The payout ratio is a vital financial metric used to assess how much of a company’s earnings are distributed to shareholders as dividends.

The payout ratio is expressed as a percentage of the company’s total earnings, reflecting the proportion allocated to dividend payments instead of being reinvested in the business or used for other purposes.

This ratio is particularly important for investors looking for income-generating investments, as it provides insight into a company’s dividend sustainability and priorities in allocating income.

Key Takeaways

- The payout ratio indicates the share of profits distributed as dividends.

- If a payout ratio is too high, dividends may need to be cut in future payments.

- It is a valuable gauge of dividend sustainability and corporate reinvestment policy.

- Financial analysts use the payout ratio to assess a company’s financial health.

From a corporate perspective, the payout ratio helps management decide on a balanced approach to shareholder remuneration and reinvestment in the company. A lower payout ratio might suggest a company is reinvesting more into its growth, while a higher ratio could indicate a company is focused on providing income to its shareholders.

For financial analysts, this ratio is a key component in a broader analysis of a company’s financial health, performance, and long-term strategy. It can influence investment decisions and is often compared across industries to gauge sector performance.

Understanding Payout Ratio

The payout ratio, also known as the dividend payout ratio, is a critical financial metric that investors use to evaluate the sustainability of a company’s dividend payments.

Definition and Importance

The payout ratio is the percentage of a company’s earnings allocated to pay dividends to shareholders. It signifies the portion of earnings distributed in the form of dividends, offering an insight into a company’s dividend policy and financial prudence. A sustainable payout ratio indicates a balance between distributing profits to shareholders and retaining funds for future growth.

Calculation of Payout Ratio

To calculate the payout ratio, one would divide the total dividends paid by the company’s net income. This can be expressed as:

Payout Ratio = (Total Dividends / Net Income) × 100

This formula reveals the share of profits that goes towards dividends. For an accurate calculation, it is important to use the correct figures for dividends paid and net income, which can be found in a company’s financial statements.

Interpreting Payout Ratios

A high payout ratio, typically above 100%, may indicate that a company is returning more money to shareholders than it earns, which might be unsustainable in the long term. Conversely, a low payout ratio suggests that a company is reinvesting a larger share of its profits into the business, which could imply future growth. Investors often seek a balanced payout ratio that reflects a commitment to shareholder returns and the company’s growth aspirations.

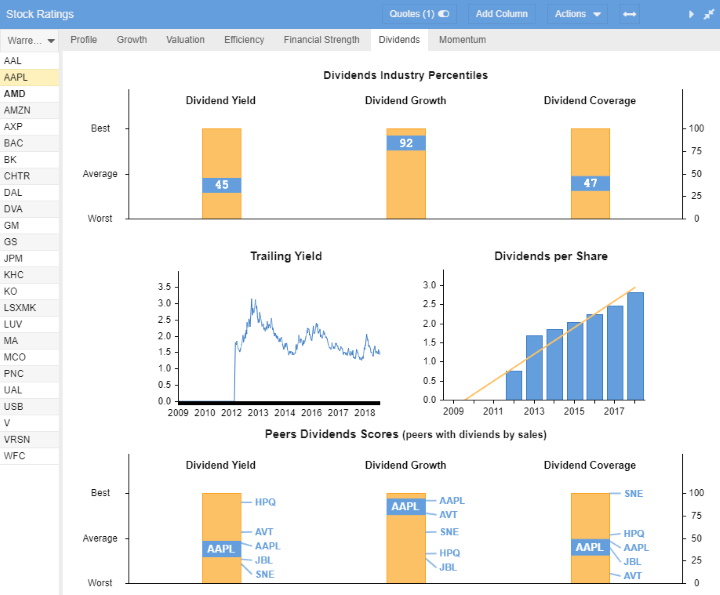

Get Detailed Dividend Reporting with Stock Rover

Impact on Shareholders

The payout ratio is a pivotal factor for shareholders as it informs them about the percentage of earnings a company distributes in dividends. This ratio affects shareholders’ current income and provides insights into the company’s future growth prospects.

Dividend Payments and Shareholder Value

Dividend payments represent a share of a company’s profits distributed to its shareholders. A company with a high payout ratio indicates a substantial portion of earnings is being paid as dividends. These dividends are a crucial source of steady income for income-oriented investors who prioritize regular income over long-term gains.

On the contrary, a lower payout ratio might signal that a company is reinvesting more profits into its growth, which can be more attractive to value investors. These investors typically look for companies with the potential for long-term share price appreciation. The distribution of dividends can also impact the share price directly, representing a tangible return on investment for shareholders.

Payout Ratio and Shareholder Decisions

The payout ratio informs shareholder decisions by indicating the company’s financial strategy and stability. For instance, a consistent or increasing payout ratio can be a positive signal for income investors, who may see it as an indication of reliable, ongoing dividend payments.

Investors also pay attention to dividends per share, which help them evaluate the actual cash return they receive per unit of stock owned. However, an exceedingly high payout ratio may raise concerns about the company’s ability to sustain dividends in the long term, potentially risking future dividend cuts. Shareholders might interpret such a figure as a need for caution, balancing the desire for immediate income against the risk of decreased dividends and share prices in the future.

Try Powerful Financial Analysis & Research with Stock Rover

Practical Example: Payout Ratio

For this practical example, we will compare two imaginary companies: High-Tech Innovators Inc. and Mature Industries Ltd.

| Financial Metrics | High-Tech Innovators Inc. ($ million) | Mature Industries Ltd. ($ million) |

|---|---|---|

| Net Income | 500 | 400 |

| Dividends Paid | 100 | 200 |

| Dividend Payout Ratio | 20% | 50% |

The formula for calculating the Dividend Payout Ratio is:

Dividend Payout Ratio = (Dividends Paid / Net Income) * 100

Let’s calculate:

- For High-Tech Innovators Inc., the Dividend Payout Ratio is (100 / 500) * 100 = 20%

- For Mature Industries Ltd., the Dividend Payout Ratio is (200 / 400) * 100 = 50%

Key Insights and Investment Strategies

From our example, it’s clear that Mature Industries Ltd., with a Dividend Payout Ratio of 50%, distributes a larger portion of its earnings as dividends compared to High-Tech Innovators Inc., which has a payout ratio of 20%. This suggests that Mature Industries Ltd. could be a more attractive option for income-focused investors prioritizing regular dividend payments.

However, investors should consider the following:

The Dividend Payout Ratio reflects a company’s dividend policy: A lower ratio might indicate that the company is reinvesting more of its profits back into the business. A higher ratio could suggest that the company is prioritizing returning profits to shareholders.

A balance is key: While a high Dividend Payout Ratio may be attractive to some investors, an excessively high ratio could indicate that the company is not investing enough in its future growth.

In conclusion, understanding the Dividend Payout Ratio is crucial to building a profitable investment strategy.

Corporate Perspective on Payout Ratios

From a corporate viewpoint, payout ratios are a strategic balance between distributing profits to shareholders as dividends and reinvesting earnings for future growth. This financial tool allows management to signal financial health and prospects to the market.

Dividend Policy and Company Strategy

Dividend policy forms a crucial aspect of a company’s overarching strategy. It is the guiding principle driving the decision of whether, when, and how much dividend should be paid out of profits. A careful analysis of earnings per share and the company’s sustainable growth objectives enables management to determine an appropriate payout ratio. For instance, a company may decide to maintain a lower payout ratio if it is focused on reinvestment strategies for future growth, indicating to growth investors the potential for significant returns on their investment.

Companies with a strong track record of consistent and rising dividends may use a high payout ratio to indicate their robust financial health, appealing to investors seeking regular income through dividends. On the contrary, a low payout ratio may imply that a company is retaining more earnings to fuel expansion, research, and development or pay down debt.

My thorough testing awarded TradingView a stellar 4.8 stars!

With powerful stock chart analysis, pattern recognition, screening, backtesting, and a 20+ million user community, it’s a game-changer for traders.

Whether you're trading in the US or internationally, TradingView is my top pick for its unmatched features and ease of use.

Explore TradingView – Your Gateway to Smarter Trading!

Earnings Retention and Growth

The retention ratio, or the proportion of profits not paid out as dividends, is essentially the flip side of the payout ratio. Retained earnings play a vital role in self-financed growth and capital accumulation. They represent a significant source of funds that a business can reinvest in profitable ventures to enhance shareholder value. Companies often compare retained earnings against return on equity to assess whether retaining earnings contributes effectively to the growth of company value.

Within this framework, management faces the pivotal decision of optimizing the balance between earnings distribution and retention for continued expansion. It becomes a strategic tool aiming to align the interests of a diverse investor base—from those seeking immediate profits through dividends to those who value reinvestment of earnings for long-term capital gains.

A 5 Step Screening Strategy To Find Top Dividend Growth Stocks

Payout Ratio in Financial Analysis

In financial analysis, the payout ratio is an essential metric used to assess a company’s dividend payment capacity in relation to its net earnings, providing insight into its financial health and approach to shareholder returns.

Evaluating Financial Health

The payout ratio is calculated by taking the dividends per share and dividing it by the earnings per share (EPS), with the result typically expressed as a percentage. It indicates the proportion of total earnings distributed to shareholders through dividends. Analysts scrutinize this ratio to determine if a company has a sustainable dividend policy. If the ratio is excessively high, above 100%, for instance, it suggests a company may be paying out more in dividends than it can afford, which could be unsustainable in the long term.

Conversely, a low payout ratio may indicate that a company is reinvesting a significant portion of its net income back into the business, which might suggest potential for future growth. These assessments are grounded in carefully examining financial statements, including the balance sheet and cash flow statements.

Comparing Ratios Across Industries

When performing analysis across different sectors, it’s crucial to consider that each industry has distinct characteristics that affect the standard payout ratio. High-growth industries, such as technology, often have lower ratios due to reinvestment needs, whereas stable sectors, such as utilities, typically have higher payout ratios. Analysts must compare a company’s payout ratio to the averages within its industry to make a meaningful analysis. This contextual understanding provides an essential backdrop for assessing risk and forecasting the potential for sustained returns to shareholders.

Try TradingView, Our Recommended Tool for International Traders

Global Community, Charts, Screening, Analysis & Broker Integration

Global Financial Analysis for Free on TradingView

Sustainability and Risks of Payout Ratios

Payout ratios are pivotal in assessing whether a company’s dividend policy is sustainable. They offer a window into a company’s financial health and capacity to maintain or grow dividends over time.

Identifying Sustainable Dividend Policies

Sustainable dividend policies are characterized by a reasonable balance between dividends paid and earnings. A low payout ratio indicates that a company retains ample profits to reinvest for growth while maintaining a comfortable cushion to continue dividend payments. Companies with stable earnings and strong cash flows typically exhibit a more predictable and steadily increasing dividend growth, which can be more sustainable in the long term.

High Payout Ratios and Potential Risks

Conversely, a high payout ratio, especially one exceeding 100%, can signal unsustainable dividends. Such a scenario implies that a company pays out more in dividends than it earns, an approach that could deplete cash reserves and escalate debt levels. In the long run, companies facing a high payout ratio may struggle to maintain dividends, let alone grow them. Furthermore, investors should be wary, as an excessive ratio may indicate underlying issues in generating enough profits or cash flows and could lead to reduced dividend payments, cause concern, and potential decline in stock appreciation or capital gains.

FAQ

What is the best software for managing dividends?

Stock Rover has the broadest selection of financial metrics and tools for in-depth dividend research and analysis. With over 650 financial screening metrics, we recommend Stock Rover.

What does it mean when a company has a negative dividend payout ratio?

When a company reports a negative dividend payout ratio, it indicates that it is experiencing a loss or its earnings were negative for that period, yet it continues to distribute dividends.

How can a company have a payout ratio exceeding 100%?

A company might have a payout ratio exceeding 100% if it distributes more money in dividends than it is earning, which can occur if it decides to maintain dividends during a period of low profits or opts to distribute reserves.

How might the dividend payout ratio vary year over year?

The dividend payout ratio can vary year over year due to changes in the company's earnings, dividend policy adjustments, or shifts in the company's investment strategies.

In what ways does the dividend payout ratio differ from the dividend yield?

The dividend payout ratio signifies the percentage of earnings paid to shareholders as dividends. In contrast, dividend yield represents the percentage of a company's share price paid out in dividends annually.

Why is the dividend payout ratio considered important?

The dividend payout ratio is important because it provides investors with insight into a company's ability to sustain its current level of dividends in relation to its earnings.

How does a 50% payout ratio impact investors?

A 50% payout ratio suggests that a company is giving half of its earnings to shareholders as dividends, which might be viewed positively as it suggests a balance between reinvesting in the company and rewarding shareholders.