heinz Company | Consumer Non-Durables | 41,344,396,816 |

| AIG | American International Group, Inc. New | Finance | 41,254,582,631 |

| MSCI | MSCI Inc. | Technology Services | 41,139,536,988 |

| DXCM | DexCom, Inc. | Health Technology | 41,133,802,998 |

| GIS | General Mills, Inc. | Consumer Non-Durables | 40,804,707,812 |

| LVS | Las Vegas Sands Corp. | Consumer Services | 40,775,610,288 |

| AEP | American Electric Power Company, Inc. | Utilities | 40,709,208,895 |

| D | Dominion Energy, Inc. | Utilities | 40,524,914,060 |

| ROST | Ross Stores, Inc. | Retail Trade | 40,442,662,027 |

| JCI | Johnson Controls International plc | Producer Manufacturing | 40,336,176,749 |

| O | Realty Income Corporation | Finance | 40,315,835,840 |

| IDXX | IDEXX Laboratories, Inc. | Health Technology | 40,155,591,970 |

| TEL | TE Connectivity Ltd. New Switzerland Registered Shares | Electronic Technology | 40,089,961,794 |

| COF | Capital One Financial Corporation | Finance | 40,066,608,402 |

| EXC | Exelon Corporation | Utilities | 39,818,718,370 |

| DHI | D.R. Horton, Inc. | Consumer Durables | 39,685,570,607 |

| HLT | Hilton Worldwide Holdings Inc. | Consumer Services | 39,436,241,542 |

| IQV | IQVIA Holdings, Inc. | Health Services | 39,184,501,014 |

| ON | ON Semiconductor Corporation | Electronic Technology | 39,152,622,117 |

| KMI | Kinder Morgan, Inc. | Industrial Services | 38,836,921,228 |

| MRNA | Moderna, Inc. | Health Technology | 38,675,818,252 |

| TFC | Truist Financial Corporation | Finance | 38,334,266,994 |

| DOW | Dow Inc. | Process Industries | 37,980,089,510 |

| BIIB | Biogen Inc. | Health Technology | 37,820,613,606 |

| SPG | Simon Property Group, Inc. | Finance | 37,348,857,720 |

| TRV | The Travelers Companies, Inc. | Finance | 37,196,259,853 |

| DLR | Digital Realty Trust, Inc. | Finance | 36,885,126,470 |

| ABC | AmerisourceBergen Corporation | Distribution Services | 36,234,062,305 |

| SYY | Sysco Corporation | Transportation | 36,212,584,375 |

| YUM | Yum! Brands, Inc. | Consumer Services | 36,180,879,085 |

| CTVA | Corteva, Inc. | Process Industries | 36,027,619,693 |

| DG | Dollar General Corporation | Retail Trade | 35,750,412,530 |

| AME | AMETEK, Inc. | Producer Manufacturing | 35,633,484,769 |

| BKR | Baker Hughes Company | Industrial Services | 35,600,396,505 |

| HAL | Halliburton Company | Industrial Services | 35,402,723,240 |

| A | Agilent Technologies, Inc. | Health Technology | 35,223,566,565 |

| GWW | W.W. Grainger, Inc. | Distribution Services | 35,178,118,744 |

| PCG | Pacific Gas & Electric Co. | Utilities | 34,965,556,809 |

| CTSH | Cognizant Technology Solutions Corporation | Technology Services | 34,746,850,091 |

| DD | DuPont de Nemours, Inc. | Process Industries | 34,613,202,897 |

| CNC | Centene Corporation | Health Services | 34,492,224,212 |

| OTIS | Otis Worldwide Corporation | Producer Manufacturing | 34,475,407,689 |

| LHX | L3Harris Technologies, Inc. | Electronic Technology | 34,323,800,660 |

| BK | The Bank of New York Mellon Corporation | Finance | 34,282,000,487 |

| KR | Kroger Company (The) | Retail Trade | 34,143,153,872 |

| AMP | Ameriprise Financial, Inc. | Finance | 34,109,837,410 |

| CEG | Constellation Energy Corporation | Utilities | 33,693,159,671 |

| PRU | Prudential Financial, Inc. | Finance | 33,686,399,336 |

| VRSK | Verisk Analytics, Inc. | Technology Services | 33,492,553,797 |

| ROK | Rockwell Automation, Inc. | Electronic Technology | 33,486,310,147 |

| LEN | Lennar Corporation | Consumer Durables | 33,253,127,551 |

| CMI | Cummins Inc. | Producer Manufacturing | 33,091,600,533 |

| PPG | PPG Industries, Inc. | Process Industries | 32,861,130,701 |

| FAST | Fastenal Company | Distribution Services | 32,845,933,656 |

| FIS | Fidelity National Information Services, Inc. | Technology Services | 32,816,665,687 |

| BF.B | Brown Forman Inc | Consumer Non-Durables | 32,777,590,369 |

| GPN | Global Payments Inc. | Commercial Services | 32,254,843,664 |

| XEL | Xcel Energy Inc. | Utilities | 32,093,691,218 |

| EA | Electronic Arts Inc. | Technology Services | 32,065,103,661 |

| DVN | Devon Energy Corporation | Energy Minerals | 32,028,594,507 |

| CSGP | CoStar Group, Inc. | Technology Services | 31,968,671,983 |

| LYB | LyondellBasell Industries NV | Process Industries | 31,573,566,550 |

| DLTR | Dollar Tree, Inc. | Retail Trade | 31,473,233,922 |

| WBD | Warner Bros. Discovery, Inc. – Series A | Consumer Services | 31,149,774,743 |

| GEHC | GE HealthCare Technologies Inc. | Health Technology | 31,092,740,873 |

| URI | United Rentals, Inc. | Finance | 30,823,490,807 |

| ED | Consolidated Edison, Inc. | Utilities | 30,808,574,522 |

| HPQ | HP Inc. | Electronic Technology | 30,623,796,049 |

| NEM | Newmont Corporation | Non-Energy Minerals | 30,358,778,395 |

| PEG | Public Service Enterprise Group Incorporated | Utilities | 30,355,935,039 |

| VICI | VICI Properties Inc. | Finance | 30,068,411,822 |

| PWR | Quanta Services, Inc. | Industrial Services | 29,485,556,313 |

| OKE | ONEOK, Inc. | Industrial Services | 29,367,465,542 |

| WST | West Pharmaceutical Services, Inc. | Health Technology | 28,641,162,474 |

| VMC | Vulcan Materials Company (Holding Company) | Non-Energy Minerals | 28,141,054,023 |

| ACGL | Arch Capital Group Ltd. | Finance | 28,061,078,428 |

| ALL | Allstate Corporation (The) | Finance | 27,776,518,622 |

| GLW | Corning Incorporated | Electronic Technology | 27,423,368,120 |

| WEC | WEC Energy Group, Inc. | Utilities | 27,124,217,149 |

| APTV | Aptiv PLC | Producer Manufacturing | 27,117,191,257 |

| AWK | American Water Works Company, Inc. | Utilities | 27,051,153,636 |

| IR | Ingersoll Rand Inc. | Producer Manufacturing | 26,888,520,479 |

| CDW | CDW Corporation | Technology Services | 26,849,788,706 |

| ALGN | Align Technology, Inc. | Health Technology | 26,814,348,905 |

| FTV | Fortive Corporation | Electronic Technology | 26,782,014,150 |

| EXR | Extra Space Storage Inc | Finance | 26,713,801,747 |

| DAL | Delta Air Lines, Inc. | Transportation | 26,695,428,470 |

| MLM | Martin Marietta Materials, Inc. | Non-Energy Minerals | 26,648,120,683 |

| FANG | Diamondback Energy, Inc. | Energy Minerals | 26,472,277,971 |

| ILMN | Illumina, Inc. | Health Technology | 26,470,927,558 |

| EIX | Edison International | Utilities | 26,462,257,324 |

| MTD | Mettler-Toledo International, Inc. | Health Technology | 25,902,812,743 |

| IT | Gartner, Inc. | Technology Services | 25,866,495,836 |

| CBRE | CBRE Group Inc | Finance | 25,496,578,260 |

| NDAQ | Nasdaq, Inc. | Finance | 25,450,176,296 |

| AVB | AvalonBay Communities, Inc. | Finance | 25,423,547,900 |

| RCL | Royal Caribbean Cruises Ltd. | Consumer Services | 25,412,398,028 |

| ANSS | ANSYS, Inc. | Technology Services | 25,394,198,567 |

| ZBH | Zimmer Biomet Holdings, Inc. | Health Technology | 24,904,346,934 |

| RMD | ResMed Inc. | Health Technology | 24,365,321,134 |

| EQR | Equity Residential | Finance | 24,167,105,804 |

| TROW | T. Rowe Price Group, Inc. | Finance | 24,136,394,198 |

| XYL | Xylem Inc. | Producer Manufacturing | 23,952,806,803 |

| SBAC | SBA Communications Corporation | Finance | 23,946,080,316 |

| TSCO | Tractor Supply Company | Retail Trade | 23,863,741,820 |

| EFX | Equifax, Inc. | Commercial Services | 23,581,893,254 |

| WY | Weyerhaeuser Company | Finance | 23,500,855,113 |

| TTWO | Take-Two Interactive Software, Inc. | Technology Services | 23,344,937,234 |

| DFS | Discover Financial Services | Finance | 23,330,145,444 |

| KEYS | Keysight Technologies Inc. | Electronic Technology | 23,075,436,555 |

| MPWR | Monolithic Power Systems, Inc. | Electronic Technology | 23,042,851,851 |

| WBA | Walgreens Boots Alliance, Inc. | Health Technology | 22,910,957,788 |

| CHD | Church & Dwight Company, Inc. | Consumer Non-Durables | 22,904,513,082 |

| MKC | McCormick & Company, Incorporated | Consumer Non-Durables | 22,897,411,947 |

| EBAY | eBay Inc. | Retail Trade | 22,877,444,824 |

| ULTA | Ulta Beauty, Inc. | Retail Trade | 22,556,636,549 |

| ES | Eversource Energy (D/B/A) | Utilities | 22,505,561,561 |

| STE | STERIS plc (Ireland) | Health Technology | 22,114,192,898 |

| HIG | Hartford Financial Services Group, Inc. (The) | Finance | 21,963,744,975 |

| HPE | Hewlett Packard Enterprise Company | Electronic Technology | 21,955,806,240 |

| RJF | Raymond James Financial, Inc. | Finance | 21,949,247,064 |

| DTE | DTE Energy Company | Utilities | 21,770,081,535 |

| GPC | Genuine Parts Company | Distribution Services | 21,749,626,175 |

| STT | State Street Corporation | Finance | 21,651,610,699 |

| CAH | Cardinal Health, Inc. | Distribution Services | 21,521,017,385 |

| ALB | Albemarle Corporation | Process Industries | 21,520,223,515 |

| HRL | Hormel Foods Corporation | Consumer Non-Durables | 21,462,877,957 |

| MTB | M&T Bank Corporation | Finance | 21,189,871,113 |

| K | Kellogg Company | Consumer Non-Durables | 21,174,142,244 |

| AEE | Ameren Corporation | Utilities | 21,169,731,270 |

| BAX | Baxter International Inc. | Health Technology | 21,162,657,247 |

| BR | Broadridge Financial Solutions, Inc. | Technology Services | 21,142,918,055 |

| FICO | Fair Isaac Corporation | Technology Services | 21,032,433,973 |

| CTRA | Coterra Energy Inc. | Energy Minerals | 20,975,165,115 |

| WTW | Willis Towers Watson Public Limited Company | Finance | 20,853,466,852 |

| VRSN | VeriSign, Inc. | Technology Services | 20,764,952,544 |

| FE | FirstEnergy Corp. | Utilities | 20,738,516,151 |

| INVH | Invitation Homes Inc. | Finance | 20,512,773,371 |

| BRO | Brown & Brown, Inc. | Finance | 20,247,139,684 |

| ETR | Entergy Corporation | Utilities | 20,210,926,603 |

| HWM | Howmet Aerospace Inc. | Electronic Technology | 20,107,506,873 |

| ARE | Alexandria Real Estate Equities, Inc. | Finance | 20,102,417,897 |

| WAB | Westinghouse Air Brake Technologies Corporation | Producer Manufacturing | 19,946,161,288 |

| ROL | Rollins, Inc. | Consumer Services | 19,865,604,921 |

| NVR | NVR, Inc. | Consumer Durables | 19,843,738,198 |

| JBHT | J.B. Hunt Transport Services, Inc. | Transportation | 19,739,854,678 |

| DOV | Dover Corporation | Producer Manufacturing | 19,662,063,762 |

| CCL | Carnival Corporation | Consumer Services | 19,539,465,362 |

| GRMN | Garmin Ltd. | Electronic Technology | 19,441,906,966 |

| FSLR | First Solar, Inc. | Electronic Technology | 19,433,698,483 |

| LYV | Live Nation Entertainment, Inc. | Consumer Services | 19,422,461,727 |

| FLT | FleetCor Technologies, Inc. | Commercial Services | 19,393,853,060 |

| DRI | Darden Restaurants, Inc. | Consumer Services | 19,154,797,608 |

| LUV | Southwest Airlines Company | Transportation | 19,149,624,084 |

| CLX | Clorox Company (The) | Consumer Non-Durables | 19,050,628,146 |

| TSN | Tyson Foods, Inc. | Consumer Non-Durables | 19,041,794,421 |

| TDY | Teledyne Technologies Incorporated | Electronic Technology | 19,000,723,618 |

| LH | Laboratory Corporation of America Holdings | Health Services | 18,998,497,128 |

| TRGP | Targa Resources, Inc. | Utilities | 18,959,615,960 |

| PPL | PPL Corporation | Utilities | 18,648,340,336 |

| PFG | Principal Financial Group Inc | Finance | 18,483,939,432 |

| RF | Regions Financial Corporation | Finance | 18,335,895,562 |

| MOH | Molina Healthcare Inc | Health Services | 18,319,608,038 |

| COO | The Cooper Companies, Inc. | Health Technology | 18,266,444,058 |

| HOLX | Hologic, Inc. | Health Technology | 17,917,512,979 |

| CNP | CenterPoint Energy, Inc (Holding Co) | Utilities | 17,793,079,273 |

| ENPH | Enphase Energy, Inc. | Electronic Technology | 17,772,560,194 |

| STLD | Steel Dynamics, Inc. | Non-Energy Minerals | 17,432,416,419 |

| FITB | Fifth Third Bancorp | Finance | 17,423,942,985 |

| PHM | PulteGroup, Inc. | Consumer Durables | 17,402,024,374 |

| ATO | Atmos Energy Corporation | Utilities | 17,364,171,547 |

| BALL | Ball Corporation | Process Industries | 17,192,747,934 |

| BBY | Best Buy Co., Inc. | Retail Trade | 17,149,165,469 |

| EXPD | Expeditors International of Washington, Inc. | Transportation | 17,130,929,366 |

| IRM | Iron Mountain Incorporated (Delaware) | Finance | 17,090,877,940 |

| PAYC | Paycom Software, Inc. | Technology Services | 17,010,591,901 |

| BG | Bunge Limited Bunge Limited | Process Industries | 16,951,788,665 |

| J | Jacobs Solutions Inc. | Technology Services | 16,816,288,687 |

| MAA | Mid-America Apartment Communities, Inc. | Finance | 16,760,646,235 |

| SWKS | Skyworks Solutions, Inc. | Electronic Technology | 16,688,402,341 |

| PTC | PTC Inc. | Technology Services | 16,628,330,745 |

| CMS | CMS Energy Corporation | Utilities | 16,608,000,108 |

| IEX | IDEX Corporation | Producer Manufacturing | 16,588,516,144 |

| FDS | FactSet Research Systems Inc. | Technology Services | 16,379,991,200 |

| CINF | Cincinnati Financial Corporation | Finance | 16,292,648,435 |

| IFF | International Flavors & Fragrances, Inc. | Consumer Non-Durables | 16,257,038,604 |

| HBAN | Huntington Bancshares Incorporated | Finance | 16,129,408,764 |

| UAL | United Airlines Holdings, Inc. | Transportation | 16,103,803,158 |

| MRO | Marathon Oil Corporation | Energy Minerals | 15,984,085,071 |

| WAT | Waters Corporation | Health Technology | 15,957,788,758 |

| WRB | W.R. Berkley Corporation | Finance | 15,950,992,307 |

| NTRS | Northern Trust Corporation | Finance | 15,885,500,213 |

| FOXA | Fox Corporation | Consumer Services | 15,882,819,682 |

| EXPE | Expedia Group, Inc. | Consumer Services | 15,880,434,951 |

| NTAP | NetApp, Inc. | Electronic Technology | 15,876,504,006 |

| CBOE | Cboe Global Markets, Inc. | Finance | 15,840,189,893 |

| FOX | Fox Corporation | Consumer Services | 15,827,508,133 |

| OMC | Omnicom Group Inc. | Commercial Services | 15,787,922,806 |

| EQT | EQT Corporation | Energy Minerals | 15,721,259,481 |

| TYL | Tyler Technologies, Inc. | Technology Services | 15,660,322,516 |

| TER | Teradyne, Inc. | Electronic Technology | 15,564,628,272 |

| AKAM | Akamai Technologies, Inc. | Technology Services | 15,307,872,094 |

| CF | CF Industries Holdings, Inc. | Process Industries | 15,252,509,998 |

| ESS | Essex Property Trust, Inc. | Finance | 15,176,141,995 |

| EG | Everest Group, Ltd. | Finance | 15,121,807,278 |

| DGX | Quest Diagnostics Incorporated | Health Services | 14,983,373,204 |

| AXON | Axon Enterprise, Inc. | Electronic Technology | 14,959,474,854 |

| MGM | MGM Resorts International | Consumer Services | 14,926,825,903 |

| TXT | Textron Inc. | Electronic Technology | 14,904,812,353 |

| SJM | J.M. Smucker Company (The) New | Consumer Non-Durables | 14,495,721,164 |

| CAG | ConAgra Brands, Inc. | Consumer Non-Durables | 14,426,798,781 |

| INCY | Incyte Corporation | Health Technology | 14,350,575,608 |

| PODD | Insulet Corporation | Health Technology | 14,320,659,040 |

| AVY | Avery Dennison Corporation | Process Industries | 14,275,248,552 |

| SNA | Snap-On Incorporated | Consumer Durables | 14,210,738,458 |

| AMCR | Amcor plc | Process Industries | 14,081,716,005 |

| RVTY | Revvity, Inc. | Health Technology | 14,054,537,712 |

| LKQ | LKQ Corporation | Consumer Durables | 14,017,277,724 |

| ZBRA | Zebra Technologies Corporation | Electronic Technology | 13,963,008,080 |

| L | Loews Corporation | Finance | 13,889,077,998 |

| EPAM | EPAM Systems, Inc. | Technology Services | 13,875,229,380 |

| SYF | Synchrony Financial | Finance | 13,871,133,172 |

| LW | Lamb Weston Holdings, Inc. | Consumer Non-Durables | 13,814,381,270 |

| SWK | Stanley Black & Decker, Inc. | Consumer Durables | 13,747,798,996 |

| TAP | Molson Coors Beverage Company | Consumer Non-Durables | 13,659,777,672 |

| POOL | Pool Corporation | Distribution Services | 13,648,272,928 |

| APA | APA Corporation | Energy Minerals | 13,587,276,256 |

| VTRS | Viatris Inc. | Health Technology | 13,506,735,802 |

| STX | Seagate Technology Holdings PLC | Electronic Technology | 13,345,754,687 |

| DPZ | Domino’s Pizza Inc | Consumer Services | 13,295,983,656 |

| NDSN | Nordson Corporation | Producer Manufacturing | 13,240,734,933 |

| PKG | Packaging Corporation of America | Process Industries | 13,215,717,773 |

| LDOS | Leidos Holdings, Inc. | Electronic Technology | 13,199,442,297 |

| MOS | Mosaic Company (The) | Process Industries | 13,128,383,057 |

| TRMB | Trimble Inc. | Technology Services | 13,106,417,733 |

| BEN | Franklin Resources, Inc. | Finance | 13,103,157,503 |

| CFG | Citizens Financial Group, Inc. | Finance | 13,087,278,227 |

| KMX | CarMax Inc | Retail Trade | 13,050,712,231 |

| GEN | Gen Digital Inc. | Technology Services | 13,025,375,345 |

| EVRG | Evergy, Inc. | Utilities | 12,955,201,859 |

| CE | Celanese Corporation | Process Industries | 12,811,907,064 |

| LNT | Alliant Energy Corporation | Utilities | 12,792,640,463 |

| MAS | Masco Corporation | Producer Manufacturing | 12,773,550,021 |

| CPB | Campbell Soup Company | Consumer Non-Durables | 12,767,276,566 |

| WDC | Western Digital Corporation | Electronic Technology | 12,714,314,114 |

| UDR | UDR, Inc. | Finance | 12,668,514,888 |

| IPG | Interpublic Group of Companies, Inc. (The) | Commercial Services | 12,452,637,209 |

| MTCH | Match Group, Inc. | Technology Services | 12,347,052,590 |

| TECH | Bio-Techne Corp | Health Technology | 12,317,835,653 |

| AES | The AES Corporation | Utilities | 12,060,019,390 |

| NWS | News Corporation | Consumer Services | 11,952,807,061 |

| NWSA | News Corporation | Consumer Services | 11,941,302,916 |

| IP | International Paper Company | Process Industries | 11,940,429,299 |

| KIM | Kimco Realty Corporation (HC) | Finance | 11,746,784,396 |

| CPT | Camden Property Trust | Finance | 11,353,978,655 |

| JKHY | Jack Henry & Associates, Inc. | Technology Services | 11,297,858,295 |

| HST | Host Hotels | Finance | 11,250,473,110 |

| CZR | Caesars Entertainment, Inc. | Consumer Services | 11,216,602,452 |

| PEAK | Healthpeak Properties, Inc. | Finance | 11,195,662,015 |

| FMC | FMC Corporation | Process Industries | 11,101,283,966 |

| BIO | Bio-Rad Laboratories, Inc. | Health Technology | 11,078,910,391 |

| CHRW | C.H. Robinson Worldwide, Inc. | Transportation | 11,059,815,670 |

| PNR | Pentair plc. | Producer Manufacturing | 10,996,547,428 |

| NI | NiSource Inc | Utilities | 10,926,457,806 |

| CDAY | Ceridian HCM Holding Inc. | Technology Services | 10,871,092,807 |

| WYNN | Wynn Resorts, Limited | Consumer Services | 10,696,343,017 |

| GL | Globe Life Inc. | Finance | 10,661,524,446 |

| REG | Regency Centers Corporation | Finance | 10,502,247,044 |

| AOS | A.O. Smith Corporation | Producer Manufacturing | 10,371,810,403 |

| TFX | Teleflex Incorporated | Health Technology | 10,225,964,365 |

| CRL | Charles River Laboratories International, Inc. | Commercial Services | 10,197,872,196 |

| KEY | KeyCorp | Finance | 10,136,001,927 |

| HSIC | Henry Schein, Inc. | Distribution Services | 9,992,333,348 |

| EMN | Eastman Chemical Company | Process Industries | 9,914,815,964 |

| BXP | Boston Properties, Inc. | Finance | 9,891,878,595 |

| AAL | American Airlines Group, Inc. | Transportation | 9,826,571,023 |

| PARA | Paramount Global | Consumer Services | 9,777,476,050 |

| QRVO | Qorvo, Inc. | Electronic Technology | 9,689,217,753 |

| ALLE | Allegion plc | Producer Manufacturing | 9,447,763,156 |

| MKTX | MarketAxess Holdings, Inc. | Finance | 9,351,536,705 |

| BWA | BorgWarner Inc. | Producer Manufacturing | 9,317,898,137 |

| DVA | DaVita Inc. | Health Services | 9,272,428,253 |

| FFIV | F5, Inc. | Technology Services | 9,211,473,469 |

| SEDG | SolarEdge Technologies, Inc. | Producer Manufacturing | 9,181,596,018 |

| ETSY | Etsy, Inc. | Retail Trade | 9,075,957,865 |

| JNPR | Juniper Networks, Inc. | Technology Services | 9,062,356,138 |

| PNW | Pinnacle West Capital Corporation | Utilities | 8,866,680,052 |

| HAS | Hasbro, Inc. | Consumer Durables | 8,846,118,248 |

| HII | Huntington Ingalls Industries, Inc. | Electronic Technology | 8,748,547,609 |

| BBWI | Bath & Body Works, Inc. | Retail Trade | 8,359,850,871 |

| NRG | NRG Energy, Inc. | Utilities | 8,351,330,487 |

| WRK | Westrock Company | Process Industries | 8,229,130,931 |

| CTLT | Catalent, Inc. | Health Technology | 7,996,854,015 |

| RHI | Robert Half Inc. | Commercial Services | 7,993,692,328 |

| UHS | Universal Health Services, Inc. | Health Services | 7,988,758,160 |

| XRAY | DENTSPLY SIRONA Inc. | Health Technology | 7,897,006,636 |

| FRT | Federal Realty Investment Trust | Finance | 7,891,495,663 |

| VFC | V.F. Corporation | Consumer Non-Durables | 7,781,256,556 |

| RL | Ralph Lauren Corporation | Consumer Non-Durables | 7,536,188,250 |

| AIZ | Assurant, Inc. | Finance | 7,460,822,436 |

| WHR | Whirlpool Corporation | Consumer Durables | 7,408,622,278 |

| NCLH | Norwegian Cruise Line Holdings Ltd. | Consumer Services | 7,096,065,671 |

| GNRC | Generac Holdings Inc. | Producer Manufacturing | 7,055,196,136 |

| IVZ | Invesco Ltd | Finance | 6,836,977,250 |

| CMA | Comerica Incorporated | Finance | 6,229,076,130 |

| MHK | Mohawk Industries, Inc. | Non-Energy Minerals | 6,216,015,268 |

| OGN | Organon & Co. | Health Technology | 5,747,731,853 |

| ALK | Alaska Air Group, Inc. | Transportation | 5,441,388,923 |

| ZION | Zions Bancorporation N.A. | Finance | 5,145,080,633 |

| SEE | Sealed Air Corporation | Process Industries | 4,976,373,834 |

| LNC | Lincoln National Corporation | Finance | 4,368,181,590 |

| NWL | Newell Brands Inc. | Producer Manufacturing | 4,365,668,193 |

| DXC | DXC Technology Company | Technology Services | 4,154,780,819 |

| AAP | Advance Auto Parts Inc. | Retail Trade | 4,150,964,094 |

| TPR | Tapestry, Inc. | Retail Trade | 4,017,225,400 |

Data from TradingView 2024

Get this S&P 500 List Live at TradingView

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

How to Export This S&P 500 List to Excel

- Drag Your Mouse Over the Table

- Right Click -> Select Copy

- Open Excel

- Right Click the First Cell A1 -> Click Paste

Our Other S&P 500 & Nasdaq 100 Companies Lists

- S&P 500 Companies by #Employees

- S&P 500 Companies List by Sector, Cap & PE

- S&P 500 Companies Listed Alphabetically

- NASDAQ 100 Companies List (Sorted By Employees)

- NASDAQ 100 Companies List (Sorted By Sector & Market Cap)

- NASDAQ 100 Index Companies List by Market Capitalization

Related Articles

- Learn more about the best-performing stock sectors over the last 10 years.

- Learn about Stock Sector Rotation Strategies.

Are You Looking For Stock Investing & Trading Software? Here Are My Favorites.

My favorite software for trading is TradingView because it does everything well. It has backtesting, great charts, stock screening, and an active community of over 3 million people sharing ideas, plus a free plan available globally.

My favorite software for investing is Stock Rover, as it specializes in deep fundamental financial screening, research, and portfolio management. It is the ideal platform for dividend, value, and growth investing.

My favorite software for stock market news is Benzinga Pro, with its super-fast real-time news engine, squawk box, and news impact ratings.

My favorite AI trading software is TrendSpider which enables automatic pattern recognition for Trendlines, Candlesticks, and Fibonacci levels. Trade Ideas uses AI to generate high probability daily trading signals for auto-trading.

My favorite stock-picking service is Motley Fool Stock Advisor, which has a proven track record of beating the market with excellent stock research reports.

Read the Full Top 10 Stock Market Software Testing & Review

Many thanks for making this available! It is really nice but unfortunately I cannot find the date of this list or how often it is updated.

Hi Dawie, every 2 months. thanks