The factors differentiating ETFs vs. Mutual Funds are ETFs have lower fees, higher liquidity, and, therefore, better compounding performance.

While Mutual Funds offer actively managed funds with higher fees that attempt to attain better performance.

Are you trying to decide between investing in ETFs vs. mutual funds? This article will help you understand the differences to better decide on mutual funds or ETFs for your portfolio.

I have no vested interest or partnerships with mutual funds or ETF companies; this is purely an educational research article. However, I have a great index ETF investing strategy that helps you beat the market if you are interested.

ETFs vs. mutual funds

ETFs and mutual funds offer broad market index tracking or a specific sector, industry, or investing strategies like growth, dividend, or value portfolios. Professional portfolio managers manage both ETFs and Mutual funds. ETFs offer more control and lower costs for the independent investor.

Are ETFs mutual funds?

No, ETFs are not mutual funds. ETFs and mutual funds share many similarities, but the big differences are how you buy and sell shares in the funds, the fund’s costs, and how they are taxed. ETFs trade openly on a stock exchange, and mutual funds are exchanged directly with a fund management company.

What is the difference between ETFs and mutual funds?

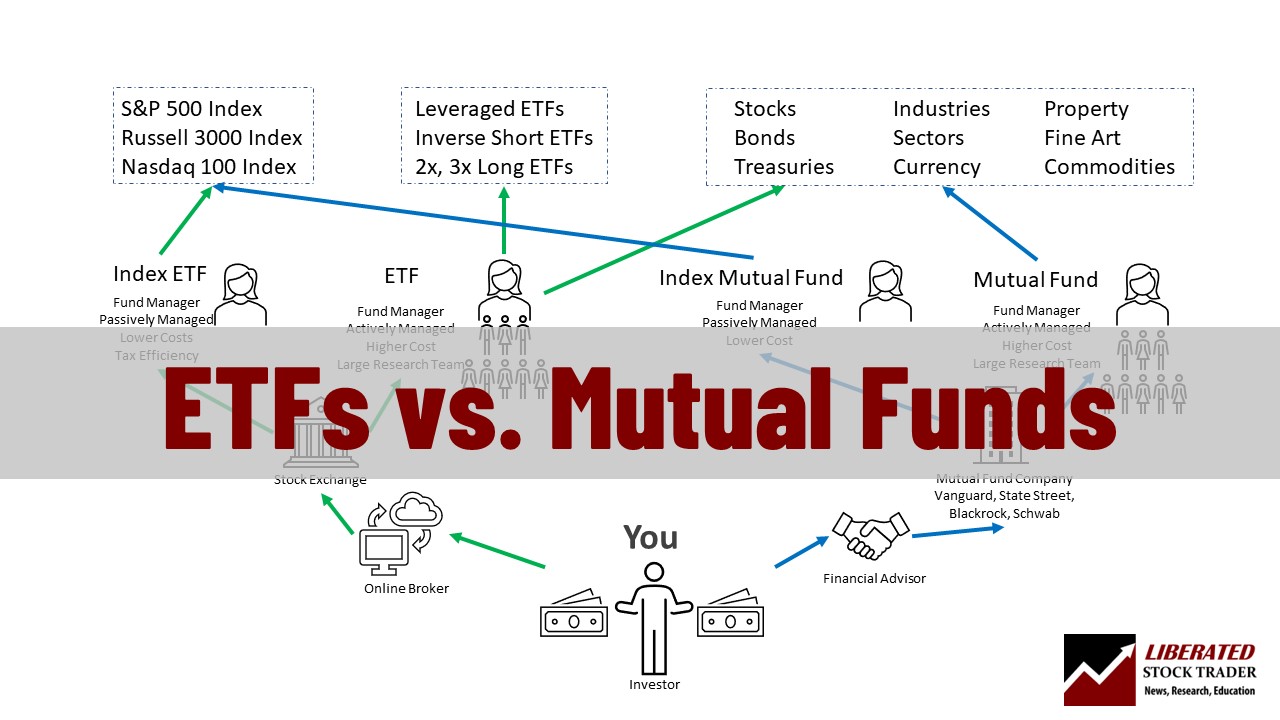

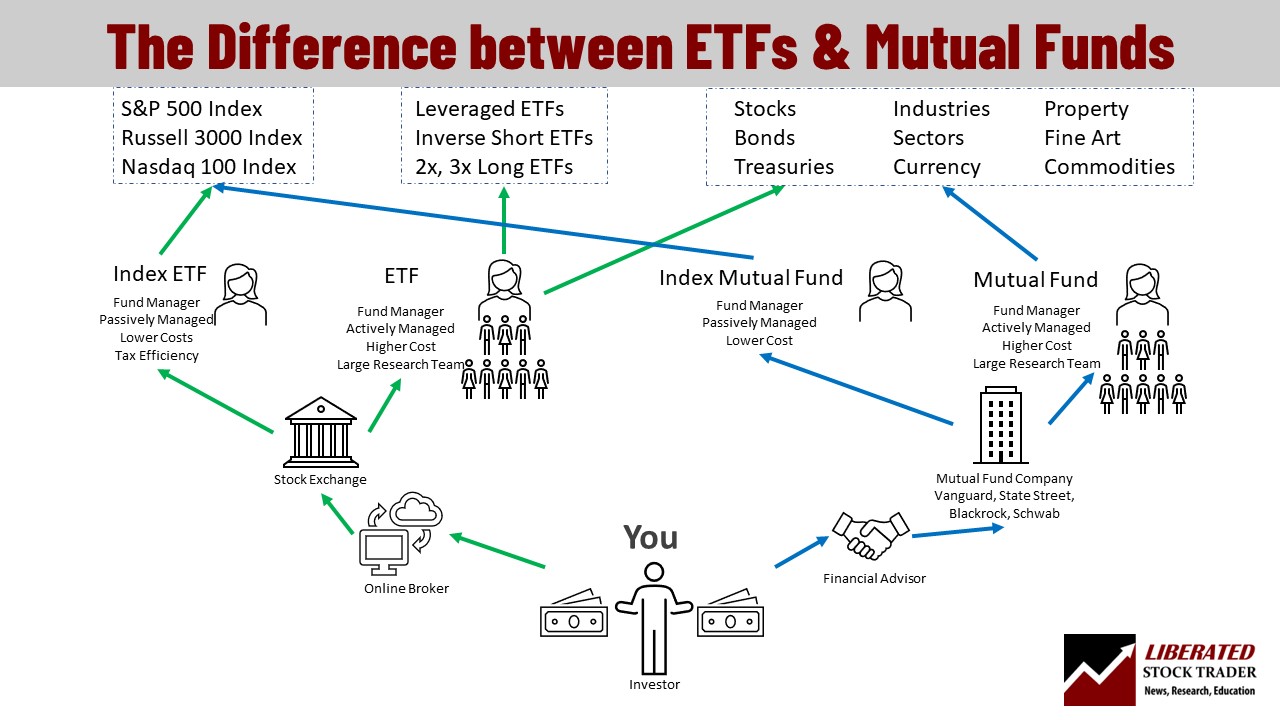

The difference between ETFs and mutual funds is where and how you buy the fund and how you get taxed. ETFs are purchased like stocks on an exchange; mutual funds are purchased through a financial advisor or directly with the fund company. ETFs are tax-efficient as transactions occur on an exchange.

The difference between ETFs and mutual funds is the flow of capital

When you buy an ETF, you go through an online brokerage and purchase a share of the ETF through an exchange for the market price. The ETF can be an index-tracking or an actively managed fund, but the differentiator is that you trade shares on the active exchange.

Purchasing a mutual fund is generally done through a financial advisor or pension fund. The higher transaction costs and annual fees of mutual funds compensate the financial advisor or pension fund, who takes a cut of the fees to cover the burden of maintaining a relationship with you.

Read in more detail about the capital flows of ETFs and mutual funds.

ETF vs. mutual funds vs. index funds?

Investors often confuse the difference between ETFs, mutual funds, and index funds. The reality is that index funds can be purchased through ETFs and mutual funds. An ETF trades on an exchange, while a mutual fund trades directly through the fund management firm, but both ETFs and mutual funds can be index-tracking funds.

An index fund tracks an index such as the S&P 500 or the Nasdaq 100.

Advantages of ETFs over mutual funds

ETFs generally have lower transaction costs, trade real-time on exchanges, and can be more tax-efficient. ETFs mostly avoid capital gains tax by allowing shares to trade between buyers and sellers on an exchange. ETFs were designed to be passively managed funds, meaning they have lower annual fees than mutual funds.

Mutual funds have a big disadvantage compared to ETFs; when you sell your mutual fund stocks, they are sold directly on your behalf, which incurs capital gains tax that you must pay.

ETFs also allow you to trade real-time long and short-leveraged bets; this is unique.

Advantages of mutual funds over ETFs

Compared to ETFs, mutual funds offer exotic investment portfolios to try to outperform a benchmark index. Mutual funds are actively managed, meaning fund managers and research teams apply their skills to create market-beating profits. Over the last three years, 32% of actively managed funds beat the market.

The key advantage of mutual funds is that they allow you to beat the overall stock market returns by employing advanced stock, commodity, and currency selection criteria and being flexible according to the current market situation.

History has proven that you have a one in three chance of beating the market with a mutual fund and considering the transaction commissions. Ongoing fees are generally five times higher; this might not make sense for most investors.

ETF or mutual fund?

ETFs are the best choice if you want to actively control your investments, buy and sell your shares, and avoid excessive taxes. Mutual funds are a good choice if you seek low-effort maintenance and active management from professional teams of portfolio managers with a 30% chance of market outperformance.

ETF vs. mutual fund tax

ETFs are more tax-efficient because transactions occur on the exchange between buyers and sellers; no stock in the index is sold, avoiding capital gains tax. When you sell shares in a mutual fund, they sell stock on your behalf, meaning you are liable instantly for capital gains tax.

ETFs are more tax-efficient because most buying and selling of shares in the fund occurs between investors, meaning the ETF does not need to actively sell the shares on the market, avoiding capital gains tax. When you sell shares in a mutual fund, they sell on your behalf, meaning you are liable instantly for capital gains tax.

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

Are ETFs better than mutual funds?

ETFs are the better choice if you want total control over your fund investments or want to invest in index funds. Mutual funds are a good choice if you prefer to have your funds managed for you with the chance of better-than-average returns at higher commissions and costs.

Are mutual funds better than ETFs?

Mutual fund portfolio managers would say, “Yes, mutual funds are better than ETFs.” Still, the reality is that 90% of the time, if you want to maximize your trading flexibility and minimize your tax burden, leading to higher returns over the long term, ETFs are a better choice.

Which is better, ETF or mutual fund?

ETFs are better for investors who want to actively manage their portfolio, buy and sell quickly, reduce costs, maximize compounding, and reduce capital gains tax. Mutual funds are better for investors seeking to minimize effort and hope that fund managers will make enough profit to offset the higher fund fees.

| ETFs vs. Mutual Funds | ETF | Mutual Fund |

| Index Funds | ✔ | ✔ |

| Actively Managed | ✔ | ✔ |

| Passively Managed | ✔ | X |

| Fees | 0% – 0-6% | 1% – 3% |

| Trade like stocks | ✔ | X |

| Tax Advantages | ✔ | X |

Table: ETFs vs. Mutual Funds Comparison

Facts about ETFs & mutual funds

- Mutual funds are generally actively managed by teams dedicated to beating the market, but only 17% succeed in their goal.

- Passively managed ETFs track a specific stock market index to equal the market returns; this beats 82.5% of mutual funds in the long term.

- Passively managed index-tracking ETFs usually incur lower management fees than actively managed mutual funds. A fee saving of 2% per year compounded for 20 years could mean an extra 48% extra in your investment.

- ETFs are exchange-traded funds, meaning they can be purchased on the open market during trading hours and typically reflect the stock index price. ETFs can also be shorted and allow options trades.

The Truth About Actively Managed Mutual Funds

According to Standard & Poor’s annual SPIVA report, over the last 10 years, 82.51% of actively managed mutual funds underperformed the benchmark. With mutual funds, you have the disadvantages of end-of-year capital gains taxes, you pay up to 3% in management fees, and you have only a 17% chance to attain the performance of a passively managed index ETF.

“Oblivious of the toll taken by costs, mutual fund investors willingly pay heavy sales loads and incur excessive fund fees and expenses, and are unknowingly subjected to the substantial but hidden transaction costs incurred by funds as a result of their hyperactive portfolio turnover.” John C. Bogle – Creator of the first Index investment Trust

For most investors, passive index-tracking ETFs are the best choice for lower taxes, fees, and long-term stable performance.

Mutual fund vs. ETF costs

Once you’ve determined a strategy and a taxation method, you must pick specific index funds to invest. Several factors determine the cost of funds and the return on investment you can receive from them. Understanding these factors can help you pick a fund. The factors include:

Mutual Fund Costs

Many index funds, including mutual funds, come with high costs. Many mutual funds require an initial cash investment, while others require investors to commit to an automatic monthly investment. Mutual fund costs include sales loads or charges, redemption fees, exchange fees, account fees, management fees, distribution fees, other expenses, total annual fund operating expenses, and purchase fees.

Federal law requires mutual funds to list all the fees in the prospectus under the heading shareholder fees. You can find the prospectus on the fund manager’s website.

You must study the fee table carefully because some costs can add up. Some funds charge a 5% sales load for purchases. That means a person who purchases $1,000 worth of the fund will only own $950. Funds can also charge a back-end sales load, which means the fund could charge a 5% fee on a sale of $1,000. Hence, the fund owner will receive $950 instead of $1,000.

There are no-load mutual funds. However, many no-load funds charge other fees, such as exchange or exemption fees.

You can determine the cost of a mutual fund with a mutual fund calculator. The calculator can tell you how much the fund will cost and offer return estimates. Many free mutual fund calculators are available online.

ETFs can be cheaper than mutual funds because they are often commission-free. Many ETFs charge account service fees and broker-assisted trading fees. You can avoid broker-assisted trading fees by trading yourself and account service fees by signing up for the electronic delivery of documents at the broker’s website.

You can determine the cost of ETFs by checking the fee section of the brokerage’s website.

Beat The Market, Avoid Crashes & Lower Your Risks

Nobody wants to see their hard-earned money disappear in a stock market crash.

Over the past century, the US stock market has had 6 major crashes that have caused investors to lose trillions of dollars.

The MOSES Index ETF Investing Strategy will help you minimize the impact of major stock market crashes. MOSES will alert you before the next crash happens so you can protect your portfolio. You will also know when the bear market is over and the new rally begins so you can start investing again.

MOSES Helps You Secure & Grow Your Biggest Investments

★ 3 Index ETF Strategies ★

★ Outperforms the NASDAQ 100, S&P500 & Russell 3000 ★

★ Beats the DAX, CAC40 & EURO STOXX Indices ★

★ Buy & Sell Signals Generated ★

MOSES Helps You Sleep Better At Night Knowing You Are Prepared For Future Disasters

Final thoughts on ETFs vs. mutual funds

Conduct as much research as possible. The more you know about funds, the easier it will be to make money and avoid losses.

Understand your tax situation. Many investors face a large tax bill because they do not understand strategies such as tax-loss harvesting and asset location.

Read the fee table and the prospectus. Many index funds contain hidden fees that take 10% to 25% of your investment. Study the fine print carefully because fund managers have many euphemisms for fees.

Don’t become obsessed with watching funds or the market. The primary advantage of index funds is that they manage themselves. There’s no reason to check the market or the fund’s performance every day.

Monitor your funds with a good portfolio tracker. The advantage of index funds is that you do not have to watch them constantly. Smart investors check fund performance monthly or bi-monthly. Sometimes, you will have to sell funds due to tax loss harvest.

ETF index funds are among the best long-term investments for smart investors, as they can profit from index funds if they are careful.

- Related Article: ETFs vs. Mutual Funds vs. Index Funds: Explained