Day trading is perceived as a high-octane, high-risk investing strategy that leads most to ruin. But in reality, a systematic data-driven approach can yield higher-than-average profits.

To be successful in day trading, you need to use proven strategies and industry-leading tools and have the experience to know how to use them.

I have been researching trading and the science of charts, technical indicators, and strategies for over 20 years. So, buckle up and embark on an enlightening, data-driven journey into the world of day trading!

What is day trading?

Day trading is a term used to describe buying and selling securities within a single day. It’s an investing strategy that seeks to capitalize on short-term changes in price, such as those caused by news events or company announcements. This type of high-frequency trading can be highly profitable if done correctly, but it also carries significant risks — including the potential for substantial losses.

Day traders typically use technical analysis to decide when to enter and exit positions and how much risk they take in a single trade. This involves studying price movements over time and understanding the various patterns observed in the data. It also requires much discipline since quick decisions and narrow profit margins often characterize day trading.

It’s important to understand that day trading is high-risk and unsuitable for everyone. While it can be an effective way to make money, it can also lead to significant losses in as little as one day.

Day trading defined

Day trading is a type of securities trade in which an investor buys and sells a security (or multiple securities) within the same day. This means that all positions must be closed by the end of the trading day, regardless of whether they show a profit or loss.

The goal of day trading is to regularly make small but rapid profits. Day traders usually employ short-term strategies, taking advantage of price movements that might last only minutes or hours and finding opportunities to buy and sell securities quickly.

Is day trading legal?

Yes, day trading is legal in the United States. The US Securities and Exchange Commission (SEC) has strict rules about how day traders must operate to protect investors from fraud and manipulation.

Day traders must abide by specific regulations limiting the amount of money they can invest at any time. Other restrictions include the “pattern day trader” rule, which requires that traders maintain at least $25,000 in their accounts or risk being restricted from further trading.

Day traders must also be registered with either an SEC-approved broker-dealer or a registered investment adviser (RIA).

What does pattern day trading mean?

The pattern day trader rule is a regulation set by the SEC that requires traders who engage in four or more day trades within five business days to maintain at least $25,000 in their accounts. This rule protects investors from taking on too much risk and losing money quickly and reduces market manipulation.

If you are a day trader with less than $25,000 in your account, you are limited to a maximum of three weekly trades. If you exceed this limit, you may be restricted from trading until your account reaches the minimum balance requirement.

Is day trading gambling?

Day trading is not gambling but involves a certain degree of risk. While there are similarities between the two activities — such as the need for discipline and quick decisions — the difference lies in how these risks are managed.

With day trading, investors make decisions based on research and analysis rather than chance. They use strategies to minimize losses and maximize profits by taking advantage of small, short-term price movements.

In contrast, gambling involves an element of luck beyond the investor’s or gambler’s control. While it is possible to make money from gambling, it is far more difficult to do so consistently than day trading.

Is day trading like gambling?

The short-term nature of day trading can be likened to gambling because of the inherent uncertainty involved. To succeed, day traders must make decisions quickly and accurately to capitalize on price movements that could last only a few minutes or hours.

While day traders may use research and analysis to inform their decisions, they still have to work within the confines of limited time and information. This can lead to more speculative trading, where day traders take on more risk in hopes of a greater reward.

While this approach has a small chance of being profitable, it also carries a higher risk of loss since there is no guarantee that price movements will favor the trader.

What do day traders look for?

Day traders typically look for patterns in stock prices over a certain period. This may involve examining specific technical indicators such as moving averages, support and resistance levels, or chart patterns.

They also pay attention to news and economic events that could cause a stock’s price to move quickly in either direction. This information can inform decisions and strategies, allowing day traders to react quickly to market conditions.

What are the risks of day trading?

Day trading involves several risks that investors should know before starting. These include the potential for large losses in a single trade, lost opportunities due to a lack of liquidity, or emotional trading errors caused by fear or greed.

It is also important to note that day trading can be highly stressful and time-consuming. Traders must constantly monitor the markets and make decisions quickly to take advantage of price movements.

Day trading also requires significant capital and knowledge of the securities market and financial instruments. As such, it is important to know the risks before starting.

Can you make money day trading? What does the data say?

Yes, it is possible to make money from day trading. However, the data shows that only a small percentage of day traders are consistently profitable.

According to a 2019 report from the US Securities and Exchange Commission (SEC), only 4% of day traders achieved profits in excess of their trading costs, while an additional 20% could break even. This means that the majority of day traders ended up losing money in their investment accounts. Source SEC

It is important to note that day trading is a high-risk strategy requiring significant capital, knowledge, and emotional discipline. As such, it is unsuitable for most investors and should only be cautiously undertaken.

How do day traders find stocks to trade?

Day traders typically look for stocks with high volatility and liquidity, as these offer the greatest profit potential.

Sources such as stock market indexes, financial news reports, and research tools can all be used to identify stocks with potentially lucrative trading opportunities. Beginner day traders also use technical indicators such as moving averages or support and resistance levels.

The four strategies day traders use?

Day traders try scalping, arbitrage, pattern trading, and even high-frequency trading as the core strategies to make profits. But how can they compete with Wall Street’s supercomputers? The key is to find the most effective and reliable strategy for individual traders.

Scalping

Scalping is a day trading strategy that involves taking small profits on multiple trades within a short period. It is based on the idea that small movements in the price of a stock can be exploited to generate quick profits.

Scalpers typically use charts and technical indicators, such as moving averages or support and resistance levels, to identify buying or selling opportunities.

If you scalp, you try to take advantage of small price movements by entering and exiting positions quickly. But can you do this quicker as a retail investor than a computer connected directly to an exchange? No.

Arbitrage

Arbitrage is another form of day trading in which a trader seeks to exploit price discrepancies between different markets. This strategy involves buying an asset in one market and selling it in another to profit from the price difference.

Arbitrage involves taking advantage of differences in pricing between different markets or asset classes, such as stocks and futures contracts.

Arbitrage is incredibly unprofitable unless you are a professional investor sponsored by an institution with access to global markets and preferential trade pricing.

High-Frequency Trading (HFT)

High-frequency trading (HFT) is an aggressive form of day trading that uses sophisticated algorithms and technology to buy and sell securities rapidly. HFT relies on computers to identify opportunities for quick profits in short-term price movements, often within seconds or minutes.

HFT is a type of algorithmic trading that uses advanced technology to enter and exit trades rapidly. This strategy typically involves large volumes of trades over short periods, aiming to take advantage of small price movements.

HFT is only available to professional investors with access to powerful computer systems and sophisticated algorithms. As such, it is not an option available for most retail investors.

In the book Dark Pools, Scott Patterson highlights how day traders, hedge funds, and other large financial institutions use HFT to gain an edge in the stock market. They can identify opportunities for small but quick profits in seconds or minutes using high-speed computers and sophisticated algorithms. However, HFT comes at the retail trader’s expense because it increases market volatility and can lead to flash crashes.

Despite the risks associated with HFT, there is no denying that it has become a major force in the stock market. Proponents of HFT argue that it adds liquidity to the markets and contributes to price discovery.

Pattern Trading

Pattern trading involves identifying and taking advantage of recurring market patterns when they appear. Pattern trading involves using technical analysis to identify stock price patterns and making decisions based on these patterns. Examples include head and shoulders or double top/bottom formations, which can be used to identify potential entry and exit points for a trade.

Pattern trading requires a keen eye for detail and the ability to recognize recurring patterns in stock prices.

Pattern trading is the only reliable strategy for retail day traders

Pattern trading is the only viable option for most retail day traders because it requires less capital, knowledge, and technology than other strategies. Furthermore, pattern recognition can be used to identify trends in the market that may not be visible to other traders or algorithms.

22 Best Stock Chart Patterns Proven Reliable By Data Testing

Pattern trading also offers the potential for larger profits than scalping or arbitrage, as patterns are typically more reliable and predictable than shorter-term price movements. Furthermore, it requires less capital to execute trades as the entry and exit points can be identified before entering a position.

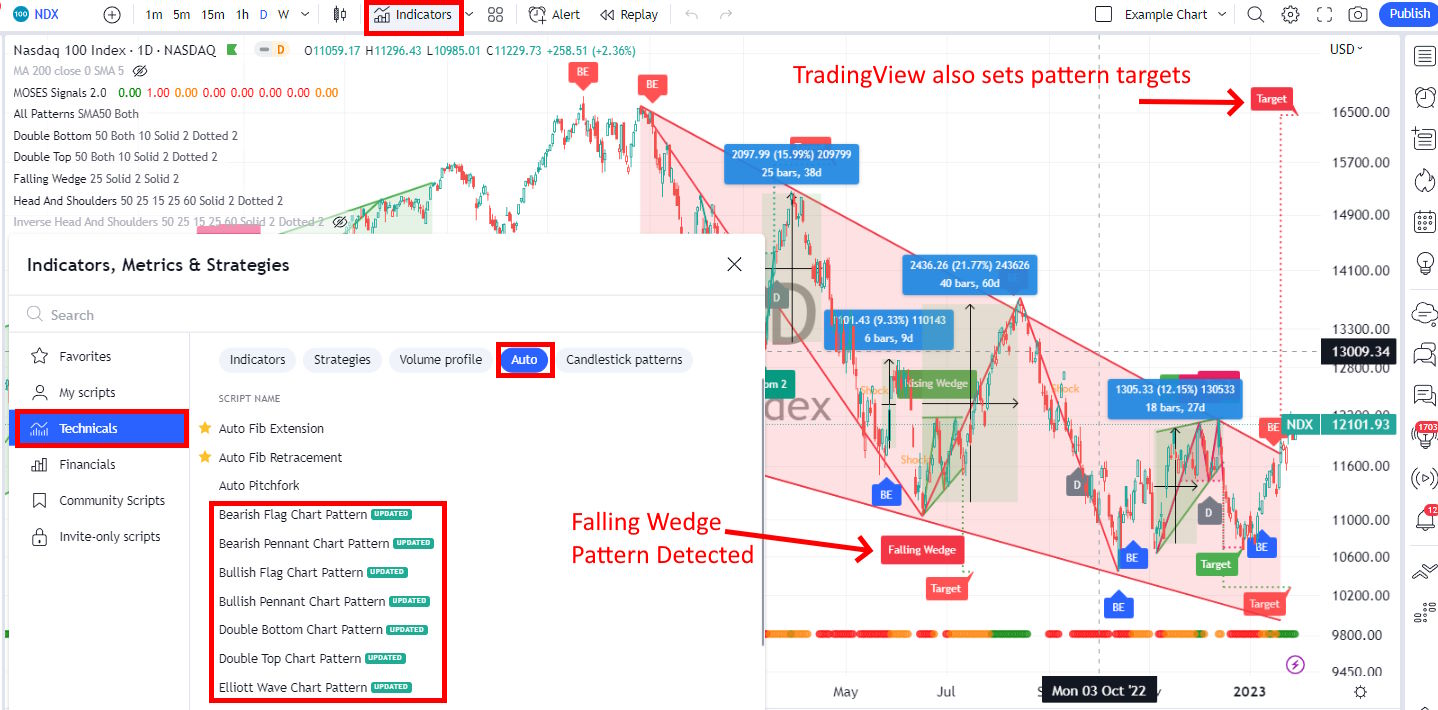

Get TradingView Chart Pattern Recognition

Finally, pattern trading is more accessible for retail day traders due to its reliance on technical analysis rather than requiring complex algorithmic models or significant amounts of capital. It is an ideal strategy for those looking to profit from the stock market without investing large amounts of money or taking on excessive risk.

Pattern trading, and fractal patterns are a viable and potentially lucrative strategy for day traders. It requires less capital than other strategies, can offer larger profits, and is easy to learn and execute. Any retail investor interested in making it successful should consider it.

The Best Software For Pattern Day Trading

The best software to accurately identify chart patterns and backtest them to confirm their validity is TrendSpider and TradingView. I have conducted thousands of years of backtested research on stock chart indicators and stock chart types and pulled from Tom Bulkowski’s two decades of research on chart patterns.

The Best Stock Charts for Day Traders

According to my research, the best chart type for trading is Heikin Ashi, a Japanese candlestick chart that removes the noise from regular charts and allows for better trend recognition. The key to success in day trading is identifying reliable chart patterns and trendlines, which Heikin Ashi excels at.

▶️The 9 Best Charts for Day Traders

Heikin Ashi charts are also great for trend-following strategies, as they provide a more accurate picture of the overall market sentiment. This makes them ideal for day traders who follow long or short-term trends to make profits.

Another useful chart type is the Renko chart, which removes all time-based information from a price chart and only displays prices when they have moved by a certain amount. This can help traders identify breakouts or reversals more easily than traditional charts.

Finally, the point-and-figure chart is another powerful tool for day traders. It eliminates the time dimension from price charts and allows traders to focus solely on price movements. This chart type can be used to identify important support and resistance levels that could help inform future trading decisions.

The Best Chart Patterns for Pattern Day Traders

According to The Encyclopedia of Stock Chart Patterns, the best chart patterns are the Inverse Head and Shoulders, Double Bottom, Rising Wedge, and Inverse Cup with Handle patterns. Each has over an 80% chance of success.

▶️The 23 Best Day Trading Patterns

These patterns have an identifiable structure that can be automatically identified and traded with AI charting software such as TrendSpider, TradingView, and Trade Ideas.

22 Best Stock Chart Patterns Proven Reliable By Data Testing

The Best Indicators for Day Traders

According to thousands of years of backtested stock exchange data, the best indicators for day trading are the Commodity Channel Index, Money Flow Index, Rate of Change, and Relative Stregth Index. Other indicators, such as Moving Averages, Parabolic SAR, Aroon, and Keltner Channels, were unreliable.

▶️The 10 Best Indicators for Day Trading

Advice for day trading?

If you try your hand at day trading, a few tips can help increase your chances of success. These include:

- Start with small amounts of capital and only invest money you’re willing to lose.

Research and understand the asset classes you wish to trade in and the strategies you plan to use. - Set realistic expectations and goals for your trading activities.

- Monitor the markets regularly and maintain discipline when making decisions.

Utilize stop-loss orders to limit losses if a trade goes against you. - Take profits by exiting open positions regularly or when target prices are reached.

- Limit your use of margin and leverage to manage risk exposure.

Knowing the risks involved is important, and you should never invest more than you can afford to lose.

11 Accurate Day Trading Indicators Tested & Proven with Data

How much money do you need to start day trading?

Generally speaking, starting day trading with at least $500-$1000 in capital is recommended, as this will give you enough liquidity to open and close positions without incurring excessive costs. Additionallyit is important to ensureng that you have sufficient funds in your trading account to cover any losses should the market move against your predictiont.

The money you need to start day trading depends on the trading strategy you want to pursue. For example, scalping requires small amounts of capital and is typically suitable for those with limited funds. On the other hand, long-term strategies require larger amounts of capital due to greater risk exposure and potential drawdowns.

How much can you make day trading based on verified data?

The amount of money you can make day trading depends on various factors such as the size of your capital, the strategy used, and market conditions. According to verified data from the US Securities and Exchange Commission, approximately 8 out of every 10 traders lose money when day trading stocks or other financial instruments.

Furthermore, studies have found that most individual investors are unlikely to make money on their investments over the long run due to bad timing, excessive fees, and poor trading decisions. As such, it is important to know the risks involved and only invest what you can afford to lose.

Finally, it is worth noting that day trading is not a get-rich-quick scheme. Developing a successful trading strategy takes time, skill, and dedication. As such, anyone looking for short-term gains should know that the probability of success is low.

Use the best day trading platforms.

According to my tests and reviews, the top platforms for day trading are TrendSpider, TradingView, and Trade Ideas. TrendSpider has an AI-powered multi-time-frame trendline and pattern with integrated Bot trading. Trade Ideas has a full AI auto trading bot with proven historical profitability. Finally, TradingView has the world’s largest trading community and first-class pattern recognition.

Is day trading worth it?

Ultimately, for 95% of speculators, day trading is not worth it. Although day traders can make significant money quickly, statistics show that most day traders lose money. Over a six-month period, excessive commissions, poor trading decisions, weak strategies, and bad market timing cause losses.

Over the typical six month horizon, using lower range assumptions regarding transaction costs, less than 20 percent of day traders earn profits net of transaction costs. Source

Therefore, it is important to remember that day trading involves significant risk and requires dedication to develop a successful trading strategy.

Is day trading profitable?

Day trading can be profitable for the few, but it is far from a guaranteed source of income. The vast majority of day traders lose money in the long run. According to the Standard and Poor annual SPIVA report, most professional hedge fund managers also lose money in the long term, which states that over 80% of stock mutual funds significantly underperform the market indexes.

FAQ

What is day trading?

Day trading is a form of short-term market speculation where traders buy and sell stocks, currencies, futures, options, or other financial instruments to make small profits over a short period.

What equipment do I need to start day trading?

To start day trading, you will need a computer connected to the Internet and a brokerage account with an online broker. You must also consider investing in AI-powered trading software with backtesting and additional hardware, such as multiple widescreen monitors.

How much money do I need to start day trading?

The minimum capital requirements for day trading may vary among brokers but typically range from $500 for individuals outside the USA to $25,000 for US residents.

Can I make money day trading?

Yes, but you will be in the minority; according to research, 85% of day traders lose money over any 6-month period. Day traders have the potential to make significant profits, but the majority lose their investment.

How long does it take to learn how to day trade?

It can take years of study and practice to become proficient at reading charts and understanding technical indicators. As with any new skill set, the more effort and practice you put into it, the faster you can master the art of day trading.

Is there risk involved in day trading?

Yes – there is a significant risk when investing in securities markets; however, by understanding how price movements work and using appropriate strategies such as stop-loss orders, traders can manage their risk when participating in day trading activities.

What type of chart should I use for day trading?

Candlestick charts are one of the most popular chart types active traders use for tracking intraday price movements. My research shows that Heikin Ashi charts should also be used when developing day trading strategies.

What strategies should day traders use?

Most day traders cannot compete with institutions using high-frequency trading, scalping, or arbitrage strategies. The most viable option is to trade proven chart patterns over days to weeks, to let profits develop.

Do I need special software for day trading?

To maximize your chances of success, our research shows that investing in AI-powered trading software with pattern recognition, backtesting, and auto-trading is a significant advantage. The leading trading software in this field is TrendSpider, Trade-Ideas, and TradingView.