Rolex is one of the world’s leading luxury watch companies, renowned for its exquisite timepieces and sophisticated craftsmanship. But can you invest in Rolex stock? What are other good alternatives?

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

Rolex Stock

Rolex stock is not available to buy on any stock exchange. No publicly available Rolex stock exists because Rolex SA is a privately held company 100% owned by The Hans Wilsdorf Foundation, a Swiss charity.

Rolex was founded by Hans Wilsdorf, and upon his death in 1960, he transferred his wealth and 100% ownership of Rolex to the Hans Wilsdorf Foundation.

There is an Indian stock called Rolex Rings Ltd (NSE: ROLEXRINGS). This stock represents an Indian auto parts manufacturer that has nothing to do with the Swiss watch company.

Note: This is an unbiased research report. The author or Liberated Stock Trader is not affiliated, paid by, or owns stock in any of the companies mentioned in this report.

Is Rolex on the Stock Market?

There are no Rolex shares on the stock market because the company is 100% privately held by the Hans Wilsdorf Foundation. This charity invests Rolex profits in conservation and scholarships for the underprivileged.

Rolex Stock Price

There is no Rolex stock price because Rolex has never had an IPO and has not floated on any stock exchange. However, the Rolex brand value is estimated at $8.35 billion, which can indicate the stock’s value.

Rolex Stock Symbol

No Rolex ticker symbol exists because Rolex SA stock is not available on any stock market. There is an Indian auto parts company with the ticker ROLEXRINGS; however, this is not the Swiss Watch Maker.

Why is Rolex not on the Stock Market?

Rolex does not need to offer public stock because Rolex is an incredibly successful luxury brand that does not need external financing. The Hans Wilsdorf Foundation retains 100% ownership and control of the company.

Private ownership means Rolex does not need to answer to shareholders and can make better long-term decisions without external interference.

Rolex does not offer stock because staying private gives management more control over the business. Staying private allows Rolex to keep its finances private and not divulge its sales figures or production costs.

Rolex IPO

There are no plans for a Rolex initial public offering (IPO) because the Hans Wilsdorf Foundation is charged with keeping the company private to preserve its unique business model. Rolex will not hold an IPO if the business makes money as a private company.

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

5 Great Alternatives to Rolex Stock

Ferrari, Kering, LVMH, Hermes, and Nike are three good alternatives to investing in Rolex stock.

1. Ferrari NV (NYSE: RACE)

Most people cannot afford a Ferrari, but they can buy Ferrari (RACE) stock. Like Rolex, Ferrari’s value comes from its brand.

Brand Finance named Ferrari the world’s strongest brand in 2020, with a Brand Strength Index (BSI) score of 94.1 out of 100. Ferrari was one of just 12 brands with an AAA+ rating.

View the Ferrari Chart Live On TrendSpider

Ferrari was Brand Finance’s strongest auto brand for seven years in a row. However, Ferrari was Europe’s second-strongest brand, with a Brand Index Score of 92.3 and an AAA+ brand rating in January 2022. Statista named Ferrari the fifth most valuable Italian brand, with a brand value of $8.34 billion in 2022.

Ferrari is a growing company. Its global net revenue grew from €3.460 billion ($3.72 billion) in 2020 to €4.271 billion ($4.59 billion) in 2021, Statista estimates.

Ferrari resembles Rolex because it has a carefully protected brand with a reputation for quality and luxury. Like Rolex, Ferrari makes a few high-quality products by hand and sells cars at a high price. Statista figures show Ferrari shipped 11,155 cars in 2021.

Ferrari caters to a growing market of millionaires like Rolex. Both Rolex and Ferrari are Formula One sponsors. Ferrari is the publicly traded company that most resembles Rolex.

2. Kering SA (Euronext Paris: KER-FR)

Kering owns the world’s most iconic and valuable luxury brands, including Gucci, Yves Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Qeelin, Montblanc, Dunhill, and ALAÏA.

Kering SA, the French luxury group known for brands like Gucci, Yves Saint Laurent, and Bottega Veneta, has shown impressive company performance in recent years.

For 2022, Kering SA reported a very solid performance with mixed results in the fourth quarter. The group’s revenue was up 30% on a comparable basis, confirming a strong year despite some headwinds. Kering Eyewear’s 2022 revenue broke through the billion-euro mark, up 58% as reported and up 27% on a comparable basis, to €1.1 billion.

In the first half of 2023, Kering Eyewear’s recurring operating income rose sharply to €186 million. However, the company had to account for corporate costs of €123 million, which impacted the overall financial results.

Kering SA’s recent performance has been strong, with significant growth in key segments like luxury eyewear. The company’s ability to maintain growth and profitability in a competitive luxury market showcases the strength of its brand portfolio and business strategy.

3. LVMH Moët Hennessy Louis Vuitton

LVMH (Moët Hennessy Louis Vuitton SE) is a French multinational conglomerate and the world’s largest luxury goods company headquartered in Paris, France. The company is a diversified luxury goods group with dozens of highly recognizable brands. Their portfolio includes fashion and leather goods (Louis Vuitton, Fendi, Celine), wines and spirits (Dom Perignon, Hennessy Cognac), perfumes and cosmetics (Givenchy, Guerlain, Christian Dior), jewelry and watches (TAG Heuer, Bulgari), select retail stores (Sephora, Le Bon Marche), and other luxury goods.

LVMH is focused on innovation and customer engagement to drive growth across its brands. The company employs over 130,000 people in more than 100 countries.

LVMH is a holding company that owns 75 luxury product brands. They divide the LVMH business into six “houses.” Each house specializes in a specific area of luxury products. The houses include:

- Wines & Spirits

- Fashion & Leather Goods

- Perfumes & Cosmetics

- Watches & Jewelry

- Selective Retailing

- Other Activities

Sephora is part of the selective retailing group LVMH, which operates over 5,000 stores worldwide. LVMH owns legendary luxury brands, including Louis Vuitton, Christian Dior, Tiffany & Co., Château Cheval Blanc, TAG Heuer, Maison Kenzo, Virgil Abloh, and Krug.

4. Hermes International (Euronext Paris: RMS)

Hermes International is a French luxury fashion house specializing in leather and lifestyle accessories. Founded in 1837 by Thierry Hermes in Paris, it is one of the oldest firms still in existence today. The company is renowned for its high-quality, handcrafted products, such as leather handbags, clothing, shoes, jewelry, perfume, silk scarves, ties, and watches.

Hermes has a long history of producing some of the most coveted items in the luxury world. Thierry’s sons Emile and Charles took on the family business after he died in 1892 and continued to expand their reach into different areas of fashion.

Over the years, Hermes has become an international powerhouse with stores across Europe, Asia Pacific, and America selling their premium clothing lines from casualwear to couture pieces, embodying the same philosophy: an appreciation for fine craftsmanship. Alongside this, they have also established strong roots within philanthropy, contributing to various charities.

5. Nike Inc. (NYSE: NKE)

Nike (NKE) is an iconic brand that dominates a category of consumer goods, like Rolex. Nike’s advantage over Rolex is its far larger consumer base.

Nike sells luxury products, shoes, and athletic apparel that middle and working-class people can afford. This gives Nike more revenue, brand value, and growth potential than traditional luxury brands such as Rolex and Ferrari.

Brand strength is Nike’s most valuable asset because it creates an enormous customer base. Around 61% of UK men love Nike, and this love drives sales. In 2023, 8.59 million Britons wore Nike shoes and apparel, and 5.3 million bought Nike products. Nike’s UK e-commerce footwear store generated £93.1 million ($112.54 million) in net sales.

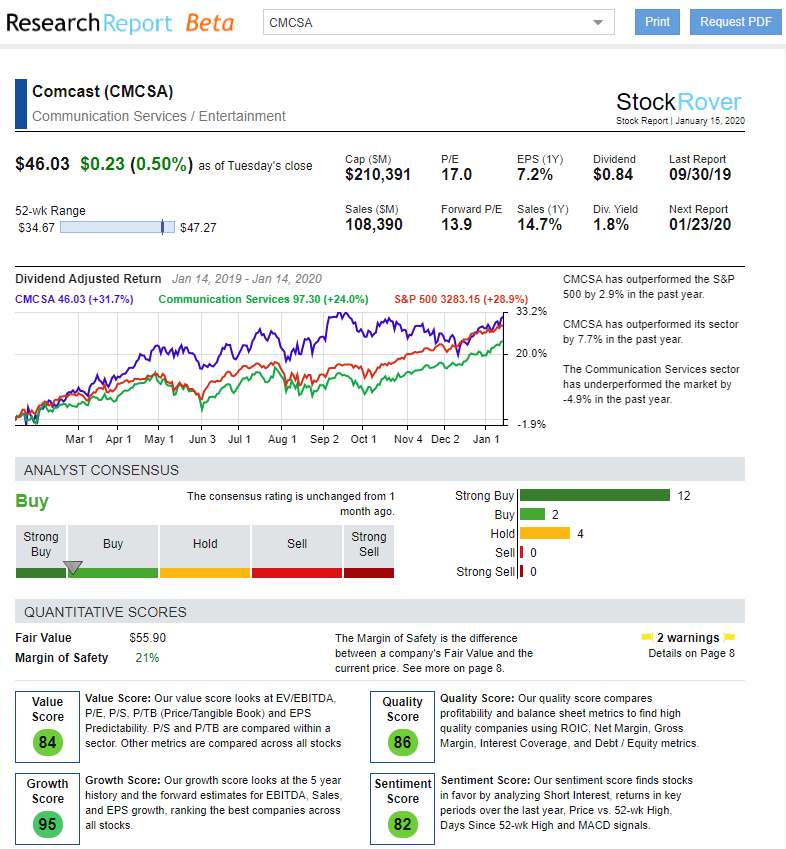

Download a Free Nike Stock Research Report From Stock Rover

Another advantage to Nike is that it pays dividends. Nike has scheduled eight 34₵ quarterly dividends between 31 March 2023 and 2 December 2024. If you want a luxury stock that can reach a mass market, Nike is worth examining.

Why Rolex Would Be A Great Investment

Rolex’s value proposition is brand value, which was $8.35 billion in 2022. It rose from $7.938 billion in 2021 to $5.927 billion in 2015.

Brand value comes from Rolex’s reputation for scarcity and quality. People pay extra for Rolex watches because they view it as a symbol of luxury and quality. Rolex’s history of selling watches to explorers, movie stars, top athletes, and celebrities enhances the mystique.

To maintain that reputation, Rolex sponsors elite sports, including golf, Formula 1 racing, tennis, and yachting. Beyond sports, Rolex sponsors cultural events such as the Academy Awards, the Opera de Paris, the Metropolitan Opera, the Royal Opera House, the Salzburg Festival, and the Vienna Philharmonic.

Rolex’s strategy pays off. Rolex is the world’s leading luxury watch brand, with $8.8 billion in turnover in 2021. Morgan Stanley estimates Rolex’s 2021 revenues to be 8.05 billion Swiss Francs ($8.72 billion). Luxury Launches estimates Rolex’s 2021 retail watch sales to be 12 billion Swiss Francs ($13 billion).

Rolex: Luxury, Quality, Scarcity

Rolex is the world’s most famous and successful luxury watch brand. Rolex watches have become iconic because of the company’s commitment to quality and design.

Nobody besides the brand’s management knows how many watches Rolex makes because the company does not divulge sales information. Morgan Stanley and LuxeConsult estimate Rolex made 1.05 million watches in 2022.

Scarcity

Rolex sales comprised 28.8% of the Swiss watch market in 2022, up from 22% in 2019. Demand for Rolex watches exceeds supply. Dealers and customers complained of a shortage of Rolex watches in 2021. Critics charge Rolex keeps watches scarce to drive up prices. Business Insider notes that Rolex denied these charges in a September 2021 press release.

“The scarcity of our products is not a strategy on our part,” the Rolex press release states. “Our current production cannot meet the existing demand exhaustively, at least not without reducing the quality of our watches–something we refuse to do as the quality of our products must never be compromised.”

Quality

Rolex claims the watch supply is small because of its high-quality production methods. They make all Rolex watches by hand in Switzerland. Rolex does not scrimp on materials or quality.

They make Rolex cases from expensive, hard-to-machine steel because they look and age better. Rolex uses a special steel called 904L for watch cases. 904L steel is more rust—and corrosion-resistant and polishes well. When they adopted 904L steel, Rolex had to replace many of its machines and tools.

Rolex processes its gold in its foundry, which allows it to use its 18-karat Everose gold, which is non-fading, in all watches. Rolex also processes all of its platinum in-house.

Rolex operates several science labs to develop new materials and technologies and maintain quality. Despite the labs, all Rolex movements are assembled by hand to maintain quality.

They test all Rolex Oyster dive watches in pressured water tanks to verify water resistance. Rolex’s Submariner watches are water resistant to a depth of 300 meters. They even developed a special high-pressure water tank to test Rolex watches. The Rolex Deep-Sea watches are pressure-tested to a depth of 12,000 meters.

Luxury

Another way Rolex maintains quality is by testing all the gems they use in the watches. They test every precious stone to ensure it is real.

The manufacturing process is so rigorous it takes Rolex one year to build a watch. The process takes a long time because Rolex makes everything in-house.

The commitment to quality allows Rolex dealers to charge high prices. Rolex Submariner Dates can sell for $26,165, and Rolex Lady Datejust Automatics can sell for $30,550. A Rolex Cosmograph Daytona can sell for $119,000.

The Rolex watches are so iconic they comprise around 75% of the used watch market. Rolex sells pre-owned watches because the used watch market was $17 billion in 2019.

Rolex watches are so popular they are the third-most counterfeited item worldwide, behind Nike sneakers and Gucci handbags. Crooks counterfeit Rolex watches because of the price. US Customs and Border Protection agents seized 460 fake Rolex watches worth $10.1 million in April 2022.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters