I believe the best ways to learn stock trading include books, audiobooks, data-backed analytical research, and reputable investing courses taught by industry-certified instructors.

It is crucial to exercise caution and avoid individuals who promote get-rich-quick schemes promising gains exceeding 25% per year.

This is our definitive list of the best resources to learn stock trading.

As an IFTA-certified financial Technical Analyst with decades of investing experience, I share the best ways to learn stock trading effectively and quickly.

1. Read the finest books on stock trading analysis

Technical analysis books are a great way to learn stock trading. You can learn important concepts such as fundamental analysis, technical analysis, charting, and risk management.

Teaching yourself stock trading with books is cost-effective but time-consuming, so you must read only high-quality material. The best stock trading books provide a rich source of knowledge and wisdom.

With thousands of books to read, where do you start? I recommend you read the books finance professionals use to learn technical analysis. Here are the best books that professional market technical analysts study to qualify for the International Federation of Technical Analysts (IFTA) or Chartered Market Technician (CMT) certifications.

The stock trading books I highly recommend are:

2. Join an online trading community

TradingView has a lively online trading community with over 13 million active traders if you want to learn to trade with other stock traders. I am also part of this community and regularly contribute and update thousands of followers.

Chart, Scan, Trade & Join Me On TradingView for Free

Join me and 20 million traders on TradingView for free. TradingView is a great place to meet other investors, share ideas, chart, screen, and chat.

3. Watch my “How to learn stock trading” video

If you prefer to watch rather than read, my guide to stock trading will help you through the entire process of learning stock market trading with every high-quality free and low-cost resource available.

4. Listen to investing audiobooks

Are you tired of reading books? Perhaps you’re too restless to sit for a stock trading movie. Why not indulge in a captivating trading audiobook while commuting, tending to your garden, or taking your furry friend for a walk?

You can learn stock trading with excellent audiobooks that teach you everything from hedge funds, investing strategies, trading tactics, and the financial system’s operation.

Our Top 20 Best Stock Market & Finance Audio Books List has great listens, like the highly rated “Flash Boys” by Michael Lewis or “The Quants” by Scott Patterson. Fill your day with learning without being chained to your desk.

I recommend these five great stock trading audiobooks:

- Flash Boys – Machine tradings impact on the stock market

- Dark Pools: The Rise of the Machine Traders

- Liars Poker – Stocks, Bonds & Leveraged Trading – Michael Lewis

- The Big Short – Financial Crisis 2008 True Story

- The Quants – Impact of HFT Trading on Financial MarkHFT

5. Take a free stock trading course

A free, structured, and well-researched stock trading course is a great way to learn stock investing. Many free stock trading courses exist, but most educators have no formal experience or certifications in stock analysis or fund management.

Liberated Stock Trader offers four free stock trading courses written by me, a certified market analyst.

Our Free Trading Courses Include:

- Course 101 – Introduction to Investing – This course will cover various investing-related topics, including investment vehicles, managing financial risk, and trading in various markets.

- Course 102 – Stock Market Investing – This course starts by looking at the different types of stock markets and how they have grown in recent years. We will then compare the global stock markets and examine their main differences. We will also examine the boom and bust cycles that often occur in the stock market and learn how to profit from them.

- Course 103 – Technical Analysis – Technical analysis studies what has happened, what is happening, and what will happen in the future with asset prices. Analysis and prediction are performed using stock charts.

6. Invest in expert training

Choosing a professional stock trading course will help you learn about stocks faster than with books, videos, and audiobooks, so you can save time and gain more experience.

The Liberated Stock Trader Pro course offers 16 hours of in-depth videos and an eBook written by myself, Barry D. Moore, a certified market technician. This training will enable you to gain the knowledge and confidence you need.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★

7. Start paper trading with free stock charting tools

Free stock charting tools may not have all the bells and whistles compared to their paid competitors, but they are perfect for beginners and will not dent your wallet. Our review of the 10 Best Free Stock Charting Services on the Web will help you choose.

5 Best Free Stock Trading Software

- TradingView: Best Free Stock Charting Software, App & Community

- Stock Rover: Best Free Stock Analysis & Research Tool

- Benzinga Pro: Free Real-time News & Charts

- Finviz: Fast, Free Stock Charting & Screening

- TC2000: Best Free Charts for Technical Analysis Scanning

8. Learn how stock trendlines work

Trendlines are an important tool for technical analysis. They help indicate if a stock is trending up or down and can also be used to identify support and resistance levels. So, to start trading stocks, you must understand how trendlines work.

The market’s direction plays a crucial role in shaping your investment outcomes. Notably, the influence of mega-companies like Apple, Microsoft, Amazon, and Nvidia can temporarily impact the market’s trajectory. It’s important to note that all stocks, including the good ones, tend to decline during a market collapse. Conversely, in a robust bull market, even the underperforming stocks witness a rise. Understanding these dynamics is crucial for making informed investment decisions.

You can use Dow Theory to assess market direction using the major indices. Dow Theory is discussed in depth in our Pro training. You can even use Ichimoku Cloud Theory to try to predict market direction.

9. Learn which indicators and patterns work

Not all stock chart indicators and patterns are useful. The study of technical analysis and the advent of automated backtesting allows us to understand which chart patterns and indicators are profitable. Here at Liberated Stock Trader, I have dedicated years of research into candlestick patterns and chart indicator backtesting to reveal the ideal combinations.

Video: The Best Indicators for Stock Trading

Additionally, I have tested candlestick patterns used in trading to discover the few that work consistently.

10. Prepare a stock trading strategy

A key step in learning to trade stocks is deciding your investing strategy. Will you implement a value investing strategy to purchase undervalued stocks, a growth strategy for profiting from stock price growth, or an income strategy to earn money from dividends?

Here are some great strategies to help you decide:

- MOSES ETF Investing Strategy: Beat The Market & Lower Risk

- Liberated Stock Trader Beat the Market Growth Stock Strategy

- Find the Best CANSLIM Stocks Using a CANSLIM Stock Screener

- How To Find Undervalued Stocks Like a Pro Value Investor

- How To Analyze Stocks: Fundamental vs. Technical Analysis

- 6 Steps to Build Your Dividend Stock Screener & Strategy

There is certainly a lot to consider when building out your investing strategy. There are core questions: Should you use a day trading strategy versus a buy-and-hold strategy? Is Value investing like Warren Buffet for you, or is the more time- and nerve-intensive swing trading more your style?

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

11. Build your stock trading system

What chart indicators will you use? Under what conditions will you buy a stock? When will you sell a stock? Why did you buy the stock, and are those reasons still valid? There are so many questions, and here are some answers.

These are all known as trade rules. Establishing your criteria for buying, holding, and selling a stock before buying it can help take the emotion out of a trade. Read 10 Steps to a Professional Stock Market System. Emotions are your worst enemy; you must treat your investment decisions with logic, not a slice of gut feel. This is when backtesting comes to the rescue.

12. Learn strategy backtesting

When stock trading, you must understand your reasons for a particular trade, but over the long term, is your hypothesis profitable? An untested hypothesis is not worth the paper (or screen) it is written on. You must spot and avoid stock market crashes and establish trading rules based on your stock trading style. Also, advanced traders will use thorough stock backtesting to ensure the strategy has worked in the past.

While system backtesting is time-consuming, it helps you understand which of the many indicators, such as the Relative Strength Index, Moving Average, and MACD, actually worked in a real-world environment in the past.

While past performance is no indicator of future performance, you can see statistically what has worked and has not worked over thousands of trades.

13. Use real-time trading news

Understanding how real-time financial news impacts stock prices is extremely useful when learning stock trading. Many traders use this information to trade stocks. To learn to trade active stock market news events, you will need a real-time streaming financial news service.

You need a good news source to track macro or microeconomic events. There are many good news sources for you to look at, including Reuters and Bloomberg. However, look at our review-winning Benzinga Pro News Service if you want cost-effective real-time streaming news and innovative market insight.

If you trade the news, you will want news delivered in real-time, which might cost.

A Quick Summary of the Most Reliable Financial News Services & Apps:

- Benzinga Pro: Real-time stock news for traders

- MetaStock R/T: Real-time global financial news app

- Bloomberg: Best finance TV channel

FAQ

How do I learn to trade on the stock market?

Learning to trade the stock market is an intellectual endeavor. You must avoid day trading scammers with Lambo's on TikTok and knuckle down to reading serious trading books and taking professional trading courses from industry professionals.

Can I get rich off stocks?

The best way to get rich off stocks is to own your own business and grow that business to an initial public offering (IPO). Secondarily, you can get rich off stocks but expect at most 25% profit yearly.

Which stock trading site is best for beginners?

For beginners, the best site for learning stock trading is LiberatedStockTrader.com; it offers extensive free and premium stock trading training from an industry-certified professional market analyst.

Can I teach myself the stock market?

Yes, you can teach yourself stock market trading, but it takes at least 100 hours of study and practice to develop good knowledge and confidence. Start by reading high-quality stock trading books and taking these online trading courses.

Do you need math for stock trading?

Basic math knowledge is helpful for stock trading, but understanding how financial news, macroeconomics, and sentiment affect stock markets is more beneficial.

Do millionaires invest in stocks?

Yes, millionaires do invest in stocks because stocks are one of the most profitable assets available. Millionaires spread their investments across a portfolio of assets, real-estate 3 annually, bonds 1-2%, and the stock market 7-9% per year. A highly successful independent stock trader can expect a long-term annual profit of a maximum of 25%.

Can you trade stocks for a living?

Yes, you can trade stocks for a living if you are a fund manager. If you are an independent trader requiring $5000 for living expenses every month and making 15% in annual stock trading profits after tax, you will need a trading portfolio of at least $400,000.

Can I start trading with nothing?

No, you cannot start trading with nothing. You need capital to make profits despite what social media influencers tell you. Best to save money and take time to study investing so you can avoid losing your hard-earned cash needlessly.

What is the easiest way to learn trading?

The easiest way to learn trading is to take a respected stock trading training course from an industry-certified professional who will provide an unbiased guide through the investing process. Following TikTok traders and YouTube influencers' cryptocurrency pump-and-dump schemes should be avoided.

Which trading is most profitable?

Long-term trading in growth stocks is the most profitable strategy. Day trading should be avoided because humans cannot compete against high-frequency machine traders. Short to medium-term swing trading can also be profitable.

How many hours does it take to learn stocks?

The truth is that learning stock investing takes multiple years. Anyone who tells you it is easy is being misleading. You can learn the theory of stock trading in 16 hours. But putting theory into practice takes a lot of time. For 99.9% of investors, it is best to invest in broad-market ETFs over the long term.

How many days will it take to learn stock market trading?

To learn stock trading properly will take at least 30 days of study and 300 days of full-time practice. I have been trading for 20 years, and I understand the effort it takes to understand the stock market.

Do you need 25k to trade stocks?

No, you do not need 25K to invest in the stock market; you can start investing with only $20. However, if you want to be an active pattern day trader in the USA, you need at least a $25K account balance.

What skills do traders need?

The skills a trader needs are:

- The ability to continually learn.

- A structure to learning and strategy development.

- Self-discipline to stick to the plan.

- The ability to learn from mistakes.

- A positive attitude, but not overconfident.

What do rich people invest in?

Rich people invest in stocks, bonds, fine art, fine wine, and real estate. Most importantly, rich people buy businesses and invest in people because those people make them richer through the power of leverage.

How to become rich in five years?

You can become rich in five years by growing your own business to fabulous wealth, robbing a bank, or marrying a rich person. Otherwise, you need to invest a lot of time growing rich slowly through earning and investing.

Can you make $1,000 a day trading stocks?

Yes, you can make $1,000 per day in stock trading if you have an account balance of $36.5 million and a trading profit of 10% per year. If you think you can make $1,000 a day in any other way, you are being misled by social media influencers.

Here is the calculation. $1,000 per day * 365 days per year = $365K. 10% return on $36.5 million = 365K per year.

How to day trade with $100?

You cannot day trade with $100. More money is needed. Any online influencer who tells you differently is misleading you.

Is trading like gambling?

Trading is similar to gambling because you make bets that your hypothesis will be proven correct. However, trading stocks is also different from gambling because the stock market goes up over the long term, and you have a lot of news and financial information at your disposal. So, trading stocks is more like investing than gambling over longer timeframes.

How much can a beginner earn trading?

If you use a stable, proven long-term investing strategy, you can expect to make 8% to 10% per year on your investment. If you are day trading, you can expect to lose your entire investment.

Thank you Barry for this beautiful article. I enjoy reading this. I appreciate your thoughts and ideas. The videos are very helpful to make them easy to understand to the viewers. Great job.

the best stock thing ever ,, i even took a stilo and start writing someowhere something ,, everything perfect and i appreciate it

Please am interested in learning stock trading, kindly walk me through the processes to get started. Is it all free learning?

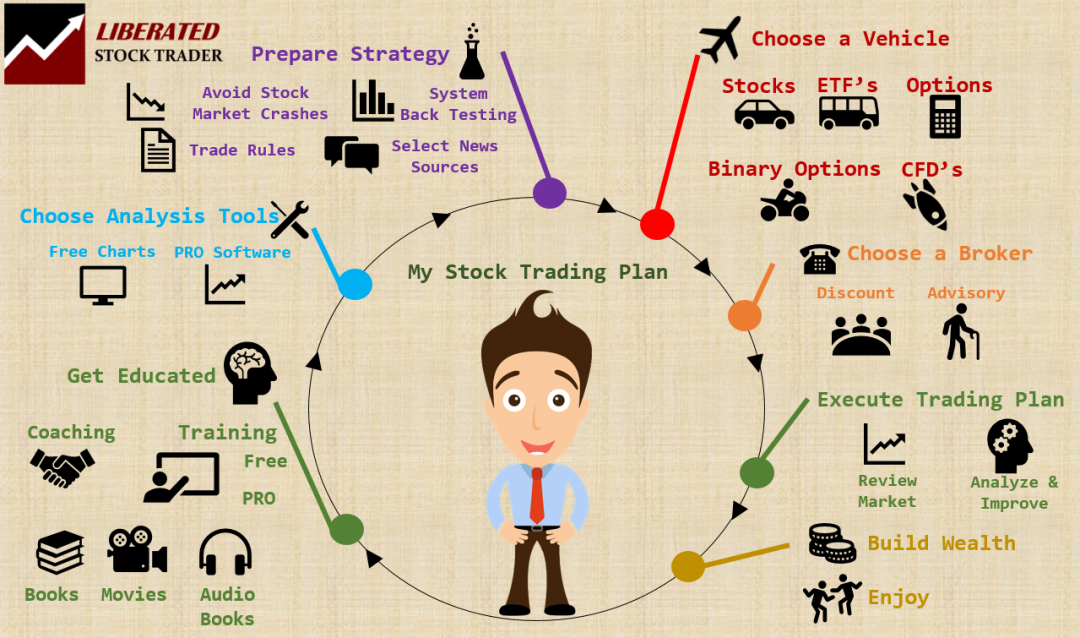

Hi Fred, the process is above, just hover over the big image at the top and you will see hints and tips pop up. Most of it is free, yes.

thanks

I hope you won’t take this as too harsh but I think if you’re planning on trading then you’re likely to lose money. Most people should not be trading at all. You’re competing against people who know what they’re doing because they do it day in and day out for a job. You’re much safer to buy a global equities index fund instead.

Hi Barry, lots of good info here. IMO the best step a beginner can take is to just take the leap and get involved with real money. There’s only so much books and articles and coaches can teach you, real life has a funny way or imparting lessons fast

Stock trading is a risky investment and it is only wise to learn all the ropes before starting out to avoid making mistakes that might cause you your investment. Thanks for the step by step guide.

Help me out please. I went to a 3 day free online trading workshop. At the end of that workshop they suggested us to sign up for 9 months intensive online trading course. The tuition ranges $20,000 to 40,000 . Does it really worth it?

Hi Longinus, I have no idea of the background here, but it seems an insanely high amount of money for a training course. I would suggest you try our PRO training, and then decide if you need further training. 20 to 40K$ is too much.

PRO Training

Wow this is great, it gives me so much structure to learn trading, and I love the picture.

Thanks Bobby, I like the picture of the little dude. I will make the next one a lady

Thanks so much Barry. I really appreciate the stuff you have compiled for me. Please allow me a day or two to go through it and perhaps come out with a plan. Thanks again.

Chris

Thanks Chris, I hope it helps