My experience shows that traders need software with excellent chart technical analysis, real-time news, market scanning, and pattern recognition. Investors need financial screening, in-depth stock research, and portfolio management. The right stock software for you depends on your needs.

My in-depth testing shows that TradingView, TrendSpider, and Trade Ideas are the best tools for traders, and Stock Rover is superior for investors. Each provides unique benefits, features, and price points.

Best Stock Analysis Software Summary

- TradingView: Winner Best Stock Software Overall.

- TrendSpider: AI-Powered Stock Chart Analysis Automation.

- Trade Ideas: Best AI Trading Signal Software & Auto Trading.

- Stock Rover: Best Stock Program for Investors.

- Benzinga Pro: Best Real-time News Trading.

- MetaStock: Technical Analysis Backtesting & Forecasting.

- Tickeron: Good AI Trading Bots & Signals.

My testing identified the best stock analysis software, TradingView, for global trading and community; Trade Ideas, for AI-powered bot trading; and TrendSpider, for pattern recognition and backtesting. Stock Rover is ideal for investors, and Benzinga Pro is perfect for real-time news traders.

I personally pay for and use three stock analysis services: TrendSpider for my in-depth trading research, scanning, and AI-powered strategy development. I use Stock Rover for research and management of my long-term stock portfolio and TradingView for fast stock analysis and trading community.

1. TradingView: Best Overall

★★★★★ 4.8

Easy to use yet powerful, TradingView has the largest trading community and the best global stock analysis software on the planet.

My testing reveals that TradingView is the best stock software overall. It offers excellent backtesting, technical analysis charts, stock screening, a highly-rated stock app, and a free global plan. TradingView benefits from an active trading community of 20 million people sharing ideas and strategies.

✅ Traders & Investors

✅ USA & International

✅ Best Stock Charts & Backtesting

✅ Integrated Broker Trading

✅ 20M Active User Community

2. TrendSpider: Best Automated Trading

★★★★★ 4.8

The AI-powered technical analysis platform allows day traders to create and test unique trading strategies and launch trading bots.

TrendSpider enables automated multi-timeframe pattern recognition for trendlines, candlesticks, and Fibonacci levels. It is best for US traders seeking cutting-edge AI algorithms that automate technical chart analysis and backtesting. TrendSpider covers Stocks, ETFs, Fx, and Cryptocurrency Markets.

✅ Stocks, Futures & Crypto

✅ USA

✅ Auto-trendlines

✅ Candlestick & Fibonacci Patterns

✅ Backtesting & Auto-trading

3. Trade Ideas: Best for Day Traders

★★★★★ 4.7

The best for dedicated day traders and AI-powered automated day trading.

The king of day trading software unleashes the power of AI with a proven track record. Trade Ideas uses AI to backtest millions of conditions daily to generate higher probability day trading signals. Trade Ideas is the best Automated trading software; using the Brokerage Plus service, you can automatically trade your signals with Interactive Brokers.

✅ Day & Swing Trading

✅ USA

✅ Best AI Market Scanning

✅ AI Bot Integrated Trading

✅ AI Trading Signals

4. Stock Rover: Best for Investors

★★★★★ 4.7

Simply the best research tool for smart long-term investors with demanding investing strategies.

Stock Rover is the best software for US value, dividend, and growth investors. It provides powerful screening, an industry-leading 10-year financial database, and real-time stock research reports. Stock Rover’s free service is very good, but Stock Rover Premium+ provides unparalleled benefits for growth investing.

✅ Growth, Income & Dividend Investors

✅ Best Stock Screening & Research

✅ Portfolio Management

✅ Stock Research Reports

✅ USA

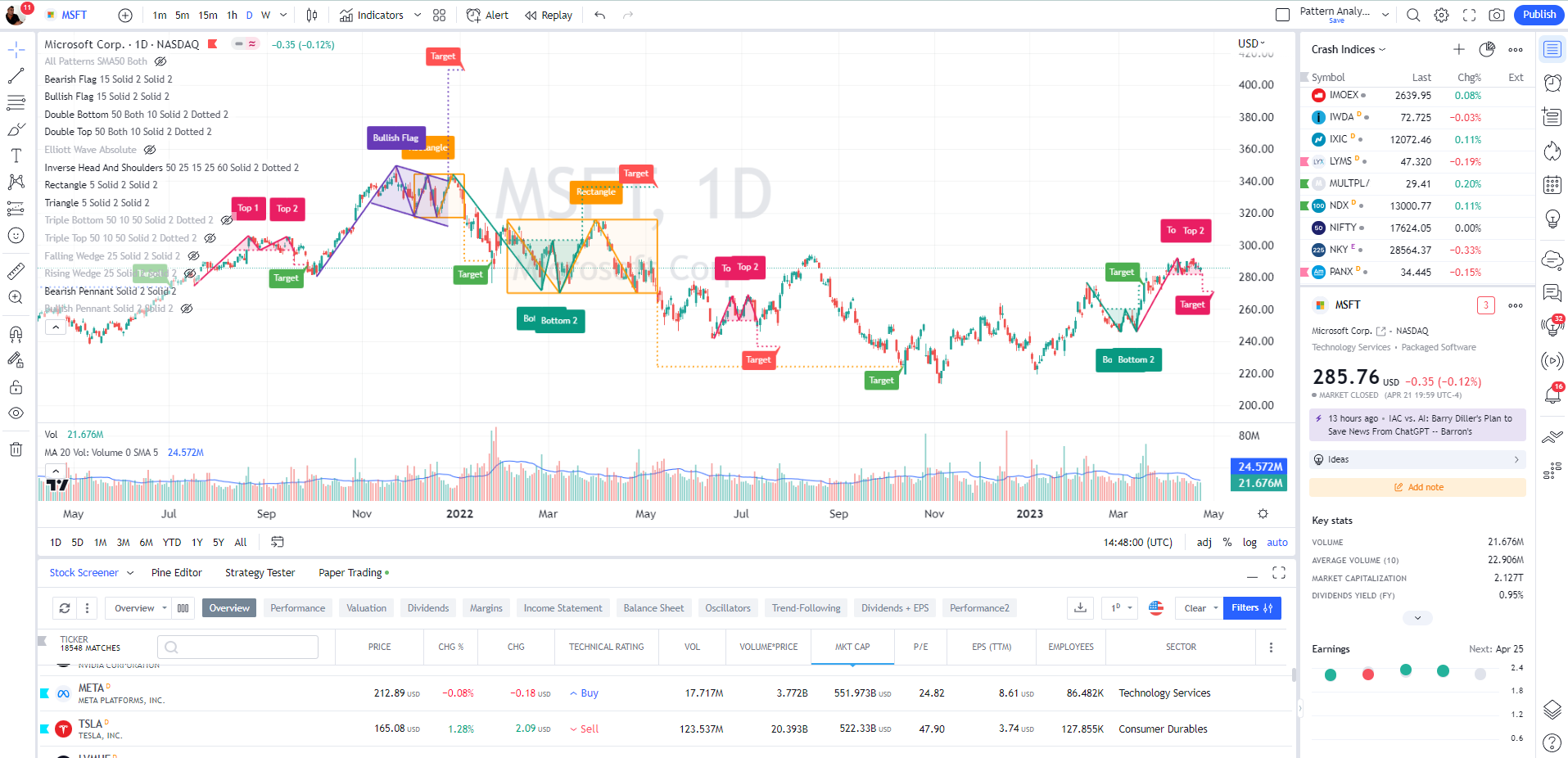

1. TradingView: Winner Overall Best Stock Software

TradingView is an easy-to-use, powerful platform that supports all international stock markets. TradingView is designed for traders who value a great price, powerful chart analysis, backtesting, and a huge social community.

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

| ⚡ TradingView Features | Charts, News, Watchlists, Screening, Chart Pattern & Candlestick Recognition, Full Broker Integration |

| 🏆 Unique Features | Trading, Backtesting, Community, Global Stock, FX & Crypto Markets, Webhook Bot Integration (with Signal Stack) |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free | $13/m to $49/m annually |

| 🆓 Free | Try TradingView’s Free Plan |

| 💻 OS | Web Browser|PC|IOS|Android |

| 🎮 Trial | Yes, Free 30-Day Premium |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Region | Global |

There is no doubt that TradingView is a worthy winner and holds its place as number one overall. I love TradingView and use it daily. I post charts, ideas, and analyses on it, chat with other traders, and develop strategies and backtest them.

Pricing & Software

TradingView is available for free, but it has limitations regarding charts, screening, and indicators. The Pro+ service is $25/m annually and has extensive benefits, including multiple devices, screens, charts, and post-market data.

The benefits of TradingView are fast data speeds and global stock exchange coverage. TradingView covers Stocks, ETFs, Funds, Futures, Forex, Bonds, and cryptocurrencies globally, making it a good choice for international investors.

My testing shows that TradingView’s pricing model and global stock exchange coverage make it the best free technical analysis software in India, the USA, and internationally.

Trading

With TradingView in the USA, you get broker integration with TradeStation for stocks and Forex.com for foreign exchange currency trading. In Europe, you have integration FXCM and Saxo Group for currency and CFD trading. You can place trades directly from charts, which will take care of profit & loss reporting and analysis. The only thing TradingView does not cover is Stock Options trading.

Scanning & Screening

TradingView has over 250 criteria for scanning and screening stocks, Forex, and Cryptocurrencies. There are 48 different fundamental criteria and 96 technical variables available. TradingView also includes 48 economic indicators available through the Federal Reserve Database (FRED), including the Federal Funds Rates and World Economic Growth.

Community & Platform

TradingView has over 20 million active users sharing ideas, charts, and chats. Thousands of groups discuss financial markets. The TradingView community is an excellent way to generate ideas and learn from other traders.

TradingView has integrated newsfeeds, including Reuters, MTNewswires, Benzinga, and DailyFX. The newsfeeds are not real-time but do add value. I would recommend trying the trading platform to see it in action.

TradingView is the King of Social Trading with the biggest and most active trading community.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

TradingView has over 160 stock chart indicators and unique charts, such as LineBreak Charts, Kagi Charts, Heikin Ashi charts, Point & Figure Charts, and Renko Charts. As an advanced technical trader, you will be well served.

As a technical analyst, I am incredibly impressed with the Kagi, Heikin Ashi, and Renko Charts, including Point & Figure and Line Break. Also, the user community has developed thousands of bespoke indicators and strategies.

Backtesting & Automated Trading

TradingView has an active community of people who are developing and selling stock analysis systems. With the premium-level service, you can create and sell your own. The community also offers many indicators and systems for free.

TradingView’s backtesting report includes everything you need to evaluate a strategy’s performance, including net profit, drawdown, buy and hold return, and strategy risk profile. TradingView is a great package, especially since the free version includes backtesting.

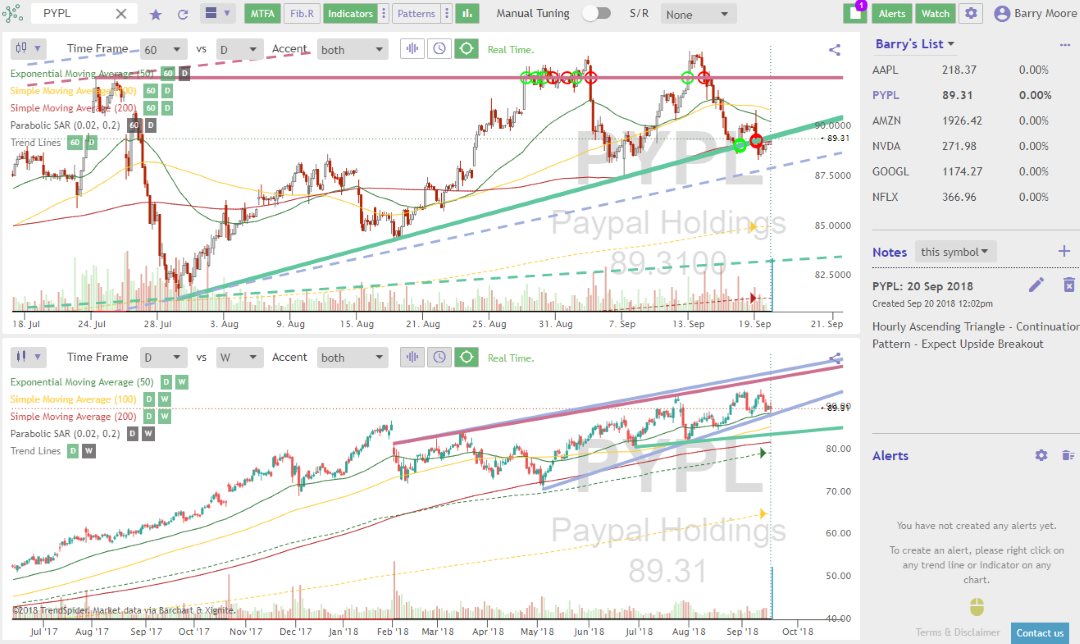

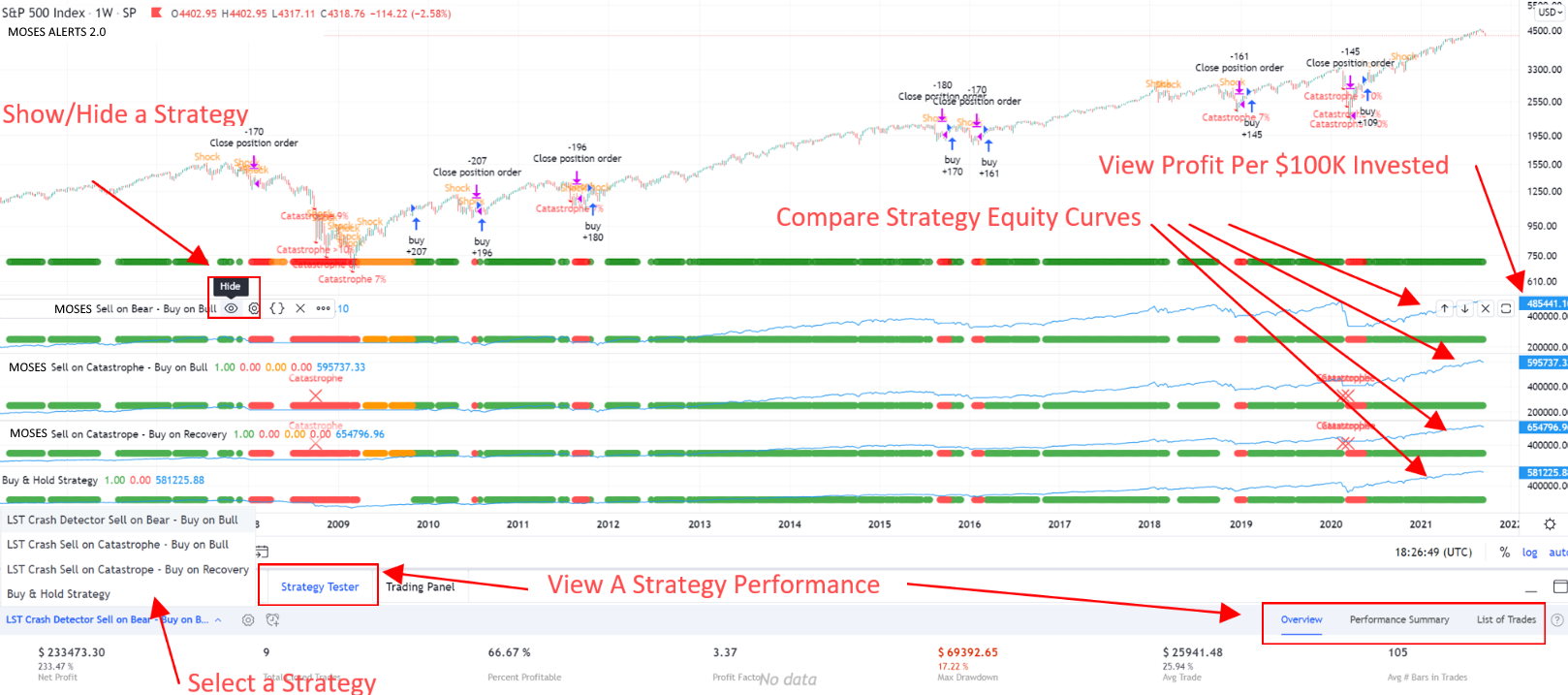

2. TrendSpider: Best Automated Chart Analysis

TrendSpider is an advanced AI-powered platform designed for traders who want to streamline their technical analysis. It offers automated trendline and pattern recognition, along with powerful tools like system backtesting and automated Fibonacci and candlestick identification. Supporting Stocks, ETFs, Forex, and Crypto markets, TrendSpider simplifies complex analysis, making it an essential tool for traders seeking precision and efficiency.

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

TrendSpider is packed with innovative technical analysis tools. If you are a serious market analyst, TrendSpider will help you do the job quicker and with better quality and prevent you from missing an opportunity.

| ⚡ Features | Charts, Watchlists, Screening, Free Real-time Data |

| 🏆 Unique Features | AI Automated Trendlines, Fibonacci, Candlestick Pattern Recognition, Auto-Bot Trading, Code-free Powerful Backtesting, Launch and Train Personal AI Models with Strategy Lab. |

| 🎯 Best for | Stock, Options, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $107/m or $48/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Region | USA |

TrendSpider’s standout capabilities include automated recognition of candlestick patterns, trendlines, and chart patterns. It simplifies backtesting and strategy creation with point-and-click functions that automatically display buy and sell signals on the chart.

Furthermore, TrendSpider now scans for financial news, analyst estimates, rating changes, insider trading data, and seasonality charts. In 2024, TrendSpider launched an AI-powered assistant, and automated trading Bot execution serves as the crowning touch.

Pricing

TrendSpider has radically simplified its pricing model for 2025. All plans include real-time data, futures, AI-powered pattern recognition, backtesting, news, options, crypto, and even automated bot trading with broker integration.- The standard price is $107 per month, and Enhanced costs $197. The best deal is opting for an annual prepaid plan, which offers a 50% discount on all services.

- Adding our partner code LST30 during checkout will save an additional 30% on your first year.

- Using our partner link will grant you an exclusive 7-day discounted trial with TrendSpider.

| TrendSpider Pricing | Monthly Subscription | Annual Subscription |

| Standard (Casual Traders) | $107 | $53.50 |

| Enhanced (Active Traders) | $197 | $98.50 |

| Professional (Professionals) | $397 | $198.50 |

| Additional Year 1, 30% Discount | -30% With Code LST30 | |

TrendSpider Coupon Code Discount

Trendspider discount coupon code "LST30" is verified and valid for 2025. It grants a 30% discount on all plans. Use coupon code "LST30" at checkout.

Using this coupon on a TrendSpider monthly subscription could save you over $2,400.- Read this article for a step-by-step guide to claiming your 30% TrendSpider Discount.

Automated Technical Analysis

One of its key features is the automated trendline detection and plotting system, which leverages sophisticated algorithms to identify and highlight thousands of trend lines. The system prioritizes those with the highest probability of success, offering a more efficient and reliable method than manual analysis.

The automated trendline & candlestick detection and recognition do a better job than any human

TrendSpider’s multi-time-frame analysis allows you to view multiple timeframe charts on a single chart, with the trendlines plotted automatically. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap.

The platform also incorporates advanced plotting of support and resistance lines, which are integrated into a chart heatmap. This visualization provides a clear and intuitive understanding of key market levels, helping traders make informed decisions based on visual data.

Another unique capability is the automated Fibonacci detection and mapping, exclusive to TrendSpider. This tool helps traders identify possible retracement levels and potential reversal points, enhancing their strategic planning.

Backtesting

TrendSpider takes a different approach to backtesting. The platform is built from the ground up to automatically detect trendlines and Fibonacci patterns, meaning it already has backtesting built into the code. The highest probability trendlines are automatically flagged, and you can adjust the sensitivity of the detection algorithm to show more or fewer lines.

TrendSpider has also implemented a strategy tester that allows you to type what you want to test freely, and it will do the coding for you. It is a smooth and straightforward implementation.

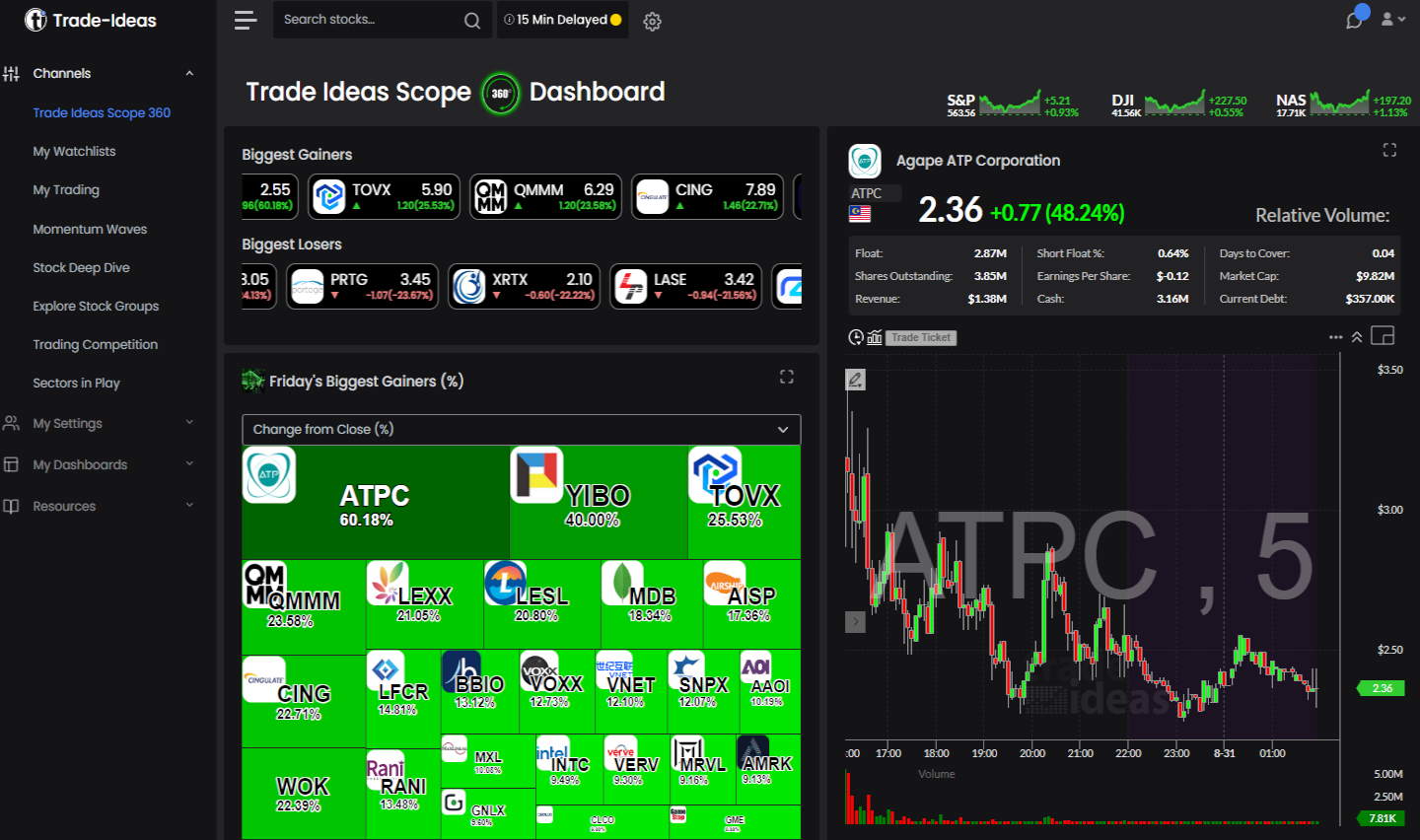

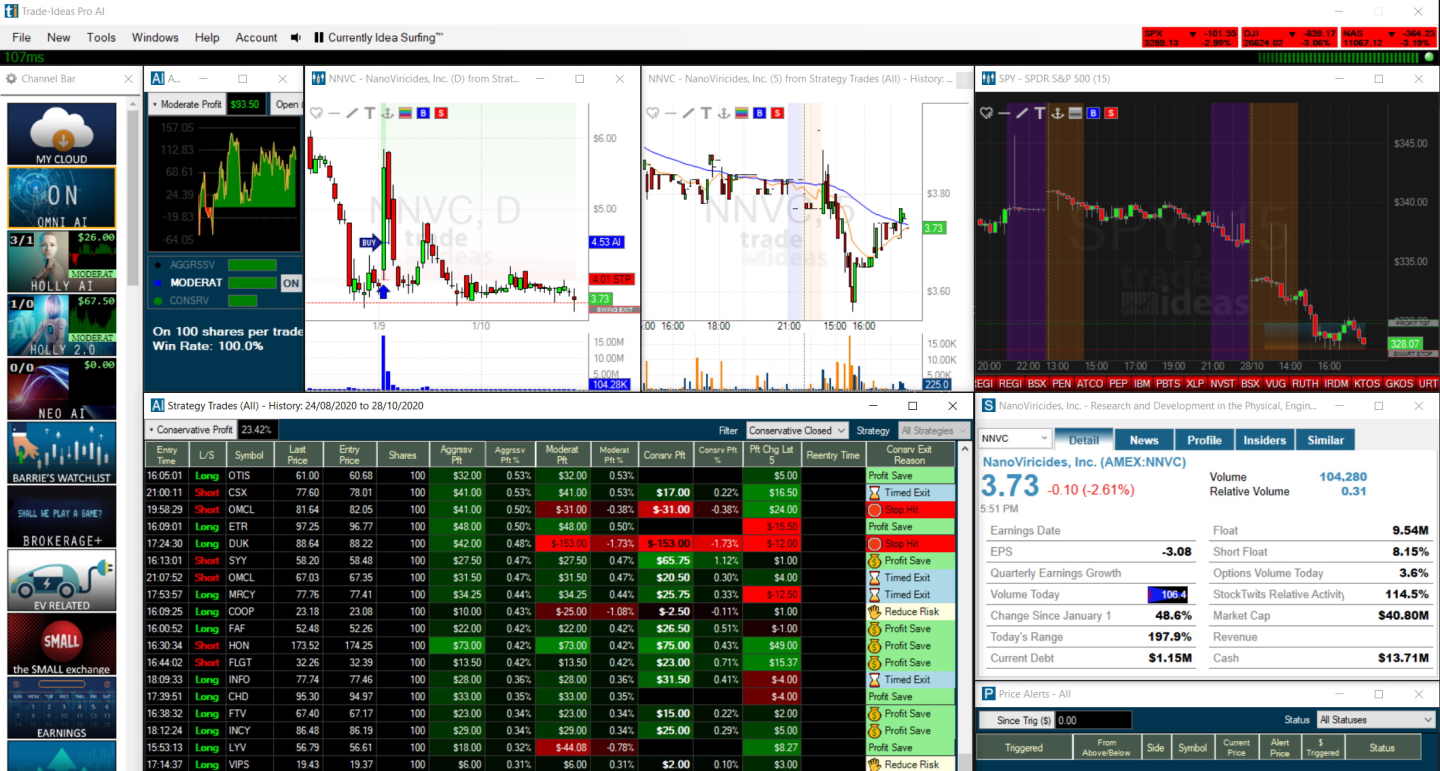

3. Trade Ideas: Winner Best AI Stock Signals

Trade Ideas is best for active day traders wanting AI-driven trading signals. It provides actual buy and sell signals for trades by performing millions of backtests daily on 70+ strategies. The Holly AI platform has an audited track record of beating the market.

My in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Trade Ideas is worth it if you are a pattern day trader trading at least three times daily with an account value of over $25K as this will help you profit after paying the Trade Ideas subscription cost.

Pros

✔ 3 AI Trading Algorithms That Beat the Market

✔ Get A Free Holly AI Stock Trade Every Week

✔ Fully Automated Backtesting

✔ Exceptional Stock Scanning

✔ Specific Audited Trade Signals

✔ Auto-trading & broker integration

✔ Auto Trade Commission Free with eTrade integration

Cons

✘ Old School User Interface

✘ No Mobile App

According to my testing, Trade Ideas is the industry-leading artificial intelligence-powered stock market scanning and trading signals generation platform. Despite a complicated user interface, the real power lies underneath with 30 channels of trading ideas & three AI systems pinpointing trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

| ⚡ Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | AI Trade Signals, Trading Room, Trading Competitions |

| 🎯 Best for | US Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $254/m or $178/m annually |

| 🆓 Free Version | ✔ |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | Free Live Trading Room |

| ✂ Discount | -15% Discount Code "LIBERATED" |

| 🌎 Region | USA |

Trade Ideas is unique because the software tells you when to buy and sell stocks by analyzing millions of trade setups daily. The analysis results in 3 to 5 high probability trades every day.

Trade Ideas is the most expensive software in this review because it offers the possibility of beating the market using AI pattern recognition and establishing a trading bot to auto-trade on your behalf. For a full pricing breakdown, see our Trade Ideas review.

Trade Ideas, unlike any other software, does all the work for you providing you specific market beating AI trading Signals, to help you make regular profits.

Platform

My extensive testing reveals that Trade Ideas is an incredibly powerful stock trading desktop app that seamlessly integrates cloud-based AI algorithmic stock signals to provide high-probability day trading opportunities.

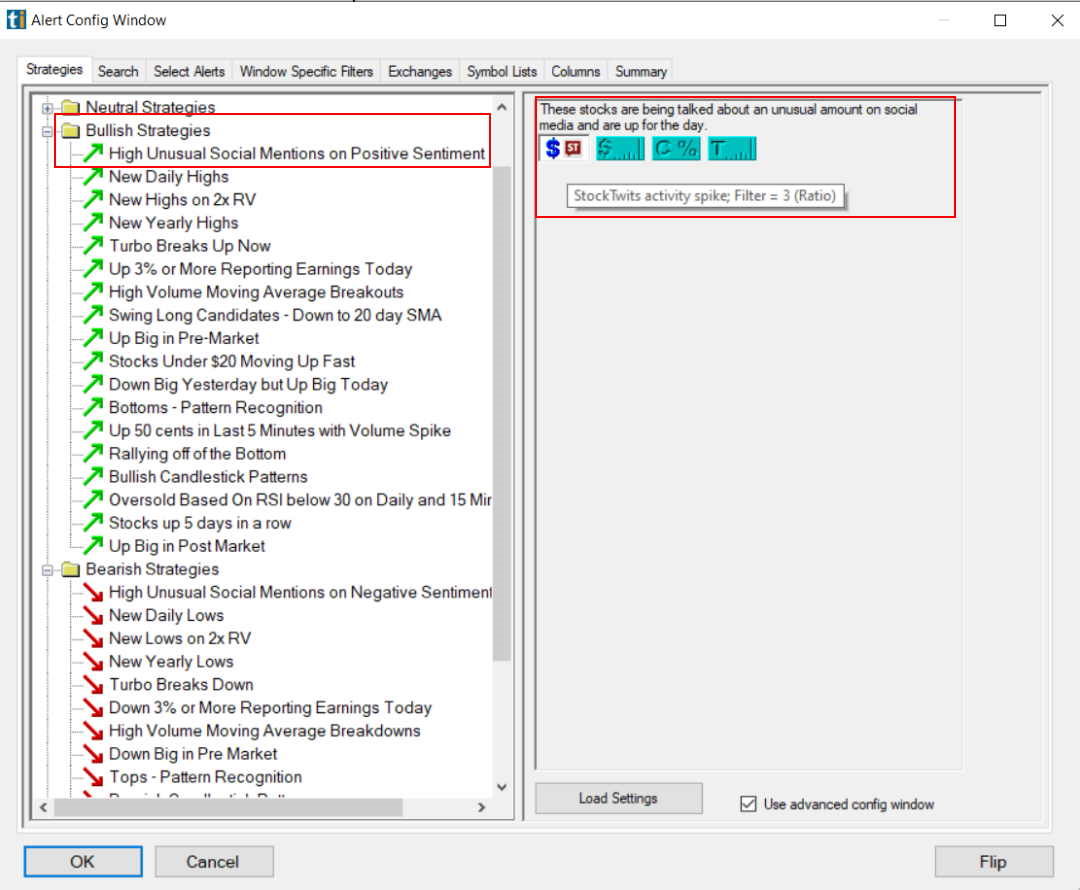

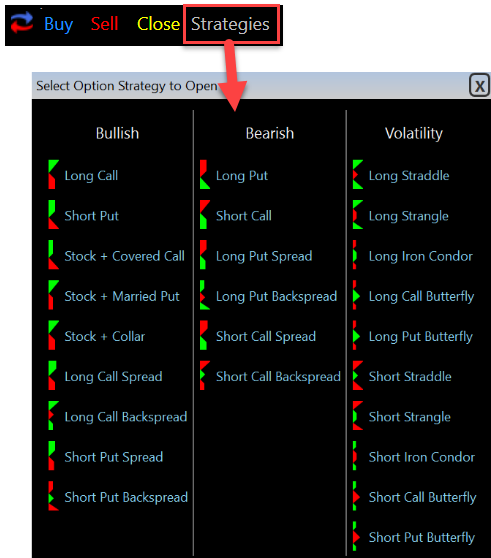

The Trade Ideas scanner system, unique in the industry, is at the heart of the trading platform. By clicking New -> Alerts, you can access the Alert Config Window, which gives you immediate access to over 40 trading scans. In the screenshot below, you can see all the built-in scans categorized as Bullish, Bearish, or Neutral. Depending on the overall market direction, you can select a potential strategy for the day.

A particularly impressive and innovative scan was discovered during testing: the “Unusual Social Mentions Scan.” The Trade Ideas AI engine constantly scans StockTwits for surges in mentions of particular stocks. If you click load settings, you will be immediately presented with a real-time list of stocks spiking on social media.

Automated AI Stock Trading

The Trade Ideas platform has a simple, easy-to-use backtesting system that does not require programming knowledge. A point-and-click backtesting system is rare in this industry; the only alternative software with this capability is TrendSpider.

Trade Ideas integrates with three brokers for stocks: Interactive Brokers, Etrade, and Esignal. The Brokerage Plus functionality is available with the Standard and Premium service.

Is Trade Ideas Easy to Use?

No, Trade Ideas is not easy to use; it takes time to learn. I estimate that you will need at least four days of effort before you understand the platform. However, Trade Ideas helps new clients by providing excellent support, a live trading room, and personal one-on-one training sessions.

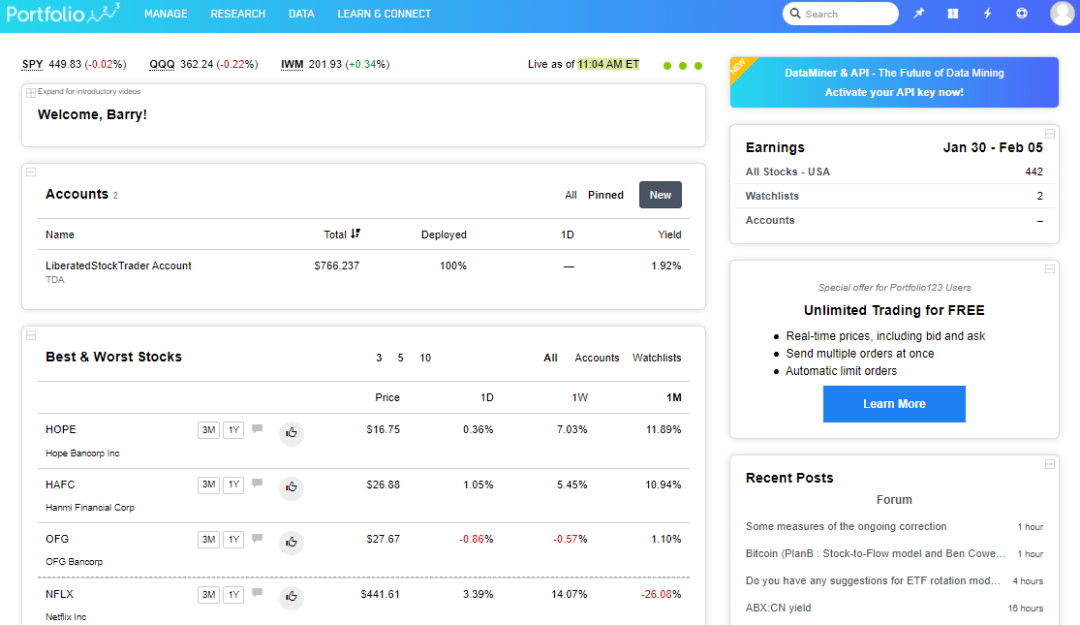

4. Stock Rover: Best Analysis Software for Investors

Stock Rover is ideal for USA value, dividend, and growth investors seeking innovative fundamental stock analysis, screening, and portfolio management software. Stock Rover enables the easy implementation of powerful investing strategies.

My testing shows Stock Rover is best for long-term dividend, value, and growth investors. Its exceptional features are in-depth screening of a 10-year financial database, research reports, and broker-integrated portfolio management.

| Stock Rover Rating | 4.7/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 Portfolio & Research | ★★★★★ |

| 📰 News & Social | ★★★✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 🖱 Usability | ★★★★★ |

Stock Rover is an industry-leading platform that enables the development of intricate dividend, value, and growth investing strategies.

With Stock Rover, I have developed incredible value strategies using its unique fair value, discounted cash flow, and margin of safety data. Its extensive growth investing data, such as performance versus the S&P 500 and industry growth and earnings rankings, make Stock Rover the best choice for serious investors.

Stock Rover’s key benefits include portfolio correlation and balancing and screening for dividends, value, and growth stocks. Its 10-year historical dataset allows you to backtest your screening criteria, which means you can see if your scans were profitable in the past.

Pros

✔ 650+ Financial Screening Metrics

✔ Potent Stock Scoring Systems

✔ Unique 10-Year Historical Financial Data

✔ Warren Buffett Value Screeners & Portfolios

✔ All Important Financial Ratios

✔ Real-time Research Reports

✔ Portfolio Management & Rebalancing

✔ Broker Integration

✔ Winner: Best Value Investing Screener

Cons

✘ No Social Community

✘ Not for Traders

✘ No Cryptocurrency or Forex Data

✘ US Markets Only

Get Stock Rover Now + 25% Discount

Stock Rover offers robust screening, a top-notch 10-year financial database, and real-time stock research reports. While Stock Rover’s free service is excellent, Stock Rover Premium + offers unmatched benefits for growth investing.

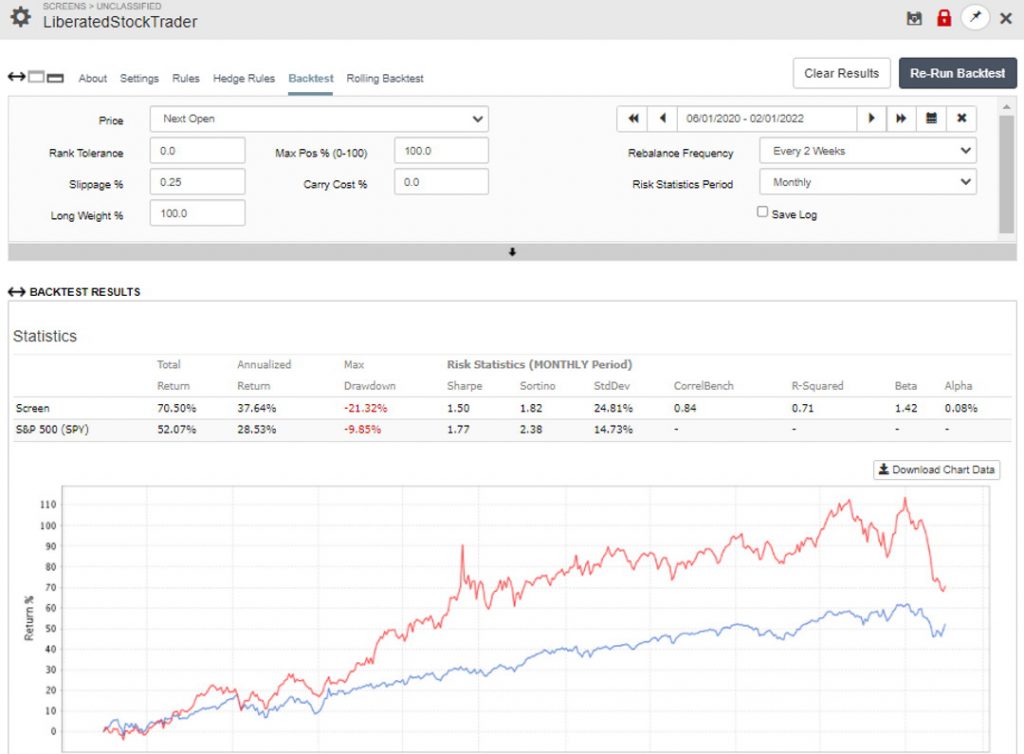

It is awe-inspiring that Stock Rover is the outright winner in our Best Stock Screener Review. I actively use Stock Rover daily to find the undiscovered gems that form the foundations of my long-term investments. I created the Liberated Stock Trader Beat the Market Stock System using Stock Rover.

I do not say this lightly. If you are a long-term US Investor, Stock Rover is the best & only software you ever need.

Pricing

Stock Rover is available for free, but the real power is unleashed with the Premium Plus service, which is superior to competing stock screeners and less expensive. Stock Rover Premium Plus costs $27.99 per month and includes unlimited stock ratings, scores, analyst ratings, margin of safety scoring, a 10-year historical database, and investor warnings.

Stock Rover has the best implementation of stock screening, research and portfolio management on the market today.

Portfolio Management

Stock Rover integrates with every major broker, including our review-winning broker, Firstrade, and Interactive Brokers. You cannot place trades from charts, but it will cover profit and loss reporting on your portfolio and provide portfolio rebalancing recommendations. Stock Rover uniquely includes current dividend earnings and future income prediction reporting, making it a unique portfolio analysis platform.

Fundamental Screening

Stock Rover is best at screening for stocks to build professional growth, dividend, and value stock portfolios. Stock Rover provides detailed research reports, historical screening, portfolio management reporting, rebalancing, and correlation.

Stock Rover has over 600 data points and historical data stretching back ten years, enabling you to backtest fundamental strategies. Stock Rover also has unique Margin of Safety, Fair Value, and Discounted Cash Flow data to help you invest like Warren Buffett.

Watchlists have fundamentals broken into Analyst Estimates, Valuation, Dividends, Margin, Profitability, Overall Score, and Stock Rover Ratings. You can even set the watchlist and filters to refresh every single minute if you wish.

Stock Rover has over 150 pre-built and tested screeners you can import and use. To take advantage of this, you need the Premium Plus service. I have analyzed most of the screeners, which are very thoughtfully built. One of my favorites is the Buffettology screener.

Research & Stock Ratings

The team at Stock Rover has implemented some great functionality; I particularly like the roll-up view for all the scores and ratings. I have imported the Warren Buffett portfolio, including his top 25 holdings. I have also selected the “Stock Rover Ratings” tab. This tab rolls up all analysis into a simple-to-view ranking system, saving a vast amount of time and effort while providing a wealth of insight.

Stock Rover provides investors with financial growth, valuation, efficiency, and profitability ratings to help them select the right stocks; this makes it the best stock-picking software available today. If you are a long-term investor, this is the software for you.

5. Benzinga Pro: Best for Real-time News Analysis

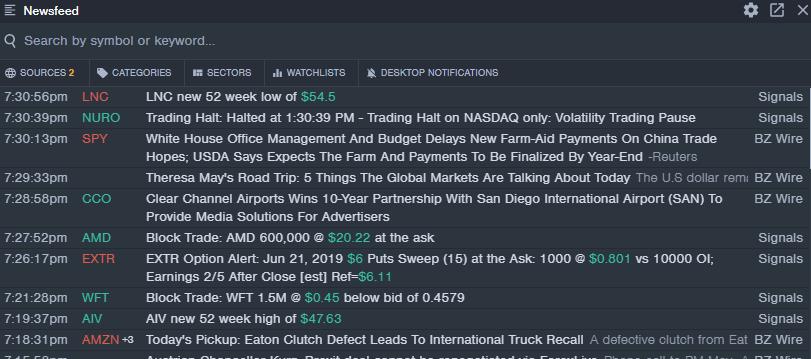

Benzinga Pro is a unique analysis software for trading real-time stock news. It is designed for day traders and delivers real-time market-moving news to give you a trading edge. The service is complete with a news squawk box, direct access to the news desk, and real-time charting and scanning.

After thorough testing, I’ve found that Benzinga Pro is an excellent choice for U.S. traders seeking a fast, actionable, real-time news feed at a fraction of the cost of a Bloomberg terminal. Priced at just 1/10th of its competitor, Benzinga Pro is particularly well-suited for active day traders and investors who rely on breaking news to inform their trades. I highly recommend it for those looking to capitalize on market-moving events efficiently.

| Benzinga Pro Rating | 4.6/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading Signals | ★★★★✩ |

| 📰 Real-time News | ★★★★★ |

| 👯 Social Community | ★★★✩✩ |

| 📡 Screening | ★★★★✩ |

| 📈 Charts | ★★★★✩ |

| 🖱 Usability & Customer Service | ★★★★★ |

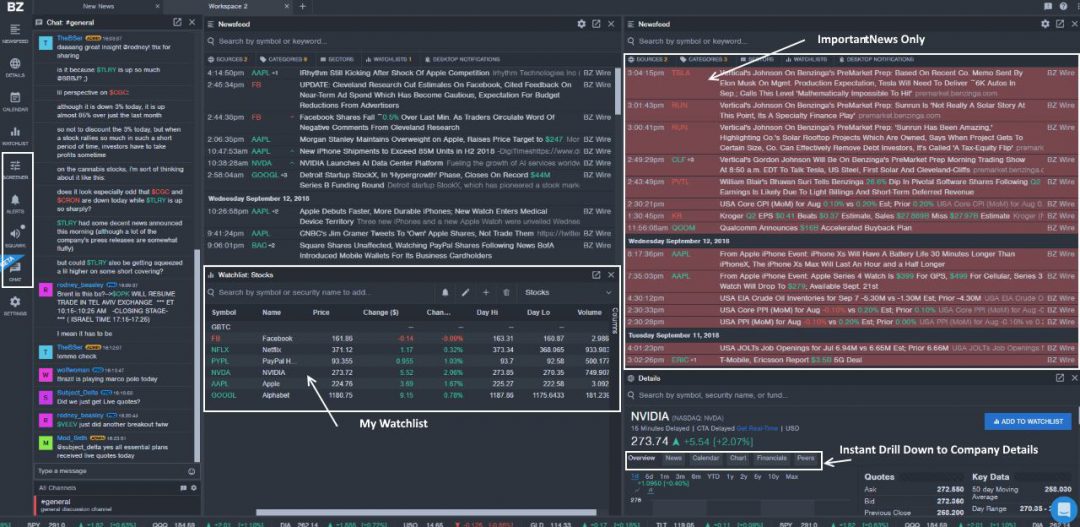

Benzinga Pro offers a comprehensive suite of tools, including detailed charts, financial data, screeners, options mentoring, and an advanced calendar system. Standout features include news sentiment analysis, direct access to a professional newsdesk, a real-time squawk box, and instant alerts for market-moving news.

Benzinga Pro offers a top-tier platform for traders, complete with integrated chat streams and expert options mentoring to help you maximize your gains. I highly recommend it.

Pros

✔ The Fastest Real-time News Feed

✔ Live Audio News Squawk Box

✔ Options Alerts

✔ Analyst Rating Calendar

✔ Price Change Since News

✔ Sentiment Indicators

✔ News Rated for Impact

✔ 1/10th Price of Bloomberg

Cons

✘ No Broker Integration

✘ No Backtesting

Benzinga Pro is the best for scanning and screening the news, but it can also screen for technical and fundamental data. Benzinga Pro has 32 fundamental screening criteria, including P/E, PEG, Profitability, Margins, and Insider Ownership. There are also 23 market scanning criteria, including volume change, relative volume, and short interest.

| ⚡ Features | Real-time News, Calendar, Charts |

| 🏆 Unique Features | Audio Squawk Box, News Sentiment, News Rating & Alerts |

| 🎯 Best for | Stock, FX & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $197/m or $166/m annually |

| 💻 OS | Web |

| 🎮 Trial | Yes 14-Day |

| 🌎 Region | North America |

Benzinga PRO costs $79 monthly for the Basic Plan, which gives you real-time newsfeeds and watchlist alerts. Benzinga Pro Essential costs $117 monthly, adding the Squawk Box, Calendars, Sentiment Indicators, and the Chat with Newsdesk functionality.

Scanning

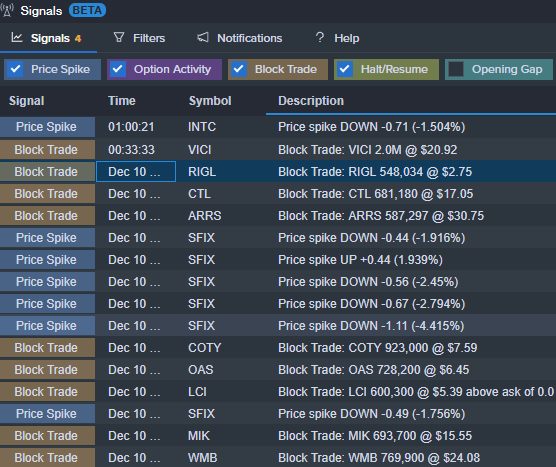

Another example of how Benzinga is continually innovating is Signals. Signals is a feed with block trade or price spike news that directly impacts a stock’s supply and demand balance at a foundational level.

Let’s take a look at a block trade. A block trade is a huge, market-moving amount of stock, either bought or sold. Block trades impact price, and you can take part in that price move or not, depending on the direction of the trade.

Signals could be a trading strategy in itself. Watch the block trades roll in, observe the direction, and make your trade. See a colossal block trade sell, buy Put Options, see a block trade buy, buy calls.

Real-Time News – BZWire

Core to the Benzinga Pro service is access to the real-time newsfeed, which updates quickly and effectively. The only news excluded in the basic package is the Securities & Exchange Commission (SEC) announcements and Public Relations (PR) newsfeeds.

Please do not underestimate the newsfeed; it is truly enormous. But despite the depth of financial content being released every minute, the Benzinga Pro web-based applications are high-speed, responsive, and configurable. The configurable nature of the newsfeed is what makes the service so great. For the full test of Benzinga, see the Benzinga Pro Review.

You can also choose to be alerted to specific categories in your newsfeed. Any category can be flagged for alerts, so you do not need to watch the newsfeed continually; you can be trading and hear the alarm as a call to action.

Squawk Box & Newsdesk

Benzinga’s Squawk Box frees you from staring at the on-screen newsfeed by having the newsroom reporters read the latest high-impact news live as it hits the feed. Squawk is one of the biggest benefits of the Benzinga Pro Essentials service.

I have Squawk Box open while watching the markets, so I do not need to watch the screen constantly. Every two minutes, a real-time audio feed announces the latest big news via my PC speakers; this service alone is worth the upgrade to Benzinga PRO Essential.

Benzinga Pro has an active user community, with eight live chat channels and a Benzinga TV channel featuring Benzinga studio’s live broadcasts. Additionally, a special live chat stream for Benzinga’s Options Signals service enables clients to pounce on Options pricing opportunities.

Is Benzinga Pro Worth It?

Yes, Benzinga Pro is worth it for day traders and investors who want an actionable real-time news service, sentiment indicators, market scanning, and financial reporting to get a profitable edge in the market.

After using Benzinga Pro for five years, I can say that the exclusive features, such as the audio squawk box, chat with the newsdesk, and the powerful calendar suite, make It worth it.

6. MetaStock: Best for Backtesting & Forecasting

MetaStock is best for stock traders who need real-time news, access to a huge stock systems marketplace, and the best technical stock chart analysis, backtesting, and forecasting. All international exchanges are covered & backed up with excellent customer service.

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex. MetaStock R/T excels with its advanced backtesting and forecasting features, alongside real-time news updates and efficient screening tools.

MetaStock is best for traders who need excellent real-time news, exceptional technical analysis, a vast stock systems marketplace with global data coverage, and excellent customer service.

However, the full Metastock suite costs $265/m. It rivals the Bloomberg terminal in functionality but lacks the new AI trading features of TrendSpider and Trade Ideas, such as AI Bot trading and pattern recognition.

Pros

✔ Great Selection of Automated “Expert Advisors”

✔ Excellent Deep Backtesting

✔ Unique Stock Price Forecasting

✔ Large Library of Add-on Professional Strategies

✔ Best Charts, Indicators & Real-Time News

✔ Xenith Add-On Rivals Bloomberg Terminals

✔ Works Online & Offline

Cons

✘ Takes Time To Learn

✘ Old School Windows App Design

✘ Too Many Add-ons

The latest release of Metastock is a big hit with improvements across the board. Considerable advances in scanning, backtesting, and forecasting make this one of the best offerings on the market.

| ⚡ Features | Charts, Watchlists, Scanning, Backtesting |

| 🏆 Unique Features | Algorithmic AI Forecasting, Real-time Global Trading News (Multi-language), Pattern Recognition with Add-ons. |

| 🎯 Best for | Stock, FX & Commodity Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | MetaStock R/T $100/m, Xenith $265/m |

| 💻 OS | PC |

| 🎮 MetaStock Free Trial | 30-Day Free Trial |

| ✂ Discount | 3 Months for 1 |

| 🌎 Region | Global |

MetaStock is designed as a broker-agnostic technical analysis platform. It does provide limited broker integration, but the execution of trades from charts and live integrated profit and loss analysis of your live portfolio is limited.

Using MetaStock R/T, you can see an incredibly in-depth analysis of company fundamentals, from debt structure to the top ten investors, including level II. Excellent watchlists featuring company financials and powerful market scanning make MetaStock unique.

Real-time News

MetaStock R/T Refinitiv integration means you get institutional quality real-time news, analysis, research, and economic outlooks. Refinitiv is the fastest global news service available in the industry. For international investors, MetaStock is unique because the news is also translated into all major languages.

Technical Chart Analysis

MetaStock has over 350 stock tools for charting, annotation, and drawing trendlines and indicators, the broadest selection of technical analysis tools on the market today. MetaStock is the clear leader in pure technical analysis of stock charts; it includes Point and Figure and Market Profile Charts, meaning it has the best stock trading charts.

Systems & Backtesting

MetaStock has over 100 computerized stock market systems called Expert Advisors. These programs scan stock charts for a system’s targeted conditions. The Expert Advisor systems, either in-built or as 3rd part add-ons, will help you understand and profit from technical analysis patterns in price and volume. This is a unique differentiator from the competition.

Forecaster Capability

The most significant MetaStock innovation is the forecasting functionality, which does not exist with any other software. By selecting Forecaster from the power console, you can choose one or more stocks, ETFs, or Forex pairs. You are then presented with an interactive report that enables you to scan through the many predictive recognizers, which help you understand the basis for the prediction and the methodology.

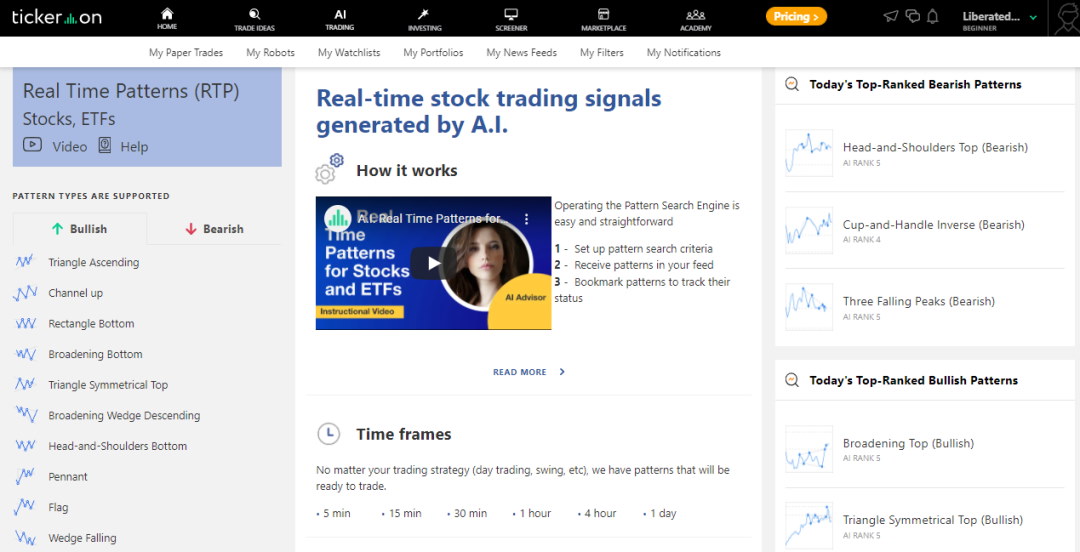

7. Tickeron: Broad Selection of AI Bots & Signals

Tickeron has impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron excels at providing thematic model portfolios, specific pattern-based trading signals, and success probability and AI confidence levels.

My Tickeron testing confirms impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron provides reliable thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

Tickeron is designed for day traders, swing traders, and investors.

Pros

✔ 45 Streams of Trade Ideas

✔ Real-Time Pattern Recognition for Stocks, ETFs, Forex, and Crypto

✔ AI Trend Prediction Engines

✔ Investing Portfolios with Audited Track Records

✔ Build Your Portfolios with AI

Cons

✘ Custom Charting Limited

✘ Cannot Plot Indicators

✘ Complicated Pricing

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus machines. Tickeron targets day traders, swing traders, and investors with intricate features and benefits specific to your investing style.

| ⚡ Tickeron Features | Portfolios, Watchlists, Screening, 45 Streams of Trade Ideas |

| 🏆 Unique Features | Real-time AI Trading Signals for ETF, Forex & Crypto & Pattern Recognition, AI Portfolios |

| 🎯 Best for | Day & Swing Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free or $250/m or $125/m annually |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | 14-Day Free Trial |

| ✂ Discount | 50% Off All Annual Plans |

| 🌎 Region | USA |

Tickeron uses AI rules to generate trading ideas based on pattern recognition. Firstly, they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine.

Of course, each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine.

Pattern Recognition

At the heart of Tickeron is its AI algorithms’ ability to spot 40 different stock chart patterns in real-time. You can select which pattern you want to trade, and it will filter stocks, Forex, or cryptocurrencies that currently show it. Patterns are split into bullish patterns for long trades or bearish patterns for those who wish to go short.

Tickeron’s real-time pattern recognition is particularly useful for swing or day traders, where market timing is the top priority. Tickeron can also scan the entire market and suggest which patterns work best on a particular day. In the screenshot above, you can see “Today’s Top Ranked Patterns,” which rates the potential success of the patterns based on the market’s current trading activity.

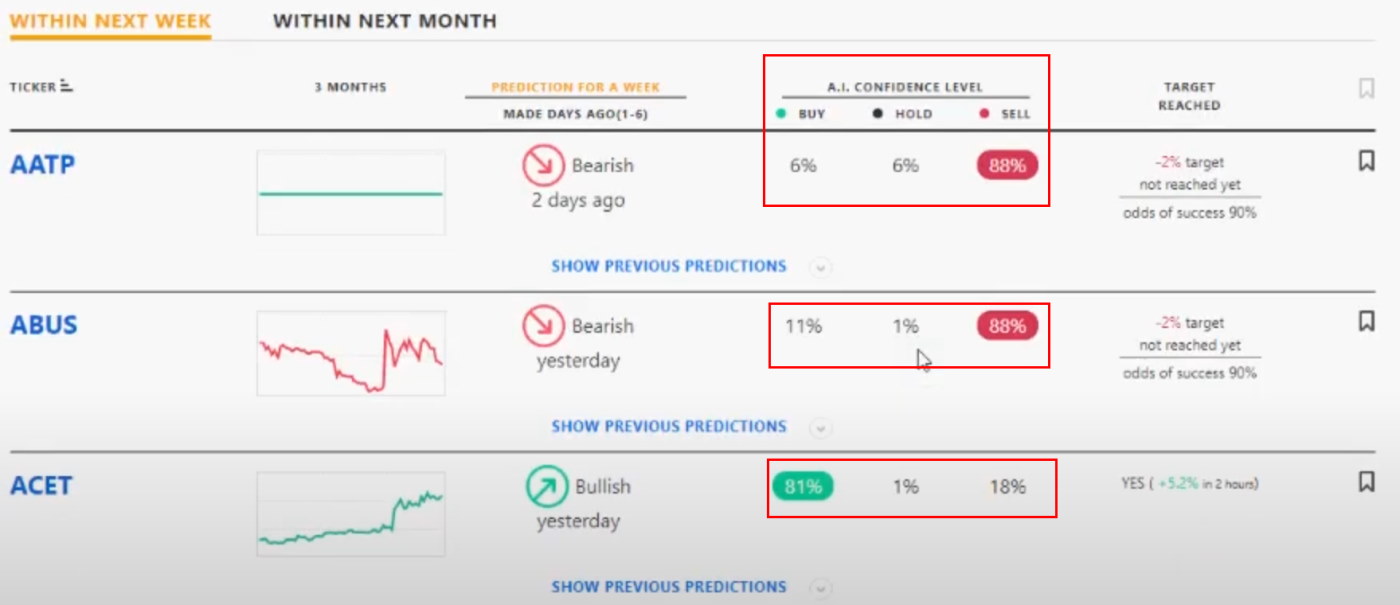

Trading Signals & Prediction

Tickeron has implemented a powerful feature called AI Confidence Level. Based on the stock’s history, the success rate of a particular pattern, and the market’s current direction, Tickeron can assign a confidence level to a trade prediction.

The screenshot below shows that the Tickeron AI predicts that ABUS has an 88% chance of declining in value and ACET has an 81% chance of increasing in value.

Is Tickeron Worth The Money?

Tickeron is worth buying if you are a short-term trader because it provides high-probability AI-backed trade signals.

8. TC2000: Best Stock Trading from Charts USA

TC2000 is best for US and Canadian traders seeking rapid, entire market scanning and screening, with excellent charts and indicators. TC2000 has an integrated brokerage, meaning you can trade stocks and options directly from charts.

My testing of TC2000 highlights its impressive real-time stock scanning, advanced charting, and customizable indicators, making it a powerful tool for US stock and options traders. It also offers seamless broker integration with TC2000 Brokerage and sophisticated technical analysis features, such as options strategy charting and trade execution.

| TC2000 Rating Our testing and rating methodology. | 4.2/5.0 |

|---|---|

| 💸 Pricing | ★★★★★ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★★ |

| 📡 Scanning | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charting | ★★★★★ |

| 💡 Pattern Recognition | ★✩✩✩✩ |

| 🔍 Backtesting | ★✩✩✩✩ |

| 🖱 Usability | ★★★★★ |

However, TC2000 falls short when it comes to backtesting capabilities and advanced AI trading features offered by platforms like TrendSpider and Trade Ideas. These include cutting-edge tools such as AI stock trading and pattern recognition, which provide traders with a significant advantage.

Pros

✔ Excellent US Customer Support

✔ Trade Stocks & Options From Charts

✔ Broad Selection of Charts & Indicators

✔ Options Strategies & Live Trading

✔ Real-time Entire Market Scanning

✔ Great Usability & Simple Setup

Cons

✘ No Social Community

✘ No Pattern Recognition

✘ No Backtesting

✘ No AI Trading Features

TC2000 has long been one of my favorite tools; I have been a subscriber for over 20 years and find the latest release another step forward. The platform offers nearly everything a trader will need and is endlessly customizable and scalable.

| ⚡ TC2000 Features | Charts, Custom Indicators, EasyScan |

| 🏆 Unique Features | TC2000 Brokerage, Options Strategies |

| 🎯 Best for | Stock & Options Traders |

| ♲ Subscription | Monthly, Yearly, Bi-Annually |

| 💰 Price | Free or $60/m or $50/m annually |

| 🆓 Free | Try TC2000 Free |

| 💻 OS | PC, Mac, Web |

| 🎮 Trial | Yes, 30-Day |

| ✂ Discount | -25% for 2-Year Subscription |

| 🌎 Region | USA |

TC2000 is a slick and powerful technical analysis platform. It enables scanning and screening the entire US market for fundamentals and technical analysis. You can use the huge library of available indicators and create custom indicators and conditions without coding.

Trade Management

The TC2000 Brokerage offers stock trades at $1 per trade, which means TC2000 has a tight integration for trading stocks from the chart and has good stock options trading visualization. TC2000 is one of the best Stock Options analysis software programs, allowing you to scan and build options strategies seamlessly. You can scan on gamma, delta, expiration, options spread, and even short interest.

Scanning, Screening & Charting

If you want fundamentals screened in real-time layered with technical screens integrated into live watch lists connected to your charts, TC2000 is a power player. TC2000 Easyscan can be set up with a few clicks, and you do not need coding experience.

TC2000 has an excellent array of technical indicators and drawing tools; all the big ones are there, from OBV, RSI, and Bollinger Bands to Fibonacci Fans and Andrews Pitchfork. With over 70 different indicators, you will have plenty to play with.

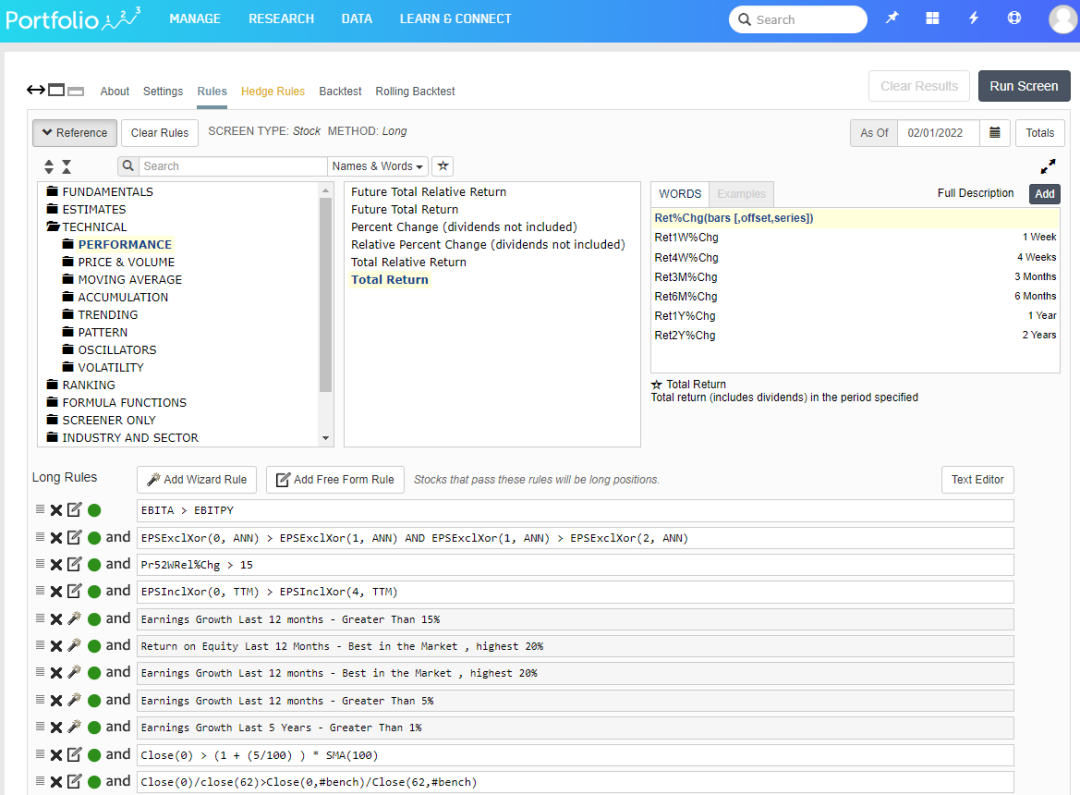

9. Portfolio 123: Screening & Backtesting for Investors

My testing of Portfolio123 shows impressive stock screening, software with a robust financial database, and integrated commission-free trading with Tradier. Portfolio123 can be used by income, value, and growth investors but is also advantageous for swing traders.

My Portfolio123 testing highlights its solid stock screening, financial database, and easy integration for commission-free trading. Charting and usability can be improved, but it is good for dividend and growth investors. Value investors should look at Stock Rover as a better alternative.

| Portfolio123 Rating | 4.1/5.0 |

|---|---|

| 💸 Pricing | ★★★★✩ |

| 💻 Software | ★★★★★ |

| 🚦 Trading | ★★★★✩ |

| 📡 Screening | ★★★★★ |

| 📰 News & Social | ★✩✩✩✩ |

| 📈 Charts & Analysis | ★★★★✩ |

| 🔍 Backtesting | ★★★★✩ |

| 💡 Portfolio Research | ★★★★★ |

| 🖱 Usability | ★★★✩✩ |

Portfolio123 covers stocks, fixed income, and ETFs on US and Canadian exchanges, so it is unsuitable for international stock investors. However, you can design a fully automated real-time trading strategy with a broker that will hold the stocks that pass your screen and sell those that don’t.

Portfolio123 is a Chicago-based company offering stock screening, research, and portfolio management software.

Pros

✔ 470+ Screening Metrics

✔ 10-Year Backtesting Engine

✔ Unique 10-Year Historical Data

✔ Pre-built Model Screeners

✔ 260 Financial Ratios

✔ Integrated $0 Trading

Cons

✘ No Integrated News

✘ No App for Android or iPhone

✘ Initially, Complex To Use

✘ Missing Fair Value & Margin of Safety Metrics

✘ Technical Analysis Charting Needs Improving

Portfolio123 covers stocks, fixed income, and ETFs on US and Canadian exchanges, so it is unsuitable for international stock investors. However, you can design a fully automated real-time trading strategy with a broker that will hold the stocks that pass your screen and sell those that don’t.

| ⚡ Portfolio 123 Features | Screening, Research |

| 🏆 Exceptional Features | Trading, Backtesting |

| 🎯 Best for | Experienced Investors |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $0-$83/mo |

| 💻 OS | Web Browser |

| 🎮 Trial | 21 Days for $9 |

| ✂ Discount | None |

| 🌎 Region | USA/Canada |

The Screener and Pro service unleashes Portfolio123’s real power. Their pricing is competitive, considering the benefits.

When you register with Portfolio123 and log in, you are greeted with the dashboard, which gives you an instant market performance breakdown but, more importantly, shows you your portfolio performance.

With Portfolio123, you get tight broker integration with Tradier and Interactive Brokers. You cannot place trades from charts, but you can automate trading based on rules or issue bulk trades; plus, Portfolio123 will take care of profit & loss reporting.

The Portfolio123 screener allows you to filter 10,000+ stocks and 44,000 ETFs to help you find the investments or trades that match your exact criteria. Portfolio123 also has ranked screening, which enables you to rank the stocks that best match your criteria, filtering a list from hundreds of stocks to a handful.

Over 225 data points will cover most ideas based on fundamentals. Portfolio123 has 460 criteria, including analyst revisions, estimates, and technical data.

Building your Portfolio123 screener is theoretically easy; select Research -> Screens, and you can start to play. No programming skills are required, but basic coding will certainly help. You must study the coding logic and understand the names of the proprietary criteria to create more powerful screening rules.

Portfolio123 is an excellent screening and backtesting platform for swing traders and medium-term growth investors. Its incredible selection of fundamental criteria, 20-year financial database, and powerful financial backtesting engine make it a great choice for experienced stock system developers.

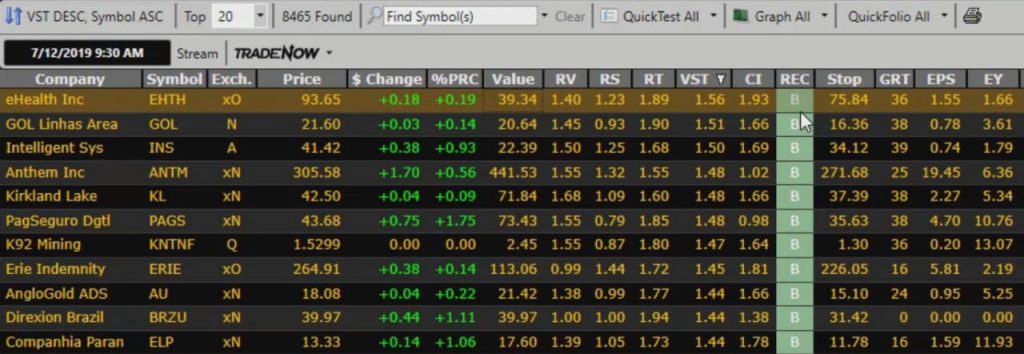

10. VectorVest: Scanning & Market Timing Software

VectorVest helps simplify market timing by providing buy and sell ratings on US, Australian, and European stocks. VectorVest is software designed to assist in market timing through precise stock strength calculations and reliable buy and sell trade signals.

After testing VectorVest, I found it to be on the pricier side. However, its stock recommendation system, which claims to have outperformed the S&P 500 by tenfold over the past 22 years, makes it a platform worth exploring. VectorVest stands out by simplifying the stock selection process through its proprietary system, offering clear bullish and bearish signals that benefit both traders and investors alike.

Over 40 years ago, Dr. Bart DiLiddo founded VectorVest with a vision to simplify investing. He developed a proprietary stock-rating system built on three key metrics: Value, Strength, and Timing. This innovative system provides clear, actionable buy and sell signals, empowering investors with confidence and ease.

Pros

✔ Simple to follow system

✔ Specific buy & sell signals

✔ Market timing signals

✔ US, Canada, Australia, & Euro Stocks

✔ Robo-trading included with premium plans

✔ Advanced options analysis upgrades

✔ Easy to use

Cons

✘ Expensive, especially with add-ons

✘ A limited number of chart indicators

Vectorvest offers various features to help novice investors find stocks. Its market timing gauge and auto-trading capabilities make it a top choice for beginner investors looking to get started in the stock market.

| ⚡ Vectorvest Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | Market Timing Gauge, Buy & Sell Signals, AI Auto-trading Bots |

| 🎯 Best for | Beginner Investors |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $58 to $125/m annually |

| 💻 OS | Web Browser |

| ✂ Discount | 1st Month $0.99 |

| 🌎 Region | USA |

What sets VectorVest apart is its commitment to transparency, as it now openly publishes its track record. With such credibility, it is worth considering as a valuable tool for investors.

VectorVest software is straightforward to use because it is designed to promote the Value, Safety, and Timing system. This means they have a minimal variety of stock market indicators; they provide only what is needed to trade within their VST system parameters.

VectorVest has 20 technical indicators and drawing tools, including trendlines, Gann, Fibonacci, moving averages, momentum, RSI, and Stochastics. However, compared to other stock analysis software, VectorVest’s chart analysis selection is very poor.

If you are an experienced technical analyst who wants to perform detailed charting analysis, you may want to consider MetaStock, which has 300+ indicators, or TradingView, which has 160+ indicators.

Summary

The best stock software and app for traders is TradingView, which has excellent chart analysis, backtesting, and screening. Trade Ideas and TrendSpider excels at AI stock prediction and charting. Stock Rover is the best stock analysis and research software for investors. Finally, Benzinga Pro and MetaStock provide excellent real-time trading news platforms.

FAQ

What is the best trading software?

The best trading software for US short-term day trading is Trade Ideas, with pinpoint trading signals up to 65 percent accuracy. TradingView is the best trading software for swing trading across international markets, with robust broker integration and a 13 million active user community.

What is the best free stock analysis software?

Our testing shows the best free stock analysis software is TradingView, offering 14 stock chart formats and 250+ filterable indicators and financial criteria for professional stock technical analysis across the global markets.

What charts do professional traders use?

Most professional traders use Candlestick charts, but Heikin Ashi, Renko, and Point & Figure charts are also used. For trading stocks, professionals use proprietary L2 direct market access brokers and AI-powered software like Trade Ideas. For retail investors globally TradingView is a good alternative.

Which stock app trading platform is best for beginners?

The best stock app for beginners is TradingView, as it provides a vibrant trading community to help you learn and easy-to-use free tools for trading, charting, and screening for all global markets.

What is the best trading platform in Europe?

The best trading platforms in Europe based on trustworthiness, reliability, and price are TradingView, Interactive Brokers, and TD Ameritrade. Contrary to many website recommendations, we do not recommend eToro, or any broker offering CFD or Forex trading.

Where can I practice stock trading for free?

Most brokers allow you to practice stock trading for free using paper trading, but they are usually restricted to one country. If you want to practice trading stocks, Forex or Cryptocurrency for free across the global markets, then we recommend TradingView's free paper trading system.

What is the best desktop stock trading software for PC?

The leading downloadable desktop stock trading software for the PC is MetaStock, TradingView, and Trade Ideas. MetaTrader and Ninja Trader are also popular for Forex and Futures trading.

What is the Best Computer for Stock Trading?

You do not need a powerful computer to trade stocks as modern stock software runs in the cloud, relieving the burden of processing from your PC. However, you will need the latest generation of processors if you run trading software on your PC and process a lot of data locally with software like MetaStock or Optuma. I do, however, recommend multiple monitor screens for all stock trading.

Thank you. I am looking for a technical analysis software for which I can upload prices. Indeed, the securities I wish to analyze are not listed. By chance, could anyone recommend one? Thanks

Hi Eric, yes the best solution is MetaStock, it is very flexible on data sources. https://www.liberatedstocktrader.com/metastock-review/

These software are really good. The role of Equity makes a huge difference. You have described it in a very simple and easy way that how it works and what are the things that we need to keep in mind. Thanks for sharing this information about Stock. Subscribed!

Thanks, Barry for writing this. I enjoy reading the article. Many things are described so well which helps me to understand the topic so eaasily. Great work.

thanks George. Barry

Love to see something on Vantage Point. Great reviews!

Hi Barry, came across your Top 10 Best Stock Trading Analysis Software & Tools 2021, what a great review very extensive and informative.

I’m in Australia and have been investing in Australian shares now for over 20 years but only as a part time and do trade two or three stocks a year and was looking to investing more time and money and was wondering if you can recommend a system that can give me a buy and sell indicator to help me become more successful at investing in mainly Australian shares with some US and possibly crypto currency.

I look forward to your reply.

Regards

N Mikhail

Hi Mikhail, well tradingview is the only software, that is international, covers crypto, US and Australia and has built in buy and sell signals.

You can see them in action on the tradingview review. They are called Technical Signals or Automatic Stock Ratings Indicators.

https://www.liberatedstocktrader.com/tradingview-review/#3_Reasons_Why_TradingView_is_Worth_the_Money

Hello Barry, I’m extremely new at trading and only have $2000 set aside to get started. What can you advise me? I’m willing to invest $30/month in on of the system you reviewed but it’s a bit intimidating and overwhelming. I currently have tradingView the free version. I’m not sure how the pick the right stock prediction program. Thanks

Hi Sagbo, its a tough question. But with $2000, you might want to stick with the free tools at the moment. TradingView is great. If you want to invest and are in the US then stockrover is free and gives you excellent research capabilities.

No software can predict 100%, so you need to decide if you want to trade short term, or invest it.

Hi Barry, thanks for the terrific article. Do you have any advice about TrendTraderPro being used on the Tradingview platform? Also, I’m looking at purchasing a new laptop and going to a MacBook Pro – can you give me your feelings on Windows vs. IOS based technology for trading.

Thanks Barry, your thoughts would be appreciated.

Hi Randy, I had a look at trend trader PRO, they do not have any published audited results for their indicator, and $1,500 seems expensive. For that money you could looks at Trade Ideas [https://www.liberatedstocktrader.com/trade-ideas-review/] who are registered with SEC and provide fully audited results, on their website and in the app.

On the question of PC vs MAC, Mac will restrict you from using TC2000, Trade Ideas or MetaStock (unless you use parallels). With a PC you can use all stock software.

I hope this helps.

Barry

Hopefully in your next round of reviews if you can include following softwares that should include all the universe of best analysis softwares such as: Multicharts; Amibroker; Metatrader 5; StrategyQuantX; Quantconnect; Quantopian; Smartquant; TradingBlox.

Thanks for the tip James,

Barry

Do you have any info on Vectorvest?

Hi Ty, I sure, do, here is a freshly minted Vectorvest review https://www.liberatedstocktrader.com/vectorvest-review/

Thank you so much for the great review, it must have take weeks to put together

Where does IBD and its various offerings fit into the equation? Thanks, very useful info here!

Hi Hugh, I never considered to include IBD in the testing, I will do it in the next round of reviews, thanks for the idea.

Barry

Just signed up for TradingView. How do I connect with your website through it and take advantage of your generous offer?

Hi Ron, you can find me here on tradingview. https://www.tradingview.com/u/liberatedstocktrader/

simply click the follow button and drop me a message in tradingview with your email address. thanks Barry.

I am Raj Kumar. And I liked your post very much. I hope this post of yours will be very useful for everyone.

What is the best automated software for professional day traders?

Hi Luke, Hopefully, this article helps. https://www.liberatedstocktrader.com/best-trading-platforms-for-day-traders/

Trendspider automates trendlines pattern recognition and backtesting

TradingView allows automated execution of trades via pine script with its integrated brokers

Which software is better for the country like India, Bangladesh, Pakistan, Nepal here the need of trading software is growing?

Hey, really cool article.

I was just wondering though how Ninjatrader compares to Metastock in terms of automated trading.

Also, what do you think is the most comfy automated trading platform?

Oh yeah, and there’s no MetaTrader there, is it depreciated or something?

Hi Anton, thanks for the comment. Ninjatrader does have automated trading, Metastock does not.

https://www.liberatedstocktrader.com/top-10-best-stock-market-analysis-software-review/#Comparison_Table_Stock_Prediction_Software_Backtesting_Forecasting_AI_Trading

The 2 options you have for fully automated trading are Ninjatrader and Tradestation.

Barry

Have you heard of or reviewed “DSS Smart Equities Program” trading software?

Hi Ed, no I have not. Let me take a look in the next round of reviews.

thanks for the comment

Barry, amazing analysis! Which provider or platform you would recommend for automated robot of mechanical trading system developed by me ? Thank you

Great job Barry on these!! Well done, 5 Stars for you!!

Thanks Joseph, I am glad you like it

Hi Barry appreciate the extensive detail you went into. What initially brought me here is I’m seeking quality equivolume charts. I see you’ve got tradingview listed as a possibility. They’re my main source for charting and would love to use equivolume on their platform. Unfortunately I haven’t been able to find anything about it on their main site. Do you know where to direct to me to or have other recommendations for equivolume charts? Metastock definitely looks interesting. Looking for crypto support though.

May be too much of an ask for equivolume AND crypto. Still would greatly appreciate any input on the situation.

Thanks, Dylan

Hi Dylan, thanks. From the vendors I reviewed, Equivolume is available in tradingview premium, metastock and quantshare. I studied equivolume but never found a great use for it as it makes it impossible to draw trend-lines because the bars change width. I guess you have a nice system based on it. Best of luck with your trading. Let me know how you get on.

Barry

Barry-thought Vector Vest would have scored higher in most areas, their ranking system is so simple & efficient. Will def. look at tradingview and tc2000, any input would be appreciated.-Eric

Hi Eric, good question. I know Vectorvest has its fans, but based on the criteria of the testing, technical analysis, access to markets, backtesting, forecasting, social.. it did not score too well. What are your experiences of the signals from VectorVest, do you make money based on its recommendations? I would be interested to hear from you.

I want to stock scanner software

Try this post https://www.liberatedstocktrader.com/stock-screener-review/

Hi Barry-I just signed up for the 30 day trial for TradingView Pro+ and found that they don’t provide forward PEs. Probably one of the most important fundamental indicators used to evaluate a company. Any idea why they wouldn’t provide that – or do they and I just can’t find it? Also, what do you think about StockRover? No realtime data feed so not optimal

Hi Jim,

you are correct I took a look and tradingview does not have a Forward P/E, I raised the topic for you on the forum, perhaps we get a reply. Regarding Stock Rover, I have never heard of it before, perhaps I will include it in a future review. Thanks for your comment.

I like IB’s platform. Not really a fan of Tradestation, as its platform feels a bit old and clunky.

Just a couple of questions…does Tradingview or TC2000 allow the use of a 4 monitor setup? How does eSignal compare to Tradingview and TC2000? Why does Tradingview make purchasing the program (Platinum in my case) so difficult: there was apparently an error in my application so “Payflow” informed me an error had occurred but never sent me back for correction. All efforts to contact Tradingview failed because I am recognized as a “FREE” user and there is just too many of us to take inquiries. Now my personal information and card information is out there and no way to trace. Tradingview may be great technically but customer support is way down their list of important things to do. Any suggestions?

Hi Stephen, Trading View does allow the use of multiple monitors, you can either open separate browsers for each window and configure them accordingly or stretch the browser across all 4 monitors and configure. I think the former is better but it takes a little more fiddling around when you start your trading day. You can have 8 charts per browser window with the premium plan and have multiple windows. Regarding your payment, sorry to hear that, to log a support request, open your profile and there is a “contact support” button. If you still have trouble, send me an email with your tradingview user ID – via “Contact Us” and I will drop my contacts a message. Alternatively, metastock is also an excellent option and better configurable for multimonitor setups.

Thanks, Barry, for the intro to TradingView and QuantShare, which had not heretofore popped up on my radar. Taking a closer look at them. I am surprised that Amibroker is not included in your review, however. Though not free, it’s reasonably priced (i.e., it’s a one-time charge to buy, good for 2 years of upgrades, and then a reasonable annual fee for upgrades thereafter), and it has been well-known as one of the most robust platforms, on the technical side, for the building and backtesting of trading strategies and screeners for a long time. Granted, there is a learning curve getting up to speed on it’s well-designed programming language (AFL) if you are to make full use of it, but the same can be said for TradeStation’s Easy Language. Again, thanks for the reviews of some very promising software.

thanks for the feedback and details on AmiBroker, I will take a look at it for the next review.

I am just getting started and first contacted Apiaryfund which is exclusive for education about forex trading by Shawn Lucas where I loaded an analysis tech software called Alveo which I can use free for 30 days until a $97/mo fee is deducted. I don’t see that one in this analysis so trying to decide is a little overwhelming. Another analysis tool is a live trading signals provided by Trading Advantage for $3000 which includes, after dragging my feet, Options, Stocks, and day trading and for more you can branch out for more kinds of investments. The tools reviewed here seem much cheaper but it is hard to compare. Anybody have suggestions?

Hi Miguel, $97 per month is expensive for Trading Software. I guess these companies are throwing in training also. But seems expensive. If you want to trade forex, then a CFD broker would work out a lot cheaper. Usually the trading software MT4 & 5 is free. The Best FOREX Brokers review is here. Many of them have education, free software and analysts providing ideas and signals.

MetaStock on this list also have expert advisors and idea strategies (predeveloped systems). TradingView also have traders you can follow

$3000 also seems very expensive, I assume with that you get a live trading room also.

I have never used a live trading room I prefer to go it alone, and also I do not day trade, I buy great stocks as a portion of my portfolio and let em run until they make a lot of profit (e.g. NFLX I am up 77% since Dec 5 2017) or disappoint. It is easier money and less effort than day trading. I like to have a life.

I would suggest the PRO Training first – so you have a great understanding of investing and technical analysis – then if you want a trading room later using your own software – much cheaper go for that.

Its up to you

By the way, the stockstogo website has been hacked with malware. If says chrome is out of date, and kicks off an auto download of an .exe file call chrome, that my Browser (Chrome) says is malicious.

Everyone – do not go to that site.

I use to use Stockstotrade, and one day I go to log on and it said my account was suspended, I called and wrote customer services and they said it was do to Market Compliance inconsistencies. because they didn’t have any of my job info. I wrote back and explained I wasn’t working at the time. and for nothing they never wrote me back, no response no nothing. this mad me really upset, I was sitting there with the market about to open with this platform that suspended, my account for what I believe is bull sh1t. Also Stockstotrade wasn’t a very good platform anyway always shutting down on me at the worse times, it literally shutdowns on you every time you try to open a window or try to click on a ticker. for $200 dollars a month it was def not worth and I wouldn’t recommend to anybody, and everytime id bad mouth it on profitly Tim Sykes would threaten to kick me off the chat for life! Hey Tim its not my fault you platform is a piece of sh1t! why don’t you make it better instead if threatening people!

Hi Joseph, there certainly are a lot of RIP off stories in the markets. I heard of this guy, he certainly has some intense sales pitch. I think it is best you choose your own stocks and go with a professional discount brokerage to execute your trades. Try the book, the “little book that still beats the markets” over on https://www.liberatedstocktrader.com/top-20-stock-market-books-review/ it is a good read and give a taste of a half decent screening system of your own.

I have been using the paid version of stockcharts.com and am curious as to how it compares or ranked and a few of your thoughts

Hi Darren, well I did do a review of its free features over on this page. https://www.liberatedstocktrader.com/top-10-best-free-stock-charting-tools/

You can see how it compares to other free charting tools. For me it misses some backtesting features and customers indicators and charts. But I might be wrong. What are your views as to how it stacks up? Perhaps I will review it for the next round. Let me know.

Have you ever evaluated Stockopedia, based in the UK? If not please consider taking a look at themin the future.

Thanks.

Ron Wacik

Hi Ron, I never heard of it. I just had a quick look, seems to have some good functionality, but quite expensive. I will check deeper next round.

thanks Ron

Barry, I just took a look at tradingview and I have been around some years investing, it loooks great, nice find. thanks for the ideas.

thanks Jay glad you liked it

You should have listed the also rans and their rating just so we know what were covered and what were left out. Also, perhaps you can do the same for scanners both stand alone as well as part of packages like above.

Good idea, I will add it for the 2018 version coming soon, thanks TR

Hi,

until now I never used one of these services, but when it comes to screening, how does it work:

Do I have to put in My own details for a good setup, or is there any (?) software that suggests me its own ideas [many different types you can think of, from classical technical analysis over Elliot-Waves to c-stick patterns]?!

So when it only comes to this – screening – what would you say is the best software?

Thanks

Hi Andy, with the top packages you can screen on Fundamentals, e.g. Low PE, High EPS last quarter, increased revenue. You can also screen on technical analysis, price above 20 day moving average or stocks at 52 week low. It really depends on how you want to trade, on fundamentals or technicals or both. I prefer both. Stocks moving higher from a lower base, with good fundamentals. Both technical and fundamental work, and Metastock, TC2000 perform the job really well. If you are in the US and want to trade Fundamtals and technical via screening then TC2000 is really easy to use and very powerful. Metastock has powerful Advisor wizards for things like Elliot waves etc.