Day and swing trading use technical chart analysis to trade short-term price moves, whereas growth and value investing use long-term fundamental financial analysis.

The tools and strategies used for trading and investing are completely different.

Investing is a long-term strategy for wealth accumulation through buying and holding assets. Conversely, trading involves frequently buying and selling stocks to exploit market fluctuations for quick profits.

Key Takeaways

- Investing is a long-term strategy over years or decades.

- Swing trading, scalping, and day trading trades last from minutes to weeks.

- Trading carries a higher risk than investing.

- Market scanners, real-time news, charting software, backtesting, and AI bots are used by traders.

- Investors use stock research reports, financial screeners, and portfolio management tools.

Whether you trade or invest, we provide detailed, proven, and tested tactics and tools for each strategy.

Investing vs. Trading: Differences

While both investing and trading are methods of wealth accumulation, they are fundamentally different in their approaches. Investing is all about patience and persistence. Investors conduct thorough research to select assets that will likely increase in the long term. They are not perturbed by short-term market volatility and stay put with their investments for years or even decades, reaping the benefits of compound interest.

Trading, in contrast, is marked by frequent transactions and shorter holding periods. Traders capitalize on short-term price fluctuations to make quick profits. They employ rigorous technical and fundamental analysis to predict market movements. Like a sprinter, a trader focuses on speed and timing, while an investor, like a marathon runner, emphasizes endurance and the overall finish line more.

Investing vs. Trading Strategies

Investing has three core strategies: value, dividend, and growth investing. In contrast, trading strategies include position, swing, scalping, and day trading.

Each investing strategy targets different stocks: value investing – buying undervalued stocks; dividend investing – purchasing stocks for a regular income; and growth investing – buying fast-growing companies to maximize profits through share price appreciation.

Trading strategies, on the other hand, are short-term in nature. Position trading involves taking a long or short position and holding it for weeks, months, or even years.

Swing trading tries to capitalize on market swings by entering and exiting positions within days or weeks. Scalping is a strategy that seeks quick profits from small price changes by frequently opening and closing positions lasting minutes or seconds. Lastly, day trading involves opening and closing positions within the same market session.

Investing

Investing is a financial strategy that involves purchasing certain assets with the expectation that your money will grow over time. This long-term approach to financial growth involves several key processes.

Firstly, investors conduct meticulous research on various industries and companies to identify those likely to yield steady, reliable returns. This process often involves evaluating a company’s financial health and examining earnings, profits, cash flow, and debt levels.

Investors also consider the broader economic environment, including market trends, trade policies, and geopolitical events, which could impact the company’s performance. Once they identify promising investments, they buy these assets: stocks, bonds, mutual funds, real estate, or other investment vehicles.

Investing doesn’t stop at the buying stage. Investors continuously monitor their investments’ performance, though they tend not to react to short-term market fluctuations. Instead, they focus on their investments’ long-term potential, ready to hold assets for several years or even decades.

Investors understand the power of compound interest, where gains from their investments are reinvested for additional growth, creating a snowball effect over time. As a result, investing is often associated with building lasting wealth and planning for long-term financial goals, such as retirement or funding a child’s education.

A key aspect of investing is risk management. Investors diversify their portfolios, spreading their investments across different assets and sectors to mitigate potential losses. This strategy ensures that even if one investment performs poorly, others in the portfolio may perform well, balancing the overall returns.

Investing can be a solid strategy for anyone looking to grow their wealth and achieve long-term financial stability. The key is to start early, invest consistently, and have patience as your investments grow.

Value Investing

Value investing is a strategy that involves buying stocks that appear to be underpriced by some form of fundamental analysis. This method, pioneered by Benjamin Graham and David Dodd, two Columbia Business School professors, in the 1930s, is rooted in buying shares at less than their intrinsic value.

Value investors actively seek stocks they believe the market has undervalued. They consider stocks of companies that may have been overlooked by other investors or are suffering from temporary misfortunes. These investors meticulously analyze a company’s fundamentals, including earnings, dividends, sales, and book value, to determine its intrinsic value. They then compare this to its current market price.

If the market price is significantly lower than the intrinsic value, the stock is considered undervalued; how much it is undervalued is known as the margin of safety. This indicates a potential opportunity for value investing. The central belief here is that the market overreacts to good and bad news, resulting in stock price movements that do not correspond with a company’s long-term fundamentals. The overreaction offers an opportunity to profit by buying when the price is deflated.

However, value investing requires patience, diligence, and understanding of financial statements. It also comes with the risk that a stock may remain undervalued for a long period or be appropriately valued due to underlying issues not evident in the financial data. Despite these challenges, value investing can be a powerful strategy for long-term wealth creation, provided the investor is willing to spend the time and effort necessary to identify and capitalize on these opportunities.

Value Investing: Tools

Value investing requires a solid understanding of finance, accounting, and economics. Investors must be able to identify undervalued stocks by accurately assessing value drivers such as earnings, revenue growth, debt levels, and dividend yields. As such, investors should use the vast array of tools available to gain insights into markets and company performance.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Investors looking to take advantage of value investing should familiarize themselves with Stock Rover and Portfolio 123. I highly recommend Stock Rover; it has the best screening and research engine for value investing, including criteria like margin of safety, fair value, intrinsic value, and the Graham number.

Stock Rover’s Screening & Portfolio Tools Full Test & Rating

Portfolio 123 is a powerful tool for value investing, having built a comprehensive market information database. Not only does it offer pre-built screening criteria for value stocks, but its backtesting feature allows investors to determine whether their strategies are working by simulating portfolios with historical data.

Portfolio123 Review 2024: Our Testing Reveals a Top Screener

These tools can provide insights into markets and company performance while helping investors identify undervalued stocks that could be prime opportunities for long-term wealth building.

Additionally, investors can use stock screener tools, such as TradingView and Finviz, to quickly identify potential opportunities in thousands of stocks.

Value Investing: Resources

I have been researching, testing, and value investing for decades. You can find all the research, strategies, and screening criteria here.

Mastering Value Investing: A Complete Strategy Workbook +pdf

Dividend Investing

Dividend investing is a strategy that focuses on stocks’ income potential. This method involves buying shares in companies that regularly issue dividends, providing investors with a reliable source of income and helping to boost returns over time.

Dividend-paying stocks tend to have more stable prices than those without dividends. Investors are likelier to hold stocks that generate income even when the stock price dips, reducing the volatility in dividend-paying stocks.

When evaluating a stock for dividend investing, several factors should be considered. Investors should pay attention to the company’s dividend payment history and the relationship between dividends and earnings. Additionally, investors may use the dividend yield, the ratio of a stock’s annual dividend divided by its current market price.

Dividend investing can be a great way to generate income and build long-term wealth. However, it comes with certain risks that investors should keep in mind. These include potential dividend changes due to external factors like declining demand or rising interest rates and changes in a company’s financial health. Investors should always conduct thorough due diligence when investing in dividend-paying stocks.

Dividend Investing: Tools

Investors looking to take advantage of dividend investing should familiarize themselves with Stock Rover and Portfolio 123.

Stock Rover is my favorite investing platform. It provides a detailed analysis of dividend stocks, including yield calculations, dividend histories, and dividend forecasting.

Portfolio 123 offers a comprehensive screener, complete with backtesting, that allows investors to find quality dividend stocks across various sectors and countries.

Dividend Investing: Resources

Investors looking to further their knowledge in dividend investing should check out our thoroughly researched dividend investing strategy whitepapers.

Growth Investing

Growth investing focuses on stocks of companies that are expected to experience rapid revenue and sales growth over the coming years. These stocks may not be paying out dividends now, but they offer the potential for significant capital gains in the future. Growth investors look for businesses with strong product offerings, competitive advantages, and attractive markets.

When evaluating potential growth investments, it is important to research the company’s competitive landscape and product and pricing strategies. Investors should also monitor market trends that may affect the potential for growth in a particular industry or sector.

Although growth investing carries a higher risk than dividend or value investing, it also offers potentially greater rewards. As such, investors looking to maximize their returns over the long term may consider allocating some funds to growth stocks.

Growth Investing: Tools

Investors looking to implement a growth stocks strategy should look at our Market Outperforming Stock ETF System (MOSES), which is integrated into Stock Rover. MOSES is a quantitative system that can identify stocks on the verge of accelerating growth with superior performance relative to their peers.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Portfolio 123 also provides extensive resources for growth investors. Its screener allows users to build customizable strategies, and its backtesting feature lets them determine whether their strategies provide consistent returns over time.

Growth Investing: Resources

Ever Dreamed of Beating the Stock Market

Most people think that they can't beat the market, and stock picking is a game only Wall Street insiders can win. This simply isn't true. With the right strategy, anyone can beat the market.

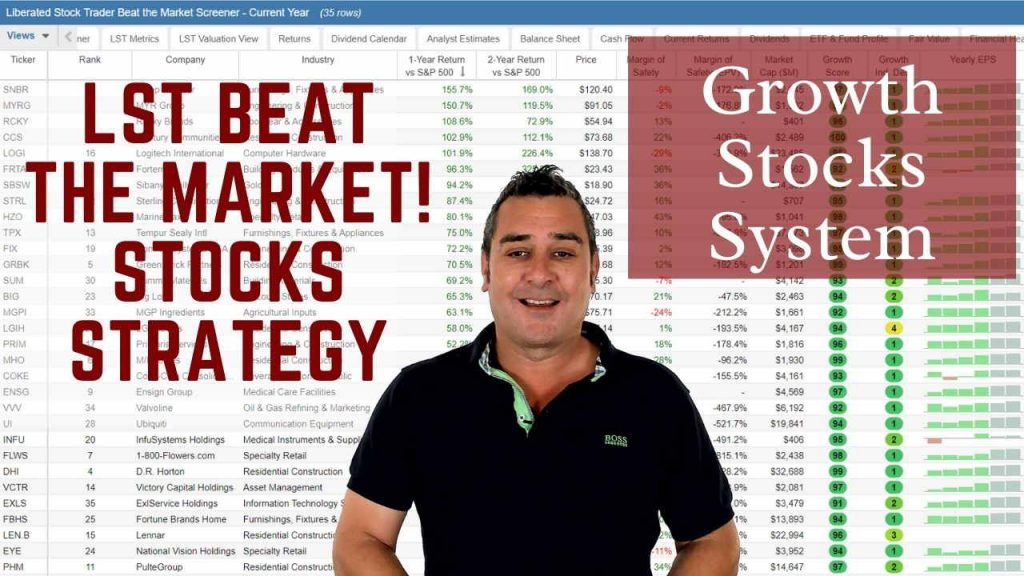

The LST Beat the Market Growth Stock Strategy is a proven system that has outperformed the S&P500 in 8 of the last 9 years. We provide all of the research and data needed to make informed decisions, so you no longer have to spend hours trying to find good stocks yourself.

The LST Beat the Market System Selects 35 Growth Stocks and Averages a 25.6% Annual Return

★ 35 Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months - Then Rotate ★

★ Fully Documented Performance Track Record ★

★ Full Strategy Videos & eBook ★

Take The Pain Out Of Stock Selection With a Proven Strategy

Trading

Trading strategies are broadly categorized into position, swing, scalping, and day trading, each with unique tactics and approaches. All these strategies typically involve chart pattern and indicator analysis.

Day Trading

Day trading is an active strategy that involves taking positions in securities over a single day to close out those positions before the trading day ends. Day traders typically use technical analysis tools like candlestick patterns and chart patterns to identify short-term trends and profitable opportunities.

This approach carries a higher risk than most strategies due to its short-term trading window. It also requires the availability of capital to make multiple trades throughout the day. Day traders may employ margin or leverage when taking positions, amplifying profits and losses.

Day Trading: Tools

Tools utilized by day traders include market scanners that can quickly identify stocks with high-volume trading activity or unusual price movements. They may also use streaming news services to stay up-to-date on breaking events that could affect their positions.

We recommend Trade Ideas, Benzinga Pro, or TrendSpider for day trading.

If you are going for the adrenaline of day trading, remove some risks by having AI on your side. The Trade Ideas AI engines spot 3 to 5 high-probability trades per day. Each trade lasts only a few minutes to hours, perfect for day traders.

Some day traders prefer to trade real-time news events; this is where Benzinga Pro excels. Benzinga Pro provides the fastest and most cost-effective real-time news, analysis, and market insights to help news traders stay ahead of the competition.

Finally, TrendSpider offers powerful real-time candlestick chart pattern recognition, multi-timeframe pattern recognition, and indicators to aid in identifying potential entry and exit points for day trading positions. It also features a backtesting engine that tests different strategies over various timeframes.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Day Trading: Resources

If you try day trading, you should use only proven indicators and candlestick patterns. We have performed detailed scientific backtesting on patterns and charts. Here are our favorite resources.

11 Accurate Day Trading Indicators Tested & Proven with Data

Swing Trading

Swing trading involves taking positions on stocks over days or weeks to capitalize on short-term price movements. Swing traders typically use technical analysis tools, such as trend lines and chart patterns, to identify possible buying and selling points for their investments.

This strategy requires frequent market monitoring and quick decision-making when opportunities arise. As such, it is well suited for investors who have the time and energy to trade daily.

Swing traders typically employ a stop-loss order to limit potential losses in case of price drops. This feature allows swing traders to exit their investments quickly if their analysis proves incorrect. Additionally, they may use margin or leverage when taking positions, amplifying gains and losses.

Swing Trading: Tools

Swing traders utilize real-time stock price charts, technical indicators, and real-time news. The three tools I recommend for swing traders are TrendSpider, TradingView, and Benzinga Pro.

TrendSpider offers automated chart patterns and trendline recognition and is the best backtesting engine in the industry.

TradingView is another great tool for swing traders. It offers powerful technical analysis charts, backtesting, indicators, and the world’s largest trading community.

Finally, Benzinga Pro is an excellent resource for swing traders with real-time news, filters, and alerts. This platform provides traders with critical market information to help them stay ahead of the competition.

Swing Trading: Resources

Scalping

Scalping is an aggressive trading strategy that involves buying and selling stocks multiple times daily to capture minor price movements. This strategy requires quick decision-making, high trading frequency, and the availability of funds for frequent trades. Scalpers typically take advantage of tiny discrepancies in the market by buying and selling within seconds or minutes of each other.

Because scalping is so active, it carries greater risk than other trading strategies. Additionally, scalpers need to consider the cost of commissions and fees when calculating potential gains or losses.

Scalping: Tools

Scalpers utilize tools such as stock scanners, which can rapidly sort through thousands of stocks to identify potential trades. They may also use charting software to watch for patterns in real-time market data, such as price spikes or dips.

To be competitive in scalping, there is only one game in town: Trade Ideas. Trade Ideas provides three industry-leading AI algorithms that identify and automatically trade scalping trades. You have to see it to believe it.

Scalping: Resources

Position Trading

Position trading is a style of investing that involves holding securities for long periods, often months to years, with the expectation that they will appreciate. This strategy is based on a thorough analysis of various economic indicators, market trends, and the financial health of the company in question.

Short-term market fluctuations do not sway position traders. Instead, they focus on their investment’s long-term performance, relying on the overall direction of the trend rather than short-term ups and downs. This method requires patience, as returns might not be seen immediately, but it can provide substantial gains over time if the trader’s analysis is correct.

This trading style is less stressful than short-term strategies, like day trading or swing trading, as it does not require constant market monitoring. However, it does necessitate a comprehensive understanding of economic factors, industry trends, and company financials. Position traders must also be emotionally disciplined to stick to their plan, even when short-term market movements suggest otherwise.

While position trading presents the potential for significant returns, it is not without risks. These include potential losses due to unforeseen market events, such as economic downturns or company-specific negative news. Therefore, it’s crucial for traders to carefully analyze their investments and be prepared to adjust their position if the long-term trend changes.

Position Trading: Tools

Investors looking to employ a position trading strategy should refer to TradingView. TradingView offers powerful technical analysis tools, including real-time charts, pattern recognition, candlestick recognition, and a broad suite of indicators, moving averages, and Bollinger Bands. It also provides alerts so traders can track market movements and adjust their positions accordingly.

Trendspider is an excellent tool for traders to utilize when looking for potential entry and exit points. Trendspider offers automated chart pattern recognition as well as advanced technical indicators. Additionally, the platform provides analysts sentiment analysis, which can provide valuable insights into investor sentiment around a particular stock.

Finally, The Motley Fool’s Stock Advisor newsletter is a great resource for position traders. This service provides exclusive access to market-beating stock picks and detailed analysis of potential investments, which can be invaluable assets for traders looking for long-term winners.

Position Trading: Resources

In addition to their choice of strategy, traders also need to pay attention to market conditions and news events that could affect their positions. This includes economic data releases, company financials, and geopolitical events that could cause shifts in market sentiment.

Staying up-to-date on these developments can help traders decide when to open or close a position. Furthermore, reducing emotional trading and sticking to the plan is key to successful investing and trading. Professional traders often develop detailed strategies before entering the market and adhere to these plans even in the face of unexpected industry changes.

Final Thoughts

Overall, investing and trading are two distinct ways of approaching markets that require different dedication and risk tolerance levels. Investors looking for higher returns over the long term may benefit from strategies like growth investing or position trading, while those seeking short-term gains may opt for swing trading, scalping, or day trading. No matter which approach is taken, it’s important to understand all the risks associated with each strategy and only invest money you can afford to lose.

Next Steps

Take the next step in your trading journey and unlock your full potential with the Liberated Stock Trader Pro Training. This comprehensive training program will equip you with the practical skills and knowledge to navigate the markets confidently. It can help you reach your financial goals, whether you are just starting out or looking to enhance your trading strategy.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

FAQ

What is the difference between investing and trading?

Investing involves holding assets for a long period, often years, to achieve incremental gains over time. Trading involves buying and selling assets more frequently, aiming for short-term profits based on market fluctuations.

What are some common investing strategies?

Common strategies include growth, dividend, and value investing. These focus on long-term growth through stock price growth, dividend payouts, or identifying undervalued assets.

What are common trading strategies?

Day trading, swing trading, and scalping are popular trading strategies. These involve frequent trades based on short-term price movements.

What tools do long-term investors use?

Smart long-term stock investors will typically use a zero-commission brokerage combined with Stock Rover. Stock Rover provides financial analysis, screening research reports, and portfolio management tools to manage their investment performance.

What tools do traders use?

Traders rely on automated trading software, AI-powered day trading platforms, or technical analysis charting software. The most experienced traders will use powerful backtesting software to develop a unique strategy.

Is investing or trading riskier?

Trading is much riskier than investing. For investors, the long-term direction of the stock market is up. For short-term day traders, stock prices have a high element of randomness. Our research shows chart patterns pasting month can be up to 90% successful, while the best short-term candlestick patterns are only 61% profitable.

Can I do both investing and trading?

Yes, many individuals engage in both activities, trading for short-term gains and investing for long-term wealth accumulation. Smart investors will use 10% of capital for trading, and 90% is invested for the long-term in lower-risk broad market ETFs.

What is day trading?

Day trading is a strategy where traders use candlesticks, volume, momentum, and indicators to buy and sell assets within the same trading day, aiming to profit from short-term price movements.

What is swing trading?

Swing trading is a strategy where traders use chart patterns, trends, and momentum to hold positions for days or weeks, aiming to profit from short-to-medium-term price movements.

What is scalping in trading?

Scalping is a high-risk trading strategy where traders aim to profit from very short-term price changes, often making dozens or hundreds of trades per day. Independent traders should not attempt this strategy, as it is dominated by super-computers at the exchanges.

What is value investing?

Value investing is a strategy where investors buy stocks they believe are undervalued by the market, expecting them to increase in value over time.

What are technical indicators in trading?

Technical indicators are mathematical calculations based on an asset's price, volume, or open interest that traders use to predict future price movements. Many technical indicators do not work, but we have tested and discovered the most profitable chart indicators.