As AI, machine learning, and large language models (LLMs) permeate our lives, high-quality AI platforms for trading and investing are emerging. Having personally tested over 30 AI platforms, I can confidently recommend the leaders.

My testing shows TrendSpider has world-class AI pattern recognition, backtesting, LLMs, and auto-trading. Trade Ideas is the best AI stock trading bot software for high-probability day trading signals. TradingView enables live bot trading broker integration, and Tickeron’s bots provide swing trading signals.

Our Top-Rated AI Stock Trading Apps

- TrendSpider: Best AI Bot Pattern Recognition & Backtesting

- Trade Ideas: Best Automated Stock Trading Bot

- TradingView: Global AI Stock & Crypto Bot Trading

- Tickeron: AI Portfolios & Trading Strategies

Ratings & Features Comparison

| AI Trading Tools | TrendSpider | Trade Ideas | TradingView | Tickeron |

|---|---|---|---|---|

| AI Software Rating | ★★★★★⯪ 4.8 | ★★★★★ 4.7 | ★★★★★⯪ 4.6 | ★★★★★⯪ 4.4 |

| AI Trading Signals | ✔ | ✔ | ✘ | ✔ |

| Alerts | ✔ | ✔ | ✔ | ✔ |

| AI Pattern Recognition | ✔ | ✔ | ✔ | ✔ |

| AI Strategies | ✘ | ✔ | ✔ | ✔ |

| Backtesting | ✔ | ✔ | ✔ | ✔ |

| Point & Click Backtesting | ✔ | ✘ | ✘ | ✘ |

| Auto-Trading Bots | ✔ | ✔ | ✔ | ✘ |

| Cloud-Based AI | ✔ | ✔ | ✔ | ✔ |

Table 1: AI Trading Software Comparison Table & Ratings

We independently research and recommend the best products. We also work with partners to negotiate discounts for you and may earn a small fee through our links.Unlike other websites, I personally test everything I recommend. Here are seven of the best AI trading and investing tools on the planet.

Review Summary

My research identifies Trade Ideas and TrendSpider as the leaders in AI trading software. Trade Ideas offers automated trading and bots, while TrendSpider offers automated pattern recognition, auto-trading, and backtesting.

Rules-based AI and day-trading Bot platforms are becoming pervasive. However, machine learning and deep learning software are still in their infancy. Trade Ideas consists of three advanced, high-performing AI algorithms: broker integration and auto-trading. TrendSpider uses AI to provide automated technical analysis and backtesting, significantly improving human chart analysis.

Tickeron offers 34 AI stock trading systems and hedge fund-style AI model portfolios with audited track records. MetaStock has a solid backtesting & forecasting engine and a large rules-based AI system marketplace.

AI Trading vs. Stock Trading Bots

A Stock Trading Bot is an autonomous algorithm that automatically finds trading opportunities and executes buy and sell orders. Trade Ideas is the leading stock trading bot available to US retail investors, with three algorithms.

Stock Trading AI algorithms are also capable of full chart pattern recognition, scanning, and backtesting. TrendSpider’s AI recognizes 148 candlestick patterns, has point-and-click backtesting, and executes automated AI bot trades.

AI stock trading software generates rules-based trade signals or entire portfolios based on backtested price patterns, price volatility, diversification, and risk. Tickeron provides a wealth of AI-generated stock, ETF, and Forex strategies.

1. TrendSpider: Best True AI-Trading, LLMs & Bots

TrendSpider is my tool of choice. It provides complete AI stock chart pattern recognition and intelligent point-and-click backtesting, enabling users to find high-probability trading opportunities quickly and effectively.

My research reveals that TrendSpider is an excellent choice for US traders seeking AI-driven tools for charting, pattern recognition, and backtesting across stocks, indices, futures, and currencies. The platform stands out by automatically detecting trendlines, Fibonacci levels, and candlestick patterns. With its robust backtesting capabilities and multi-timeframe analysis, TrendSpider is particularly well-suited for seasoned technical traders looking to refine their strategies.

TrendSpider stands out by leveraging AI and machine learning to streamline traders’ workflow, bringing automated trend and pattern recognition to the forefront. With TrendSpider, traders gain access to advanced analysis and strategy testing capabilities, surpassing manual efforts in scale and efficiency.

Pros

✔ 150+ chart and candle patterns recognized

✔ True AI Model Training & Deployment

✔ Point-and-click backtesting

✔ Auto-trading bots

✔ Multi-timeframe analysis

✔ Real-time data included

✔ US Stocks, ETFs, Forex, Crypto, & Futures

✔ Seasonality charts, options flow

✔ News & analyst ratings change scanning

✔ 1-on-1 training included

Cons

✘ Not ideal for value or dividend investors

✘ No social community or copy-trading

| ⚡ Features | Charts, Watchlists, Screening, Free Real-time Data |

| 🏆 Unique Features | AI Automated Trendlines, Fibonacci, Candlestick Pattern Recognition, Auto-Bot Trading, Code-free Powerful Backtesting, Launch and Train Personal AI Models with Strategy Lab. |

| 🎯 Best for | Stock, Options, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $107/m or $48/m annually |

| 💻 OS | Web Browser |

| 🎮 Trial | ❌ |

| ✂ Discount | Use Code "LST30" for -30% on monthly or -63% off annual plans |

| 🌎 Region | USA |

TrendSpider’s AI revolutionizes stock analysis, automating trend line detection and multi-time-frame analysis; it offers a holistic view of the market, aiding in strategy formulation.

Backtesting is simple yet powerful, and real-time exchange data ensures up-to-the-minute information. The tool’s automatic Fibonacci trend detection identifies significant price levels. Supporting stocks, ETFs, forex, crypto, indices, and futures makes TrendSpider a go-to tool for traders.

AI Strategy Lab

I recently tried out TrendSpider’s AI Strategy Lab, and wow—it completely changed the way I trade! With its advanced AI tools, I could analyze multiple indicators and timeframes all at once, giving me a clearer and more detailed view of the market. Plus, it saved me hours of time I used to spend manually backtesting strategies across different conditions.

But here’s the real game-changer: the ability to create custom trading algorithms. This feature lets me craft strategies tailored perfectly to my trading style. The flexibility and control were next-level, helping me fine-tune my strategies with laser-like precision. If you’re serious about trading smarter, this tool is a total must-try!

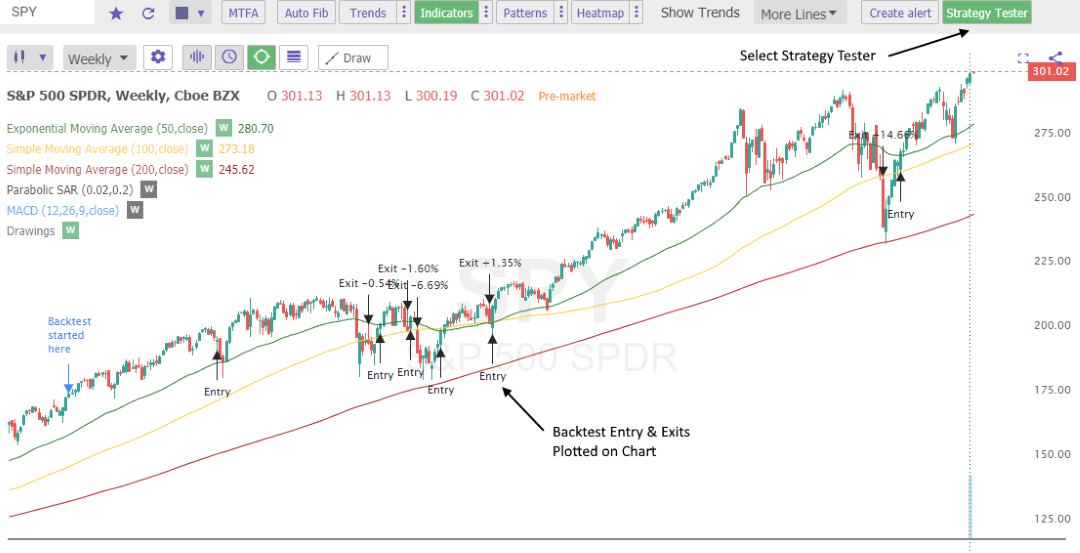

AI Charts & Backtesting

TrendSpider has fully automated AI-driven trendlines, Fibonacci, and multi-timeframe analysis on stocks, forex, crypto, and futures. Add a robust backtesting engine, and you have a great AI technical analysis platform.

TrendSpider takes a different approach to backtesting. The platform is built from the ground up to detect trendlines and Fibonacci patterns automatically; it already has an element of backtesting built into the code’s heart.

The highest-probability trendlines are automatically flagged, and you can adjust the algorithm’s sensitivity, which controls whether or not the detection shows more or fewer lines.

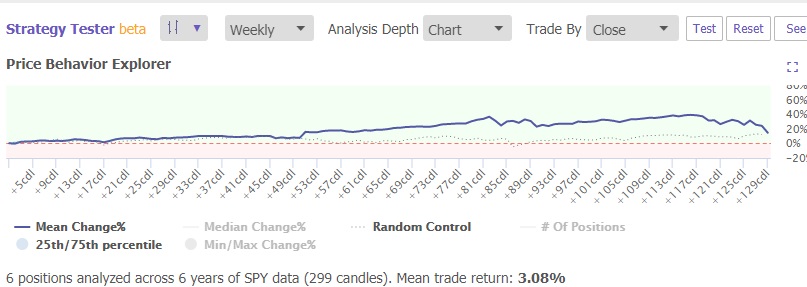

TrendSpider has also implemented a strategy tester that allows you to type what you want to test freely, and it will do the coding for you. It is a smooth and simple implementation that had me up and running in minutes.

Integrated backtesting of automated trendlines, showing win rate, profitability, and drawdown, is a welcome addition; the team propels TrendSpider into one of the industry’s leading technical analysis packages.

They have also implemented an AI assistant that allows you to type what you want to test freely, and it will do the coding for you.

It is a smooth and straightforward implementation that had me up and running in minutes. I like the ability to adjust your backtest conditions on the fly, and the “Price Behaviour Explorer” and “System Performance Chart” automatically update. You can jump into coding if you want to, but the key here is that you do not HAVE to.

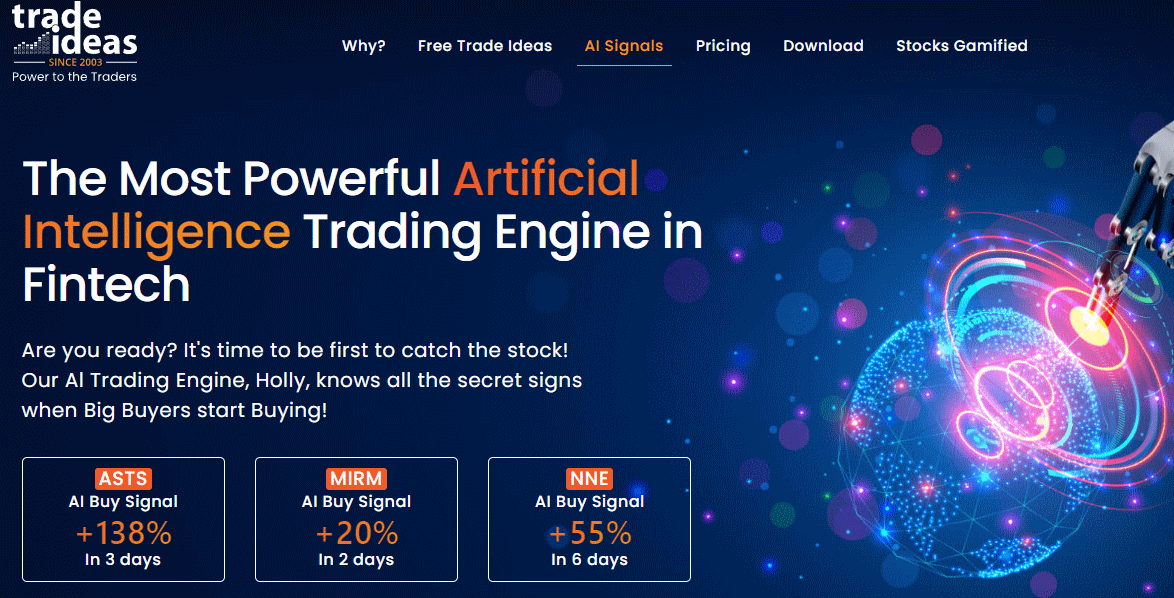

2. Trade Ideas: Winner Best AI Stock Trading Signals

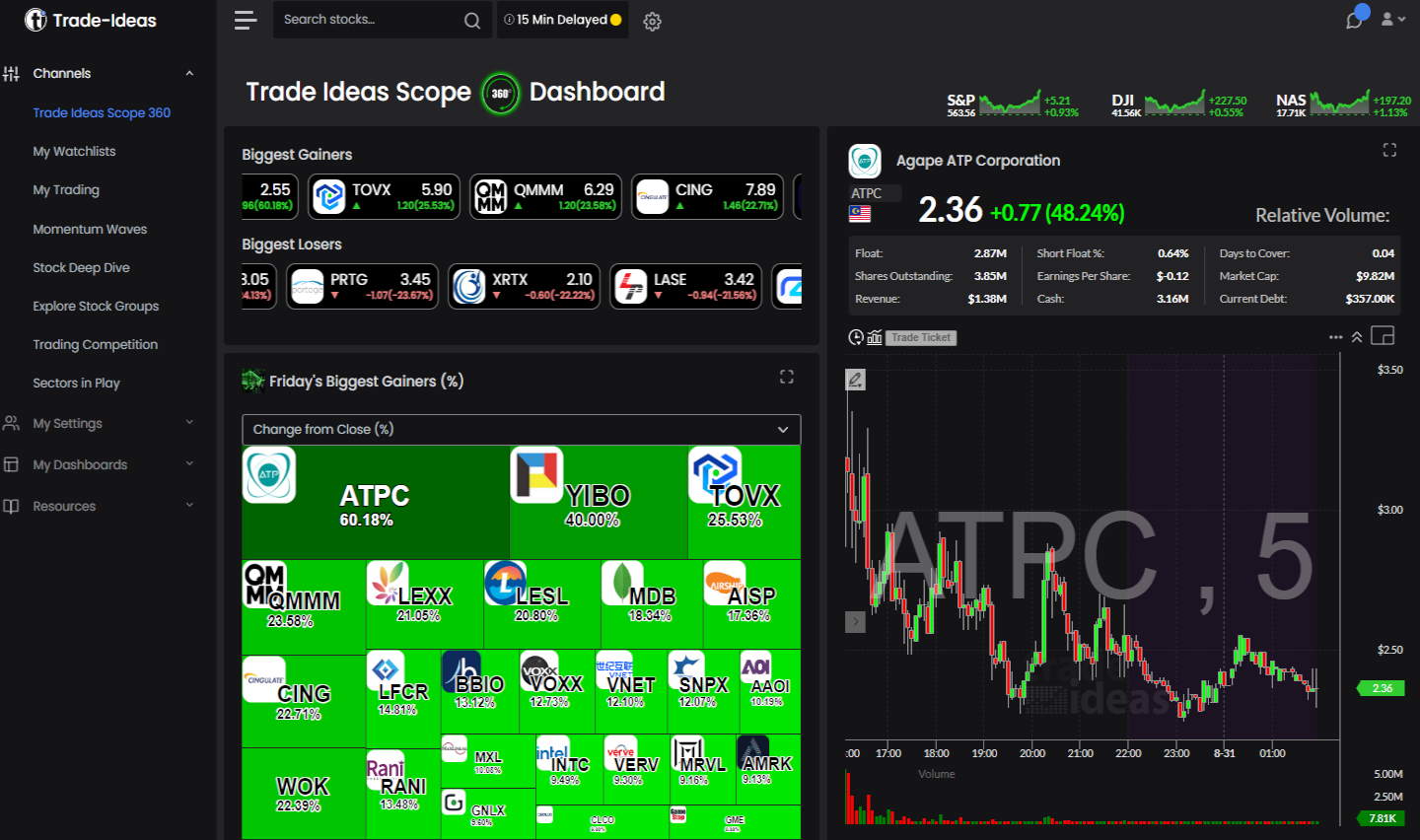

Trade Ideas is the leading AI trading software for finding day trading opportunities. Trade Ideas has three cutting-edge AI stock trading bots that backtest all US stocks in real time for high-probability trading opportunities.

My in-depth testing shows Trade Ideas is the ultimate black box AI-powered day trading signal platform with built-in automated bot trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

Trade Ideas is best for active US day traders seeking real-time AI-driven high probability trades, excellent stock scanning, and a live trading room to learn trading techniques.

Trade Ideas is worth it if you are a pattern day trader trading at least three times daily with an account value of over $25K as this will help you profit after paying the Trade Ideas subscription cost.

Pros

✔ 3 AI Trading Algorithms That Beat the Market

✔ Get A Free Holly AI Stock Trade Every Week

✔ Fully Automated Backtesting

✔ Exceptional Stock Scanning

✔ Specific Audited Trade Signals

✔ Auto-trading & broker integration

✔ Auto Trade Commission Free with eTrade integration

Cons

✘ Old School User Interface

✘ No Mobile App

The AI algorithms developed by Trade Ideas are the main reason you want to sign up. I had a lengthy Zoom session with Sean Mclaughlin, senior strategist over at Trade Ideas, to delve into how Holly AI works, and I was very impressed. This company is laser-focused on providing traders with the best data-supported trading opportunities. There are currently three AI systems in operation that apply over 70 different strategies.

| ⚡ Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | AI Trade Signals, Trading Room, Trading Competitions |

| 🎯 Best for | US Day Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $254/m or $178/m annually |

| 🆓 Free Version | ✔ |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | Free Live Trading Room |

| ✂ Discount | -15% Discount Code "LIBERATED" |

| 🌎 Region | USA |

Holly AI Bot

The Holly AI stock bot is the original incarnation of their AI algorithms. Holly applies 70 different AI strategies to all the US stock exchanges; 70 strategies multiplied by 8,000+ stocks means millions of backtests daily. Only the strategies with the highest backtested win rate of over 60% and an estimated risk-reward ratio of 2:1 will be suggested as potential trades the following day.

Holly 2.0

Holly 2.0 is a newer version of the Holly AI Bot, presenting more aggressive day trading scenarios. Trade Ideas operates three key trading strategies with its AI Stock Bot: Conservative, Moderate, and aggressive. According to my research, Holly 2.0 is the most aggressive stock trading Bot and provides the best trading returns of 33% annually.

Holly Neo

Holly NEO is Trade Ideas’ latest AI day trading Bot. It seeks to trade real-time chart patterns and utilizes a mix of important day trading technical analysis strategies, such as trading stock price pullbacks and breakouts, either long or short.

- Pullback Long: This strategy seeks to identify trades in which the stock price is down and is seeking to start moving up on higher volume.

- Breakout Long: Where stock price breaks out through a key resistance or to new highs.

- Pullback Short: identifying a short pullback opportunity in price.

- Breakdown Short: A shorting opportunity where upward momentum breaks down.

Buy & Sell Signals

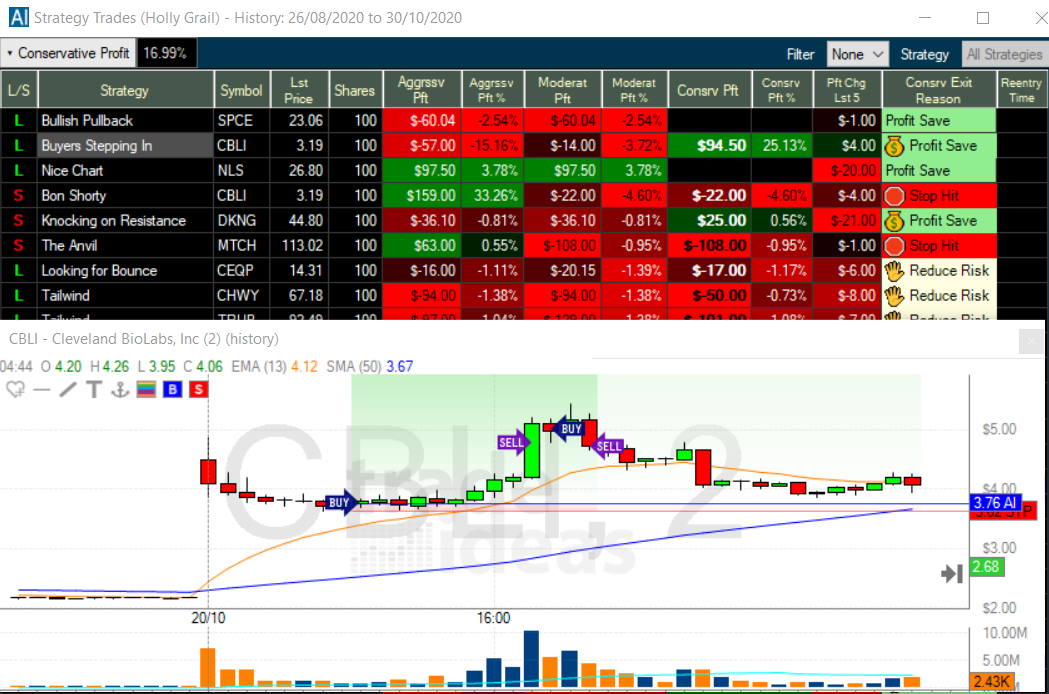

A significant benefit of Trade Ideas is that it visually shows you every buy and sell signal on a chart. I have highlighted a trade Holly AI (Holly Grail) recommended in the chart below. This trade for Cleveland Biolabs (Ticker: CBLI) made a 25% profit within 4 hours. Not how the buy and sell signals are depicted on the chart.

Get A Free Stock Trade Idea Every Week From Holly AI

Automated Stock Trading

Trade Ideas is one of the few services that offer fully end-to-end automated AI stock trading. It lets you connect to eTrade or Interactive Brokers for automated trade execution. Trade signals generated from Holly AI cannot be autotraded, but alert window scans can be auto-executed in a sandbox or live with your brokerage using Brokerage Plus (available in the premium plan).

My Trade Ideas AI Testing

After testing the Trade Ideas platform and assessing the AI stock trading and the day trading Bot performance, I can say this is the most compelling application of stock market AI for retail investors available today. This AI stock picker produces 3 to 10 trades daily, each lasting 2 minutes to 3 hours.

3. TradingView: Global Stock & Crypto Bots

TradingView is the most developed and highly automated platform for international stock, FX, and Crypto traders. It automatically detects chart patterns and candlestick patterns and enables AI Bot trading.

TradingView stands as the world’s premier trading platform, trusted by over 20 million active traders worldwide. It offers a seamless blend of powerful charting tools, advanced screening features, and in-depth analysis, covering a wide range of assets, including stocks, indices, ETFs, and cryptocurrencies.

TradingView provides best-in-class technical analysis tools to analyze financial markets. It offers heatmaps, super charts, indicators, strategy development tools, and backtesting capabilities. Its vibrant community of traders shares ideas, strategies, and custom indicators, making it an invaluable resource for learning and collaboration.

Pros

✔ 20 million users sharing ideas

✔ Trading from charts

✔ Powerful screening and technical analysis

✔ All stock exchanges globally

✔ 100,000+ user-generated strategies

✔ Free and low-cost plans

✔ Flexible backtesting with pine script

Cons

✘ Not ideal for value or dividend investors

✘ Coding skills required for backtesting and custom indicators

| ⚡ TradingView Features | Charts, News, Watchlists, Screening, Chart Pattern & Candlestick Recognition, Full Broker Integration |

| 🏆 Unique Features | Trading, Backtesting, Community, Global Stock, FX & Crypto Markets, Webhook Bot Integration (with Signal Stack) |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free | $13/m to $49/m annually |

| 🆓 Free | Try TradingView’s Free Plan |

| 💻 OS | Web Browser|PC|IOS|Android |

| 🎮 Trial | Yes, Free 30-Day Premium |

| ✂ Discount | $15 Discount Available + 30-Day Premium Trial |

| 🌎 Region | Global |

TradingView can automatically detect and scan for hundreds of chart patterns, such as the double top or rectangle, and bullish and bearish candle patterns like Harami, Doji, or Marubozu. This feature enhances the platform’s usability and empowers users with comprehensive market analysis tools.

TradingView has incredibly powerful backtesting, which can automatically identify complex trading setups and issue Webhook alerts to systems like SignalStack to execute.

To use the Pine script backtesting, you must learn basic scripting, which can take some time. There is no code-free backtesting or indicator development engine.

Although not a coder, I’ve leveraged TradingView to develop my Market Outperforming Stock & ETF System (MOSES). MOSES effectively identifies potential stock market declines and opportune moments to reinvest.

TradingView AI Bot Integration

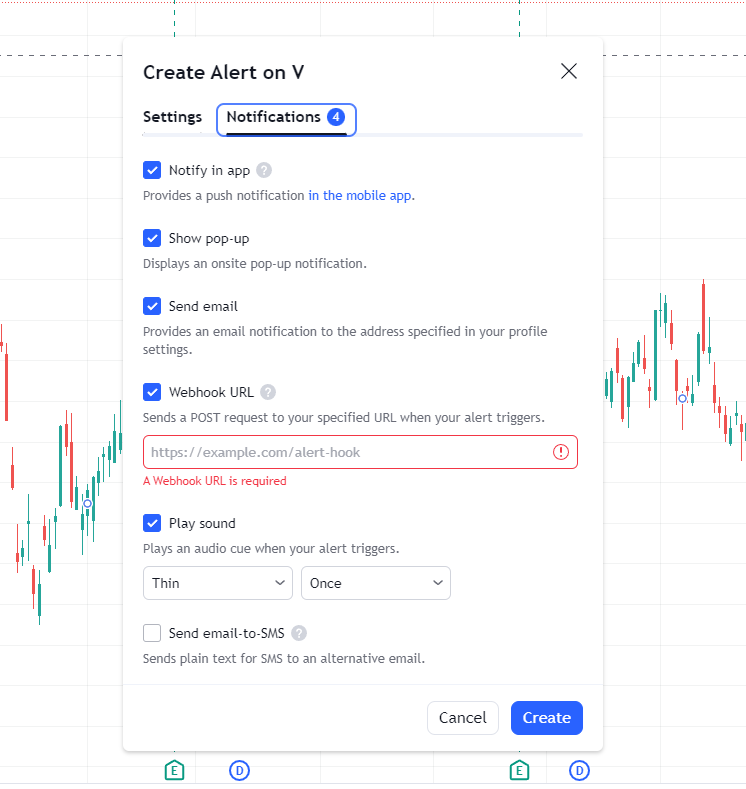

Enabling AI Bot integration on TradingView is easy: Right-click a chart, Select “Add Alert,” Click “Notifications,” and add a Webhook URL. (See my screenshot image below.)

One noteworthy advantage of TradingView is its extensive selection of integrated Brokers. No matter where you are located, you can find a reputable and authorized broker to execute trades on your behalf seamlessly.

Moreover, TradingView boasts the largest global community of traders and is the world’s number-one investing website. With global availability across stocks, ETFs, Forex, and Crypto exchanges, TradingView remains the preferred platform for traders worldwide.

4. Tickeron: Top AI Investing Bots

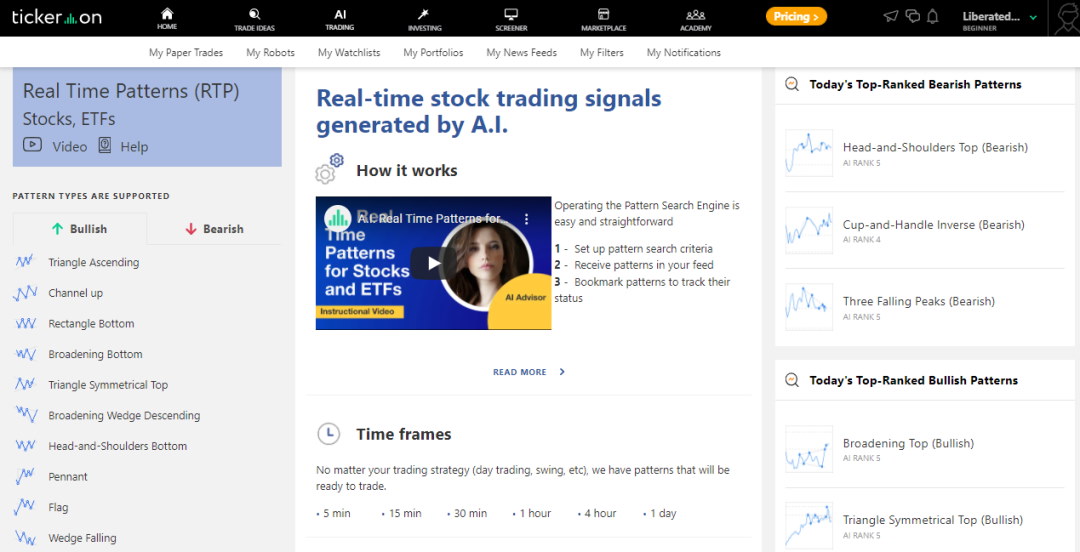

Tickeron is an excellent AI trading software that uses stock chart pattern recognition to predict future trends, providing 45 streams of trading ideas. Tickeron allows you to build your AI portfolios with predictive returns.

My Tickeron testing confirms impressive AI-powered chart pattern recognition and prediction algorithms for stocks, ETFs, Forex, and Cryptocurrencies. Tickeron provides reliable thematic model portfolios, specific pattern-based trading signals, success probability, and AI confidence levels.

Tickeron’s trading platform is unique and innovative. It combines artificial intelligence and human intelligence based on the community of traders, so you can compare what humans think versus what machines think.

Tickeron is designed for day traders, swing traders, and investors.

Pros

✔ 45 Streams of Trade Ideas

✔ Real-Time Pattern Recognition for Stocks, ETFs, Forex, and Crypto

✔ AI Trend Prediction Engines

✔ Investing Portfolios with Audited Track Records

✔ Build Your Portfolios with AI

Cons

✘ Custom Charting Limited

✘ Cannot Plot Indicators

✘ Complicated Pricing

| ⚡ Tickeron Features | Portfolios, Watchlists, Screening, 45 Streams of Trade Ideas |

| 🏆 Unique Features | Real-time AI Trading Signals for ETF, Forex & Crypto & Pattern Recognition, AI Portfolios |

| 🎯 Best for | Day & Swing Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | Free or $250/m or $125/m annually |

| 💻 OS | Web Browser, PC |

| 🎮 Trial | 14-Day Free Trial |

| ✂ Discount | 50% Off All Annual Plans |

| 🌎 Region | USA |

Tickeron is a wholly-owned subsidiary of SAS Global, a leader in data analytics whose services are used by most Fortune 500 companies. Tickeron uses AI rules to generate trading ideas based on pattern recognition. Firstly, they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Of course, each detected pattern has a backtested track record of success, and this pattern’s success is factored into the prediction using their Trend Prediction Engine.

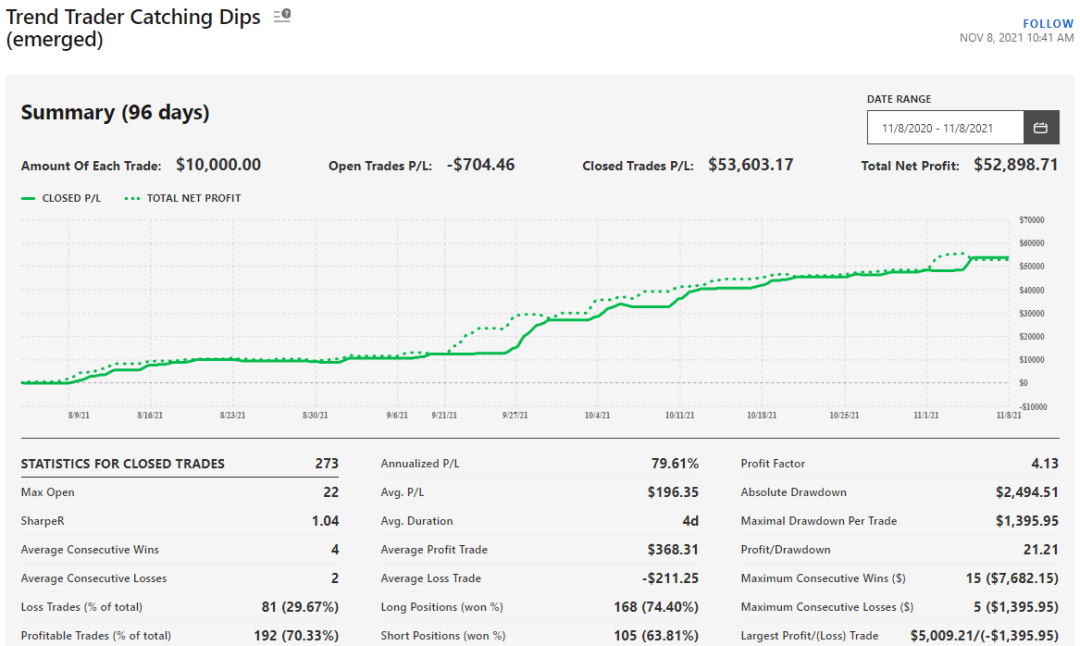

Tikeron AI Bot Performance

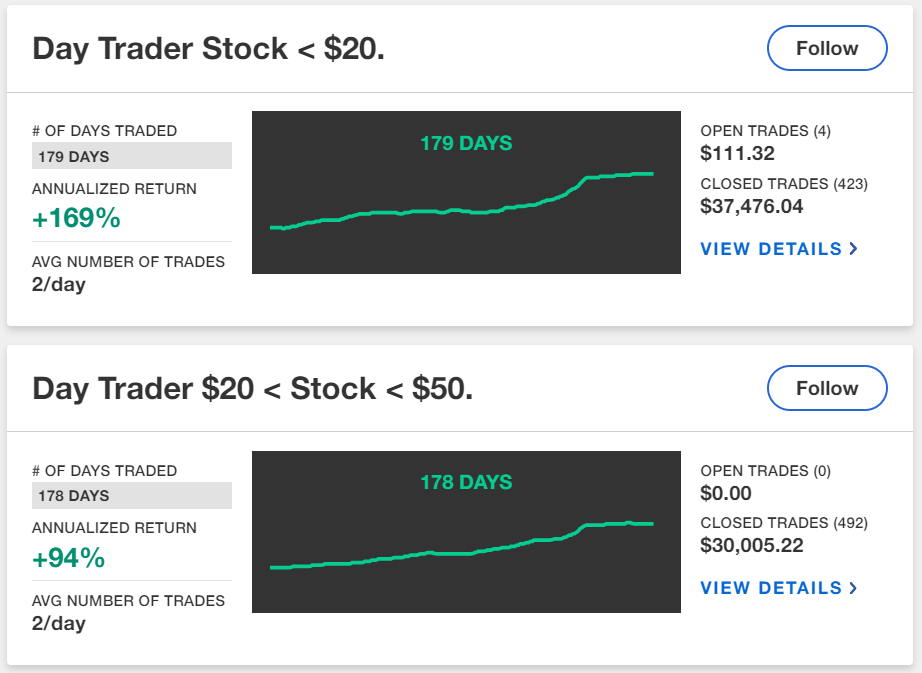

Tickeron is the only AI software on this list (apart from Trade Ideas) that shares its track record of success. Of the 34 AI Trading Bots I looked at, only 2 claimed less than a 30% annualized gain; the other AI Bots claimed from a 40% to 169% annualized gain, as shown in the image below. Tickeron claims impressive returns and audits all returns trade by trade.

Tickeron illuminates its AI algorithm’s performance by providing a fully audited track record of every stock Bot under management. Before purchasing a strategy, you can see its entire performance summary, trade amounts, percentage profitable trades, Sharpe ratio, and trade duration.

AI Stock Picks & Portfolios

Tickeron uses its artificial intelligence engine to provide specific stock picks. The algorithm can also be run on a specific index or watchlist to generate trading opportunities on your selection of stocks. Tickeron also offers innovative portfolios that use AI to build a portfolio with characteristics like diversification and high return. One specific AI stock asset allocation is “GROWING BIG DATA & CREATING BLOCKCHAINS PASSIVE,” which selects the best mix of AI stocks and blockchain companies.

Having tested Tikeron, I have to say that Tickeron is a very professional, sophisticated, and easy-to-use stock market AI software that delivers results. Tickeron is well worth trying.

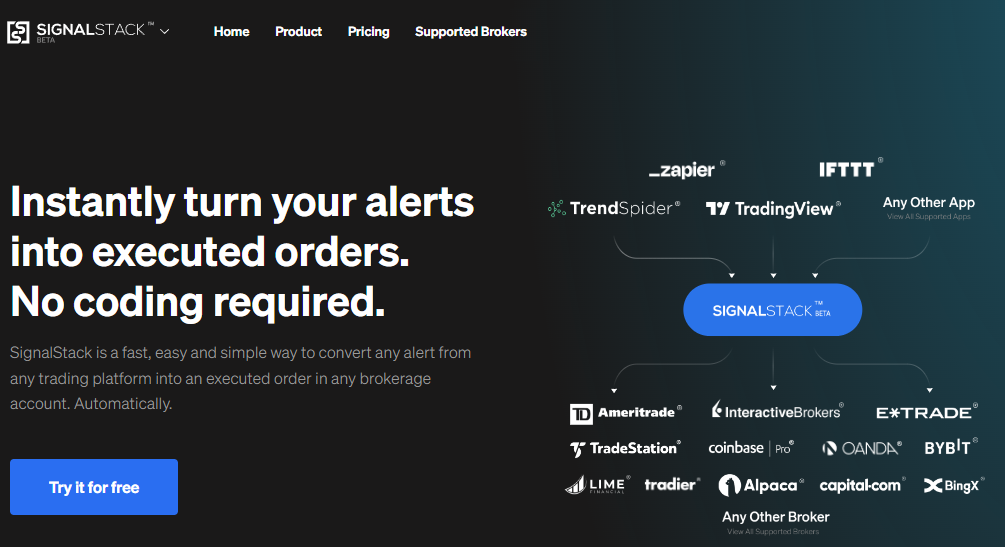

5. SignalStack: Converts Signals Into Trading Bots

SignalStack is an AI webhook-based automation tool that converts charting software like TradingView, TrendSpider, Schwab, and TradeStation into automated trading bots. This enables traders to automate and react quickly and accurately to market conditions without manually monitoring the markets all day.

SignalStack works with any software that can generate Webhook alerts so traders can easily execute high-probability trading opportunities.

| Signal Stack Rating | 4.5/5.0 |

|---|---|

| ⚡ AI Trading Features | Order Execution, Investing Bots, 99.99% Uptime |

| 🏆 Unique Features | Connects Charting Software to Brokers |

| 🎯 Best for | Stock, Fx & Crypto Traders |

| ♲ Subscription | Per Signal |

| 💰 Price | $0.59-$1.49/signal |

| 💻 OS | Web Browser |

| 🎮 Trial | 25 Signals Free |

| 🌎 Region | Global |

If your current trading software lacks AI Bot trading capabilities, SignalStack could be the solution you’ve been seeking. SignalStack is an intelligent middleware platform connecting your trading software with your broker.

SignalStack offers a multitude of benefits that revolutionize your AI trading experience. Firstly, it facilitates efficient order execution, eliminating the need for manual oversight and ensuring swift market order placements.

Moreover, the platform provides high availability to 99.99%, customization, and flexibility, allowing investors to tailor their strategies to align with their individual investment goals and risk tolerance.

SignalStack is designed to process incoming signals from external systems seamlessly and swiftly convert them into live orders within a brokerage account. This groundbreaking technology was previously inaccessible to retail traders.

6. MetaStock: Forecasting & Algo Systems

MetaStock has industry-leading AI stock backtesting and forecasting capabilities. It is a stock market technical analysis and charting service with over 600 types of charts and indicators. MetaStock allows the charting of stocks, ETFs, indices, bonds, and currencies.

My MetaStock testing highlights it as a robust trading platform. It offers over 300 charts and indicators for global markets, including stocks, ETFs, bonds, and forex. MetaStock R/T excels with its advanced backtesting and forecasting features, alongside real-time news updates and efficient screening tools.

MetaStock is best for traders who need excellent real-time news, exceptional technical analysis, a vast stock systems marketplace with global data coverage, and excellent customer service.

However, the full Metastock suite costs $265/m. It rivals the Bloomberg terminal in functionality but lacks the new AI trading features of TrendSpider and Trade Ideas, such as AI Bot trading and pattern recognition.

Pros

✔ Great Selection of Automated “Expert Advisors”

✔ Excellent Deep Backtesting

✔ Unique Stock Price Forecasting

✔ Large Library of Add-on Professional Strategies

✔ Best Charts, Indicators & Real-Time News

✔ Xenith Add-On Rivals Bloomberg Terminals

✔ Works Online & Offline

Cons

✘ Takes Time To Learn

✘ Old School Windows App Design

✘ Too Many Add-ons

| ⚡ Features | Charts, Watchlists, Scanning, Backtesting |

| 🏆 Unique Features | Algorithmic AI Forecasting, Real-time Global Trading News (Multi-language), Pattern Recognition with Add-ons. |

| 🎯 Best for | Stock, FX & Commodity Traders |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | MetaStock R/T $100/m, Xenith $265/m |

| 💻 OS | PC |

| 🎮 MetaStock Free Trial | 30-Day Free Trial |

| ✂ Discount | 3 Months for 1 |

| 🌎 Region | Global |

Another area where MetaStock excels is what they call “Expert Advisors.” MetaStock’s Expert Advisors are Trading Bots designed to help you understand and profit from technical analysis patterns and supply and demand fluctuations as a beginner or intermediate trader. These algorithms are not as advanced as the stock market AI provided by Trade Ideas, but you can improve upon them with a little coding knowledge.

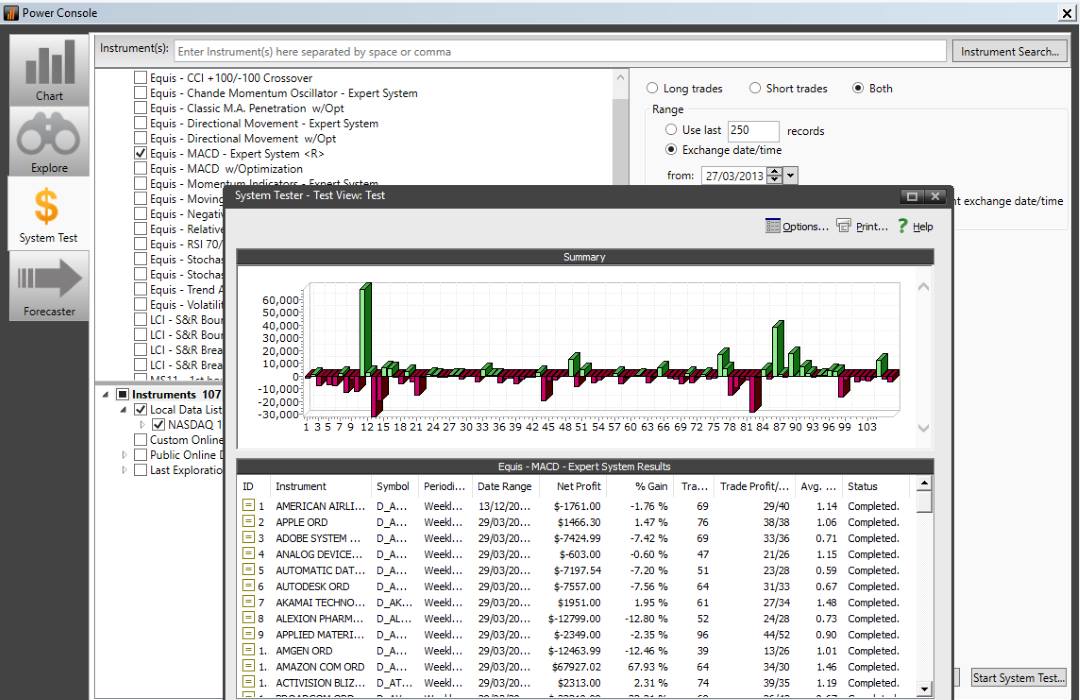

Smart Backtesting

As you launch MetaStock, you will be presented with the power console, enabling you to quickly select what you want to do. Select System Test, and you will have access to 58 systems you can backtest. In the example below, I selected the Equis—MACD Expert System and ran it on the entire Nasdaq 100.

After 60 seconds, the backtest was completed, and a list of every buy or sell trade and the drawdown on the portfolio chart was presented. See the image below. You can click through to any trade to see the trade background, trade size, duration, and profit or loss.

Of course, the inbuilt systems will not make you super-rich; you want to backtest and develop your own winning system to get an edge in the market. With some scripting or programming skills, you will achieve this with MetaStock. If you do not, you can ask MetaStock or one of many MetaStock Partners to assist you in building your system.

There are also many premium stock trading systems for MetaStock sold by their partners, which are usually supported by training and webinars.

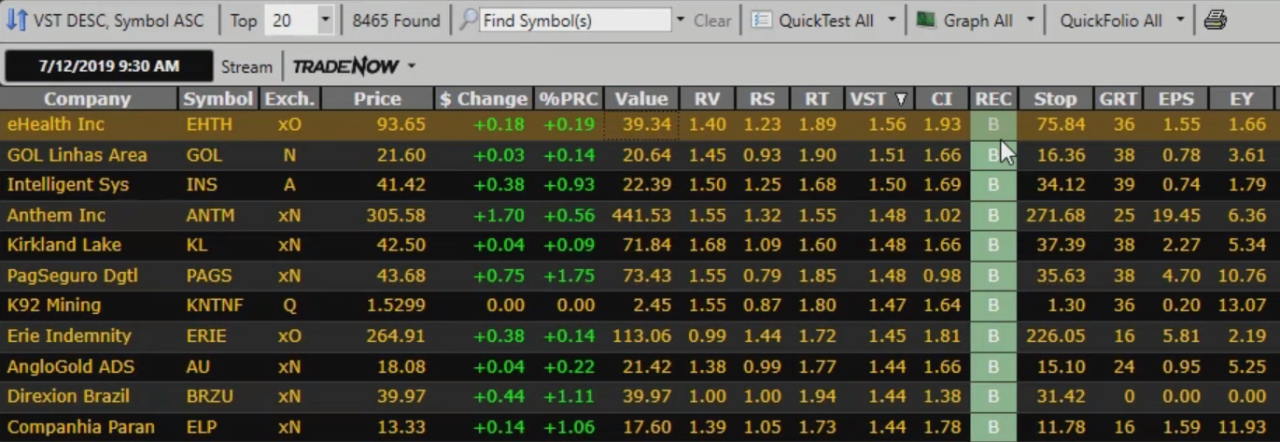

7. Vectorvest: Auto-Trading Bots & Signals

Vectorvest provides automated AI bot trading, signals, options analysis, and AI trading strategies. Although VectorVest may have a higher price tag, it claims its stock recommendation system has outperformed the S&P 500 by an impressive tenfold over the past 22 years. With such remarkable results, it is definitely worth trying.

| ⚡ Vectorvest Features | Charts, Watchlists, Screening |

| 🏆 Unique Features | Market Timing Gauge, Buy & Sell Signals, AI Auto-trading Bots |

| 🎯 Best for | Beginner Investors |

| ♲ Subscription | Monthly, Yearly |

| 💰 Price | $58 to $125/m annually |

| 💻 OS | Web Browser |

| ✂ Discount | 1st Month $0.99 |

| 🌎 Region | USA |

VectorVest benefits traders and investors by primarily simplifying the process of finding stocks based on its proprietary system and providing general bullish and bearish signals.

Dr. Bart DiLiddo founded VectorVest over 40 years ago to provide a simple-to-use system for recommending buy and sell signals to investors based on a proprietary stock-rating system based on Value, Strength, and Timing.

VectorVest software is straightforward because it promotes the Value, Safety, and Timing system. This means they have a minimal variety of stock market indicators; they provide only what is needed to trade within their VST system parameters.

AI Rules

VectorVest continually evaluates every stock on the exchanges they cover to provide their proprietary ratings.

- RV Relative Value shows the estimated return versus a AAA Corporate Bond.

- RS Relative Safety measures the consistency of a company’s financials.

- RT Relative Timing is a technical indicator that defines the short-term stock trend.

- VST Value-Safety Timing indicator aggregates RV, RS, and RT into one number.

Ultimately, VectorVest recommends that you trade stocks with good fundamentals that are moving in an uptrend, as the market is in an uptrend. This makes sense to me and is the foundation of my stock investing strategy.

VectorVest Performance

My only issue with these ratings is that they are proprietary, so we have no idea how they are calculated. Usually, if proprietary indicators are the unique selling point of stock market software, you would want to publish confirmed results of the system’s effectiveness. Unfortunately, that does not exist.

The only published VectorVest performance is a 20-year-old reference to fantastic returns of 2,000%+, which is unrepresentative of reality.

But does the VectorVest rating system produce market-beating gains? There is no proof for that.

AI Trading Bots to Avoid

Kavout: Avoid this AI Venture

Upon researching Kavout, I believe it is another defunct business claiming to be an amazing AI AI-automated trading chatbot. While I could register on the website for the free services, there was no free service.

While there are people listed on the website, I believe it is a failed project venture by a group of Chinese entrepreneurs. Its last funding round was in 2017, and there has been no news on the company in 3 years. With no YouTube channel, social media, or Trustpilot reviews, this is one company to avoid.

Algoriz: Avoid – No Business Information

It would be wise to avoid Algoriz. I tried registering with Algoriz to perform tests on the service, but it was impossible. It promises a trading chatbot that will understand your requests and turn them into profitable AI trading solutions. Alumni of Goldman Sachs supposedly built it, but no business or financial services registration information is available on its website.

Algoriz has no listed business owners, a YouTube channel, social presence, or Trustpilot reviews. Finally, Although It received $120K of seed funding in 2017, no funding has been received since. This suggests that the company is no longer a going concern.

StockHero: Avoid – Unrealistic Profit Claims

StockHero bills itself as “advanced AI trading software” but fails to deliver on its promises. It claims a win rate of 90%, but there is no evidence or track record performance audit. In fact, a 90% win rate is unrealistic and not in line with the most successful AI trading systems like Trade Ideas, which have a 20-25% win rate. Furthermore, StockHero provides no hard evidence or proof that its trading algorithms work. We recommend avoiding this program at all costs.

When I tried to register with StockHero to test the app, I was denied, which made me want to investigate further. StockHero demonstrated multiple red flags.

Final Advice

My hands-on testing confirms that Trade Ideas, TrendSpider, TradingView, and Tickeron are the clear leaders in AI stock trading algorithms and AI investing portfolios. Trade Ideas, TrendSpider, and TradingView are designed for stock trading, and all provide fully automated trading, while Tickeron specializes in AI investing and portfolio creation.

If you are looking for AI stock software that automatically uses alerts to execute day trades, then Trade Ideas is perfect. If you want to use AI stock charts to perform your backtesting and stock chart pattern recognition, then TrendSpider is ideal. For a global community and global data, TradingView is the best choice.

If you seek a broad selection of profitable AI stock-picking systems to generate trade signals or even structure hedge fund-style portfolios, then Tickeron is the best choice.

FAQ

Is AI Good For Trading?

Yes, AI is good for trading; most major investment banks use AI for arbitrage and portfolio selection. Modern AI trading software like Trade Ideas is now available for retail investors, providing automated trading with audited past performance and risk analysis.

AI has finally matured for stock trading. No one can guarantee a profit using AI for trading, but it does stack the odds in your favor.

Is AI Trading Legal?

The use of AI in trading is perfectly legal. As detailed in Dark Pools: The Rise of the Machine Traders, investment banks, dark pools, and market makers have been using AI to profit from arbitrage and inequity in stock prices. Twenty years later, AI trading is now available to retail investors through established companies like Tickeron and Trade Ideas.

Is AI Trading Profitable?

Very few AI trading systems remain profitable over the long term, especially in changing market conditions. Profitable AI trading systems need a proven, transparent track record over at least 3-years and demonstrate good risk management practices.

How Reliable are Trading Bots?

Trading Bots are only as reliable as the AI engine and algorithms that support them. The only indication of reliability is an audited track record of past performance. No one truly knows how reliably Trading Bots will perform in the future; we can only see past performance.

Can Trading be Automated?

Yes, trading can be automated. Over 80 percent of stock market trading is automated because investment banks, hedge funds, and market makers operating dark pools use computers to automate high-frequency trading (HFT) to arbitrage differences in asset prices between markets.

Do Trading Bots Work?

Yes, Trading bots do work, but future performance is never guaranteed. An AI algorithm may work for some time, but the market dynamic, business cycle, and investor sentiment are always changing, so different AI trading strategies need to be adopted in specific situations. The most reliable Trading Bot I have tested is Trade Ideas.

Is AI Stock Trading Worth It?

AI stock trading can be effective, providing you use a proven system with mature technology. Using AI to initiate stock trades is complex and requires stable infrastructure. AI algorithms do not guarantee success, but a good system can provide a slight edge.

Should I Use An Automated Trading Bot?

Using an automated trading Bot to execute your trades has inherent risk. The 2010 flash crash caused a one-day 9 percent crash of the S&P 500 and was widely blamed on high-frequency AI algorithms and their unpredictable behavior. If you use an automated trading Bot you need to ensure it has a proven track record and good risk management rules.

Are Trading Bots Safe?

Untested, unproven Trading Bots are not safe. There are significant risks with using complex trading bots if you do not thoroughly understand the logic behind the algorithms. A safe trading bot would have a proven performance history and provide transparency into the decision-making logic and risk controls.

What are the best free stock Bots?

Free stock Bots are generally not available because cutting-edge development, testing, and maintenance are expensive. The best Trading Bots like Trade Ideas require a monthly subscription.

Are trading Bots Legal?

Trading bots used to actively trade stocks, crypto, and other assets are 100 percent legal. 80 percent of equity trades in the US are executed by trading Bot and algorithms. The most common use of trading bots is in high-frequency trading to arbitrage asset prices. There are far fewer trading bots trying to beat the market, as it is so much more difficult.

Are Trading Bots Worth It?

If you are using trading bots to arbitrage asset prices, it is worth it. Citadel investments prove the value of trading Bots as they are one of the world's largest, most profitable market makers. Retail investors cannot compete with the cost and infrastructure required to deploy arbitrage trading bots, but they can compete using trading bots that use strategies to predict individual trade swings, such as Trade Ideas.

Can AI predict stocks?

AI trading systems can be used to predict stocks, but the success rate differences are small. If a trader predicts 51% of trades accurately, and an AI algorithm correctly predicts 55% of trades, this would be considered a big success.

How much money can a trading bot make?

Trading Bots do not make as much money as you might think. Any claims that trading bots can make you over 50% per year on your money should not be trusted. Seeking Alpha, Zacks, and Trade Ideas claim between 20% and 25% profit per year. Do not forget, Trading Bots can also lose money. The stock market return averages 8% per year; any trading Bot that exceeds this performance over time would be considered successful.

Is there a trading Bot that works?

From my research, two trading bots are proven to work. Tickeron's Long ETF Bot has a 49 percent annualized return over 4 years, and the Trade Ideas Holly AI Bot returned 23.2 percent, on a moderate risk setting.

What's the difference between AI, Machine Learning & Deep Learning?

AI is a broad category that includes machine learning and deep learning. AI refers to the execution of rules/algorithms that mimic human behavior. Machine learning refers to rules that allow a machine to form assumptions based on its data and begin developing its own rules, essentially learning. The final area of AI is a subset of machine learning known as deep learning; here, the machine teaches itself new behaviors based on its current data and past experience.

Our research shows that machine learning or deep learning employed in stock trading is exclusively available to institutions or hedge funds, as in the case of J4 Capital. This does not mean that broader AI rules execution cannot be successful in trading; it simply means that a revolutionary machine-driven approach to trading is not there yet.

What is AI Backtesting in Stock Trading?

As the creator of three reliable algorithmic approaches to investing (the Stock Market Crash Detector, LST Beat the Market Growth Stocks System & MOSES), I know that none of this is possible without backtesting a trading strategy. Backtesting means testing a hypothesis on historical data and assessing how often that hypothesis is true. In this comparison, all five of the AI stock trading software platforms use rigorous backtesting to improve the chance of trading success.

Can You Use AI to Predict the Stock Market?

Yes, AI stock trading algorithms are designed to predict the future direction of stocks and the stock market. However, they are not perfect predictors of the market. An AI algorithm with a prediction accuracy of 60 percent is considered highly successful. An exceptional trader would be thrilled with a 52 percent success rate, similar to the house edge at a Las Vegas blackjack table. Renaissance Technologies, perhaps the most profitable quant firm globally, has generated a fortune by leveraging bets with a 60 percent win rate, similar to Trade Ideas.

The date on your article is April 30, 2024, yet reading comments, they date from 2021. That’s a little confusing. I bring it up, because the section on Trade Ideas is now outdated… Holly no longer auto-trades, and according to Chris Varley at TI, Holly auto trading was discontinued 17 months ago. That part of your article is now outdated, and shouldn’t show a current date.

Hi Locolady, thanks for your input. I have now updated the article to reflect the changes. Staying on top of all the changes in all the trading software is challenging and I appreciate your feeback. Barry

Hi,

Great article. But none of the software quite fit my needs. From my perspective I have say algorithms helping to determine entry/exit etc. for a symbol or a group of dependent symbols. As well as flexible entry/exit criteria, like risk/reward metrics and so on. I can back test on my brocker’s software. What I want is an AI/machine-learning platform to automate trading that a:- has access to realtime data over any timeperiod. b:-allows me to simply program my algos in, process realtime market data (tick/minute/5min/4hour etc); generating trade entry and exit signals. c:- has an API compatible with my (ticker/ETF/Futures/Crypto) brokers to execute the trades, d:-has the ability to be replicated for each stock or account running in parallel (cloud/server scalable).

From the article I would losely compare (a/b) “AI Trading Signals”. and (c) with “Automated Trading Bots”. They all seem to lack the flexibility I am looking for. Is there a more bare-bones AI out there reasonably easy to adapt to trading. Or does say “Trade Ideas” have more flexibility in the algorithim definitions/design then what the literature suggests.

Any input is greatly appreciated.

Hi Jim, wow what a question. How about https://www.algotrader.com/ this might suit your needs. Let me know how you get on with your research.

Barry

Hello Liberated stock trader,

I read your review on AI-systems and found it very useful. I am testing the trade-ideas Holly-AI at the moment. My problem is: the commissions… Although low (1$ per 100 shares or 5$ per 1000), they minimize the profit. You wrote that one could make about 20% a year. I have all three segments running, assuming 10.000 $ of buy and sell together every day invested ( and flattened), how much should I be making in one year? 10.000 x 0.2 = 2000? Minus commissions? That would not even cover the costs?! Could you explain? If I wanted to invest more four or five real bad days in a row would wipe out my account, wouldnt they?

Thanks in advance… A “trader”

Hi Bernd, I forwarded your question to my contacts at Trade Ideas, here is the answer to your question from Chris Varley @ trade-ideas.

Hello,

While I do not have the exact figures on how IB structures commissions (one of the two brokers we directly link to) From my experience with them and the commissions structure I selected with them it works out to be about $1 in and $1 dollar out per trade when taking 150-300 shares per trade, so realistically those commissions should not bare much affect on your trades. They will add 1-2 cents at most to the cost basis per share.

Example: you buy 200 shares market at $15 your cost basis is $15.01 When buying more shares the commission goes up a bit the cost basis will remain relatively the same

You can have a look at IB’s page for the different commission structures https://www.trade-ideas.com/ibkr

You would have to pay IB for live data if you are looking at automation with Holly and that costs about $4.50 a month for one plan, or you can take a $10 plan and have the fee waved if you have $30 in commissions a month.

Etrade which is the other broker we link to has no commissions or data fees.

If you are only looking to manually trade then you can go with any broker you choose

As for the question what you should be making in a year- There really is no way to know, aside from commissions there are other factors involved. There is slippage, HTB stocks or No Borrow stock, and while these things do not happen often they play a role.

This here is a video I did on Holly in simulation with some realistic thoughts behind it>https://www.youtube.com/watch?v=vQ6wFHvbT80&list=PLrjuUll3PvdJUKmXXA8wqtaSzc7JndiHY&index=11&t=10s

I would also like to invite you to our daily 12pm Est Q&A session and/or our 3:30pm Est Q&A session were we can address any other questions. Here is that link https://www.liberatedstocktrader.com/trade-ideas-trading-room This room goes Live at 9am Est with Barrie but has the live Q&A’s at the aforementioned times

Best,

Chris Varley

How can I get started and how much the cost

Hi Marvin, simply select the software you want to try and go from there.

Do you have any fully automated trading programs that trade themselves? Thanks.

Phillip

Hi Phillip, thanks for the question.

The best that I know of is Trade Ideas, they have a fully automated solution based on their AI engine. https://www.liberatedstocktrader.com/trade-ideas

Barry