The falling wedge pattern is a bullish chart pattern in technical analysis that forms when the price consolidates between two downward-sloping trendlines.

☆ Research You Can Trust ☆

My analysis, research, and testing stems from 25 years of trading experience and my Financial Technician Certification with the International Federation of Technical Analysts.

According to published research, the falling wedge pattern has a 74% success rate in bull markets with an average potential profit of +38%.

The descending wedge is a reasonably reliable pattern that, if used correctly, can improve your trading outcomes. Understanding how to identify and trade this pattern correctly is essential to taking advantage of potential profits.

We know chart patterns’ success rates and profitability because Tom Bulkowski, the author of The Encyclopedia of Chart Patterns, has spent decades researching charting. I thank Tom for his permission to use a few of his valuable insights.

What Is a Falling Wedge Chart Pattern?

A falling wedge is a technical analysis pattern with a predictive accuracy of 74%. The pattern can break out up or down but is primarily considered bullish, rising 68% of the time. The falling wedge is formed when an asset price rises, but instead of continuing its upward trajectory, it contracts as the trading range tightens. This contraction is reflected in the slope of two falling and converging trend lines plotted above and below the price action.

Traders should be cautious when they see the falling wedge form. As the price action continues to fall, the trading range tightens, indicating that selling pressure pushes the stock downward. Ultimately, there is a 68% chance of an upward breakout as buyers take control.

A falling wedge has two declining trendlines connecting a series of lower highs and lows. Depending on the direction of the price breakout, a falling wedge can be bearish or bullish or a reversal or continuation pattern.

KEY FALLING WEDGE TAKEAWAYS

- The falling wedge has a reliability of 74% in testing 1.

- The pattern breakout is bullish 68% of the time.

- The pattern is more reliable if the wedge occurs in an uptrend.

- The target of a falling wedge breakout can be calculated by adding the height of the widest part of the wedge to the breakout zone.

Falling Wedge Chart

TradingView’s powerful pattern recognition algorithms have autodetected this falling wedge pattern. TradingView detected the pattern and set a price target equal to the length of the wedge’s apex. The target was flagged green once the target was achieved.

Auto-detect this Chart Pattern with TradingView

What the Falling Wedge Indicates

The falling wedge is a bullish chart pattern that indicates increasing buying pressure. The price movement of the pattern consists of lower highs and lower lows, with prices generally trending downwards in a narrow range. The price breaks above the upper trendline and should continue rising as buyers take control. The breakout signals that bulls have taken control over bears and that the downside pressure has been broken.

The falling wedge can also break down into a bearish trend 32% of the time, which averages a 14% price decline.

How Reliable is a Falling Wedge Pattern?

A falling wedge stock chart pattern is 74% reliable on an upside breakout of an existing uptrend. When the price breaks through resistance, it has an average 38% price increase. If the price breaks downwards, it is 71% successful, with an average price decrease of 14%.

| Chart Pattern | Success Rate | Average Price Change |

| Falling Wedge | 74% | +38% |

It should be noted that this pattern does not guarantee a profit.

How to Identify a Falling Wedge?

A falling wedge is identified by two converging declining trendlines on a chart. The upper trendline represents the resistance, while the lower line represents support. As the price moves up and down between these lines, it creates a wedge pattern as price volatility decreases.

When the price breaks above or below one of these lines, it indicates that bullish or bearish momentum is gaining strength. Investors should watch for a break above the upper trendline to enter long positions and look for a break below the lower trendline to enter short positions.

It is important to note that falling wedges can be either continuation or reversal patterns, depending on the direction of the prior trend. If the market was in an uptrend before the wedge formed, then a break above the upper trendline is likely to lead to prices continuing in the direction of the prior trend. Similarly, if the market was in a downtrend before forming a falling wedge, a break below the lower trendline could signal a continuation.

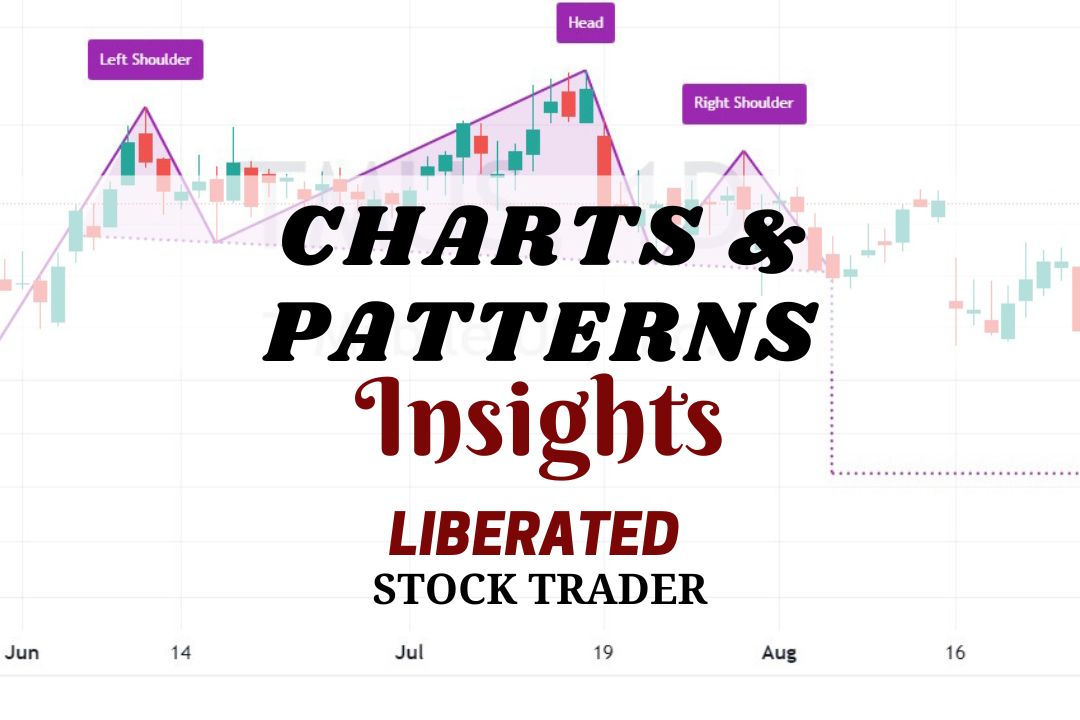

Example: Falling Wedges Chart

This Merk & Company (MRK) chart shows two falling wedges with plotted price targets. Notice how both wedges occur during an uptrend. Then, the wedge declines over a period of weeks on lower volume and then breaks up through the wedge resistance lines to rally and meet the price targets.

Auto-detect this Chart Pattern with TradingView

How to Draw a Falling Wedge?

There are two simple steps for drawing the falling wedge to prepare for the trade. (See the chart below)

- Draw the falling resistance trendline joining the price highs

- Draw the falling support trendline connecting the higher lows

If the security price breaks out above the wedge resistance, especially with volume increases, it signals a possible 74% chance of going higher. Generally, the pattern should be visible on an intraday or daily chart. After identifying the wedge, we must measure and set a price target.

How to Trade a Falling Wedge Chart Pattern

A falling wedge chart pattern generally signals a bullish continuation when the price breaks out of the wedge. A trader that finds a clear descending wedge formation should prepare for a potential long trade.

When trading a falling wedge chart pattern, setting your stop loss inside the wedge pattern and adjusting your target level based on the breakout size is important. You can expect a target of 50% up to 100% of the distance from the entry point to the wedge resistance line.

Auto-detect this Chart Pattern with TradingView

Traders should pay attention to volume when trading a falling wedge chart pattern. Lower volume during the falling wedge formation is considered a confirmation of the pattern. In the above chart, both wedges display decreasing volume during formation.

Falling Wedge Entry and Exit Points

The entry point for a falling wedge pattern is under the price breakout of the wedge. Traders should place a stop-loss order below the breakout to protect against potential losses. The exit point can be determined by placing an initial target at 50% of the wedge’s height. (See Chart Above)

It is also important to remember that falling wedges can fail at a rate of 29%, and traders should always have an exit strategy in case of a failed pattern. Furthermore, managing risk during any trade is essential, as the potential for loss is still real.

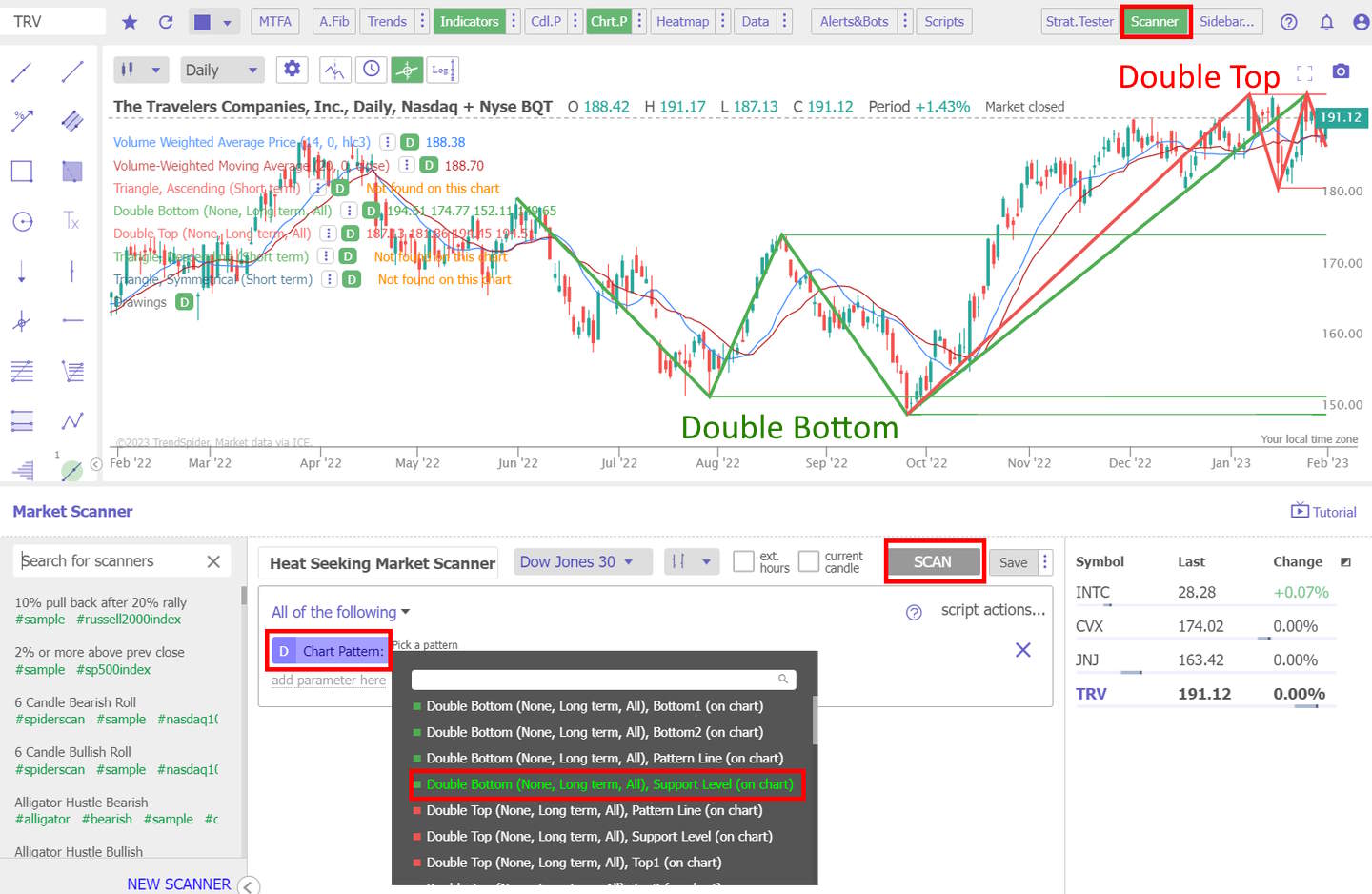

Our original trading research is powered by TrendSpider. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability.

✔ AI-Powered Automated Chart Analysis: Turns data into tradable insights.

✔ Point-and-Click Backtesting: Tests any indicator, pattern, or strategy in seconds.

✔ Never Miss an Opportunity: Turn backtested strategies into auto-trading bots.

Don't guess if your trading strategy works; know it with TrendSpider.

How to Measure a Falling Wedge & Set a Price Target.

If the distance from the wedge’s starting apex is 10%, the logical price target should be 10% above or below the breakout. It is calculated by adding the pattern’s starting height to the breakout point. This gives traders a good indication of where to expect prices to move following a successful breakout. As shown in the chart above, once the falling wedge breakout is confirmed, traders should set their stop-loss order inside the wedge.

The Falling Wedge Pattern Timeframe

Descending wedges can form on any chart timeframe and frequently occur during bull markets. Thus, the falling wedis ge a great pattern for all traders. However, the pattern is most reliable when it forms over a 3-week time frame. It’s important to note that falling wedges can also form in downtrends.

It is important to consider volume as an additional indicator when attempting to identify and trade the falling wedge pattern.

What Happens After a Falling Wedge Pattern?

Two decades of research by Tom Bulkowski show that after a falling wedge pattern is confirmed on a break of either the support or resistance line on higher volume, the price increase averages +38%. Once the falling wedge pattern is confirmed, traders should consider opening a long position.

What Happens When a Falling Wedge Fails?

A falling wedge pattern in a bull market fails 24% of the time. When this pattern fails, the stock price fails to achieve the price target or reverses back to the breakout zone. At this point, you should exit your trade.

A Falling Wedge Pattern in a Downtrend

A falling wedge can form within an existing bear market. It is usually a sign of weakness and could indicate an upcoming rally due to excessively low prices. Traders should be aware that this pattern may provide false signals, as it does not guarantee that the trend will continue, and prices could reverse at any time.

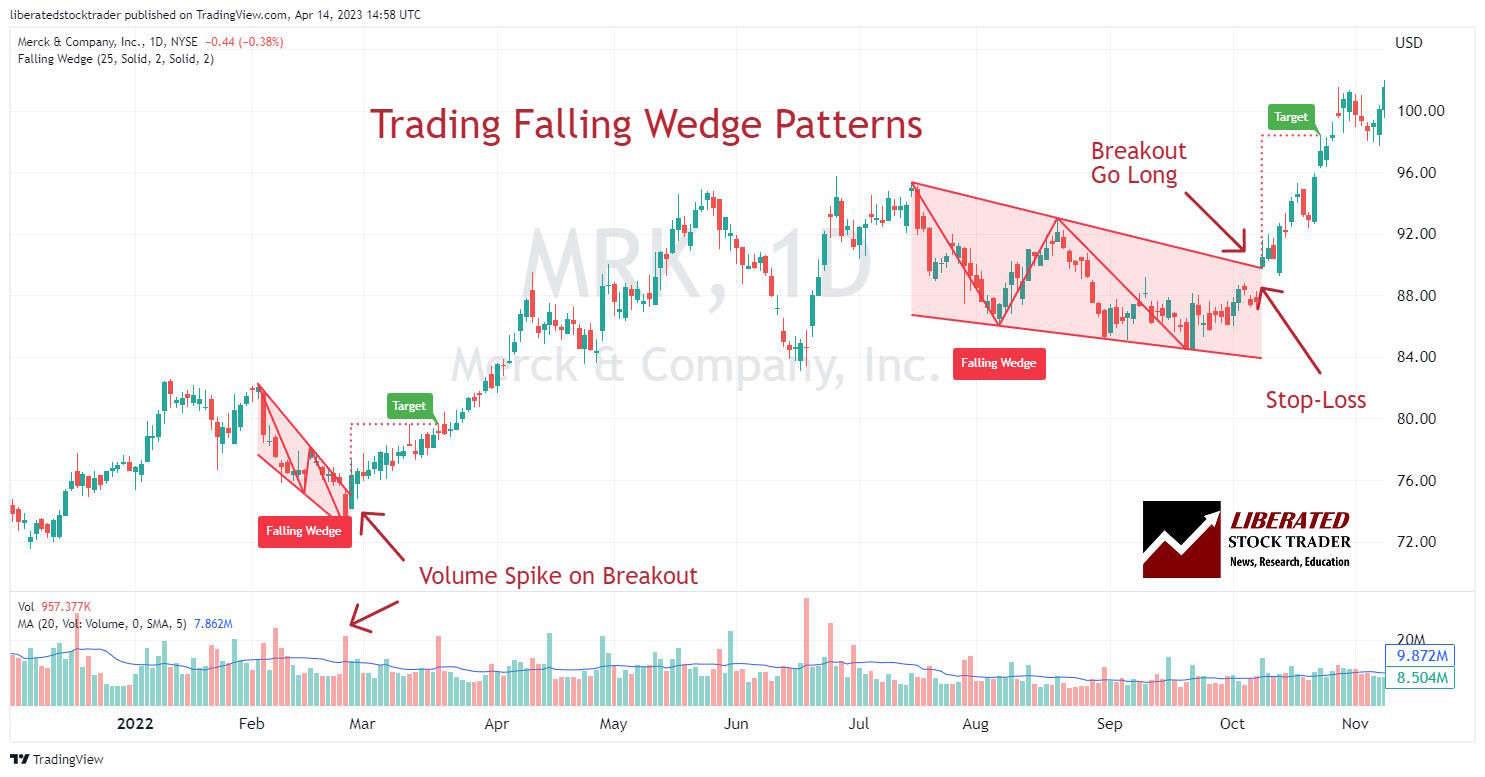

How to Automatically Identify Falling Wedges?

TradingView automatically identifies falling wedge patterns. Go to TradingView and click Indicators > Technicals > Patterns. Next, select the Falling Wedge chart pattern. Now, a chart with a falling wedge pattern will be clearly marked.

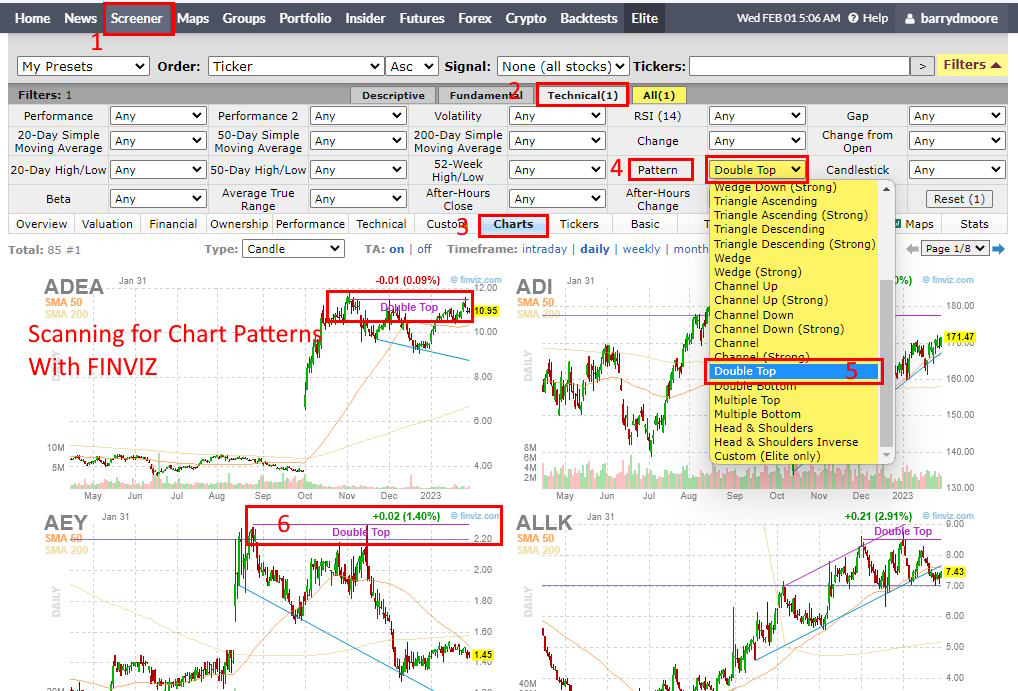

The Best Falling Wedge Pattern Scanners

There are currently two trading platforms offering falling wedge scanning and screening. TrendSpider and FinViz enable complete market scanning for falling wedges. Finviz is a good free pattern scanner, whereas TrendSpider enables full backtesting, scanning, and strategy testing for chart patterns.

TrendSpider Pattern Scanning in Action

Scanning for falling wedge patterns with TrendSpider is easy. Visit TrendSpider, select Market Scanner > All of the Following > Chart Pattern > Triangle, Descending > Scan, and you will be presented with a list of stocks with falling wedge patterns.

Scan for this Chart Pattern with TrendSpider

Using AI-Driven Pattern Scanning

One of the major benefits of using AI-driven technical analysis tools like TrendSpider is the ability to backtest historical data. This allows traders to compare the performance of their strategy over different periods and markets. With TrendSpider, you can go back in time to find stocks exhibiting falling wedge patterns and then use the platform’s advanced analytics tools to analyze how effective this pattern was for trading at any given time. TrendSpider’s AI-driven algorithms also help traders identify the most reliable entry and exit points for falling wedge patterns.

By combining AI-driven technical analysis with traditional charting methods, TrendSpider helps traders take full advantage of market opportunities presented by the falling wedge pattern. With features such as automated alerts, backtesting, and real-time market data, you can quickly spot and take advantage of falling wedge patterns as they emerge.

How to Find Falling Wedge Pattern Stocks

FinViz has a great feature for scanning for falling wedge patterns. You can easily find stocks exhibiting this pattern by selecting “Wedge Down” as your scan criteria. It is especially useful to traders who want to monitor potential trading opportunities.

Scan for this Chart Pattern with FinViz

The first step to finding stocks with potential falling wedge patterns is to select a set of criteria. FinViz offers a range of pre-defined filters and sorting options, enabling traders to quickly narrow their search by sector, industry, market capitalization, and more. After selecting the desired criteria, traders can apply the filter to the Finviz screener.

FAQ

How accurate is a falling wedge pattern?

Descending wedge patterns are 74 percent accurate as an uptrend continuation pattern in a bull market. The accuracy changes if in a bear market and if the pattern acts as a continuation or a reversal pattern. Consult Tom Bulkowski's book, The Encyclopedia of Chart Patterns, for details.

Is a falling wedge bullish?

Yes, a falling wedge is mostly bullish. Research shows a falling wedge is 68% bullish and 32% bearish. It acts as a bearish pattern in a market during a price downtrend. When formed in an uptrend during a bull market, it is bullish.

How do you trade falling wedges?

The best risk-reward for the descending wedge pattern is a bullish trade. According to testing, an upward breakout of the wedge increases on average 38 percent, versus a downward break which only averages -14%.

Can a falling wedge be bearish?

Yes, according to studies, a falling wedge is bearish 32% of the time. This also means that it has a 68% chance of being bullish. Traders should watch how the stock responds when it reaches resistance and the direction it breaks out above or below the wedge.

Is a falling wedge good or bad?

A falling wedge is generally good for bullish traders 68% of the time, generating a 38% profit. It is also good for short-sellers because the pattern is bearish 32% of the time, netting an average of 14% profit.

What is the success rate of a falling wedge?

According to Tom Bulkowski's research, the success rate of a falling wedge is a 74 percent chance of a 38 percent price increase in a bull market on a continuation of an uptrend.

How do you target stop losses in descending wedge patterns?

Traders should set the approximate target stop loss level in a falling wedge at the point below the breakout of the wedge. The exact percentage stop loss depends on the price target expectations and the timeframe.

What are the benefits of trading falling wedges?

The benefits of trading falling wedges include predicting when a trend will change. The success rate for falling wedges can be quite high, with research reporting up to a 74% chance of generating at least a 38% profit.

What are the risks of trading a falling wedge?

The main risk of trading falling wedges is that they can be difficult to predict precisely. A trader may incur losses due to incorrect stop-loss placement if the wedge breaks out and reverses. This pattern has a 62% throwback rate, meaning a pattern failure after the breakout.

Do falling wedges fail?

Falling wedges fail approximately 26% of the time during a bull market. But even when a wedge has a successful breakout, there is always a 62% chance of a pullback before the pattern hits its target. This can force traders out of an otherwise successful trade.

What is the psychology behind falling wedges?

The psychology behind falling wedges is that of a market correction. Typically, the price action will form a basing pattern and gradually squeeze together until it breaks out and resumes its initial trend. This suggests that buyers are willing to buy at these levels and that prices will rise again.

How reliable is a falling wedge pattern?

The falling wedge pattern is a reliable chart indicator, with success rates of 74 percent during a bull market on an upward breakout. During a downtrend, the pattern is 71% reliable.

Do falling wedges hold?

Yes, falling wedge patterns hold 74 percent of the time, according to decades of research compiled by Tom Bulkowski in his book The Encyclopedia of Chart Patterns.

How to identify falling wedges?

Falling wedge patterns can be identified automatically with TradingView or TrendSpider. Alternatively, you can manually identify it by looking for a pattern with two rising trendlines that converge at the apex.

How to measure a falling wedge pattern?

TradingView can automatically measure a falling wedge pattern and set a price target. Alternatively, to measure manually, use an arithmetic chart and plot the distance between the wedge's broadest point. This distance will be the future price target you should plot on the chart's pattern breakout.

What is the failure rate of the falling wedge?

Falling wedges have a failure rate of 26 percent based on 800 trades conducted by Tom Bulkowski over multiple years and documented in his book The Encyclopedia of Chart Patterns.

How many waves are in a falling wedge?

Testing shows that there should be at least five waves in a falling wedge pattern, meaning that the price should touch the inside of the wedge five times.

What invalidates a falling wedge pattern?

A falling wedge pattern can be invalidated if the price goes sideways instead of continuing to trend downwards. Additionally, the wedge is invalidated if the price breaks higher and lower than the wedge trendlines due to volatility.

Learn the Success Rates of 65 Chart Patterns

The Encyclopedia of Chart Patterns by Tom Bulkowski details the reliability and success rates of 65 chart patterns and shows you how to trade them. It is an indispensable resource for traders and investors looking to increase their profitability by taking advantage of stock chart patterns. This comprehensive reference book contains in-depth explanations and detailed illustrations of more than 65 different patterns, including Head and Shoulders, Double Tops, Wedges, Flags, Gaps, and more.

The researched statistics in this article are reproduced with the author’s permission.