Everyone loves a bargain; we spend countless hours searching for the lowest price for that TV we want to buy or looking for discounts on our favorite foods.

The stock market is no different.

The best way to find cheap stocks is by using future earnings, asset valuation, discounted cash flow, fair value, and the margin of safety.

Do not look at stock price alone to assess if a stock is undervalued; stock price is only useful in combination with other criteria.

What Are Cheap Stocks?

The stock market has no single definition of a cheap stock. A stock can be considered “cheap” if its price is below a company’s true value or potential future earnings. Investors use measures such as future earnings, asset valuation, and price-to-earnings (P/E) ratio to determine whether a stock is undervalued or overvalued.

Investors may also consider the stock’s market capitalization or the total dollar value of all outstanding shares in a company. Small-cap stocks (stocks with a lower market cap than large-cap stocks) are often considered cheap stocks, as they typically have less liquidity and carry more risk.

Many inexperienced investors seek out low-priced stocks, often priced below $5. However, penny stocks of this nature typically entail considerable risk for the investor. While the stock price may be modest, it seldom reflects a sound value proposition. This remains a common blunder made by novices in the field.

A stock might be cheap, depending on what you are looking for.

Anything might be cheap, based on several reasons. A Ferrari might be cheap because the seller wants a quick sale; it might cost $50,000, but relatively, that might still be a bargain.

A washing machine might be cheap because the demand for washing machines has dropped, and the manufacturer needs to get rid of surplus stock and lower the price. A dishwasher might be cheap because its manufacturer uses inferior materials and labor to undercut the competition, and the product may be a poorly designed, low-quality piece of junk.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

How to Find Cheap Stocks?

To identify cheap or undervalued stocks, consider future earnings, asset valuation, discounted cash flow, fair value, and the margin of safety. Avoid relying solely on stock price to determine undervaluation; combine it with other criteria.

1. Avoid Choosing Stocks Based on Low Stock Price.

Finding cheap stocks based on a low stock price alone is a recipe for disaster; the stock price itself is meaningless. In this section, I will share research that proves this point.

This is where most beginners in the stock market look first. People take the same ideas about bargain hunting from the real world into the stock market. International Frontier Resources (Ticker: IFRTF) has a share price of $0.01, which sounds cheap compared to one of the highest-priced stocks on the US stock market, Google (Ticker: GOOG), priced at $1482.83.

But because IFRTF has a stock price of 1 cent, it is not cheap, nor does Google’s stock price make it expensive.

Google has averaged a 26% gain for the last five years to 2020. What a great investment that was. Would you consider that cheap?

IFRTF hit a price high in 2017 of 30 cents per share and lost over 97% of its value in 3 years to 2020. The company must have done many things very badly to lose over 97% of its value. It is now very cheap but has had no revenue growth over the past five years and does not look to have made a profit in this time frame either.

If this stock continues down and goes bankrupt, this means you will lose your entire investment. That does not make it cheap, which makes it very expensive and extremely risky.

The Cheap Stock Price Experiment

Using the excellent TradingView Stock Screener, I examined the price performance of all US stocks over the past year. I analyzed stocks with a price lower than $5, lower than $10, and those with a higher price than $10.

Performance of Stocks Priced Lower Than $5

Stocks with a price lower than $5 – how many beat the performance of the S&P-500 by more than +10% = 891

Stocks with a price lower than $5 – how many were worse than the performance of the S&P-500 by more than (minus) -10% = 1571

Buying stocks with a price lower than $5, you would mean you would have nearly twice as many losers to gainers.

Performance of Stocks Priced Lower Than $10

Stocks with a price lower than $10 – how many beat the performance of the S&P-500 by more than +10% = 1270

Stocks with a price lower than $10 – how many were worse than the performance of the S&P-500 by more than (minus) -10% = 1850

Buying stocks with a price lower than $10 would have a 59% chance of losing on average.

Performance of Stocks Priced Higher Than $10

Stocks with a price higher than $10 – how many beat the performance of the S&P-500 by more than +10% = 1265

Stocks with a price higher than $10 – how many were worse than the performance of the S&P-500 by more than (minus) -10% = 572

Buying stocks with a stock price higher than $10, you would have had a 67% chance of beating the SP-500 average, e.g., beating the market.

The key here is not the stock price but the expected returns.

This was a simple experiment to show that the stock price is meaningless, and in fact, there is probably less chance of finding high performance with a stock priced lower than $5 or $10.

Stock Rover Finds Great Undervalued Stocks

Use Stock Rover to Find Great Value Stocks

2. Find Stocks Based on Past & Future Earnings

Earnings and revenue growth are key in this strategy. A simple way to value a stock is to look at its historical and future earnings. Let us take another look at Google, the 5th highest-priced stock in the US Stock Market.

Google Inc. has a five-year expected sales growth of 20% and expected EPS for 2021 of 31%. Google also has a P/E Ratio (The Stock Price Per Share / Earnings Per Share) of only 31.

If we expect Google’s earnings growth to continue at this rate into the future, combined with the P/E valuation of 31 and the expected earnings growth of 30%, we could say that Google is cheap, even though it does have a high share price.

This same strategy can be used to identify cheap stocks on the market. By looking at historical and future earnings, you can determine if a stock is undervalued or overvalued based on its current P/E ratio. You may also want to consider how much revenue growth is expected from that company in the next five years. Looking at both these factors will help you find

Did the piece about the P/E Ratio confuse you? If so, read this article on the PE Ratio.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

3. Find Bargain Stocks Based on Asset Valuation

You could base your opinion on whether a stock is cheap on simple asset valuation or even on how much the current assets and cash in the company’s bank are worth.

For example, let’s assume a company has 50 million shares outstanding. Let’s also assume that this company has $150 million cash in the bank in short-term investments (Current Assets) if the stock price is $3 per share. If we divide the current assets worth $150 million by the outstanding shares of 50 million, we get a Cash Per Share of $3. If the stock price is $2, you have found an amazingly cheap investment, provided the company is not swamped in debt or massive pending liabilities.

If the Cash per Share is $3 and the Stock Price is $2, you get the stock at a 33% discount.

Any reasonably healthy company’s stock price will usually not fall below the value of its cash and current assets. Was that a little difficult to grasp? I have defined a detailed strategy for finding these stocks in the Liberated Stock Trader PRO Training Course.

4. Find Value Stocks Using Discounted Cash Flow

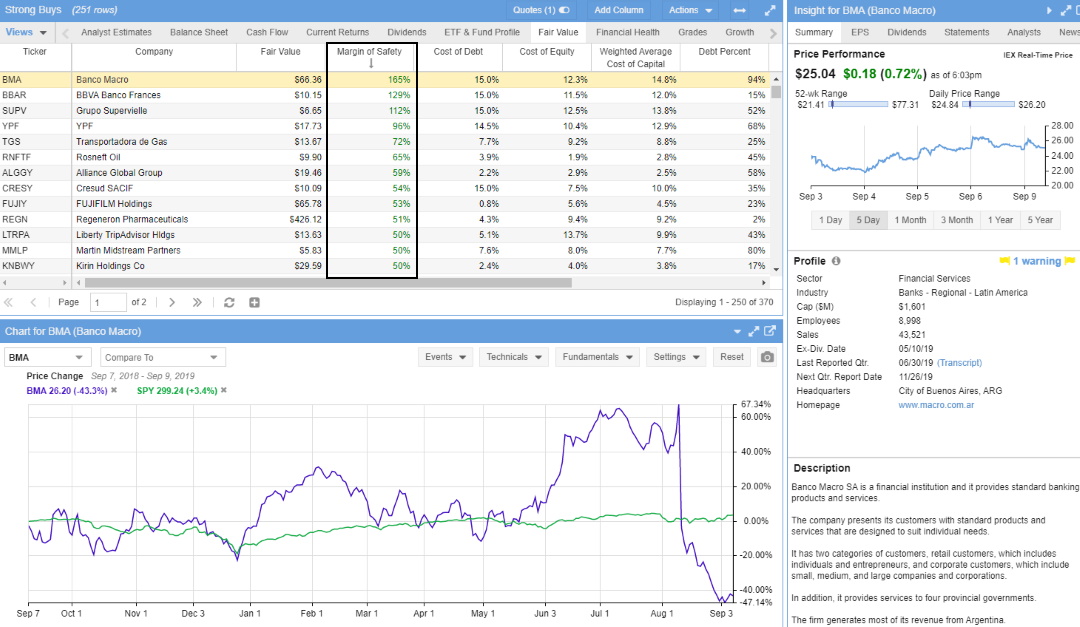

Value investing is used by legendary investors such as Buffett and Klarman & Munger. It is considered the gold standard in finding investments that represent great value to the investor. By estimating and discounting a company’s ten-year cash flow and dividing it by the outstanding number of shares, you arrive at a fair value for the company. If that fair value per share is less than the current stock price, you essentially have a Margin of Safety.

A Margin of Safety greater than 30% is the best way to find cheap stocks

Investing In Stocks Can Be Complicated, Stock Rover Makes It Easy.

Stock Rover is our #1 rated stock investing tool for:

★ Growth Investing - With industry Leading Research Reports ★

★ Value Investing - Find Value Stocks Using Warren Buffett's Strategies ★

★ Income Investing - Harvest Safe Regular Dividends from Stocks ★

"I have been researching and investing in stocks for 20 years! I now manage all my stock investments using Stock Rover." Barry D. Moore - Founder: LiberatedStockTrader.com

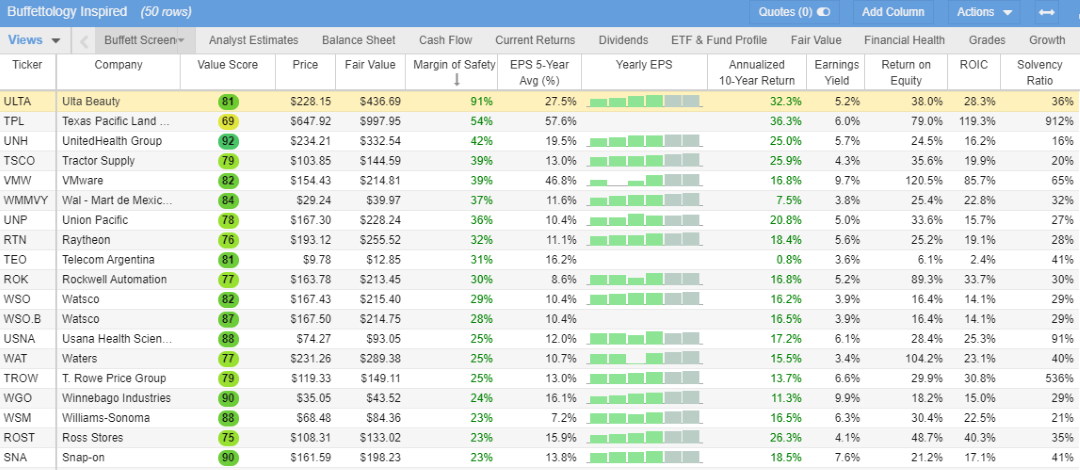

5. Try Buffett’s Fair Value & Margin of Safety Strategy

Buffett’s most important measure to decide whether to invest in a company, the Margin of Safety, is the percentage difference between its Fair Value and actual stock price. This metric is the most significant valuation factor, as it is the final output of a detailed discounted cash flow analysis.

Fair Value & Margin of Safety Buffett Strategy Screening Criteria

*Exclusive to StockRover |

Building the Best Buffett Stock Screener for Value Investing

Fair Value Warren Buffett bases his Intrinsic Value / Fair Value calculations on future free cash flows. To explain, Buffett thinks cash is a company’s most important asset, so he tries to project how much future cash a business will generate and discount it against inflation. This is called the Discounted Cashflow Method.

A Strong Earnings Per Share History & Growth Rate. Unsurprisingly, earnings per share (EPS) is an important metric for Buffett and Wall Street. Buffett looks for companies with a consistent track record of earnings growth, particularly over a 5 to 10-year period.

A Consistently High Return on Equity. This profitability measure is calculated as net income as a percentage of shareholders’ equity, also called ROE. A high ROE shows an effective use of investor’s money to grow the value of the business.

Return on Invested Capital (ROIC) quantifies how well a company generates cash flow relative to the capital it has invested in its business.

Is the Company Conservatively Financed? The solvency ratio measures whether a company generates enough cash to stay solvent. It is calculated by summing net income and depreciation and dividing by current liabilities and long-term debt. A value above 20% is considered good.

If a company cannot make a profit per share higher than the return of a safe asset like treasury bonds, you should not invest in it. This is an easy calculation, and we will use the Earnings Yield. Earnings Yield is the earnings per share for the most recent 12-month period divided by the current market price per share.

- More Value Investing Strategies in Our Guide, “7 Value Investing Strategies & How To Set Them Up.”

I have read the bible on value investing, The Intelligent Investor by Benjamin Graham, an excellent book.

Summary: Are Cheap Stocks Good Value for Money?

Do not think a stock is cheap because its dollar price is below a certain value.

Think about the quality of a company and the fundamentals before you judge a stock to be cheap. You need to consider the investment carefully if a company is low-priced. Also, you may increase your exposure to volatility if a company struggles; the market conditions may even impact you.

Low-price, penny, and micro-cap stocks are low-priced for a reason. Usually:

- Bad management

- Failure to adapt to changing market conditions

- A shrinking market

- Uncompetitive products

- Bad financial management

FAQ

What is the best software for finding cheap stocks?

Stock Rover is the best software for finding cheap, undervalued stocks. It provides all the features every value investor needs, including in-depth analytics, portfolio tracking, and research capabilities to help you gain better insight into your investments.

What are cheap stocks?

Cheap stocks, also known as penny stocks, are shares of companies that trade at a low price, under $5 per share. They offer the potential for huge losses and increased risk.

Are cheap stocks a good investment?

No, cheap penny stocks are considered low-grade investments and should be avoided. They can carry substantial risks and losses and are unsuitable for long-term investors. However, investing in undervalued stocks is much more profitable and less risky.

What should I consider before investing in cheap stocks?

Before investing, consider the company's financial health, management team, industry trends, and growth potential. Also, understand your own risk tolerance and investment goals.

Can I make money from cheap stocks?

Yes, making money from cheap stocks is possible, but it is highly unlikely. These stocks are highly volatile and have the potential for huge losses. Conduct thorough research before investing; never invest more than you can afford to lose. Investing in undervalued stocks that have good fundamentals is a much safer bet.

How do I research cheap stocks?

Research involves examining the company's financial statements, industry position, and management team. Online resources like Stock Rover or Portfolio 123 are extremely helpful in finding undervalued stocks.

Are all cheap stocks penny stocks?

Not necessarily. While penny stocks are typically cheap, not all cheap stocks are penny stocks. "Penny stock" refers to stocks trading under $5 per share. In contrast, a company with an undervalued stock price can be cheap and a good investment.

What are the risks of investing in cheap penny stocks?

Risks include high volatility, lack of liquidity, susceptibility to manipulation, and the potential for business failure. Always invest what you can afford to lose.

How can I reduce risk when investing in cheap stocks?

Diversifying your portfolio, researching thoroughly, setting stop-loss orders, and investing only what you can afford to lose can help reduce risk.

Are cheap stocks listed on major exchanges?

Some cheap stocks are listed on major exchanges like the NYSE or NASDAQ, while others trade on over-the-counter (OTC) markets.

What is an OTC market?

OTC markets are decentralized markets where securities not listed on major exchanges are traded directly between two parties. They are best avoided.

Can I day trade with cheap penny stocks?

Yes, day trading with cheap stocks is possible but not recommended; it comes with high risk due to the stocks' volatility and lack of liquidity.

How many cheap stocks should I own?

The number of stocks you should own depends on your investment goals, risk tolerance, and the size of your portfolio. Diversification is key to managing risk.

Can cheap stocks become expensive stocks?

Yes, if a company performs well, its stock price may increase significantly. However, this isn't guaranteed and requires thorough research and a bit of luck.

How long should I hold onto a cheap stock?

The time you should hold onto a stock depends on your investment strategy. Some investors hold for long-term growth, while others aim for short-term gains.

Hello.This article was really interesting, particularly because I was investigating for thoughts on this topic last Monday.

Your fundamentals in a nutshell with a simple example is fantastic and valuable lessons to learn when looking at stocks