Stock market cycle theory is the practice of understanding economic, political, and psychological events and their impact on the stock market.

The effect of cycles on the economy, stock markets, and business is clear; in this section, we will look into the theory of cycles and how we can apply them to improve our understanding of market fluctuations and major moves. This will, in turn, enable us to make better trading decisions.

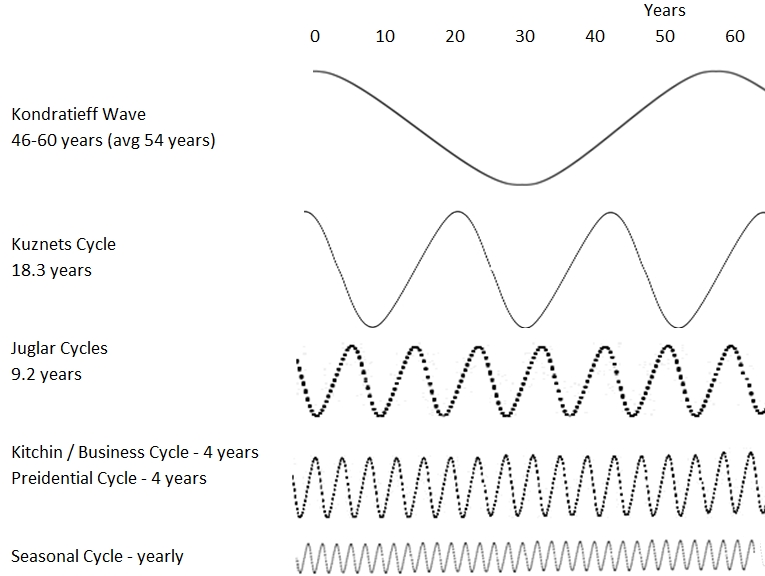

The most famous cycles are the Kondratieff Wave, Kuznets Cycle, Business Cycle, Presidential Cycle, Seasonal Cycle, and Daily Cycles. There are even intraday cycles.

What are stock market cycles?

A stock market cycle is a repeated trend in the prices of stocks over time. There are many stock market cycles, but some of the most common ones include the Kondratiev wave, the Juglar cycle, and the Kuznets cycle. Each of these cycles has unique characteristics, but they all share one common trait: they tend to repeat themselves over time.

While stock market cycles can be difficult to predict, they can provide valuable insights into the future movements of the markets. For example, if a particular cycle is currently in a downward trend, it may be a good time to sell stocks. On the other hand, if a cycle is in an upward trend, it may be a good time to buy stocks.

Investors who can identify and understand stock market cycles can use this knowledge to their advantage. By understanding how these cycles work, investors can make better-informed decisions about when to buy or sell stocks.

Stock market cycle theory

The theory behind stock market cycles is that they are caused by various factors, including economic conditions, human psychology, and political events. These factors can cause the prices of stocks to rise or fall over time, creating a repeating trend in the markets.

While there is no definitive explanation for stock market cycles, economists have a general consensus that they are caused by economic, psychological, and political factors.

Economic conditions

Economic conditions play a major role in stock market cycles. For example, periods of high economic growth tend to be followed by periods of higher stock prices. This is because investors are willing to pay more for stocks during strong economic growth.

Conversely, periods of weak economic growth tend to be followed by periods of lower stock prices. This is because investors are less willing to pay high stock prices during weak economic growth.

Psychological factors

Psychological factors also play a role in stock market cycles. For example, investor confidence tends to be higher during periods of strong economic growth. This means that investors are more likely to buy stocks during these periods.

Conversely, investor confidence tends to be lower during periods of weak economic growth. This means that investors are less likely to buy stocks during these periods.

Investor confidence is measured using sentiment indicators. Look at the Liberated Stock Trader Fear & Greed Index for a detailed investor confidence dashboard.

Political factors

Political factors can also influence stock market cycles. For example, periods of political stability tend to be followed by periods of higher stock prices. This is because investors feel confident about the future when there is political stability.

Conversely, periods of political instability tend to be followed by periods of lower stock prices. This is because investors worry about the future when political instability exists.

Cycles in the stock market

Over the past 200 years, much has been written about cycles, some very useful and some not so applicable to trading success. Cycles are evident in nature in the form of the earth’s rotation (days), the earth’s rotation around the sun (years), the moon’s rotation around the earth (tides), the seasons, animal migration, and solar activity. Some traders believe natural cycles affect the market. In some ways, they do; for example, weather cycles can affect crop output, which can affect commodity prices, affecting a company’s stock price dependent on the commodity. However, other cycles can be measured for general stock market activity.

How long are stock market cycles?

The length of stock market cycles can vary from 4 years (presidential cycle) to 54 years (Kondratieff Wave), depending on the factors causing them. However, most stock market cycles tend to last for a few years. For example, the presidential cycle is a four-year cycle caused by investors’ expectations about the future economic conditions under a new president. Similarly, the 10-year cycle is a longer-term cycle that is caused by a combination of economic, psychological, and political factors.

Stock market cycle chart

Image courtesy of Liberated Stock Trader PRO Training

The Kondratieff Wave

The Kondratieff wave measures between 46 and 60 years with a periodicity of 54 years. Based on wholesale prices in the US in the 1800s, this phenomenon has been mapped from the 1800s through to today. The last trough was in 1940, and the prediction for a trough in 2000 seemed correct. However, if this cycle theory proves correct, we must wait another 40 to 50 years. How actionable this data is is another question. Normally, statistical data proves a trend/theory after 12 to 16 data points, which we certainly do not have here. Also, this theory is quite controversial in the annals of economists. Is it a tradable cycle? Well, not really.

10-year cycle in the stock market

A 10-year cycle in the stock market refers to the general trend of the stock market over ten years, known as the Juglar cycle.

Juglar Cycle

Clement Juglar was one of the first to develop an economic theory of business cycles; the Juglar cycle is approximately half of the 18.3-year cycle at 9.2, fluctuating between 7 and 11 years. This highlights the concept of nominality, meaning each larger wave detected seems to be twice the size of the next smaller wave. The Juglar cycle is of a similar wavelength to the 10-year “stock market cycle.”

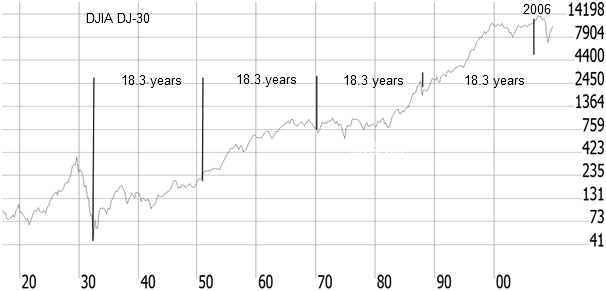

The Kuznets Cycle

The Kuznets Cycle, named after Simon Kuznets, lasts 18.3 years, and here you can see it plotted onto the Dow Jones Industrial Average starting in 1934.

The Kuznets cycle works well, marking the low point of the 1930s depression, the start of the price surge in the 1950s, the market crash of 1987, and the consequent establishment of the roaring bull market that lasted until 2000. However, its timing seems slightly off in 2008, as it predicted a new phase from 2006 onwards.

However, all in all, Kuznets is a very interesting element of cycle analysis.

What is the presidential cycle in stocks?

The presidential cycle is a 4-year cycle that occurs in the stock market, where stock prices tend to rise during the first two years of a new president’s term and then fall during the last two years of the president’s term. This cycle is believed to be caused by investors’ expectations about the future economic conditions under a new president. When a new president is elected, investors tend to have high expectations for the economy and are willing to pay higher prices for stocks. However, as the president’s term progresses, these expectations fall, and stock prices usually follow suit. While the presidential cycle is not an exact science, it can provide valuable insights into the future movements of the stock market.

Summary

The four-year Business Cycle is popular and trustworthy. This suggests business and production output fluctuate within a regular four-year cycle. This means within four years, we tend to see a bull market rise and fall.

You want to be a successful stock investor but don’t know where to start.

Learning stock market investing on your own can be overwhelming. There’s so much information out there, and it’s hard to know what’s true and what’s not.

Liberated Stock Trader Pro Investing Course

Our pro investing classes are the perfect way to learn stock investing. You will learn everything you need to know about financial analysis, charts, stock screening, and portfolio building so you can start building wealth today.

★ 16 Hours of Video Lessons + eBook ★

★ Complete Financial Analysis Lessons ★

★ 6 Proven Investing Strategies ★

★ Professional Grade Stock Chart Analysis Classes ★