Find the best growth stocks to buy now using a 12-year-tested and proven growth strategy system that selects stocks that outperform the S&P 500.

Instead of following stock tips from financial websites, you can adopt a structured approach to find stocks with a proven track record of beating the market.

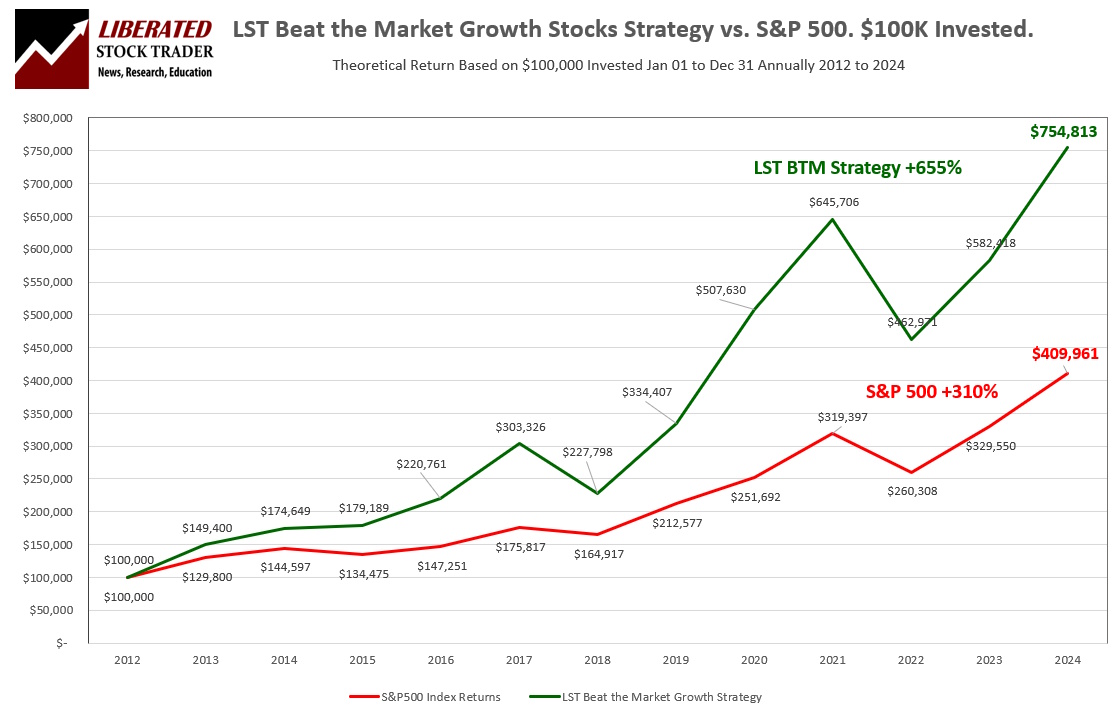

The Liberated Stock Trader Beat the Market Growth Stock Strategy has outperformed the S&P 500 in 10 of the last 12 years, providing a 12-year total return of 655%, beating the S&P 500 by 84%.

The LST Beat the Market™ (LSTBTM) screener is a 12-year proven strategy that finds financially healthy high-growth stocks with a track record of outperformance. It identifies the 35 best growth stocks to buy now to help you beat the S&P 500. A system that gives you an investing edge.

35 Best Growth Stocks To Buy Now

The LSTBTM system has identified the best growth stocks to buy now. This selection is based on high EPS, impressive Greenblatt financial ratios, a top Stock Rover growth score, and a track record of beating the S&P 500 in the previous year.

Here is the full list for April 2025.

| Ticker | Rank | Company | Free Cash Flow (m) | Greenblatt ROC | 1-Year Return vs S&P 500 | EPS 1-Year Chg (%) | Growth Score | Greenblatt Earnings Yield |

|---|---|---|---|---|---|---|---|---|

| GSHD | 1 | Goosehead Insurance | 59 | 87.80% | 95.40% | 92.20% | 100 | 1.90% |

| PODD | 2 | Insulet | 296 | 16.40% | 34.50% | 73.60% | 100 | 2.00% |

| EXEL | 3 | Exelixis | 634 | 48.50% | 51.90% | 170.80% | 99 | 7.50% |

| MELI | 4 | MercadoLibre | 7,058 | 43.20% | 42.60% | 69.20% | 99 | 2.40% |

| UTI | 5 | Universal Technical | 74 | 17.60% | 85.80% | 164.90% | 99 | 4.80% |

| AGI | 6 | Alamos Gold | 239 | 10.70% | 96.60% | 32.70% | 98 | 4.20% |

| CINT | 7 | CI&T | 62 | 76.70% | 15.80% | 72.10% | 98 | 8.70% |

| GFI | 8 | Gold Fields | 424 | 27.00% | 36.80% | 74.70% | 98 | 8.60% |

| LRN | 9 | Stride | 260 | 28.30% | 127.60% | 39.60% | 98 | 6.40% |

| PGR | 10 | Progressive | 14,834 | 1391.40% | 25.50% | 47.40% | 98 | 6.70% |

| AROC | 11 | Archrock | 71 | 799.70% | 23.10% | 26.50% | 97 | 8.40% |

| CTRE | 12 | CareTrust REIT | 236 | 60.10% | 22.30% | 50.90% | 97 | 2.70% |

| GHC | 13 | Graham Hldgs | 324 | 65.90% | 26.00% | 169.40% | 97 | 29.70% |

| RBC | 14 | RBC Bearings | 259 | 32.70% | 21.70% | 13.90% | 96 | 3.30% |

| DORM | 15 | Dorman Products | 192 | 27.20% | 19.70% | 23.50% | 95 | 7.50% |

| ESE | 16 | ESCO Technologies | 108 | 28.90% | 47.20% | 11.80% | 95 | 3.90% |

| HALO | 17 | Halozyme Therapeutics | 468 | 56.30% | 45.20% | 42.30% | 95 | 7.10% |

| ERJ | 18 | Embraer | 405 | 18.60% | 70.10% | 35.00% | 94 | 9.20% |

| IDR | 19 | Idaho Strategic Resources | 5 | 26.80% | 105.70% | 168.00% | 94 | 3.40% |

| WRB | 20 | WR Berkley | 3,573 | 499.80% | 22.00% | 16.20% | 94 | 8.90% |

| BKNG | 21 | Booking Holdings | 7,894 | 137.70% | 26.40% | 30.10% | 93 | 5.70% |

| EGO | 22 | Eldorado Gold | 16 | 8.80% | 26.70% | 139.30% | 93 | 11.20% |

| HMY | 23 | Harmony Gold Mining Co | 521 | 29.50% | 94.70% | 16.40% | 93 | 8.00% |

| TIPT | 24 | Tiptree | 237 | 329.30% | 39.10% | 124.10% | 92 | 19.00% |

| ATGE | 25 | Adtalem Glb Education | 234 | 66.50% | 130.90% | 97.40% | 91 | 6.50% |

| DGICB | 26 | Donegal Gr | 67 | 2552.70% | 28.50% | 856.30% | 91 | 10.10% |

| GOLD | 27 | Barrick Gold | 1,317 | 15.00% | 20.00% | 48.80% | 91 | 13.80% |

| INOD | 28 | Innodata | 27 | 48.80% | 475.20% | 1012.50% | 91 | 2.30% |

| TMUS | 29 | T-Mobile US | 9,982 | 27.00% | 61.70% | 31.40% | 91 | 4.40% |

| DGICA | 30 | Donegal Gr | 67 | 2552.70% | 35.10% | 856.30% | 90 | 10.20% |

| MMSI | 31 | Merit Medical Systems | 183 | 15.60% | 19.60% | 16.70% | 90 | 3.10% |

| NATH | 32 | Nathan’s Famous | 25 | 109.80% | 40.30% | 20.80% | 90 | 9.00% |

| PRI | 33 | Primerica | 833 | 1099.30% | 15.20% | 27.90% | 90 | 9.80% |

| AXS | 34 | Axis Capital Holdings | 1,845 | 1163.10% | 53.30% | 88.80% | 87 | 14.50% |

| CAKE | 35 | Cheesecake Factory | 107 | 8.10% | 36.30% | 46.10% | 87 | 4.30% |

This list is updated daily, so for the latest stocks, consider applying this strategy.

A Strategy To Find the Best Growth Stocks

LSTBTM Selects 35 Growth Stocks With A Significant Proven Chance to Outperform The Stock Market

A Unique Market-Beating System That Takes The Pain Out Of Stock Selection

★ Stocks That Have Strong Earnings Growth ★

★ Stocks That Make Great Use Of Their Assets ★

★ Stocks With A Growing Cashflow ★

★ Stocks That Already Beat The Market ★

★ Buy The Stocks & Hold For 12 Months – Then Rotate ★

★ Full Video Training Course ★

Performance Chart

Or buy now and take your trading to the next level!

If you have any questions on the course or issues with the payment process, please get in touch with me directly @

✉ support (at) liberatedstocktrader.com.

Warranty

As with any stock market investment strategy, past performance does not guarantee future success. The effectiveness of any system diminishes as more institutions adopt it. This “beat the market growth stocks” strategy is no exception. LiberatedStockTrader.com assumes no responsibility for the outcomes of using this content. We do not recommend specific stock purchases and are not liable for any losses incurred. By utilizing this or any other published material for investment purposes, you acknowledge and agree to our disclaimer.

- You will need a Stock Rover Premium Plus subscription to use the system with Stock Rover.

This system has proven very effective to date (2025), but its future performance is not guaranteed.

I have an annual tradingview plan on renewal and only 25 percent discount offered. So I am cancelling that plan if they don’t offer me any better discount. Would my indicators and templates go away too if I cancel my sub ?

Hi Ash, don’t do it. The best thing to do is wait for the November Black Friday -60% discount and renew then. Then you get a full year of 60% less. Remember to subscribe to our newsletter, and I will let you know when the special offer starts