The inverse cup and handle is a technical analysis chart pattern traders use to identify a continued bearish stock trend. It occurs in a downtrend, and the price forms the outline of an upside-down cup.

Two decades of trading research indicate that the inverse cup and handle pattern has an 82% success rate and average price drops of 17%. It is an ideal pattern for short-selling.

62% of inverse cup and handle trades reach the average price target, meaning this is a good short-selling setup.

Learn how to effectively identify, target, and trade the inverse cup and handle to enhance your trading outcomes.

What Is an Inverse Cup and Handle Chart Pattern?

According to research, the inverse cup and handle has an impressive 82% success rate. This continuation pattern consists of two distinct parts: the inverted cup and the handle. The “inverse cup” portion of the pattern forms an inverted U-shape in price, followed by a decline that terminates near the price level where it began. The “handle” forms when the price rallies again, usually within a 5-20% range and near the inverse cup’s low before resuming its downtrend.

Auto-detect this Chart Pattern with TradingView

The inverse cup and handle chart pattern is a technical analysis trading strategy. Traders use it to identify a breakdown in asset prices and aim to profit from short-selling a sharp price decline.

Based on 556+ trades, the inverse cup and handle chart pattern is considered reliable, with an 82% success rate in bull markets.

KEY TAKEAWAYS

- The inverse cup and handle is a bearish continuation pattern.

- This inverse cup and handle is the most reliable bearish pattern in technical analysis.

- The inverse cup forms a wide inverted U-shape over at least 35 days.

- The handle is an uptrend after the inverse cup is formed.

- The pattern is proven successful in the Encyclopedia of Chart Patterns

How to Identifying It

The inverse cup and handle chart pattern is difficult to identify. First, you will notice an “inverse cup” shape in the chart that forms when an asset’s price rises and then retraces over at least 35 trading days. Secondly, you will see two inclining trendlines forming the “handle.” The handle should be less steep than the inverse cup and last at least five days.

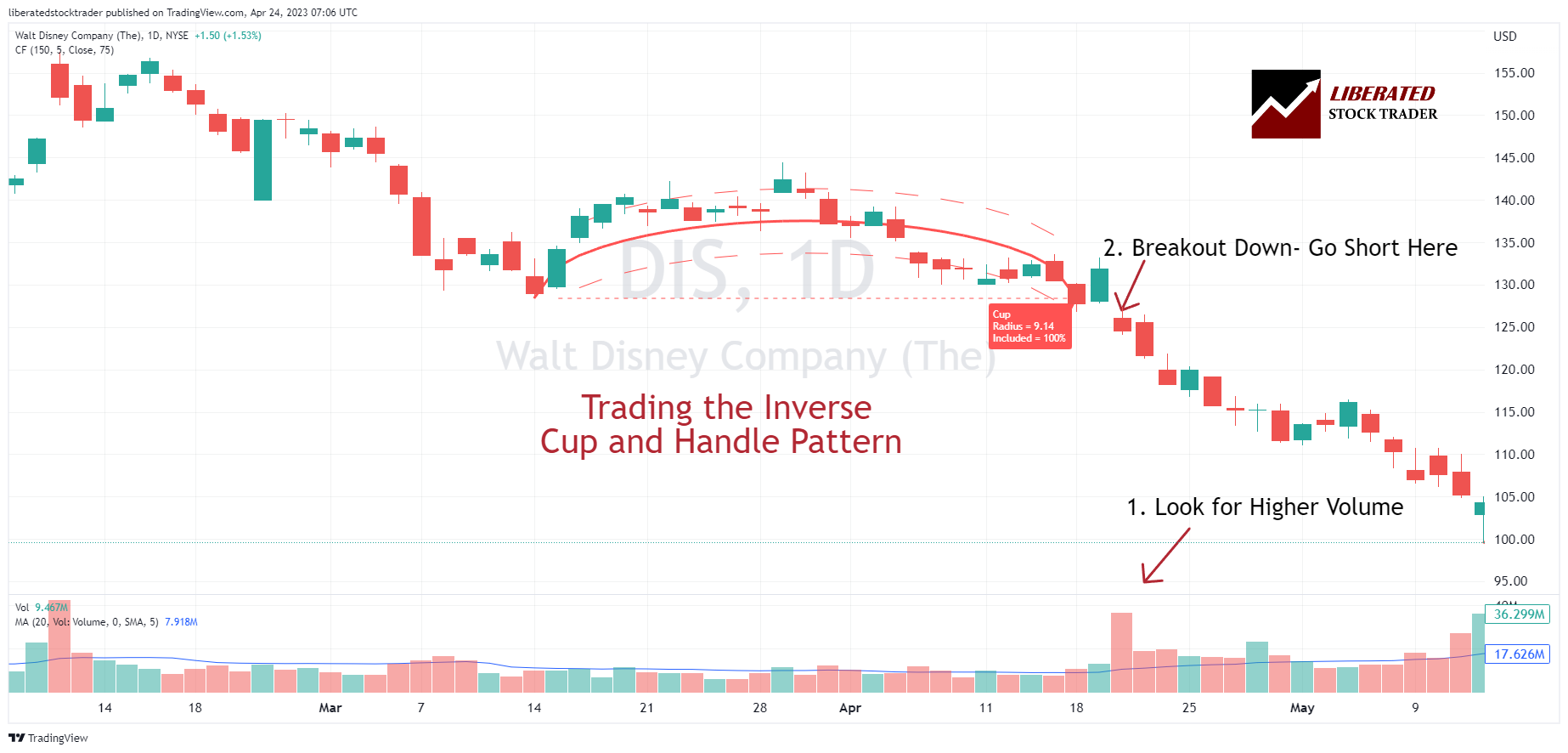

The breakout occurs when the asset’s price breaches the lowest point of the inverse cup, which is known as the support line – this often indicates that an average 17% decline will occur. Traders look for a strong volume increase to confirm the breakout. After the breakout, you can expect to see a long downward price trend that lasts anywhere from several weeks to several months.

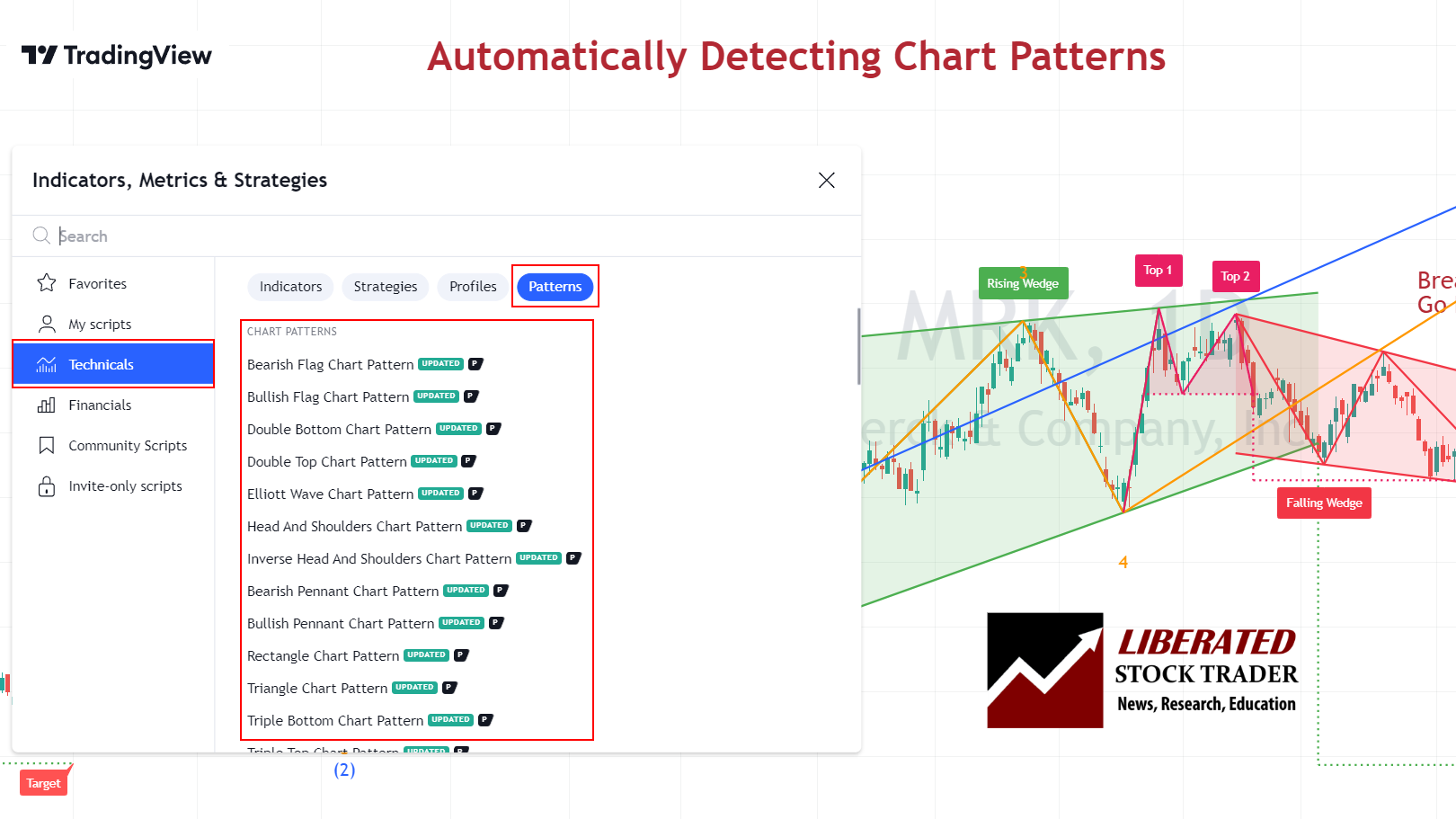

To expedite the identification of inverse cup and handle patterns, utilize TradingView’s Inverse Cup and Handle Pattern Recognition tool. This intuitive tool enables swift detection of these patterns, simplifying the identification of high-probability trades.

How Reliable is an Inverse Cup and Handle?

Published research shows an inverse cup and handle pattern is incredibly reliable, with an 82% success rate on a continuation of a downtrend in a bull market. When the price breaks down through support, there is an average 62% chance of a -17% price decrease.

| Chart Pattern | Success Rate | Average Price Change |

| Inverse Cup and Handle | 82% | -17% |

How To Trade It

To trade inverse cup and handle chart patterns, look for a price breakdown below the inverse cup’s rim and the bottom of the handle. After the price closes below the rim, enter a short trade and place a stop-loss above the breakout. Verifying a high trade volume at the breakout increases pattern reliability.

Auto-detect this Chart Pattern with TradingView

Traders should pay attention to volume when trading an inverse cup and handle chart pattern. Higher volume on the breakdown is considered a confirmation of trend (see the above chart). This means traders should be vigilant and wait for higher volumes before entering a trade on any breakdown situation.

Entry and Exit Points

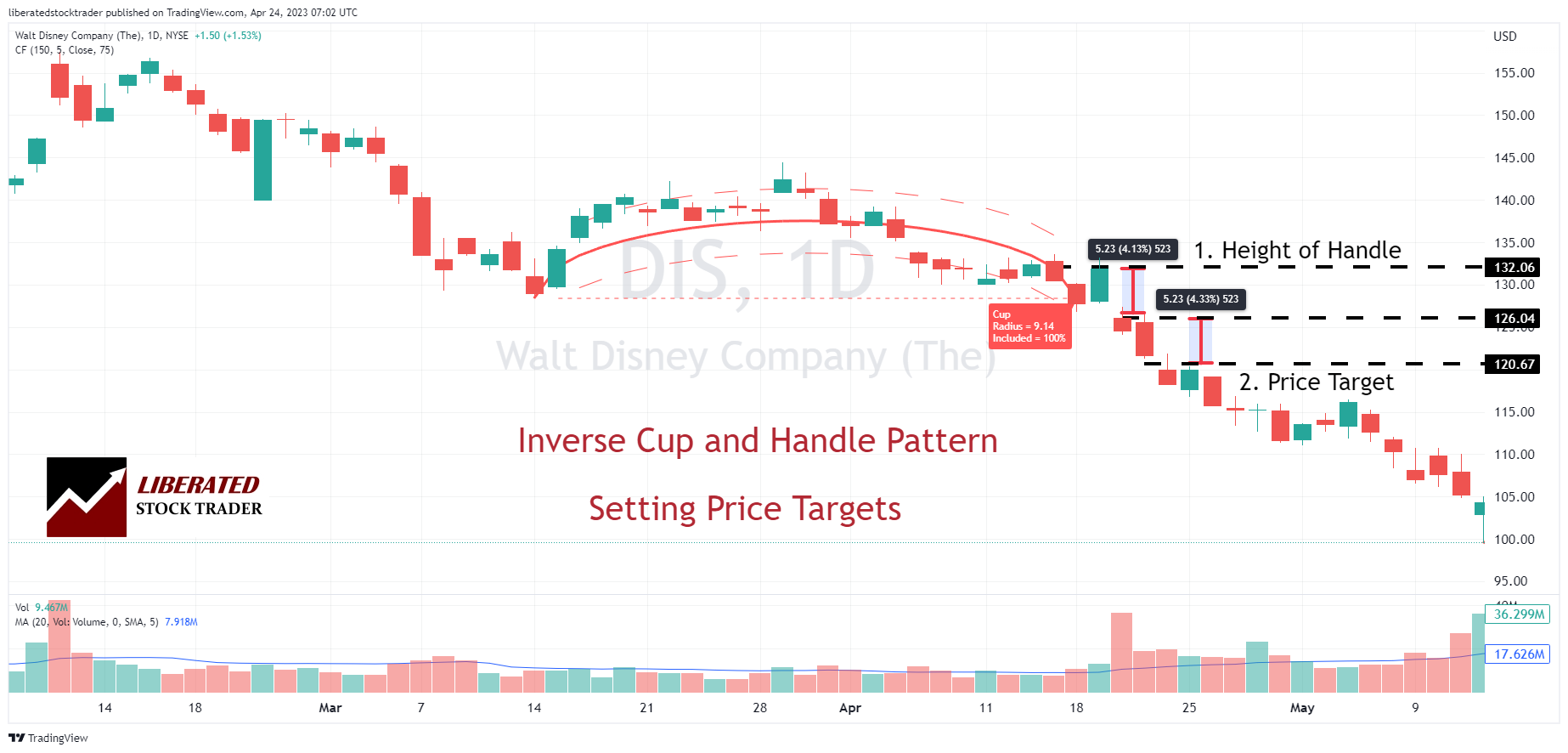

The entry point for an inverse cup and handle trade is at the break of the support neckline after the handle is formed. Traders should place a stop-loss order above the neckline to protect against potential losses. The exit point can be determined by setting a price target based on the inverse cup depth. (See Chart Below)

Inverse cup and handle formations may fail at an 18% or higher rate in bull markets. To reduce the likelihood of unsuccessful patterns, traders should establish a clear exit strategy.

Setting Price Targets

To set a price target for an inverse cup and handle trade, traders can measure the height of the inverse cup’s handle from its high to the low point. For example, if the inverse cup’s handle has a height of $8, the price target should be $8 below the breakout level. This will provide a high probability exit point with a healthy potential for profit. Additionally, traders can use a trailing stop loss to protect their profits if the stock reverses direction due to outside influences.

The chart above shows that the height/depth of the inverse cup’s handle is equal to the price target. This method of price targeting is different from the method for a standard cup and handle pattern.

Trading Timeframe

Inverse cup and handle patterns can form across various timeframes, but the most reliable timeframe is a daily chart, with the pattern forming over multiple weeks and months. Even though inverse cups and handles are relatively uncommon, they are effective for longer-duration trades.

What Happens After it Forms?

Two decades of research by Tom Bulkowski show that after an inverse cup and handle pattern is confirmed on a break of the neckline on higher volume, the price decreases an average of 17%.

Once the inverse cup and handle pattern is confirmed, traders should consider opening a short position near the resistance area and placing a stop-loss order above the handles’ high. This will help them better manage their risk as they enter a trade.

What Happens with Failed Inverse Cup and Handles?

An inverse cup and handle pattern in a bull market fails 18% of the time. When this pattern fails, the stock price moves above the neckline resistance, declining or consolidating sideways. Proper risk management is essential to limit losses on failed patterns.

Automatically Identifying an Inverse Cup and Handle

You can automatically identify inverse cup and handle patterns using TradingView pattern recognition. Go to TradingView > Click Indicators > Type: “Cup.”> Select: “Cup Finder.” Now, any chart with an inverse cup and handle pattern will be clearly marked.

Auto-detect this Chart Pattern with TradingView

Inverse Cup and Handle Rules

- The inverse cup should be roughly bowl-shaped, forming an inverted U-shape.

- The handle should form an upsloping channel above the cup’s rim.

- The pattern should mark a significantly lower price before forming the inverse cup.

- A short-sell signal is triggered once the price breaks below the inverse cup’s rim.

- The pattern breakdown needs to be on higher trading volume.

The Best Chart Pattern Scanners

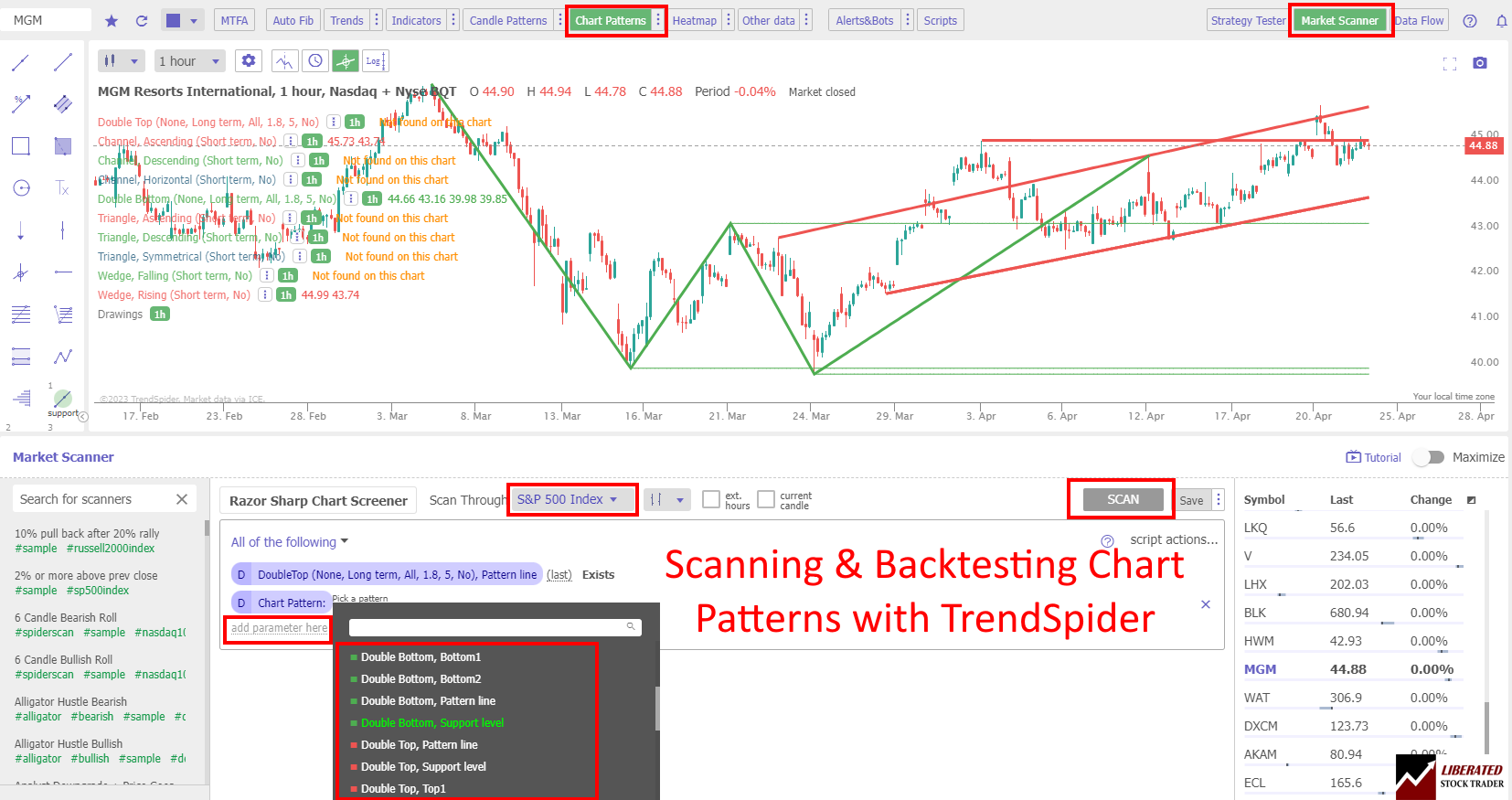

Two trading platforms offer in-depth pattern scanning and screening: TrendSpider and FinViz. Finviz is a good free pattern scanner, whereas TrendSpider enables full backtesting, scanning, and strategy testing for chart patterns.

TrendSpider Pattern Scanning in Action

Scanning for chart patterns with TrendSpider is easy. Visit TrendSpider, select Market Scanner > All of the Following > Chart Pattern > Scan. You will be presented with a list of chart patterns you want to trade.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

AI-Driven Technical Analysis

One of the major benefits of using AI-driven technical analysis tools like TrendSpider is the ability to backtest historical data. This allows traders to compare the performance of their strategy over different periods and markets. With TrendSpider, you can go back in time to find stocks exhibiting profitable patterns and then use the platform’s advanced analytics tools to analyze how effective this pattern was for trading historically. TrendSpider’s AI-driven algorithms also help traders identify the most reliable entry and exit points for inverse cup and handle patterns.

By combining AI-driven technical analysis with traditional charting methods, TrendSpider helps traders take full advantage of market opportunities presented by chart patterns. In addition, its interactive charts allow traders to analyze various aspects of the pattern without manually drawing each line onto the chart.

Scan Chart Patterns for Free

FinViz has a great feature for scanning 28 chart patterns. To Scan for chart patterns, Visit FinViz > Select Screener > Technical > Charts > Pattern >Select a Pattern. This is especially useful to traders who want to monitor potential trading opportunities.

Scan for Chart Patterns with FinViz

The first step to finding stocks that have profitable chart patterns is to select a set of criteria. Finviz offers a range of pre-defined filters and sorting options, enabling traders to quickly narrow their search by sector, industry, market capitalization, and more. After selecting the desired criteria, traders can apply the filter to the Finviz screener.

Once the filter has been applied, traders can view the results on a chart. Depending on the complexity of the search, several stocks may meet the criteria. By clicking on each stock name, traders can open a chart.

Final Thoughts

Inverse cup and handle patterns are dependable chart formations that provide high-probability trades for skilled short sellers. Proper risk management techniques enhance gains and diminish losses. Trading fundamentals rather than focusing solely on chart patterns is vital to bear in mind while executing trades.

Ultimately, traders must determine whether to incorporate inverse cup and handle formations into their overall trading strategy.

FAQ

Is an inverse cup and handle pattern profitable?

Yes, an inverse cup and handle pattern yields an average profit of 17 percent on the short side; it is a good way to identify potential trades. Tom Bulkowski's research confirms an accuracy of 82 percent for inverse cup and handle patterns.

Can an inverse cup and handle fail?

Yes, at least 18% of inverse cup and handle patterns fail. The successful inverse cup and handles have a strong trend formed over many months, meaning the price has a high probability of emerging bearish after trend confirmation.

How reliable is an inverse cup and handle pattern?

The inverse cup and handle pattern is an incredibly reliable chart indicator, with success rates of 82 percent during a bull market. The pattern is most reliable when formed over many months.

Is an inverse cup and handle good or bad?

Considering the evidence, the inverse cup and handle is a good short-seller pattern. As this pattern takes months to form, it is not ideal for day traders or scalpers.

What is the success rate of an inverse cup and handle?

According to Tom Bulkowski's research, the success rate of an inverse cup and handle is an 82 percent chance of a 17 percent price decrease in a bull market on a continuation of a downtrend. Traders should note this the pattern meets its 17 percent target only 62 percent of the time.

How do you target stop losses in an inverse cup and handle pattern?

Traders should set the approximate target stop loss level in an inverse cup and handle below the inverse cup's rim after the handle is formed. The exact percentage stop loss depends on the price target expectations and the timeframe.

What are the benefits of trading inverse cup and handles?

Inverse cup and handle patterns enable traders to exploit new downtrends and optimize profits. Moreover, they indicate a high probability of the continuation of bearish trends.

How accurate is an inverse cup and handle pattern?

Published research demonstrates inverse cup and handle patterns are highly reliable, being bearish 82 percent of the time, with a 62% chance of a 17% price decline.

Can an inverse cup and handle be bullish?

Inverse cup and handles can be bullish, but it happens only 18% of the time. If the price reverses and increases after the pattern is confirmed, it is considered bullish, and the pattern has failed.

How to measure an inverse cup and handle pattern?

TradingView can automatically detect and measure an inverse cup and handle pattern and set a price target. Alternatively, to measure manually, use an arithmetic chart and plot the depth of the inverse cup's handle. This distance will equal the future price target, which you should annotate in the breakout direction on the chart.

Is an inverse cup and handle a continuation or reversal pattern?

Testing shows that the inverse cup and handle is a bearish continuation pattern. This pattern is highly predictive, up to 82%. It's important to note that an inverse cup and handle pattern may take three weeks up to 12 months before confirmation.

What are the best inverse cup and handle pattern scanners?

To find an inverse cup and handle pattern, TradingView offers the best and only scanner. When you look at any chart on the platform, it will automatically be scanned for this pattern. Additionally, you can even run backtests on the pattern.

What are the risks of trading an inverse cup and handle?

The biggest risk of trading an inverse cup and handle is an 18% chance of not breaking even or the 62% chance it will not meet its price target. Experienced traders will manage risk and use a rolling stop-loss.

Do inverse cup and handle patterns hold?

Inverse cup and handle patterns hold only 82 percent of the time on a downward breakout in bull markets, according to decades of research compiled by Tom Bulkowski in his book The Encyclopedia of chart patterns. This means it is one of the best-performing bearish patterns.

How to identify inverse cup and handles?

Inverse cup and handle patterns can be identified automatically with TradingView. Alternatively, you can manually identify it by looking for an inverted U-shaped pattern spanning at least two months, followed by a price increase of at least five days.

What is the opposite of an inverse cup and handle pattern?

The opposite of an inverse cup and handle pattern is a cup and handle pattern. Unlike the bearish cup and handle, the inverse cup and handle is bullish and provides a reliable setup for long trades in uptrending markets.

Learn the Success Rates of 65 Chart Patterns

The Encyclopedia of Chart Patterns by Tom Bulkowski details the reliability and success rates of 65 chart patterns and shows you how to trade them. It is an indispensable resource for traders and investors looking to increase their profitability by taking advantage of stock chart patterns. This comprehensive reference book contains in-depth explanations and detailed illustrations of more than 65 different patterns, including Head and Shoulders, Double Tops, Wedges, Flags, Gaps, and more.