TradingView is the most popular investing platform on the planet. But why do over 20 million traders use it?

My 2025 testing awards TradingView 4.8 stars due to its continued innovation in chart analysis, pattern recognition, screening, and backtesting. TradingView is my top recommendation for US and international traders.

As an 8-year paid subscriber to TradingView, I rely on it daily and have extensive experience with the platform. In this overview, I’ll break down its free and premium features, offering insights on how they compare to its top competitors.

TradingView Test Results & Ratings

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

My Verdict

My testing shows TradingView is best for international stock, FX, and cryptocurrency traders. It’s the ultimate all-rounder with a global community, heatmaps, broker integration, pattern recognition, backtesting, and screening.

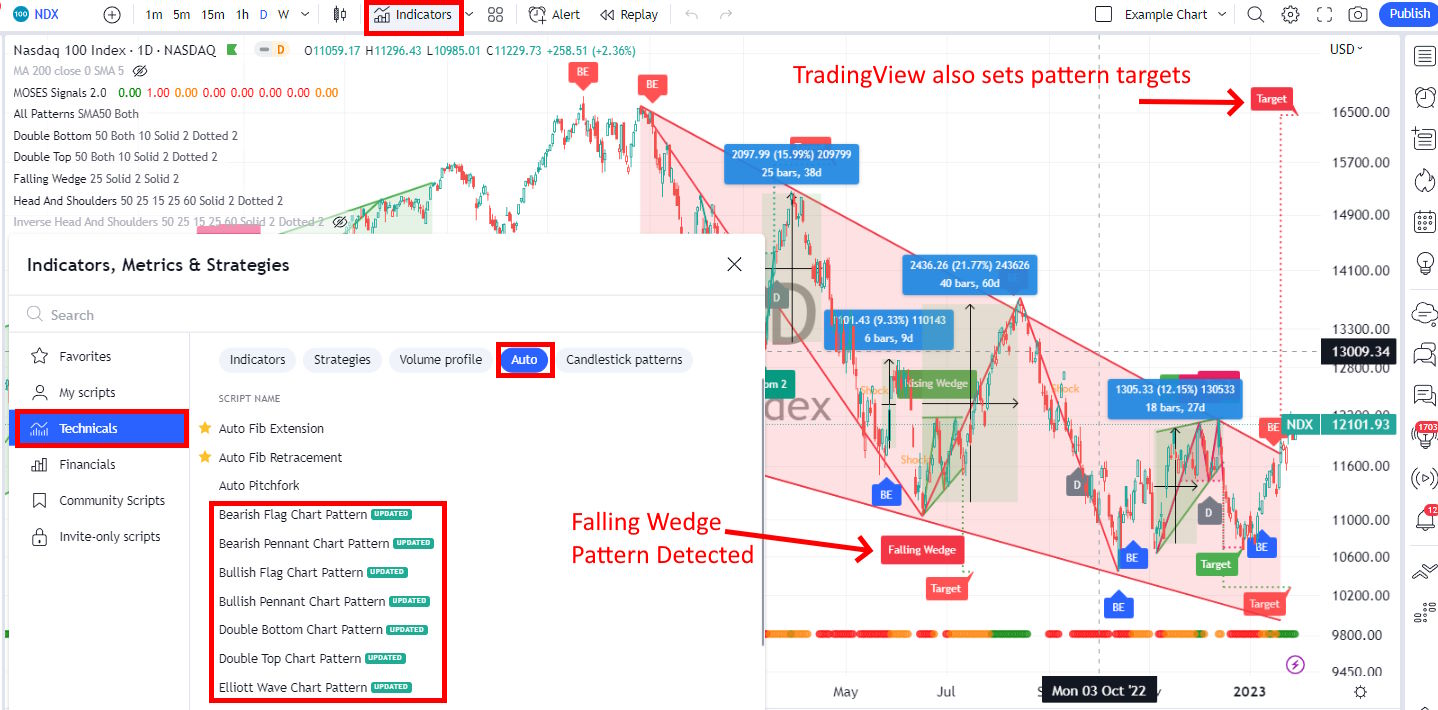

It automatically identifies chart and candlestick patterns, making it incredibly useful for technical analysis.

Additionally, TradingView offers excellent backtesting capabilities and a thriving trading community, making it a great choice for international traders.

TradingView’s powerful scanning and charting software appeals to day and swing traders. However, if you want to implement long-term growth, dividend, or value investing strategies, consider my alternatives to TradingView.

With excellent social integration, chat, news, and the ability to follow other investors and share trade ideas, combined with global stock exchange data, TradingView is the worldwide leader in stock charting analysis.

Key Features

| ⚡ TradingView Features | Charts, News, Watchlists, Screening, Chart Pattern & Candlestick Recognition, Full Broker Integration |

| 🏆 Unique Features | Trading, Backtesting, Community, Global Stock, FX & Crypto Markets, Webhook Bot Integration (with Signal Stack) |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free | $13/m to $49/m annually |

| 🆓 Free | Try TradingView’s Free Plan |

| 💻 OS | Web Browser|PC|IOS|Android |

| 🎮 Trial | Yes, Free 30-Day Premium |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Region | Global |

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.

Compared to Similar Products

When comparing TradingView to TrendSpider, MetaStock, and Trade Ideas, my research shows that it is the best overall stock analysis software passing 9/11 tests. However, for automated stock chart analysis, backtesting, and automated bot trading, TrendSpider is better. Stock Rover is better than TradingView for long-term growth, dividend, and value investors. For AI-driven robotic day trading, Trade Ideas is better. For trading real-time news, Benzinga Pro is a better alternative.

| Features | TradingView | TrendSpider | Trade Ideas | MetaStock |

| Rating | 4.8 | 4.8 | 4.6 | 4.4 |

| Pricing | Free | $13/m to $49/m annually | $107/m or $48/m annually | $254/m or $178/m annually | MetaStock R/T $100/m, Xenith $265/m |

| Global Market Data | ✔ | USA | USA | ✔ |

| Powerful Charts | ✔ | ✔ | ✘ | ✔ |

| Stocks | ✔ | ✔ | ✔ | ✔ |

| Futures | ✔ | ✔ | ✘ | ✔ |

| Forex | ✔ | ✔ | ✘ | ✘ |

| Cryptocurrency | ✔ | ✔ | ✘ | ✘ |

| Social Community | ✔ | ✘ | ✔ | ✘ |

| Real-time News | ✘ | ✘ | ✘ | ✔ |

| Screeners | ✔ | ✔ | ✔ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ |

| Code-Free Backtesting | ✘ | ✔ | ✘ | ✘ |

| Automated Analysis | ✔ | ✔ | ✔ | ✔ |

Pricing

TradingView pricing starts at $0 for the Basic ad-supported plan and includes screening, charting, trading, scripting, and three indicators per chart. The Free plan is a great way to test the service, but it is also ad-supported, which can be annoying.

TradingView Essential costs $14.95/mo and is ad-free. It includes two charts per layout, five indicators per chart, and 20 alerts. It also enables access to the full social network. The Pro plan is ideal for beginner and intermediate traders wanting more flexibility.

TradingView Plus (Recommended) costs $29.95/mo and includes ten indicators per chart, 100 alerts, and ten chart layouts. It is for intermediate to demanding traders who want the best balance of functionality and price.

TradingView Premium costs $59.95/mo, and targets experienced traders who want unlimited functionality and the ability to develop and publish indicators and trading strategies for their clients.

I use the Premium plan to develop indicators, scripts, and strategies. Still, I recommend TradingView Plus to most traders because it has the right balance of features and cost.

TradingView Pricing vs. Competition

| Pricing | Free | Pro | Ranking |

| TradingView | ✔ | Free | $13/m to $49/m annually | #1 |

| TrendSpider | ✘ | $107/m or $48/m annually | #2 |

| Trade Ideas | ✘ | $254/m or $178/m annually | #3 |

| MetaStock | ✘ | MetaStock R/T $100/m, Xenith $265/m | #4 |

As you can see, TradingView is the price leader in every category, but ultimately, it depends on what you are looking for. If you want an intraday spread and custom charts, go for the Plus plan.

Is TradingView Free?

Yes, TradingView is free, and unlike other stock charting software, you can perform stock analysis and screening and read community ideas for no charge. However, the free tier is ad-supported, and you can only save one chart in a single workspace.

Is TradingView Real-time?

Yes, TradingView provides real-time exchange data if you subscribe to any of the Premium services. Most exchanges charge extra for real-time data, but TradingView’s real-time data costs are the lowest in the industry, charging only $2 per month per exchange, compared to competitors charging $10 to $15.

Is TradingView Premium Worth It?

TradingView Plus and Premium are absolutely worth the investment. These plans unlock advanced features like multiple indicators, charts, and alerts while granting full access to the community. They also empower users with enhanced tools for more effective and comprehensive technical analysis.

How to get TradingView Premium for Free

You can access TradingView Premium for free! Sign up for a 30-day free trial of TradingView and enjoy full access to all Premium features at no cost. Take advantage of this opportunity to explore everything TradingView has to offer!

Trading

Tradingview integrates with over 50 brokers for stocks, futures, Forex, and CFDs. TradingView in the USA provides broker integration with TradeStation and Interactive Brokers for stocks. In Europe, you have integration FXCM and Saxo Group for currency and CFD trading.

TradingView pulls data from 13 American stock exchanges, nine European exchanges, and 30 Asian exchanges. It also covers all major cryptocurrency exchanges, foreign exchange, and commodity futures markets.

With TradingView, you can trade stocks and indices globally and all the major and minor foreign exchange currencies. Additionally, one can trade energy, metals, agriculture futures, and all major cryptocurrencies.

- Stocks – 90% of the world’s stock markets covered.

- Forex (FX) Currencies – All the Major, Minor, and Exotic currencies covered

- Futures – Energy, Metals, Agriculture, Indices, and even Interest Rates

- Crypto Currencies – 26 including Bitcoin, Ripple, Ethereum, Bitcoin Cash

- Bonds – 30+ Government Bond Types

Screening

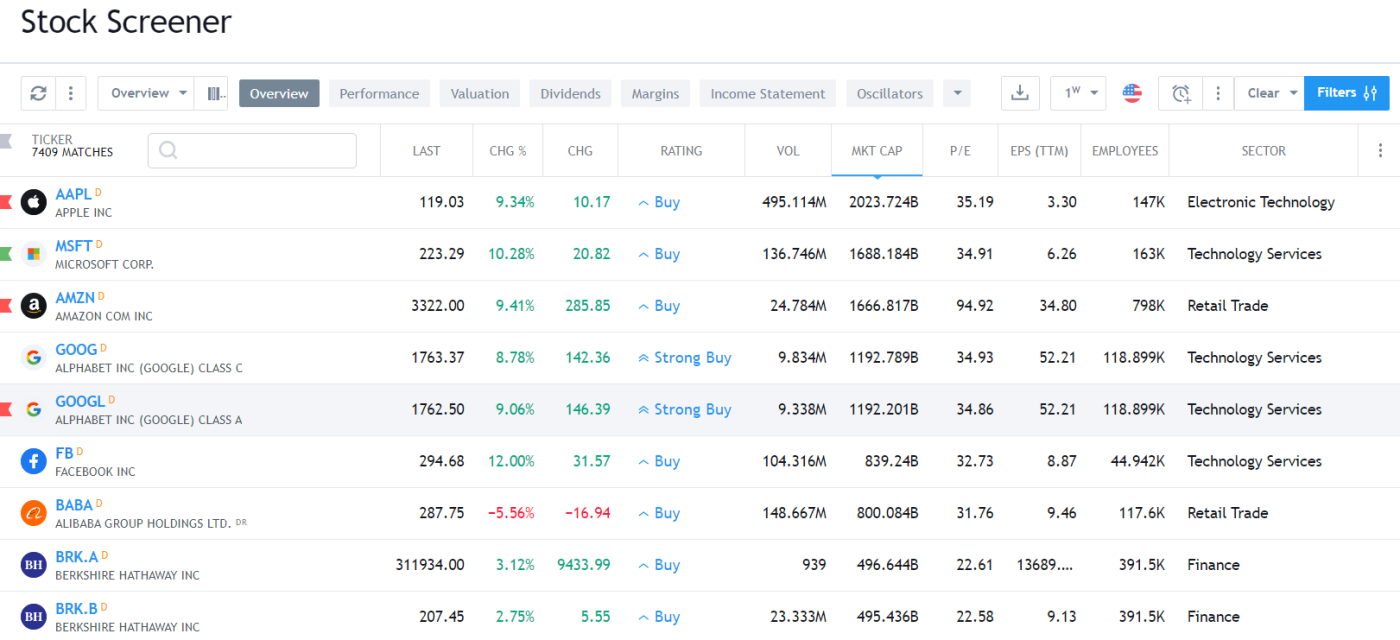

Testing the TradingView stock screener shows it excels at screening for technical indicators. It provides real-time scanning and filtering on 172 metrics, including 42 financial filters. TradingViews stock screener also includes a useful scan for technical buy and sell ratings.

TradingView’s screening watchlists have fundamental data separated into Performance, Valuation, Dividends, Margin, Income Statement, and Balance Sheet. TradingView stands out with its charting of economic indicators, for example, comparing the civilian unemployment rate versus the growth in company profits. You can set the screening watchlist and filters to refresh every minute.

Another great thing about the screener implementation is that it is very customizable; you can configure the columns and filters exactly how you like them. As you can see above, I have changed the overview screen to include the number of employees, P/E, and EPS TTM.

Forex & Cryptocurrency Screeners

TradingView’s Forex screener shows the major and minor pairs by default, and you can add exotic FX pairs. You can also filter on rising and falling FX pairs and set alerts directly from the screener.

What is unique here is the availability of screeners for chart patterns and setups for TradingView foreign exchange pairs, making it very valuable for day traders searching for volatility and leverage.

The ability of TradingView to also provide crypto screening is unique. The cryptocurrency rating system enables you to select the cryptos rated as “strong sell” to use as candidates for short trades and strong buys as candidates for long trades, saving you a lot of time.

Technical Analysis & Charts

With over 160 different indicators and unique specialty charts such as LineBreak, Kagi, Heikin Ashi, Point & Figure, and Renko, you have everything you need as an advanced trader, day trader, or swing trader. I have a Premium membership and get fully integrated Level II data and insight.

TradingView has an exceptional selection of 65 chart drawing tools, including those unavailable on other platforms like extensive Gann and Fibonacci, plus hundreds of icons for your charts, notes, and ideas.

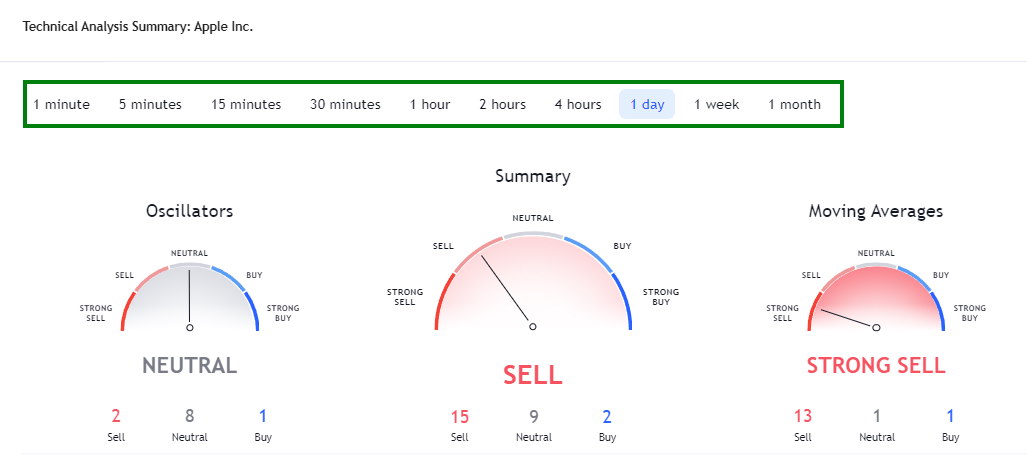

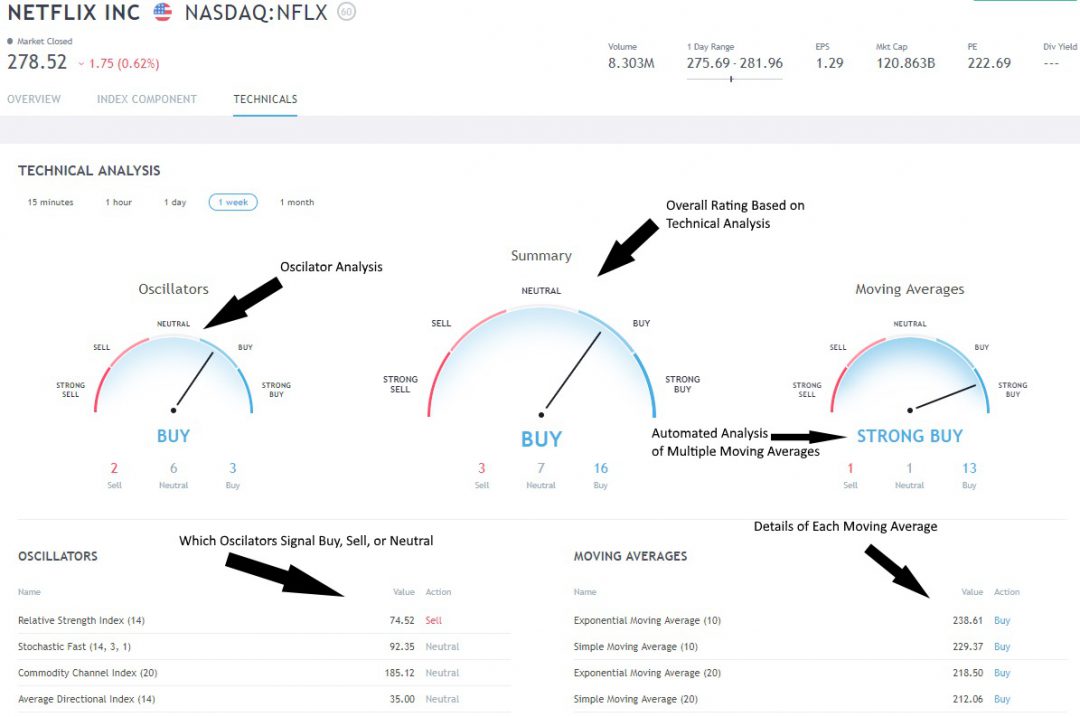

Automatic Stock Indicator Ratings

Most people do not want to learn in-depth how each indicator works. This innovation allows you to save time by getting an instant readout of which indicators are bullish, bearish, or neutral.

The stock indicators ratings are well implemented because there are two critical technical analysis indicators: moving averages based on price and oscillators based on price and volume. Based on my observations, the TradingView buy and sell indicators are a good measure of sentiment and are featured in my Fear & Greed Index Dashboard.

When viewing a chart, click “Technicals,” and you are presented with three gauges. The left gauge shows the oscillating indicators like relative strength, stochastics, and the Average Directional Index. On the right, you have a selection of Moving Averages, Simple, Exponential, and even Ichimoku Cloud.

Each indicator is averaged out to give an overall Buy, Sell, or Neutral Rating, making it an excellent implementation of automated technical analysis designed with the user in mind.

| Technical Charting | Rank | Chart Types | Indicators |

| TradingView | #1 | 17 | 160 |

| TrendSpider | #1 | 6 | 206 |

| MetaStock | #2 | 10 | 150 |

| Finviz | #3 | 5 | 22 |

| Trade Ideas | #4 | 6 | 16 |

Table: TradingView vs. The Competition – Charting. Read the In-depth Best Technical Analysis Charting Software Review

TradingView Advanced Charts

I was incredibly impressed with the offering of Kagi, Heikin Ashi, and Renko Charts, including Point & Figure and Line Break. Also, the user community has developed indicators as exotic as Moon Phase.

This chart selection gives you everything you need as an advanced trader. You also get Level II insight, which is fully integrated with the Premium membership. Well done, TradingView.

They have also implemented Darvas Box, Elliot Wave, and Point & Figure Charts for experienced technical analysts. Overall, this is an excellent package.

Backtesting

TradingView has incredibly powerful and flexible backtesting, enabling advanced strategy testing. However, there are two drawbacks. First, you need to learn Pine script to code the strategy. Second, you cannot test your strategy on a basket of stocks. For these two reasons, TradingView gets 4.6 stars.

The only thing TradingView cannot do is forecast future stock prices; for that, you would be better off with MetaStock.

| Backtesting Software | Backtesting | No-Code Backtesting | Auto-Trading | Rating |

|---|---|---|---|---|

| TrendSpider | ✔ | ✔ | ✔ | 4.9 |

| Trade Ideas | ✔ | ✔ | ✔ | 4.7 |

| TradingView | ✔ | ✘ | ✔ | 4.6 |

| Stock Rover | ✔ | ✘ | ✘ | 4.5 |

| MetaStock | ✔ | ✘ | ✘ | 4.4 |

Table: TradingView vs. Competition – Backtesting. See the full Backtesting Software Review.

TradingView Strategy Tester

TradingView has an active community of people who are developing and selling stock analysis systems. With the premium-level service, you can create and sell your own. The community also offers many indicators and systems for free.

They have implemented backtesting straightforwardly and intuitively. In the image below, I have implemented an in-built strategy called “Slow Stochastics,” which initiates a trade when the stochastics indicators are oversold and sells when stochastics are overbought.

I like that you have results in a few clicks [strategy tester -> Add Strategy]. You can also tweak the strategy parameters, as you can see below, and observe the results.

TradingView’s backtesting reporting shows net profit, drawdown, buy-and-hold return, percentage profitable trades, and the number of trades.

I have even implemented my MOSES ETF Trading strategy into TradingView; I am no developer, but the Pine Script language is so natural that anyone can do it.

TradingView also has market replay functionality, enabling you to play through the timeline. It shows the chart scrolling and the trades executed; all buy and sell orders are drawn on the chart and highlighted.

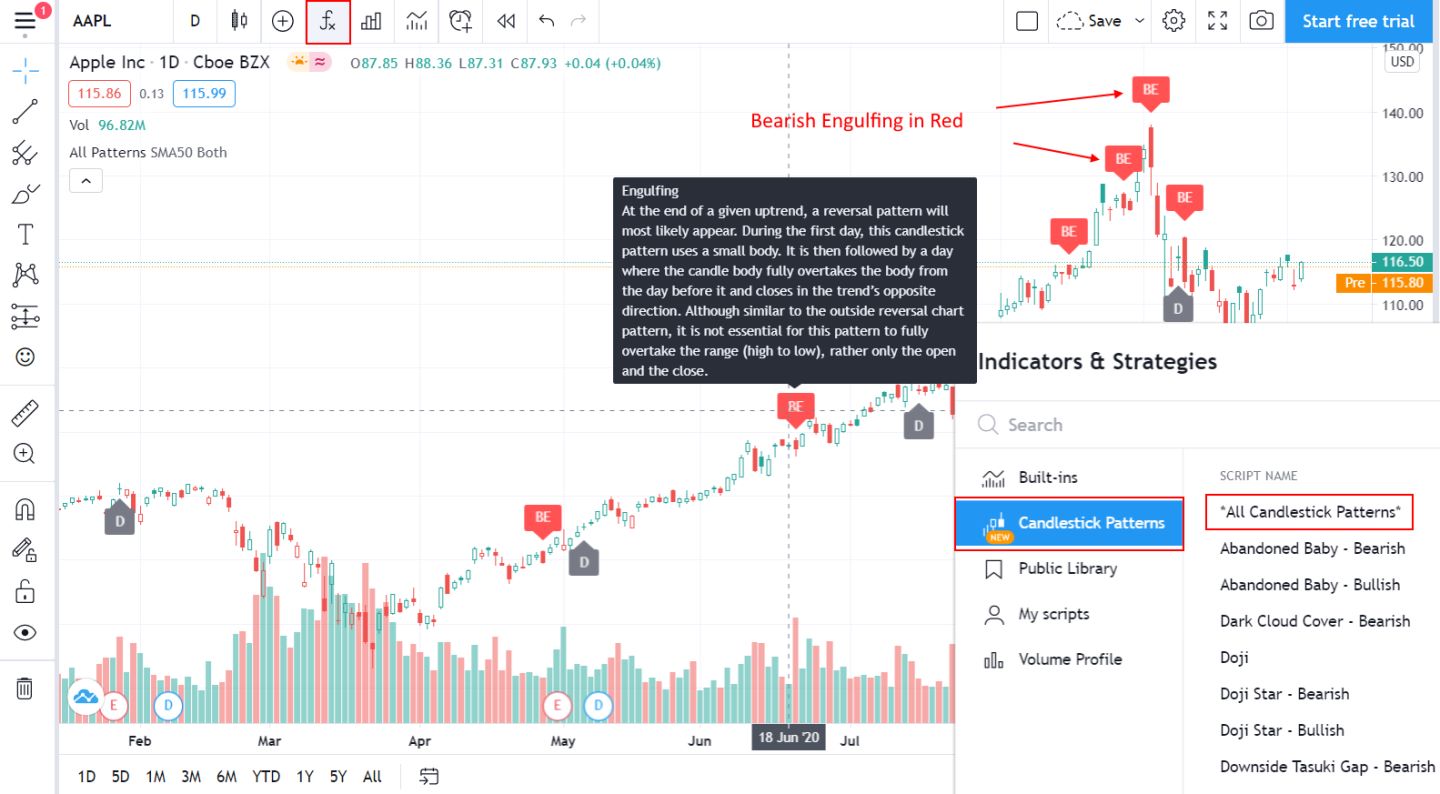

Candlestick Pattern Recognition

TradingView offers automated candlestick recognition for 48 patterns for free. The Candlestick pattern recognition works globally on stocks, ETFs, Forex, and cryptocurrencies. Candlestick pattern recognition is a core component of the platform, which means you do not have to pay anything extra for a plugin; it is simply there.

In the image below, you can see that pattern recognition is intelligently implemented. The Bearish Engulfing (BE) patterns are highlighted in Red, with an arrow pointing downward, suggesting that this candle is a bearish sign. You can also observe that the Doji (D) patterns are grey and pointing upwards, indicating a possible price direction change.

Finally, I like that you can hover your mouse over the pattern and get a full and detailed explanation of its meaning.

| Pattern Recognition Software | TrendSpider | TradingView | Finviz |

| Rating | 4.9 | 4.6 | 4.4 |

| # Candle Patterns Recognized | 150 | 40 | 11 |

| # Chart Patterns Recognized | 18 | 10 | 12 |

| Trendline Recognition | ✔ | ✘ | ✔ |

| Backtesting Patterns | ✔ | ✔ | ✔ |

Table: TradingView vs. Competition – Pattern Recognition. See the In-depth Best Pattern Recognition Software Review

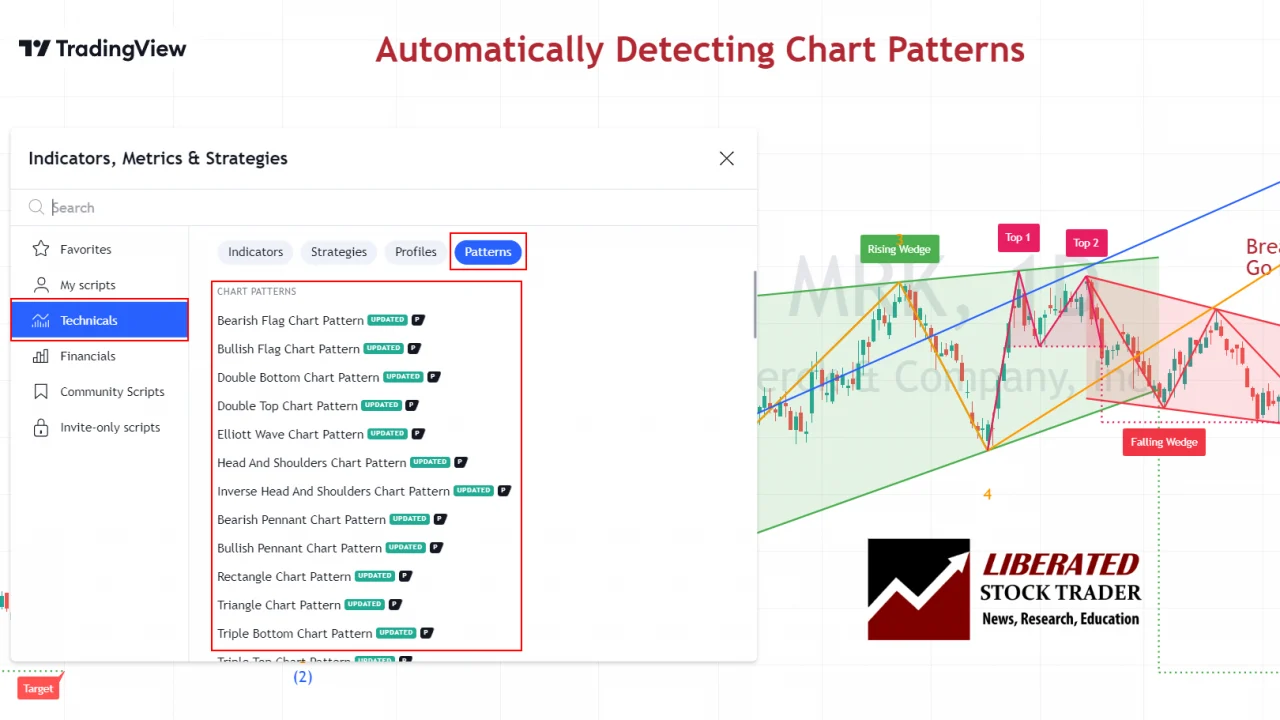

Chart Pattern Recognition

In addition to candlestick pattern recognition, TradingView can also detect 16 high-probability chart patterns, including double tops, bottoms, flags, wedges, and triangles.

News & Social

TradingView is built with people at the forefront and is the best to share and learn socially; forget StockTwits; Tradingview is the best. TradingView’s fully integrated chat forum and publishing system are excellent ways to share your charts and ideas.

Check out my published ideas on TradingView and follow me for regular market and stock analysis ideas and commentary.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

TradingView presents an excellent way to generate trade ideas or learn from other traders. You have to try it and see it in action to understand the power of the implementation.

TradingView has also integrated Benzinga, Reuters, and MT newswire feeds. As soon as you connect to TradingView, you realize it was also developed for the community. You can look at community trade ideas, post your charts and ideas, and join limitless groups covering everything from bonds to cryptocurrencies.

The TradingView news service is only second to Benzinga Pro and MetaStock R/T with real-time newsfeeds.

| News & Community | Rank | Real-time News | News Scanning | Community |

| TradingView | #1 | ✘ | ✘ | ✔ |

| Benzinga Pro | #2 | ✔ | ✔ | ✘ |

| MetaStock R/T | #3 | ✔ | ✔ | ✘ |

| TrendSpider | #4 | ✘ | ✔ | ✘ |

Table: TradingView vs. the Competition – News & Community. See the Full Best News Services for Traders Review

Mobile App

The TradingView app has a 4.9/5 star rating on the Apple app store and a 4.8/5 rating on the Google Play store, meaning the mobile app is first-class. TradingView’s app has limited functionality as it understandably favors simplicity.

If you want the full power, visit TradingView.com on your mobile browser. You do not need an app for smartphones or tablets.

Usability

Within one minute, I was using TradingView without a credit card, installing or configuring data feeds; it was just there. Even better, it is already configured for use. All controls are intuitive, and the charts look amazing. TradingView’s ease of use is impressive, especially considering its vast data feeds and backend power.

Can I Paper Trade on TradingView?

TradingView has implemented paper trading by default for all of its subscription plans. You can paper trade for free with TradingView; when you view a chart, click the “Buy” button and choose “Paper Trading.”

Is TradingView Good for Day Trading?

Yes, TradingView is a good choice for day traders. It offers broker integration for free stock trades, real-time exchange data, and powerful pattern recognition and backtesting tools.

Can I Trade Bitcoin on TradingView?

Theoretically, yes, but only outside the USA. You can enable this with an account through a CFD Broker. I say theoretically because CFD (Contracts for Difference) Brokers will not allow you to fill your Bitcoin Wallet; they will only enable a virtual trade open with a selling price that “should” reflect the current market price.

It’s like buying a gold ETF rather than buying actual physical gold.

Is TradingView Trustworthy?

Yes, TradingView is a trustworthy company that provides reliable trading software. TradingView has vigilant moderators for community content. I have been a demanding customer and partner of TradingView for six years and find the service extremely reliable.

Is TradingView Worth It?

Yes, TradingView is worth it, and 20 million active monthly users agree. TradingView is the leading global financial market analysis platform for traders. It has powerful charts, indicators, screening, backtesting, and a competitive price.

Why TradingView Pro is Worth It!

TradingView Pro is worth investing in because of its unique features, such as technical stock ratings, global broker integration for trading, and screening with built-in pattern recognition. Perhaps its best feature is the global community of traders creating customer indicators and sharing trading ideas.

Summary

TradingView combines charting, screening, and backtesting into an innovative technical analysis trading platform. TradingView’s cloud-based software covers Stocks, Forex, Crypto, and Bonds for nearly every exchange. With a vast, active social community, TradingView is a global solution for traders.

FAQ

Can you use TradingView without a broker?

Yes, you can use TradingView without a broker. TradingView connects to 51 brokers in Europe, North America, and Asia. However, you do not need a broker to use TradingView; you can instead use their Paper Trading system for practice.

Is TradingView better than MT4?

TradingView is better than MT4 for stock, crypto, and ETF traders because it offers a huge social trading community, better charts, more indicators, and entire market scanning globally. For currency trading, MetaTrader offers better algorithmic trading.

How does TradingView make money?

TradingView makes money from selling charting subscriptions to its customers. Additionally, to support its free service tier, TradingView shows non-intrusive adverts.

What is the most accurate indicator on TradingView?

The is no single most accurate indicator on TradingView. In technical analysis, it is best to use a price indicator and a price volume indicator together. I recommend a mix of moving averages with volume indicators and the Relative Strength Index (RSI).

What is the minimum deposit for TradingView?

There is no minimum deposit for TradingView. TradingView is not a broker and does not maintain a brokerage account for you. TradingView allows you to connect to brokers, and it is those brokers who might require a minimum deposit.

Is a TradingView account free?

Yes, a TradingView account is free for screening, charting, and backtesting without charge. Paying for a subscription (I recommend Pro+) will unlock key benefits like more charts, indicators, alerts, and premium real-time exchange data.

Does TradingView sell your data?

According to TradingView's terms and conditions, it does not sell your data as FaceBook does. TradingView is more like Netflix; it generates revenues from selling subscriptions to customers.

Can you use TradingView in Europe?

Yes, TradingView is available to use in Europe. In fact, TradingView covers 52 exchanges across the globe, so TradingView can be used in the Americas, Europe, and Asia. TradingView is also very popular in India.

Are TradingView charts real-time?

Yes, TradingView provides free real-time charts for all stock tickers supported by the Better Alternative Trading Systems (BATS). TradingView sells premium real-time data subscriptions for $5/mo for 52 stock exchanges.

Does TradingView tell you when to buy and sell?

TradingView does provide indicators to tell you when to buy and sell. TradingView's Buy and Sell gauges compare over 20 technical indicators to provide an instant readout of which stocks are bullish, bearish, or neutral.

Yes, TradingView provides free real-time charts for all stock tickers supported by the Better Alternative Trading Systems (BATS). Additionally, TradingView sells premium real-time data subscriptions for $5/mo for over 51 exchanges.

Does TradingView save your charts?

Yes, TradingView has an Autosave function that saves all changes to your charts. If you want to save your charts manually, deselect autosave and click save to ensure you keep your changes.

What indicator should I use on TradingView?

Our testing shows the best free TradingView indicators are Volume Profile HD, VWAP, Technical Ratings, Supertrend, ATR, and automated chart pattern recognition.

Can TradingView be used for day trading?

Yes, TradingView can and is used for day trading. The TradingView charting platform has been designed for Day and Swing Traders but also has features for long-term investors.

Is there anything better than TradingView?

If you are a long-term value, dividend, or growth investor, then Stock Rover is better than TradingView. Additionally, if you want to use AI-powered algorithmic trading, Trade Ideas is better. Otherwise, TradingView is a great option for most traders.

How much is TradingView monthly?

The monthly cost for TradingView ranges from $0- for the free version, $12.95 for Pro, $24,95 for Pro+, and $49.95 for Premium. You can get up to a 60% discount on these rates by following the instructions in our TradingView discounts article.

Is TradingView desktop better than the web?

Yes, TradingView desktop is better than the web version if you use multiple monitors and want even more speed and flexibility between charts. If you are using the free service, it does not make sense to use TradingView desktop because you cannot use real-time premium data or multiple charts.

Can TradingView identify patterns?

Yes, TradingView can identify patterns in stock charts. Recently released, TradingView's automated stock chart pattern recognition identifies 20 stock chart patterns. Select: Indicators -> Technicals -> Auto, and select the patterns you want to see.

Why is TradingView so popular?

TradingView is popular for two reasons. Firstly, it offers the best free and premium stock charting, screening, and backtesting services for traders. Secondly, it has 20+ million monthly users, making it the largest active social trading community on the web.

Can you scan stocks in TradingView?

Yes, you can scan stocks in TradingView with 172 metrics, including 42 financial filters. Not only stocks, but you can also scan currencies, ETFs, and crypto on TradingView.

Can you draw lines on TradingView?

Yes, you can draw lines on TradingView. In fact, TradingView has over 65 tools for drawing not only trendlines but Gann boxes, Fibonacci retracement, Elliott Waves, and Andrews Pitchfork lines.

Is TradingView safe and secure?

TradingView is safe to use; it uses a secure SSL 256-bit encrypted connection. Additionally, TradingView Inc. is located in a safe location in Ohio in, the USA. Finally, TradingView has high-profile private equity investors like Tiger Capital, who would not invest in an unsafe business.

What are the limitations of a TradingView free account?

There are 4 limitations of the free TradinView Account. You can only use 1 chart layout, 3 indicators, and 1 watchlist. Additionally, you cannot publish public ideas.

What is the best free TradingView alternative?

The best free alternatives to TradingView are Benzinga Pro for day traders, Finviz for stock screening, and Stock Rover for long-term investors.

Does TradingView do after hours data?

TradingView offers after-hours and pre-market data for all free and premium service tiers. In fact, TradingView is the only stock charting package to offer this service for free.

How far back can TradingView go?

TradingView goes back 5,000 bars/days for their free service; for Pro and Pro+, the charts go back 10,000 bars. For the Premium service, you get 20,000 bars on all timeframes.

Is stockcharts.com better than TradingView?

No, according to our test results, StockCharts.com is not better than TradingView. TradingView beats stockcharts.com in interactive chartings, assets covered, backtesting, scanning and screening globally. TradingView equals or beats StockCharts in every category.

Which is the best TradingView Plan?

The best TradingView plan is Pro+ because it offers the best balance of features at the right price. Pro+ unlocks all the important features of TradingView, including unlimited charts, indicators, and multiple screens and devices.

What is TradingView's Reputation?

TradingView rates every user with a reputation score. Publish an idea on TradingView; others can comment and like your post. Liking your content increases your reputation score in TradingView, thus assuring other users of your trustworthiness.

TradingView Review & Test: Is It Worth Using In 2025

My 2025 testing awards TradingView 4.8 stars due to its continued innovation in chart analysis, pattern recognition, screening, and backtesting. TradingView is my top recommendation for US and international traders.

Price: 49

Price Currency: USD

Operating System: Windows, Web Browser

Application Category: Investing

4.78

Pros

- 20 Million User Community, Perfect For Learning

- Trading From Charts

- 1st Class Screening & Chart Analysis

- All Stock Exchanges Globally

- 100,000+ User Generated Strategies

- Cost Effective

- The Best Usability & Setup

- Flexible Backtesting with Pine Script

Cons

- Not the Best for Value or Dividend Investors

- No Stock Options Features

I have the free version of Trading View and could not find some of the things you discussed in your video; for example, the technical analysis stock screener, and candle stick patterns. Is that because you are using the Pro version? Where can I go to learn more about how Trading View works. I currently use Thinkorswim for charting and trading.

Thanks,

Ron

Hi Ron, thanks for the question, Yes, candlestick pattern recognition is available for free in the free version. Go to: Indicators -> Technicals -> Patterns and scroll down the list to get to Candlestick Patterns.

Barry

Can the screener scene for OTC only?

And scan OTC for intraday real time biggest gainers?

Does it have full Level 2 depth for OTC?

Hi Mike, I just tested it for you.

Can the screener scene for OTC only? YES

And scan OTC for intraday real time biggest gainers? YES

Does it have full Level 2 depth for OTC? NO

Barry

Looks interesting… Is it possible to combine external signals from file in charts and/or PineScript for backtesting? Or is there a menu where you can enter additional data so without the need to hack the scripts on a daily or weekly base?

Hi drftr,

I think with Pine Script you can create any signals you like, it is extremely flexible. The signals will change with the chart timeframe, but also you can hard code them. Finally, I do not think you can connect to external signals.

Barry

what is the time delay on these charts

Hi Alvin, thanks for the question. It really depends on the exchange and the data. Some exchanges like BATS in the USA give real-time data for free, some will charge. It depends on country and exchange. If the data is freely available tradingview will not have to charge extra.

Customer service even for premium accounts is terrible – very slow response times, very poor responses once they are finally received – strongly advise to consider this – if you have no queries great but when you do – prepare to get no support.

tradingview is absolutely great, so much social and great charrts thx. I signed up for premium, just what i was lookin for